Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

This post might break in your email inbox. You can read it in the web browser on your device by clicking here.

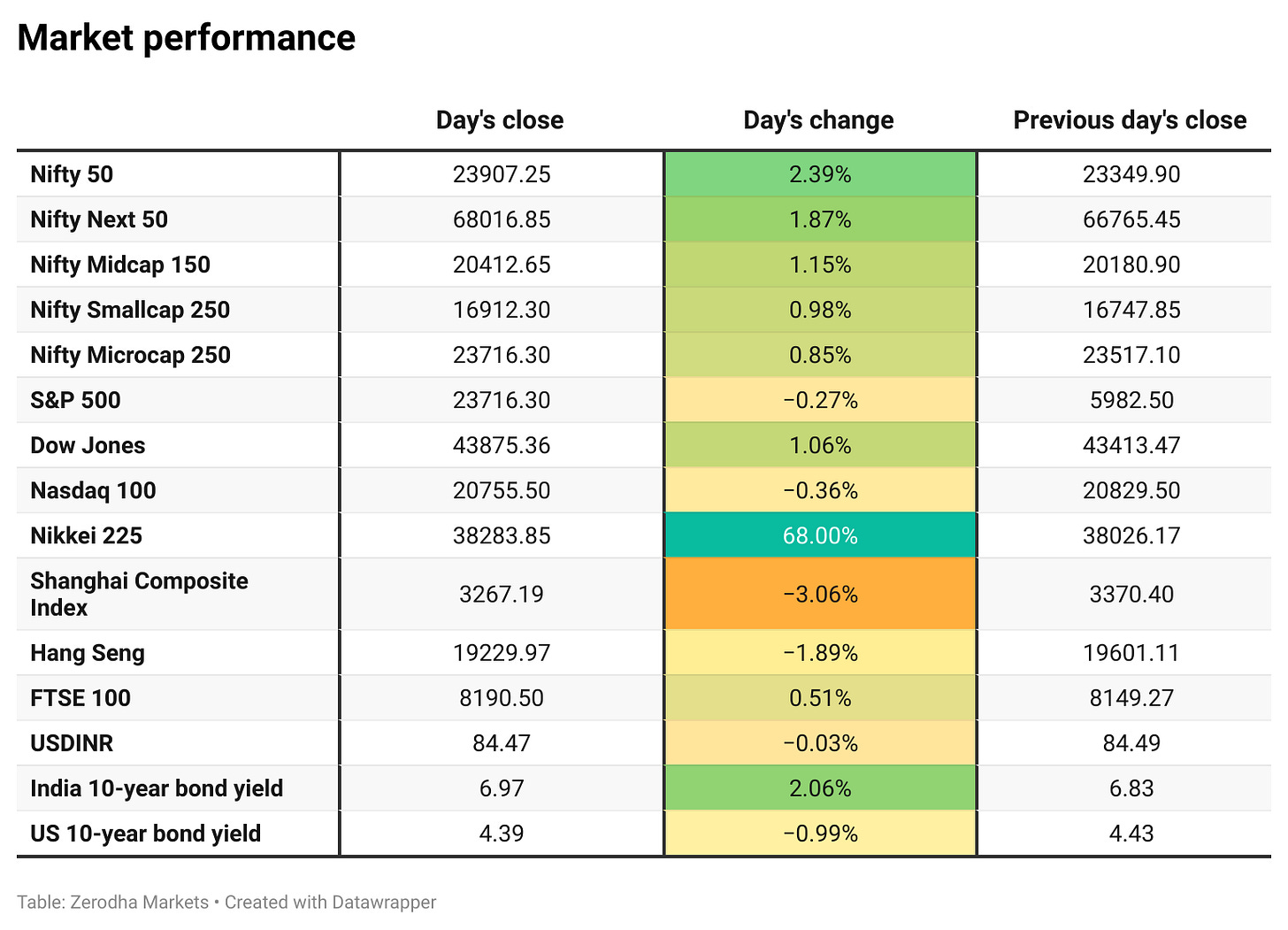

Markets rebounded sharply, driven by short covering ahead of Maharashtra and Jharkhand state election results. Nifty climbed 2.39%, while Sensex rose 2.54%, recovering from the previous session's losses.

Sentiment turned positive, with 1,917 stocks advancing, 877 declining, and 74 remaining unchanged.

The rebound was driven by easing concerns after Thursday’s decline and improved global market sentiment. Gains in U.S. markets and optimism around upcoming domestic events added support.

Note: The above numbers for Commodity futures were taken around 4 pm.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 28th November:

The maximum CE OI is at 24000 followed by 23900, and the maximum Put OI is at 23500 followed by 23400.

Immediate support on the downside can be seen at 23500, which holds the highest Put OI, followed by 23400. Resistance is at 23900, followed by 24000, which holds the highest Call OI.

Note: This is subject to multiple interpretations but generally, in a falling market if there is an increase in the call OI, it indicates resistance.

Source: Sensibull

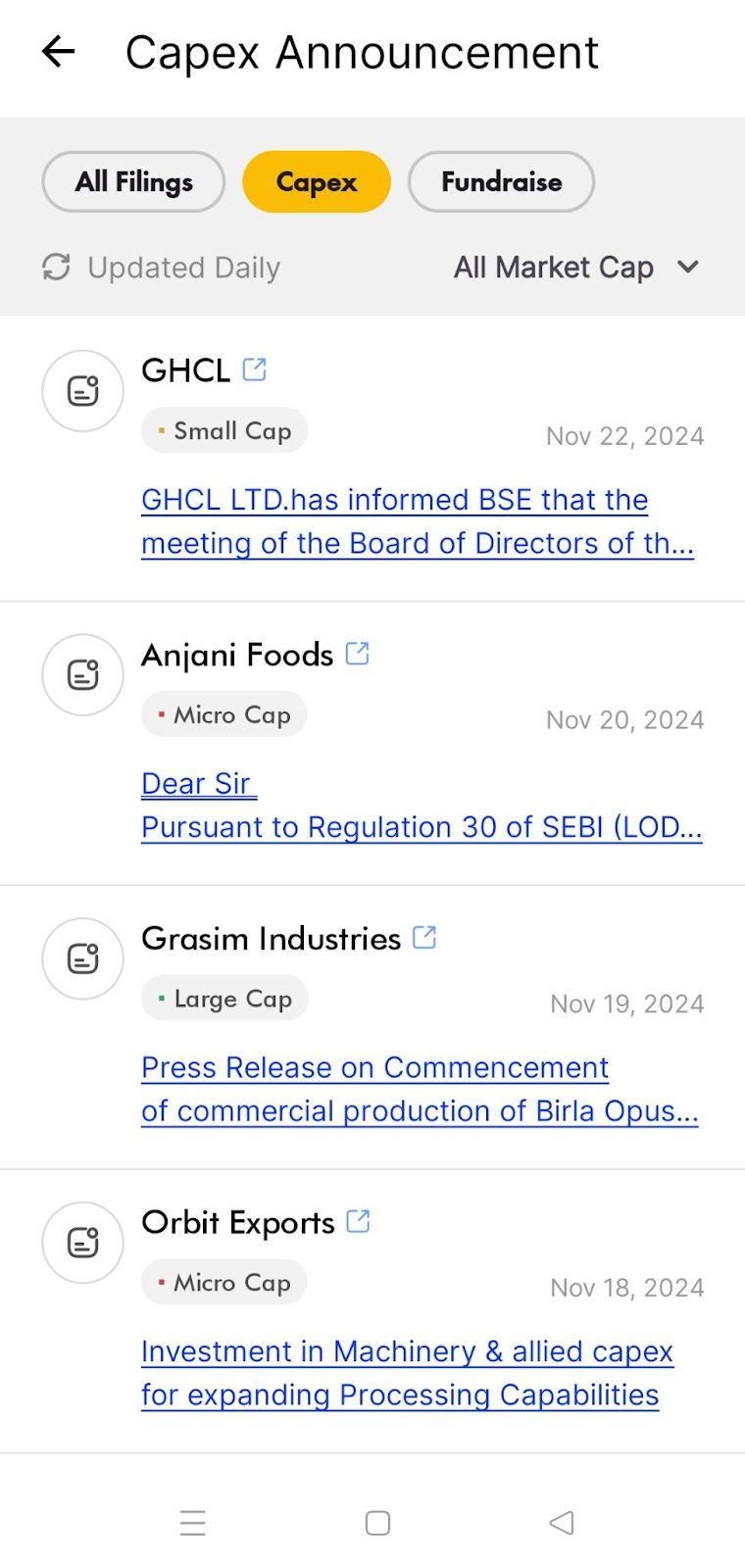

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

BEML Ltd. has secured an order worth ₹246.8 crore from Central Coalfields Ltd. to supply 48 BH60M rear dump trucks, along with spares, consumables for a year, and after-sales support for four years. The trucks, manufactured at BEML's Mysuru facility, feature advanced technologies like a 360-degree rear camera and a driver-fatigue monitoring system. Deliveries will commence after final inspections. Dive deeper

India added 16.4 GW of solar capacity in January-September 2024, a 167% rise year-on-year, driven by delayed project completions, according to Mercom Capital. The total solar capacity now stands at 89.1 GW, with utility-scale projects dominating. Rajasthan, Gujarat, and Karnataka led installations, while 57.6 GW of tenders were announced during the period, marking a 40% increase from 2023. Dive deeper

SEBI has removed the requirement for companies to deposit 1% of the issue size with stock exchanges before a public issue, simplifying the process for issuers. The regulator cited reforms like ASBA payments, UPI integration, and mandatory demat allotments as reasons for this change, making the earlier safeguard unnecessary. Dive deeper

Raymond surged over 18% to hit a high of ₹1,712.25 after receiving BSE and NSE approval for the demerger of Raymond Realty, which will now become an independent listed entity. Shareholders will receive a 1:1 share allocation in Raymond Realty. Dive deeper

HDFC Bank plans to sell car loans worth ₹12,372 crore through pass-through certificates (PTCs) by early December to manage its loan-to-deposit ratio. The AAA-rated PTCs, with tenures of 2026, 2027, and 2030, offer yields of 8.3-8.4% and include 1.83 lakh car loans with a strong repayment record. This move follows a similar ₹10,000 crore issuance in September as part of the bank's strategy to balance its credit-deposit ratio, which stood at 100% in September. Dive deeper

The Indian rupee stayed near its record low of 84.4 per USD in November, pressured by rising inflation, delayed RBI rate cuts, and capital outflows amid weak market sentiment and a stronger dollar. Dive deeper

Tata Power shares gained 2% after the company signed an MoU with the Asian Development Bank (ADB) at COP29 in Baku. The agreement focuses on evaluating financing for projects worth $4.25 billion, including renewable energy initiatives, hydro storage, and distribution network upgrades, supporting India's clean energy goals. Dive deeper

SEBI is reviewing whether the Adani Group complied with disclosure norms regarding a U.S. Justice Department investigation into alleged bribery. The review follows U.S. charges against the group related to solar energy contracts, with potential regulatory action based on findings. Dive deeper

What’s happening globally

India's foreign exchange reserves fell by $17.7 billion to $657.89 billion as of November 15, driven by a $15.5 billion drop in Foreign Currency Assets and a $2 billion decline in gold reserves, as per RBI data. Despite this, India remains among the top four holders of forex reserves globally. Dive deeper

Japan's annual inflation eased to 2.3% in October 2024, its lowest since January, driven by slower rises in electricity and gas prices. While food, housing, and transport costs edged higher, core inflation fell slightly to 2.3%, staying above expectations.

Germany's economy grew by just 0.1% in Q3 2024, revised down from an earlier estimate of 0.2%, narrowly avoiding a recession. Weak exports and reduced investments offset a slight rise in consumption, highlighting ongoing challenges such as manufacturing slowdowns and sluggish global demand. Political uncertainty and potential U.S. trade policies add further pressure to the struggling economy. Dive deeper

Starbucks is considering selling a stake in its Chinese operations to boost growth and compete with local rivals like Luckin Coffee. The company has explored interest from private equity firms and local investors but has not made a final decision. China, its second-largest market, accounts for 19% of Starbucks’ global stores, though recent sales have declined. New CEO Brian Niccol is focused on strategic partnerships to strengthen its position. Dive deeper

Brazilian state-run Petrobras approved R$20 billion ($3.4 billion) in extraordinary dividends, including R$15.6 billion from 2023 reserves and R$4.4 billion from 2024 profits. The company also unveiled a $111 billion investment plan for 2025-2029, focusing on $77 billion for exploration and production, $20 billion for refining and petrochemicals, and $16.3 billion for low-carbon initiatives, a 42% increase from the previous plan. Dive deeper

Calendars

In the coming days, We have the following major events and corporate actions:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

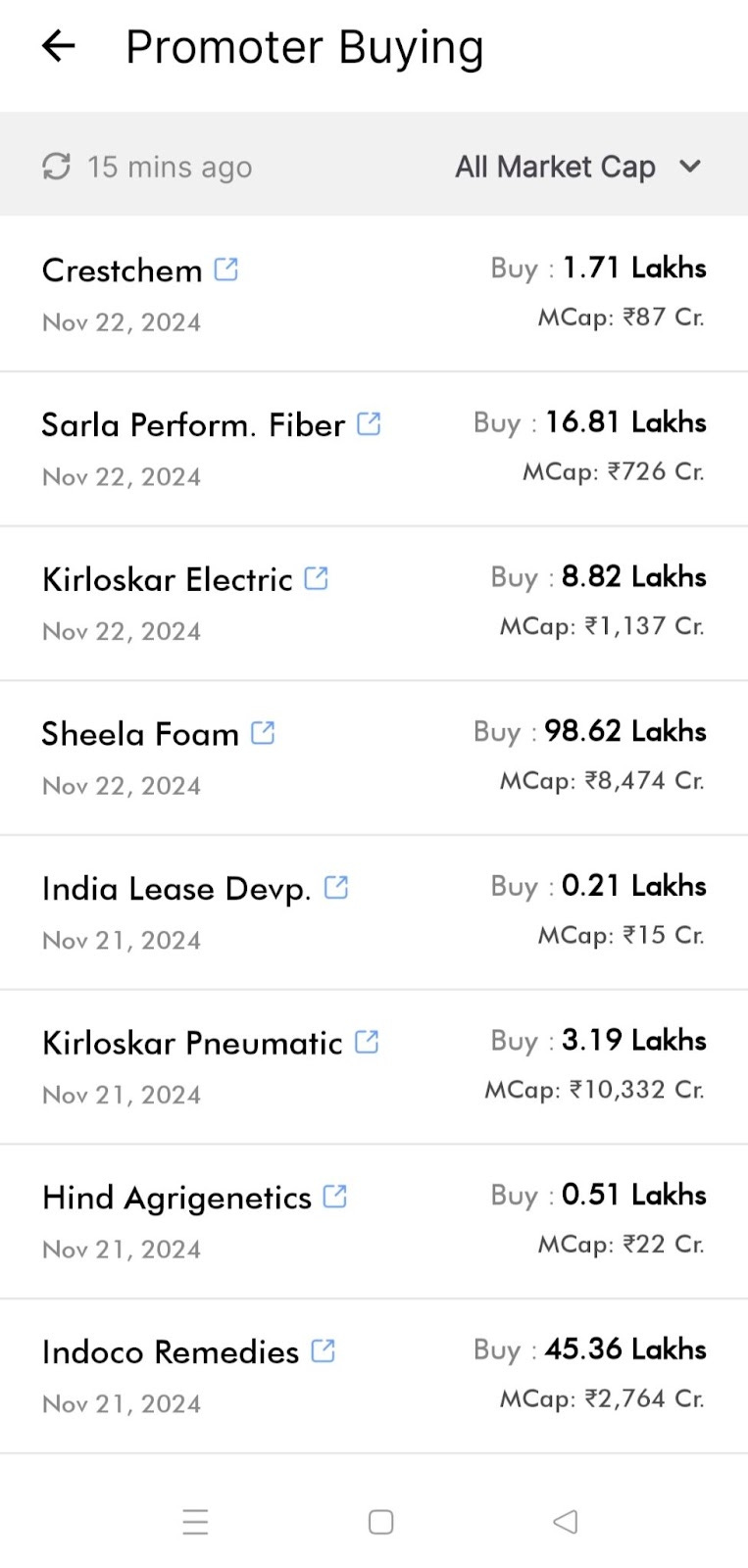

why not promoter sellers

Nikkei 25, wouldn't it have been 0.68% & not 68 %