Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

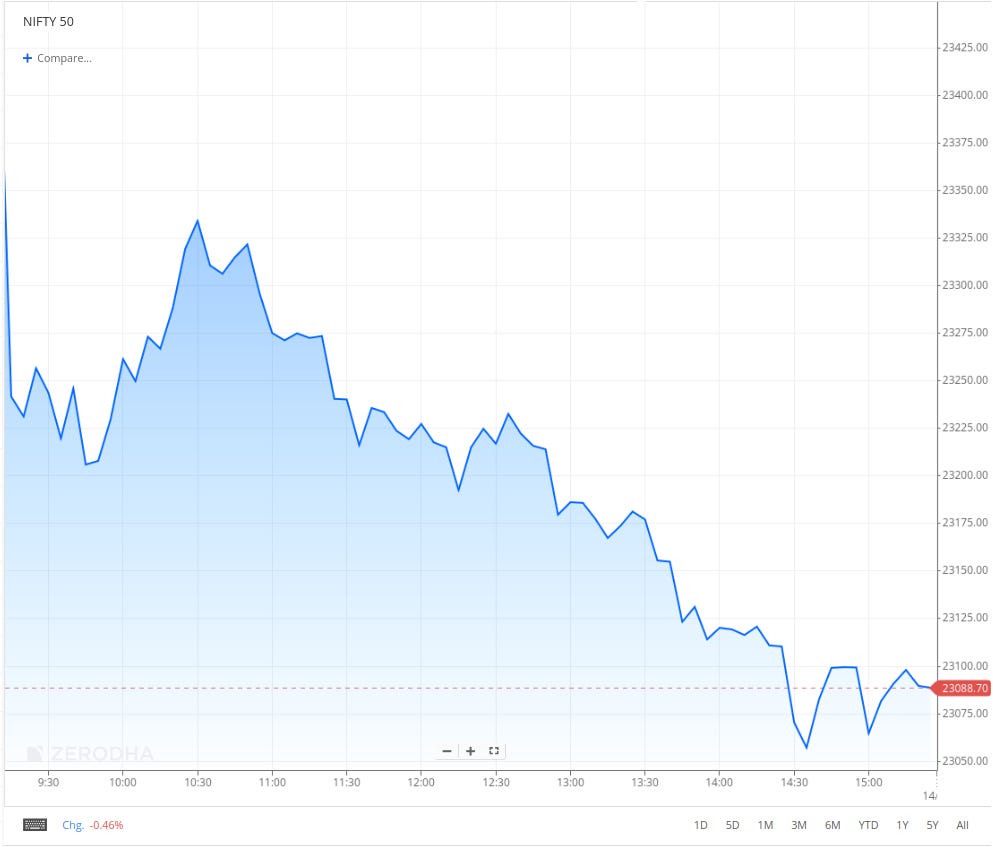

Markets opened sharply lower on Monday, following a more than 1.5% drop in U.S. markets on Friday, driven by strong U.S. jobs data. The Nifty slid 235 points to 23,195.40 at the open, and despite some attempts to recover, the index struggled to find momentum. After a brief bounce to an intraday high of 23,340.95, the market traded within a narrow range of 23,300-23,330 until 11 AM.

However, a steady sell-off began, with broad-based weakness across sectors, leading to a decline that showed no signs of recovery. By the end of the session, Nifty closed at 23,085.95, marking a loss of 1.47%.

The weak performance was driven by macroeconomic factors, including a surging Dollar Index nearing 110, U.S. 30-year bond yields climbing back to 5%, and Brent crude spiking above $80 per barrel. Additionally, the USD-INR exchange rate weakened past 86, trading around 86.60—its steepest drop in nearly two years.

With macro factors weighing heavily on sentiment, the outlook remains cautious. Moving forward, market movements will likely be influenced by these global economic trends, with investors hoping for stabilization to stem the ongoing sell-off.

Broader Market Performance:

The broader markets faced an even tougher day compared to the headline indices. On the NSE, 326 stocks advanced, 2,525 declined, and 84 remained unchanged.

Sectoral Performance:

Sectoral performance showed a broadly negative trend, with all sectors ending in the red except for FMCG. The Nifty FMCG index managed to close marginally higher, up by 0.15%. Among the losing sectors, Nifty Realty saw the steepest decline, dropping over 5%, while Metals and PSU Banks fell by nearly 3% and 2.5%, respectively. Pharma and Auto sectors also registered losses, down 1.59% and 1.79%, respectively.

Note: The above numbers for Commodity futures were taken around 4 pm.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 16th January:

The maximum Call Open Interest (OI) is observed at 23,500, followed by 23,400. Meanwhile, the maximum Put Open Interest (OI) is at 23,000, followed closely by 23,100 and 23,200.

Immediate support is identified in the 23,000–22,900 range, while resistance is expected between 23,350 and 23,500.

Note: OI is subject to multiple interpretations but generally, in a falling market if there is an increase in the call OI, it indicates resistance, and in a rising market, if there is an increase in the put OI, it indicates support.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

India's annual inflation rate eased to 5.22% in December 2024 from 5.48% in November, aligning with market expectations and staying within the RBI's target range. The slowdown was mainly due to lower food inflation (8.39% vs. 9.04%) and a slight easing in housing costs, while deflation in fuel and light moderated. Retail prices fell 0.52% month-on-month, marking the sharpest drop in over a year. Dive deeper

Mangalore Refinery and Petrochemicals Limited (MRPL), launched its new product, Toluene, with a 40 TMT annual capacity, inaugurated by Petroleum Minister Shri Hardeep Singh Puri. This move aims to reduce imports and save $3 million annually, supporting India’s self-reliance in petrochemicals. Dive deeper

Waaree Energies shares initially rose after announcing the ₹792 crore acquisition of Enel Green Power India but closed 3.03% lower at ₹2,487.20. The deal, set to close within three months, aims to diversify Waaree’s revenue and strengthen its wind project execution through Enel’s 640 MWAC/760 MWDC solar and wind assets. Dive deeper

Biocon shares rose 1.18% to close at ₹365.20 after the U.S. FDA classified its Malaysia insulin facility as Voluntary Action Indicated (VAI) following a cGMP inspection. Dive deeper

Godrej Properties launched its first Hyderabad project, Godrej Madison Avenue in Kokapet—a 50-storey premium residential tower with 3 & 4 BHK apartments and luxury amenities, valued at ₹1,300 crore. Dive deeper

NLC India Renewables Limited and Assam Power Distribution Company Limited have signed a Joint Venture Agreement to develop 1,000 MW of solar power projects in Assam. NIRL will hold a 51% stake and APDCL 49%, aiming to boost Assam's energy security with sustainable and affordable power. Dive deeper

Power Grid Corporation of India Limited has acquired 100% equity in Kudankulam ISTS Transmission Limited (KISTSTL) for ₹7.44 crore under the Tariff-Based Competitive Bidding (TBCB) route. KISTSTL will develop a 400kV transmission line for evacuating power from Kudankulam Units 3 and 4 in Tamil Nadu. Dive deeper

Brigade Enterprises Limited has signed an MoU with Technopark to develop a World Trade Center and business hotel in Thiruvananthapuram, spanning 1.5 million sq. ft. This project aims to attract IT MNCs and create over 10,000 jobs. Brigade plans to invest approximately ₹1,500 crores in Kerala, expanding its presence following the success of WTC Kochi. Dive deeper

Zen Technologies Limited approved an investment of up to USD 10 million in its wholly owned subsidiary, Zen Technologies USA, Inc., to expand growth in the U.S. defense and security market. Dive deeper

CAMSRep, a subsidiary of Computer Age Management Services Limited, has crossed 1 crore e-policies across 80 lakh e-Insurance Accounts, becoming India’s largest insurance repository. Over 90% of insurers now issue digital policies through CAMSRep. Dive deeper

Puravankara Limited reported pre-sales of ₹1,265 crores in Q3FY25, up 2% YoY, with customer collections rising 6% to ₹993 crores. For 9MFY25, pre-sales reached ₹3,724 crores, and collections grew 19% to ₹2,991 crores. The company invested ₹1,100 crores in land acquisitions, adding a potential Gross Development Value (GDV) of ₹10,500 crores. Dive deeper

Bharat Electronics Limited (BEL) has secured additional orders worth ₹561 crores for communication equipment, electro-optics, satcom network upgrades, radar and fire control systems, spares, and services. This brings BEL's total orders to ₹10,362 crores for the current financial year. Dive deeper

ITI Limited secured contracts worth ₹64 crores, including a ₹35 crore Wi-Fi and LAN project at Sambalpur University and a ₹29.14 crore integrated security system for Central Railways in Mumbai, expanding its presence in ICT and security solutions. Dive deeper

What’s happening globally

The dollar index crossed 110, its highest since October 2022, as expectations for Federal Reserve rate cuts eased following a strong jobs report. The dollar gained notably against the British pound and the euro, with upcoming Consumer Price Index (CPI) and Producer Price Index (PPI) data in focus. Dive deeper

Newcastle coal futures dropped below $114 per tonne in January, the lowest in over three years, due to rising output and high inventories. Weaker demand from China and increased hydroelectric use further pressured prices. Dive deeper

The U.S. 10-year Treasury yield neared 4.8%, its highest since October 2023, while the 30-year yield rose above 5% for the first time in over a year. Expectations for Federal Reserve rate cuts in 2024 were reduced following a strong jobs report and inflation concerns. Dive deeper

Brent crude oil rose over 2% to $81.5 per barrel due to new U.S. sanctions on Russia's energy sector, raising supply concerns. Falling U.S. stockpiles and colder weather further supported prices. Dive deeper

China's vehicle sales rose 10.5% year-on-year to 3.489 million units in December 2024, driven by strong demand for new energy vehicles (NEVs), which jumped 34% to 1.596 million units. Total vehicle sales for 2024 grew 4.5% to 31.436 million units, with NEVs accounting for 40.9% of sales. Sales are expected to grow 4.7% in 2025. Dive deeper

The offshore yuan held around 7.33 per dollar after China increased support through warnings and capital control adjustments to stabilize the currency. The People’s Bank of China (PBOC) raised the cross-border funding parameter to 1.75 and plans record bill issuance in Hong Kong to boost yuan demand. Meanwhile, China’s trade surplus rose to $104.84 billion in December, driven by a 10.7% surge in exports. Dive deeper

China's exports rose 10.7% year-on-year in December 2024, driven by strong demand and tariff concerns. For the full year, exports grew 5.9% to $3.58 trillion, led by gains in key sectors like mechanical and electrical products. Dive deeper

Quarterly results

In this section, we'll dive into all the key highlights from today's intriguing results, covering the most impactful performances and standout moments. The numbers are comparable on a year-on-year (YoY) basis.

Avenue Supermarts Ltd. (DMart) (0.18%)

Financials:

Revenue: ₹15,972.55 crore, up 17.68% YoY from ₹13,572.47 crore.

EBITDA: ₹1,217.3 crore, up 8.7% YoY from ₹1,119.9 crore.

EBITDA Margin: 7.6%, down from 8.3% YoY.

Net Profit (PAT): ₹723.72 crore, up 4.79% YoY from ₹690.61 crore.

EPS: ₹11.12, up from ₹10.62 YoY.

Key Highlights:

Same-store revenue growth for two years and older stores was 8.3%.

DMart Ready grew by 21.5% in the first nine months of FY25, with home delivery outpacing pick-up points.

Opened 10 new stores in Q3 FY25, expanding the retail area to 16.1 million sq. ft. with 387 operating stores.

Outlook:

Focused on evolving the grocery e-commerce segment, aligning the business to higher home delivery demand.

Leadership transition with Neville Noronha stepping down and Unilever's Anshul Asawa set to take over as CEO & MD in February 2026.

HCL Technologies Ltd. (-0.28%)

Financials:

Revenue: ₹25,944 crore, up 10.6% YoY from ₹23,458 crore.

EBITDA: ₹6,814 crore, up 12.2% YoY from ₹6,070 crore.

EBITDA Margin: 26.3%, slightly improved from 25.9% YoY.

Net Profit (PAT): ₹4,096 crore, up 8.7% YoY from ₹3,769 crore.

EPS: ₹15.2, up from ₹14.0 YoY.

Key Highlights:

Revenue growth is driven by strong performance in digital and engineering services.

Expansion in client base across multiple geographies and sectors.

Investments in AI-based solutions and digital transformation initiatives contributed to growth.

Outlook:

HCLTech projects sustained revenue growth with a focus on digital transformation and cloud solutions.

The company remains optimistic about expanding its global presence and enhancing operational efficiencies.

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Anish Shah, Group CEO & MD, Mahindra Group on the SUV growth story

So, we have a 23% market share in SUVs. We have a 44% market share in tractors. We have a 49% market share in LCVs. So, in SUVs we still have a long way to go. There is a lot more share that we can pick up and for us it is creating outstanding products and what we have just launched recently in electric vehicles has captured the imagination of customers and the feedback we get is very-very strong. - Link

K Krithivasan, CEO & MD, TCS

“Between Q2 and Q3, there was not a substantial difference in our BSNL revenue. We should see the BSNL revenue tapering down, going forward. We seek to replace that revenue either through other international new projects, the new entry series that we have won, or increasing the revenue through regional markets. We continue to look at opportunities through which we can replace this revenue.”

“I'm not saying it's easy or I'm not being flippant about it. But we are confident that this revenue could be replaced over a period of time,” - Link

Calendars

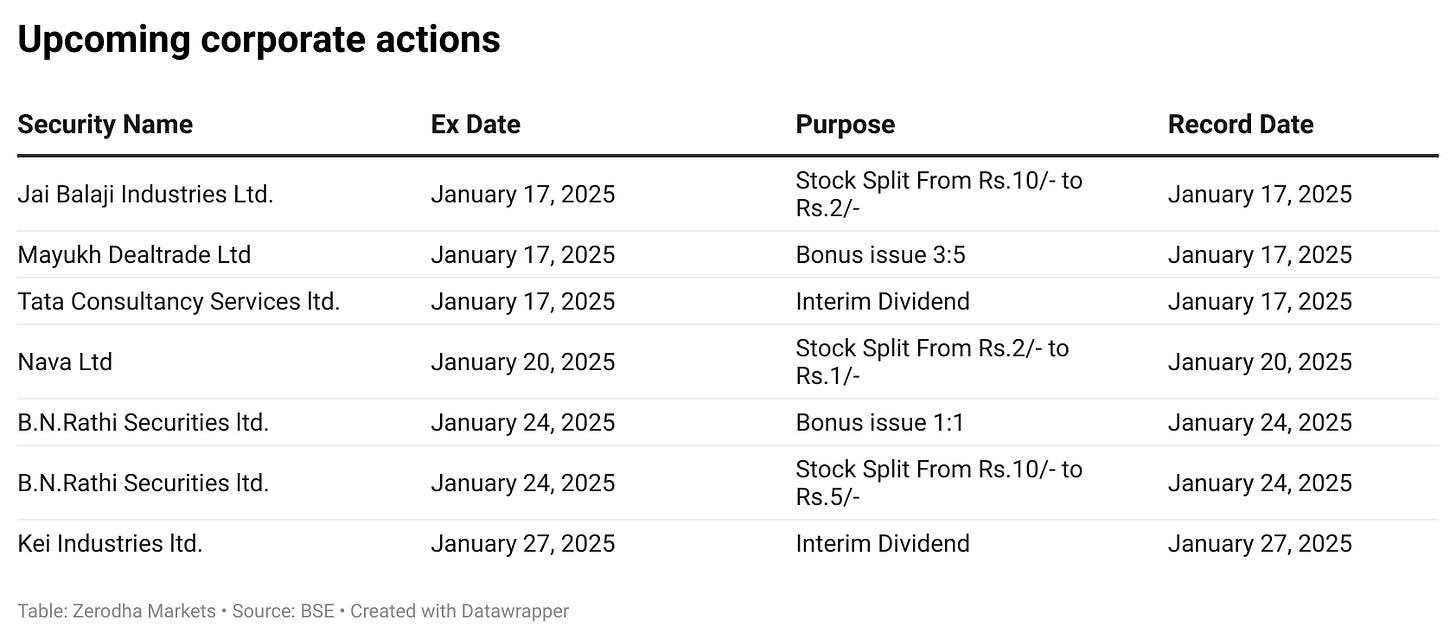

In the coming days, we have the following major events, corporate actions, and upcoming earnings releases:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

Good

What's the source for commodity data?