Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

Nifty opened 70 points higher at 22,119.30, tracking strong global cues. However, as seen in recent sessions, the gap-up move faded within the first hour, with Nifty falling over 200 points intraday to test the 22,030 level. After a brief recovery to 22,100, the market slipped again, making an intraday low of 22,004. In the second half, a sharp recovery of nearly 150 points lifted Nifty to 22,150, supported by broader market strength. However, after testing 22,150 multiple times, the index retreated about 30 points and eventually closed flat at 22,119.30, down 0.02%.

Market sentiment remains cautious amid continued FII outflows and tariff concerns. It remains to be seen whether the market can stabilize at these lower levels or if the downtrend of the past five months will persist.

Broader Market Performance:

The broader market showed a slight improvement in breadth compared to Friday, though declining stocks still outnumbered advancers. Out of 3,026 stocks traded on the NSE today, 879 advanced, 2,071 declined, and 76 remained unchanged.

Sectoral Performance:

Nifty Realty was the top gainer of the day, rising 1.26%, while Nifty Media was the top loser, falling 1.10%. Out of the 12 sectoral indices, 8 closed in the green and 4 ended in the red.

Note: The above numbers for Commodity futures were taken around 4 pm.

Net Flow Breakdown for the day:

FII: Net outflow of ₹4,788.29 crore (Bought ₹9,846.33 crore, Sold ₹14,634.62 crore)

DII: Net inflow of ₹8,790.70 crore (Bought ₹17,344.39 crore, Sold ₹8,553.69 crore)

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 6th March:

The maximum Call Open Interest (OI) is observed at 22,500, followed by 22,400, indicating strong resistance at these levels. First strong resistance levels shall most likely be at 22,400, followed by 22,500.

The maximum Put Open Interest (OI) is at 22,000, followed by 21,900, suggesting potential support at 22,000, with additional support at 21,800.

Note: OI is subject to multiple interpretations, but generally, an increase in the call OI indicates resistance in a falling market, and an increase in the put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

Goods and Services Tax (GST) collections in February rose 9.1% to ₹1,83,646 crore, driven by a 10.2% increase in revenue from domestic transactions. In contrast, GST from imports grew by 5.4%, reflecting modest growth in the value of inbound shipments. Dive deeper

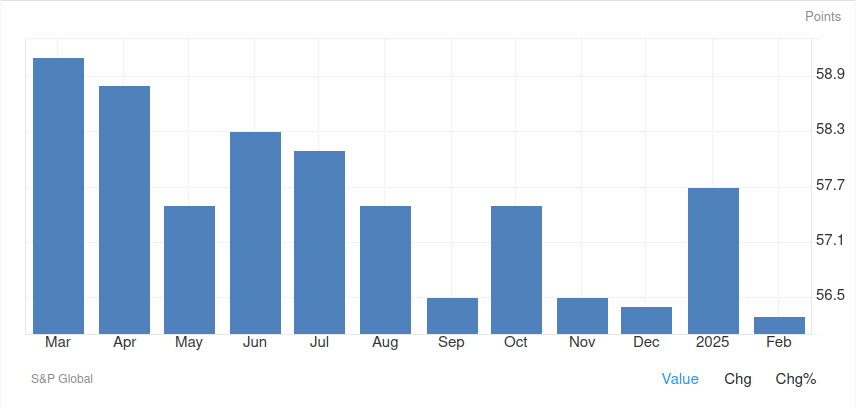

India’s manufacturing sector eased to a 14-month low in February, with the HSBC India Manufacturing PMI falling to 56.3 from 57.7 in January, as growth in new orders and production slowed. Dive deeper

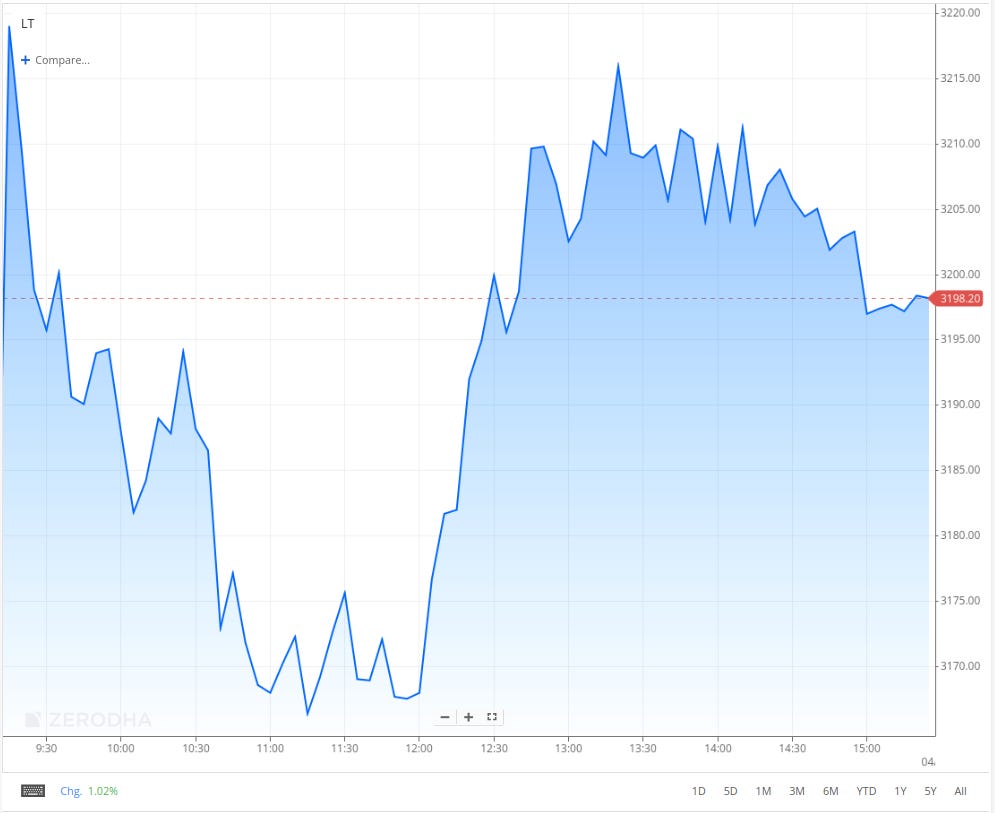

Larsen & Toubro's power transmission and distribution business has secured new orders both in India and overseas. Domestically, it won projects for transmission lines in a Renewable Energy Zone in Uttar Pradesh and for power evacuation from a non-fossil fuel plant in the southern region. Internationally, L&T secured orders for a Gas Insulated Substation in Saudi Arabia and a new grid station in Abu Dhabi. Dive deeper

Sudarshan Chemical acquires Heubach Group, enhancing its global footprint across 19 sites and creating a leading pigment provider with comprehensive technological capabilities. Rajesh Rathi to lead the entity as CEO. Dive deeper

The government has granted 'Navratna' status to Indian Railway Catering and Tourism Corporation (IRCTC) and Indian Railway Finance Corporation (IRFC), making them the 25th and 26th Navratna Central Public Sector Enterprises (CPSEs), respectively. Dive deeper

Tips Music and Sony Music Publishing expanded their partnership to include YouTube, boosting global reach and publishing revenue. Tips plans heavy investment in film albums. This positions both for international growth in Indian music. Dive deeper

Jupiter Electric Mobility launched JEM TEZ and opened a manufacturing facility in Indore, aiming to produce 8,000–10,000 e-LCVs annually. The company targets ₹100 crore revenue in the first year with plans for significant growth. Dive deeper

EIH Ltd. reports its highest-ever Q3 performance with standalone revenue at Rs. 722 crore and announces two upcoming luxury resorts in Rishikesh in partnership with The Ladhani Group. Dive deeper

Zuari Infraworld, a subsidiary of Zuari Industries, partners with Gangothri Developers for a 9.4-acre luxury residential project in Hyderabad, marking a strategic expansion into high-growth markets in India. Dive deeper

Glenmark Pharmaceuticals Inc., USA acquires and launches Acetylcysteine Injection, adding to their U.S. hospital segment and expected to leverage a $15.2 million market opportunity. Dive deeper

Adani Ports reported 36.5 MMT cargo volume in Feb'25 (+3% YoY), with strong growth in containers (+16% YoY) and liquids/gas (+12% YoY).

Transformers and Rectifiers (India) Limited received domestic and international orders worth ₹350 crore. Major domestic order from Adani Group, export orders from Iraq and Australia. Dive deeper

MOIL achieved its best-ever February 2025 production of 1.53 lakh tonnes of Mn ore and increased sales by 3% over the previous year. Dive deeper

Eicher Motors reported a 19% increase in total motorcycle sales for February 2025, driven by strong growth in models exceeding 350cc and international sales. Dive deeper

What’s happening globally

European shares extended gains on Monday, trading near record highs, driven by a rally in defense stocks amid expectations of increased military spending across the region. Dive deeper

The Swiss National Bank reported a record annual profit of 80.7 billion Swiss francs ($89.5 billion) for 2024, driven by strong gains in equity markets, rising gold prices, and a stronger U.S. dollar. This marks a sharp rebound from its 2023 loss of 3.2 billion francs and surpasses its previous record profit of 54 billion francs in 2017, slightly exceeding January’s estimate of around 80 billion francs. Dive deeper

Bitcoin jumped over 20% from last week's lows on Monday, with several other cryptocurrencies also rallying after U.S. President Donald Trump suggested the creation of a new U.S. strategic reserve that would include various digital assets. In a post on Truth Social, Trump said his January executive order on digital assets would establish a reserve featuring currencies like Bitcoin, Ether, XRP, Solana, and Cardano—marking the first time these specific names were mentioned. Dive deeper

France and Britain have proposed a one-month partial truce between Russia and Ukraine, aimed at halting attacks on air, sea, and energy infrastructure while excluding ground combat, according to French President Emmanuel Macron and his foreign minister. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Sameer Khetarpal, MD & CEO, Jubilant FoodWorks on the rationale behind not hiking prices

It is absolutely very conscious. Price hike is the easiest thing to do. It is a policy decision at the end of the day. But by not taking price hikes in the last nine quarter or 10th quarter running, what we have been able to do is gain massive market share. While everybody talks about mandi and demand slow down, we are growing the fastest. So, it is testimony of not only our execution but some of the bold decisions we have taken on technology and an execution on the ground along with shying away from taking any price hike. It is giving more value to consumers and that is what Domino's stands for, great food, fast delivery and renowned value. - Link

Christopher Wood, Global Head-Equity Strategy, Jefferies

My view going forward is that US equities will underperform. This mighty peak in the US equity market both from a relative and absolute return performance also went hand-in-hand with growing commentary around US exceptionalism as applied to the stock market. Personally, I do not believe in US exceptionalism as applied to the stock market. There is one area where the US has long been and truly exceptional in economic and financial matters and that is that the US prints the reserve currency of the world. - Link

V. Anantha Nageswaran, Chief Economic Advisor

“Gold will remain relevant for investors as a portfolio diversification mechanism with a “likely ascending importance” as an asset class in the coming years,” - Link

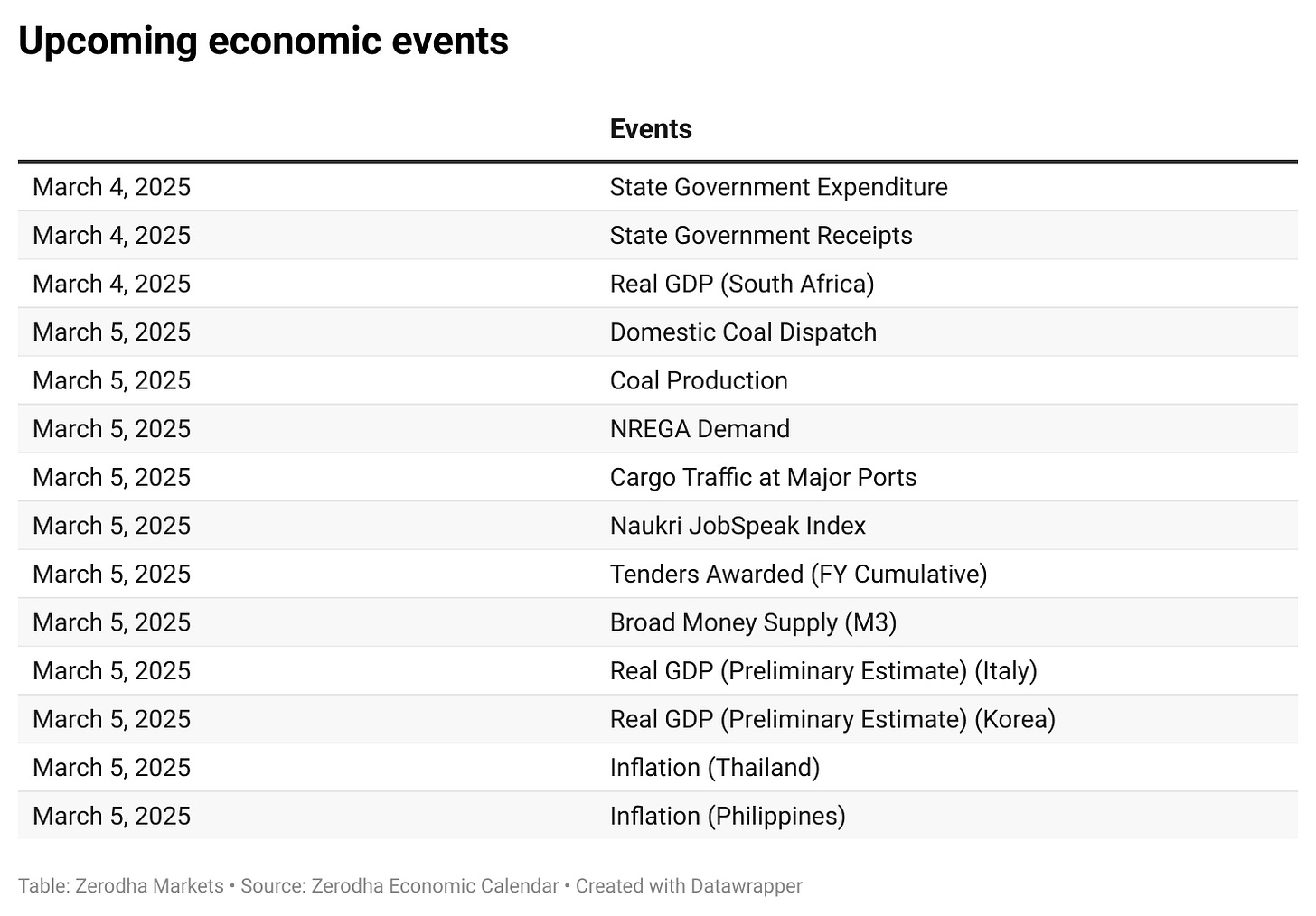

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

NICE REVIEW