Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

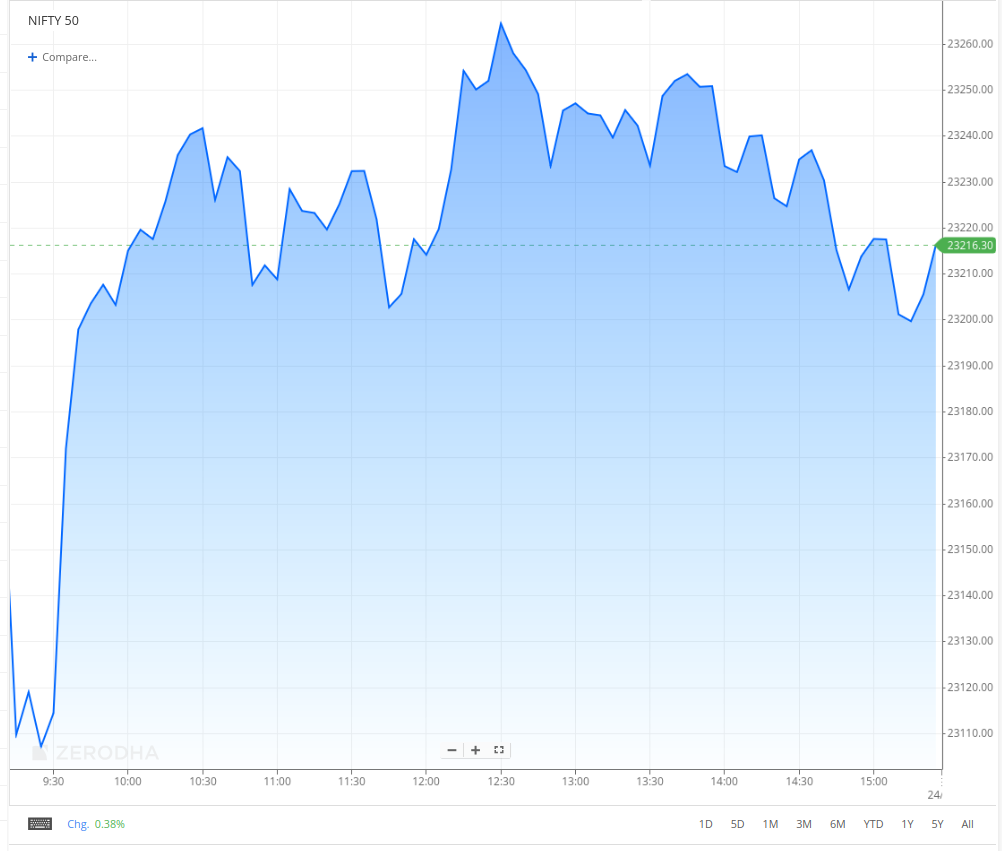

The Nifty opened 27 points lower at 23,128 and stayed within a 40-point range between 23,090 and 23,130 for 20 minutes. Following strength in the broader market, the Nifty then surged higher by 100 points, hitting 23,200. The markets maintained a 40-point range between 23,200 and 23,240 for the next two hours.

In the second half of the trading session, the Nifty attempted to surpass the day’s high, touching 23,270, but couldn't break through. For the remaining three hours, it was traded within a 50-point range between 23,250 and 23,000 and eventually closed at 23,205.35, up by 0.21%.

Looking ahead, market trends are expected to be influenced by global economic developments and earnings reports from key index heavyweights. Investors will vigilantly monitor signs of stabilization to alleviate ongoing selling pressure, particularly with the Union Budget session scheduled for February 1.

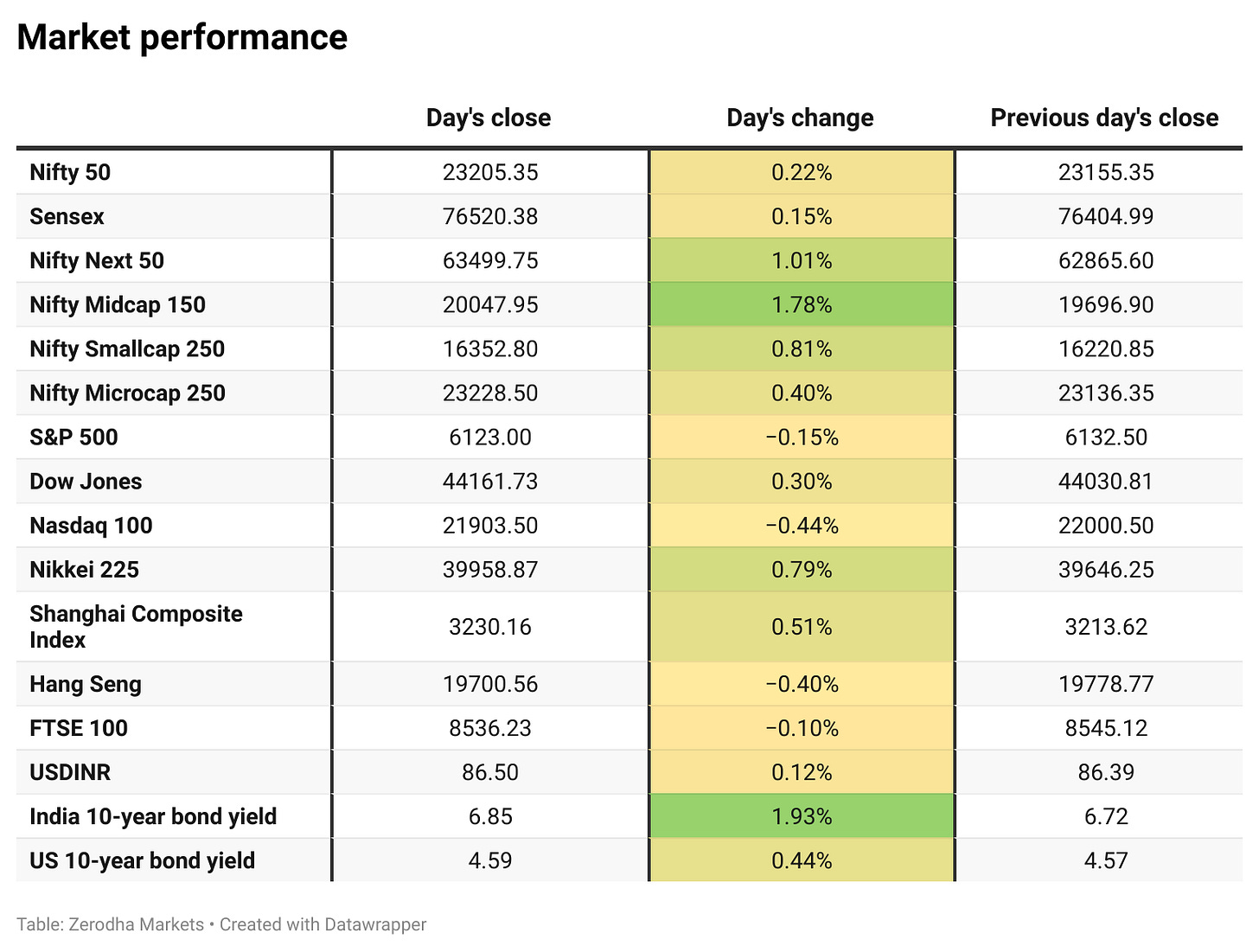

Broader Market Performance:

The broader market bounced back strongly today and outperformed the headline indices. On the NSE, 1575 stocks advanced, 1236 declined, and 77 remained unchanged.

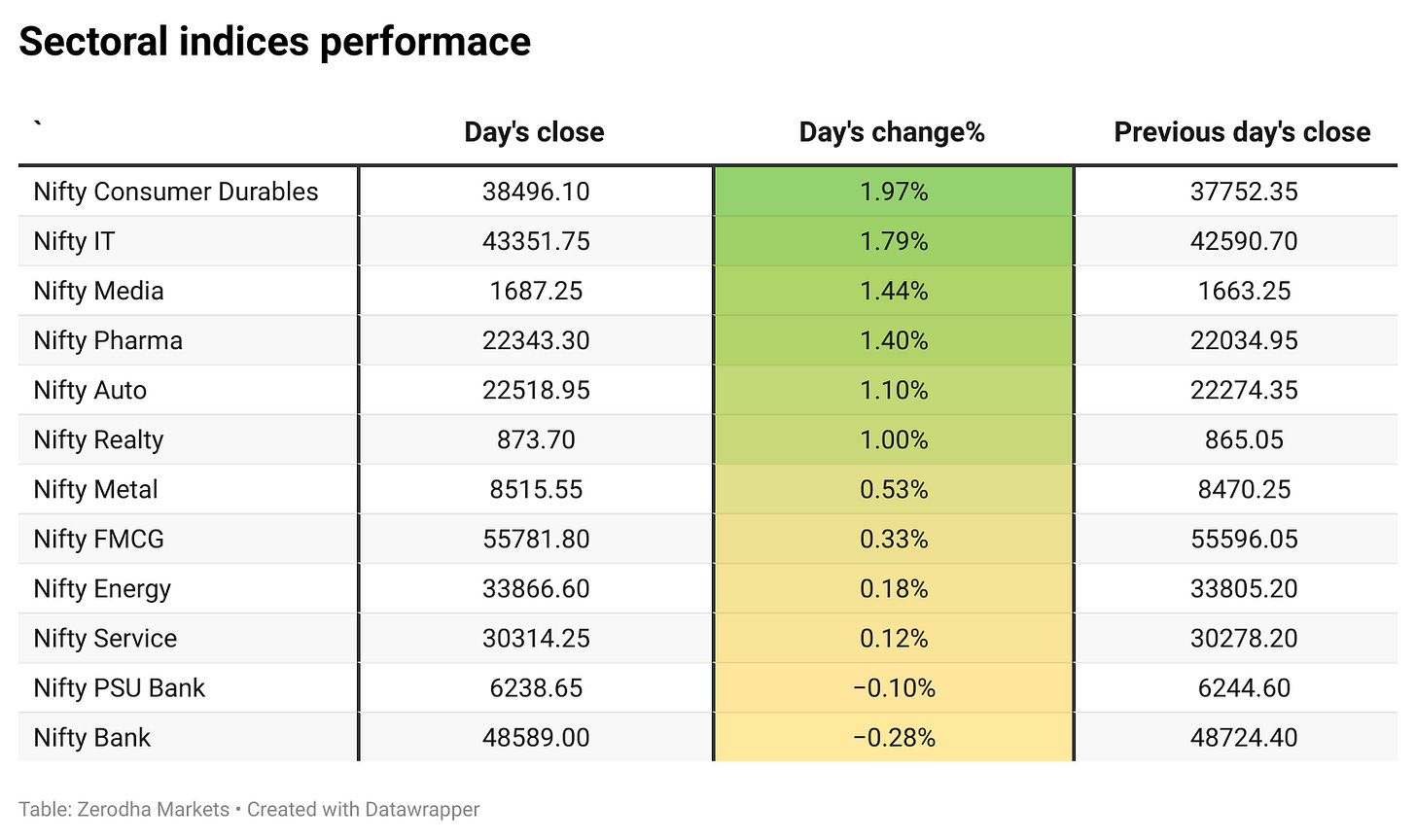

Sectoral Performance:

The overall sectoral performance was robust, with ten indices closing in the green while two ended in the red. The Nifty Consumer Durables sector was the top gainer, recording a gain of 1.97%, whereas the Bank Nifty sector fared the worst, falling by 0.28%.

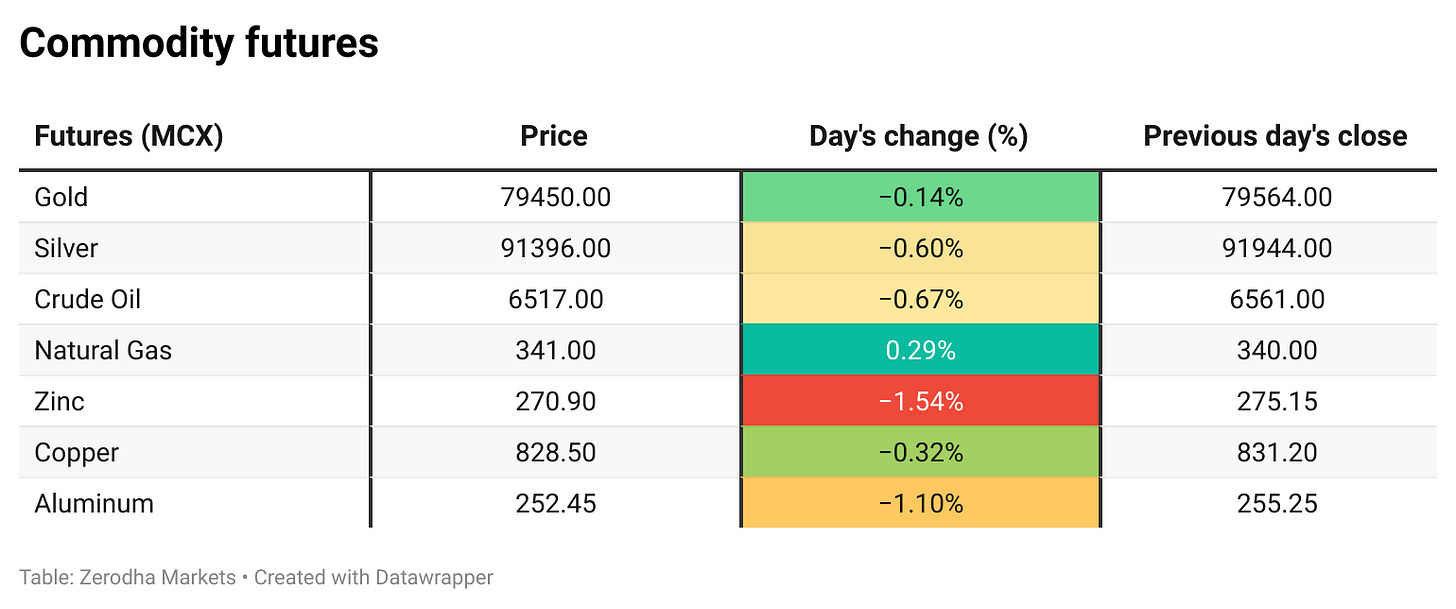

Note: The above numbers for Commodity futures were taken around 4 pm.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 30th January:

The maximum Call Open Interest (OI) is observed at 23,500, followed by 23,200. Meanwhile, the maximum Put Open Interest (OI) is at 23,000, followed by 23,200.

Immediate support is identified in the 23,000–22,800 range, while resistance is expected between 23,400 and 23,550.

Note: OI is subject to multiple interpretations but generally, in a falling market if there is an increase in the call OI, it indicates resistance, and in a rising market, if there is an increase in the put OI, it indicates support.

Source: Sensibull

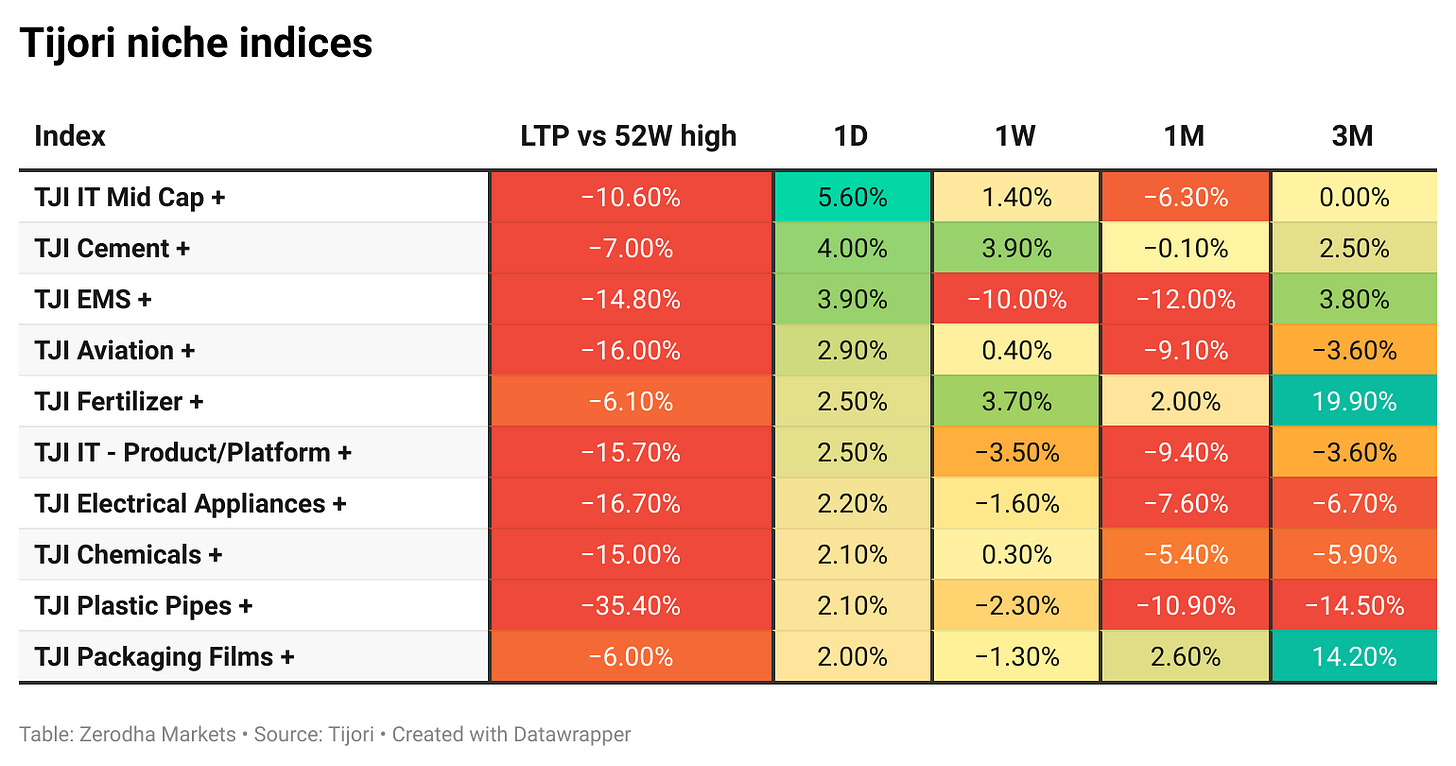

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

IREDA's board approved raising up to ₹5,000 crore via QIP in multiple tranches, ensuring the government’s stake sale remains limited to 7% of its 75% holding, retaining majority ownership, and is subject to shareholder approval. Dive deeper

Jaguar Land Rover faces profitability challenges in China due to weak demand and a shift to EVs. Tata Motors CFO PB Balaji cited declining profitability and tighter credit but remains focused on optimizing inventory and investing in new products to achieve a net cash position by year-end. Dive deeper

Mahindra Lifespace Developers Ltd., through its subsidiary Anthurium Developers Ltd., has acquired 8.2 acres of land in North Bengaluru with a Gross Development Value (GDV) of nearly ₹1,000 crore. The project, set to launch within nine months, will offer mid-premium residential apartments near key locations such as the international airport and major tech parks. Dive deeper

Schaeffler India is presenting advanced motion technology solutions for machine tools and automation at IMTEX 2025, Bengaluru. The showcase features high-performance bearings, robotics solutions, and condition monitoring systems to enhance precision and efficiency in manufacturing. Dive deeper

Coforge Inc. will acquire Xceltrait Inc. for $17.85 million to enhance its ServiceNow capabilities in the P&C insurance sector. The deal includes an initial $7 million payment and up to $10.85 million in earnouts, with completion expected by February 28, 2025. Dive deeper

Zydus Lifesciences received USFDA Orphan Drug Designation for Usnoflast, an oral NLRP3 inhibitor for Amyotrophic Lateral Sclerosis (ALS), offering development incentives and potential market exclusivity. The company plans to advance clinical trials to address the critical need for ALS treatment. Dive deeper

Hindustan Unilever Limited (HUL) has approved acquiring Vishwatej Oil Industries’ palm undertaking in Telangana to support its palm localisation strategy and India’s National Mission on Edible Oils. Dive deeper

Gokaldas Exports Limited stated that the special resolutions proposed via postal ballot on December 19, 2024, aim to strengthen the management team, optimize fund allocation across group companies, and support future growth. The ESOP plan is considered key to attracting and retaining talent in alignment with the company’s growth objectives. Dive deeper

Emcure Pharmaceuticals inaugurated a new R&D centre in Ahmedabad, Gujarat, to develop advanced drug delivery systems across multiple dosage forms. The facility, with 350 professionals, focuses on pharmaceutical innovation and sustainable practices. Dive deeper

PNB Housing Finance expects sustained growth driven by strong housing demand across segments. The affordable housing book doubled to ₹3,838 crore in nine months, targeting ₹5,800 crore by March 2025. The company aims to expand its branch network to 350 and achieve ₹1 lakh crore retail book by FY27. Dive deeper

AWS will invest $8.3 billion in Maharashtra’s cloud infrastructure by 2030, supporting over 81,300 jobs annually and contributing $15.3 billion to India’s GDP. Dive deeper

Mazagon Dock Shipbuilders advanced as the Defence Ministry cleared its bid for the next stage of a submarine project with TKMS, while L&T's bid was rejected. The ₹43,000 crore project now moves to commercial evaluation. Dive deeper

Telangana signed MoUs at the World Economic Forum, securing ₹45,500 crores from Sun Petrochemicals for hydropower projects, ₹800 crores from JSW UAV for a drone facility, and ₹10,000 crore from CtrlS for an AI datacentre. HCLTech will expand in Hyderabad, creating 5,000 jobs. Dive deeper

Avaada Group secured ₹8,500 crore from multiple lenders, including SBI and Yes Bank, for nine renewable energy projects across various segments. Dive deeper

Vedanta plans to raise ₹4,000 crore via NCDs at 9.75% to meet debt and operational expenses. Its holding company, Vedanta Resources, aims to repay part of its $1 billion private credit facility and has refinanced $3.1 billion since September 2024. The proposed demerger into six listed entities is pending approval. Dive deeper

Bank of India, in its board meeting on January 23, 2025, approved raising ₹5,000 crore through Long Term Infrastructure Bonds in Q4 FY 2024-25. Dive deeper

What’s happening globally

US stock futures remained steady Thursday after the S&P 500 reached a record high. Wednesday's gains were supported by strong earnings, including Netflix and Oracle, with the focus now shifting to upcoming earnings and jobless claims data. Dive deeper

The STOXX 50 and STOXX 600 remained flat on Thursday, halting a seven-session rally. Technology stocks led declines, with ASML falling 3.4% amid weak chip demand and export concerns, while Puma shares dropped 14% following disappointing earnings. Dive deeper

The average US 30-year fixed mortgage rate fell to 7.02% from 7.09% for the week ending January 17, 2025, according to the Mortgage Bankers Association. This marks the first decline this month, tracking lower Treasury yields amid easing inflation concerns. Dive deeper

The China Securities Regulatory Commission (CSRC) unveiled steps to support equity markets, targeting over CNY 100 billion in stock investments in H1 2025. Insurers will allocate 30% of new premiums to A-shares, and mutual funds are urged to raise A-share holdings by 10% annually amid economic slowdown concerns. Dive deeper

Japan's exports increased 2.8% year-on-year to a record JPY 9,910.6 billion in December 2024, surpassing forecasts of 2.3% growth. The rise was led by machinery, semiconductors, chemicals, and scientific instruments, while transport equipment declined. Exports grew to Hong Kong, Taiwan, and ASEAN countries but fell to China, the United States, and Australia. Dive deeper

France's manufacturing climate indicator dropped to 95.3 in January 2025, the lowest in three months, as pessimism grew over order books. However, views on production prospects, selling price trends, and economic uncertainty showed slight improvements. Dive deeper

South Korea's economy grew 0.1% quarter-on-quarter in Q4 2024, below expectations of 0.2%. Growth was supported by private and government consumption, facilities investment, and higher IT exports, while construction investment declined and imports fell slightly. Dive deeper

The Central Bank of Turkey cut its repo rate by 250bps to 45% in January 2025, citing easing inflation trends despite potential services price pressures. It forecasts year-end inflation at 21%, while markets expect 27%. Dive deeper

UK manufacturing sentiment fell to -47 in January 2025, the lowest in over two years, amid declining orders, rising costs, and weak investment. Employment is expected to drop sharply, with manufacturers calling for government support. Dive deeper

Norges Bank held its policy rate at 4.5% on January 22, as expected, but signalled a likely rate cut in March. While inflation is nearing target levels and the economy has cooled, rising business costs and global uncertainties remain concerns. Dive deeper

Amazon plans to phase out operations in Quebec, affecting 1,700 jobs and transitioning to a third-party delivery model. The company cited operational review findings for the decision, while the Canadian government and labour union CSN have responded to the development. Dive deeper

Quarterly results

In this section, we'll dive into all the key highlights from today's intriguing results, covering the most impactful performances and standout moments. The numbers are comparable on a year-on-year (YoY) basis.

Ultratech Cement (ULTRACEMCO) (+6.80%)

Financials:

Revenue: ₹17,193.33 crore (+2.71% YoY)

EBITDA: ₹2,887 crore (-7.8% YoY)

Net Profit (PAT): ₹ 1,473.51 crore (-16.98% YoY)

Key Highlights:

Capacity utilization stood at 73%; domestic sales volume grew by 10% YoY.

Energy costs were reduced by 13% YoY due to lower fuel costs.

Consolidated cement capacity increased to 171.11 MTPA with ICEM acquisition.

Outlook:

Sustained volume growth of 7–8% is expected, driven by government infrastructure and housing projects.

Syngene International (SYNGENE) (+2.28%)

Financials:

Revenue: ₹943.7 crore (+10.57% YoY from ₹853.5 crore)

Net Profit (PAT): ₹131.1 crore (-7.66% YoY from ₹141.5 crore)

EPS: ₹3.27 (Basic; Not annualized)

Key Highlights:

Growth in revenue driven by consistent performance in contract research and manufacturing services.

Decline in profit attributed to higher expenses, including employee benefits and depreciation.

Outlook:

Continued investments in manufacturing capacity and operational expansion are expected to drive growth.

Adani Energy Solutions Limited (ADANIENSOL) (+0.75%)

Financials:

Revenue: ₹5830.26 crore (+27.78% YoY)

EBITDA: ₹2215.7 crore (+39.2% YoY)

Net Profit (PAT): ₹561.78 crore (+72.91% YoY)

Capex: ₹3,074 crore (+165% YoY)

Key Highlights:

Secured the largest project in its history: Rajasthan Phase III Part-I (Bhadla–Fatehpur HVDC) worth ₹25,000 crore.

Commissioned MP Package-II transmission line; under-construction project pipeline now at ₹54,761 crore.

Smart meter deployment progressing at 15,000 units/day, expected to reach 20,000 units/day next quarter.

Outlook:

Strong growth trajectory supported by new project wins and robust operational execution.

Continued expansion of transmission network and smart metering business with significant revenue potential.

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

G Krishnakumar, Chairman & MD, BPCL

Hopeful of LPG under-recoveries being compensated by March, not sure of entire LPG under-recoveries being compensated.

Will have to source Saudi & US crude in the coming days.

Will have to pay a slight premium on crude in the range of $2-3/bbl.

We are assessing the impact of Russian sanctions, 35% of our crude mix was from Russia.

The new unit in Kochi refinery will now be completed by Apr 2027 rather than July 2027. - Link

Sanjay Kulshrestha, CMD, HUDCO

Loan book will cross Rs 1.25 lakh cr in FY25 as we transition from being a housing finance company to an infrastructure financing institution.

yields likely to be steady with NIM sustaining at 3 - 3.2% - Link

Satya Nadella, CEO, Microsoft on financing Stargate

"Look, all I know is: I'm good for my $80 billion. I am going to spend $80 billion building out Azure. Customers can count on Microsoft with OpenAI models being there everywhere in the world serving OpenAI models and other models. That's I think, what I know." - Link

Calendars

In the coming days, we have the following major events, corporate actions, and upcoming earnings releases:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

https://substack.com/profile/308262555-sureshkumar-t/note/c-88180552?r=53j4wr