Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

Nifty opened flat at 22,073.05 and, after hitting the day's low in the opening tick, began moving higher, testing the 22,200 mark within the first hour. The index continued its upward trend with brief pauses, reaching the day's high of 22,394.90 around 12:30 pm. In the second half, the market saw a pullback towards 22,300 but recovered to close at 22,337.30, up 1.15%. Broader markets outperformed, ending higher by 2.5-3%.

The rally was supported by easing Brent crude prices, a decline in US bond yields, and a correction in the Dollar Index, which has dropped to 105 from 109 over the past couple of weeks. However, it remains to be seen whether this is just a dead cat bounce or if the recovery has more momentum left in this swing.

Broader Market Performance:

Broader markets led the rally, outperforming the headline indices with strong market breadth. Of the 2,967 stocks traded on the NSE today, 2,461 closed higher, 436 declined, and 70 remained unchanged.

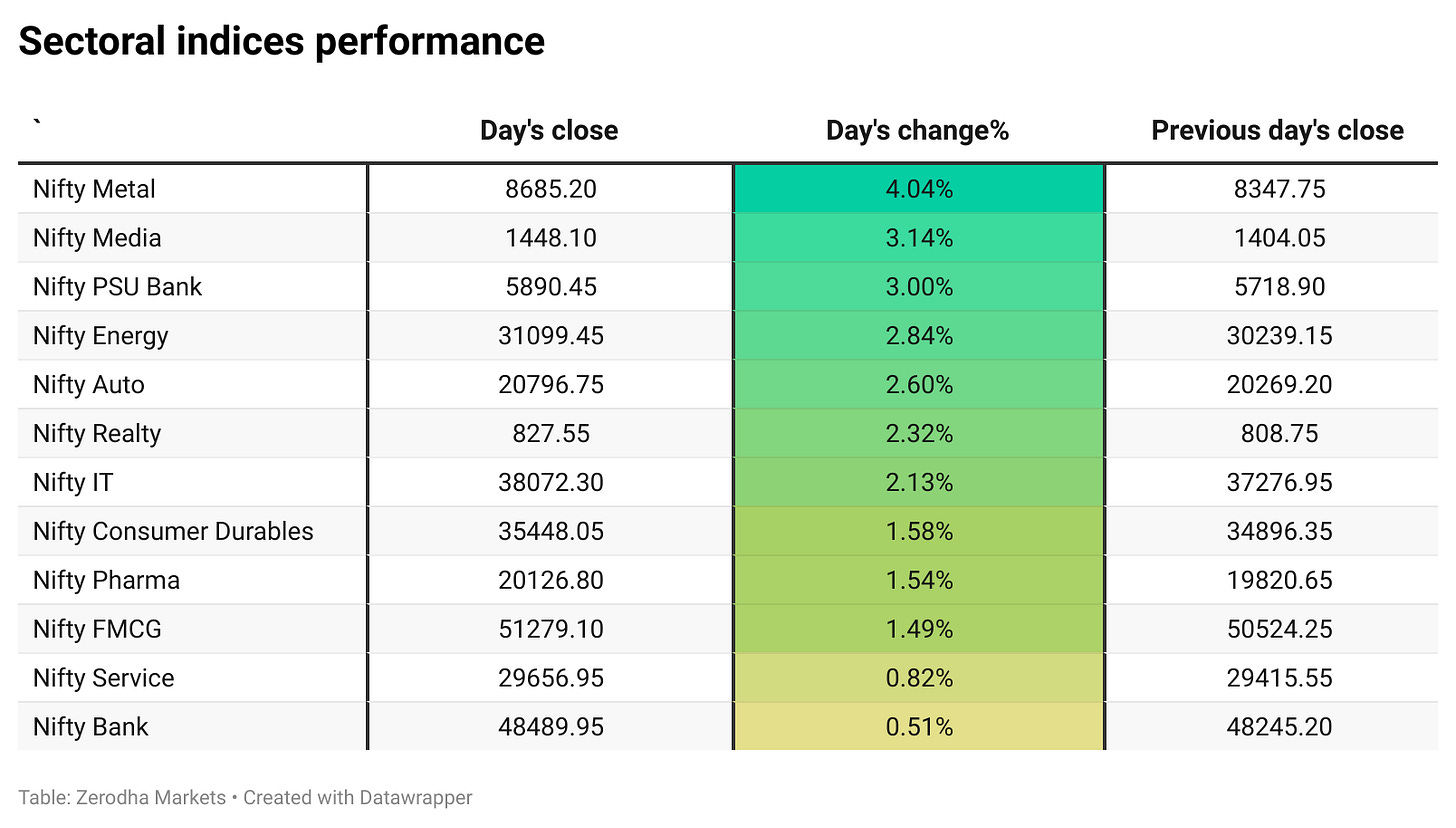

Sectoral Performance:

Sectoral indices witnessed strong gains today, with Nifty Metal leading the pack after rising 4.04%. On the other end, Nifty Bank was the least performer, inching up by 0.51%. Notably, it was a completely positive day across the board, as all 12 sectors closed in the green, with none ending in the red.

Note: The above numbers for Commodity futures were taken around 4 pm. NSE has not yet released the FII-DII data for the yet.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 6th March:

The maximum Call Open Interest (OI) is observed at 22,500, followed by 22,600, indicating strong resistance at these levels. First strong resistance levels shall most likely be at 22,500, followed by 22,600.

The maximum Put Open Interest (OI) is at 22,000, followed by 22,100, suggesting potential support at 22,100, with additional support at 22,000.

Note: OI is subject to multiple interpretations, but generally, an increase in the call OI indicates resistance in a falling market, and an increase in the put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

The Indian rupee strengthened today, posting its best single-day gain since February 11, as a weaker U.S. dollar lifted most Asian currencies. The dollar slipped on worries over a U.S. economic slowdown and the impact of trade tariffs, while crude oil holding near $70 per barrel provided relief to importers like India. Supported by these global cues, the rupee ended 0.3% higher at 86.9550 against the U.S. dollar. Dive deeper

Gensol Engineering slumped 10% on Wednesday, hitting a 52-week low of ₹372.60, extending their sharp decline after falling 20% in the previous session. The stock has now dropped 28% over just two days, weighed down by CARE Ratings' downgrade of the company's long-term and short-term bank facilities following delays in repaying its term loan obligations. Dive deeper

BSE Ltd. dropped over 9% on Wednesday to a four-month low before paring losses to end 3.6% lower. The decline came after the National Stock Exchange announced that from April 4, the monthly and quarterly expiry of key futures and options contracts, including Nifty and Bank Nifty, will shift to the last Monday of the expiry month. Dive deeper

Wipro launched TelcoAI360, an AI-first Managed Services platform for telcos, enhancing automation and security while reducing costs and accelerating product rollouts. Dive deeper

Zydus Lifesciences received USFDA approval to manufacture Dasatinib Tablets. This product treats specific leukemia types, with 2025 US sales of $1807.7mn. Dive deeper

Coforge approved a 5:1 share split and announced acquisitions of Rythmos Inc. and TMLabs Pty Ltd through subsidiaries, pending conditions. These strategic actions aim to enhance market presence and drive future growth. Dive deeper

Galaxy Surfactants Ltd announced on Wednesday (March 5) that it has entered into a strategic collaboration with a global customer through its group companies. Under the partnership, Galaxy will provide engineering, procurement, and construction (EPC) services for setting up a performance surfactants and specialty ingredients manufacturing plant at an overseas location. Dive deeper

Bharat Electronics Ltd (BEL) shares closed higher by 3.64% after the company declared an interim dividend of ₹1.50 per equity share for the financial year 2024-25. Dive deeper

What’s happening globally

Copper futures jumped over 5% to above $4.76 per pound on Wednesday, hitting a nine-month high after US President Trump announced tariffs on copper imports during his address to Congress. This move contradicted earlier statements suggesting that any decision on copper tariffs was still under review by the Department of Commerce. Dive deeper

China has set its 2025 economic growth target at "around 5%", aiming to stabilize its economy amid a property crisis and weak demand. To support growth, the government raised its budget deficit target to 4% of GDP and plans to issue 1.3 trillion yuan in special bonds, while also boosting defense spending by 7.2% amid rising U.S. trade tensions. Dive deeper

The dollar index fell 0.8% to a four-month low of 104.8 on Wednesday amid growing concerns over the economic impact of new US tariffs. Fresh duties on imports from Canada, Mexico, and China triggered retaliatory measures, fueling fears of a deeper trade war. Early signs of strain are already visible, with the latest ISM Manufacturing data showing slowing activity and rising costs. Dive deeper

Germany's coalition negotiators have agreed to establish a €500 billion infrastructure fund and revise borrowing rules to boost the military and support economic growth. The plan marks a major shift in spending strategy. The proposals are set to be presented to parliament next week. Dive deeper

French plane maker Dassault Aviation reported higher full-year sales on Wednesday, driven by rising defense spending amid growing global tensions, particularly in Europe, following the conflict in Ukraine. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Bjorn Gulden, CEO, Adidas on Trade War

“If there are 25% duties coming and it is on more countries, inflation will go up and volumes will go down. We know that, but how much? I mean, we can give you a number, but the only thing we know is we will have to adjust very, very quickly." - Link

Hemant Sikka, President of M&M’s Farm Equipment Sector on Tractor industry momentum

The agriculture industry, especially the tractor industry, has been on a roll this year. We are very happy with the way the industry has grown. We are looking at a very strong quarter four. February was a very good month for the industry, which grew by 13.6%. At Mahindra, we have outperformed the industry significantly by growing 19%. So we have gained some good market share.

We are expecting this momentum to continue into quarter four, for which our guidance stays at 15%. Since we are gaining market share, our growth will be of obviously better than the industry number. - Link

JP Chalasani, CEO of Suzlon Energy, on the company’s prospects and India’s goal of 100 GW wind energy by 2030

“When we look at the Indian market, for us it looks great. We have increased our manufacturing capacity to 4.5 GW, which we can further increase. Our aim should not be the market share but can we deliver 80% to 90% of our manufacturing capacity,”

India’s goal of 100 GW wind energy by 2030 requires a run rate of 10 GW per year, but current progress suggests reaching 7 GW per year in the coming years. - Link

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

FII data?