Day of consolidation in markets after recent volatility

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

After a challenging day for the markets yesterday, the Nifty opened 63 points higher at 23,679.90 but quickly reversed, dropping 140 points to hit the day’s low of 23,637.80 within the first hour. However, the market rebounded sharply, recovering 100 points to test the 23,750 level.

From 10:30 AM onwards, the Nifty traded within a narrow 70-point range, fluctuating between 23,760 and 23,690. It eventually closed at 23,707.90, up 0.38% for the day.

As concerns about the HMPV outbreak ease slightly, the focus now shifts to the upcoming earnings season, set to begin on January 9, which is likely to influence market movements.

Broader Market Performance:

Broader markets outperformed the headline indices, with 2,076 stocks advancing, 751 declining, and 72 remaining unchanged.

Sectoral Performance:

The sectoral performance showed a positive trend, with all sectors closing in the green except for IT and Services. Nifty Media, Energy, and Metal led the gains, each rising over 1.2%, while the IT sector lagged, ending the day down by 0.68%.

Note: The above numbers for Commodity futures were taken around 4 pm.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 9th January:

The maximum Call Open Interest (OI) is observed at 24,000, followed by 24,200. Meanwhile, the maximum Put Open Interest (OI) is at 23,200, followed by 23,500.

Immediate support is identified in the 23,500–23,300 range, while resistance is expected between 24,000 and 24,200.

Note: OI is subject to multiple interpretations but generally, in a falling market if there is an increase in the call OI, it indicates resistance, and in a rising market, if there is an increase in the put OI, it indicates support.

Source: Sensibull

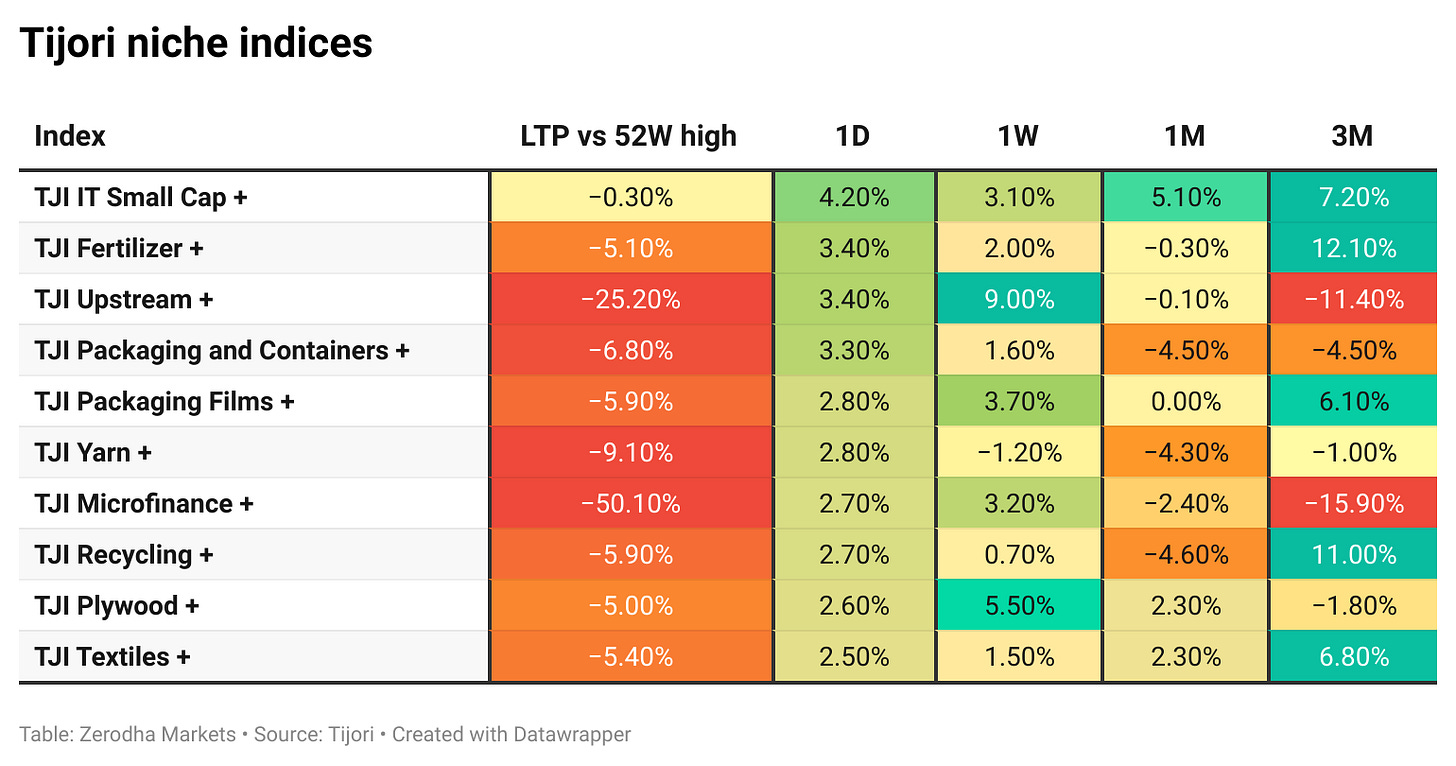

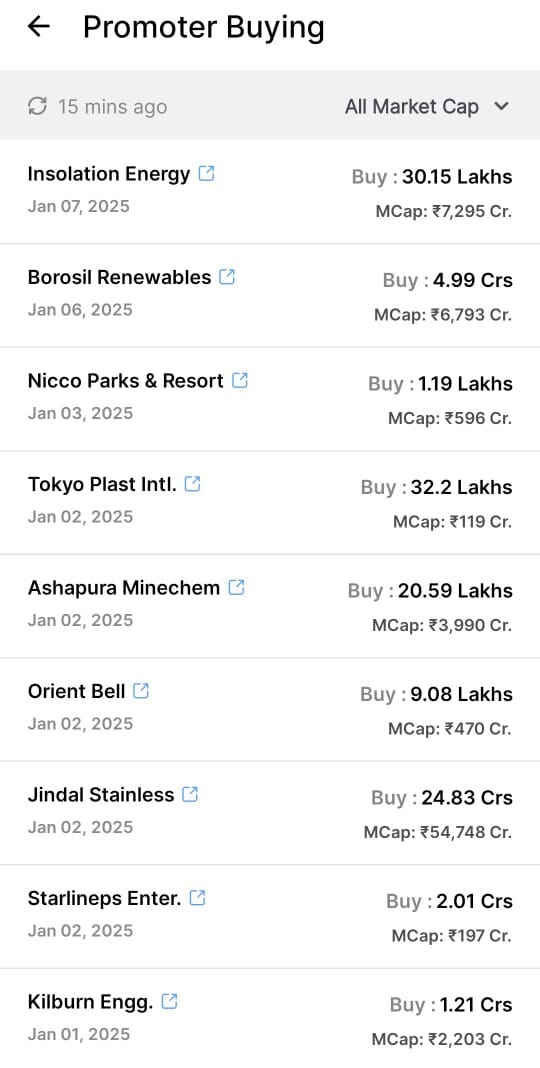

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

India’s GDP growth is projected to slow to a four-year low of 6.4% in 2024-25, down from 8.2% in the previous year. Key sectors like manufacturing, mining, and construction are expected to show slower growth, while agriculture and public administration are expected to improve. Private consumption is set to rise by 7.3%, with the economy facing challenges due to high interest rates and lower fiscal stimulus. Dive deeper

Tata Elxsi and CSIR-National Aerospace Laboratories (CSIR-NAL) have signed an MoU to collaborate on advanced air mobility, focusing on UAVs, UAM, and eVTOLs. The partnership combines NAL’s aerospace expertise with Tata Elxsi’s tech capabilities to accelerate product development and support global markets. This initiative will drive innovation and strengthen India’s air mobility ecosystem. Dive deeper

Tata Technologies partners with Telechips to enhance automotive semiconductor solutions, focusing on software-defined vehicles. Dive deeper

Zydus Lifesciences Limited announced that the U.S. FDA has accepted for priority review the New Drug Application for Sentynl Therapeutics' CUTX-101, aimed at treating Menkes disease. This potential first FDA-approved therapy for the rare, fatal pediatric condition has shown significant survival benefits in trials. The FDA’s decision is due by June 30, 2025. Dive deeper

Larsen & Toubro's Power Transmission & Distribution (PT&D) business has secured new orders in India and the Middle East. These include a smart power distribution system project in West Bengal, a 380kV substation in Saudi Arabia, a 400kV substation project in Kuwait, and EHV substations in Dubai. Dive deeper

Birlasoft Limited has been appointed to the UK Government's G-Cloud 14 Procurement Framework, enhancing its role in public sector digital transformation. As an approved supplier, Birlasoft will offer specialized cloud support and testing services aimed at modernizing government operations. Dive deeper

Shakti Pumps (India) Limited has announced plans to raise up to Rs. 400 crores through qualified institutional placements (QIP), as approved in the Board meeting held on January 7, 2025. The fund-raising, subject to shareholder and regulatory approvals, aims to bolster the company's financial position for strategic expansions. Dive deeper

Biocon Biologics celebrates its first anniversary as a global biosimilar enterprise, now operating in over 120 countries. The company has achieved significant milestones, including surpassing $1 billion in revenue and launching over 60 products globally. Dive deeper

Mahindra & Mahindra Ltd. increased its production capacity by 20% in December 2024, reaching 53,361 units to meet rising demand. SUVs accounted for two-thirds of this output, supporting a 24% year-on-year growth in dealer dispatches. Dive deeper

SEBI has revised settlement norms for inactive brokerage accounts, allowing settlements to align with scheduled monthly or quarterly dates if trading occurs after 30 days of inactivity. This change aims to reduce procedural inefficiencies and is effective immediately, following recommendations from the Brokers’ Industry Standards Forum (ISF). Dive deeper

NTPC will integrate bamboo with coal at its Solapur Thermal Power Station in Maharashtra, initiating India's first biomass-based thermal project. This move aims to enhance clean energy production and support local bamboo farmers with secure purchasing commitments. Dive deeper

MobiKwik's Q2FY25 Payment GMV was up 267.3% YoY with strong financial performance. Net loss at INR 35.94 Million due to investments. Dive deeper

India's car industry enters 2025 with nearly two months of unsold inventory, as retail sales via VAHAN registrations reached 40.74 lakh units in 2024, compared to 42.86 lakh dispatched to dealerships. This reflects subdued demand, with inventory levels equating to approximately 5.5 lakh unsold cars worth ₹55,000 crore. Dive deeper

Paras Defence shares surged 10% after securing a lifetime license from the Department for Promotion of Industry & Internal Trade (DPIIT) to manufacture MK-46 and MK-48 Light Machine Guns with an annual capacity of 6,000 units each. This strengthens the company's defence manufacturing portfolio, with its order book now exceeding ₹850 crore. Dive deeper

Wockhardt expects ₹400 crore in revenue from its pneumonia antibiotic Miqnaf over the next two to three years. The drug, approved for community-acquired bacterial pneumonia, will launch in FY26 with an initial revenue target of ₹70-80 crore. Dive deeper

Vodafone Idea is preparing for a phased 5G rollout, with 46,000 new sites added in 2024 to enhance connectivity. By March 2025, thousands of additional sites will improve the network experience. The company is partnering with Ericsson, Nokia, and Samsung on a three-year investment plan and has improved indoor coverage. Dive deeper

Happy Forgings approves Rs. 650 crore investment to expand into heavyweight components, targeting non-automotive industrial segments, and enhancing forging capabilities with a new Asian facility. Dive deeper

What’s happening globally

Microsoft CEO Satya Nadella announced a $3 billion investment to expand AI and cloud infrastructure in India, aiming to train 10 million people in AI by 2030 and support the country's development goals. Dive deeper

Euro Area inflation rose to 2.4% in December 2024, driven by higher energy prices and rising service costs. Inflation increased in Germany, France, and Spain but eased in Italy, while core inflation remained steady at 2.7%. The ECB expects inflation to return to its 2% target by year-end. Dive deeper

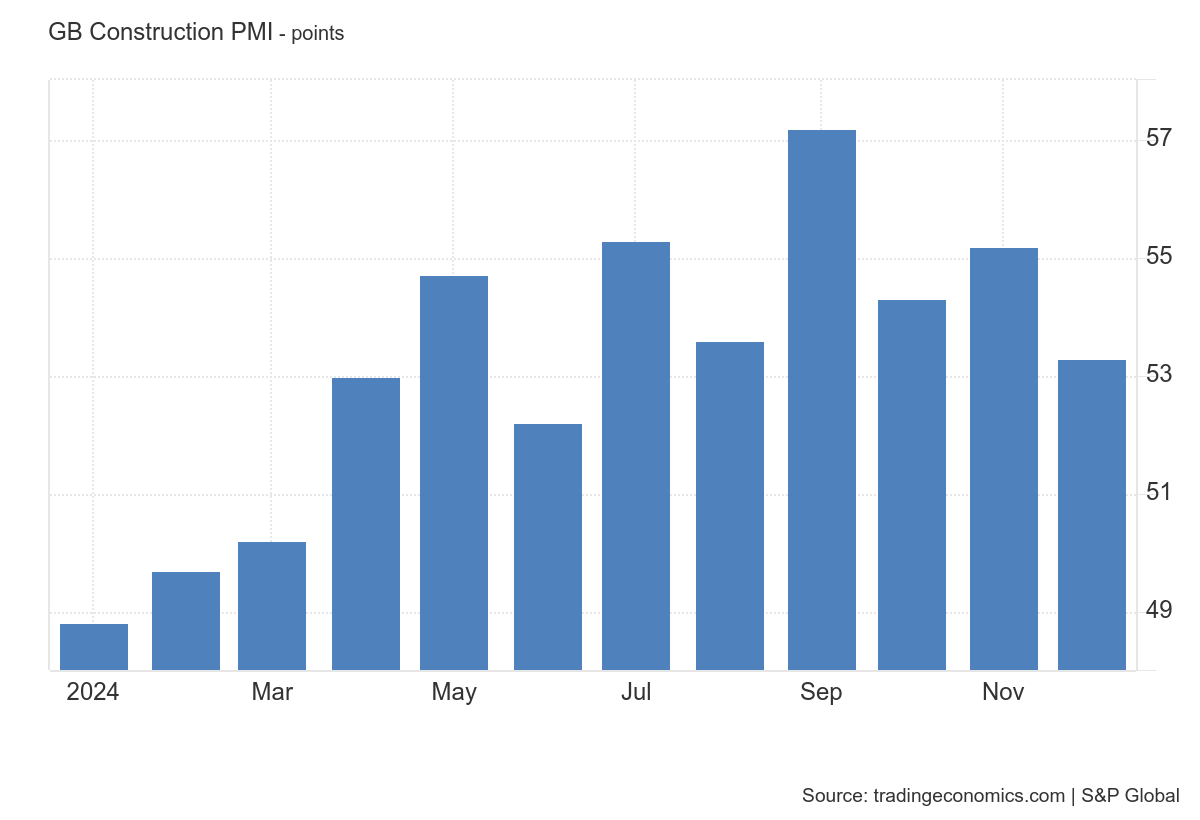

The S&P Global UK Construction PMI fell to 53.3 in December 2024, reflecting slower growth due to weaker demand, high borrowing costs, and subdued confidence. While commercial and civil engineering sectors expanded, residential construction contracted sharply. Optimism for 2025 remains cautious amid economic concerns. Dive deeper

Italy's unemployment rate fell to 5.7% in November 2024, the lowest since records began in 1983, beating market expectations of 6%. The number of unemployed dropped to 1.46 million, while labour force participation remained steady at 66.3%. Dive deeper

China's foreign exchange reserves fell to $3.2 trillion in December 2024, the lowest in eight months, amid a stronger US dollar and a 1.2% yuan depreciation. Gold reserves rose slightly to 73.29 million troy ounces, but their value dropped to $191.34 billion due to falling gold prices. Dive deeper

France's annual inflation rate held steady at 1.3% in December 2024, below expectations. Energy prices rebounded, but food prices stalled, with overall consumer prices rising 0.2% month-on-month. Dive deeper

Japan's Prime Minister Shigeru Ishiba expressed concerns that President Biden's decision to block Nippon Steel's $14.9 billion takeover of U.S. Steel over national security could deter future Japanese investments in the U.S. Dive deeper

Jaguar Land Rover (JLR) UK sales increased by 15% in 2024, reaching 77,907 vehicles, with Jaguar sales up 16.7% and Land Rover sales increasing by 14.8%. Despite this annual growth, December saw a significant decline of 28.2% in sales. Dive deeper

Nippon Steel and US Steel are legally contesting President Biden's decision to block their merger, citing national security concerns. They've initiated lawsuits in U.S. courts, arguing that the merger would actually strengthen, not compromise, U.S. national security. Dive deeper

U.S. companies are accelerating their bond issuance, with 22 companies launching new bonds this week, aiming to raise nearly $65 billion. This surge is in response to expected increases in Treasury yields, following a year of robust borrowing in 2024 where firms raised $1.52 trillion. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Satya Nadella, Chief Executive Officer, Microsoft

“I am really excited to announce the single largest expansion we have ever done in India by putting $3 billion dollars to expand our Azure capacity,” - Link

Harsha Upadhyaya, Fund Manager, Kotak AMC

Agriculture production in the last quarter is very strong

The consumption basket has changed

Rural consumption will pick up in the next 2-4 quarters

Govt capex is picking up

We will continue to hold in discretionary consumption

The market is not expecting Q3 and Q4 earnings to be strong

Current valuations are not different in the FMCG sector from 5-year average valuations - Link

Calendars

In the coming days, we have the following major events and corporate actions:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.