Decent earnings over the weekend keep markets afloat

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

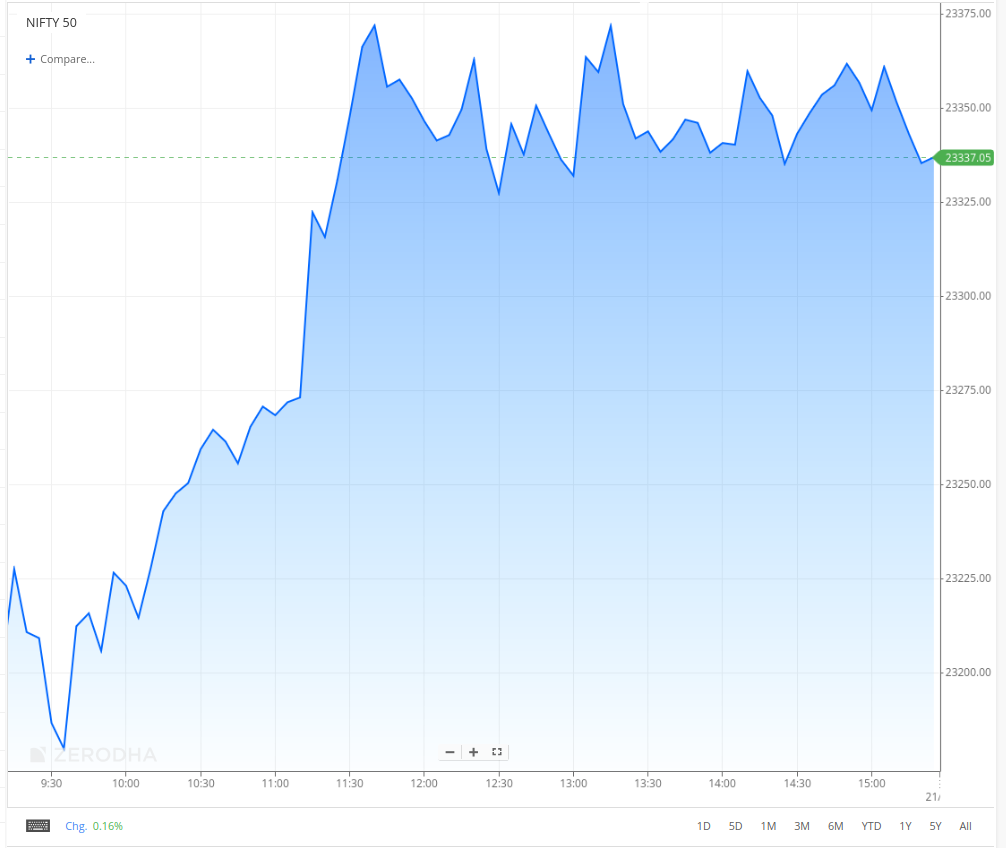

The Nifty opened 87 points higher at 23,290.40, driven by positive earnings from heavyweights Kotak Mahindra Bank and Wipro. However, the index quickly lost momentum as overall market sentiment remained weak. It hit the day’s low at 23,170.65 before starting to recover around 11:30 AM. The Nifty then gained further strength, reaching the day’s high of 23,391.10.

In the second half, the market traded within a narrow 40-point range between 23,330 and 23,370. Ultimately, the Nifty closed at 23,344.75, marking a gain of 0.61%.

Despite this recovery, macroeconomic concerns continue to weigh on market sentiment, keeping the outlook cautious. Moving forward, market trends are expected to be influenced by global economic developments and earnings reports from key index heavyweights. Investors remain focused on signs of stabilization that could help ease ongoing selling pressure.

Broader Market Performance:

The broader market closed on a positive note, reflected in a healthier advance-to-decline ratio. On the NSE, 1,809 stocks advanced, 1,053 declined, and 87 remained unchanged.

Sectoral Performance:

The overall sectoral performance showed positive momentum, with ten sectors closing in the green and two in the red. Nifty PSU Banks led the gains, climbing 1.99%, while Nifty Auto was the biggest laggard, slipping 0.52%.

Note: The above numbers for Commodity futures were taken around 4 pm.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 23rd January:

The maximum Call Open Interest (OI) is observed at 23,600, followed by 23,500. Meanwhile, the maximum Put Open Interest (OI) is at 23,000, followed by 23,200.

Immediate support is identified in the 23,000–22,900 range, while resistance is expected between 23,400 and 23,550.

Note: OI is subject to multiple interpretations but generally, in a falling market if there is an increase in the call OI, it indicates resistance, and in a rising market, if there is an increase in the put OI, it indicates support.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

The Indian rupee hovered near its record low of 86.6 per USD in January amid slowing economic growth and expectations of RBI rate cuts. Lower inflation and GDP growth fueled capital outflows, adding pressure on the currency. Dive deeper

Laxmi Dental shares made a strong debut on the NSE, opening at ₹542 per share. The stock surged by as much as 7.7% during the day, reaching an intraday high of ₹584, before settling at ₹550.55, reflecting a gain of 28.63%. Dive deeper

Tata Consultancy Services (TCS) has inaugurated a new delivery center in Toulouse, France, to support AI-driven transformation in the aerospace and defence industries. This is TCS’ fourth centre in France, aimed at enhancing aircraft design, manufacturing, and maintenance processes. Dive deeper

TVS Motor Company has introduced the TVS King EV MAX, a Bluetooth-connected electric three-wheeler featuring smart connectivity and a range of 179 km. Initially available in select states, it aims to enhance sustainable urban mobility. Dive deeper

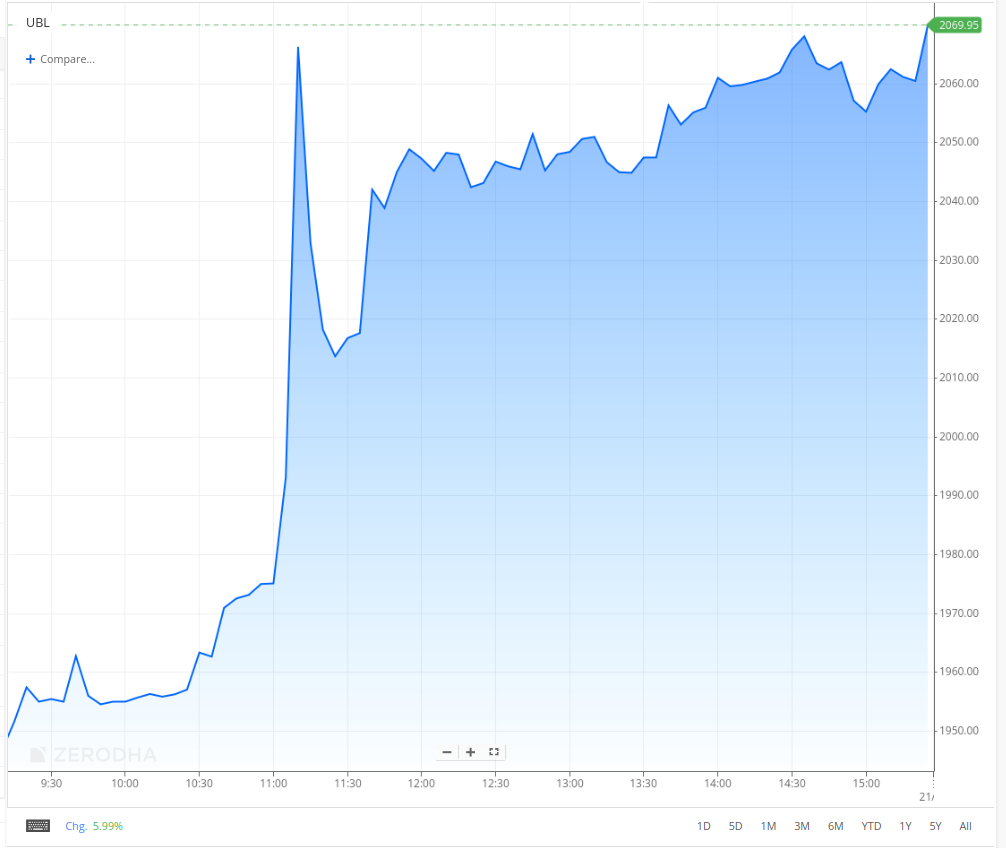

United Breweries has resumed beer supply to Telangana Beverages Corporation Ltd. after receiving assurances on pricing and outstanding payments. The decision, taken in the interest of consumers and stakeholders, follows constructive discussions with Telangana State Beverages Corporation Limited. Dive deeper

Akasa Air CEO Vinay Dube attributed pilot underutilization to Boeing’s aircraft delivery delays, with the remaining pilots expected to start flying by end-2025. Despite challenges, the airline remains financially strong and committed to its long-term strategy. Dive deeper

Mangalore Refinery and Petrochemicals Limited (MRPL) has approved the acquisition of additional equity shares in Mangalore SEZ Limited (MSEZ), increasing its stake to 27.92%. The board also reviewed and approved the standalone and consolidated unaudited financial results for the third quarter of FY2024. Dive deeper

IREDA announced a board meeting on January 23, 2025, to consider fund-raising via QIP. Dive deeper

Coromandel International has launched a Soil and Leaf Testing Laboratory in Kakinada to provide farmers with precise nutrient analysis, supporting sustainable farming through advanced technology and digital solutions. Dive deeper

Cyient has expanded its partnership with Deutsche Aircraft through a multi-year contract to manage technical documentation for the D328eco regional turboprop. This collaboration supports Deutsche Aircraft’s global operations and aligns with the “Make in India” initiative, reinforcing Cyient’s role in the aerospace sector. Dive deeper

Nazara Technologies' Board approved a preferential allotment of up to 50,00,000 equity shares, an increase in investment limits, and the acquisition of gaming IPs from Zeptolab UK. An Extraordinary General Meeting (EGM) is scheduled for February 13, 2025, to seek necessary approvals. Dive deeper

Bharti Airtel and Bajaj Finance have partnered to enhance digital financial services, combining Airtel's reach with Bajaj Finance’s product offerings. Initially, select financial products will be available on the Airtel Thanks App, with plans for further expansion. The partnership aims to improve access to financial services while ensuring regulatory compliance and data security. Dive deeper

PurFi Global and Arvind Manufacturing plan a textile circularity facility in Gujarat to support H&M Group’s sustainability goals by converting textile waste into reusable fibres. Dive deeper

Zydus Lifesciences has received USFDA approval to conduct a Phase II(b) clinical trial for Usnoflast, an oral NLRP3 inflammasome inhibitor, in ALS patients. The company aims to advance neuroscience and develop transformative treatments. Dive deeper

Motilal Oswal Asset Management Company has denied social media allegations, calling them baseless and aimed at tarnishing its reputation. The company reaffirmed its commitment to ethical practices, regulatory compliance, and investor trust, assuring stakeholders that operations remain unaffected. Dive deeper

Hyundai Motor Company and TVS Motor Company unveiled the concept of electric three-wheelers and micro four-wheelers at Bharat Mobility Global Expo 2025. The partnership aims to explore sustainable last-mile mobility solutions, with Hyundai providing design and technology while TVS focuses on manufacturing and marketing. Dive deeper

A World Economic Forum (WEF) report recognizes India as a fast-growing economy and a global startup hub. C4IR India, launched in 2018, has improved 1.25 million lives and aims to reach 10 million through AI, climate tech, and space initiatives. Dive deeper

What’s happening globally

Donald Trump begins his second term as US president today amid market shifts and geopolitical developments. Dive deeper

The dollar weakened amid anticipation of Trump's policy plans and potential Fed rate cuts, with the biggest declines against the New Zealand and Australian dollars. Trading was subdued due to the US holiday. Dive deeper

Brent crude oil futures eased to around $80.5 per barrel amid speculation over potential changes in U.S. sanctions on Russian oil under the incoming Trump administration. Dive deeper

Japan's core machinery orders rose 3.4% month-on-month to 899.6 billion yen in November 2024, surpassing expectations. Manufacturing orders increased by 6%, while non-manufacturing rose by 1.1%, with notable growth in chemicals and information services. Annually, orders climbed 10.3%, up from 5.6% in October. Dive deeper

British companies are increasing share buybacks, with FTSE 100 firms committing £56.9bn in 2024, outpacing US counterparts. Buybacks are preferred for flexibility and tax efficiency, though concerns remain about their impact on long-term investment. Dive deeper

Citigroup faces a €59mn lawsuit from UK-based Alcimos, alleging misleading advice on investor interest for its 2018 IPO, leading to financial losses. Citi denies the claims, stating investor appetite was insufficient. The case adds to Citi’s recent regulatory challenges. Dive deeper

Euro Area construction output rose 1.4% year-on-year in November 2024, rebounding after a stall in October. Growth was driven by building construction (1.6%), specialized activities (0.9%), and civil engineering (4.5%). Italy and Spain saw gains, while France and Germany posted declines. Monthly, output increased by 1.3%. Dive deeper

Germany's producer prices rose 0.8% year-on-year in December 2024, driven by higher capital and consumer goods prices, while energy costs declined. Excluding energy, prices increased by 1.2%. On a monthly basis, PPI fell 0.1%. Dive deeper

Malaysia's exports rose 16.9% year-on-year to MYR 138.5 billion in December 2024, the highest in 27 months, driven by strong demand for manufacturing and agricultural products. Exports to key markets like Singapore, China, and the US increased, while shipments to Japan and Mexico declined. Dive deeper

The Japanese yen strengthened past 156 per dollar, driven by expectations of a potential Bank of Japan rate hike and government support. Strong inflation and wage data, along with better-than-expected machinery orders, further boosted the currency. A weaker US dollar ahead of Donald Trump’s inauguration also supported the yen. Dive deeper

Quarterly results

In this section, we'll dive into all the key highlights from today's intriguing results, covering the most impactful performances and standout moments. The numbers are comparable on a year-on-year (YoY) basis.

Zomato (ZOMATO) (-3.64%) :

Financials:

Net Profit: ₹59 Cr vs ₹76 Cr loss, up 8.2% YoY.

Revenue: ₹5,405 Cr vs ₹3,288 Cr up 18.5% YoY.

EPS: ₹0.56 vs ₹0.45 up 5.6% YoY.

Other Comprehensive Income: ₹119 Cr up 4.3% YoY.

Key Highlights:

The company successfully raised ₹8,500 crore through a Qualified Institutional Placement (QIP).

Acquiring Orbgen Technologies and Wasteland Entertainment for ₹2,014 Cr.

The company is facing disputed GST demands from Maharashtra and West Bengal.

Outlook:

The company remains positive, driven by Blinkit's rapid expansion and strong growth in the food delivery segment, despite ongoing challenges in quick commerce.

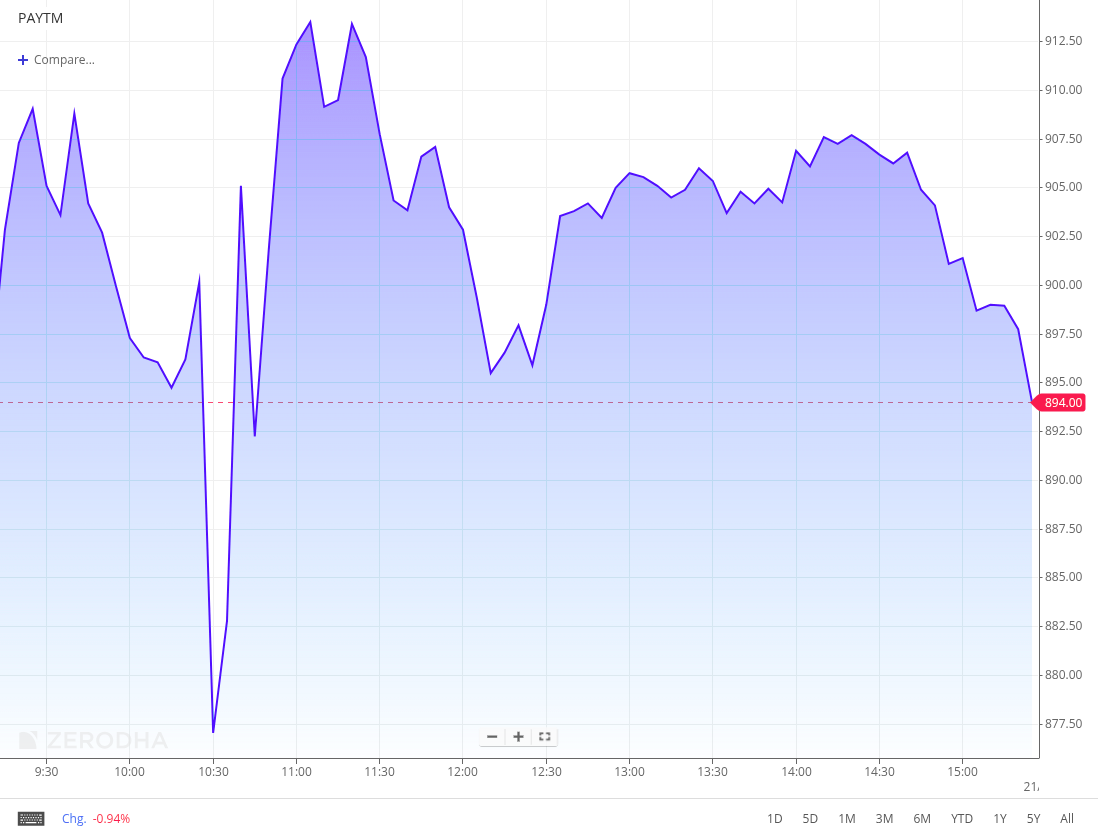

One 97 Communications Limited’s (Paytm) (-0.27%)

Financials:

Revenue: ₹2,062 crore, a 42% increase YoY from ₹1,456 crore.

EBITDA: ₹31 crore, compared to an EBITDA loss of ₹(393) crore in Q3 FY24.

EBITDA Margin: 1.5%, an improvement from -27% in the same period last year.

Net Profit (PAT): ₹(392) crore, a 50% reduction in loss YoY from ₹(778) crore.

Earnings Per Share (EPS): ₹(5.9), improved from ₹(12.1) in Q3 FY24.

Key Highlights:

Total loans disbursed grew by 137% YoY to ₹9,958 crore.

Gross Merchandise Value processed through the platform increased by 38% YoY to ₹3.46 lakh crore.

The number of merchants using Paytm’s services expanded to 3.5 crore, up from 2.8 crore in the previous year.

Outlook: Paytm continues to focus on expanding its financial services offerings and enhancing profitability through increased operational efficiencies.

Kotak Mahindra Bank Limited (KOTAKBANK) (9.21%)

Financials:

Revenue from Operations: ₹23,945.79 Crore, a 0.9% YoY increase from ₹24,083.15 Crore.

Interest Earned: ₹16,633.14 Crore, a 14.75% increase YoY from ₹14,494.96 Crore.

Net Profit: ₹4,701.02 Crore, a 10.23% YoY increase from ₹4,264.78 Crore.

Total Comprehensive Income: ₹5,043.5 Crore, up 8.44% YoY from ₹4,653.1 Crore.

Earnings Per Share (EPS): ₹23.64 (Basic), ₹23.64 (Diluted), up from ₹21.46 YoY.

Key Highlights:

Operating profit increased to ₹7,234.25 Crore, up from ₹6,275.59 Crore YoY.

The capital adequacy ratio (Basel III) stood at 22.79%.

Gross NPA rose to ₹7,218.17 Crore, or 1.51% of gross advances, up from 1.48% in the previous quarter.

Net NPA stood at ₹2,070.42 Crore, or 0.44% of net advances.

Total assets increased to ₹817,823.72 Crore, up from ₹703,089.35 Crore YoY.

Retail banking segment revenue reached ₹8,842.99 Crore, driven by growth in both digital and traditional banking activities.

Corporate/wholesale banking revenue totaled ₹6,090.04 Crore.

Outlook:

The bank anticipates continued growth through its diversified banking segments, supported by a strong capital position and strategic focus on retail and corporate banking.

Indian Railway Finance Corporation Limited’s (IRFC) (0.35%)

Financials:

Revenue from Operations: ₹6,763.43 crore, up 0.40% YoY from ₹6,736.57 crore.

Net Profit: ₹1,630.66 crore, up 2.00% YoY from ₹1,598.93 crore.

Total Comprehensive Income: ₹1,627.62 crore, up 1.37% YoY from ₹1,605.56 crore.

EPS: ₹1.25, up 2.46% YoY from ₹1.22.

Key Highlights:

Total cumulative funding to Indian Railways reached ₹4.5 lakh crore, supporting various infrastructure projects.

Maintained a zero Non-Performing Assets (NPA) status, reflecting strong financial discipline.

Stood at 18%, well above the regulatory requirement, indicating robust financial health.

Outlook:

IRFC plans to continue its support for Indian Railways’ expansion plans, focusing on sustainable financing and maintaining strong asset quality.

IDBI Bank (2.54%)

Financials:

Revenue: ₹4,228 crore, a growth of 23% YoY from ₹3,435 crore.

Operating Profit: ₹2,802 crore, up 20% YoY from ₹2,327 crore.

Net Profit (PAT): ₹1,908 crore, a 31% increase YoY from ₹1,458 crore.

Earnings Per Share (EPS): ₹1.77, up 30% YoY from ₹1.36.

Key Highlights:

Operating Profit rose 20% YoY to ₹2,802 crore.

Net Interest Income grew 23% YoY to ₹4,228 crore.

Cost to Income Ratio improved to 43.71%, down from 47.22% YoY.

The gross NPA ratio improved to 3.57%, down from 4.69% YoY.

Provision Coverage Ratio (PCR) increased to 99.47%.

Outlook: The bank anticipates steady growth with a focus on expanding its deposit base, improving asset quality, and maintaining strong capital adequacy while leveraging digital innovations to strengthen its position in the market.

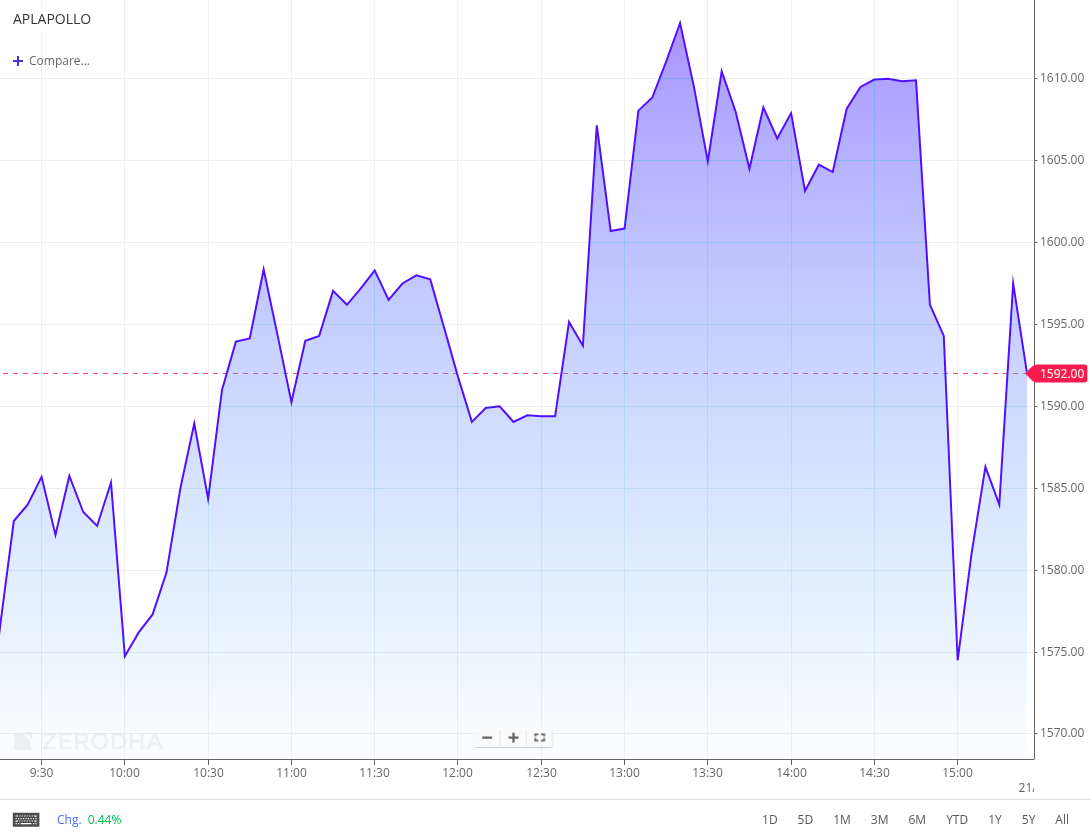

APL Apollo Tubes Limited (APLAPOLLO) (1.27%)

Financials:

Revenue from Operations: ₹5,432.73 crore, up 30.7% YoY from ₹4,177.76 crore.

Operating Profit: ₹280.10 crore, up 28.0% YoY from ₹218.99 crore.

Net Profit (PAT): ₹316.57 crore, up 91.0% YoY from ₹165.51 crore.

Earnings Per Share (EPS): ₹7.82, up 30.0% YoY from ₹5.97.

Key Highlights:

Revenue from the sale of products increased 30.6% YoY to ₹5,267.02 crore.

Total revenue from operations increased by 30.7% YoY to ₹5,432.73 crore.

EBITDA margin stood at 19.96%, a decrease of 7.13% YoY.

Net Profit surged 91% YoY to ₹316.57 crore.

Provision for taxation rose to ₹313 crore, up 17.7% YoY.

Other comprehensive income included a decrease in equity instruments by ₹23.49 crore.

Outlook: The company expects sustained growth with an emphasis on operational efficiency and continuing expansion in the domestic and international markets.

ICICI Securities Limited (ISEC) (0.57%)

Financials:

Revenue from Operations: ₹158.56 Crore, up 19.92% YoY from ₹132.24 Crore.

Net Profit (after tax): ₹50.34 Crore, up 8.23% YoY from ₹46.51 Crore.

Total Comprehensive Income: ₹50.44 Crore, up 8.44% YoY from ₹46.53 Crore.

Earnings Per Share (EPS): ₹15.50, up 7.68% YoY from ₹14.39.

Key Highlights:

Revenue from Brokerage & Distribution stood at ₹140.08 Crore, contributing significantly to the overall performance.

Total assets reached ₹3,251.85 Crore, showcasing strong asset management and financial growth.

The capital employed was ₹501.83 Crore, highlighting the effective utilization of capital in operations.

Outlook:

ICICI Securities expects continued growth across its key segments, particularly in brokerage and advisory services, while focusing on capital efficiency.

RBL Bank (RBL) (2.29%)

Financials:

Interest Earned: ₹3,536.33 Crore, up 10.91% YoY

Other Income: ₹1,073.33 Crore, up 37.93% YoY

Total Income: ₹4,609.66 Crore, up 16.14% YoY

Interest Expended: ₹1,951.27 Crore, up 18.87% YoY

Operating Expenses: ₹1,661.76 Crore, up 6.65% YoY

Net Profit: ₹32.63 Crore, down 86.08% YoY

EPS: ₹0.54 (Basic), down 85.07% YoY from ₹3.67.

Key Highlights:

The Capital Adequacy Ratio stands at 14.86%, reflecting a decrease from 15.66% in the previous year.

The Gross NPA is ₹2,701 Crore, which accounts for 2.92% of advances. The Net NPA is ₹481.64 Crore, representing 0.53% of advances.

The personal loan portfolio of ₹184.37 Crore was securitised in Q3 FY25.

Outlook:

The bank is focused on enhancing profitability and managing non-performing assets while continuing to leverage growth in its core banking segments.

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Akshant Goyal, CFO, Zomato on Blinkit

"As we continue to bring forward store expansion, our networks may have to carry a greater load of under-utilized stores which will impact near-term profits in the next one or two quarters...Once we come out from this period of expansion, the business is likely to turn sharply from being loss-making to becoming meaningfully profitable," - Link

Aman Desai, Promoter And Whole Time Director – Aether Industries Ltd.

The pharma and the agro continue to be interesting, especially with the work that we are doing with the CRAMS players, especially in the agro-business for the new chemical entities and the innovators. In the pharma world, in the generics advanced incomes worn for large skin manufacturing.

The demand is solidly in place. And as Rohan mentioned in his script, as the Chinese New Year ends and the industry sales over again, we anticipate an increased pricing trend to happen as well, which will be beneficial for us. And especially in the non-pharma non-agro world of material sciences, in oil and gas, which is very interesting.

And as I've mentioned, we have numerous projects, including new projects that have kicked in, in the CRAMS model, which we anticipate translating into the contract and exclusive manufacturing business model in the very near future. And so I think we are very upbeat much more so on the material science, the oil and gas, and the sustainability of the business segments that we have in terms of manufacturing potential and possibilities for new projects. - Link

Santosh Iyer, CEO, Mercerdes India

Enquiry levels of top-end cars have gone up.

Targeting for another best-ever year in 2025 in terms of sales.

Brand desirability is at an all-time high.

Discounts are at an all-time low in January.

EV is still not as profitable as ICE variants.

5% of cars are through the direct import channel, which gets impacted by currency fluctuation first.

2000 customers are currently waiting in the order book. - Link

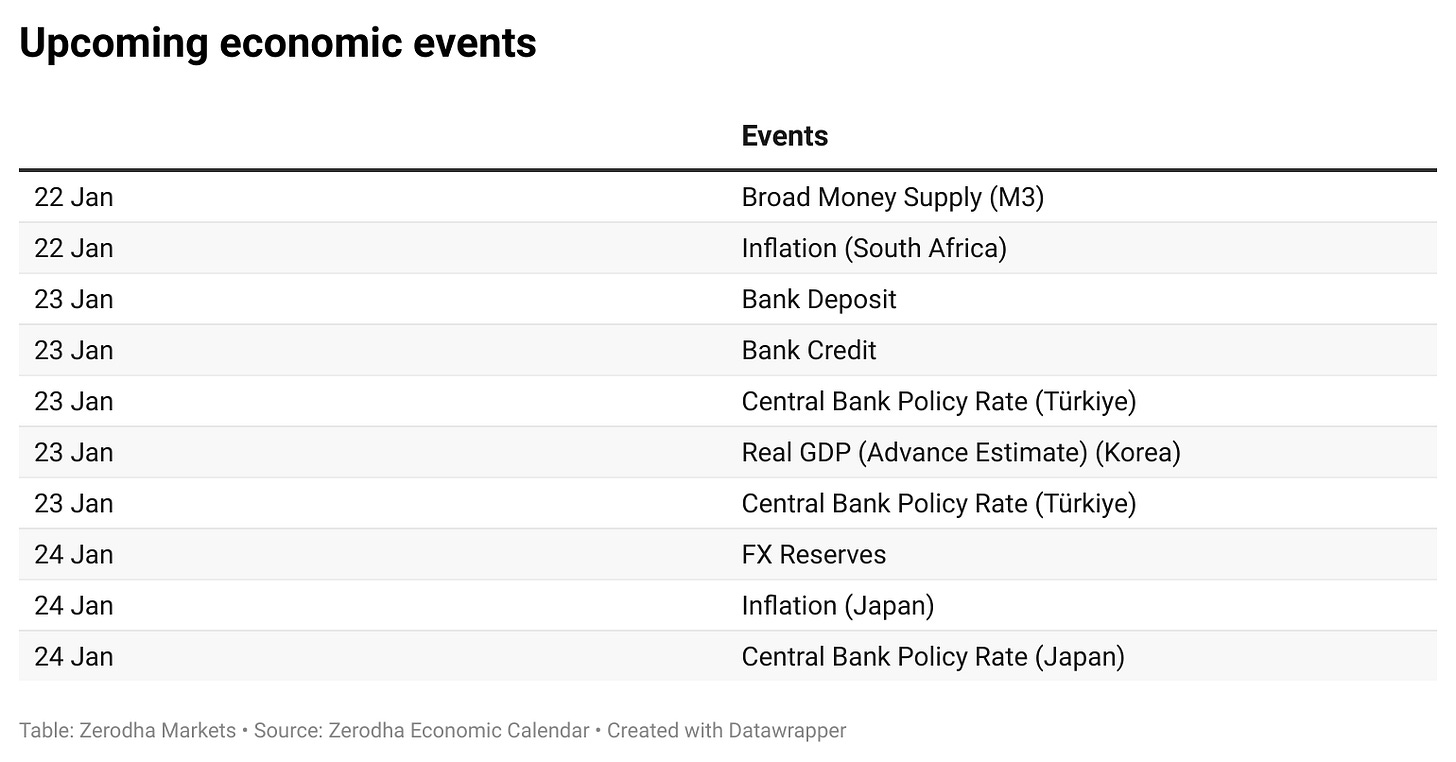

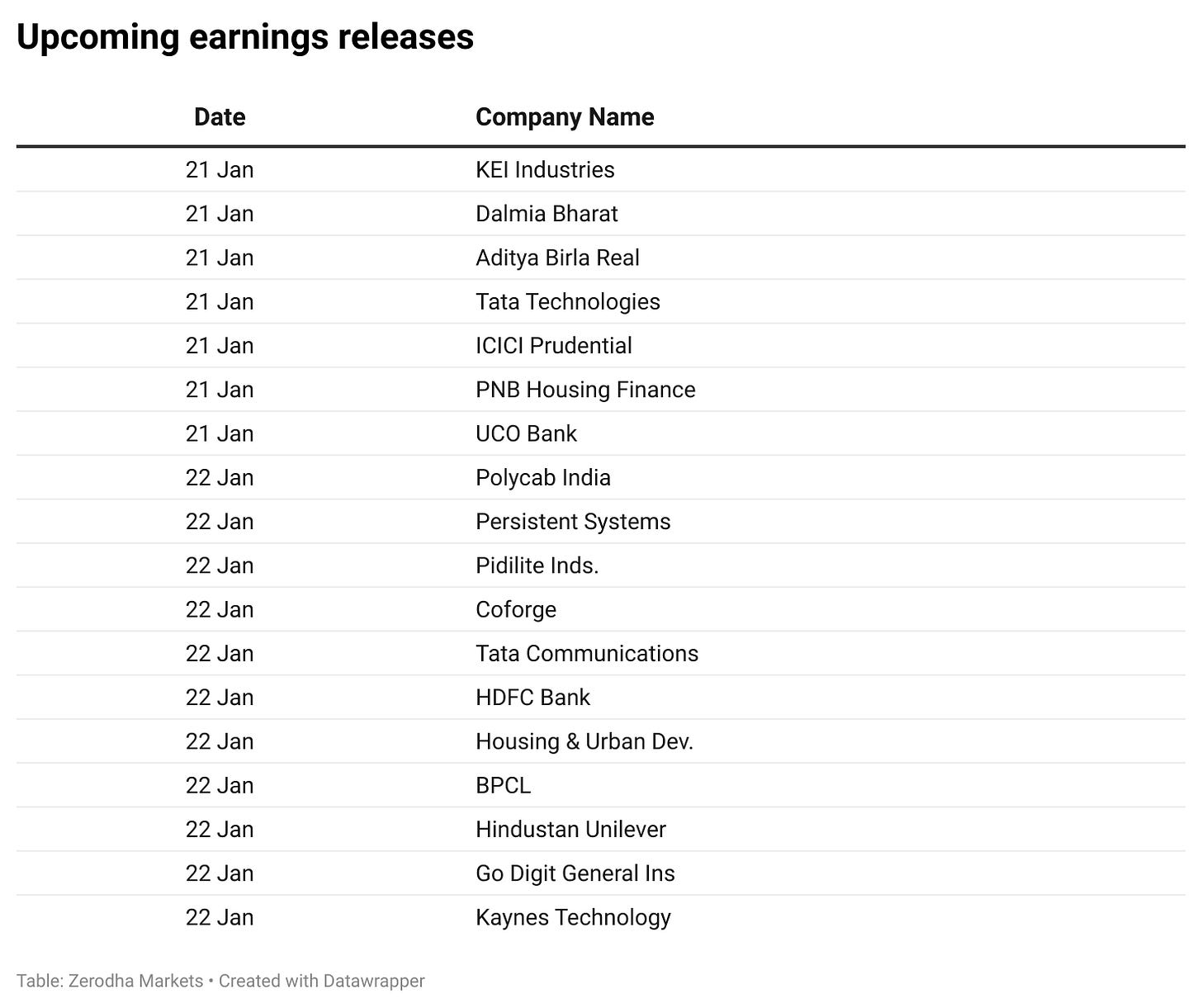

Calendars

In the coming days, we have the following major events, corporate actions, and upcoming earnings releases:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.