Welcome to the weekly edition of the Aftermarket Report, a newsletter where we do a quick weekly wrap-up of what happened in the markets—both in India and globally.

Catch “Who Said What”, a weekly show where we'll pick fascinating comments from notable figures, break them down, and explore the broader stories behind them.

Market Overview This Week

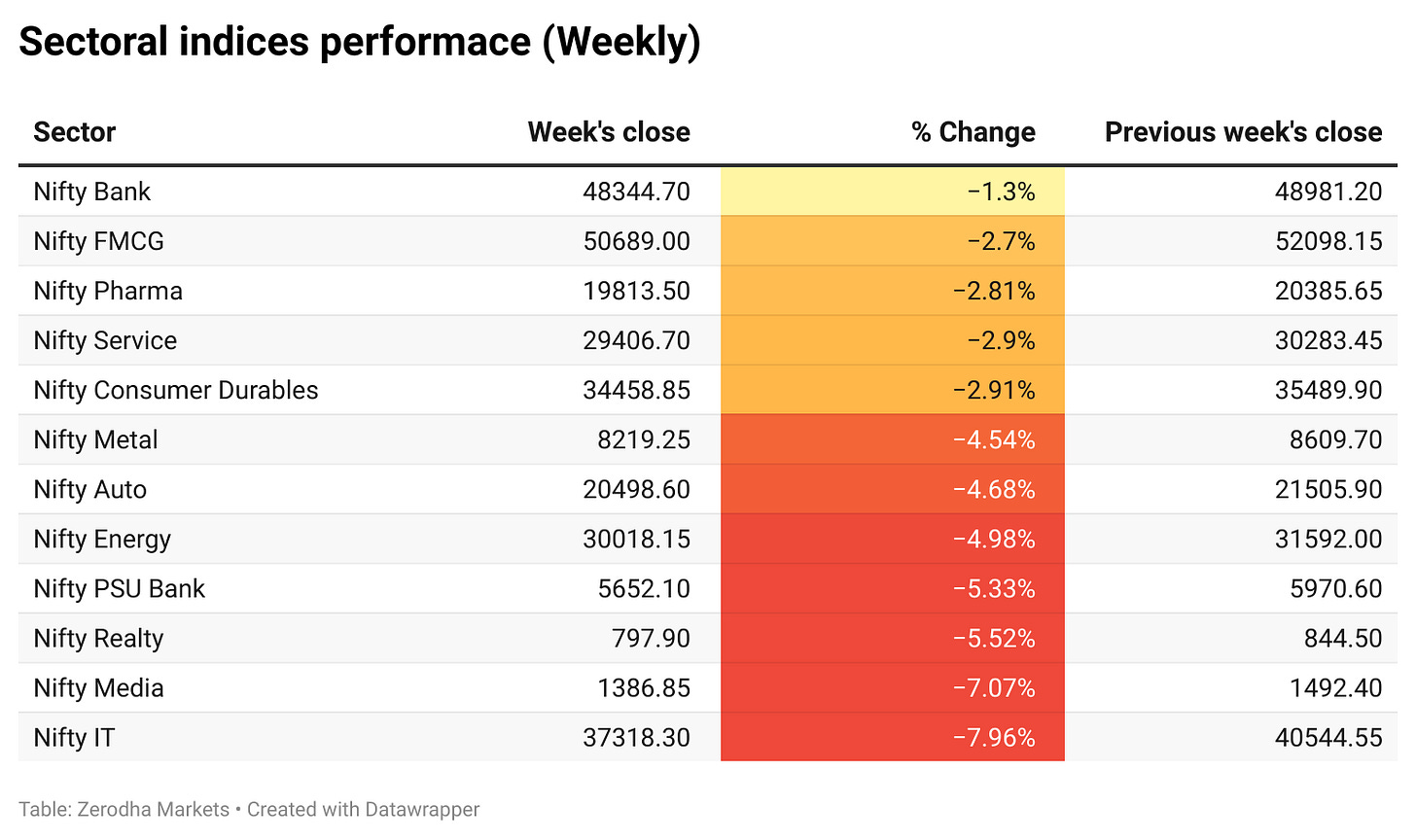

The Indian indices saw a significant downturn this week, with Nifty 50 closing at 22,124.7, down 2.94% from the previous week. Midcap and Smallcap indices also saw steep declines, with Nifty Midcap 150 down 4.98%, Nifty Smallcap 250 falling 5.71%, and Nifty Microcap 250 plunging 6.16%.

Globally, the Dow Jones showed resilience, closing up by 0.95% at 43,845.91, while the Nasdaq 100 faced a decline of 3.47%, closing at 20,909. The broader global sentiment remained mixed, with European indices like the FTSE 100 rising 1.74%, while Asian markets like the Nikkei 225 and Hang Seng experienced losses of 4.18% and 2.29%, respectively.

With India's GDP growth coming in at 6.2%, it remains to be seen whether the weak sentiment stabilizes at these lower levels or continues the downtrend seen over the past five months. Market sentiment remains cautious due to FII outflows and tariff concerns, compounded by global economic uncertainties.

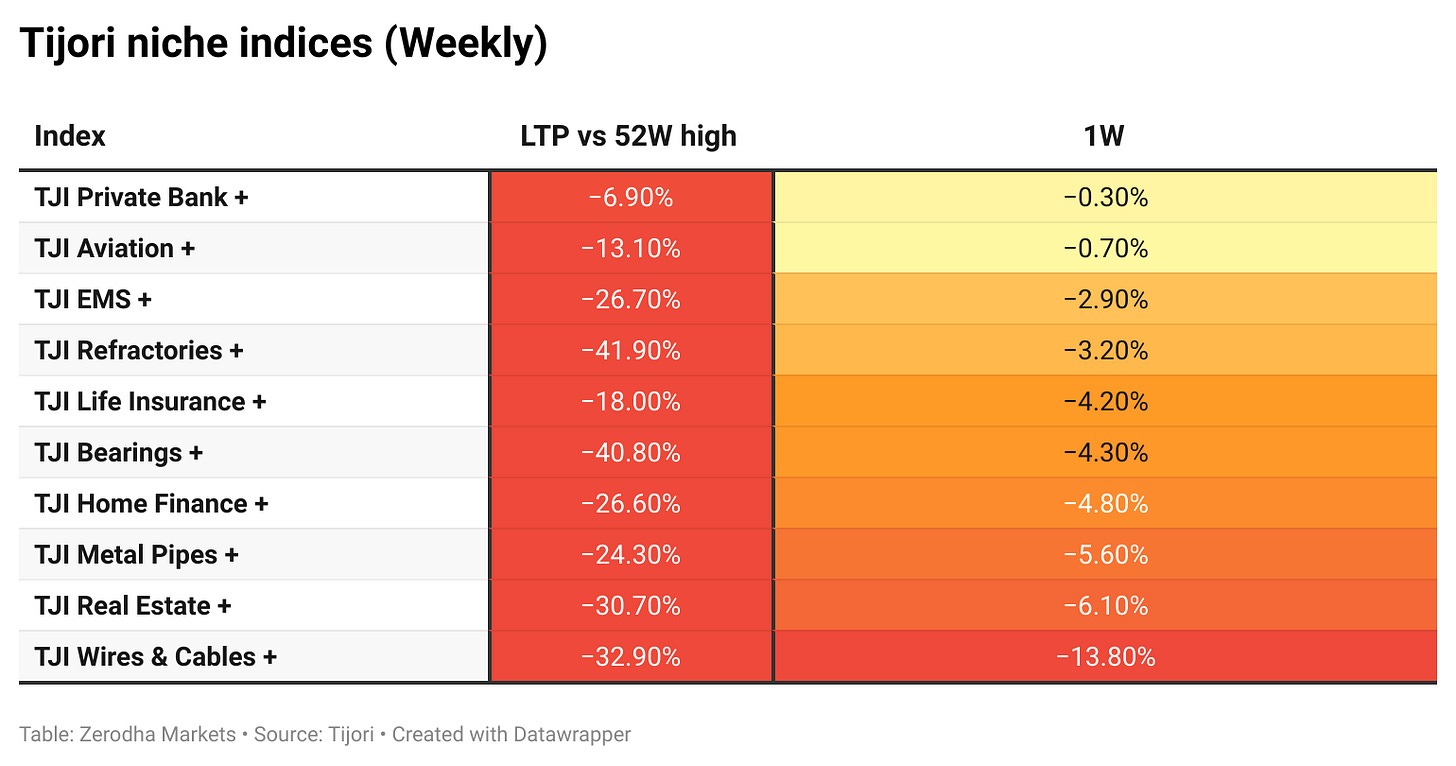

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market.

What happened in India?

India’s GDP is expected to grow by 6.5% in FY25, slightly above the estimated 6.4%. Growth is slowing due to high energy prices and RBI’s tight monetary policy. Dive deeper

India’s fiscal deficit widened to ₹11.7 trillion (74.5% of FY target) in April-Jan. Expenditure grew 6.4%, while receipts rose 6.6%. Dive deeper

RBI injected $10 billion via a forex swap on Feb. 28 to ease liquidity pressure. The three-year swap follows a $5 billion infusion last month amid tightening banking liquidity. Dive deeper

SEBI plans to expand QIB definitions and remove the 200-investor cap for angel funds. The move aims to boost startup funding while ensuring only financially strong investors participate. Dive deeper

RBI’s curbs slowed personal loan growth to 13.7% in December from 15.2% in September. Overall bank credit grew 11.8%, while term deposits surged 14.3%, now 62.1% of total deposits. Dive deeper

India is finalizing a $1 billion solar subsidy plan to cut dependence on China. The policy focuses on wafer and ingot production, awaiting cabinet approval. Dive deeper

The World Bank urged India to accelerate reforms for high-income status by 2047. It called for investment, labour force expansion, and productivity gains. Dive deeper

India’s IT sector is projected to grow 5.1% to $282.6 billion in FY25. Employment rose by 1.26 lakh to 58 lakh, with ER&D firms growing the fastest. Dive deeper

SEBI launched Bond Central, a platform for corporate bonds. It offers risk assessments, bond documents, and comparisons with G-Secs. Dive deeper

Tuhin Kanta Pandey was appointed SEBI chairman, replacing Madhabi Puri Buch. An ex-Finance Secretary, he played a key role in Air India’s privatisation. Dive deeper

Axis Bank may sell a majority stake in Axis Finance for $900M-$1B. The bank is reviewing options but may choose not to proceed with the sale. Dive deeper

Vedanta will invest ₹50,000 crore in Assam and Tripura’s oil and gas sector. The goal is to produce 1 lakh barrels/day and create 1 lakh jobs. Dive deeper

HSBC raised $1 billion via an AT1 dollar bond at 7.5% initial guidance. The proceeds will strengthen its capital base and fund corporate operations. Dive deeper

India imported €49B worth of Russian oil in the third year of the Ukraine war. Russian crude now accounts for 40% of India's imports, with some refined oil exported to Europe. Dive deeper

Delhi Airport’s proposed tariff hike will raise domestic airfares by 1.5-2%. The Yield Per Passenger will increase from ₹145 to ₹370. Dive deeper

Passenger vehicle sales may grow 4-7% in FY26, while two-wheeler sales may rise 6-9%. CV growth will be marginal, with M&HCVs and LCVs growing 0-3% and 3-5%, respectively. Dive deeper

Retail inflation for farm workers and rural labourers eased to 4.61% and 4.73% in January. CPI-AL and CPI-RL fell due to a decline in food prices. Dive deeper

India’s air passenger traffic rose 11% in January, reaching 1.46 crore. IndiGo led with a 65.2% market share, while Air India’s rose to 25.7%. Dive deeper

RBI announced the premature redemption schedule for Sovereign Gold Bonds (April–Sept 2025). Investors can redeem at IBJA’s average gold price. Dive deeper

Bharti Airtel is in talks with Tata Group for a potential merger of Tata Play with Bharti Telemedia. Discussions are ongoing. Dive deeper

Swiggy plans to invest ₹1,000 crore in Scootsy Logistics via a rights issue. The investment will expand its supply chain and distribution network. Dive deeper

Havells India will enter the EV charging market within six months. It aims to serve automakers, charging infra firms, and real estate developers. Dive deeper

Assam secured ₹4.78 lakh crore in investment commitments at its business summit. ₹2.75 lakh crore came from 270 agreements, with ₹78,000 crore for infrastructure. Dive deeper

Paytm partnered with Perplexity to integrate AI-powered search into its app. Users can explore topics in local languages to make informed financial decisions. Dive deeper

UltraTech Cement’s ₹1,800 crore entry into the cables & wires sector triggered a sharp sell-off. Stocks like KEI Industries, Polycab, and Havells fell up to 17%, with analysts citing cost advantages but concerns over distribution challenges. Dive deeper

RVNL won a ₹136-crore contract for Bhusaval-Khandwa’s railway section. The project, aimed at boosting freight capacity, will take 24 months. Dive deeper

India’s gold jewellery exports to the U.S. may drop 50% due to tariff hikes. Manufacturers may shift production to Oman and UAE. Dive deeper

EPFO retained the 8.25% interest rate on EPF deposits for 2024-25. Ministry of Finance approval is pending. Dive deeper

Ola Electric sold 25,000 scooters in February, but only 8,390 were registered. The gap arose due to vendor contract renegotiations, with no change in actual sales. Dive deeper

What happened across the globe?

Brent crude fell to $73 per barrel, marking its biggest monthly drop since September. US economic concerns and a potential Ukraine peace deal weighed on prices, but sanctions on Venezuela and Iran limited losses. Dive deeper

Nvidia’s Q4 profit surged 80% to $22.09 billion, with revenue up 78% to $39.33 billion. Strong AI chip demand and new Blackwell chips drove sales despite data center and geopolitical risks. Dive deeper

US new home sales fell 10.5% in January to 657,000, missing estimates. High mortgage rates and severe weather hurt demand, with sales plunging across most regions except the West. Dive deeper

UK car production fell 17.7% in January to 78,012 units, marking 11 straight months of decline. Plant restructuring and weak demand persist, with industry leaders calling for government support. Dive deeper

The dollar index stayed around 107.3, supported by Trump’s tariffs on Mexico, Canada, and China. Markets priced in potential Fed rate cuts amid economic slowdown fears and rising jobless claims. Dive deeper

Gold fell to $2,850 per ounce, posting its biggest weekly drop since November. A stronger dollar and inflation concerns limited Fed rate cut expectations, while consumer spending unexpectedly declined. Dive deeper

European natural gas futures fell 1.2% to below €45/MWh, after a 9% surge. Gas prices remain 20% below February’s peak, with EU nations considering easing storage mandates ahead of winter. Dive deeper

UK house prices rose 3.9% YoY in February, slightly below January’s 4.1% but above forecasts. Monthly growth hit 0.4%, as housing transactions surged 14% in H2 2024 despite affordability concerns. Dive deeper

Microsoft’s Brad Smith urged the US to ease AI chip export curbs, warning of China’s advantage. The Biden-era rule restricts AI model training exports, raising concerns over global competition. Dive deeper

Calendars

In the coming week, we have the following economic events and corporate actions:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

Promoter buying data