Global market jitters weigh on Nifty; Broader Indices see heavy selling

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

Tracking weak cues from the US markets, Nifty opened with a 30-point gap down but quickly recovered, turning positive and crossing 22,600. It surged to a high of 22,676.75 within the first hour. The index then traded within a narrow range of 22,600–22,640 until 11:45 AM. However, over the next two hours, it gradually declined toward 22,550 before extending its losses after 2 PM, eventually slipping below 22,450 and closing at 22,460.30, down 0.40%.

The recent rally, supported by factors such as easing crude oil prices and a weakening dollar index, has now paused due to weakness in global markets, particularly the US. Going forward, Nifty’s direction will depend on whether it attempts to retest the higher band around 22,800 or moves lower toward 22,200–22,000 levels.

Broader Market Performance:

The broader markets had a tough day with extremely weak market breadth. Of the 2,988 stocks traded on the NSE, 607 advanced, 2,308 declined, and 73 remained unchanged.

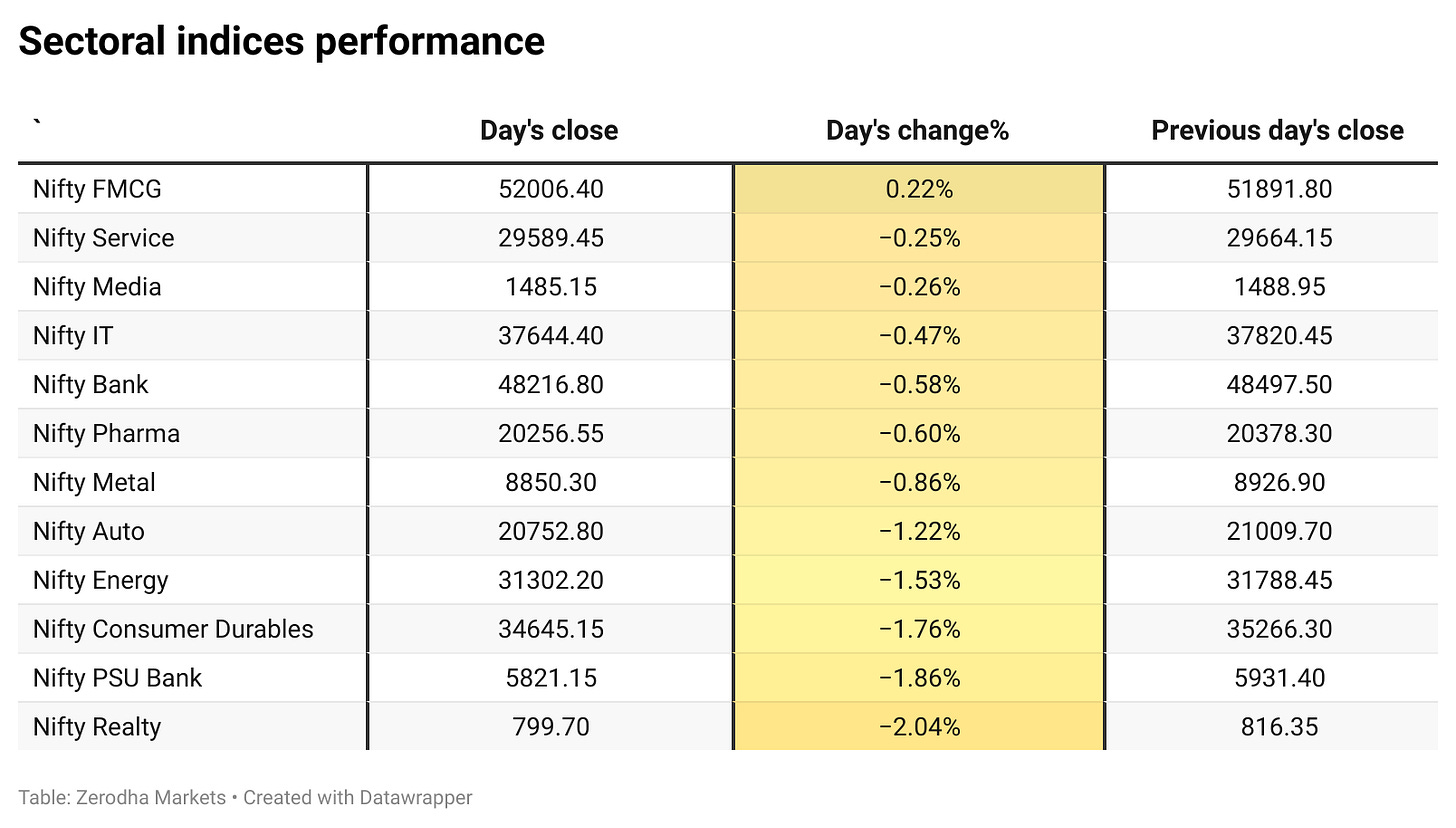

Sectoral Performance:

The top gaining sector for the day was Nifty FMCG, which closed 0.22% higher, standing out as the only sector in the green. On the other hand, the top losing sector was Nifty Realty, which saw the steepest decline, dropping 2.04%.

In terms of overall sectoral performance, only one sector (Nifty FMCG) managed to close in the green, while the remaining 11 sectors ended in the red, indicating broad-based weakness across the market.

Note: The above numbers for Commodity futures were taken around 4 pm. NSE has not released today’s FII-DII data yet. Here’s the trend from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 13th March:

The maximum Call Open Interest (OI) is observed at 22,700, followed by 22,600, indicating strong resistance at these levels. First strong resistance levels shall most likely be at 22,600, followed by 22,800.

The maximum Put Open Interest (OI) is at 22,000, followed by 22,200, suggesting potential support at 22,200, with additional support at 22,000.

Note: OI is subject to multiple interpretations, but generally, an increase in the call OI indicates resistance in a falling market, and an increase in the put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

India’s housing finance market is projected to double to ₹81 lakh crore in five years, driven by structural growth and government incentives. Banks hold a dominant 74.5% market share, while HFCs maintain a stable 19%, focusing on smaller loan segments. Dive deeper

SEBI tightened SME IPO norms, requiring ₹1 crore EBITDA for two of the last three years and capping OFS at 20%. Promoters' excess holdings face a phased lock-in, while IPO proceeds cannot be used to repay promoter-related loans. The move aims to enhance investor protection and align SME IPOs with main-board standards. Dive deeper

Ola Electric shares fell 4.74% to ₹53.85 after reports of raids and vehicle seizures over regulatory violations. Bloomberg found that 95% of its showrooms lacked trade certificates under India’s Motor Vehicles Act, prompting investigations and enforcement actions. Ola refuted the claims, calling them “misplaced” and “prejudiced.”

Ather Energy has converted 1.73 crore preference shares into 24.04 crore equity shares, a key step toward its IPO, expected in April. Dive deeper

The government sought Parliament’s approval for ₹51,462.86 crore in net additional spending for FY25, primarily for pensions and fertilizer subsidies. Of the ₹6.78 lakh crore gross additional outlay, ₹6.27 lakh crore will be met through savings and receipts. Key allocations include ₹12,000 crore for fertilizer subsidies and ₹13,449 crore for government pensions. Dive deeper

The Indian Solar Manufacturers Association (ISMA) has urged the government to impose safeguard duties on polysilicon, ingot, and wafer imports to curb dumping and strengthen domestic manufacturing. While India is self-sufficient in module production and expanding cell capacity, ISMA emphasized the need to develop upstream manufacturing, currently reliant on China, through duty protection and policy support. Dive deeper

PepsiCo aims to double its India revenue in five years, viewing the country as a key growth market and investing aggressively in capacity expansion. The company has set up new plants in Uttar Pradesh and Assam, with further investments planned. Dive deeper

NMDC worker unions continue protests over delayed wage revision, despite ongoing negotiations and prior agreements. The strike, which began on March 6, has led to a 60% drop in production, jeopardizing NMDC’s FY25 target of 48 million tonnes. Dive deeper

Haier plans to invest ₹1,000 crore in India by 2028 to expand capacity, targeting $2 billion in sales by 2027. The company is setting up new AC and injection moulding units, increasing annual capacity to 4 million units. Dive deeper

Sun Pharma will acquire Nasdaq-listed Checkpoint Therapeutics for up to $355 million, strengthening its onco-derm portfolio. The deal includes an upfront cash payment of $4.10 per share, with additional payouts based on regulatory milestones. Dive deeper

IREDA shares fell 3.77% to ₹147.15 after the RBI rejected its proposal to invest in Nepal’s 900 MW Upper Karnali Hydro project. The company, which had secured board approval and a non-binding JV agreement, plans to resubmit the proposal. The ₹290 crore investment remains subject to regulatory approvals. Dive deeper

Anupam Rasayan signs a 10-year $106 million LOI with a Korean MNC for niche chemicals, enhancing global market presence. Dive deeper

Zydus Lifesciences received USFDA approval for Ketoconazole Shampoo, enhancing its manufacturing capacity in the U.S. market, with significant annual sales potential. Dive deeper

What’s happening globally

Brent crude fell to $70.2 per barrel as weak Chinese economic data and U.S. tariff uncertainty fueled demand concerns. Deflation in China and shifting U.S. trade policies added pressure, while OPEC+ confirmed output hikes for April. Losses were limited by the possibility of stricter U.S. sanctions on Russia and a potential OPEC+ policy reversal. Dive deeper

Gold dipped to $2,900 per ounce but stayed near record highs as investors awaited U.S. inflation data for Fed insights. Trade tensions persisted, with Trump hinting at new tariffs on Canadian goods and uncertainty over recession risks. Dive deeper

European natural gas futures rebounded past €40/MWh from a five-month low as Russian attacks on Ukrainian gas infrastructure disrupted supply. Optimism over EU efforts to secure alternative sources and potential concessions for Slovakia added support, while warmer weather and easing storage targets limited price pressures. Dive deeper

US stock futures fell nearly 1% on Monday, extending last week’s losses as concerns over economic growth mounted. Trump hinted at a possible recession, Powell acknowledged rising uncertainty and jobs data signalled a cooling labour market. Dive deeper

Japan’s 10-year bond yield neared 1.6%, a 16-year high, as markets bet on further BOJ rate hikes. Deputy Governor Uchida signalled policy normalization is just beginning, though conditions remain accommodative. Meanwhile, Japan posted its first current account deficit in two years, and real wages fell 1.8% year-on-year. Dive deeper

China’s consumer prices fell 0.7% in February 2025, marking the first deflation since January 2024 and outpacing forecasts of a 0.5% drop, driven by fading seasonal demand after the Spring Festival, steep falls in food costs, and slightly lower non-food prices; core inflation slipped 0.1%, while monthly CPI declined 0.2%, reversing January’s 0.5% rise. Dive deeper

Saudi Arabia’s Q4 2024 growth was revised to 4.5% y/y, the fastest since Q4 2022, driven by a 3.4% rebound in oil output and a 4.7% rise in non-oil activities. Household spending grew 3.9%, while fixed investment and government spending declined. GDP rose 1.3% in 2024, rebounding from a 0.8% contraction in 2023. Dive deeper

China's imports reached USD 369.4 billion in January-February 2025, up from December, amid rising trade tensions. Trump imposed a 10% tariff on Chinese goods, prompting China to levy tariffs on U.S. agricultural products starting March 10. Dive deeper

Germany’s exports fell 2.5% in January 2025 to EUR 129.2 billion, reversing December’s growth, with shipments to the EU (-4.2%) and the US (-4.2%) declining. Sales to China dropped slightly (-0.9%), while exports to the UK (1.7%) and Russia (7.2%) rose. In 2024, exports fell 1.0% to EUR 1.6 trillion. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Fernando Fernandez, Newly elevated CEO, Unilever Plc on HUL and Indian market

"Quick commerce is now 2% of our sales. We expect this to be 10-15% in the next three to four years,"

"The only category in which we have some headwinds due to channel and segment development is in beauty, The acquisition of Minimalist is fundamentally an indication of what we will do in India to really move our portfolio fast," - Link

Arunish Chawla, DIPAM Secretary on dividend policy of PSUs

“The government ensures that PSUs adopt a fair and sustainable dividend policy. CPSEs are required to distribute at least 30% of their profit after tax (PAT) or 4% of their net worth, whichever is higher, as dividends. This ensures that even if the stock market is down, minority shareholders continue to receive higher dividends. Investors, senior citizens, and mutual fund houses should allocate a portion of their portfolios to PSU stocks.”

PSUs are expected to pay 10% higher dividends to minority shareholders in the current financial year, amounting to Rs 1.4 lakh crore. The dividends will increase by another 10% in the next financial year compared to the current one. - Link

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.