Index leaders propel Nifty higher, broader markets stay under pressure

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

The Nifty opened 75 points higher at 23,100, tracking stable global markets overnight. However, the market remained confined to a narrow range of 50 points between 23,050 and 23,100, with persistent selling pressure at higher levels.

In the second half, the Nifty initially dropped 60 points, sliding from 23,040 to test the day’s low at 22,981.30. However, following HDFC Bank's results, the market staged a strong recovery, gaining nearly 190 points in the final 90 minutes of trading. The index ultimately closed at 23,155.35, up 0.56%.

While the headline indices ended higher, broader indices underperformed, closing over 1% lower.

Looking ahead, market trends are likely to be influenced by global economic developments and earnings reports from key index heavyweights. Investors will closely monitor signs of stabilization to mitigate ongoing selling pressure, especially with the Union Budget session scheduled for February 1.

Broader Market Performance:

The broader market ended on a weak note, underperforming the headline indices. On the NSE, 780 stocks advanced, 2,052 declined, and 62 remained unchanged.

Sectoral Performance:

The overall sectoral performance was weak, with four indices closing in the green while eight ended in the red. Nifty Realty was the worst performer, falling 4.56% amid growth concerns.

Note: The above numbers for Commodity futures were taken around 4 pm.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 23rd January:

The maximum Call Open Interest (OI) is observed at 23,500, followed by 23,300. Meanwhile, the maximum Put Open Interest (OI) is at 23,000, followed by 23,100.

Immediate support is identified in the 23,000–22,800 range, while resistance is expected between 23,400 and 23,550.

Note: OI is subject to multiple interpretations but generally, in a falling market if there is an increase in the call OI, it indicates resistance, and in a rising market, if there is an increase in the put OI, it indicates support.

Source: Sensibull

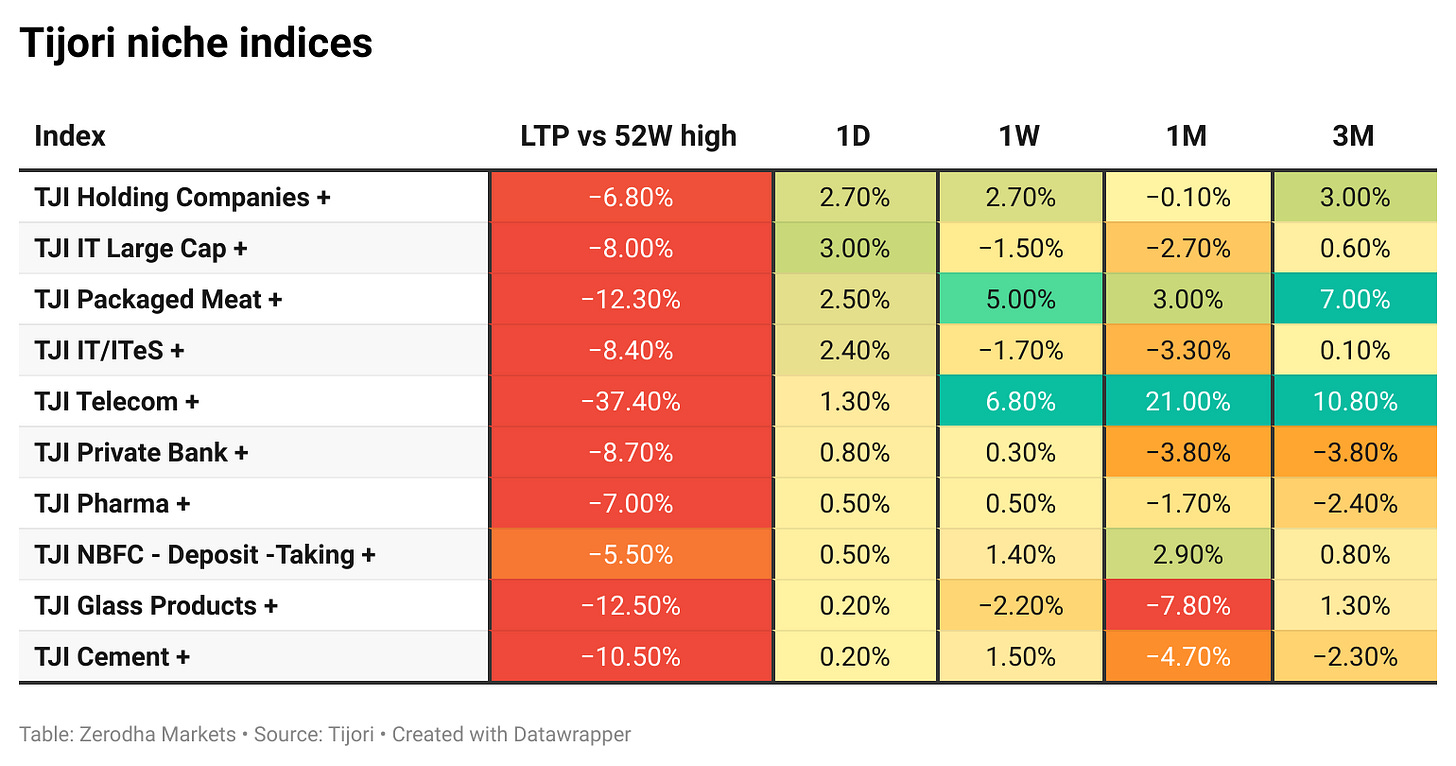

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

Waaree Energies has supplied 132.3 MW of Topcon solar modules to Radiance Renewables, fulfilling an order received in July 2024. The project is expected to offset 202,826 tons of CO2 annually, equivalent to planting 8.4 million trees, supporting India’s climate goals. Dive deeper

Meanwhile, the share dropped over 9% on fears of potential US tariffs under Trump, impacting Indian solar exports. Dive deeper

Reliance and BlackRock have each invested ₹58.5 crore in their 50:50 joint venture, Jio BlackRock Asset Management, by subscribing to 5.85 crore equity shares at ₹10 per share. The total investment amounts to ₹117 crore. Dive deeper

Aditya Birla Fashion and Retail Ltd. raised ₹1,860 crore via QIP, issuing 6.85 crore shares at ₹271.3 each. The oversubscribed issue, along with a recent ₹2,379 crore preferential issuance, will make the company debt-free and support growth plans. Dive deeper

The northeastern region's direct selling industry grew 16% in FY 2023-24, reaching ₹2,109 crore, with Assam leading at ₹1,009 crore. The sector contributes ₹300 crore annually to the region’s exchequer and supports 4.2 lakh sellers. Dive deeper

The Centre disbursed nearly ₹1,600 crore under the PLI scheme in H1 FY25, with the electronics sector receiving ₹964 crore, followed by pharmaceuticals at ₹604 crore. Electronics exports surged 27.4% to $22.5 billion in April-November, making it the third-largest export segment. Dive deeper

ITI Limited has secured a ₹167 crore contract from the Maharashtra government to implement and manage Aaple Sarkar Seva Kendras across Gram Panchayats in select regions. The project aims to enhance e-governance services through digital platforms, with ITI providing operational support and maintenance for one year. Dive deeper

Jana Small Finance Bank plans to apply for a universal banking license after the fiscal year, aiming to maintain net NPAs below 1% to meet eligibility criteria. The bank has increased its secured loan book to 68% and made accelerated provisions to improve asset quality. Dive deeper

JK Tyre secured a $100 million Sustainability-Linked Loan from IFC to expand energy-efficient tyre production at its Banmore and Laksar plants, supporting sustainability goals. Dive deeper

UCO Bank plans to raise ₹2,000 crore via QIP this quarter to meet SEBI’s minimum public shareholding norms. The government has approved the plan, and the bank has appointed advisors and started engaging with investors. Dive deeper

SEBI plans to allow pre-listing share sales to curb grey market activity, enabling trading between allotment and listing. A portal for related party transactions is also in the works to enhance corporate governance. Dive deeper

Essar Oil & Gas is exploring a $275 million overseas bond sale for expansion and debt refinancing, marking its first fundraising since restructuring. Discussions with global banks are in the early stages, with no final decision yet. Dive deeper

MSTC Limited has transferred its entire 100% stake in Ferro Scrap Nigam Ltd (FSNL) to Japan's Konoike Transport Co. for ₹320 crore, successfully concluding its strategic disinvestment. MSTC (formerly known as Metal Scrap Trade Corporation) secured a bid exceeding the government's reserve price of ₹262 crore, with the new management taking charge of FSNL. Dive deeper

Bandhan Bank received a ₹290 crore payout under the Credit Guarantee Fund for Micro Units (CGFMU) scheme from NCGTC, following a forensic audit. The bank had insured ₹20,807 crore, with 85% repaid and 15% written off as NPAs. Dive deeper

Clean Science and Technology Limited has subscribed to 10,85,117 equity shares of its wholly owned subsidiary, Clean Fino-Chem Limited, at a face value of ₹10 each and a premium of ₹588 per share, totaling ₹64.89 crores. The capital infusion will support CFCL’s projects. Dive deeper

LTIMindtree has renewed its strategic alliance with the Association of American Medical Colleges (AAMC) to support its technology infrastructure, enhance application development, and improve decision-making processes. Dive deeper

Time Technoplast is setting up a new production facility in Saudi Arabia’s MODON Industrial Area through its subsidiary, Gulf Powerbeat, KSA. The plant, operational by Q2 2025, will manufacture Intermediate Bulk Containers (IBCs) and plastic drums to meet growing regional demand. Dive deeper

What’s happening globally

The $500 billion Stargate Project, led by OpenAI, Softbank, and Oracle, offers India a major opportunity to advance its AI ambitions through deeper US partnerships under agreements like iCET and IPEF. Experts see opportunities for Indian professionals in the initiative and urge the government to strengthen AI strategy for autonomy and data control. Dive deeper

The STOXX 50 and STOXX 600 rose 0.6%, supported by gains in the tech sector following announcements of a major AI investment plan in the US. Key stocks, including SAP, Siemens, and Adidas, saw positive movement, while discussions on potential tariffs remained in focus. Dive deeper

South Africa’s inflation rose to 3% in December 2024 from 2.9% in November, staying below the forecasted 3.2% and well under the central bank’s 4.5% target. Core inflation eased to 3.6%, the lowest since February 2022. Dive deeper

Brent crude fell to around $79 per barrel, extending losses for the fourth session amid concerns over US tariff threats on China and Trump's plans to boost oil production. Recent US sanctions on Russia and a winter storm affecting North Dakota's output provided some support. Dive deeper

Donald Trump's executive orders have halted over $300 billion in federal infrastructure funding tied to Biden's climate policies, affecting key clean energy and manufacturing projects. The move has raised concerns about stranded capital and future investments in the sector. Dive deeper

UK public sector net borrowing rose to £17.81 billion in December 2024, exceeding forecasts. Spending grew by £13 billion to £112.2 billion, while receipts increased by £2.9 billion to £94.4 billion. Dive deeper

Adidas reported a 19% rise in Q4 revenue, reversing a €377 million loss to a €57 million profit. Full-year revenue grew 12% to €23.68 billion with a 50.8% gross margin. CEO Bjørn Gulden remains optimistic about continued growth. Dive deeper

Netflix added 18.9 million subscribers in Q4, reaching 302 million globally, driven by live events and hit series. Revenue grew 16% to $10.2 billion, with a $15 billion share buyback announced. Dive deeper

Apple is close to resolving Indonesia's iPhone sales ban by negotiating an investment package to meet local manufacturing requirements. The ban was imposed in October due to non-compliance with domestic investment targets. Dive deeper

Malaysia's inflation eased to 1.7% in December 2024 from 1.8% in November, the lowest since January. Food prices rose 2.7%, while core inflation increased 1.6%, the slowest since January 2022. Dive deeper

The Shanghai Composite fell 0.89% to 3,217, and the Shenzhen Component lost 0.77% to 10,226, as concerns over potential US tariffs on Chinese imports weighed on sentiment. Dive deeper

Quarterly results

In this section, we'll dive into all the key highlights from today's intriguing results, covering the most impactful performances and standout moments. The numbers are comparable on a year-on-year (YoY) basis.

HDFC Bank (HDFCBANK) (1.44%)

Financials:

Net Profit: ₹16,736 crore, up 2.2% YoY.

Interest Earned: ₹76,007 crore, an increase of 7.6% YoY.

Interest Expenses: ₹45,354 crore, a rise of 7.7% YoY.

Net Interest Income (NII): ₹30,653 crore, up 8% YoY.

Gross NPA: ₹36,081 crore, down 5.2% QoQ.

Consolidated Net Revenue: ₹652.8 billion.

Earnings Per Share: ₹21.9.

Key Highlights:

Deposits increased by 4.2% to ₹24.53 lakh crore.

Gross Advances rose by 0.9% to ₹25.43 lakh crore.

The Gross Non-Performing Assets (NPA) ratio slightly increased to 1.42%.

Outlook:

HDFC Bank's diversified portfolio, strong CASA franchise, and efforts towards improving asset quality continue to present a favorable outlook for sustained growth.

Tata Communications (TATACOMM) (-1.13%)

Financials:

Revenue: ₹5,798.07 crore, up 3.76% YoY from ₹5,587.78 crore.

Net Profit (PAT): ₹236.08 crore, up 424% YoY from ₹45.05 crore.

Key Highlights:

The significant increase in net profit is primarily attributed to a lower tax outgo during the quarter.

Outlook:

The company continues to focus on strategic initiatives to drive growth and enhance profitability.

Polycab India Limited (POLYCAB) (-6.03%)

Financials:

Revenue: ₹5,226 crore, up 20.4% YoY from ₹4,340 crore.

EBITDA: ₹721 crore, up 26.5% YoY from ₹570 crore.

EBITDA Margin: Expanded by 70 basis points to 13.8% from 13.1%.

Net Profit (PAT): ₹464.3 crore, flat YoY compared to ₹460 crore.

Key Highlights:

Revenue grew by 24% YoY to ₹15,422 crore.

Revenue increased by 12% YoY; margins expanded by 50 basis points to 13.5% in the Wires & Cables Segment.

Outlook:

The management expects to surpass its FY26 revenue growth guidance of ₹20,000 crore in the current financial year.

A robust order book is anticipated to sustain momentum into Q4

Persistent Systems Limited (PERSISTENT) (-3.62%)

Financials

Revenue grew by 20.1% YoY TO ₹2897 crore

EBITDA: ₹447 crore (EBIT margin: 14.6%, +60 bps YoY)

Net Profit (PAT): 23.4% YoY increase at ₹325 crore

EPS: ₹45.98

Key Highlights:

Robust financial profile driven by healthy cash flow generation and capital structure

Acquisitions of Arraka and SohoDragon contributed +50 bps to growth

Persistent was the best performer in the Nifty IT index in 2024, gaining 74%

Outlook:

Positive growth momentum is expected to continue with consistent performance across key verticals.

UCO Bank (-2.13%)

Financials:

Net Profit: ₹639 crore, up 27% YoY from ₹503 crore.

Operating Profit: ₹1,586 crore, up 42% YoY from ₹1,119 crore.

Net Interest Margin: 3.17%, up 33 bps YoY.

Net Interest Income: ₹2,378 crore, up 20% YoY.

Provision: ₹590 crore, up 73% from ₹342 crore last year.

EPS: ₹3.43.

Key Highlights:

Gross NPA decreased to 2.91% from 3.85% YoY.

Net NPA dropped to 0.63% from 0.98% YoY.

Gross advances grew by 16.44% YoY to ₹2.09 lakh crore, while total deposits rose by 9.36% YoY to ₹2.80 lakh crore.

Outlook: The bank aims to maintain a stable NIM around the 3%-3.10% range, supported by strong asset quality and continued growth in advances and deposits.

India Cements Limited (INDIACEM) (-8.29%)

Financials:

Revenue: ₹903.16 crore, down 5.05% YoY from ₹958.28 crore.

Total Income: ₹913.78 crore, down 10.94% YoY from ₹1,026.40 crore.

Profit After Tax (PAT): ₹428.84 crore, a loss compared to ₹239.98 crore in Q3FY24.

EPS: ₹144.64.

Key Highlights:

Exceptional items showed a ₹190.26 crore credit, helping reduce the loss.

Other comprehensive income saw a significant increase to ₹4,911.36 crore, compared to a loss of ₹20.58 crore in the same period last year.

Outlook: The company remains focused on its ongoing cement business and will manage challenges related to financial penalties and legal proceedings while also navigating strategic shifts after UltraTech Cement Ltd's increased stake.

PNB Housing Finance Limited (PNBHOUSING) (1.44%)

Financials:

Revenue: ₹1,941.76 crore, up 10.67% YoY.

Total Income: ₹1,943.11 crore, up 10.66% YoY.

Total Expenses: ₹1,327.46 crore, up 0.89% YoY.

Profit Before Tax: ₹615.65 crore, up 39.88% YoY.

Net Profit: ₹483.27 crore, up 42.71% YoY.

EPS: ₹18.08, up 38.85% YoY.

Key Highlights:

Revenue growth was driven by increased interest income and fees.

Profit saw significant YoY improvement due to better income and cost management.

Gross NPA improved to 3.57% from 4.69% YoY, reflecting enhanced asset quality.

Outlook: The company expects steady growth driven by stable revenues, operational efficiency, and continued focus on improving asset quality.

Bharat Petroleum Corporation Ltd (BPCL) (-0.92%)

Financials:

Revenue from Operations: ₹1,27,520.50 crore (YoY: -1.86%)

EBITDA Margin: 4.19% (YoY: 2.98%)

Net Profit (PAT): ₹4,649 crore (YoY: +36.85%)

Key Highlights:

Interim dividend declared at ₹5 per share

PAT surged by 94% QoQ (from ₹2,397 crore in Q2 FY25)

Revenue up 8.14% QoQ

Outlook: Positive with strong margin improvement

Hindustan Unilever Limited (HINDUNILVR) (0.10%)

Financials:

Revenue: ₹15,408 crore (YoY: +1%)

EBITDA: ₹3,570 crore (YoY: +1%)

EBITDA Margin: 23.15% (YoY: -0.15%)

Net Profit (PAT): ₹3,001 crore (YoY: +19%)

Key Highlights:

Home Care revenue is up 5.4%, and EBIT is up 9% (YoY).

Beauty business revenue is up 1%, and EBIT is down 8% (YoY).

Volume growth remained flat.

Approved demerger of Kwality Wall’s ice cream business into a separate listed entity.

Acquired a 90.5 percent stake in the skincare startup Minimalist through secondary buyouts (and primary capital infusion) at a pre-money enterprise value of Rs 2,955 crore.

Outlook: Demand conditions are expected to remain similar to the previous quarter, with price hikes driving underlying volume growth in soaps and tea.

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Morten Wierod, CEO of ABB Ltd.

“Large economies, particularly the US, remain the driving forces behind global growth, but India is also rapidly climbing up the ladder and can become among the largest economies in the world”

"With China's stimulus measures aimed at reigniting growth, there is potential for a stronger China in the coming years," - Link

Krishan Lalit Bansal, Chairman and MD, DEE Development Engineers

"We are putting up a specialized forged seamless pipe plant also. The pipes produced out of that shall primarily be used for power sector...subsequently, once we get established, we shall be going in for subsea applications,"

We are expecting our revenues to triple to around Rs 2,400 crore in the next three to five years as we embark on the company’s next phase of growth” - Link

Rohit Jawa, CEO, and Managing Director, HUL on Q3 results

FMCG demand trends remained subdued with continued moderation in urban growth while rural sustained its gradual recovery. In this operating context, we delivered competitive growth by driving unmissable brand superiority, investing behind brands and capabilities whilst maintaining healthy margins.

In line with our strategic intent to transform our portfolio in fast-growing spaces, I am excited to announce the acquisition of the premium actives-led beauty brand Minimalist. This acquisition is another key step to grow our Beauty & Wellbeing portfolio in the high growth masstige beauty segment.

We continue to make progress on unlocking a billion aspirations by contemporizing our core business, driving premiumization through our future core business, and ushering market-making in new demand spaces. While we keep a close watch on the pace of recovery and the broader economic outlook in the short term, we remain confident of the medium to long-term opportunity in the Indian FMCG sector and HUL’s ability to grow competitively.

Calendars

In the coming days, we have the following major events, corporate actions, and upcoming earnings releases:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.