Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

The Nifty 50 fell 100.60 points to close the trading session at 25,111.45, while the Sensex dropped 375.24 points to close at 82,259.24. The Nifty swung between a session high of around 25,238 and a low near 25,100 before closing near the day's lower end.

The fall was largely driven by pressure in IT and PSU banking shares, amid delayed cues from weak U.S. Fed commentary and global trade uncertainties.

Broader Market Performance:

The market breadth was mildly negative. Out of approximately 3,023 stocks traded, 1432 stocks closed higher, 1502 stocks declined, while 89 remained unchanged.

Sectoral Performance:

On the sectoral front, Realty and Metal indices were top performers for the day. The IT sector was down the most, with the index down around 1.4% for the day as index heavyweights like Tech Mahindra, Infosys, HCL Tech, and LTIMindtree led the decline on weak Q1 commentary.

Note: The above numbers for Commodity futures were taken around 4 pm. Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 17th July:

The maximum Call Open Interest (OI) is observed at 25,200, which saw an addition of 33.5 lakh contracts, suggesting a strong resistance at those levels. It is followed closely by 25,500, which saw an addition of 27.2 lakh contracts.

The maximum Put Open Interest (OI) is observed at 24,900, followed closely by 25,000, suggesting strong support at 25,000 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

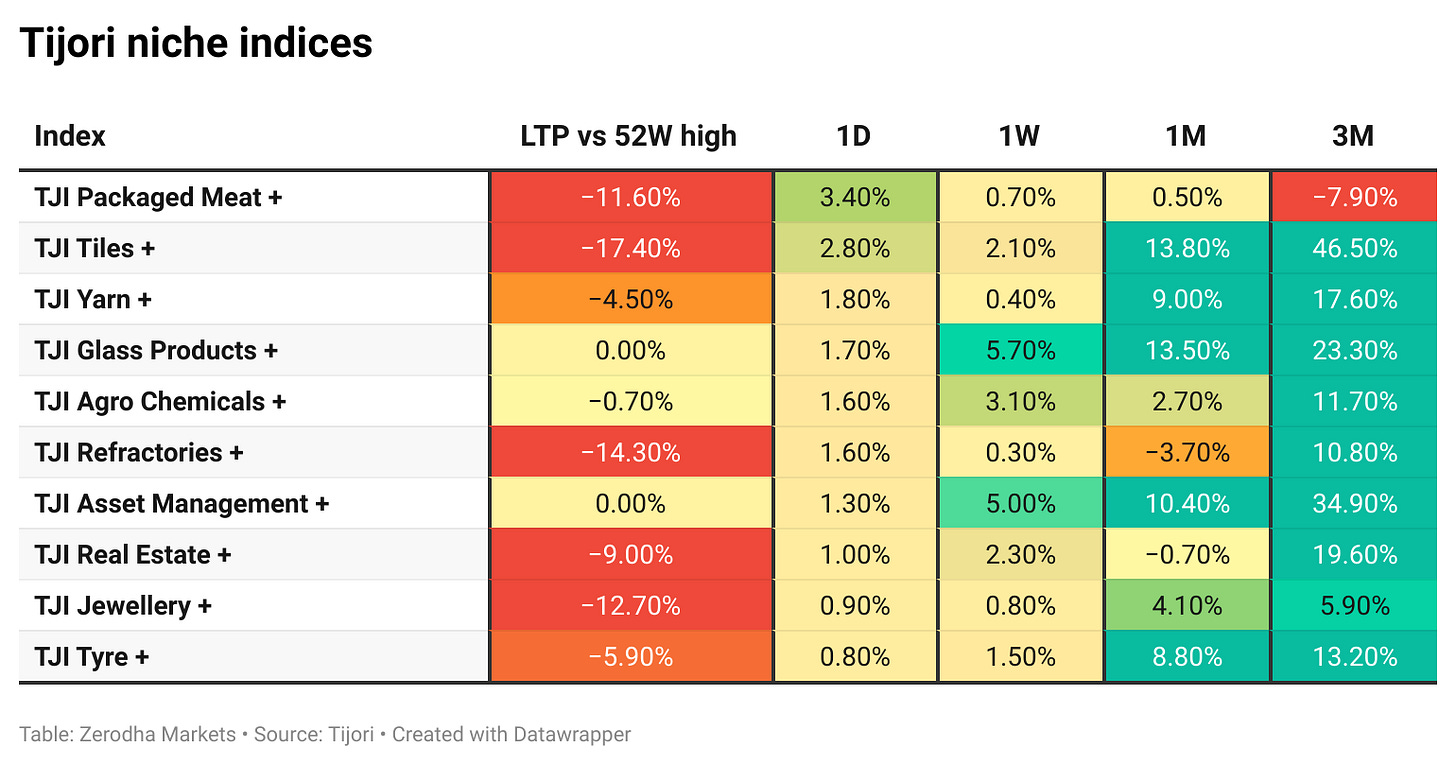

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

Axis Bank’s standalone net profit fell to ₹5,806 crore in Q1 FY26, down 4% YoY, as provisions for bad loans doubled to ₹3,948 crore. Net interest income edged up 0.8% to ₹13,560 crore, while gross NPA ratio rose to 1.57% from 1.28% Dive deeper.

Adani Enterprises has sold 20% of AWL Agri Business (formerly Adani Wilmar) to Wilmar’s unit Lence Pte Ltd at ₹275/share, raising about ₹7,150 crore. Post-transaction, Wilmar will hold ~64% and become majority owner of the joint venture. Dive deeper.

HUDCO’s bond committee has cleared a ₹3,000 crore unsecured, taxable, non-convertible debentures (Series-D) issuance with a 6.64% coupon rate and 3‑year tenor. Funds will support lending and debt refinancing needs. Dive deeper.

India slips to 4th most-favoured Asian market, according to Bank of America’s survey as foreign fund flows shift to Japan, Taiwan, and South Korea amid chip-driven rallies, while Indian equities struggle with IT sector weakness and lack of fresh triggers. Dive deeper.

Dixon Technologies acquired 40.37% in Lightanium Technologies, a lighting OEM, by issuing 1.15 crore equity shares in a non-cash deal. Dive deeper

Hexaware Technologies has acquired SMC Squared for $90 million, aiming to strengthen its Global Capability Center (GCC) services and accelerate growth via AI and digital innovation. Dive deeper

Tech Mahindra reported a 34% YoY rise in PAT to ₹1,141 crores and EBIT of ₹1,477 crores. Revenue stood at ₹13,351 crores. Deal wins surged 51% YoY to $809 million. Dive deeper

Bharti Airtel has partnered with Perplexity to provide a 12-month Perplexity Pro subscription worth ₹17,000 free to all its 360 million customers — Perplexity’s first tie-up with an Indian telco. Dive deeper

Mahindra Logistics' board has approved a ₹749.27 crore rights issue via 2.7 crore equity shares at ₹277 each, aimed at boosting shareholder value.

Dive deeper

Patanjali Foods board approved a 2:1 bonus issue, tripling share capital from ₹72.5 crore to ₹217.5 crore, subject to shareholder approval. Dive deeper

Housing & Urban Development Corp. board approved raising ₹3,000 crore through unsecured non-convertible debentures at a 6.64% coupon rate. Dive deeper

South Indian Bank reported Q2 2025 net profit of ₹321.95 crore on total income of ₹2,984.13 crore. Operating profit stood at ₹672.2 crore, EPS at ₹1.23. Dive deeper

HDFC Asset Management Company posted ₹968.15 crore in sales for Q1 2025, up by 24.9% YoY. Net profit grew by 23.8% YoY to ₹747.55 crore. Dive deeper

Newgen Software reported Q1 FY26 revenue of ₹321 crore. Subscription revenue rose 19% YoY and the company added 12 new customers. PAT stood at ₹50 crore.

Dive deeper

Heritage Foods posted ₹11,367.55 million in revenue for Q1 FY26, up 11.5% YoY. Net profit rose 7.4% YoY to ₹405.46 million. Dive deeper

Polycab India reported ₹59,060 million in revenue for Q1 FY26, up 26% YoY, led by strong Wires & Cables demand. PAT rose 49% YoY, reflecting improved margins. Dive deeper

Sterling & Wilson posted ₹1,761.63 crore in revenue for Q1 FY26, up from ₹915.06 crore YoY. Net profit rose to ₹78.43 crore from ₹73.59 crore, reflecting steady earnings growth. Dive deeper

Clean Science & Technology reported revenue of ₹2,428.69 million in Q1 FY26, up by 8.42% YoY. Net profit grew to ₹700.63 million, marking a 6.27% YoY increase on the back of stable operating performance. Dive deeper

What’s happening globally

Asian stock indices remained subdued ahead of tech earnings from TSMC and Netflix, with European futures showing modest gains and U.S. futures slightly down. Dive deeper.

The dollar weakened amid uncertainty about the future of Fed Chair Jerome Powell, though markets regained composure after President Trump clarified he was unlikely to fire him. Dive deeper.

Oil prices rose—Brent crude climbed to ~$68.76/barrel—on strong U.S. and Chinese economic data and easing trade tensions. Dive deeper.

Gold edged lower, pressured by a firmer dollar following Trump’s comments on Powell’s status. Dive deeper.

The pound rose after UK labor market data showed a stronger jobs situation, boosting its value against the euro. Dive deeper.

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Samir Arora, founder of Helios Capital, on India-US Trade Deal

"We have got some advantage over others in areas like textile exports, but beyond that, there isn't much,"

"The rest of the world is outperforming US this year. The dollar is down nearly 10%. People also feel that we need to move some money into other markets," - Link

President Trump on Powell's termination

"It's highly unlikely unless he has to leave for fraud."- Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

The link is pointed to wrong addressee, appreciate if you can fix it.

South Indian Bank reported Q2 2025 net profit of ₹321.95 crore on total income of ₹2,984.13 crore. Operating profit stood at ₹672.2 crore, EPS at ₹1.23. Dive deeper