Market declines ahead of Union Budget amid sectoral weakness and cautious sentiment.

Welcome to the weekly edition of the Aftermarket Report, a newsletter where we do a quick weekly wrap-up of what happened in the markets—both in India and globally.

Catch "The Big Perspective" as we dive into REITs with Alok Aggarwal, MD & CEO of Brookfield India Real Estate Trust, and Preeti Chheda, CFO of K Raheja Corp Investment Managers. Discover key insights on investing, regulations, taxation, and the global landscape of REITs in India!

Market Overview this week

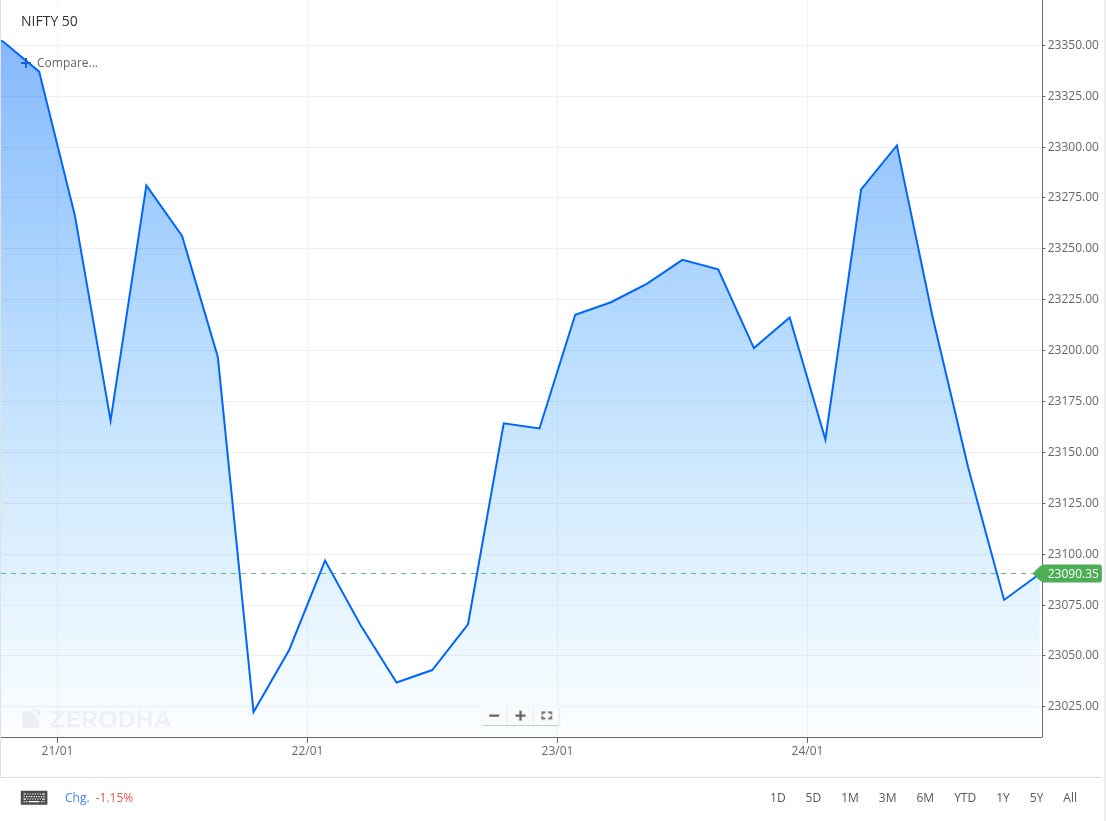

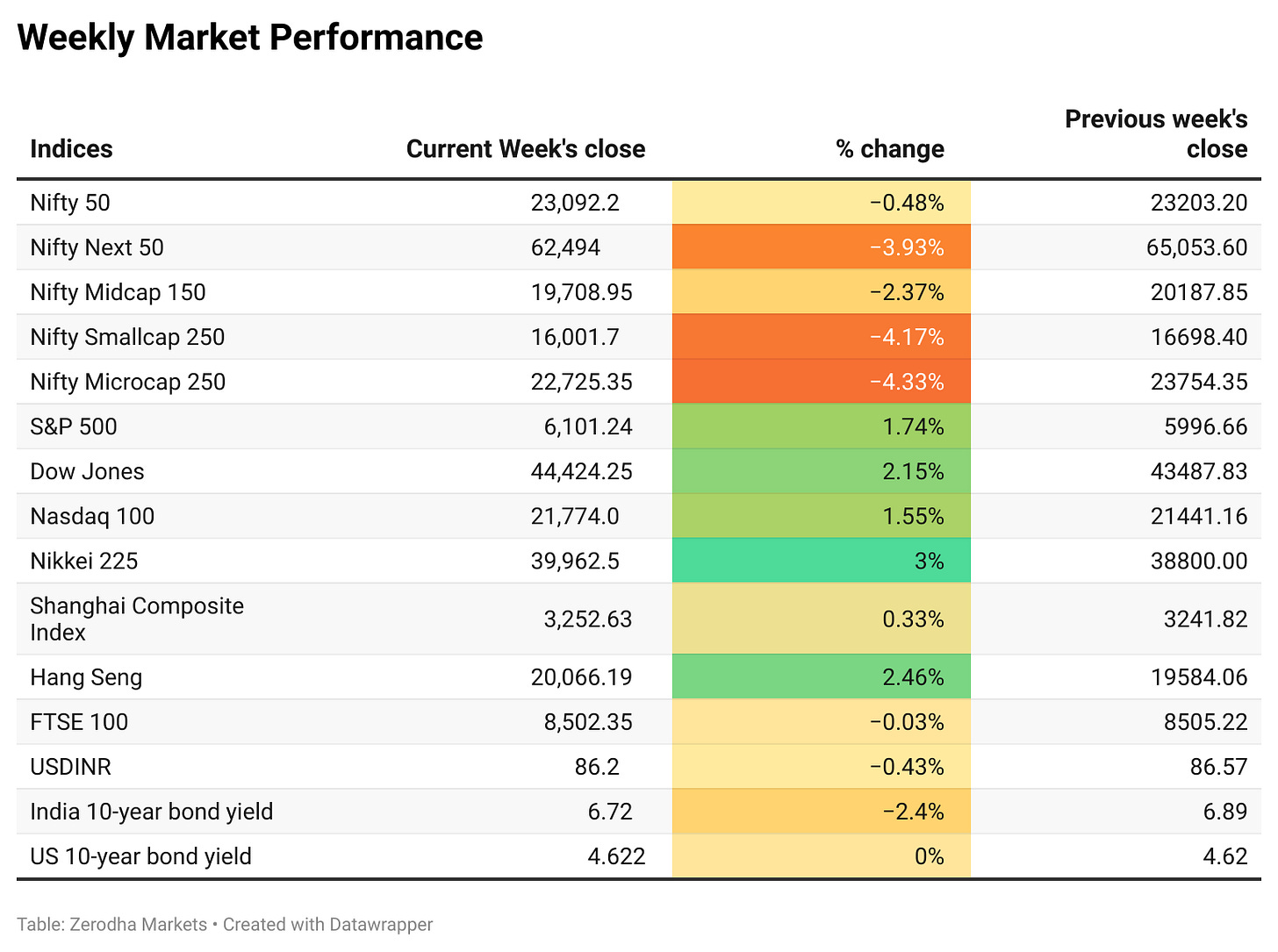

Nifty dropped 0.49% this week, extending its decline for the third consecutive week.The Nifty Realty index saw a notable decrease of 9.03%. Sectors such as energy, auto, media, pharma, PSU banks, and healthcare also faced declines.

Investor sentiment remained cautious due to concerns over weak domestic growth, foreign fund outflows, and rising food prices. While 2024 showed positive growth, market volatility is expected to continue, influenced by the Union Budget, RBI policy, and ongoing earnings reports.

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market.

What happened in India?

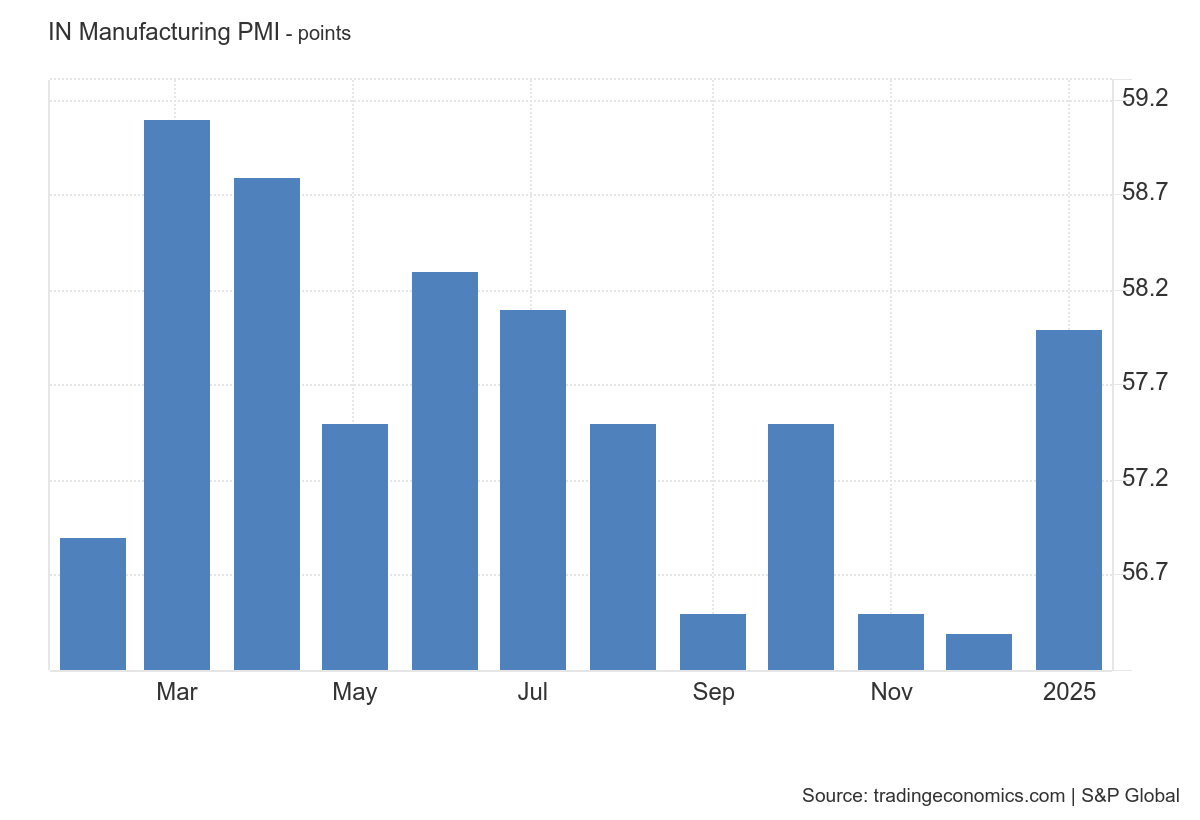

HSBC India's Composite PMI declined to 57.9 in January, reflecting slower growth in services but stronger factory activity. Despite the dip, employment reached a record high, and business sentiment improved among manufacturers. Dive deeper

India’s Manufacturing PMI rose to 58 in January, marking the fastest growth since July. Export demand and stronger job creation drove the increase while easing input cost inflation provided some relief to manufacturers. Dive deeper

Adani Group denied reports of its 484 MW wind power projects in Sri Lanka being cancelled, clarifying that the government’s tariff review is a routine process under the new administration. The company reaffirmed its commitment to investing $1 billion in Sri Lanka’s green energy sector, further enhancing its renewable energy portfolio. Dive deeper

United Breweries resumed beer supply to Telangana Beverages Corporation after receiving assurances on pricing and payments. Dive deeper

Nazara Technologies’ Board approved a preferential allotment and acquisition of gaming IPs from Zeptolab UK. The Extraordinary General Meeting (EGM) is scheduled for February 13, 2025. Dive deeper

Tata Consultancy Services (TCS) inaugurated its fourth delivery centre in Toulouse, France, to support AI-driven transformation in the aerospace and defence industries. Dive deeper

India’s data centre market is expected to see substantial growth, with demand reaching 450 MW and supply at 600 MW by 2025. This expansion is largely driven by rising cloud adoption and digital transformation across the country. By 2030, the market is expected to reach a total of 3,400 MW, with key metros like Mumbai leading demand in 2024. Dive deeper

The Reserve Bank of India (RBI) mandated Asset Reconstruction Companies (ARCs) to get board-approved policies for settlements over ₹1 crore, aimed at enhancing efficiency and transparency. Dive deeper

Reliance Industries and BlackRock jointly invested ₹117 crore in their 50:50 joint venture, Jio BlackRock Asset Management, subscribing to 5.85 crore equity shares. The investment underscores their commitment to expanding the asset management business in India and supporting the growing demand for sustainable investment solutions. Dive deeper

Aditya Birla Fashion and Retail Ltd. raised ₹1,860 crore through a Qualified Institutional Placement (QIP), which helped make the company debt-free and supported future growth. Dive deeper

Waaree Energies fulfilled an order of 132.3 MW of solar modules for Radiance Renewables, contributing to India’s climate goals by offsetting 202,826 tons of CO2 annually. Dive deeper

The government disbursed ₹1,600 crore under the Production-Linked Incentive (PLI) scheme for electronics and pharmaceuticals, with the electronics sector receiving ₹964 crore. Electronics exports surged 27.4% to $22.5 billion in April-November, making it the third-largest export segment, showing the government's strong push towards manufacturing and exports. Dive deeper

Bharti Airtel and Bajaj Finance partnered to enhance digital financial services by combining Airtel's reach with Bajaj Finance’s product offerings. Initially, select products will be available on the Airtel Thanks App, with expansion plans. The partnership aims to improve access to financial services while ensuring compliance and data security. Dive deeper

Hyundai Motor Company and TVS Motor Company unveiled a concept for electric three-wheelers and micro four-wheelers at the Bharat Mobility Global Expo 2025, exploring sustainable mobility solutions. Dive deeper

Essar Oil & Gas explored a $275 million overseas bond sale for expansion and debt refinancing, with discussions underway with global banks. Dive deeper

Motilal Oswal Asset Management refuted social media allegations, reaffirming its commitment to ethical practices and regulatory compliance. Dive deeper

Adani Energy Solutions Ltd. secured a ₹25,000 crore project to evacuate 6 GW of renewable energy from Rajasthan, under a tariff-based competitive bidding process. Dive deeper

Tata Consultancy Services (TCS) surpassed a $20 billion brand value, reaching $21.3 billion, driven by its investments in AI and innovation. Dive deeper

Avaada Group secured ₹8,500 crore from multiple lenders for nine renewable energy projects across various segments. Dive deeper

Kalpataru Projects International Limited secured ₹2,038 crore orders in its Transmission & Distribution business across domestic and international markets. Dive deeper

Hindustan Unilever Limited (HUL) acquired Vishwatej Oil Industries' palm undertaking in Telangana to support its palm localisation strategy. Dive deeper

Vedanta planned to raise ₹4,000 crore via Non-Convertible Debentures (NCDs) at a 9.75% coupon rate to meet debt and operational expenses. The company has been refinancing its debt, with a proposed demerger into six listed entities pending approval. Dive deeper

PNB Housing Finance expected sustained growth, with its affordable housing book doubling to ₹3,838 crore. The company plans to expand its branch network to 350 and achieve a ₹1 lakh crore retail book by FY27. Dive deeper

Exicom Tele-Systems Ltd. secured a ₹1,412 crore advance purchase order from Rail Vikas Nigam Ltd. for telecom equipment under BharatNet Phase III in Uttar Pradesh. The project will span three years, with a 10-year maintenance contract. Dive deeper

Suzlon and Torrent Power achieved a milestone of 1 GW in wind energy capacity, securing a 486 MW order for a project in Gujarat. Dive deeper

Government Pension Fund Global reduced its stake in Home First Finance Company India Ltd. by selling 13,076 shares via open market transactions. Dive deeper

Paytm clarified that it had not received any notice from the Enforcement Directorate (ED) regarding a crypto scam. The company emphasized that the case involved third-party merchants, not Paytm or its subsidiaries. Dive deeper

What happened across the globe?

Donald Trump began his second term as US president, amid market shifts and geopolitical developments. Dive deeper

WTI crude oil futures dropped to $74.5 per barrel, hitting their worst week since November after Trump urged OPEC action. US crude inventories fell, while gasoline stocks rose. Dive deeper

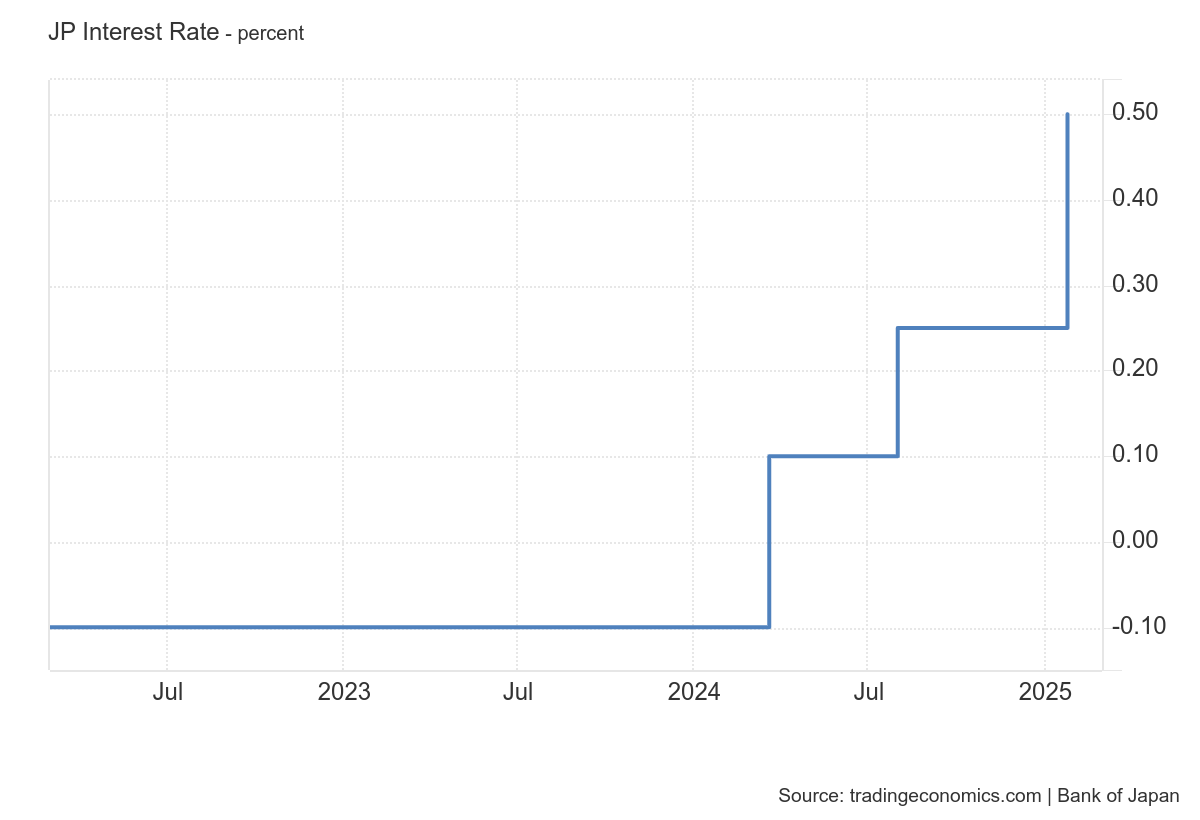

The Bank of Japan raised rates to 0.5%, citing wage growth and inflation. It lowered GDP growth to 0.5% and revised inflation to 2.7% for FY 2024. Dive deeper

The US 10-year Treasury yield fell to 4.63%, with markets expecting a July rate cut after Trump’s call for reductions. Dive deeper

Japan's core machinery orders rose 3.4% month-on-month to 899.6 billion yen in November 2024, exceeding expectations. Manufacturing orders climbed 6%, and non-manufacturing increased by 1.1%. Annually, orders grew by 10.3%. Dive deeper

Citigroup faces a €59 million lawsuit from Alcimos, alleging misleading advice during its 2018 IPO. Citi denies the claims, stating there was insufficient investor interest. Dive deeper

Germany's ZEW economic sentiment index fell to 10.3 in January 2025 from 15.7 in December, missing expectations of 15.3, amid economic contraction and inflation. Weak household spending and construction demand, along with political uncertainty, are key concerns. Dive deeper

Taiwan's export orders rose 20.8% YoY to USD 52.9 billion in December 2024, driven by strong AI demand, especially in electronics, with the US leading the growth at 31%. Dive deeper

EU passenger car registrations rose 5.1% YoY in December 2024 to 910,505 units, led by Spain, but Germany and Italy saw declines. BEV registrations fell 10.2%, with a 15.9% market share. Total registrations for 2024 grew 0.8% to 10.6 million units, with BEVs at 13.6%. Dive deeper

The $500 billion Stargate Project, led by OpenAI, Softbank, and Oracle, presents a major opportunity for India to advance its AI ambitions through stronger US partnerships under agreements like iCET and IPEF. Experts urge the government to enhance its AI strategy for greater autonomy and data control. Dive deeper

South Africa’s inflation rose to 3% in December 2024 from 2.9% in November, staying below the forecast of 3.2% and under the central bank’s 4.5% target. Core inflation eased to 3.6%, the lowest since February 2022. Dive deeper

Donald Trump's executive orders have halted over $300 billion in federal infrastructure funding tied to Biden's climate policies, impacting clean energy and manufacturing projects. The move raises concerns about stranded capital and future investments. Dive deeper

Apple is negotiating an investment package with Indonesia to meet local manufacturing requirements and resolve its iPhone sales ban, imposed in October due to non-compliance with domestic investment targets. Dive deeper

The average US 30-year fixed mortgage rate fell to 7.02% from 7.09% for the week ending January 17, 2025, marking the first decline this month. The drop followed lower Treasury yields amid easing inflation concerns. Dive deeper

The China Securities Regulatory Commission (CSRC) announced plans to support the equity market, aiming for over CNY 100 billion in stock investments in H1 2025, with insurers allocating 30% of new premiums to A-shares. Dive deeper

Japan's inflation rose to 3.6% in December, driven by food and energy prices, with core inflation at 3.0%. Dive deeper

The Central Bank of Turkey cut its repo rate by 250bps to 45% in January 2025, forecasting year-end inflation at 21%. Dive deeper

Puma shares declined following lower-than-expected Q4 sales and a drop in annual profit, raising concerns about competitiveness. Dive deeper

Singapore’s central bank eased monetary policy for the first time since 2020, addressing trade concerns and moderating inflation. GDP growth is expected to slow in 2025. Dive deeper

France's manufacturing climate indicator dropped to 95.3 in January 2025, reflecting pessimism over order books, but some improvements were noted in production and pricing outlooks. Dive deeper

Amazon plans to phase out operations in Quebec, affecting 1,700 jobs, and transition to third-party delivery. Dive deeper

Quarterly results

This section highlights the key takeaways from the week's results, focusing on the most notable performances and key moments. The price changes are based on weekly movements.

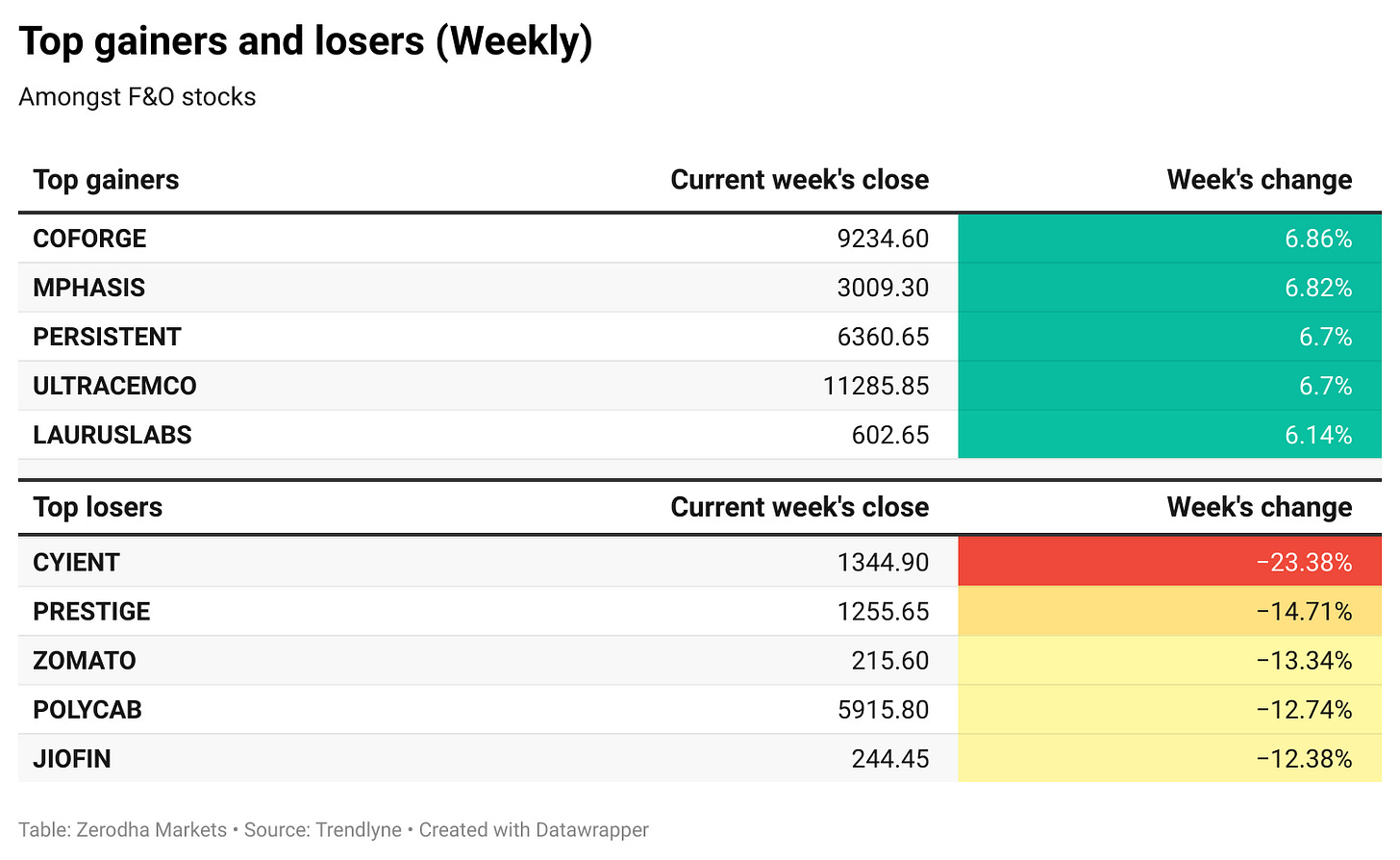

Zomato (ZOMATO) (-13.34%)

Financials:

Net Profit: ₹59 Cr vs ₹76 Cr loss, up 8.2% YoY.

Revenue: ₹5,405 Cr vs ₹3,288 Cr up 18.5% YoY.

EPS: ₹0.56 vs ₹0.45 up 5.6% YoY.

Other Comprehensive Income: ₹119 Cr up 4.3% YoY.

Key Highlights:

The company successfully raised ₹8,500 crore through a Qualified Institutional Placement (QIP).

Acquiring Orbgen Technologies and Wasteland Entertainment for ₹2,014 Cr.

The company is facing disputed GST demands from Maharashtra and West Bengal.

Outlook:

The company remains positive, driven by Blinkit's rapid expansion and strong growth in the food delivery segment, despite ongoing challenges in quick commerce.

Kotak Mahindra Bank Limited (KOTAKBANK) (7.26%)

Financials:

Revenue from Operations: ₹23,945.79 Crore, a 0.9% YoY increase from ₹24,083.15 Crore.

Interest Earned: ₹16,633.14 Crore, a 14.75% increase YoY from ₹14,494.96 Crore.

Net Profit: ₹4,701.02 Crore, a 10.23% YoY increase from ₹4,264.78 Crore.

Total Comprehensive Income: ₹5,043.5 Crore, up 8.44% YoY from ₹4,653.1 Crore.

Earnings Per Share (EPS): ₹23.64 (Basic), ₹23.64 (Diluted), up from ₹21.46 YoY.

Key Highlights:

Operating profit increased to ₹7,234.25 Crore, up from ₹6,275.59 Crore YoY.

The capital adequacy ratio (Basel III) stood at 22.79%.

Gross NPA rose to ₹7,218.17 Crore, or 1.51% of gross advances, up from 1.48% in the previous quarter.

Net NPA stood at ₹2,070.42 Crore, or 0.44% of net advances.

Total assets increased to ₹817,823.72 Crore, up from ₹703,089.35 Crore YoY.

Retail banking segment revenue reached ₹8,842.99 Crore, driven by growth in both digital and traditional banking activities.

Corporate/wholesale banking revenue totaled ₹6,090.04 Crore.

Outlook:

The bank anticipates continued growth through its diversified banking segments, supported by a strong capital position and strategic focus on retail and corporate banking.

Indian Railway Finance Corporation Limited’s (IRFC) (-3.77%)

Financials:

Revenue from Operations: ₹6,763.43 crore, up 0.40% YoY from ₹6,736.57 crore.

Net Profit: ₹1,630.66 crore, up 2.00% YoY from ₹1,598.93 crore.

Total Comprehensive Income: ₹1,627.62 crore, up 1.37% YoY from ₹1,605.56 crore.

EPS: ₹1.25, up 2.46% YoY from ₹1.22.

Key Highlights:

Total cumulative funding to Indian Railways reached ₹4.5 lakh crore, supporting various infrastructure projects.

Maintained a zero Non-Performing Assets (NPA) status, reflecting strong financial discipline.

Stood at 18%, well above the regulatory requirement, indicating robust financial health.

Outlook:

IRFC plans to continue its support for Indian Railways’ expansion plans, focusing on sustainable financing and maintaining strong asset quality.

Multi Commodity Exchange of India Limited (MCX) (-4.89%)

Financials:

Revenue: ₹301 crores, up 57% YoY

Net Profit: ₹160 crores, from a loss of ₹5 crores YoY.

EBITDA: ₹216 crores, compared to a loss of ₹2 crores in Q3 FY24.

Key Highlights:

Notional ADT of Options increased 124% YoY to ₹1,82,134 crore.

Total traded clients in derivatives grew 49%, reaching 11 lakhs during 9M FY24-25.

Commodity deliveries included 5.6 MT of Gold, 489 MT of Silver, and 49,986 MT of Base Metals.

Outlook: The company anticipates continued growth driven by increased market participation and operational efficiency, with a focus on maintaining a stable financial position.

Tata Technologies Limited (TATATECH) (-3.07%)

Financials:

Net Profit (PAT): ₹168.64 crore, down by 0.92% YoY from ₹170.22 crore.

Revenue from Operations: ₹1,317.38 crore, up 2.16% YoY from ₹1,289.45 crore.

EBITDA: ₹235 crore with an EBITDA margin of 17.8%.

EBIT: ₹211.9 crore, up 3.1% QoQ with EBIT margin improving by 20 bps to 16.1%.

Key Highlights:

Net Profit declined marginally by 0.92% YoY to ₹168.64 crore.

Revenue from operations grew by 2.16% YoY, reaching ₹1,317.38 crore.

EBITDA margin stood at 17.8%, while EBIT margin improved sequentially.

Standalone profit after tax for the quarter was ₹103 crore, showing a 9.7% YoY increase.

Outlook: The company anticipates continued growth with strong performance across its business segments, supported by new deal wins and expansions, especially in high-margin areas like Digital Engineering and Smart Manufacturing.

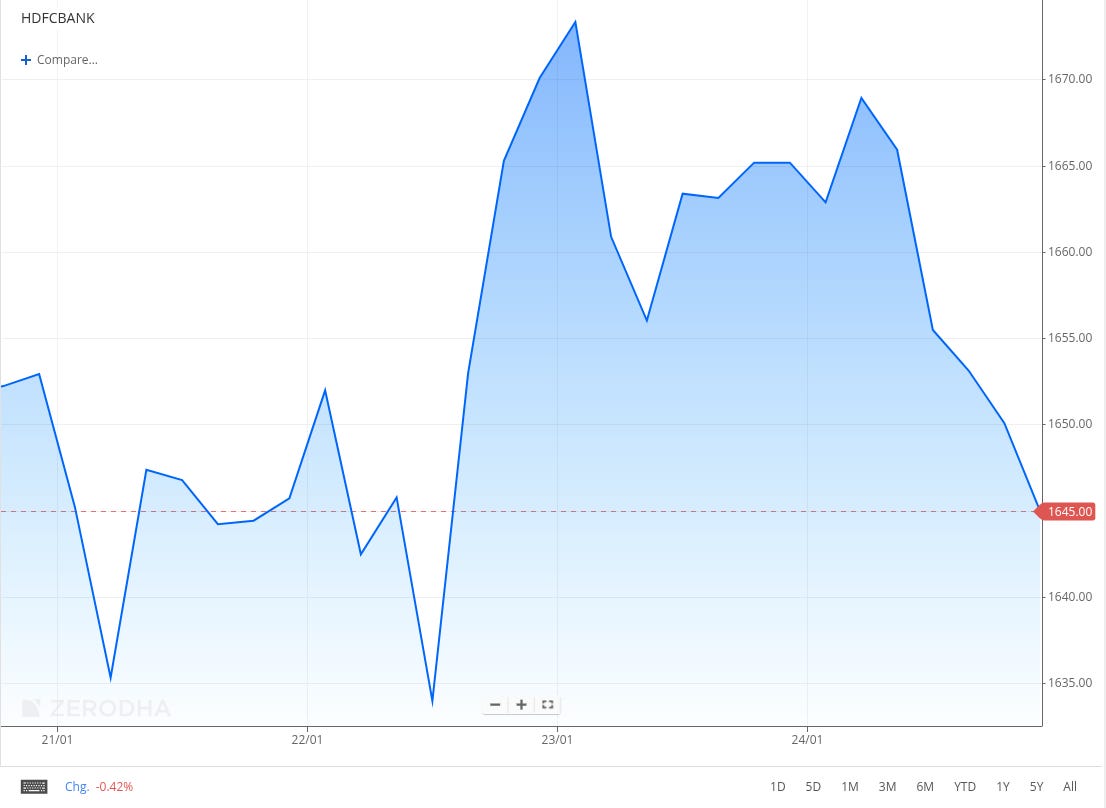

HDFC Bank (HDFCBANK) (0.8%)

Financials:

Net Profit: ₹16,736 crore, up 2.2% YoY.

Interest Earned: ₹76,007 crore, an increase of 7.6% YoY.

Interest Expenses: ₹45,354 crore, a rise of 7.7% YoY.

Net Interest Income (NII): ₹30,653 crore, up 8% YoY.

Gross NPA: ₹36,081 crore, down 5.2% QoQ.

Consolidated Net Revenue: ₹652.8 billion.

Earnings Per Share: ₹21.9.

Key Highlights:

Deposits increased by 4.2% to ₹24.53 lakh crore.

Gross Advances rose by 0.9% to ₹25.43 lakh crore.

The Gross Non-Performing Assets (NPA) ratio slightly increased to 1.42%.

Outlook:

HDFC Bank's diversified portfolio, strong CASA franchise, and efforts towards improving asset quality continue to present a favorable outlook for sustained growth.

PNB Housing Finance Limited (PNBHOUSING) (-4.48%)

Financials:

Revenue: ₹1,941.76 crore, up 10.67% YoY.

Total Income: ₹1,943.11 crore, up 10.66% YoY.

Total Expenses: ₹1,327.46 crore, up 0.89% YoY.

Profit Before Tax: ₹615.65 crore, up 39.88% YoY.

Net Profit: ₹483.27 crore, up 42.71% YoY.

EPS: ₹18.08, up 38.85% YoY.

Key Highlights:

Revenue growth was driven by increased interest income and fees.

Profit saw significant YoY improvement due to better income and cost management.

Gross NPA improved to 3.57% from 4.69% YoY, reflecting enhanced asset quality.

Outlook: The company expects steady growth driven by stable revenues, operational efficiency, and continued focus on improving asset quality.

Bharat Petroleum Corporation Ltd (BPCL) (-3.58%)

Financials:

Revenue from Operations: ₹1,27,520.50 crore (YoY: -1.86%)

EBITDA Margin: 4.19% (YoY: 2.98%)

Net Profit (PAT): ₹4,649 crore (YoY: +36.85%)

Key Highlights:

Interim dividend declared at ₹5 per share

PAT surged by 94% QoQ (from ₹2,397 crore in Q2 FY25)

Revenue up 8.14% QoQ

Outlook: Positive with strong margin improvement

Hindustan Unilever Limited (HINDUNILVR) (-3.58%)

Financials:

Revenue: ₹15,408 crore (YoY: +1%)

EBITDA: ₹3,570 crore (YoY: +1%)

EBITDA Margin: 23.15% (YoY: -0.15%)

Net Profit (PAT): ₹3,001 crore (YoY: +19%)

Key Highlights:

Home Care revenue is up 5.4%, and EBIT is up 9% (YoY).

Beauty business revenue is up 1%, and EBIT is down 8% (YoY).

Volume growth remained flat.

Approved demerger of Kwality Wall’s ice cream business into a separate listed entity.

Acquired a 90.5% stake in the skincare startup Minimalist through secondary buyouts (and primary capital infusion) at a pre-money enterprise value of Rs 2,955 crore.

Outlook: Demand conditions are expected to remain similar to the previous quarter, with price hikes driving underlying volume growth in soaps and tea.

Ultratech Cement (ULTRACEMCO) (6.67%)

Financials:

Revenue: ₹17,193.33 crore (+2.71% YoY)

EBITDA: ₹2,887 crore (-7.8% YoY)

Net Profit (PAT): ₹ 1,473.51 crore (-16.98% YoY)

Key Highlights:

Capacity utilization stood at 73%; domestic sales volume grew by 10% YoY.

Energy costs were reduced by 13% YoY due to lower fuel costs.

Consolidated cement capacity increased to 171.11 MTPA with ICEM acquisition.

Outlook:

Sustained volume growth of 7–8% is expected, driven by government infrastructure and housing projects.

Adani Energy Solutions Limited (ADANIENSOL) (-1.83%)

Financials:

Revenue: ₹5830.26 crore (+27.78% YoY)

EBITDA: ₹2215.7 crore (+39.2% YoY)

Net Profit (PAT): ₹561.78 crore (+72.91% YoY)

Capex: ₹3,074 crore (+165% YoY)

Key Highlights:

Secured the largest project in its history: Rajasthan Phase III Part-I (Bhadla–Fatehpur HVDC) worth ₹25,000 crore.

Commissioned MP Package-II transmission line; under-construction project pipeline now at ₹54,761 crore.

Smart meter deployment progressing at 15,000 units/day, expected to reach 20,000 units/day next quarter.

Outlook:

Strong growth trajectory supported by new project wins and robust operational execution.

Continued expansion of transmission network and smart metering business with significant revenue potential.

Hindustan Petroleum Corp Ltd (HINDPETRO) (-1.69%)

Financials:

Revenue: ₹1,19,415 crore, up by 0.35% from ₹1,19,000 crore.

Net Profit (PAT): ₹3,023 crore, up by 471% from ₹529 crore.

Gross Refining Margin (Apr-Dec): $4.73 per barrel, down from $9.84 per barrel in the previous year.

Key Highlights:

Crude throughput rose to 6.47 MMT, up by 21.1% from 5.34 MMT last year.

Quarterly market sales increased to 12.32 MMT, up by 8.5% from 11.36 MMT.

Significant profit growth driven by high marketing margins, declining crude oil prices, and improved domestic sales.

Outlook:

Continued focus on enhancing domestic sales and operational efficiency to sustain profitability despite lower refining margins.

Dr. Reddy's (DRREDDY) (-6.49%)

Financials:

Revenue: ₹8,358.6 crore, up by 15.85% from ₹7,214.8 crore.

EBITDA: ₹2,298 crore, up by 8.9%, EBITDA margin at 27.5% down from 29.3%.

Net Profit (PAT): ₹1,413.3 crore, up by 2.5% from ₹1,378.9 crore.

Key Highlights:

Newly acquired nicotine replacement therapy (NRT) business contributed ₹605 crore to revenue and ₹124 crore to profit before tax.

Excluding the NRT acquisition, underlying revenue growth stood at 7.5%.

Double-digit growth supported by new launches and improved operational efficiencies.

Outlook:

Continued focus on leveraging recent acquisitions, new product launches, and operational efficiencies to drive growth. Commitment to affordability and innovation remains a key priority.

Adani Green Energy (ADANIGREEN) (-6.13%)

Financials

Revenue: ₹2,365 crore, up by 2.3% from ₹2,311 crore.

EBITDA: ₹1,601 crore, down by 4% from ₹1,666 crore.

EBITDA margin at 67.7% down from 72.1%/.

Net Profit: ₹474 crore, up by 85.2% from ₹256 crore.

Key Highlights:

Greenfield capacity additions of 3.1 GW boosted operational performance.

Development is underway for the world's largest renewable energy plant in Khavda, Gujarat, and large-scale projects in Rajasthan.

Strategic focus on battery energy storage systems (BESS) to enable renewable growth and grid integration.

Outlook: The company remains focused on capacity expansion and innovation in renewable technologies to drive future growth and improve operational efficiency.

United Spirits (UNITDSPR) (2.96%)

Financials:

Revenue: ₹7,732 crore, up by 11% from ₹6,962 crore.

Net Profit (PAT): ₹335 crore, down by 4.3% from ₹350 crore.

Total Expenses: ₹7,256 crore, up by 10.7% from ₹6,555 crore.

Key Highlights:

Profit impacted by higher expenses and a ₹65 crore charge for severance costs related to a closed unit.

Strong revenue growth is driven by consistent demand in core operations.

Outlook: The company aims to optimize cost structures and streamline operations to enhance profitability in upcoming quarters.

Calendars

In the coming days, we have the following major events and corporate actions:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.