Welcome to the weekly edition of the Aftermarket Report, a newsletter where we do a quick weekly wrap-up of what happened in the markets—both in India and globally.

Catch “Who Said What”, a weekly show where we'll pick fascinating comments from notable figures, break them down, and explore the broader stories behind them.

Market Overview this week

Nifty slid 2.39% on a weekly basis, closing at 23,431.5. The decline was driven by fears over the HMPV outbreak, ongoing selling by FPIs, and concerns about economic growth. These factors weighed heavily on investor sentiment, contributing to the broader market weakness throughout the week.

Nifty IT was the sole gainer this week, supported by strong business updates. Meanwhile, Nifty PSU declined by 8.1%, and Nifty Realty ended the week 7.8% lower.

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market.

What happened in India?

India’s GDP growth was projected to slow to 6.4% in 2024-25, driven by slower growth in manufacturing, mining, and construction. However, sectors like agriculture and public administration were expected to see improvement. Dive deeper

HDFC Bank's total advances grew 3% YoY to Rs 25.42 lakh crore in Q3 FY2025, with deposits up 15.8%. Retail loans rose 10%, while corporate loans fell 10.3%. Dive deeper

India's forex reserves fell by $5.693 billion to $634.585 billion in the week ending January 3, due to revaluation and RBI's forex market interventions to manage rupee volatility. Dive deeper

SEBI revised settlement norms for inactive brokerage accounts, streamlining processes and reducing inefficiencies. The change aims to enhance efficiency in settlements, effective immediately following recommendations from the Brokers’ Industry Standards Forum (ISF). Dive deeper

The Export and Import Bank of India (Exim Bank) aimed to raise at least $500 million through 10-year bonds, setting a benchmark for future Indian NBFC dollar fundraisings. Dive deeper

Corporate bond issuance in India reached a three-month high of Rs 1.05 lakh crore in December 2024, contributing to a record Rs 10.66 lakh crore for the year, spurred by strong demand from long-term investors. Dive deeper

Infosys postponed its annual salary increases to FY25 Q4 due to global demand uncertainties. This decision mirrored cost management strategies adopted by competitors such as HCLTech and LTIMindtree. Dive deeper

Shares of ITI Ltd rose driven by strong financial results and investor confidence, boosted by the government's infrastructure focus. Dive deeper

Vodafone Idea prepared for a phased 5G rollout with 46,000 new sites in 2024 and additional sites by March 2025, enhancing network connectivity. Dive deeper

Shares in the hotels and airline sectors dropped up to 6.4% after the confirmation of HMPV cases in India, while the healthcare sector saw positive movement. The India VIX index rose 13%, signaling increased market uncertainty. Dive deeper

Shares of diagnostics companies surged following reports of an HMPV outbreak in China and two confirmed cases in India. The ICMR reassured that India’s surveillance system remained robust. Dive deeper

ndia's services sector expanded in December, with the HSBC Services Business Activity Index rising to 59.3. New orders continued to increase, while job creation softened. Dive deeper

Paras Defence secured a lifetime license for manufacturing MK-46 and MK-48 Light Machine Guns, strengthening its defence portfolio. Dive deeper

United Breweries suspended Kingfisher beer supply to Telangana due to unpaid dues, impacting its stock. Dive deeper

The Finance Ministry met with microfinance institutions (MFIs) to address rising bad loans and delinquencies. The meeting highlighted increased stress in the sector, as indicated by the RBI report, with concerns over borrower indebtedness and the rising average loan ticket size. Dive deeper

The Centre released ₹1.73 lakh crore in tax devolution to state governments, significantly higher than the ₹89,086 crore released in December 2024. The increased devolution aims to support states in financing development and welfare activities. Dive deeper

SEBI warned Ola Electric over failing to announce expansion plans on social media before stock exchange disclosures, stressing the need for timely information sharing. Dive deeper

India revised its November gold imports down by $5 billion, reducing the trade deficit, though imports still hit a record $47 billion in 2024. Dive deeper

The gems and jewellery sector requested a 1% GST reduction in the upcoming Budget to ease costs and improve affordability, particularly in rural areas. Dive deeper

Zomato re-launched its 15-minute food delivery service in select locations in cities like Mumbai and Bengaluru. Dive deeper

Borosil Renewables increased its solar glass manufacturing capacity by 50% to 1,500 tons per day, supporting the supply chain for PV module manufacturers. Dive deeper

Swiggy Instamart expanded to 76 cities and launched a standalone app, increasing accessibility for over 100 million users. Dive deeper

Tata Motors Group reported global wholesales of 341,791 units in Q3 FY25, a 1% increase YoY. Passenger vehicle wholesales grew by 1%, while Jaguar Land Rover’s sales rose by 3%, with Land Rover contributing the majority of sales. Dive deeper

LIC's Bima Sakhi Yojana reached 50,000 registrations within a month, with plans to recruit 2 lakh Bima Sakhis over the next three years, offering a monthly stipend and commission-based earnings. Dive deeper

SpiceJet was set to unground 10 aircraft by mid-April 2025, increasing its fleet size to 28 and expanding its network with 60 new flights. Dive deeper

Strata received SEBI approval to launch its Small and Medium Real Estate Investment Trust (SM-REIT), offering retail and institutional investors access to commercial properties. Dive deeper

Mahanagar Gas Ltd. received a 26% increase in domestic gas allocation from GAIL, effective January 16, to raise its CNG supply. Dive deeper

Indian Overseas Bank (IOB) sold ₹11,500 crore of non-performing assets (NPAs) to asset reconstruction companies (ARCs), aiming to enhance asset quality. Dive deeper

RBI accepted 77% of the notified amount in January’s government security buyback auctions, totalling ₹19,217.5 crores from ₹25,000 crores. Dive deeper

Adani Group planned to raise ₹7,148 crore from the sale of up to 20% of its stake in Adani Wilmar to support its core infrastructure focus. Dive deeper

What happened across the globe?

Job openings in the U.S. rose by 259,000 to 8.098 million in November 2024, surpassing expectations. Openings increased in professional services, finance, and education. Dive deeper

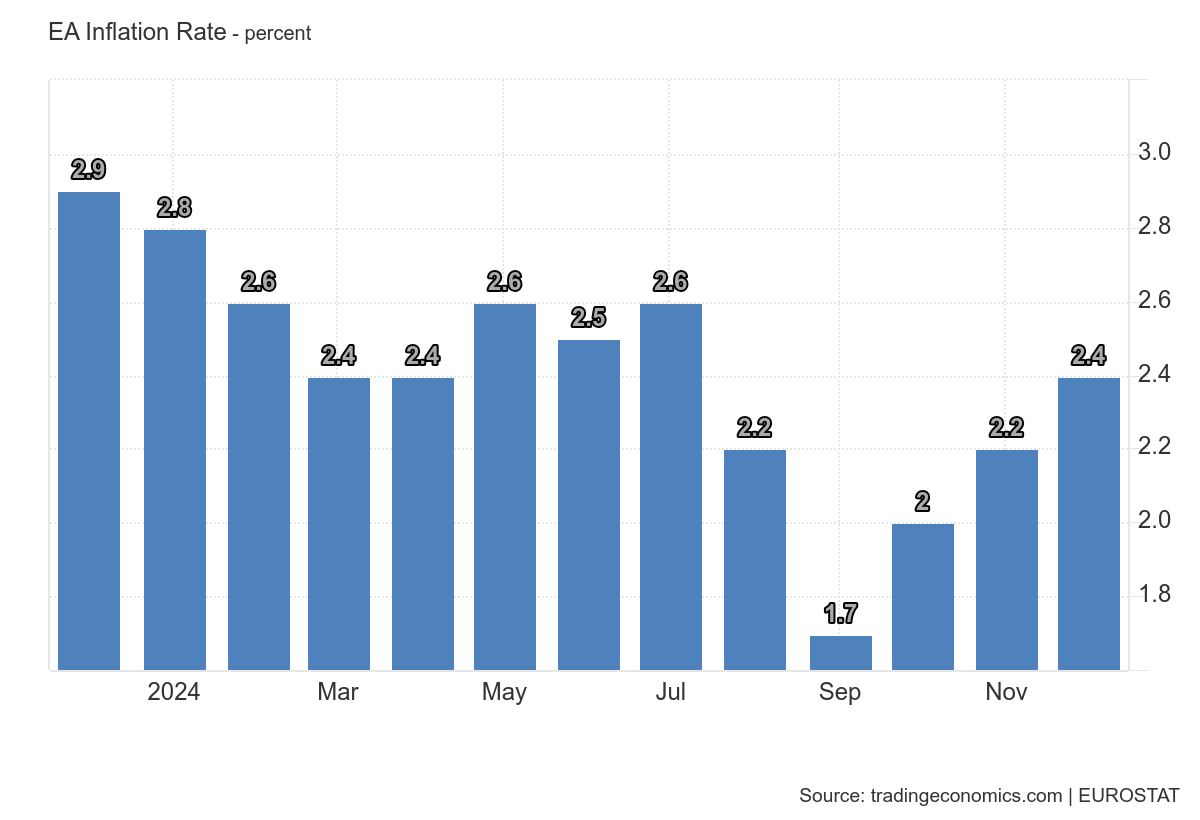

Euro Area inflation rose to 2.4% in December 2024, driven by higher energy prices and rising service costs. Core inflation remained steady at 2.7%, with inflation easing in Italy. Dive deeper

Minutes from the December 2024 Federal Open Market Committee (FOMC) meeting showed rising inflation risks. The Fed cut rates by 25bps in December and signalled further cuts in 2025. Dive deeper

Brent crude oil futures rose 2% to surpass $78.5 per barrel, driven by a drop in U.S. crude stockpiles and cold weather reducing inventories at Cushing, Oklahoma. Dive deeper

Taiwan’s exports rose 9.2% YoY in December 2024 to USD 37.5 billion, driven by growth in electronics, machinery, and base metals. Exports to ASEAN and South Korea saw strong demand. Dive deeper

China’s 10-year government bond yield dropped to 1.62% after the PBoC halted treasury bond purchases. Economic data showed consumer prices fell to 0.1% in December, while producer. Dive deeper

Apple remained unable to sell the iPhone 16 in Indonesia due to not meeting the 35% local content requirement. The production facility built for Airtag devices didn’t fulfil the criteria. Dive deeper

Germany’s retail sales fell 0.6% MoM in November 2024, driven by a 1.8% decline in non-food retail, including e-commerce. However, year-on-year, retail sales rose 2.5%. Dive deeper

Singapore’s competition regulator approved AMD’s $4.9 billion acquisition of ZT Systems, stating it would not harm market competition. The deal will enhance AMD’s AI and data centre position. Dive deeper

Shares of Nippon Steel fell after President Biden blocked its $15 billion takeover of U.S. Steel due to national security concerns. Both companies plan to contest the decision legally. Dive deeper

The Caixin China General Services PMI rose to 52.2 in December 2024, driven by stronger domestic demand. However, the new export business fell and input price inflation increased. Dive deeper

The People’s Bank of China (PBoC) auctioned CNY 60 billion in six-month bills to reduce yuan liquidity. This move came amid concerns over China’s economy and U.S. tariffs. Dive deeper

Foxconn’s shares rose after reporting a 15.2% increase in Q4 2024 revenue to T$2.13 trillion, driven by strong demand for AI servers in cloud and networking products. Dive deeper

Amazon invested $11 billion in expanding its AWS infrastructure in Georgia, strengthening its cloud computing and AI capabilities. The investment is part of its market positioning strategy. Dive deeper

Microsoft CEO Satya Nadella announced a $3 billion investment to expand AI and cloud infrastructure in India. The company aimed to train 10 million people in AI by 2030. Dive deeper

The S&P Global UK Construction PMI fell to 53.3 in December 2024, reflecting slower growth due to weaker demand, high borrowing costs, and subdued confidence. Optimism for 2025 remained cautious. Dive deeper

Japan’s Prime Minister Shigeru Ishiba expressed concerns that President Biden’s decision to block Nippon Steel’s takeover could deter future Japanese investments in the U.S. Dive deeper

Germany’s industrial production rose by 1.5% in November 2024, driven by sectors like energy, construction, and transport equipment. However, production fell by 1.1% on a three-month basis. Dive deeper

U.S. natural gas futures rose over 6% to above $3.6 per MMBtu due to supply disruptions and strong global demand. Utilities withdrew 40 billion cubic feet of gas in the week ending January 3. Dive deeper

The U.S. added 160K jobs in December 2024, with the unemployment rate staying at 4.2%. Wages rose 0.3%, maintaining a 4% annual growth, with total payroll gains for 2024 expected at 2.144 million. Dive deeper

Japan’s household spending fell 0.4% YoY in November 2024, marking its fourth consecutive decline, though the drop was the mildest. Spending on food, fuel, and furniture decreased. Dive deeper

Quarterly results

In this section, we'll dive into all the key highlights from today's intriguing results, covering the most impactful performances and standout moments. The numbers are comparable on a year-on-year (YoY) basis.

Tata Consultancy Services Limited (4.04%)

Financials:

Revenue: ₹63,973 crores, up 5.59% YoY, down 0.4% QoQ

Net Profit (PAT): ₹12,380 crore, up 12% YoY (from ₹11,058 crore in Q3 FY24)

Dividend: ₹76 per share, including ₹66 as special dividend

Operating Margin: 24.5%, down 50 bps YoY, up 40 bps sequentially

Key Highlights:

Revenue growth of 5.6% YoY, driven by growth in BFSI and CBG segments.

Strong Total Contract Value (TCV) performance across industries, geographies, and service lines.

BFSI and CBG segments have returned to growth, providing positive momentum.

Effective handling of currency fluctuations helped mitigate risks and added to financial stability.

Outlook:

TCS continued to show strong performance across multiple sectors and regions, with good visibility for future growth.

Indian Renewable Energy Development Agency (- 12.75%)

Financials:

Revenue: ₹1,698.45 crore, up 35.6% YoY

Net Profit: ₹425.38 crore, up 27% YoY (from ₹335.53 crore in Q3 FY24)

Operating Profit: ₹652 crore, up 51% YoY

Interest Income: ₹1,654.45 crore, up from ₹1,577.05 crore in Q2 FY25

Other Income: ₹30.93 crore, up from ₹9.53 crore in Q2 FY25

Expenses: ₹1,160.78 crore, up from ₹867.06 crore in Q3 FY24

Key Highlights:

Strong growth in revenue and operating profit due to increased interest income.

The company's NPAs have increased, but the NPA percentage has improved slightly.

Increase in debt-to-equity ratio, indicating higher leverage.

Outlook:

IREDA continues to focus on expanding its loan book and maintaining its growth in the renewable energy sector, despite rising leverage and NPA levels.

GTPL Hathway (-6.62%)

Financials:

Revenue: ₹887.27 crore, up 4.27% YoY

EBITDA: ₹113.80 crore, down 12.76% YoY

Net Profit: ₹10.17 crore, down 57.03% YoY (from ₹23.67 crore in Q3 FY24)

EBITDA Margin: 12.7%, down from 15.2% YoY

Key Highlights:

Weak financial performance with a significant decline in net profit and EBITDA.

Modest revenue growth, primarily driven by increased subscriber base across business divisions.

Outlook:

Despite weaker financials, subscriber growth across segments provides some support for future performance.

G M Breweries Limited (-11.77%)

Financials:

Net Sales: ₹165.84 crore, up 5.66% YoY

Net Profit (PAT): ₹21.97 crore, down 2.79% YoY (from ₹22.60 crore in Q3 FY24)

EBITDA: ₹30.95 crore, down 4.09% YoY

EPS: ₹9.61, down from ₹12.37 YoY

Key Highlights:

Revenue growth, despite a decline in net profit and EBITDA.

The decline in profit was primarily driven by higher raw material costs and increased expenses.

Outlook:

GM Breweries continues to show modest growth in sales, although profitability has been under pressure.

Calendars

In the coming week, We have the following quarterly results and other major events:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

Thanks for the research and providing brief summary on key market findings!