Market Optimism Builds Ahead of Tomorrow's Union Budget

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

Nifty opened slightly higher at 23,296.75 and gained momentum throughout the session. In the final hour, it added about 100 points to reach the day’s high of 23,546.80 before closing near that level at 23,508.40, up 1.11%.

Consumer goods stocks led the rally, alongside energy and capital goods counters, fueling the day’s gains. Broader indices also traded in the green, with mid and small-cap segments posting solid advances. Meanwhile, the India VIX declined 6.56%, indicating a drop in market volatility.

Market optimism was supported by the Economic Survey’s projection of 6.3–6.8% GDP growth for FY26 and anticipation of the Union Budget tomorrow.

Broader Market Performance:

The broader market had a positive session today, with a strong number of advancing stocks. A total of 2,919 stocks were traded, of which 2,130 advanced, 711 declined, and 78 remained unchanged.

Sectoral Performance:

Sectoral performance was positive, with Nifty Energy leading the gains, up by 2.63%, followed by Nifty Consumer Durables and Nifty FMCG, which rose by 2.44% and 2.04%, respectively. Nifty Realty also showed a solid gain of 1.94%. On the other hand, Nifty Pharma had the smallest increase, rising by 0.09%.

Net Flow Breakdown for the day:

FII: Net outflow of -₹1,188.99 crore (Bought ₹14,000.07 crore, Sold ₹15,189.06 crore)

DII: Net inflow of ₹2,232.22 crore (Bought ₹13,549.67 crore, Sold ₹11,317.45 crore)

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 06th February:

The maximum Call Open Interest (OI) is observed at 24,000, followed by 23,500, indicating strong resistance levels around these strikes.

The maximum Put Open Interest (OI) is at 23,000, followed by 23,500, 23,400, 23,300, and 23,200, suggesting key support zones around these levels, particularly 23,000.

Note: OI is subject to multiple interpretations, but generally, an increase in the call OI indicates resistance in a falling market, and an increase in the put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

The Indian rupee hit a record low of 86.6525 per USD, becoming the worst performer among major Asian currencies in January. The decline was driven by portfolio outflows, expectations of a rate cut, and uncertainty over U.S. trade tariffs. The rupee fell 1.1% in January, marking its second consecutive monthly decline. Dive deeper

The RBI initiated a Rs 20,000 crore liquidity infusion through an open market operation (OMO), purchasing a mix of liquid and illiquid bonds to manage market sentiment. The operation involved a mix of premium and discount bond purchases, and the RBI plans a second liquidity measure with a dollar-rupee swap. Dive deeper

SEBI has issued guidelines mandating market infrastructure institutions (MIIs) to undergo external performance evaluations of their statutory committees every three years, starting FY 2024-2025. The evaluations aim to improve transparency, with a focus on roles, meeting effectiveness, and governance. Dive deeper

IRDAI has capped annual health insurance premium hikes for senior citizens at 10%, aiming to prevent steep increases that burden policyholders aged 60 and above. This directive ensures that insurers cannot raise premiums without prior approval, addressing concerns about escalating healthcare costs for seniors. Dive deeper

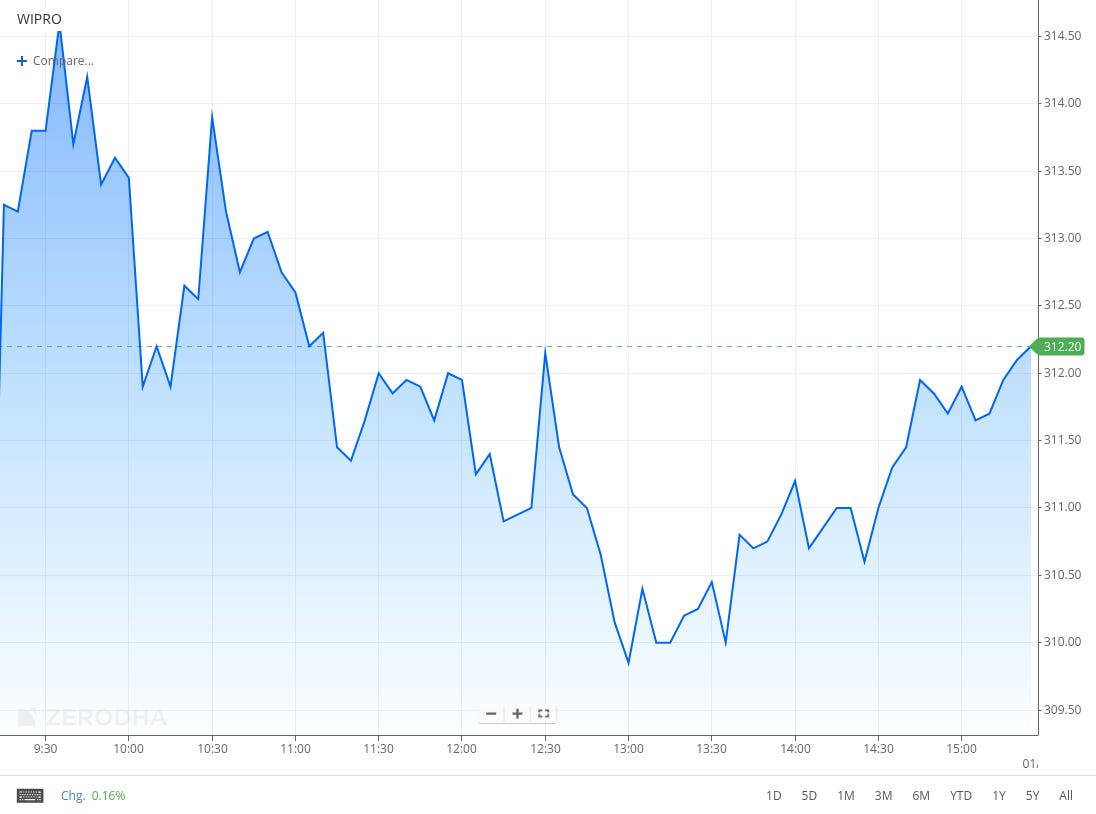

Wipro secured a multi-million-dollar, five-year contract with Etihad Airways to modernize its technology and enhance operational efficiency. The deal will provide real-time insights into resource utilization and improve scalability across Etihad’s operations. Dive deeper

Bharat Electronics Limited (BEL) reported a 47% rise in Q3 profit to ₹1,316.06 crore, with a turnover increase of 37% to ₹5,643.25 crore. Its order book reached ₹71,100 crore, signalling strong future revenue growth. Dive deeper

Aarti Industries has agreed to acquire 49% equity in Clean Max Indus for ₹49,000, supporting its renewable energy goals. The 16.5 MW wind-solar project aims to reduce power costs and is expected to be completed within 10 days. Dive deeper

Visametric Vize Hizmetleri, a step-down subsidiary of BLS International, has acquired 100% of Visametric Albania SHPK for €106, making it a wholly owned step-down subsidiary. The company offers visa counselling services for the German Consulate. Dive deeper

Ola Electric launched its Gen 3 scooters, featuring a 320 km range and innovations like dual-channel ABS and brake-by-wire technology. The S1 Pro+ is powered by Ola's Made-in-India 4680 Bharat Cell battery. Dive deeper

JSW Steel has completed the acquisition of 100% equity shares in ThyssenKrupp Electrical Steel India Private Limited (tkES India) through its wholly owned subsidiary Jsquare Electrical Steel Nashik Private Limited. The total consideration for the transaction, including the technology package from ThyssenKrupp, amounts to Rs. 4,158.6 crore. Dive deeper

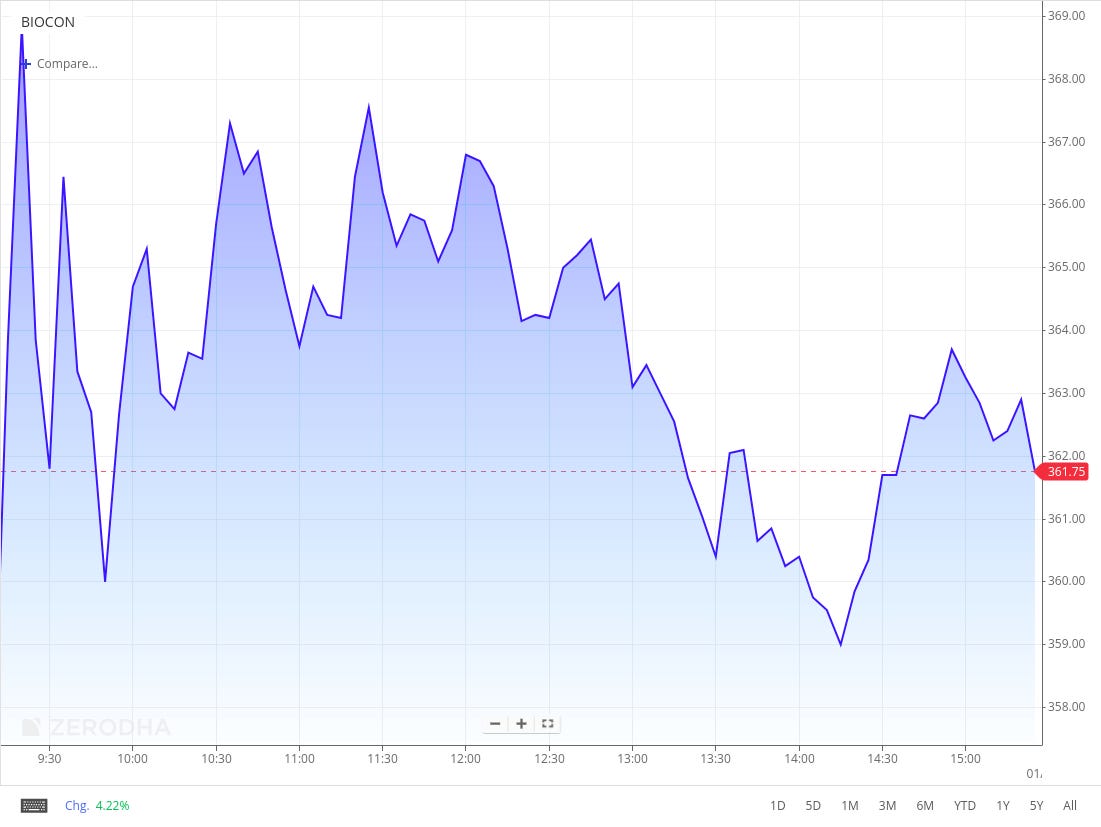

Biocon Limited has approved purchasing 1.5% equity in its subsidiary, Biocon Biologics Limited, from an existing investor for Rs. 5,550 million, increasing its stake to 90.2%. The acquisition is set to be completed by February 1, 2025. Dive deeper

NODWIN Gaming has acquired StarLadder, a leading esports event company, in a deal valued at USD 5.5 million, expanding its AAA IP and event production portfolio. The acquisition strengthens NODWIN's position in global esports, with StarLadder founder Roman Romanstov continuing to lead the business. Dive deeper

Wockhardt's Zaynich achieved a 96.8% clinical cure rate in a Phase III study, surpassing meropenem and setting a new standard for antibiotics in treating complicated urinary tract infections. The company plans to seek regulatory approval from the US FDA and EMA. Dive deeper

Moscow is in talks with India to introduce a group-free visa regime, allowing small tourist groups to visit without a visa. The proposal aims to boost tourism, with India being the second-largest source market after China. Dive deeper

Airtel Africa's Q3 FY25 net profit surged over 11-fold to $169 million, driven by a $94 million gain from currency appreciation and lower finance costs. Revenue grew 2% to $1.26 billion, with a second $100 million share buyback announced. Dive deeper

Paradeep Phosphate will invest Rs 4,000 crore over five years in Odisha to boost phosphatic fertilizer production and infrastructure, creating up to 1,150 jobs. The investment aims to increase capacity, reduce environmental impact, and support agricultural growth. Dive deeper

What’s happening globally

Brent crude oil futures rose towards $76 per barrel as traders awaited clarity on President Trump's tariff deadline and the OPEC+ meeting on February 3. The market is expecting OPEC+ to maintain its current supply policy, with price pressures from Trump and the impact of US sanctions on Russia. Dive deeper

Gold surged to an all-time high of $2,800 per ounce, fueled by fears of trade wars after President Trump's tariff threats and support from looser global monetary policies. Dive deeper

The US economy grew 2.3% in Q4 2024, the slowest pace in three quarters, with personal consumption rising 4.2%, but a decline in fixed investment and private inventories dragged down growth. For the full year, the economy expanded by 2.8%. Dive deeper

The dollar index stayed above 108 as markets await Trump's tariff decisions and the PCE price report. Despite a slight miss in Q4 GDP growth, the dollar is set to gain against most currencies but may fall against the yen. Dive deeper

US initial jobless claims fell by 16,000 to 207,000 for the week ending January 25th, below market expectations, signalling a steady labour market. Recurring claims also decreased by 42,000, indicating a strong labour market and supporting the Fed's stance on maintaining restrictive rates. Dive deeper

Germany's seasonally adjusted unemployment rate rose to 6.2% in January 2025, the highest since October 2020, with the number of unemployed individuals increasing by 11,000 to 2.88 million. This increase aligns with typical seasonal trends, according to labor office head Andrea Nahles. Dive deeper

France's annual inflation rate rose to 1.4% in January 2025, slightly below the expected 1.5%, marking the fourth consecutive month of inflation increases. This was driven by higher manufactured goods and energy prices, though offset by a slowdown in services and tobacco prices. Dive deeper

The European Central Bank lowered interest rates by 25 bps in January 2025, reducing the deposit, refinancing, and lending rates. This move aims to ease borrowing costs while addressing inflation pressures and targeting a 2% inflation goal. Dive deeper

European stocks extended gains on Friday, with the STOXX 50 and STOXX 600 hitting new highs, rising 0.3% each. This came after positive corporate results and below-forecast inflation in France. Dive deeper

Spain's retail sales rose 4% year-on-year in December 2024, surpassing expectations, with non-food product sales up 5.5%. Spending on food increased by 2.7%, and monthly retail trade grew by 1.5%. For the full year, retail sales grew by 1.7%. Dive deeper

UK house prices rose 4.1% year-on-year in January 2025, easing from a 4.7% high in December. Despite resilience, affordability remains a challenge, with buyers spending a higher portion of income on mortgages than the long-run average. Dive deeper

Japan's industrial production rose 0.3% in December 2024, reversing a previous decline, driven by gains in production machinery, electronic parts, and chemicals. Yearly, production fell 1.1%, improving from November's 2.7% drop. Dive deeper

OpenAI is in talks to raise up to $40 billion in funding led by SoftBank, with a post-money valuation of $300 billion. The deal would make SoftBank a major investor, marking a significant step in OpenAI’s plans to expand AI infrastructure and technology. Dive deeper

Samsung expects limited Q1 2025 earnings growth due to weak memory chip demand. Q4 2024 operating profit dropped 29%, impacted by its mobile and chip businesses, but a recovery in memory demand is expected by Q2 2025. Dive deeper

Intel's Q4 revenue surpassed expectations, but its Q1 forecast missed estimates due to weak demand for data centre chips and ongoing leadership uncertainty. The company also paused its AI chip design, Falcon Shores, and faces competition from Nvidia and AMD. Dive deeper

Apple shares rose after forecasting strong sales growth, driven by AI features and device upgrades, despite a slight dip in iPhone sales. Strong iPad and Mac sales helped offset losses, with a moderate sales growth outlook for Q2 2025. Dive deeper

Quarterly results

In this section, we'll dive into all the key highlights from today's intriguing results, covering the most impactful performances and standout moments. The numbers are comparable on a year-on-year (YoY) basis.

Nestlé India (+4.32%)

Financials:

Revenue: ₹4,780 crores, up by 4% YoY.

EBITDA: ₹1,085 crores, down by 1% YoY.

Net Profit: ₹696 crores, down by 5% YoY.

EPS: ₹7.22, up by 6% YoY.

Key Highlights:

The company expanded its portfolio by launching NESPRESSO in India and increased its manufacturing capacity with a new confectionery unit at the Sanand factory.

Nestlé India is advancing its sustainability efforts, notably by installing biodigesters in dairy farms to mitigate methane emissions and promote sustainable agricultural practices.

Outlook:

The company continues to focus on product innovation and market expansion to drive growth amid competitive pressures.

Marico Limited (-0.22%)

Financials

Revenue from Operations: ₹2,794 crores, up 15.34% YoY.

Net Profit:₹406 crores, up 5.18% YoY.

EPS: ₹3.08.

Key Highlights:

Marico demonstrated robust sales growth in its core categories, driving a notable increase in overall revenue.

Effective cost management strategies contributed to profitability despite rising input costs.

Outlook:

The company continues to focus on expanding its market share through innovative product launches and strategic market interventions.

Punjab National Bank (+4.85%)

Financials

Revenue: ₹31,895 crores, up by 15% YoY.

EBITDA: ₹24,401 crores, up by 33% YoY.

Net Profit: ₹4,811 crores, up by 97% YoY.

EPS: ₹4.18, up by 89% YoY.

Key Highlights:

The bank has seen a significant net profit increase due to robust revenue growth and effective cost management.

Continued expansion in core banking operations and significant gains from treasury operations contributed to the financial performance.

Outlook:

The company is focusing on enhancing digital banking capabilities and expanding its retail banking segment to sustain growth momentum.

Biocon Limited (+1.55%)

Financials

Revenue: ₹3,821 crores, down by 3% YoY.

EBITDA: ₹752 crores, down by 17% YoY.

Net Profit: ₹81.1 crores, down by 96% YoY.

EPS: ₹0.21, down by 96% YoY.

Key Highlights:

The company faced significant challenges, markedly impacting both EBITDA and net profit due to reduced operational performance.

Cost management and operational adjustments are ongoing to align with current market conditions and internal forecasts.

Outlook:

The company is focusing on strategic initiatives to recover from the downturn, including enhancing operational efficiency and exploring new market opportunities to bolster growth.

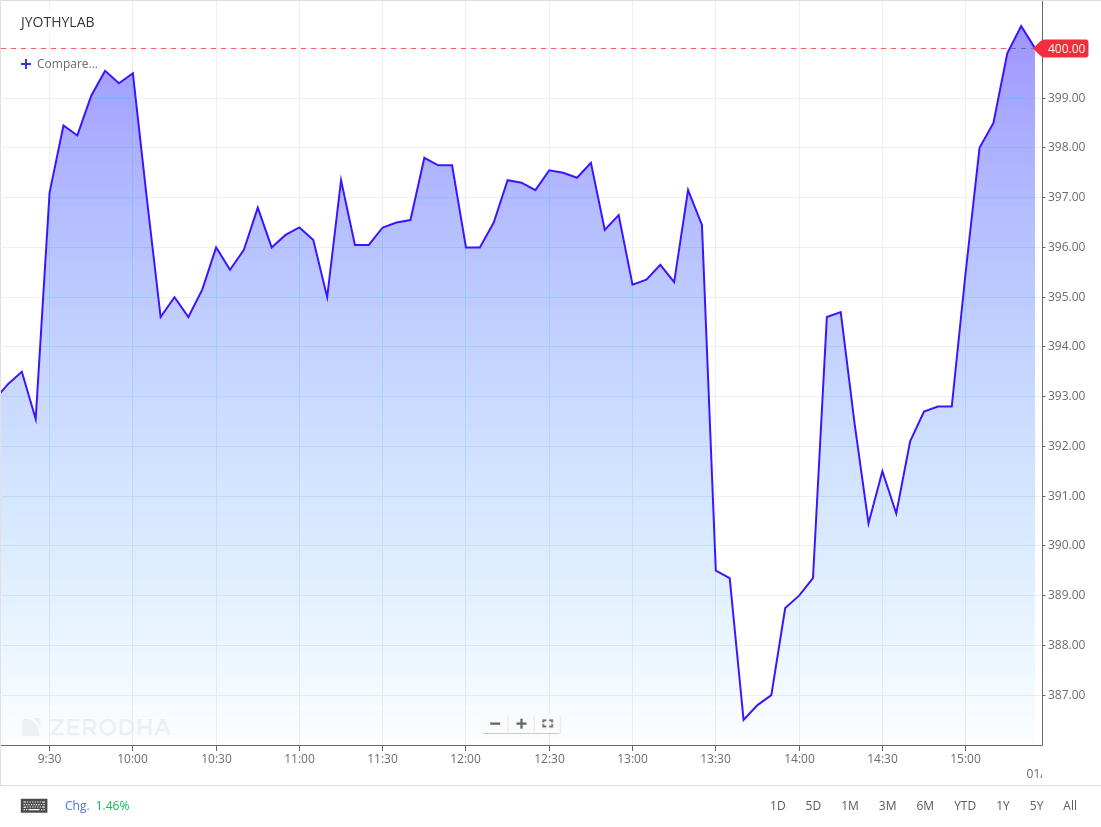

Jyothy Labs (+0.42%)

Financials

Revenue: ₹704 crores, up by 4% YoY.

EBITDA: ₹116 crores, down by 2% YoY.

Net Profit: ₹87.4 crores, down by 4% YoY.

EPS: ₹2.38, down by 4% YoY.

Key Highlights:

Jyothy Labs continues to enhance market reach and brand visibility through targeted marketing campaigns.

The company has firmly focused on cost-efficiency measures to offset the increasing raw material prices.

Outlook:

The company is strategically focusing on product diversification and market penetration to sustain growth in the competitive FMCG sector.

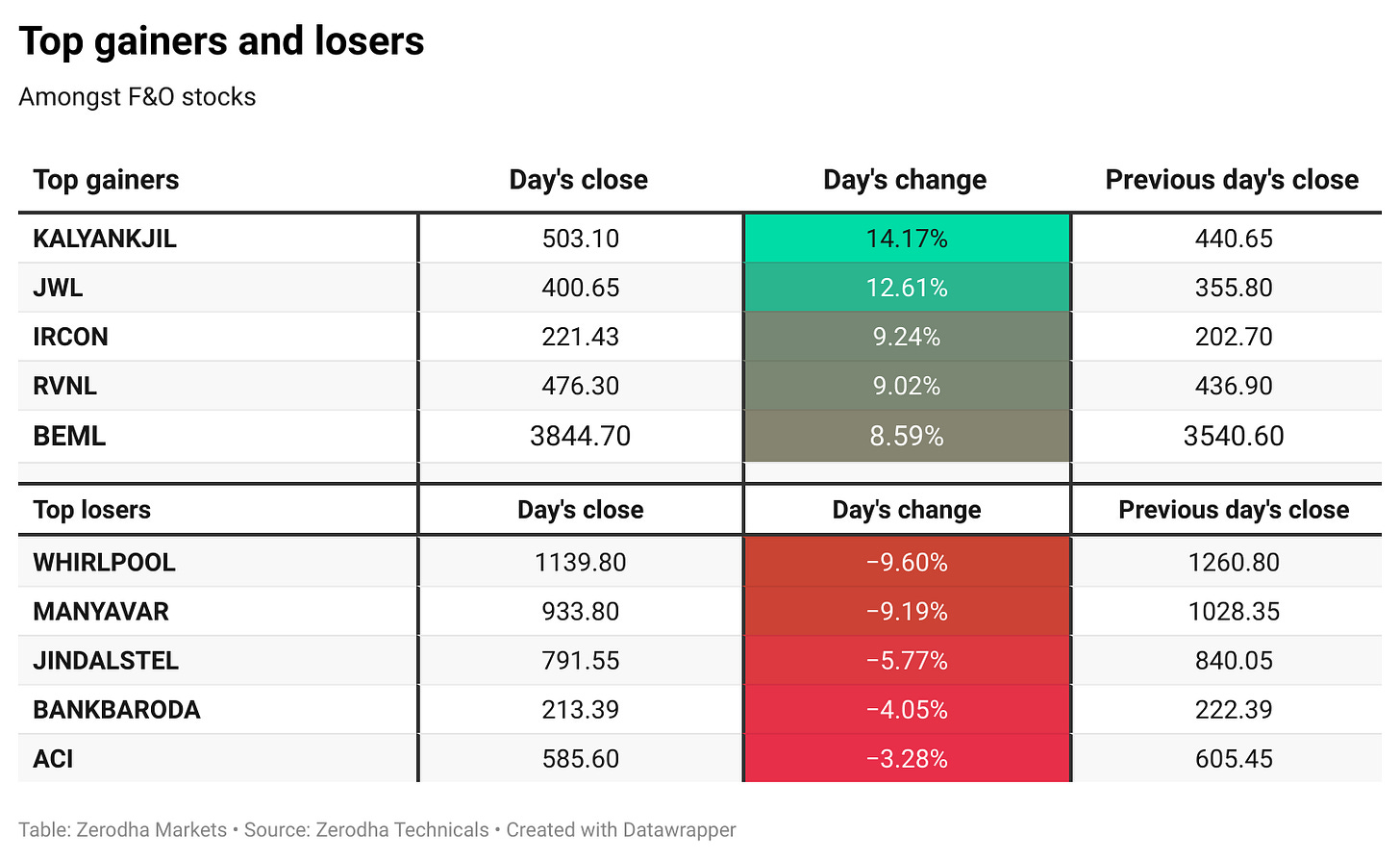

Kalyan Jewellers (+14.17%)

Financials:

Revenue: ₹7,287 crores, up by 40% YoY.

EBITDA: ₹439 crores, up by 19% YoY.

Net Profit: ₹219 crores, up by 21% YoY.

EPS: ₹2.12, up by 21% YoY.

Key Highlights:

The company saw robust sales growth, driven by strong festive demand and expansion in tier 2 and 3 cities.

Kalyan Jewellers has enhanced its focus on high-margin diamond jewellery, which contributed to improved profitability.

Outlook:

The company is optimistic about sustaining growth momentum through strategic store expansions and enhancing customer engagement initiatives.

PB Fintech Ltd. (+4.27%)

Financials:

Revenue: ₹1,292 crores, up by 48% YoY.

EBITDA: ₹27.6, up by 203% YoY.

Net Profit: ₹72 crores, up by 92% YoY.

EPS: ₹1.56, increased by 86% YoY.

Key Highlights:

PB Fintech's insurance premium reached ₹6,135 crores this quarter, with a 44% growth in new core online insurance premiums.

The health and life insurance segments were particularly strong, driving the revenue and profit surge.

The company also highlighted its strategic expansions and technological enhancements, contributing to its operational successes.

Outlook:

The company continues to focus on expanding its insurance offerings and enhancing platform capabilities to sustain growth and leverage emerging market opportunities.

Tata Consumer Products (+5.99%)

Financials:

Revenue: ₹4,444 crores, up by 17% YoY.

EBITDA: ₹565 crores, down by 1% YoY.

Net Profit: ₹282 crores, down by 16% YoY.

EPS: ₹2.82, down by 2% YoY.

Key Highlights:

Revenue growth is driven by increased demand across all segments.

Higher commodity costs and operational expenses impacted EBITDA and net profit.

Outlook:

The company is focusing on cost optimisation and expanding its market presence to enhance profitability in future quarters.

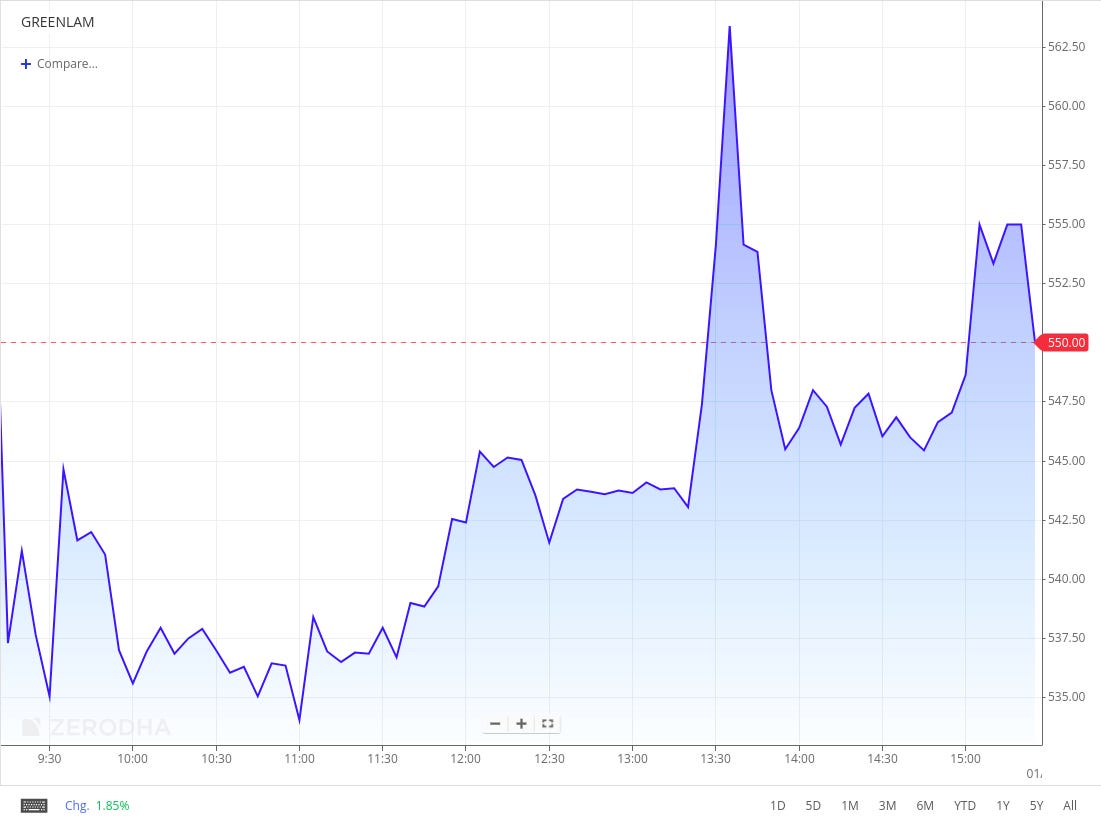

Greenlam Industries (+0.36%)

Financials

Revenue: ₹602 crores, up by 7% YoY.

EBITDA: ₹63.5 crores, down by 11% YoY.

Net Profit: ₹12.5 crores, down by 50% YoY.

EPS: ₹1.00, down by 49% YoY.

Key Highlights:

The company has focused on expanding its laminates and allied products.

Efforts to enhance operational efficiencies and cost management were emphasised to mitigate the impact of rising material costs.

Outlook:

The company is committed to innovation and improving operational efficiencies to strengthen its market position.

Container Corporation of India Ltd. (+3.15%)

Financials

Revenue: ₹2,208 crores.

EBITDA: ₹465 crores, down by 10% YoY.

Net Profit: ₹367 crores, up by 11% YoY.

EPS: ₹6.02, up by 11% YoY.

Key Highlights:

The company maintained stable revenues despite challenging market conditions.

Achieved a significant increase in net profit, reflecting improved operational efficiency.

Outlook:

The company aims to enhance operational efficiencies and expand its service network to drive future growth.

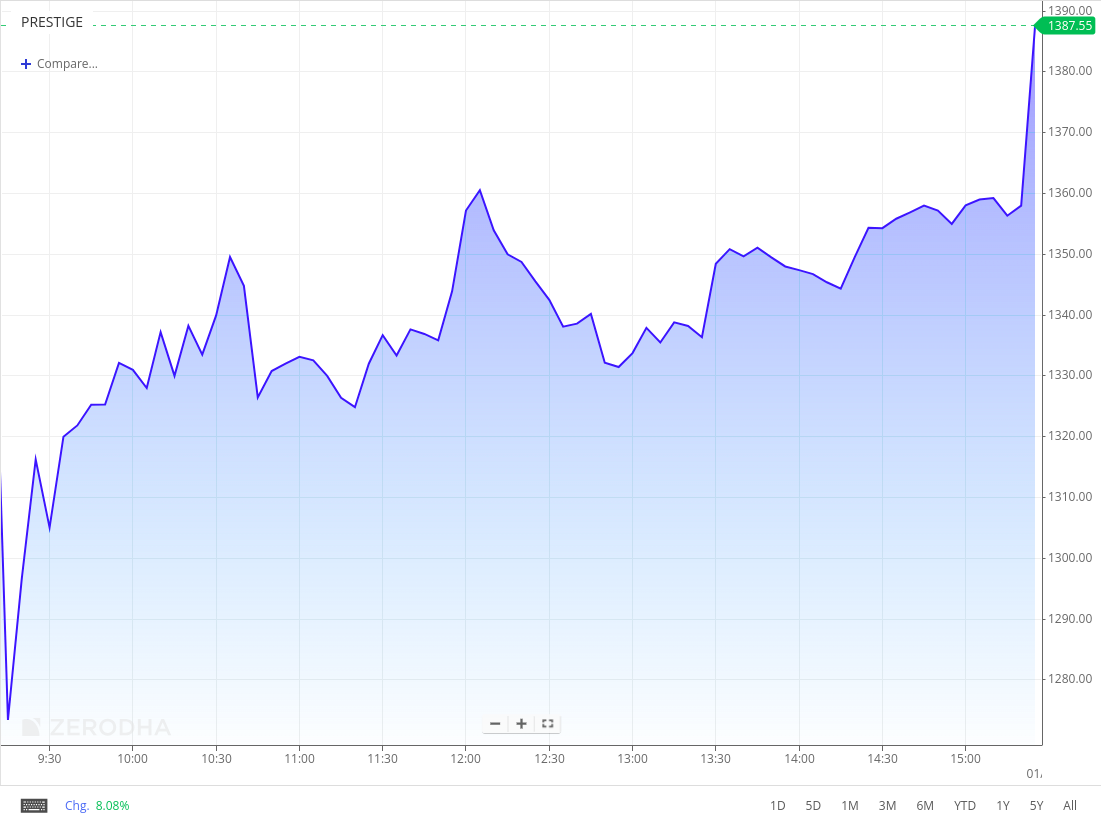

Prestige Estates (+1.28%)

Financials

Revenue: ₹1,654 crores, down by 8% YoY.

EBITDA: ₹583 crores, up by 9% YoY.

Net Profit: ₹32.2 crores, down by 85% YoY.

EPS: ₹0.41, down by 86% YoY.

Key Highlights:

Prestige Estates faced challenges in sales but managed to improve operational efficiency, leading to a higher EBITDA.

Significant net profit and EPS decrease primarily due to higher operational costs and a challenging economic environment.

Outlook:

The company is focused on strategic investments and operational adjustments to navigate the ongoing market volatility and improve profitability.

Equitas Small Finance Bank (+0.41%)

Financials:

Revenue: ₹1,612 crores, up by 13% YoY.

EBITDA: ₹645 crores, down by 10% YoY.

Net Profit: ₹66.3 crores, down by 67% YoY.

EPS: ₹0.58, down by 68% YoY.

Key Highlights:

The bank has enhanced its focus on digital banking initiatives to streamline customer service and improve operational efficiency.

A strategic shift towards higher-yielding asset classes is observed to effectively manage interest rate volatility and credit risk.

Outlook:

The company is prioritising technology integration and expansion of its retail banking sector to capture a larger market share and improve profitability amidst a competitive financial landscape.

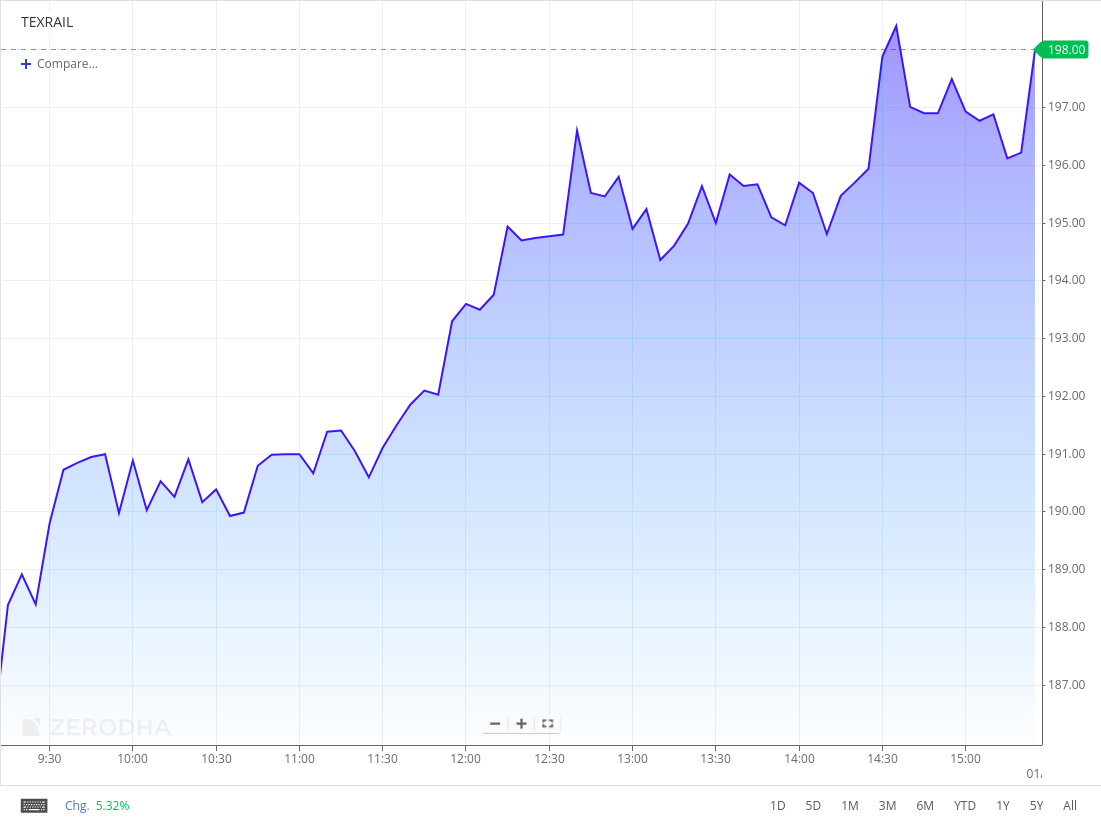

Texmaco Rail & Engineering Ltd (+5.76%)

Financials:

Revenue: ₹1085.87 crores, up by 21.14% YoY.

Net Profit: ₹47.01 crores, up by 60.12% YoY.

EPS: ₹1.18, up by 32.58% YoY.

Key Highlights:

Texmaco continued to enhance its operational efficiencies across various segments, leading to substantial revenue growth.

The company has been actively expanding its capacity and capabilities in the freight car division, significantly increasing its revenue streams.

Outlook:

The company continues to focus on expanding its market presence and enhancing operational efficiency to drive further growth.

Cholamandalam Investment & Finance Company Ltd. (+0.50%)

Financials:

Revenue: ₹6,733 crores, up by 34% YoY.

EBITDA: ₹4,695 crores, up by 31% YoY.

Net Profit: ₹1,088 crores, up by 25% YoY.

EPS: ₹12.94, up by 25% YoY.

Key Highlights:

The company has shown a robust increase in its operational income and profitability with a substantial revenue and net profit growth trajectory.

The EPS increase aligns with the net profit growth, indicating efficient profitability management.

Outlook:

The company is expected to maintain its growth momentum, leveraging its strong market position and diversified financial services.

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Amit Paithankar, CEO, Waaree Energies on Q3 results and growth

"Strong execution is what led to order book realizations. 45% of the current order book is coming from India."

"The gestation period for orders varies from one month for retail orders to 18-24 months for export orders, with an average of 9-12 months."

"The US business contributed 15–20% to revenues in the first nine months of this fiscal, and the order pipeline remains strong." - Link

Calendars

In the coming days, we have the following major events, corporate actions, and upcoming earnings releases:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.