Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real time by Tijori.

Market Overview

Nifty opened with a slight gap down of 17 points at 23,796.90 and initially dipped to 23,725 levels. It then recovered 100 points to trade flat, remaining range-bound until 11 AM. Around this time, it broke out to reach 23,900, hitting an intraday high of 23,915.35.

However, after reaching its high, the market experienced a sudden 100-point drop to 23,800, where it paused briefly. Following 12:30 PM, the market resumed its decline, breaking the day’s low and falling another 200 points to hit a new low of 23,600. In the final hour, the Nifty attempted a recovery to 23,700 but ultimately closed lower at 23,644.90, down 0.7% for the day.

Broader Market Performance:

The market faced rejection at the 23,900 level once again, leading to a 300-point decline from the peak. The broader market also showed weakness, with 947 stocks advancing, 1,913 declining, and 82 remaining unchanged. Although broader market indices, such as midcap and small-cap, outperformed the Nifty, the overall market breadth remained negative.

Sectoral Performance:

Sectoral performance was largely negative, with Nifty Pharma emerging as the top gainer, up 1.01%. FMCG and Consumer Durables also posted modest gains of 0.3% and 0.24%, respectively. Meanwhile, Bank Nifty saw a sharp 1,000-point decline from its highs, while sectors like Metals, Autos, Realty, and Media dropped between 1.3% and 1.8%.

Note: The above numbers for Commodity futures were taken around 5 pm.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 2nd January:

The maximum Call Open Interest (OI) is observed at 24,000, followed by 23,800, while the maximum Put Open Interest (OI) is at 23,500, followed by 23,200.

The addition of Put OI at the 23,200 level, coupled with unwinding at 23,800 and 23,500, suggests that put sellers are losing confidence as the market consistently faces rejection near the 23,900 mark.

Immediate support is identified around 23,500, with additional support in the 23,300–23,400 region. On the upside, resistance is noted at 23,900 and 24,000, with the 23,800–23,900 range being a key area to watch.

Note: OI is subject to multiple interpretations but generally, in a falling market if there is an increase in the call OI, it indicates resistance, and in a rising market, if there is an increase in the put OI, it indicates support.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

Carraro India debuted at a 7.52% discount to its issue price of Rs 704 and closed 9.63% lower at Rs 636.20. Senores Pharmaceuticals opened with a 53% premium but ended 42.47% higher at Rs 557.05. Ventive Hospitality debuted with an 11.7% premium and closed 9.54% higher at Rs 704.35.

Adani Enterprises has signed an agreement with Wilmar International to exit its joint venture, Adani Wilmar Ltd. This move will raise over $2 billion, with proceeds aimed at fueling growth in AEL's core infrastructure businesses, including Energy, Utility, Transport, and Logistics. The transaction is expected to be completed by March 31, 2025. Dive deeper

Mahindra Electric Automobile Limited has revised its funding plan with British International Investment Plc. (BII). The final tranche of BII's investment will be reduced to Rs. 650 Crores, from the originally planned Rs. 725 Crores, with completion scheduled by March 31, 2025. The total investment by BII Group in MEAL will now be Rs. 1,850 Crores, resulting in a shareholding of 2.64% to 4.58% on a fully diluted basis. Dive deeper

UltraTech Cement Limited has approved the acquisition of up to 3.70 crore equity shares of Star Cement Limited, representing around 8.69% of the company, at a price of up to Rs. 235 per share. The acquisition, set to be completed within a month, is for a non-controlling minority stake. Dive deeper

Gujarat Fluorochemicals came into focus after a gas leak at its CMS-1 plant in Dahej, Gujarat, on December 28, tragically claiming four lives, including one employee and three contractual workers. The incident was swiftly contained, but operations at the plant have been temporarily disrupted, the company stated. Dive deeper

Mahindra & Mahindra has incorporated Ultrogen Hybren Private Limited as a wholly-owned subsidiary of Mahindra Susten. The company, formed on December 29, 2024, will focus on renewable energy, including power generation and rooftop solar installations. This move aligns with Mahindra's commitment to expanding its renewable energy portfolio. Dive deeper

Shares of KEC International Ltd. closed up 3.79% on Monday after the company announced securing new orders valued at Rs. 1,073 crore. These orders span across various segments including transmission and distribution, civil, transportation, and cables, and feature international projects in the Middle East and South Asia, domestic industrial orders, and a joint venture for a passenger ropeway project in Northeast India. Dive deeper

Bharat Petroleum Corporation Limited (BPCL) is replacing Russian crude with Middle Eastern oil, including new sources from Oman, Argentina, and Qatar, due to a shortfall in expected Russian supplies. Additionally, BPCL plans to invest ₹1.7 trillion in expanding its refinery capabilities over the next five years and has recently secured a contract to import 10,000 BPD from Qatar starting the fiscal year 2025/26. Dive deeper

Reliance Industries Limited (RIL) announced the acquisition of Karkinos Healthcare, a technology-driven oncology platform, for Rs 375 crore through its subsidiary, Reliance Strategic Business Ventures (RSBVL). The all-cash transaction makes Karkinos a step-down wholly-owned subsidiary of RIL, enhancing its focus on affordable and innovative cancer diagnosis and treatment services. Dive deeper

Shares of Ola Electric declined 5.4% to Rs 85.07 after Chief Technology and Product Officer Suvonil Chatterjee and Chief Marketing Officer Anshul Khandelwal resigned. Dive deeper

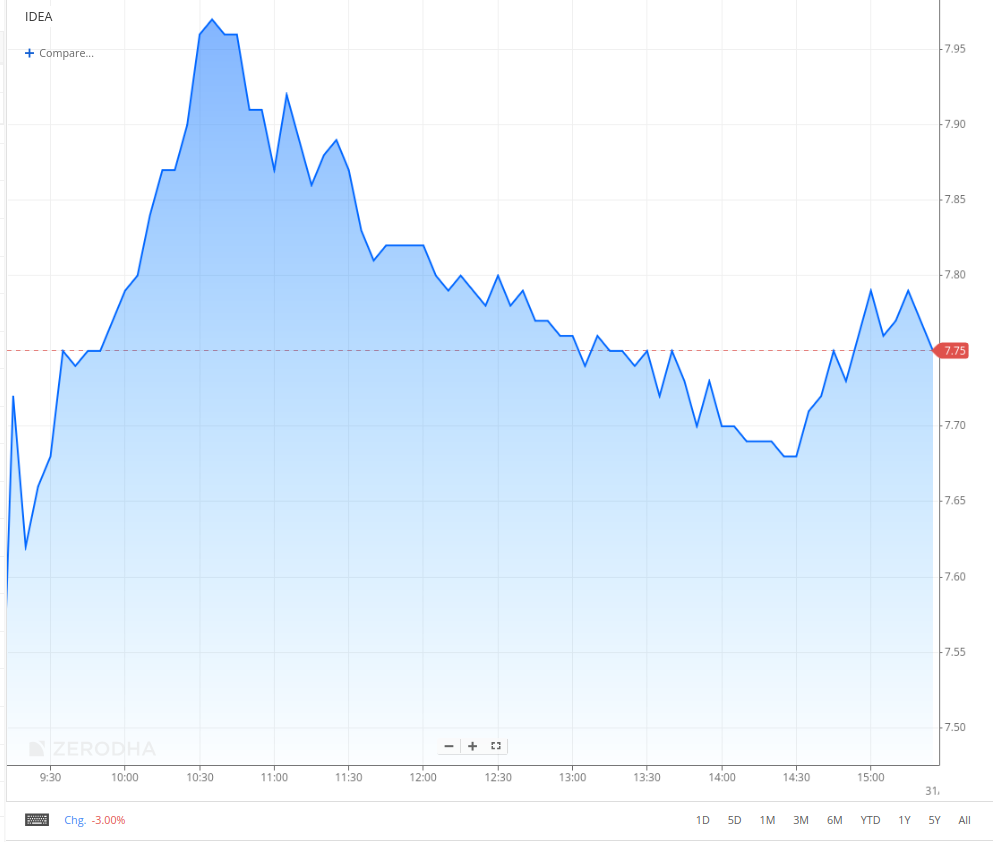

Vodafone Group has repaid about Rs 11,650 crore (109 million pounds) of debt, clearing a pledge on its nearly entire stake in Vodafone Idea. This action, detailed in a regulatory filing, has released the encumbrance on 22.56% of Vodafone Idea's equity share capital, held by Vodafone's promoter shareholders. Dive deeper

What’s happening globally

WTI crude oil futures hovered around $70.5 per barrel, with concerns over an oversupplied market in 2025 and weaker demand from China weighing on prices. Potential policy changes under President-elect Donald Trump, including tariffs on Canada and Mexico and stricter sanctions on Iran, add to the uncertainty. Oil remains on track for an annual decline, influenced by global demand trends and geopolitical tensions. Dive deeper

Hong Kong's trade deficit widened to $43.4 billion in November 2024 from $27.9 billion a year earlier. Imports grew by 5.7%, driven by office machines and non-ferrous metals, while exports rose by 2.1%, led by office machines and power-generating equipment. Dive deeper

Germany's 10-year Bund yield held near 2.4% amid expectations of a slower ECB rate-cut pace. ECB official Robert Holzmann cited persistent inflation, while Spanish inflation rose to 2.8% in December, exceeding forecasts. Dive deeper

Spain's current account surplus rose to a record €4.9 billion in October 2024, up from €3.1 billion a year earlier. The goods and services surplus expanded to €7.2 billion, driven by lower energy import costs, while the deficit for primary and secondary accounts widened to €2.2 billion. Dive deeper

Eurozone bank shares are set for their best year-end since 2010, with the Euro Stoxx Banks index rising over 20% in 2024. Profits remained strong despite falling interest rates, supported by effective structural hedging. Top performers included UniCredit and Intesa Sanpaolo, while BNP Paribas lagged. Dive deeper

The KOF Economic Barometer dropped to 99.5 in December from 102.9 in November, indicating a slowdown in Switzerland's economic outlook. The decline affected manufacturing, services, hospitality, and private consumption, with slight improvements seen in the wood, glass, and stone sector. Dive deeper

Global corporate debt sales hit a record $8 trillion this year, driven by strong investor demand and favourable borrowing costs. Issuance of corporate bonds and leveraged loans rose over a third to $7.93 trillion, with major companies like AbbVie and Home Depot capitalizing on market conditions. Despite narrowing spreads, borrowing costs remain elevated, attracting significant investor inflows. Dive deeper

The UK government will end the tax exemption for private schools starting January 1, 2025, introducing a 20% VAT on tuition fees to raise over £1.5 billion for public education. The funds will be used to hire 6,500 new teachers in state schools by 2030. The move, part of Labour's election promise, aims to address educational inequalities. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Girish Kousgi, MD & CEO of PNB Housing Finance

Expect the affordable housing book to reach ₹5,000 cr from current levels of ₹3,000 cr.

South, North, and West are focused areas for the affordable housing segment for us.

Retail book is at ₹68,000 cr; intend to take it to ₹1 lakh cr by FY27.

Hope that retail loan growth will be more than 17% in FY25.

Expect retail home loan growth of 18–19% over the next few fiscal. - Link

Jyotindra Mehta, Chairman of National Urban Cooperative Finance and Development Corporation (NUCFDC)

"We are planning to double the profit of urban cooperative banks in the next five years and have few products to help with compliance," - Link

Calendars

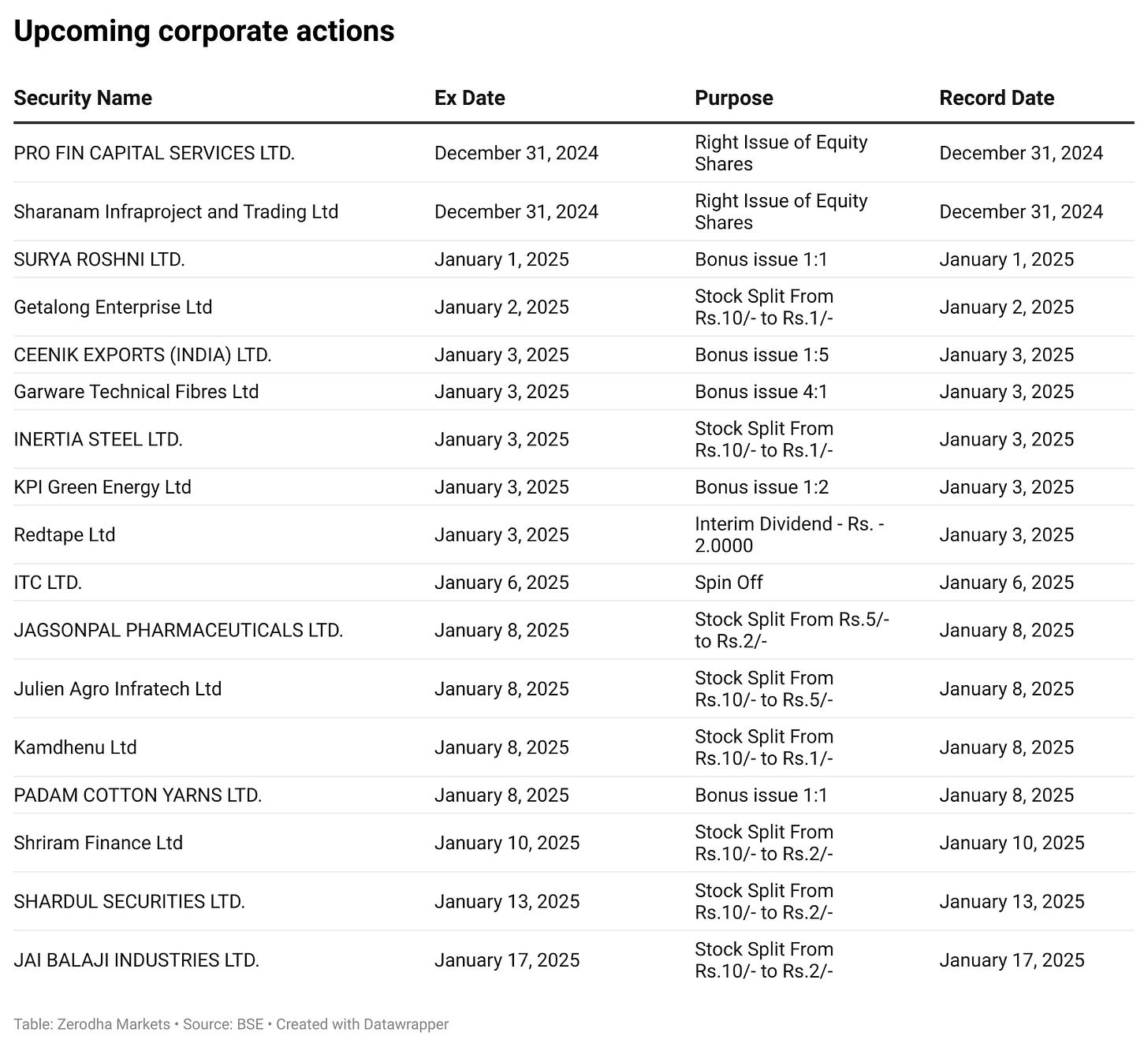

In the coming days, we have the following major events and corporate actions:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

Very good initiative, I am now daily reader of this blog.

Thanku zerodha team.