Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

Nifty opened higher by 40 points at 24,045.80 and climbed an additional 45 points to hit the day's high of 24,089.95. However, it soon dipped 150 points before briefly recovering to the 24,020 level. From there, the market nosedived nearly 400 points, touching the 23,600 level.

After a short rebound of 150-160 points to around 23,750, Nifty fell another 200 points in the last couple of hours, testing the day's low of 23,551.90. A final recovery of 100 points saw the index stabilize within a range before closing at 23,616.05, down 1.61%.

With this, Nifty closed below the 200 DMA for the third time in recent weeks. The decline is attributed to fears surrounding the HMPV outbreak after two confirmed cases in India, coupled with lackluster quarterly updates from key financial companies over the weekend. Markets will closely monitor developments on the HMPV outbreak and the upcoming earnings season, set to begin on January 9.

Broader Market Performance:

Alongside the headlines, the broader market showed even weaker breadth. A total of 413 stocks advanced, 2,473 declined, and 65 remained unchanged.

Sectoral Performance:

The sectoral performance displayed a downward trend, with all sectors ending in the red. Nifty PSU Banks was the biggest loser, dropping 4%, while Nifty Energy, Metals, and Realty each declined by over 3%. Nifty IT remained relatively flat, slipping just 0.12%.

Note: The above numbers for Commodity futures were taken around 4 pm.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 9th January:

The maximum Call Open Interest (OI) is observed at 24,000, followed closely by 24,100. Meanwhile, the maximum Put Open Interest (OI) is at 23,300, followed by 23,500.

A significant increase in Call OI and unwinding of Put OI at higher levels, ranging from 24,100 to 23,700, coupled with today’s market decline, suggest limited upside potential. Additionally, Put sellers seem hesitant to hold positions at higher levels this week.

Immediate support is identified in the 23,500–23,300 range, while resistance is expected between 24,000 and 24,200.

Note: OI is subject to multiple interpretations but generally, in a falling market if there is an increase in the call OI, it indicates resistance, and in a rising market, if there is an increase in the put OI, it indicates support.

Source: Sensibull

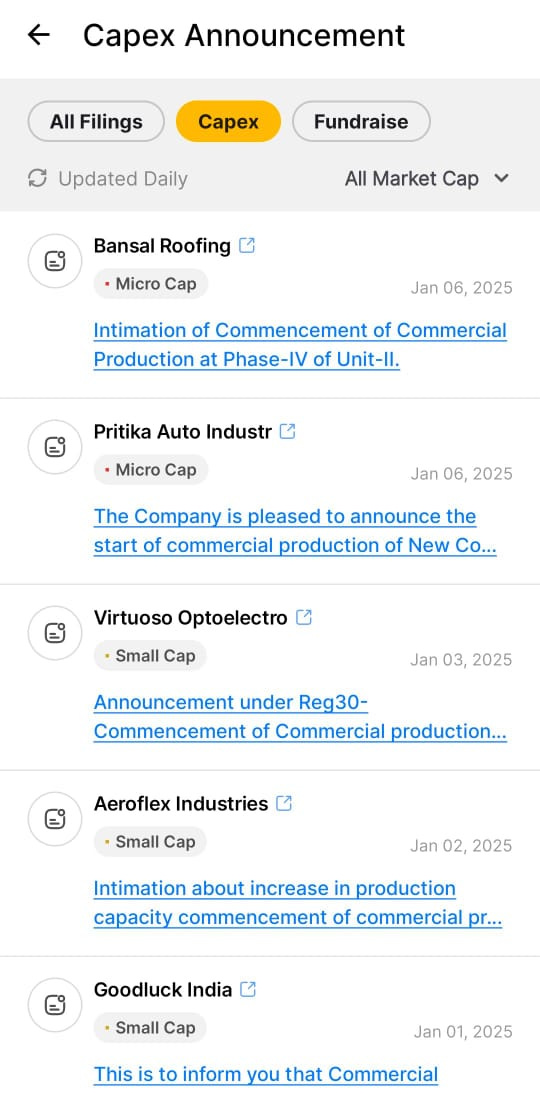

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

Shares of diagnostics companies surged following reports of an HMPV outbreak in China and two confirmed cases in India. The Indian Council of Medical Research (ICMR) reassured that the country's surveillance system is robust, with no unusual increase in related illnesses, while the health ministry continues to monitor the situation. Dive deeper

Shares in the hotels and airline sectors dropped up to 6.4% on Monday after the confirmation of three Human Metapneumovirus (HMPV) cases in India, sparking concerns over a potential health impact. Meanwhile, the healthcare sector saw positive movement. The India VIX index rose 13%, signaling increased market uncertainty. Dive deeper

HDFC Bank's total advances grew 3% YoY to Rs 25.42 lakh crore in Q3 FY2025, with deposits up 15.8% to Rs 25.63 lakh crore. Retail loans rose 10%, while corporate loans fell 10.3%. The bank also securitized Rs 21,600 crore in loans during the quarter. Dive deeper

India's services sector expanded in December, with the HSBC Services Business Activity Index rising to 59.3. New orders increased for the 41st month, while job creation softened. Input cost inflation eased, but service providers continued raising fees. Dive deeper

The Indian government has allocated ₹4,300 crores for the revised Production Linked Incentive (PLI) scheme for the steel sector, focusing on boosting specialty and electrical steel production. The scheme, launching on January 6, 2025, follows an earlier version that attracted significant investments but didn’t meet all expectations. It aims to strengthen sectors like defence, automobiles, and electricals. Dive deeper

ITC Ltd's shares closed at Rs 442.65, down 8.09%, following the special pre-open session for the hotel arm's demerger. Dive deeper

Indian Energy Exchange (IEX) achieved a record monthly electricity traded volume of 11,132 MU in December 2024, marking a 29% YoY growth. The Green Market saw a significant 236% YoY growth in December, while the Renewable Energy Certificate (REC) market also surged, with a 58% increase in traded volumes. Dive deeper

The Export and Import Bank of India (Exim Bank) aims to raise at least $500 million through 10-year bonds to overseas investors, initially priced at 130 basis points above the 10-year US Treasury. This issuance, the first in two years, could set a benchmark for future dollar fundraisings by Indian NBFCs, backed by its quasi-sovereign status. Dive deeper

Waaree Energies Limited has announced the commencement of trial production at its new 5.4 GW solar cell manufacturing facility in Chikhli, Gujarat. The facility marks a significant milestone in the company’s expansion into solar energy manufacturing. Dive deeper

Hyundai Motor India is launching the Hyundai CRETA Electric at the Bharat Mobility Global Expo 2025. The electric SUV features Vehicle-to-Load (V2L), ADAS-linked regenerative braking, and fast-charging capabilities. Dive deeper

Shares of ITI Ltd rose by 19.09%, reaching Rs 544.35, driven by strong financial results and growing investor confidence, fueled by the government's infrastructure focus and demand for telecom equipment. Dive deeper

Happy Forgings Limited has approved a Rs. 650 crore capex budget to establish facilities for producing heavy forged and machined components, targeting sectors like power generation, marine, and aerospace. Dive deeper

Titan Company Ltd. reported a 24% YoY growth in Q3FY25, with significant expansions across its retail network, adding 69 stores, bringing the total to 3,240 stores. The Jewellery segment saw a 26% growth, driven by strong festive demand, while Watches & Wearables grew 15% YoY. CaratLane recorded a 25% growth, adding its first international store in New Jersey. Dive deeper

Shares of FSN E-Commerce Ventures (Nykaa) rose 5% during the day, reaching an intraday high of Rs 176.60, before closing at Rs 171.52, up 2.19%. The strong Q3 FY2025 performance, with net revenue growth expected to surpass mid-twenties and growth in the beauty vertical, boosted investor sentiment. Dive deeper

NCC Limited has secured a ₹349.70 crore order in December 2024 for its Building Division from a private company. The order, which is not related to any internal transactions, is set for completion over 32 months and does not involve related party transactions. Dive deeper

IDBI Bank reported a 13% YoY growth in total business, reaching Rs 4.89 lakh crore in Q3 FY2024. Net advances grew 18% YoY, and total deposits rose by 9%. Dive deeper

Former temporary workers of Maruti Suzuki met to demand 30,000 permanent jobs and a 40% pay increase, advocating for fair recruitment and better training at the company’s upcoming Kharkhoda plant. The meeting drew participants from multiple states and highlighted ongoing disparities between permanent and temporary employees. Dive deeper

Mahindra & Mahindra Ltd. reported a 16% year-on-year increase in overall vehicle sales for December 2024, reaching 69,768 units. The company sold 41,424 utility vehicles domestically, marking an 18% growth. Additionally, Mahindra's total exports surged by 70%, with a notable 22% growth in the year-to-date export figures. Dive deeper

LT Foods Limited has completed the acquisition of a 17.5% stake in Nature Bio-Foods Limited, its organic arm, from India Agri Business Fund II Limited for Rs. 110 crores. Following this acquisition, Nature Bio-Foods has become a wholly owned subsidiary of the company as of December 31, 2024. Dive deeper

Hero MotoCorp concluded the calendar year 2024 with a 7.5% YoY growth in sales, reaching 59.1 lakh units, including a 49% growth in global sales. The company also made significant strides in electric mobility, with 46,662 VIDA V1 e-scooter sales. In line with its expansion, Hero launched several new models, including the Maverick 440, and entered markets in Nepal, Brazil, and the Philippines. Dive deeper

Marico Ltd. anticipates margin pressure from rising input costs and brand investments but remains focused on achieving double-digit growth in FY 2025. Recent price hikes in response to input cost inflation have supported revenue growth, particularly in the Parachute and Saffola brands. Dive deeper

Corporate bond issuance in India reached a three-month high in December, totalling Rs 1.05 lakh crore, driven by robust demand from long-term investors and increased activity from non-banking finance companies (NBFCs). Over the course of 2024, issuances hit a record high of Rs 10.66 lakh crore, spurred by low interest rates and substantial infrastructure bond issuances by banks. Dive deeper

Infosys has postponed its annual salary increases to the fourth quarter of FY25, aligning with its last wage hike in November 2023. This decision, influenced by global demand uncertainties, mirrors cost management strategies adopted by competitors like HCLTech and LTIMindtree. Dive deeper

What’s happening globally

Foxconn's shares rose after the company announced a 15.2% increase in Q4 2024 revenue, reaching T$2.13 trillion. This was driven by strong demand for AI servers, particularly in its cloud and networking products division. Dive deeper

The Caixin China General Services PMI rose to 52.2 in December 2024, up from 51.5 in November, driven by stronger domestic demand. New export business fell, and input price inflation increased, leading to higher selling prices. However, employment declined, and sentiment weakened amid concerns over competition and the global economic outlook. Dive deeper

Vietnam's GDP rose 7.55% in Q4 2024, exceeding the annual target with a year-end figure of 7.09%. Growth was driven by strong consumption, investment, and an 11.35% increase in exports. The service sector grew to 8.21%, supporting robust overall economic expansion. Vietnam aims for a 6.5% to 7.0% GDP growth in 2025 and targets over 10% annual growth from 2026 to 2030. Dive deeper

Gold traded below $2,640 as traders awaited key U.S. economic data, while Fed officials indicated a cautious approach to rate cuts. Geopolitical tensions and central bank purchases continue to support the metal. Dive deeper

Singapore's competition regulator has approved AMD's $4.9 billion acquisition of ZT Systems, stating it will not harm market competition. The acquisition will strengthen AMD's position in AI and data centres, with the deal expected to close in 2025. Dive deeper

Shares of Nippon Steel fell after President Biden blocked its $15 billion takeover of U.S. Steel due to national security concerns, a move criticized as "unlawful" by both companies, who plan to contest it legally. The decision, opposed by lawmakers and unions fearing job losses, led to a significant decline in U.S. Steel's share price. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Viral Acharya, Former Deputy Governor, RBI on Rupee and its volatility

“You don’t need to kill volatility to manage excessive volatility,” The RBI must allow “some baseline volatility because it maintains a certain level of private hedging, which is important because the central bank can’t do full absorption of risk.”

“No matter what your stock of reserves is, if you lose a very big quantity of it in a short period, it doesn’t send a good signal to the market,” - Link

Nishant Pitti, former Chief Executive Officer, and Co-founder, EaseMyTrip on plans going forward

"I'll be taking care of international expansion...related to selling part, we had confirmed that there is no more selling from promoters side and...we are a bootstrapped company. When we did not have any investors before on our table, we were 100% owned by us between the family. Now, we are going ahead with a different dimension and there will be massive hiring in senior management team also," - Link

Calendars

In the coming days, we have the following major events and corporate actions:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

Thank you for this comprehensive newsletter, please keep doing what you're doing!

error in fii and dii buying and selling activity.