Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Market Overview

The Nifty opened flat at 24,204.80 and traded within a narrow range of 24,170 to 24,200 for the first three hours before climbing toward 24,350. After testing the 24,350 level for the third time in as many days, the index dipped slightly to close at 24,274.90.

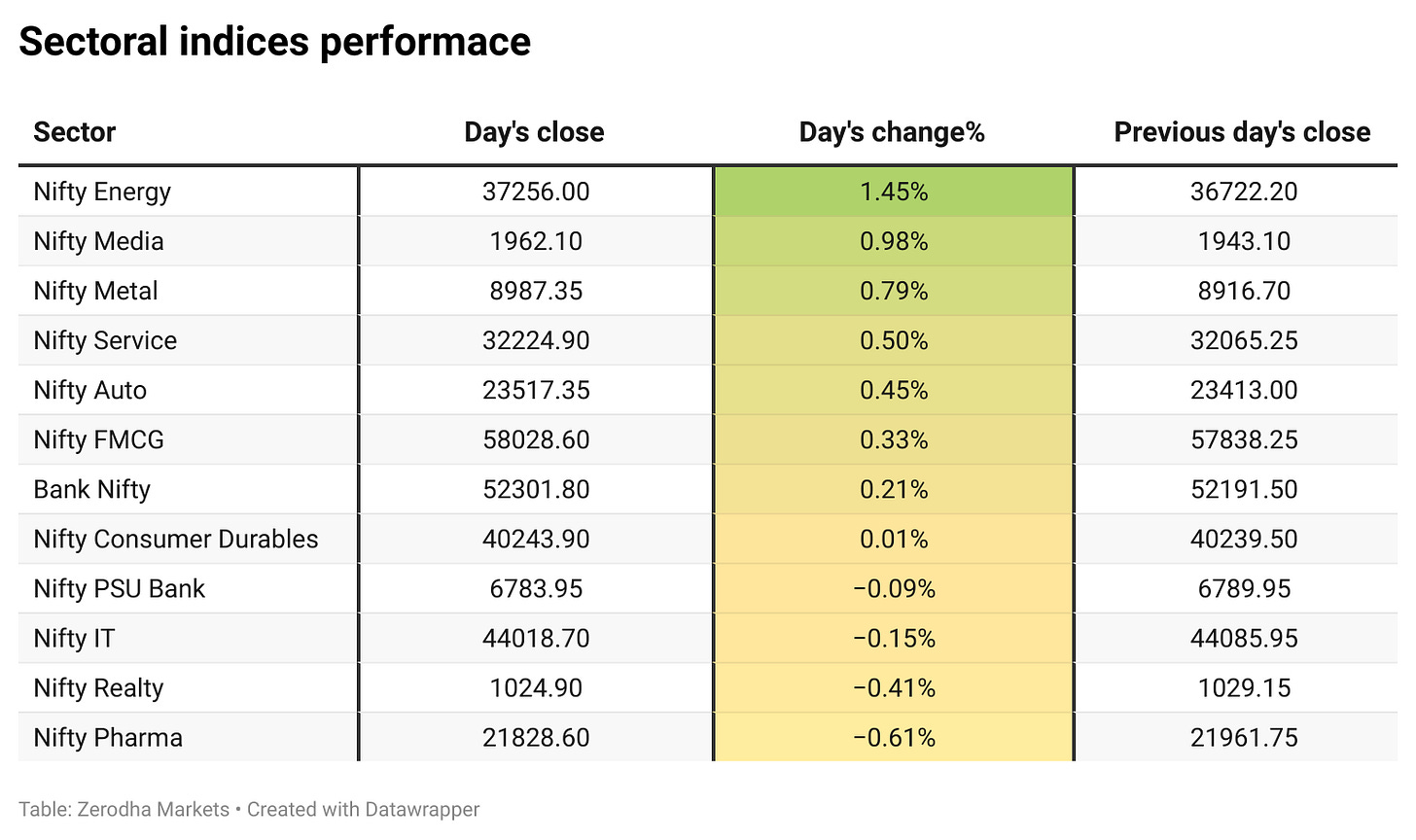

Market breadth improved, with 1,902 stocks advancing and 874 declining on the NSE. Midcap stocks moved in line with the Nifty, while small-cap and micro-cap indices outperformed, gaining 1.02% and 1.68%, respectively. Nifty IT saw profit booking after record highs, while weakness in pharma was offset by strength in financials, autos, and FMCG stocks, providing overall market stability.

Note: The above numbers for Commodity futures were taken around 4 pm.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 28th November:

The maximum CE OI is at 24500 followed by 24300, and the maximum Put OI is at 24000 followed by 24200.

Immediate support on the downside for tomorrow can be seen at 24200 followed by 24000, which holds the significant Put OI. Resistance is at 24300 and 24350 levels, followed by 24500, which holds the highest Call OI.

Note: OI is subject to multiple interpretations but generally, in a falling market if there is an increase in the call OI, it indicates resistance, and in a rising market, if there is an increase in the put OI, it indicates support.

Source: Sensibull

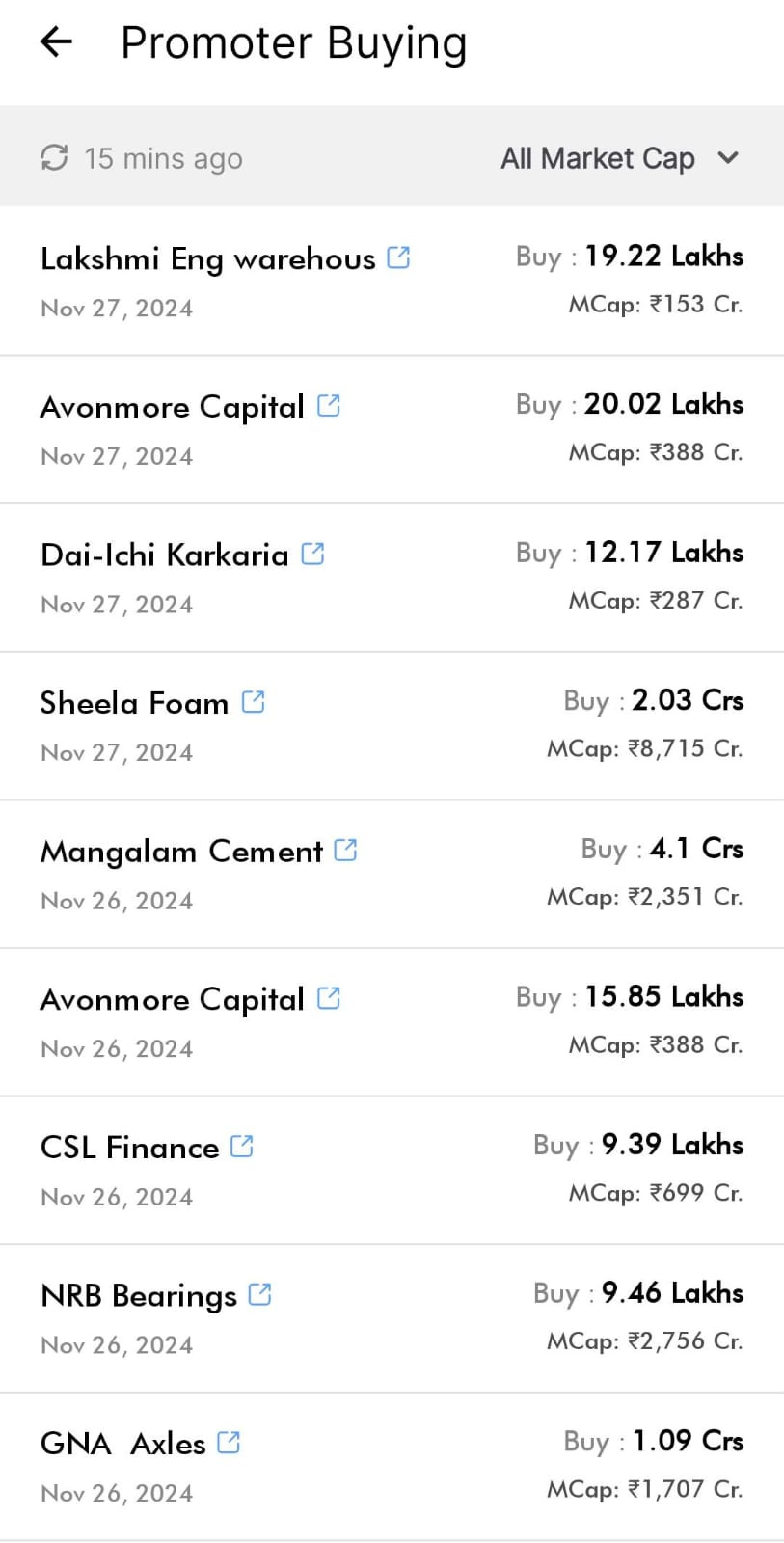

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

NTPC Green Energy Limited, the renewable energy subsidiary of NTPC Limited, had a strong debut on the stock exchanges. The stock opened at ₹111.5, a 3.2% premium, and reached an intraday high of ₹121.35, a 12.4% increase. It closed at ₹118, marking a 9% gain over the listing price.

Exide Industries Limited has invested an additional ₹100 crore in its subsidiary, Exide Energy Solutions Limited (EESL), bringing its total investment to ₹3,052 crore. This funding supports EESL's development of a new manufacturing facility in Bengaluru, focused on producing lithium-ion battery components for India's electric vehicle (EV) market and other applications. - Dive deeper

Adani Group stocks staged a strong recovery today after the group clarified that Gautam Adani, Sagar Adani, and Vineet Jain have not been charged with violations of the US Foreign Corrupt Practices Act (FCPA) in the recent indictment by US authorities. The charges instead pertain to alleged securities fraud, wire fraud conspiracy, and Adani Green Energy's violations of US securities laws. This clarification helped drive the rebound in Adani Group stocks. Dive deeper

Vedanta Ltd., led by Anil Agarwal, will invest $2 billion to build copper-processing facilities in Saudi Arabia, including a smelter and refinery with a 400,000 metric ton annual capacity and a plant producing 300,000 tons of copper rods per year. The project supports Saudi Arabia's Vision 2030 to diversify its economy and reduce fossil fuel dependency. - Dive deeper

Ola Electric shares closed at 20% upper circuit for that after it announced two new affordable electric scooters, the S1 Z and Gig, with prices starting at ₹39,000. These models feature removable batteries that can also function as home inverters using the Ola PowerPod. Reservations are now open, and deliveries will commence in April 2025.

The Reserve Bank of India injected ₹6,956 crore into the banking system as liquidity tightened due to a $23 billion balance of payments deficit and RBI's dollar sales to support the rupee. Higher borrowing costs followed, with forex reserves dipping to $657.9 billion and the trade deficit widening to $27.14 billion in October. Dive deeper

Kotak Mahindra Bank received approval from the Competition Commission of India (CCI) to acquire Standard Chartered Bank India's personal loans portfolio for ₹4,100 crore. This move aligns with Kotak's strategy to expand in retail credit and affluent customer segments. Dive deeper

What’s happening globally

With mediation from the US and France, Israel and Hezbollah reached a ceasefire agreement effective November 27, 2024, ending more than a year of hostilities. The agreement outlines key measures, including Hezbollah's withdrawal north of the Litani River, Israel's gradual withdrawal from southern Lebanon, compliance with UN Resolution 1701, and the implementation of international monitoring mechanisms. - Dive deeper

Europe is preparing for its coldest winter since the onset of the Ukraine conflict, raising concerns about energy security. Natural gas prices have surged to over €50 per megawatt-hour, doubling from early 2024 levels. This increase is attributed to colder temperatures, reduced wind energy production, and geopolitical tensions affecting gas supplies. - Dive deeper

In October 2024, China's industrial profits declined by 10% year-on-year, an improvement from the 27.1% drop in September. This reduction is attributed to the government's pro-growth policies, which have bolstered production and revenues in key sectors.

Notably, the equipment manufacturing sector experienced a 4.5% profit increase, returning to positive growth. Despite these gains, challenges such as weak domestic demand and deflationary pressures persist, as evidenced by a 4.3% profit decline over the first ten months of the year. - Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Achyuta Ghosh, Head- Insights, Nasscom on whether AI is bad for IT services

I do not think so. We feel that, of course, GenAI will be writing code, but the people at the bottom they will rise up. There will be more demand for code checkers, for code validators. And we see a world where human-machine collaboration is the way forward when it comes to development of code writing.

I think that is the way forward in terms of how the pyramid will shape up. So, that could mean, emergence of new skills. In fact, we have done some work on recently on what is happening in the BPO space and most people thought that BPO would be impacted.But what we see is that GenAI tools, whether it is for the contact centres or whether it is for back office transformation, has actually created new opportunities. In fact, some of the recent results, Genpact was a good example of how they said that the increasing amount of data engineering work that is coming as they prepare organisations for this GenAI related world is actually creating more opportunities and driving industry revenue and this will be an ongoing phenomenon.

There is no end to it because there will be a lot of industries who will be the first movers. Then, there will be other companies who would come in later and so on and so forth and this work will continue. So, at an overall piece, this is something to be positive for India also. - Link

Amit Paithankar - Chief Executive Officer, Waaree Energies Limited about the impending duties from the USA

With the change in administration in the United States, we have been closely monitoring the situation and seeking clarity. From my perspective, we are likely to gain a better understanding by January, considering the ongoing shifts in the U.S. political landscape.

Currently, a significant portion of our exports to the U.S. are directly from India. Additionally, as you know, we are setting up our own 1.4-gigawatt manufacturing facility in the United States. Together, these factors mean that any potential impact on us will be limited. - Link

Calendars

In the coming days, we have the following major events and corporate actions:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

Top Gainers and losers >adani ports> Day close > there is typo it should be 1199.95 instead of 119.95