Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Market Overview

The Nifty opened 44 points lower at 24,633.90 and briefly climbed to 24,700 before declining to the day’s low of 24,580 around 10 AM. For the remainder of the day, the index traded in a narrow 50-point range between 24,620 and 24,670, displaying limited volatility. It eventually closed at 24,619, down by 0.23%.

Broader Market Performance:

The overall market breadth remained positive, with 1,546 stocks advancing, 1,318 declining, and 80 unchanged. However, this shows some weakening compared to recent days.

Sectoral Performance:

FMCG: The sector was the top loser after weak guidance from Godrej Consumer Products (GCPL), which expects flat volume growth and mid-single-digit sales growth in the December quarter.

Media, Auto, and PSU Banks: All witnessed negative action.

IT and Metals: These sectors traded positively.

Note: The above numbers for Commodity futures were taken around 5 pm.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 12th December:

The maximum CE OI is at 25000 followed by 24700 and 24800, and the maximum Put OI is at 24500 closely followed by 24600 and 24700.

With 1.1 crore contracts and 1 crore contracts respectively, 25000 and 24700 will be the key resistance zones for this week.

Immediate support on the downside can be seen at 24500 levels followed by 24400 levels. Resistance on the upside is at 24700 and 24800 levels followed by 25000.

Note: OI is subject to multiple interpretations but generally, in a falling market if there is an increase in the call OI, it indicates resistance, and in a rising market, if there is an increase in the put OI, it indicates support.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

Sanjay Malhotra, a 1990-batch IAS officer and current Revenue Secretary, has been appointed as the new Governor of the Reserve Bank of India (RBI). With over 33 years of experience in finance, taxation, and public policy, he has held critical roles in shaping India’s fiscal and banking policies. Dive deeper

The Nifty FMCG index dropped over 2% on Monday, led by a 9% fall in Godrej Consumer Products (GCPL) shares to ₹1,120. GCPL expects flat volume growth and mid-single-digit sales growth in the December quarter, citing higher soap prices and subdued demand. Other key stocks, including Hindustan Unilever, Dabur, and Marico, also declined, reflecting broader weakness in the FMCG sector. Dive deeper

Asian Paints' share price fell to a three-year low of ₹2,398.05, down 2% on Monday. The stock has declined 19% since November and 30% in 2024, underperforming the BSE Sensex's 13% rally. Factors such as subdued consumer sentiment, extended rains, and weak demand for decorative coatings affected Q2FY25's performance. Dive deeper

Tata Motors (-2.21%) will increase the price of its passenger vehicles, including electric models, by up to 3% from January 2025 to offset rising input costs and inflation. Other automakers, including Maruti Suzuki, Hyundai, and luxury brands, are also raising prices for the same reasons. Dive deeper

CEAT's share price surged 15.82% to an all-time high of ₹3,581.45 after announcing the acquisition of Camso's Off-Highway construction equipment tyre and tracks business from Michelin for $225 million. The deal, expected to be completed in 6-9 months, expands CEAT's portfolio in the Off-Highway tyres and tracks segments. Dive deeper

Gland Pharma Limited (-1.17%) received US FDA approval for Latanoprost Ophthalmic Solution, 0.005%, used to treat glaucoma and ocular hypertension. Dive deeper

Styrenix Performance Materials Ltd. (+3.55%) hit a life high of ₹2,895 after announcing the $20 million acquisition of INEOS Styrolution (Thailand) Co., a supplier of specialty ABS and SAN polymers. The deal, approved by the board, will be executed through its Dubai unit and includes incorporating a step-down subsidiary in Thailand. The company also declared an interim dividend of ₹31 per share, with Dec. 17, 2024, as the record date. Dive deeper

TVS Motor Company (-1.30%) launched the TVS iQube 2.2 kWh electric scooter in Sri Lanka, featuring fast charging from 0 to 80% in two hours, advanced connectivity, and affordability to boost EV adoption. Dive deeper

Hyundai Motor India Limited (-1.71%) plans to install 600 EV fast charging stations nationwide over seven years, with 50 operational by the end of 2024. The network has already facilitated 50,000 sessions for over 10,000 Hyundai and non-Hyundai EV users, dispensing 7.30 lakh units of energy. With access to 10,000 charging points via the myHyundai app and collaborations with partners, HMIL aims to strengthen EV infrastructure and support India's shift to green mobility. Dive deeper

Shares of One97 Communications (Paytm) rose over 3% intraday to touch a 52-week high of ₹1,007 after approving the sale of its 7.2% stake in Softbank's PayPay Corporation, valued at approximately ₹2,000 crore in July 2024, but closed 0.44% lower. Dive deeper

Lloyds Metals and Energy Limited (+4.49%) announced its entry into the Mines Development and Operations (MDO) business, aimed at reducing costs for its integrated steel operations and enhancing profitability. The strategic move expands the company's capabilities in the metals and mining sector, with plans to explore opportunities for sustainable mining practices. Dive deeper

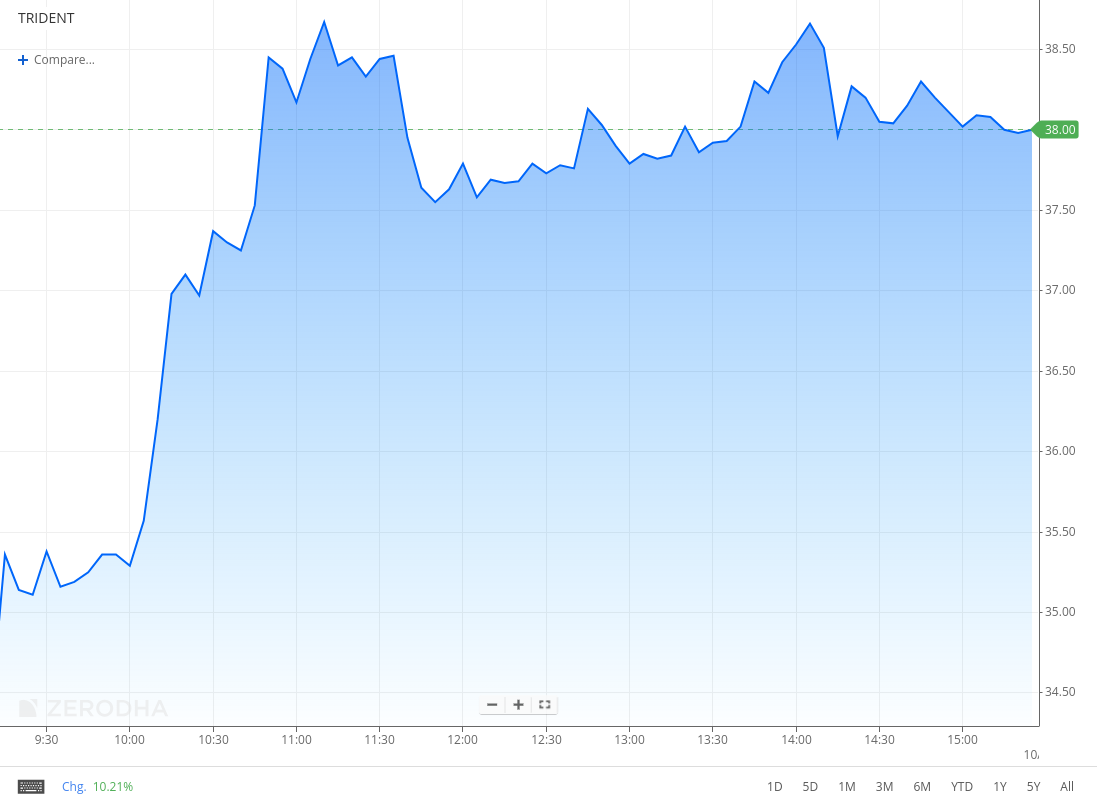

Rajinder Gupta, Chairman of Trident Limited (+10.24%), has announced a ₹3,000 crore investment in Madhya Pradesh's textile sector. The investment will create over 3,000 jobs, 50% of which will be reserved for women, with a focus on sustainability and inclusive growth. Dive deeper

Waaree Energies Limited (+2.35%) secured a 1 GW solar module supply order from a domestic renewable energy company. The deliveries will span FY 2024-25 and FY 2025-26, marking a notable development in Waaree's operational scale. The company clarified no related party was involved in this transaction. Dive deeper

JSW Steel (0.81%) reported a consolidated crude steel production of 23.23 lakh tonnes for November 2024, marking a 5% YoY growth. Indian operations contributed 22.53 lakh tonnes, up 7% YoY, with a capacity utilization of 94%. Production from JSW Steel USA – Ohio stood at 0.70 lakh tonnes. The company remains focused on sustainable growth, aligning with global climate commitments and renewable energy goals. Dive deeper

Bharat Electronics Ltd (+0.27%) secured additional orders worth ₹634 crores, bringing its total order book for FY24 to ₹8,828 crores. Major orders include maintenance of Akash Missile Systems, telescopic sights, communication equipment, jammers, electronic voting machines, and test stations. Dive deeper

The IRDAI and the Finance Ministry support reducing GST on insurance premiums, with the GST Council set to discuss the proposal on December 21. Recommendations include exempting premiums for senior citizens' health insurance, policies with coverage up to ₹500,000, and term life insurance while retaining existing rates for other policies. The IRDAI noted that similar exemptions in countries like Canada and the EU could encourage insurance penetration in India. Currently, GST on health and term policies is 18%, with lower rates for select plans. Dive deeper

Shares of CE Info Systems Ltd., parent of MapMyIndia, surged over 18% in the final hour of trading after the board announced it would not proceed with equity or debt investments in a new venture proposed by former CEO Rohan Verma. Dive deeper

What’s happening globally

The U.S. defence bill negotiations excluded a proposed provision to blacklist five Chinese-linked biotechnology firms from federally funded research, citing the need for due process. Lawmakers may revisit the measure in upcoming government funding discussions. Dive deeper

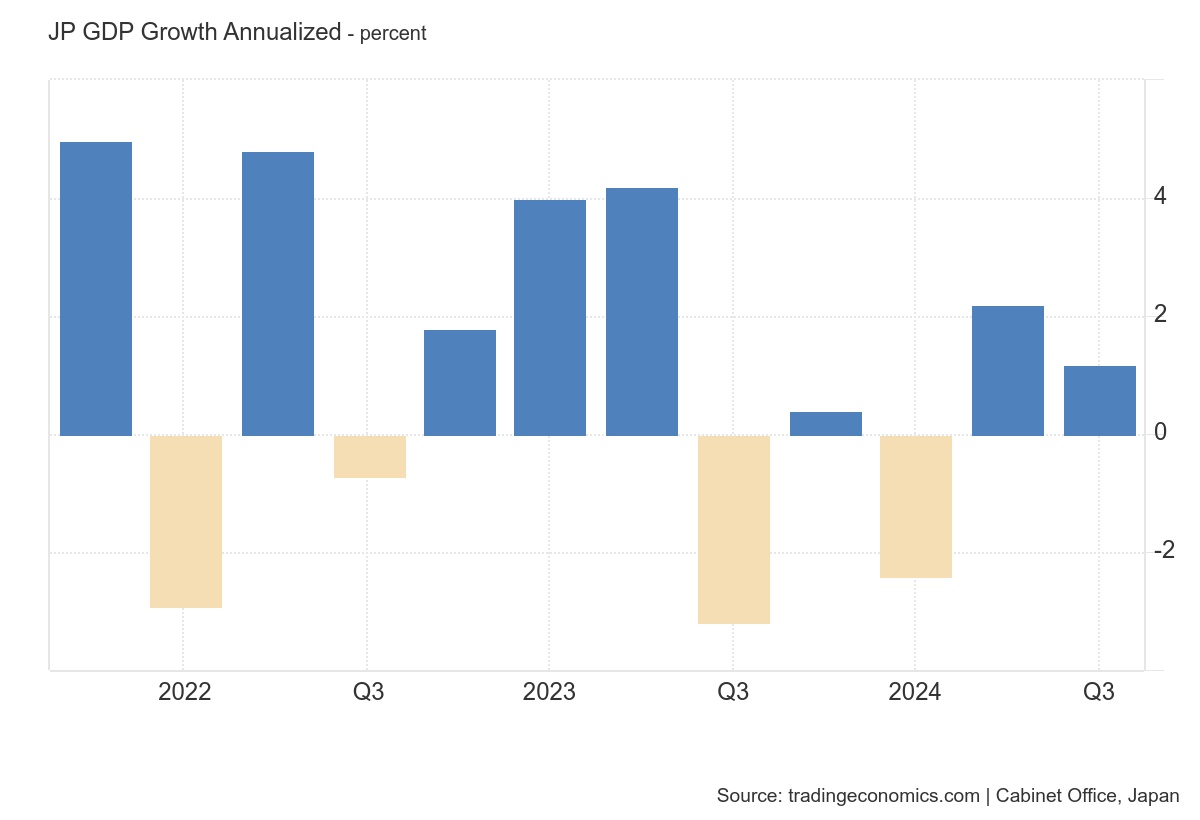

Japan's 10-year government bond yield fell below 1.04% as uncertainty persists over the timing of the next Bank of Japan rate hike. While Governor Kazuo Ueda signalled stability in economic performance, concerns about wage growth and economic fragility remain. Q3 economic growth was revised to 0.3%, exceeding expectations. Dive deeper

China’s Politburo, the top decision-making body of the Communist Party, has pledged more supportive fiscal and monetary policies to address the economic slowdown, shifting to "moderately loose" monetary measures. Premier Li Qiang criticized trade restrictions like high tariffs for hindering global growth. The policies aim to counter weak consumer spending, a sluggish property market, and youth unemployment, with plans for increased government spending and easier credit to stabilize growth and boost consumption. Dive deeper

Japan's economy grew by 1.2% annualized in Q3 2024, exceeding the 0.9% preliminary estimate but softer than Q2's 2.2% growth. Capital expenditure and government spending slowed amid rising rates, while private consumption rose on wage hikes. External demand continued to weigh on GDP for the third consecutive quarter. Dive deeper

Mainland China and Hong Kong regulators are encouraging faster offshore listings of Chinese firms, focusing on Hong Kong as a key destination. Meetings with global banks aimed to streamline approvals and improve the listing process, with an emphasis on second listings of mainland companies. These efforts align with broader initiatives to boost fundraising and support economic growth. Dive deeper

Global equity funds saw inflows of $21.8 billion in the week ending Dec. 4, the highest since mid-November, driven by optimism in U.S. economic growth and tech stocks. U.S. equity funds led with $8.85 billion, followed by European and Asian equity funds with $5.92 billion and $4.58 billion, respectively. Global bond funds maintained their 50-week inflow streak, attracting $10.82 billion. Dive deeper

China's consumer inflation slowed to 0.2% in November, a five-month low, as fresh food prices declined. Factory deflation continued, highlighting the limited impact of recent economic support measures. Month-on-month, the CPI fell 0.6%, driven by weather-related food price drops, indicating further policy support may be needed to bolster growth. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

R. K. Vij, President Emeritus, Textile Association of India

While the Bangladesh crisis is ongoing, India has a significant opportunity.

Bangladesh lacks a value chain.

Orders have increased by 15-20% in the past few weeks.

All garment production is fully booked for the next 4-5 months.

A Trump return in the U.S. could bring benefits to India.

Bangladesh's stabilization appears unlikely soon.

India’s textile industry is expected to perform well over the next 10-15 years.

In the last 3-4 years, China’s garment industry has not grown due to high wages.

India’s exports have increased over the past 6-8 months.

India’s exports are projected to reach USD 80 billion in the next 4-5 years. - Link

Calendars

In the coming days, we have the following major events and corporate actions:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.