Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

This post might break in your email inbox. You can read it in the web browser on your device by clicking here.

Market Overview

Nifty opened at 23,529.55 and experienced a steady rise throughout the day, reaching a high of 23,780.65. However, after 2:30 PM, it gave up most of the gains, closing near the day's low at 23,518.50.

Market sentiment was positive, with 1,687 stocks advancing and 1,116 declining on the NSE.

The abrupt decline in the last hour was primarily attributed to global news, notably Bloomberg's report on Ukraine's first use of ATACMS missiles inside Russia, which has the potential to escalate the conflict. This development led to global markets trading in the red. Additionally, domestic markets may react to the exit poll results of the assembly elections on Thursday.

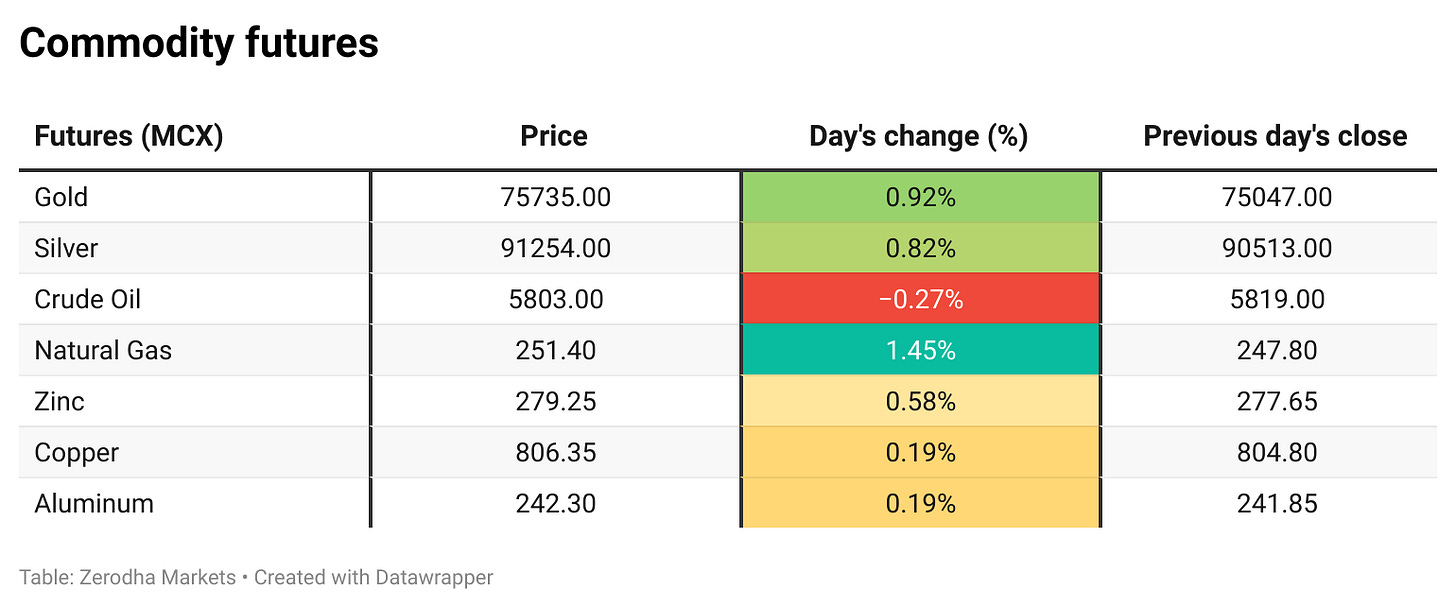

Note: The above numbers for Commodity futures were taken around 4 pm.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 21st November;

The maximum CE OI is at 24000 followed by 23800 and Put OI is at 23000 followed by 23500.

The addition of fresh 12.38 lakh contracts to the 24000 CE, along with a decrease in the Call OI at 23500, and 23600 by 9.35 lakh and 4.92 Lakh contracts respectively indicates position unwinding before the Maharashtra assembly results. Strong unwinding in the puts OI was also witnessed.

Immediate support on the downside can now be seen at 23000 which has the maximum OI for contracts expiring on 21st November and resistance at 23800 followed by 24000.

Please note that we have a trading holiday on Wednesday this week on account of the Maharashtra Assembly elections. Markets may be looking forward to Assembly election results later this week.

Note: This is subject to multiple interpretations but generally, in a falling market if there is an increase in the call OI, it indicates resistance.

Source: Sensibull

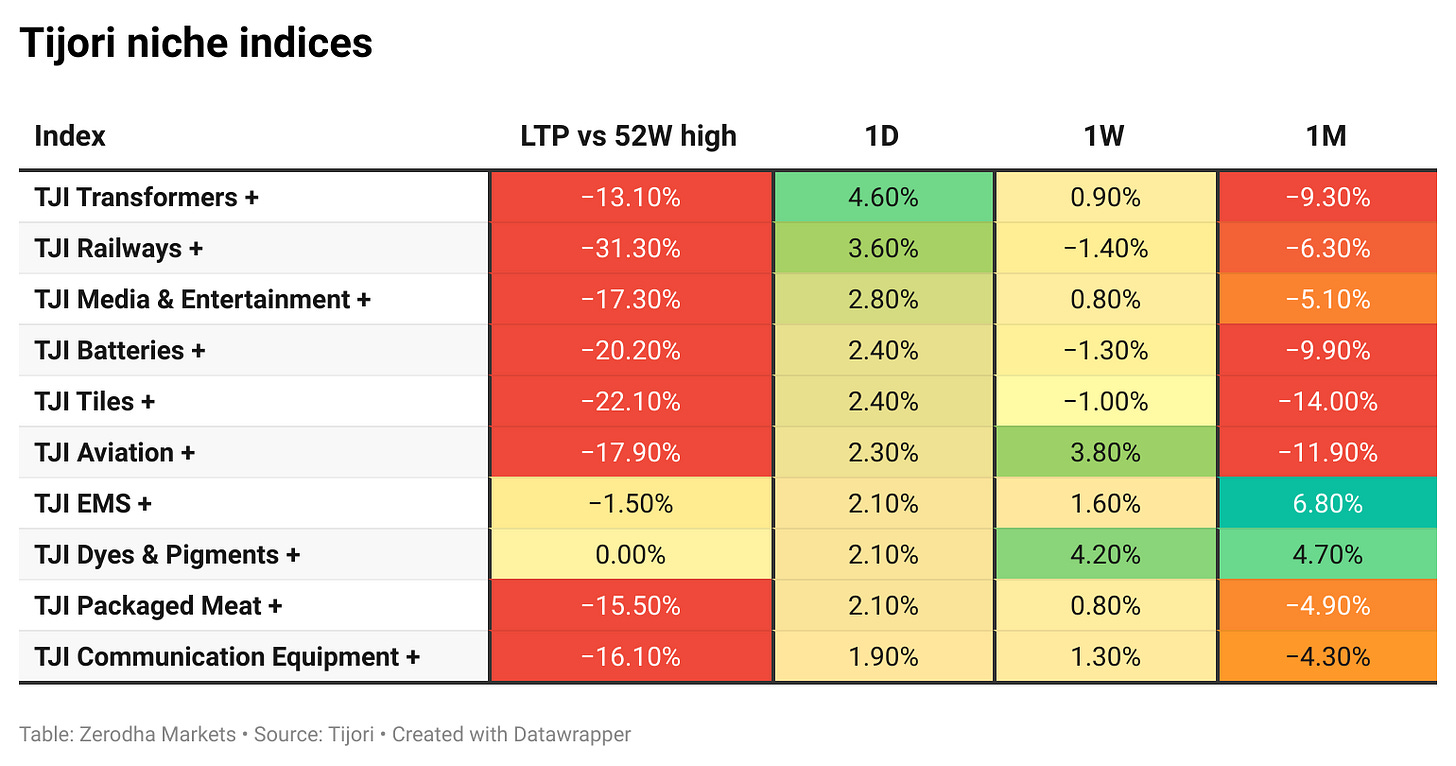

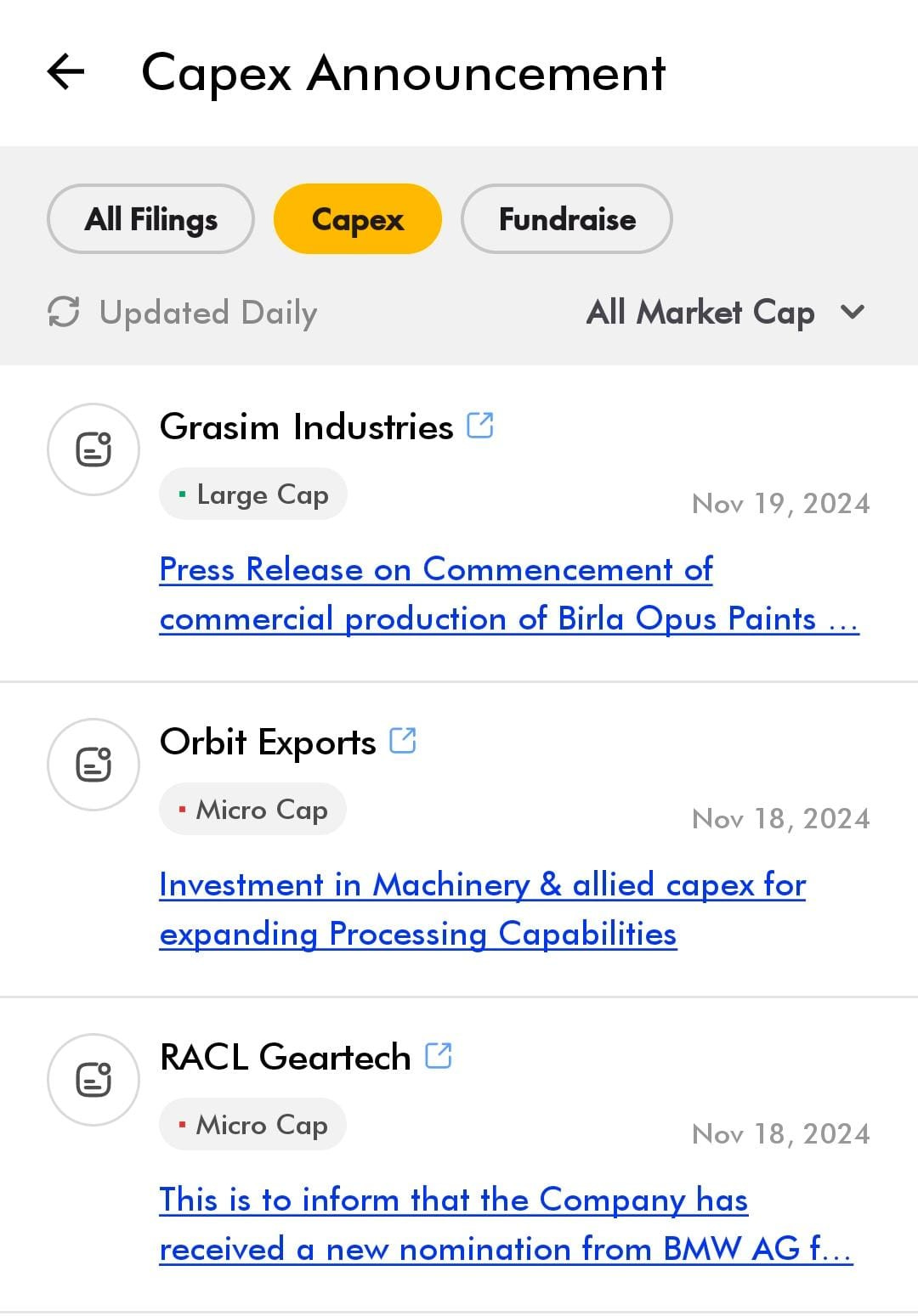

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Capex activity by the companies in Tijori App’s idea dashboard.

What’s happening in India

Finance Minister Nirmala Sitharaman stated that India’s economy is strong, supported by stable fundamentals, high e-way bill generation, strong foreign reserves, and moderating inflation. She assured that the government is taking steps to keep the country on track to becoming the world’s third-largest economy.

She highlighted the need for affordable borrowing costs to encourage industrial growth and addressed inflation risks from perishable items, highlighting efforts to improve storage and reduce supply issues. Dive deeper

The Indian government is planning to sell minority stakes in Central Bank of India, Indian Overseas Bank, UCO Bank, and Punjab and Sind Bank to meet SEBI’s public shareholding norms, which require a 25% public stake in listed companies. Currently, the government holds over 93% stakes in these banks, with a deadline to comply by August 2026.

The stake sale will likely be through an open market offer, with timing and size dependent on market conditions. Shares of the banks rose 3–4% following the news, while past measures like QIPs have been used by public banks to raise capital and reduce government holdings. Dive deeper

State Bank of India issued $500 million in senior unsecured fixed-rate bonds at a 5.125% coupon, maturing in five years, to fund its international operations and general corporate purposes. This marks SBI's third global bond issuance in 2024, following $600 million in January and $100 million in June. Dive deeper

The government revised guidelines for Central Public Sector Enterprises (CPSEs) on dividends, buybacks, bonus shares, and stock splits. CPSEs must pay a minimum annual dividend of 30% of PAT or 4% of net worth, while those meeting specific criteria may opt for buybacks or issue bonus shares. Listed CPSEs with shares priced above 150 times their face value can consider stock splits, with a mandatory three-year gap between splits. The sector Nifty CPSE closed stronger by 0.72% on this news. Dive deeper

The rupee fell to a record low of 84.4150 due to dollar demand from foreign banks and importers, including oil companies. RBI likely intervened to prevent further losses, with state-run banks intermittently offering dollars. The dollar index rose slightly to 106.3, while Asian currencies traded mixed. Dive deeper

Zee Entertainment shares rose 6.2% after MD Punit Goenka resigned from his role, effective November 18, to focus on operational responsibilities while retaining his board position. The CFO, Mukund Galgali, was designated as Deputy CEO to strengthen the company's leadership team. Dive deeper

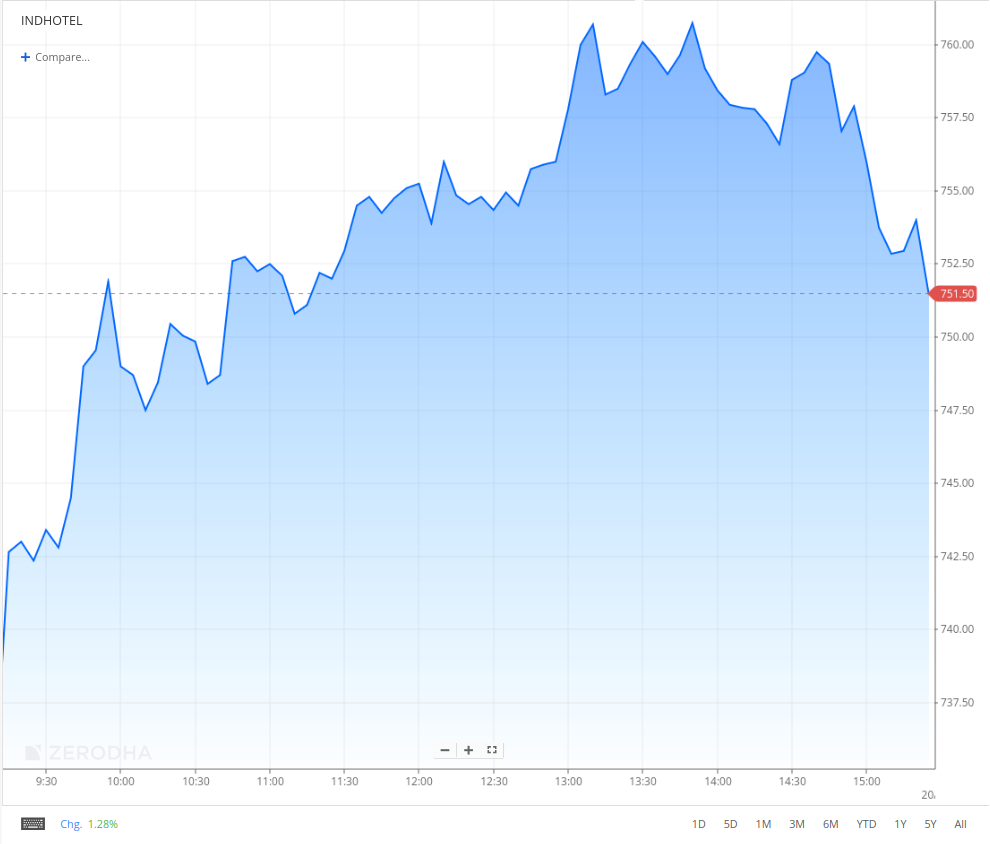

Indian Hotels Company plans to expand its portfolio to 700 hotels by 2030 under its "Accelerate 2030" strategy. It aims to double its revenue to ₹15,000 crore, grow new businesses, and maintain strong profits. Shares rose nearly 2.3% after the announcement. Dive deeper

What’s happening globally

As per the Bloomberg report, Ukraine has commenced the use of U.S.-supplied Army Tactical Missile Systems (ATACMS) to strike targets within Russian territory, marking a significant escalation in the ongoing conflict. This development follows President Joe Biden's authorization, allowing Ukraine to employ these long-range missiles against Russian and North Korean forces, particularly in the Kursk region. - Dive deeper

Beijing pledged to advance capital market reforms and open its financial sector to foreign investors while supporting Hong Kong as a global financial hub. China’s leaders focused on creating a business-friendly environment, while Western executives raised concerns about slow deal-making and issues with capital movement in Asia. Dive deeper

Eurozone inflation reached 2.0% in October, mainly driven by higher costs in services, while energy prices lowered the overall rate. EU inflation was 2.3%, with big differences across countries, from 0% in Slovenia to 5% in Romania. Inflation increased in 19 EU countries compared to September. Dive deeper

Source: Trading Economics

Nestle plans to save 2.5 billion Swiss francs by 2027 through cost-cutting measures in procurement, commercial investments, and structural costs. The company will also spin off its water and premium drinks business into a separate unit in January 2025, focusing more on advertising and marketing to boost growth. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian Economy.

Nirmala Sitharaman, Union Finance Minister

On Interest rates

"When you look at India's growth requirements, and you can have so many different voices coming out and saying the cost of borrowing is really very stressful, and a time when we want industries to ramp up and building capacities, bank interest rates will have to be far more affordable." - Link

Distribution of Insurance by Banks

"While this model has significantly contributed to improving insurance penetration across the country, it has also raised concerns about instances of mis-selling … I would say, it added or contributed in indirect ways to the increased cost of borrowing for the customers." - Link

Ramesh Kalyanaraman, Executive Director – Kalyan Jewellers, on lab-grown diamonds.

We don’t see any demand at the store level because, as I’ve mentioned before, we are retailers. When there is demand, we will surely go ahead and supply. However, at the store level, there is currently no demand for lab-grown diamonds. Additionally, because the prices have not yet stabilized, major brands are not actively promoting them, as customers tend to trust the brand more than the product itself. When prices remain unstable, we, as brands, refrain from promoting lab-grown diamonds as well. The one or two players you are referring to treat lab-grown diamonds as fashion accessories with a very low ticket size, which may serve as a substitute for artificial jewelry - Link

Rakesh Ranjan, VP, Food delivery at Zomato on growth prospects for the food delivery business

The food delivery sector is still in its nascent stages in the country and … more competition will only foster innovation and growth which will benefit the sector overall. We expect the company to maintain the annual growth pace of 30% and above for the next four to five years, ”if not more” - Link

Calendars

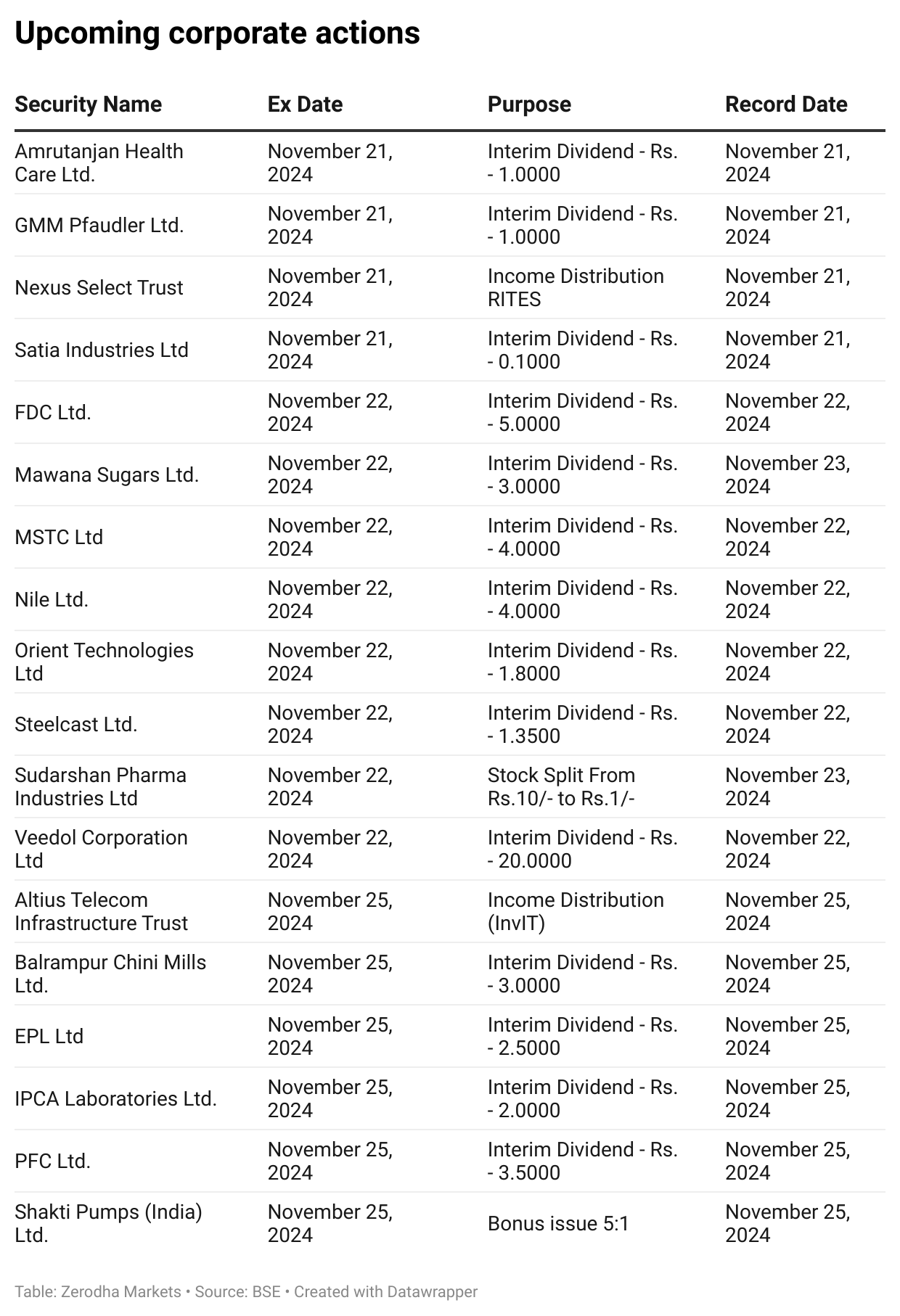

In the coming days, We have the following major events and corporate actions:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

very nice content! however, since each article is quite long, a table of contents at the top will help navigate this better. Otherwise any interesting topic way down in the newsletter just may not end up getting read.

I like the episodes on what's happening in india, globally and management chatter.

Management chatters helps us to give the broad view of what's the company is planning and how the industry is shaping. I like this section very much. Thanks for this.

I found it hard to follow and understand quarterly results of the companies covered by aftermarket report in the previous articles since it was an information overload with numbers and very little info to really understand the quarterly results of the company.