Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

Nifty 50 closed at 24,968, down 143.05 points (–0.57%). It hit an intraday low near 24,918 before recovering slightly late in the afternoon. Sensex fell by 501.5 points (–0.61%), closing the trading session at 81,757.

The decline comes amid weak earnings from Axis Bank, which dropped ~6% due to a surprise profit miss and rising bad loans, and a broader sell-off in financials dragging the market lower. This marks the third straight weekly fall for both Nifty and Sensex amid global trade uncertainty and earnings pressure.

Broader Market Performance:

Coming to the broader market performance, of the 3038 stocks traded on NSE, 1133 stocks advanced, 1820 stocks declined, while 85 remained unchanged, suggesting an overall weak sentiment.

Sectoral Performance:

Only three sectors, Media, Metal, and IT, managed to close the day in the green. The banking sector was the biggest loser, losing close to a percent, dragged down by Axis Bank, Kotak, HDFC, and ICICI Bank.

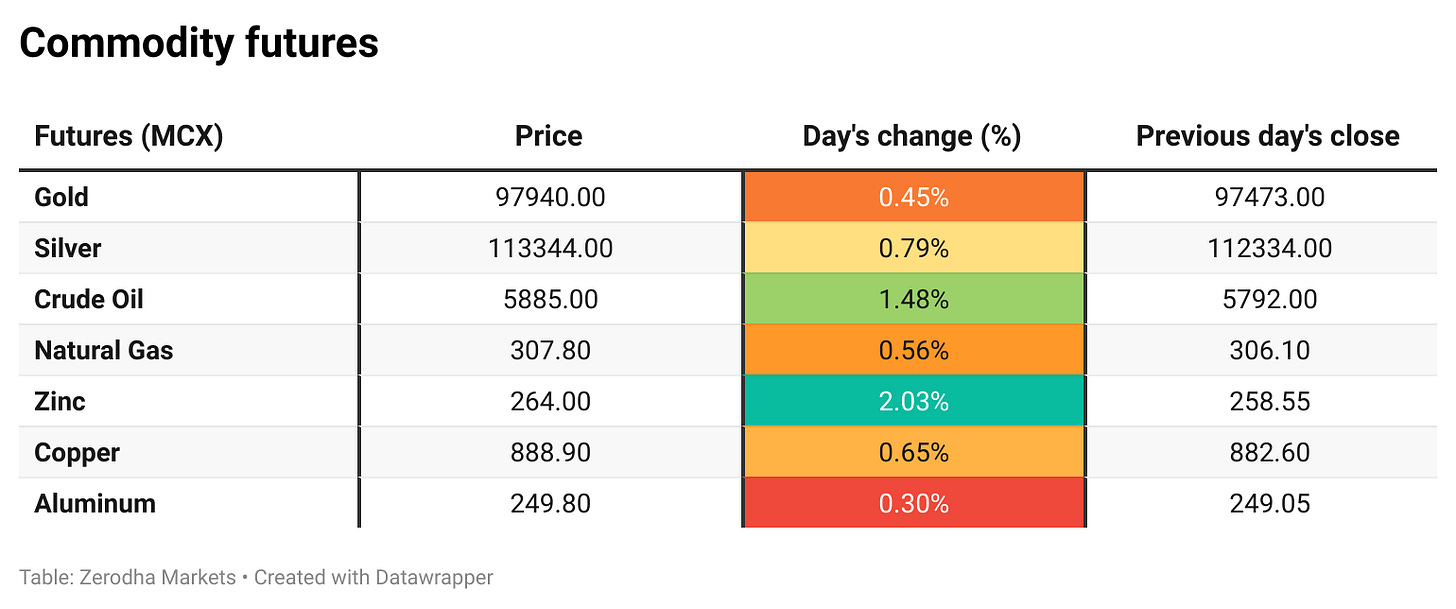

Note: The above numbers for Commodity futures were taken around 4 pm. Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 17th July:

The maximum Call Open Interest (OI) is observed at 25,200, which saw an addition of 35.7 lakh contracts, followed closely by 25,100, which saw an addition of 64.6 lakh contracts, indicating strong resistance in the 25,100 - 25,200 range.

The maximum Put Open Interest (OI) is observed at 24,900, which saw the addition of 22.7 lakh contracts, indicating immediate support at that level.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

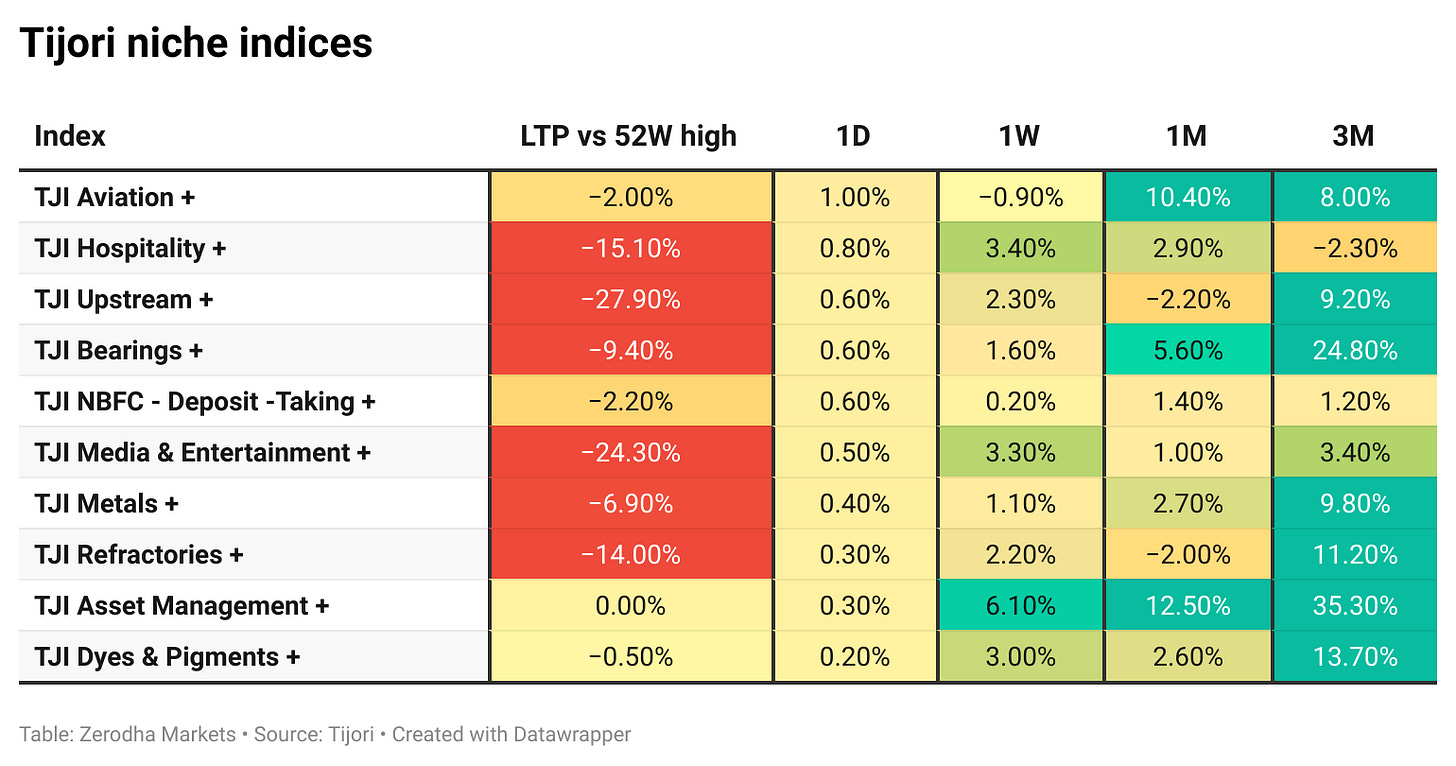

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

Godrej Properties acquires 48-acre land in North Bengaluru’s Doddaballapur to develop plotted housing with ~1.1 mn sq ft saleable area. Dive deeper.

Tata Power Renewable wins 30 MW/120 MWh battery storage project from NHPC for Kerala grid; to be commissioned in 15 months. Dive deeper.

SEBI's ban on Jane Street triggered a 35% drop in NSE’s index‑options premium turnover over two weeks, from ₹60,605 cr average to ₹39,626 cr, as India’s largest derivatives player exited the market Dive deeper.

GST department has flagged around 60,000 traders using UPI without GST registration—issuing notices and prompting many, especially in Bengaluru and Mysuru, to refuse UPI and demand cash to avoid scrutiny. Dive deeper.

Jio Financial reported a 48% YoY rise in Q1 FY26 Total Income. Strong growth in AUMs under JioBlackRock AM and Jio Credit; secured full control of Jio Payments Bank and new regulatory approvals. Dive deeper.

Wipro reported a net profit of ₹3,336 crore for Q1 FY26, up 10% YoY, despite a 2.3% YoY decline in constant currency revenue.

The company saw strong deal wins, with total contract value (TCV) rising 51% YoY to $4.97 billion, including $2.7 billion from large deals. Dive deeper.

Polycab India reported a 26% YoY rise in Q1 FY26 revenue to ₹5,906 crores, with net profit surging 49% YoY to ₹600 crores, driven by strong performance across core segments. Dive deeper.

Reliance Retail acquired Kelvinator to strengthen its position in India's consumer durables space and tap into the premium appliances market. Dive deeper.

CEAT reported a 10.5% YoY rise in Q1 FY26 revenue to ₹3,529.4 crore. Despite margin pressure from higher raw material costs, debt was reduced by ₹115 crore, and the company earned global recognition for sustainability and brand strength. Dive deeper.

Indian Overseas Bank reported a 76% YoY jump in Q1 FY26 net profit to ₹1,111 crore. Gross NPAs improved to 1.97% from 2.89%, while net NPAs dropped to 0.32%. Total income rose to ₹8,866 crore, and the capital adequacy ratio strengthened to 18.28%. Dive deeper.

What’s happening globally

Markets pulled back as investors stay cautious ahead of Sunday’s upper-house election, with election outcome concerns weighing on investor sentiment Dive deeper.

Powell several congressional lawmakers criticized renovation costs for the Federal Reserve's Washington headquarters; he responded, defending the expenses as essential upkeep. Dive deeper.

The EU’s latest sanctions blacklist a Rosneft-linked refinery in Vadinar, India, and cut the Russian oil price cap to ~$47–48/barrel. Over 100 tankers and 20 banks face new restrictions to curb Russia’s energy revenue. Dive deeper.

The House passed the GENIUS Act 308–122, setting nationwide oversight for USD-backed stablecoins, including reserve audits and consumer protections. Companion bills—the Clarity Act and Anti-CBDC Act—also passed. Bill now goes to President Trump for signature. Dive deeper.

Kinetic Green and Tonino Lamborghini aim to tap the $1 billion global golf cart market with a luxury EV lineup under a new joint venture. Dive deeper.

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Anand Shah, CIO- PMS & AIF Investments, ICICI Prudential AMC

"Metal pack, especially in the ferrous metals, is still fairly muted globally."

"We are seeing very strong exports coming out of China which is putting a lot of pressure on the profitability" - Link

Dhananjay Sinha, CEO and Co-Head Institutional Equities, Systematix Group

"I would say that private banks had actually done well. There has been a significant revival in the investor interest in names such as HDFC Bank, Kotak Bank, etc, and even Bajaj Finance in the NBFC sector."- Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

Calendars

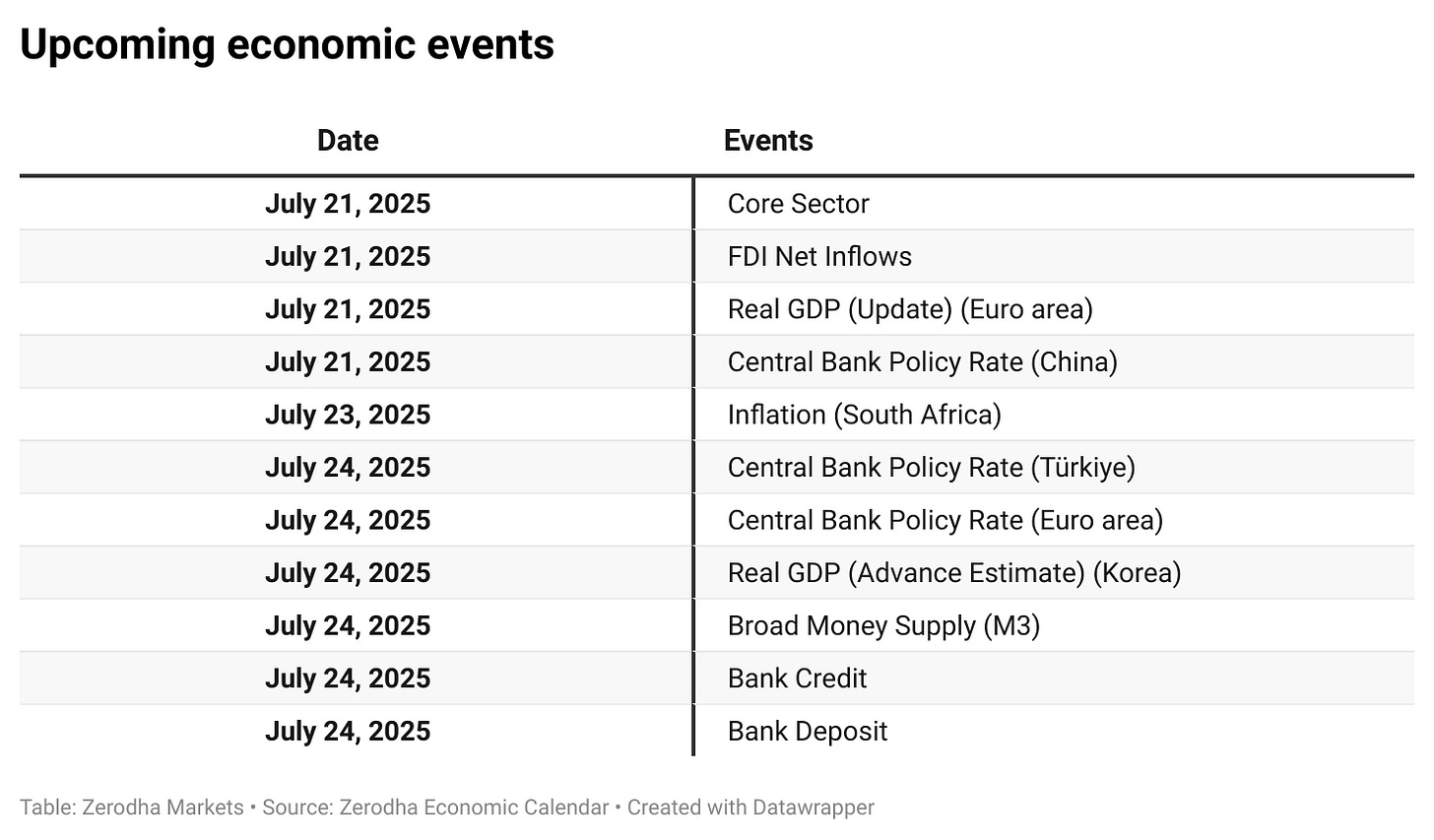

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

Suggestion

When you mention market breadth like 1100 stocks out of 3000 stocks kindly mention previous 4 days numbers on a graph or a table for better view of current week

Thanks 👍