Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

Nifty opened flat at 24,196.40, which also marked the day’s high. It immediately began drifting lower, reaching 24,060 within the first half hour. After consolidating in a range for some time, the market slipped further to hit a fresh intraday low near 24,010 by 11 AM.

However, a quick recovery followed, with the index climbing 120 points to test 24,130. After a brief consolidation at this level, it slid again and traded within a range with a downward bias. In the final hour, the market hit a new low of 23,976 before closing at 24,004.75, down 0.76% for the day.

Following two days of a strong 650-point rally, the market took a breather, with profit booking in the pharma and IT sectors, continued underperformance in banking stocks, and lackluster global cues contributing to the decline.

Broader Market Performance:

While the headline indices paused, the broader market maintained a positive breadth. A total of 1,470 stocks advanced, 1,349 declined, and 84 remained unchanged.

Sectoral Performance:

The sectoral performance showed mixed trends, with some sectors posting modest gains while others recorded losses. Nifty Media emerged as the top gainer, rising by 1.7%, while Nifty Bank, Pharma, and IT declined by 1.2%, 1.23%, and 1.41%, respectively.

Note: The above numbers for Commodity futures were taken around 4 pm.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 9th January:

The maximum Call Open Interest (OI) is observed at 24,500, closely followed by 24,200, while the maximum Put Open Interest (OI) is at 23,700, followed by 24,000.

Immediate support is observed in the 23,800–24,000 range, while resistance lies between 24,200 and 24,400.

Note: OI is subject to multiple interpretations but generally, in a falling market if there is an increase in the call OI, it indicates resistance, and in a rising market, if there is an increase in the put OI, it indicates support.

Source: Sensibull

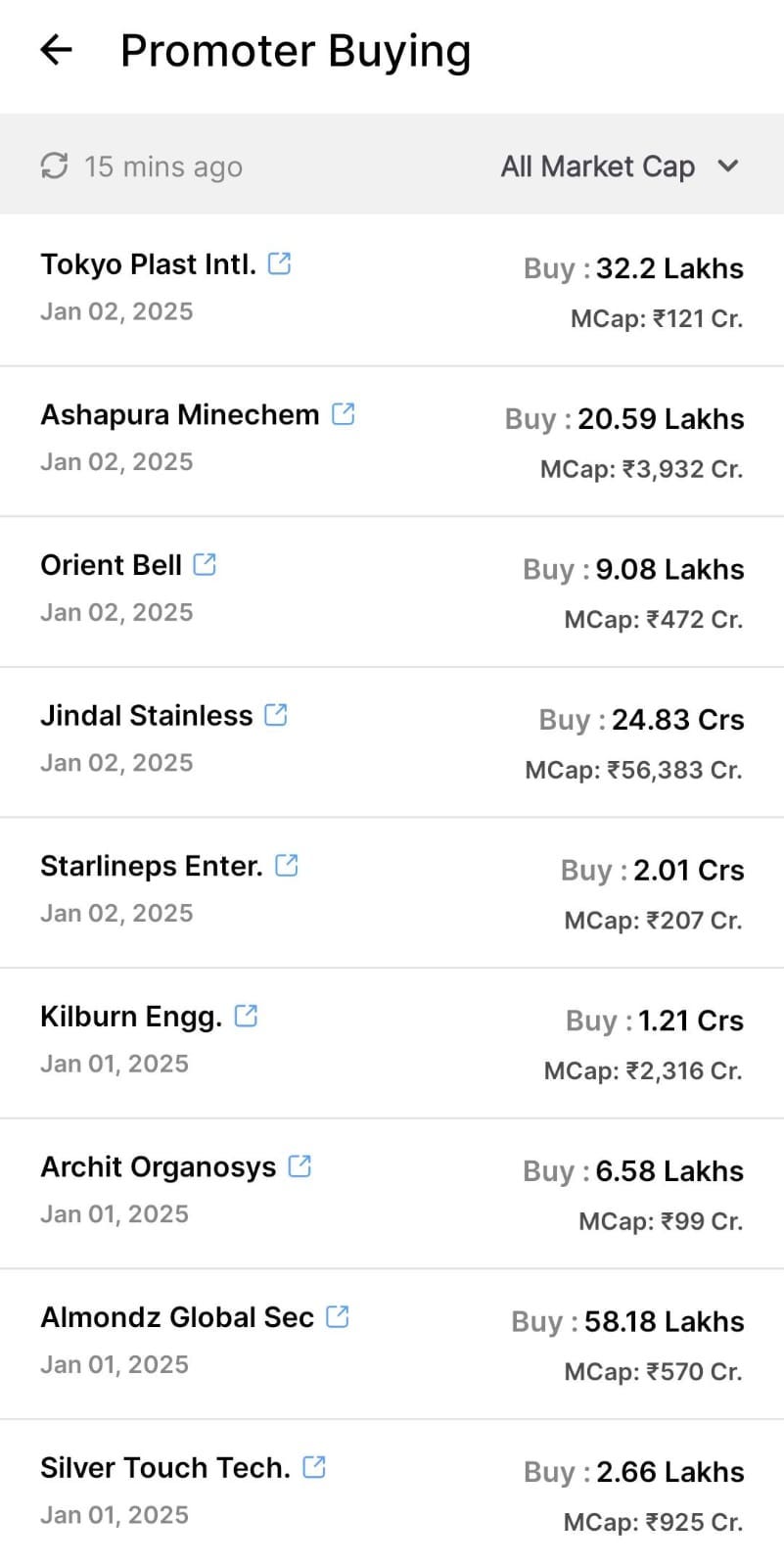

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

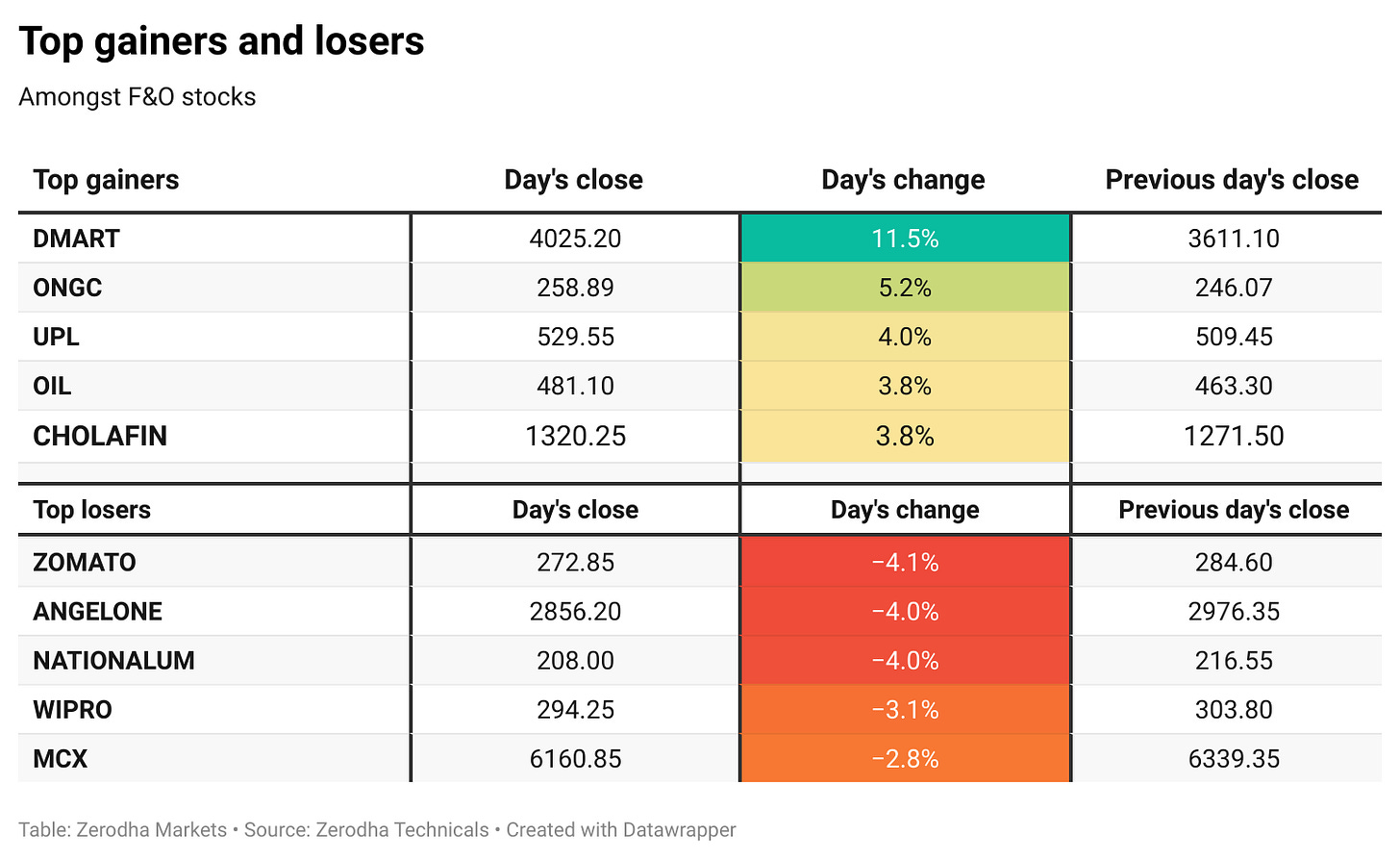

Avenue Supermarts Ltd., the parent company of DMart, reported a 17.5% rise in standalone revenue for Q3 FY2024, reaching ₹15,565.23 crore. Following the announcement, its stock surged over 15% to ₹4,165 before closing with an 11.5% gain, reflecting strong market confidence. Dive deeper

In December 2024, India’s banking system slipped into a liquidity deficit for the first time since June, despite a ₹1.16 lakh crore infusion through the easing of the cash reserve ratio (CRR). However, the Reserve Bank of India maintained overnight borrowing costs near the policy repo rate by fine-tuning variable rate repo (VRR) auctions. Dive deeper

India's forex reserves declined by $4.1 billion to $640.28 billion as of December 27, 2024, following an $8.4 billion drop the previous week. The decline was primarily due to a $4.6 billion fall in Foreign Currency Assets (FCAs) to $551.92 billion, while gold reserves rose by $541 million to $66.26 billion, according to RBI data. Dive deeper

Western Carriers India Ltd secured a Rs. 139 crore order from Vedanta Ltd for a four-year material handling contract at Jharsuguda Plant. Dive deeper

KEC International Ltd. secures Rs. 1,097 crores in orders for international Transmission & Distribution, boosting their YTD intake by 70% to Rs. 19,500 crores. Dive deeper

Afcons Infrastructure Ltd. surged over 6% before closing higher by 1.6% after securing a ₹1,080 crore order from the Defence Research & Development Organisation for upgrading ship lift facilities in Visakhapatnam. The project, expected to be completed within 36 months, was confirmed through an exchange filing. Dive deeper

Zairus Master, Chief Business Officer of Honasa Consumer Ltd., the parent company of Mamaearth, has resigned for personal reasons and will step down on February 28, 2025, the company announced. Dive deeper

Zomato's Blinkit has launched a quick-response ambulance service in Gurugram to improve emergency medical assistance, CEO Albinder Dhindsa announced on X. Starting with five ambulances, the service can be booked via the Blinkit app, with plans to expand to major cities nationwide over the next two years. Dive deeper

Hero MotoCorp fell 1.6% after it reported a 17.5% year-on-year decline in December 2024 sales, with total volumes decreasing to 324,000 units from 393,000 units in December 2023. Dive deeper

RITES Ltd. surged 3% higher before closing with 0.78% gains after securing a ₹69.78 crore contract from the Steel Authority of India Limited (SAIL) for the Bhilai Steel Plant in Chhattisgarh. Dive deeper

Dhanlaxmi Bank’s Provisional business data shows a 7.26% increase in total business, 10.3% in gross advance, and 32.82% in gold loans year-over-year. Dive deeper

IDFC First Bank reported a 25.2% YoY growth in total business to ₹4,58,213 crore for Q3 FY24, driven by a 21.9% YoY rise in advances to ₹2,30,947 crore and a 28.8% YoY increase in customer deposits to ₹2,27,266 crore. CASA deposits grew 32.3% YoY to ₹1,13,091 crore, with the CASA ratio improving to 47.8% from 46.8% a year ago. Dive deeper

What’s happening globally

New unemployment claims in the U.S. fell to 211,000 last week, the lowest since April 2024, signaling minimal layoffs and a robust labor market as the year ends. This decline, better than the 222,000 forecasted, aligns with strong economic data like consumer spending, supporting the Federal Reserve's expectation of fewer interest rate cuts and sustained economic growth. Dive deeper

China is expanding its consumption subsidies to include smartphones, tablets, and smartwatches, aiming to boost domestic spending amid growing external challenges. Officials announced that the existing trade-in program for home appliances and cars will now cover personal electronic devices. Dive deeper

Germany's unemployment rose by 10,000 in December to 2.87 million, less than the 15,000 increase predicted by analysts, according to the Federal Labor Office. The rise was attributed to the usual seasonal impact of the winter break. Dive deeper

Tesla Inc. reported its first annual decline in shipments from its Shanghai plant since the facility began mass production in 2020, highlighting growing local competition and cooling global demand. The automaker, led by Elon Musk, delivered 916,660 electric vehicles from its first factory outside the US in 2024, marking a 3% drop from the previous year, according to preliminary data from China’s Passenger Car Association. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Rakesh Sharma, Executive Director, Bajaj Auto

I would say that the economic backdrop is very important going into 2025. Right now, it is evenly balanced. The issue is about inflation. Particularly in the urban areas, we have seen that the rental inflation has been, for example, very high, which reduces the disposable surplus.

The disposable income of our average customer, who is earning Rs 40,000 to Rs 60,000 per month, gets impaired. While we capture food and groceries, we feel that rental inflation has also impacted the accumulation of disposable surplus. That factor has been slightly less prominent in the smaller towns and rural areas. In the last few months, particularly, we have seen that the big towns or metros or mini-metros and deep rural areas have not done as well as the middle, which is the mid-sized towns, and the small towns, which has been outperforming the other two.So, as we get into the new year and there will be budget, etc, if our customers get more money in their pocket, either from taxation coming down or other schemes which benefit them, they will be in an optimistic mood and that then translates into purchase for us. - Link

Sunder Balasubramanian, Chief Marketing Officer, Myntra

"We've now at a stage where influencer-based performance marketing is as good as any other performance marketing" - Link

Sanjay Budhia, Chairman of the CII National Committee on EXIM

"Exporters are indeed facing significant challenges on the liquidity front, with high interest rates and declining export finance impacting their competitiveness,"

This coverage which is currently at ₹50 crores could be extended to ₹100 crore, and more banks could be brought into the fold to ensure better access to credit - Link

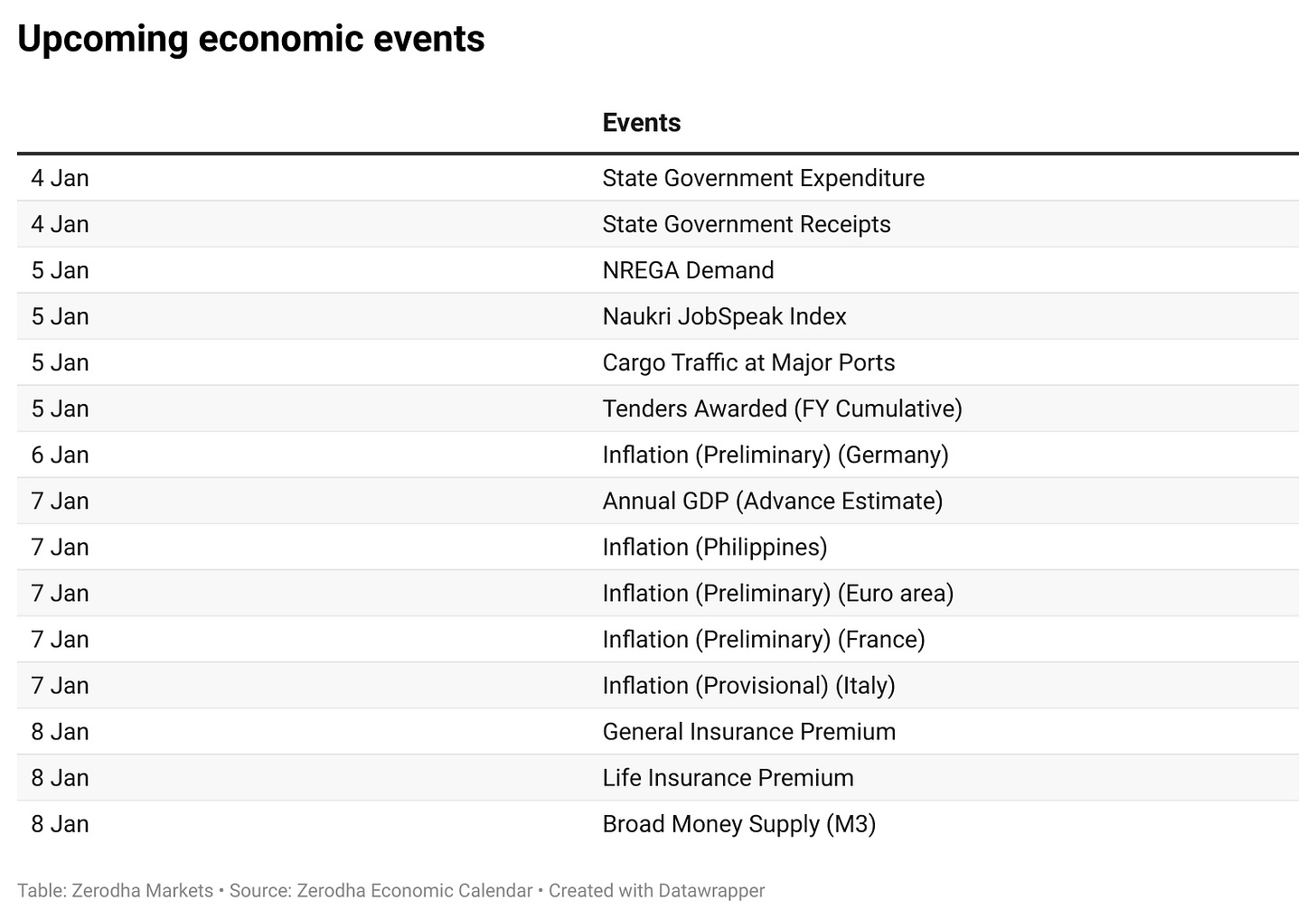

Calendars

In the coming days, we have the following major events and corporate actions:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

amazing info

Promoter selling should also be added