Markets extend losing streak to 4th Day amid weak rupee, tariff concerns

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real time by Tijori.

Market Overview

Nifty opened flat at 23,543.80 but fell immediately after the opening tick, trending lower toward 23,400. After a brief 50-point bounce, the index resumed its decline, staying below 23,400 throughout the day. It touched an intraday low of 23,316.30 before attempting to reclaim 23,400 in the final hour, but the effort fell short. Nifty eventually closed at 23,381.60, down 0.75%.

The sentiment was weighed down by the rupee's weakness against the dollar and concerns over Trump's tariffs on aluminum and steel imports. Looking ahead, markets are expected to track global cues, domestic economic developments, and market-related news, including the final phase of the earnings season.

Broader Market Performance:

Underperforming the headline indices, the broader market saw an even sharper decline in advance-to-decline ratios. Out of 2,955 stocks traded on the NSE, 627 advanced, 2,257 declined, and 71 remained unchanged.

Sectoral Performance:

From the sectoral indices performance, Nifty Bank was the least affected sector, recording the smallest decline of -0.35%. On the other hand, Nifty Realty suffered the most, plunging -2.99%, making it the top loser. All sectors ended in the red, with no sector showing gains, indicating broad-based selling pressure across the market.

Note: The above numbers for Commodity futures were taken around 4 pm.

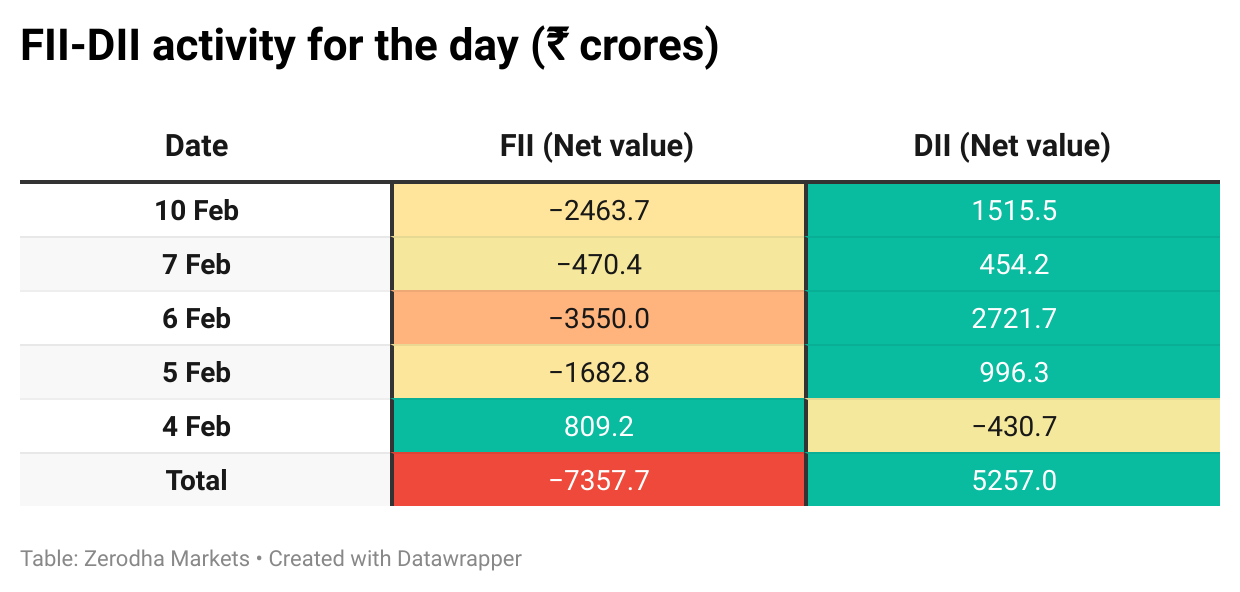

Net Flow Breakdown for the day:

FII: Net outflow of ₹2,463.72 crore (Bought ₹9,607.92 crore, Sold ₹12,071.64 crore)

DII: Net inflow of ₹1,515.52 crore (Bought ₹9,802.45 crore, Sold ₹8,286.93 crore)

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 13th February:

The maximum Call Open Interest (OI) is observed at 23,700, followed by 23,600. Meanwhile, The maximum Put Open Interest (OI) is at 23,000, followed by 23,100.

Immediate support is identified in the 23,350–23,300 range, while resistance is expected between 23,600 zones followed by 23,700.

Note: OI is subject to multiple interpretations, but generally, an increase in the call OI indicates resistance in a falling market, and an increase in the put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

The rupee plunged 45 paise on Monday, nearing the 88 per US dollar mark, pressured by a stronger dollar and tariff concerns. However, selling at higher levels helped it settle flat at 87.50. The dollar strengthened globally after President Trump announced a 25% tariff on steel and aluminum imports, along with reciprocal tariffs on countries taxing U.S. exports, raising fears of a global trade war, especially with China's retaliatory measures taking effect. Dive deeper

The Indian Pharmaceuticals Market (IPM) maintained strong growth, rising 8.7% year-on-year in January 2025, compared to 7.7% in December 2024 and 9.5% in January 2024. The growth was primarily driven by price increases and new product launches, while volume growth remained subdued at 0.9% year-on-year. For the full calendar year 2024, the IPM averaged 7.7% annual growth. Dive deeper

L&T Finance shares closed lower by 1% after the company’s board approved the acquisition of Paul Merchants Finance’s gold loan business. The Rs 537 crore deal, executed through a business transfer agreement, marks L&T Finance’s entry into the gold loan segment. Dive deeper

Transrail Lighting reported an order intake of Rs. 4,715 Crore and a total order book of Rs. 11,499 Crore as of December 31, 2024. Dive deeper

Lupin Limited received U.S. FDA approval for a generic equivalent of Atrovent Nasal Spray, estimated at $22M U.S. market annually. Dive deeper

Ajmera Realty & Infra is launching six projects with a GDV of INR 4,300 crores, aims to reduce debt by 14% and has strong revenue visibility with projects totaling INR 6,000 crores. Dive deeper

Mastek partners with OpenAna to enhance AI-driven software development, focusing on integrating GenAI into SDLC processes for efficiency. Dive deeper

JSW Steel reported consolidated Crude Steel production for the month of January’25 at 25.18 Lakh tonnes. Indian Operation and Consolidated production was higher by 7% YoY. Capacity utilisation for January’25 at Indian Operations excluding under trial-run was at 90%. Dive deeper

VA TECH WABAG secures a $371M consortium order for a 200 MLD sewage plant in Riyadh, enhancing its leadership in the Middle East. Dive deeper

Hitachi Energy India received a Letter of Intent to design and execute a 6000 MW HVDC project with BHEL, impacting renewable energy transmission in India. Dive deeper

What’s happening globally

President Donald Trump announced plans to impose a 25% tariff on all steel and aluminum imports aiming to counter trade imbalances. He also vowed to introduce reciprocal tariffs on countries that tax U.S. imports, with those measures set to take effect almost immediately after the announcement. Dive deeper

South Africa's JSE index climbed 0.5% on Monday, surpassing 87,800 to reach a new record high and extending its winning streak to five sessions. The gains were driven by heavyweight resource-linked sectors, particularly gold miners, as investors sought safer assets amid renewed fears of a global trade war following Donald Trump’s latest tariff plans. Dive deeper

The Hang Seng jumped 388 points (1.8%) to 21,522 on Monday, marking its third straight gain and the highest level since early October. The rally was driven by broad sector gains, easing deflation concerns as consumer inflation hit a five-month high, and fading worries over U.S.-China trade tensions, with traders viewing tariff threats as negotiation tactics. Dive deeper

Chinese stocks extended their gains on Monday, with the Shanghai Composite rising 0.56% to close at 3,322 and the Shenzhen Component gaining 0.52% to reach 10,631—both marking their highest levels in over a month. The rally was fueled by continued optimism surrounding breakthroughs in artificial intelligence in China, particularly with companies integrating DeepSeek’s open-source model into their operations. Dive deeper

Copper futures rose above $4.58 per pound on Monday, hitting a four-month high amid supply concerns from Chile and strong demand from China post-Lunar New Year. U.S. buyers also stocked up ahead of potential tariffs, adding to the bullish momentum. Dive deeper

Quarterly results

In this section, we'll dive into all the key highlights from today's intriguing results, covering the most impactful performances and standout moments. The numbers are comparable on a year-on-year (YoY) basis.

Varun Beverages (-1.91%)

Revenue: ₹3,689 crores, up by 38% YoY.

EBITDA: ₹579 crores, up by 38% YoY.

Net Profit: ₹196 crores, up by 40% YoY.

EPS: ₹0.55, up by 34% YoY.

Key Highlights:

Varun Beverages demonstrated robust growth in revenue and profitability metrics, reflecting strong operational performance.

The significant increase in EBITDA and net profit highlights efficient management and operational leverage.

Outlook:

The company is expected to continue its growth trajectory, supported by strategic initiatives and market expansion efforts.

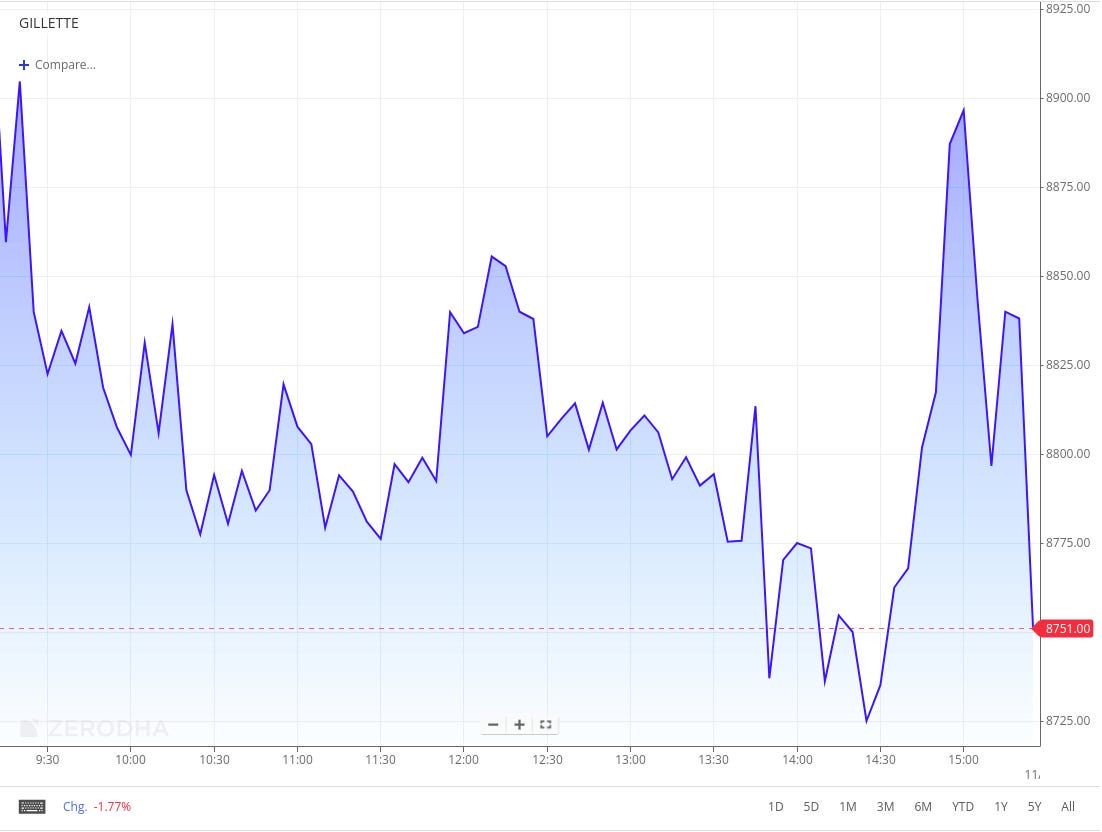

Gillette India (-1.77%)

Revenue: ₹686 crores, up by 7% YoY.

EBITDA: ₹183 crores, up by 17% YoY.

Net Profit: ₹126 crores, up by 21% YoY.

EPS: ₹38.66, up by 21% YoY.

Key Highlights:

The company declared an interim dividend of ₹65 per equity share for the financial year 2024-25.

The dividend will be paid on or before March 7, 2025.

Outlook:

Gillette India continues to focus on innovative product offerings and market expansion strategies to strengthen its brand presence and market share in the personal care industry.

HBL Engineering Limited (-3.94%)

Revenue: ₹4,505.57 crores, up by 8.13% YoY.

Net Profit (PAT): ₹583.90 crores, up by 12.54% YoY.

EPS: ₹2.31, up from ₹2.84 YoY.

Key Highlights

Noted improvement in revenue and PAT, indicating strong operational performance.

Exceptional items expense of ₹5.07 crores, a significant drop from ₹283.93 crores in the same quarter the previous year, suggesting less one-time financial impacts.

Outlook

The company is poised for steady growth with ongoing improvements in operational efficiencies and market expansion.

Saregama India Limited (+1.47%)

Revenue: ₹483.4 crores, up by 137% YoY.

EBITDA : ₹84.4 crores, up by 29% YoY.

Net Profit (PAT): ₹62.3 crores, up by 19% YoY.

EPS: ₹3.23 crores, up by 19% YoY.

Key Highlights

Record-breaking revenue and PAT for the quarter, driven significantly by the Event segment.

Major success in live events, notably the "Dil Luminati" concert, marking it as the highest-grossing in Indian history.

Released over 1250 originals and premium recreations across multiple languages, enhancing their music catalogue's breadth and appeal.

Outlook

The company is set for profitable growth, focusing on unlocking synergies from its diverse business segments.

Gujarat State Fertilizers & Chemicals Limited (-2.15%)

Revenue: ₹1,626 crores, up by 33.18% YoY.

EBITDA: ₹149 crores, up by 43.27% YoY.

Net Profit (PAT): ₹119 crores, up by 6.25% YoY.

EPS: ₹3.00, up from ₹2.82 YoY.

Key Highlights

Significant increase in revenue and EBITDA, driven by higher trading revenues from DAP and increased fertilizer output.

Production of fertilizers saw a 23% increase in Q3 YoY, with sales volume up by 25%.

Substantial growth in operating efficiency, from 8.52% to 9.16% in Q3, and from 10.95% to 12.41% over the nine months.

Outlook

Positive outlook for Rabi crops is expected to support strong sales in Q4. However, challenges like global supply constraints and pricing pressures due to INR depreciation could impact the fertilizer industry.

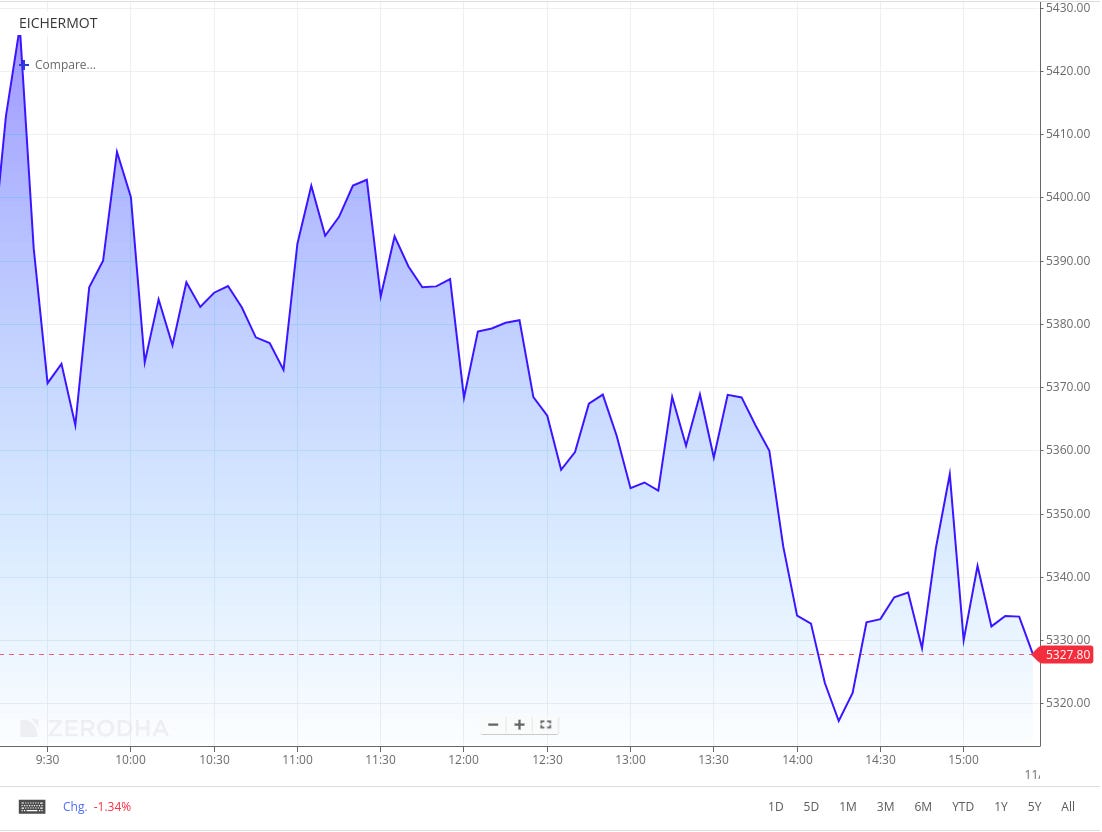

Eicher Motors (-0.83%)

Revenue: ₹4,908.14 crores, up by 21.07% YoY.

Net Profit (PAT): ₹1,056.23 crores, up by 15.56% YoY.

EPS: ₹38.53, up from ₹33.38 YoY.

Key Highlights

Significant increase in revenue from operations, largely attributed to strong sales performance.

Notable growth in PAT reflecting effective cost management and operational efficiencies.

Declared an interim dividend, highlighting strong cash flow and profit generation.

Outlook

The company continues to focus on expanding its market presence and enhancing operational efficiencies to sustain growth momentum.

Transrail Lighting Ltd. (+0.28%)

Revenue from Operations: ₹1,340.25 crores, up by 62.82% YoY

EBITDA: ₹130.57 crores, up by 55.64% YoY

Net Profit (PAT): ₹97.57 crores, up 108.31% YoY.

EPS: ₹7.83 (Basic), up from ₹3.99 YoY.

Key Highlights

Significant revenue growth, attributed to increased operating performance and better cost efficiencies.

Enhanced profit margins despite higher costs of materials and employee expenses.

Other income declined compared to last year's quarter, slightly offsetting higher operational gains.

Outlook

The company is optimistic about sustaining growth through operational efficiencies and strategic market positioning.

Nykaa (-1.69%)

Revenue: ₹2,267.21 crores, up by 26.7% YoY.

EBITDA: ₹141 crores, up by 43% YoY.

Net Profit (PAT): ₹26.12 crores, up by 61% YoY.

EPS: ₹ 0.09, up by 50% YoY.

Key Highlights

Revenue grew 21% YoY, with GMV growth of 8% despite subdued demand.

Strong growth driven by successful campaigns like "Nykaaland" and "Nykaa wali Shaadi."

Improved profitability through cost reductions and higher content income, supporting gross margin improvement.

Outlook

The company is focused on further improving profitability and leveraging successful marketing strategies to sustain growth.

Escorts Kubota Limited (+0.93%)

Revenue: ₹2,948 crores, up by 8% YoY.

EBITDA: ₹332 crores, up by 2% YoY.

Net Profit (PAT): ₹321 crores, up by 6% YoY.

EPS: ₹28.66, up from ₹27.01 YoY.

Key Highlights

The Agri Machinery Products segment drove the majority of revenue, supported by strong market demand.

Operational efficiency initiatives contributed to stable EBITDA margins despite rising costs.

Improved performance in the Construction Equipment segment also supported overall growth.

The company declared an interim dividend of ₹10 per share.

Outlook

The company anticipates steady growth in the coming quarters with a focus on cost efficiencies and market expansion.

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Varun Beverages on growing competition

Our products do not compete with Campa. We don’t feel there is any threat to our growth from any competition. We are seeing enhanced growth in the ongoing quarter. Link

Rajesh Jejurikar, ED & CEO, Auto & Farm Sector, M&M on reasons for company’s outperformance

You are right that we have grown much faster than the industry, both on the auto and the tractor side. So, let us first take the SUV piece, where we grew 20% in the quarter, while the industry was much lesser. We have gained market share and our revenue market share in SUV is about 23% now, which is quite substantial. But what is really interesting is that in spite of the price points that we have, which are way above the average price points of the industry, we are still number two on volume share.

We are still a very large volume player doing about 48,000 to 50,000 a month. And we always believe and I am sure you will want to know that in the context of the EVs that are coming as well which is demand gets created by products and products create excitement with customers or they do not and we have had a series of good launches. So, the reason we are growing this year is two very good launches that happened in 2024, the 3XO and we were weak in that segment which is the subcompact, less than four-meter segment, and then the ROXX. So, both of these have done very well and added volumes for us while we have kept the rest of the portfolio strong and robust. - Link

Calendars

In the coming days, we have the following major events, corporate actions, and upcoming earnings releases:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.