Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

This post might break in your email. You can read the full post in the web browser of your device by clicking here.

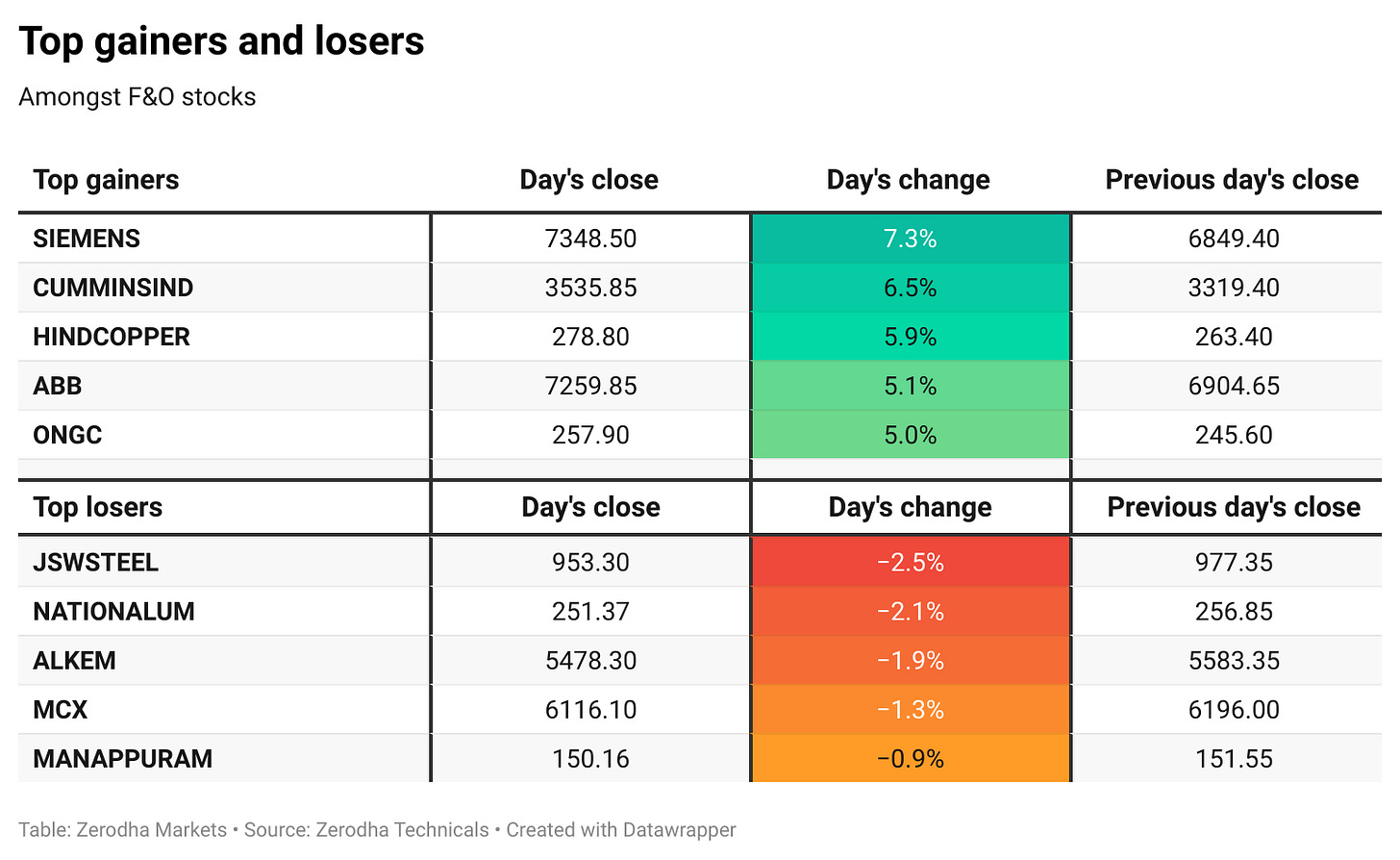

Benchmark indices continued their rally on Monday with Nifty up 1.32% and Sensex rising 1.25%. Indices are now almost up by 4% in the last two trading sessions, reaching their highest closes since November 6.

Market sentiment remained positive, with 1,950 stocks advancing, 874 declining, and 81 remaining unchanged.

The market's rise was supported by a broad rally across sectors, fueled by positive global sentiment. The NDA's victory in the Maharashtra assembly elections also helped improve sentiment.

Note: The above numbers for Commodity futures were taken around 4 pm.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 28th November:

The maximum CE OI is at 24500 followed by 24300, and the maximum Put OI is at 24300 followed by 24000.

Immediate support on the downside can be seen at 24000, which holds the significant Put OI. Resistance is at 24500, followed by 24300, which holds the highest Call OI.

Note: This is subject to multiple interpretations but generally, in a falling market if there is an increase in the call OI, it indicates resistance.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

TotalEnergies has paused new investments in Adani Group companies after U.S. authorities charged Adani Green Energy executives with corruption. The charges are against individuals, not the company itself. TotalEnergies, which owns a 19.75% stake in Adani Green Energy and 50% in some joint ventures, said it follows strict anti-corruption rules and is waiting for more clarity. Dive deeper

NSE and BSE could face profit declines under SEBI's proposal to reduce their stakes in clearing houses to make them independent utilities. Clearing houses contribute significantly to their earnings, and the changes may impact margins. SEBI has invited public feedback on the plan, with comments due by December 13. Dive deeper

Paytm shares rose over 4% to a 52-week high of ₹939 after introducing an automatic top-up feature for its UPI LITE service, enabling PIN-free payments under ₹500 and supporting small transactions up to ₹2,000 without cluttering bank statements. After early gains, the stock saw profit booking and closed at ₹892. Dive deeper

The Adani Group reported a net debt-to-EBITDA ratio of 2.46 times in the first half of FY25, below its guidance of 3.5-4.5 times. It holds ₹53,024 crore in cash reserves, enough for 28 months of debt repayments. EBITDA rose 1.2% YoY to ₹44,212 crore, with 87% contributed by infrastructure businesses. Investments during this period totalled ₹75,277 crores, raising total assets to ₹5.53 lakh crore. Dive deeper

The Morgan Stanley Capital International (MSCI) index quarterly rejig is set for November 25, with Indian equities expecting around $2.5 billion in FII passive inflows. HDFC Bank’s weightage increase could draw significant inflows, while five stocks, including Voltas and BSE, join the Standard Index. Dive deeper

Tips Music has partnered directly with TikTok to expand global access to its library of over 31,000 songs, including Bollywood and regional hits. The collaboration aims to meet the growing demand for Indian music among global audiences and enhance cultural connections through the platform. Dive deeper

Central Bank of India shares rose 10% after receiving RBI approval to partner with Generali Group for insurance ventures, including Future Generali India Insurance and Life Insurance. The move follows the Competition Commission’s clearance of the bank’s stake acquisition in Future Enterprises' insurance units. In Q2 FY24, the bank reported a 51% profit increase to ₹913 crore. Dive deeper

IFCI Ltd shares surged 14.7% on Monday to ₹66.59 after its board approved the consolidation of IFCI Group companies. The move, directed by the Ministry of Finance, involves merging key subsidiaries into IFCI and restructuring others under a consolidated entity. Dive deeper

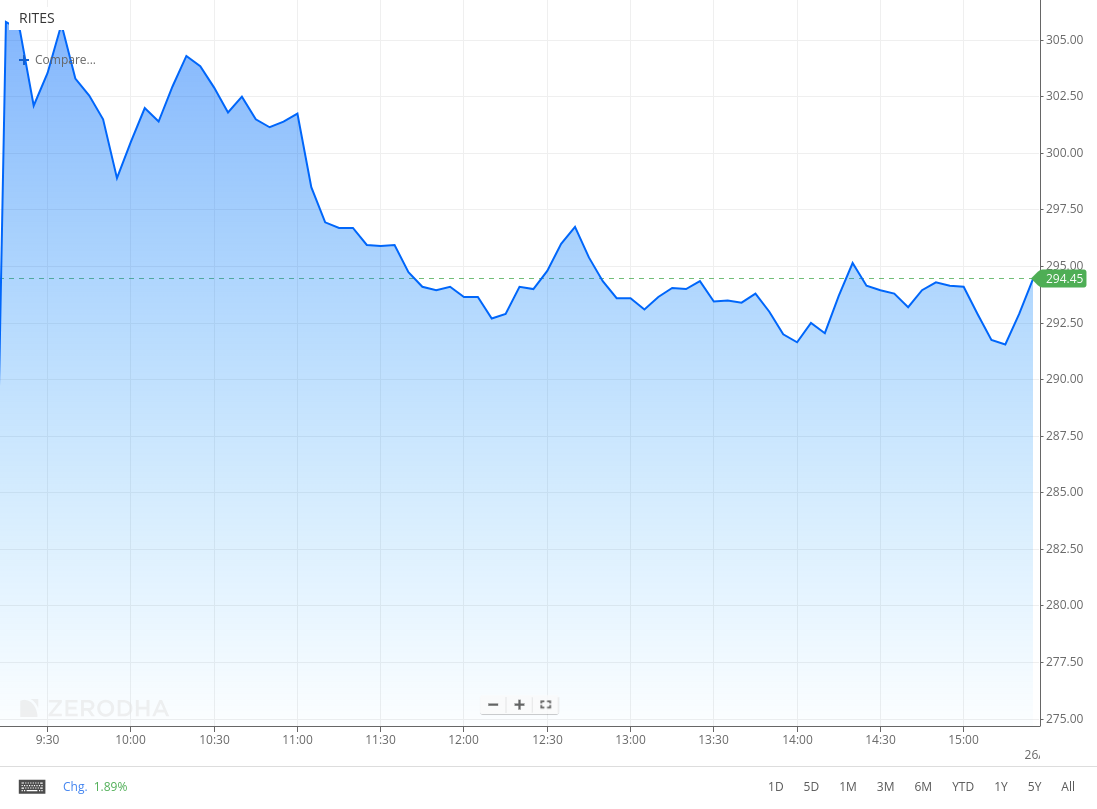

Shares of RITES Ltd surged 12.6% to an intraday high of ₹310 after securing a ₹531.77 crore order for railway electrification from Northeast Frontier Railway, up from the project’s original cost of ₹288.44 crore. The project covers electrification work for the Lumding-Badarpur section on a turnkey basis. Dive deeper

Cochin Shipyard signed an MoU with Seatrium Letourneau USA to design and supply jack-up rigs for the Indian market, supporting the "Make in India" initiative. It posted a 4% rise in Q2 net profit to ₹189 crore, with revenue up 13% at ₹1,143.2 crore. Shares have jumped 140.9% in the past year, despite recent dips. Dive deeper

Zee Entertainment CEO Punit Goenka has withdrawn his consent for reappointment as MD at the November 28 AGM, focusing instead on his CEO role. The company also promoted CFO Mukund Galgali to deputy CEO, aiming to strengthen its leadership and business focus. Dive deeper

LTIMindtree and Microsoft have partnered to boost AI-driven digital transformation for businesses worldwide. The partnership will use LTIMindtree’s expertise and Microsoft’s AI tools, like Microsoft 365 Copilot and Sunshine Migrate, to help companies adopt AI faster, improve decision-making, and streamline operations. Dive deeper

What’s happening globally

The yield on the US 10-year Treasury note dropped 5 basis points to 4.35% after President-elect Donald Trump nominated hedge fund manager Scott Bessent as Treasury Secretary, calming investor concerns. Bessent's focus is expected to be on economic stability. Markets await key data this week, including Federal Open Market Committee (FOMC) minutes and Personal Consumption Expenditures (PCE) inflation, which could influence future interest rate expectations. Dive deeper

Cargo volumes at central government-owned ports fell 3.2% year-on-year (YoY) in October to 68.22 million metric tons (MMT), driven by declines in coal and crude oil exports, while coastal cargo rose 5.3%. In contrast, private ports saw a 5.7% growth in cargo, with Adani Ports reporting an 8% rise, led by container and liquid cargo. Dive deeper

China’s central bank kept the medium-term lending facility rate at 2.0%, issuing 900 billion yuan in one-year loans to maintain currency stability and ample liquidity. Economists expect further monetary easing, including possible reserve ratio cuts, to balance economic recovery and currency stability. Dive deeper

Poland's industrial production rose by 4.7% in October 2024, recovering from a 0.4% drop in September, with manufacturing and utility output improving. Monthly production increased by 10%, building on an 8.8% rise the previous month. Dive deeper

Silver prices fell 2% to $30.70 per ounce on Monday, tracking a drop in gold as safe-haven demand weakened. Reports of a potential ceasefire between Israel and Hezbollah eased geopolitical tensions, reducing the appeal of precious metals. Dive deeper

The Solvent Extractors Association of India (SEA) has urged the government to lift the ban on futures trading in commodities like crude palm oil and soybean, citing financial challenges and increased price volatility. The ban imposed in December 2021, has hindered price risk management, according to SEA President Sanjeev Asthana. Dive deeper

Malaysian palm oil futures rose nearly 2% to over MYR 4,700 per tonne, recovering from a three-week low due to tight supplies, reduced stocks, and higher consumption. India’s palm oil imports surged 60% in October, driven by festive demand, while Malaysia’s exports in November fell 1.38%, capping gains. Dive deeper

Goldman Sachs faces a $900 million loss after Swedish battery maker Northvolt, once seen as a key player in Europe's green transition, filed for bankruptcy. Goldman, Northvolt's second-largest shareholder, invested heavily through its private equity funds, raising concerns about future investor confidence in green transition projects. Dive deeper

Bosch plans to cut up to 5,500 jobs in its automotive division over the next few years due to slow global auto sales, extra factory capacity, and delays in the shift to electric vehicles. Half of these cuts will affect Germany, mainly in advanced driving tech, vehicle software, and factory jobs. Dive deeper

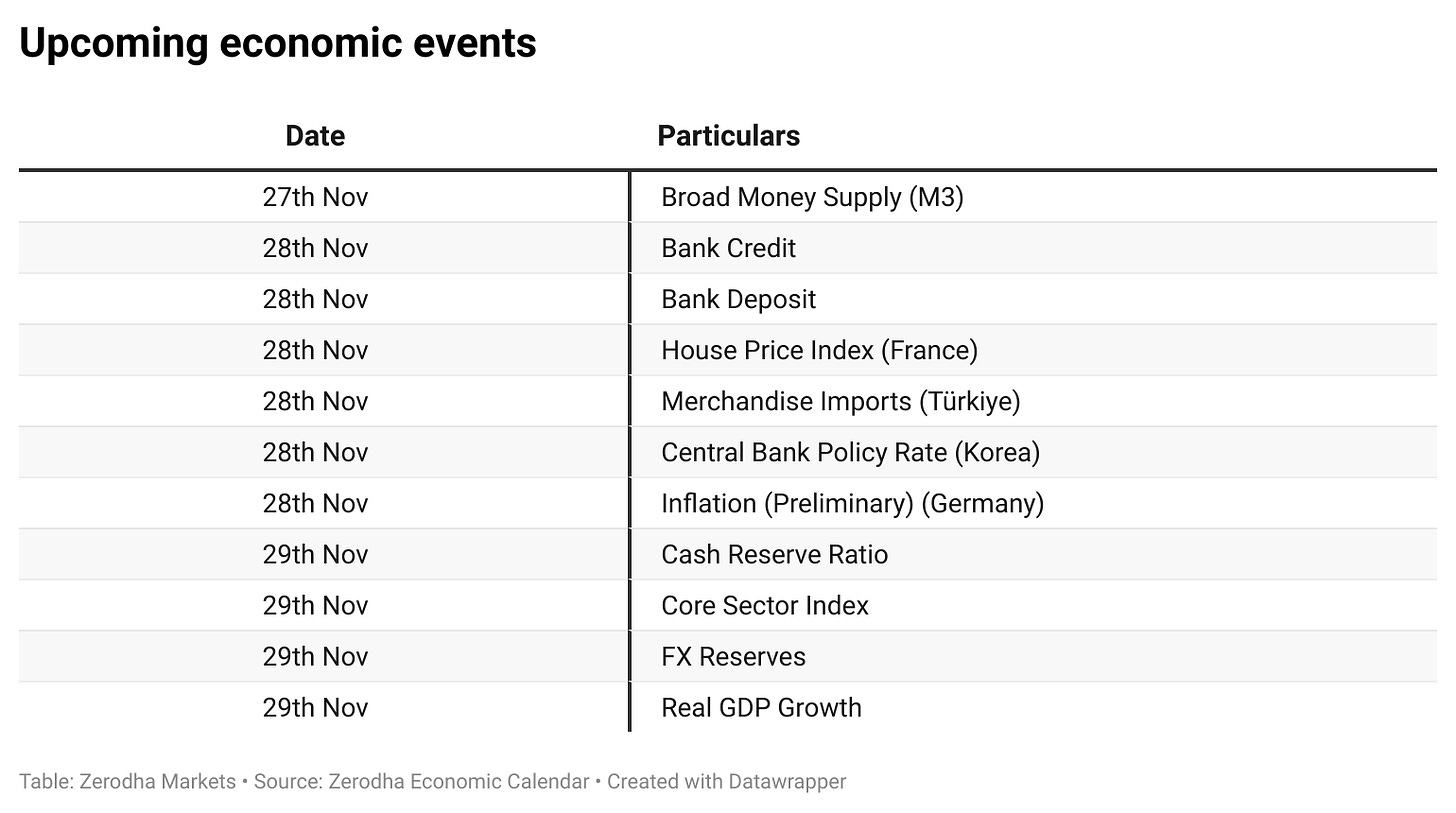

Calendars

In the coming days, We have the following major events and corporate actions:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

I didn't understand the sudden change in momentum of FII'S and DII'S Position.

Is this a sign of stability in Market ?

FII and DII daily data are the same for 21st and 22nd Nov, could you pls update the numbers