Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real time by Tijori.

Market Overview

Tracking global cues and a positive US market close, Nifty opened with a 60-point gap up at 23,096.45 but quickly lost momentum, dipping 60 points. It remained range-bound between 23,025 and 23,075 until 10:30 AM, after which all indices tumbled. Nifty fell nearly 250 points to 22,820 before stabilizing briefly, only to breach its low again an hour later, touching 22,774.85.

In the last 90 minutes, the market staged a recovery of nearly 200 points from the day’s low, eventually closing at 22,929.25, down 0.44%.

Market sentiment remains weak, weighed down by concerns over Trump’s proposed tariffs and broader market softness. Going forward, Nifty is expected to take direction from global developments and domestic economic factors.

Broader Market Performance:

The broader market saw heavy selling, with a sharply deteriorating advance-to-decline ratio, underperforming the headline index. Of the 2,931 stocks traded on the NSE, 459 advanced, 2,412 declined, and 60 remained unchanged.

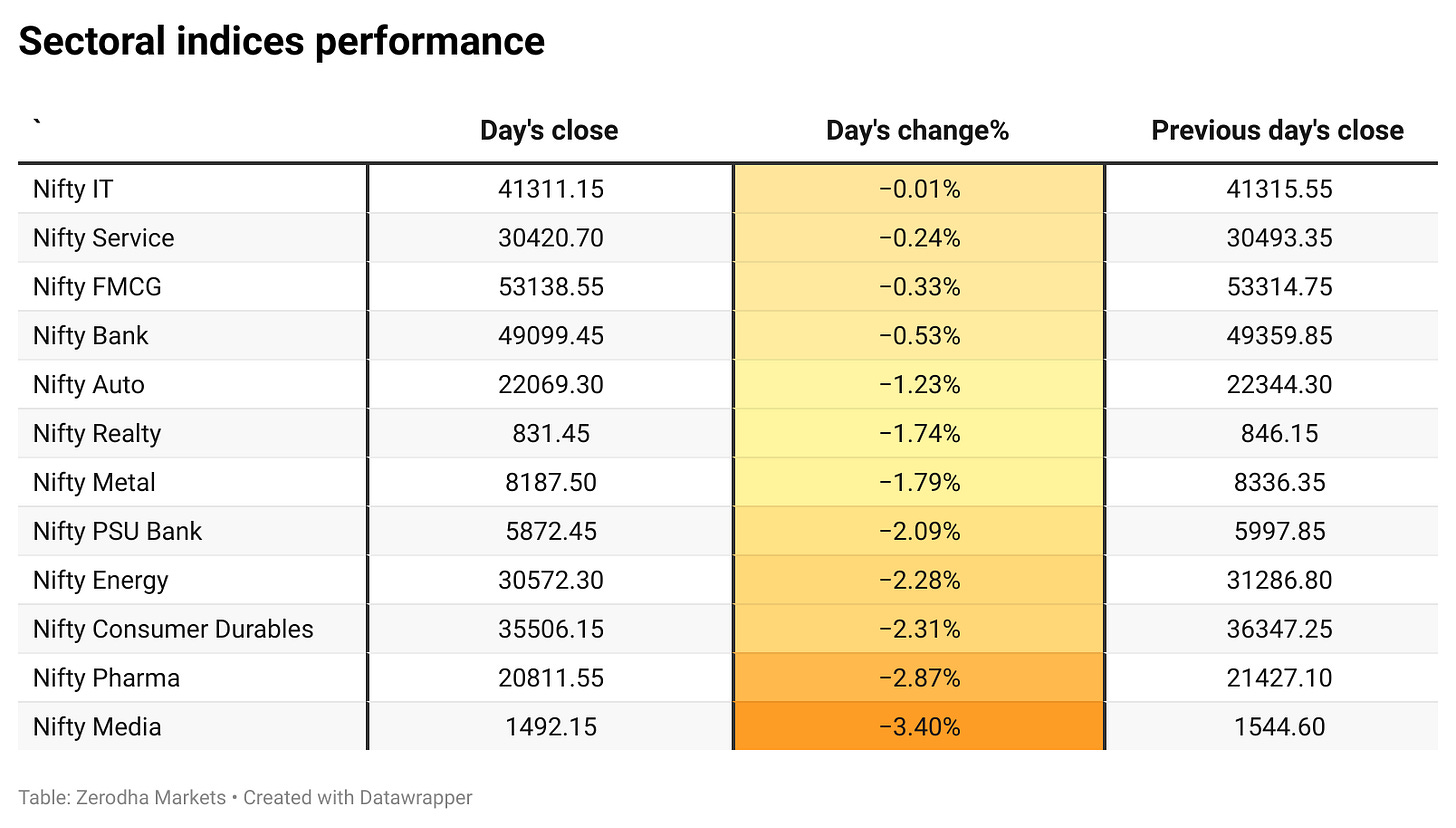

Sectoral Performance:

Based on the sectoral indices performance, Nifty IT saw the smallest decline of just -0.01%, making it the most resilient sector for the day. On the other hand, the top losing sector is Nifty Media, which dropped -3.40%, making it the worst-performing sector.

All sectors ended in the red, meaning there were 0 sectors in green and 12 sectors in red, indicating a broad-based market decline.

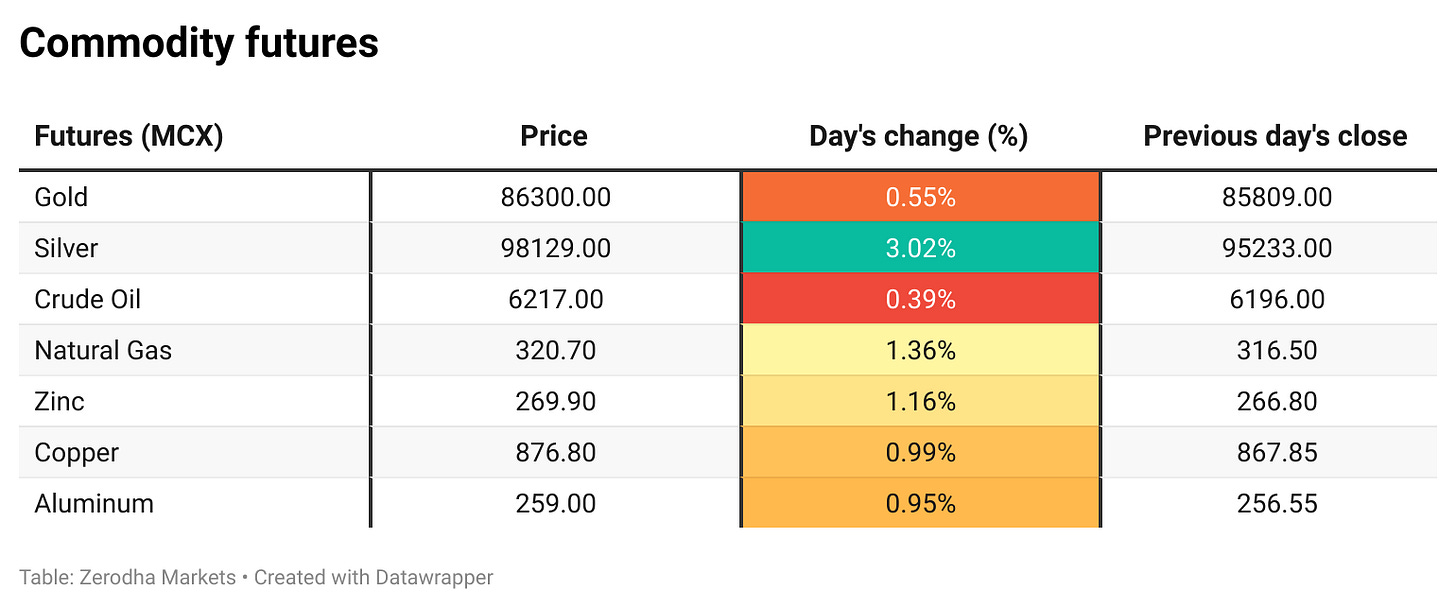

Note: The above numbers for Commodity futures were taken around 4 pm.

Net Flow Breakdown for the day:

FII: Net outflow of ₹4,294.69 crore (Bought ₹9,064.18 crore, Sold ₹13,358.87 crore)

DII: Net inflow of ₹4,363.87 crore (Bought ₹12,826.66 crore, Sold ₹8,462.79 crore)

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 20th February:

The maximum Call Open Interest (OI) is observed at 23,300, followed by 23,200. Meanwhile, The maximum Put Open Interest (OI) is at 22,500, followed by 22,800.

Immediate support is identified in the 22,800–22,700 range, while resistance is expected between 23,200 zones followed by 23,300.

Note: OI is subject to multiple interpretations, but generally, an increase in the call OI indicates resistance in a falling market, and an increase in the put OI indicates support in a rising market.

Source: Sensibull

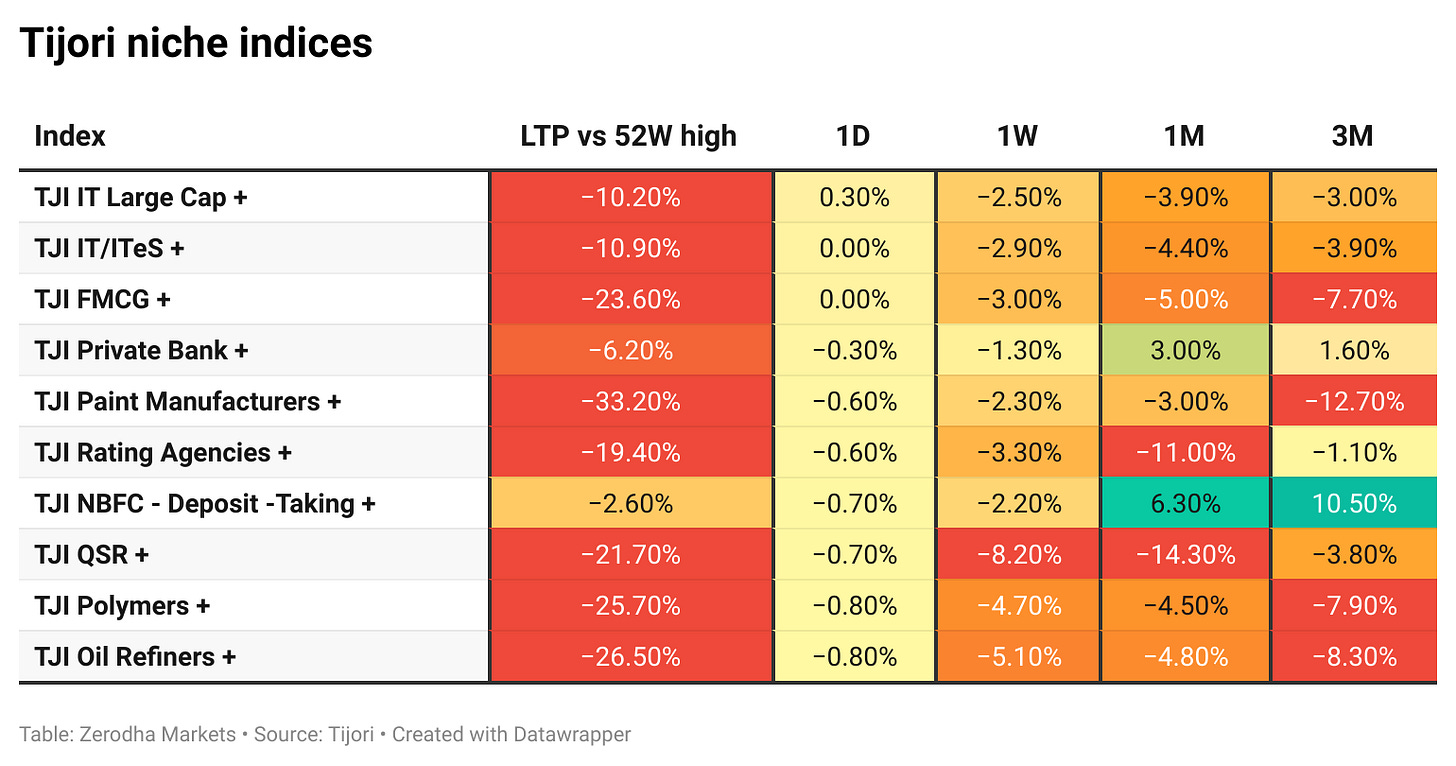

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

Prime Minister Narendra Modi met US President Donald Trump at the White House for key talks on defense, trade, technology, and energy. They announced COMPACT (Catalyzing Opportunities for Military Partnership, Accelerated Commerce & Technology), a new initiative to enhance cooperation in these areas. Dive deeper

India’s wholesale inflation eased slightly to 2.31% in January from 2.37% in December, as slower food inflation was offset by rising manufacturing costs. Fuel and power inflation stayed negative, with prices down 2.8% year-on-year, compared to a 3.8% drop in December. The Wholesale Food Index rose 7.5%, moderating from the 8.9% increase seen in the previous two months. Dive deeper

Vodafone Idea Ltd. stock fell 5.32% after the Supreme Court rejected telecom firms' review petitions on AGR dues, affirming the Department of Telecommunications' calculations and closing all legal options. Dive deeper

Zydus Lifesciences and Beihai Biotech signed an exclusive agreement to commercialize BEIZRAY injection in the US, a significant oncology partnership. Dive deeper

Grasim Industries' Birla Cellulose announces a joint development agreement with LNJ Bhilwara Group for graphene technology in textiles, enhancing performance and sustainability. Dive deeper

Fortis Healthcare to acquire Shrimann Superspecialty Hospital, Jalandhar for INR 462 Crores, enhancing Punjab's presence with over 1000 beds. Dive deeper

BPCL finalized an LNG sourcing agreement with ADNOC Trading and a crude supply contract with TotalEnergies, enhancing energy security and portfolio diversity. Dive deeper

Asian Paints divests Indonesian operations for SGD 7.5 million, shifting focus to the Middle East and South Asia. Dive deeper

Glenmark Pharmaceuticals launched Latanoprost Ophthalmic Solution, 0.005% in the U.S., claiming it is bioequivalent to Xalatan®, targeting a $113.5M market. Dive deeper

Premier Energies received orders worth INR 1234 crore for solar modules, commencing April 2025. Dive deeper

RITES entered an MoU with NUPPL for the operation & maintenance of railway siding, valued at Rs. 120.13 Crores for 5 years. Dive deeper

Anupam Rasayan signs a 10-year LOI with a US MNC to supply specialty chemicals for $195 million (₹1,697 crores), enhancing its polymer application portfolio. Dive deeper

United Breweries approved an INR 750 crore investment in a new brewery in UP to address growth in the beer category. Project to complete by Q4 2026-27 using debt and equity. The facility will produce mainstream and premium products. Dive deeper

What’s happening globally

Trump has directed his economic team to develop a plan for reciprocal tariffs on countries that impose taxes on U.S. imports, aiming to overhaul trade relations. Speaking from the Oval Office, he emphasized "fairness" and called for matching foreign tariffs while also seeking the removal of non-tariff barriers like value-added taxes and vehicle safety restrictions. Dive deeper

As per Bloomberg reports, Apple plans to release its artificial intelligence features on Chinese devices by the middle of the year, as it links up with local firms to meet Beijing's regulatory requirements. Dive deeper

The yield on the Russian 10-year OFZ sank to the 15.3% mark after having tested three-year lows of 17% earlier in the month, tracking the strong momentum for all classes of Russian assets amid fresh expectations that the Russian war with Ukraine could head toward a ceasefire. US President Trump stated that he talked with Russian President Putin and pledged that the US will soon mediate a peace deal with Ukraine. Dive deeper

The MOEX Russia index surged to the 3,220 mark in February, its highest since May of last year and in line with the strong momentum for other Russian assets amid expectations that Russia’s war with Ukraine may be approaching its end. Dive deeper

Silver extended its rally past the $33 per ounce mark on Friday, the highest in over three months, and outperformed other bullion as its demand in electrification and manufacturing magnified the support from a global pivot to safety. Dive deeper

Quarterly results

In this section, we'll dive into all the key highlights from today's intriguing results, covering the most impactful performances and standout moments. The numbers are comparable on a year-on-year (YoY) basis.

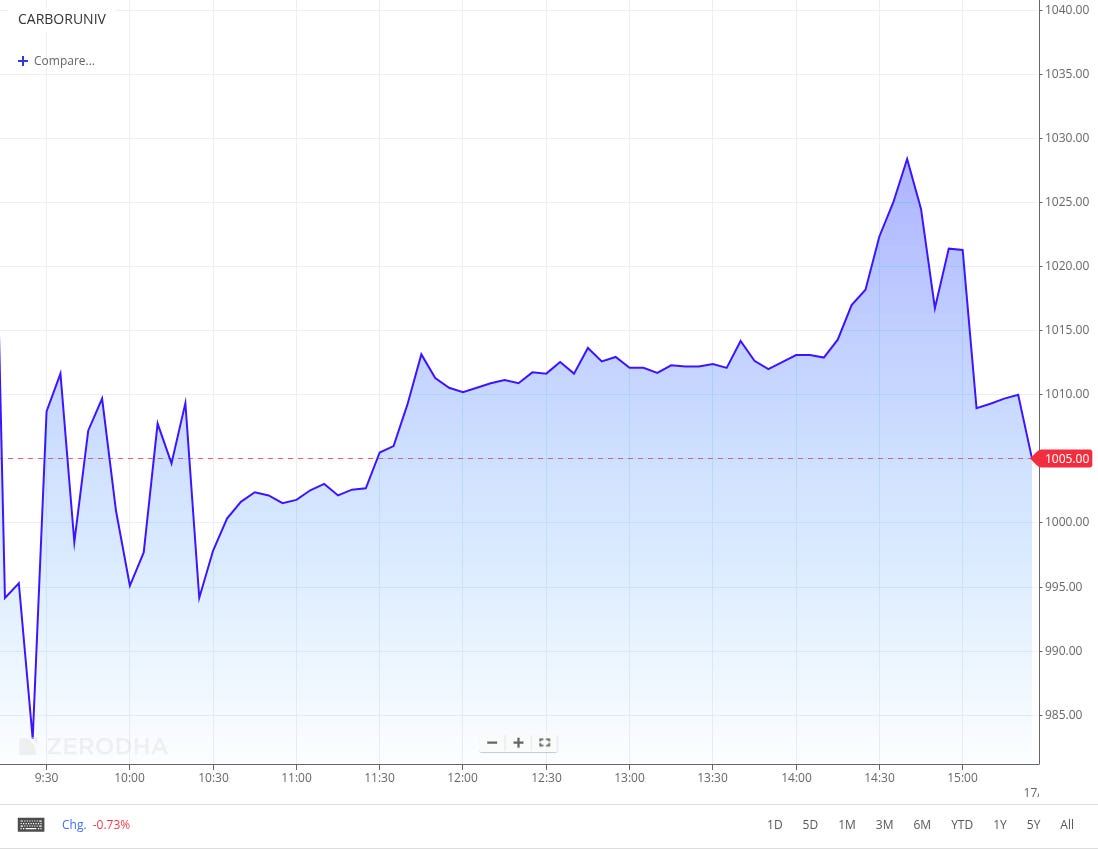

Carborundum Universal Limited (-1.29%)

Revenue: ₹1,255 crores, up by 9% YoY.

EBITDA: ₹177 crores, down by 8% YoY.

Net Profit: ₹37.6 crores, down by 141% YoY.

EPS: ₹1.83, down by 69% YoY.

Key Highlights:

Revenue growth is driven by strong performance in the ceramics and electrominerals segments.

EBITDA declined due to higher costs and margin pressures in key business units.

Exceptional losses related to U.S. sanctions on subsidiary VAW impacted profitability.

Interim dividend of ₹1.50 per share declared for FY25.

Outlook:

Carborundum Universal is focused on expanding its ceramics and electrominerals businesses while managing geopolitical risks and cost efficiencies to sustain long-term growth.

Hindalco Industries Limited (+0.61%)

Revenue: ₹58,390 crores, up by 11% YoY.

EBITDA: ₹7,583 crores, up by 29% YoY.

Net Profit: ₹3,735 crores, up by 61% YoY.

EPS: ₹16.62, up by 60% YoY.

Key Highlights:

Strong revenue growth is driven by higher aluminum and copper segment performance.

Novelis segment reported higher shipments and improved product mix, contributing to EBITDA growth.

Cost efficiencies and higher global aluminum prices supported margin expansion.

Continued investments in sustainability and value-added products to enhance future profitability.

Outlook:

Hindalco remains focused on strengthening its global presence, enhancing cost efficiencies, and capitalizing on strong demand for aluminum and copper.

ITI Limited (-5.00%)

Revenue: ₹1,035 crores, up by 300% YoY.

EBITDA: ₹-10.5 crores (negative), improved by 76% YoY.

Net Profit: ₹-67.1 crores (negative), improved by 34% YoY.

EPS: ₹-0.70, improved by 34% YoY.

Key Highlights:

Significant revenue growth due to strong execution of projects, particularly in the telecom and defense sectors.

EBITDA and net loss improved, reflecting better cost control and operational efficiencies.

The order book remains strong, with continued government support and ongoing project execution.

Despite improvements, high finance costs and operational expenses continue to impact profitability.

Outlook:

ITI Limited is focused on executing its large order book efficiently while improving financial stability through cost control and operational enhancements.

Kalpataru Projects International Limited (-10.46%)

Revenue: ₹5,732 crores, up by 17% YoY.

EBITDA: ₹479 crores, up by 13% YoY.

Net Profit: ₹140 crores, down by 1% YoY.

EPS: ₹8.31, down by 4% YoY.

Key Highlights:

Strong revenue growth is driven by higher execution in EPC and infrastructure projects.

EBITDA growth is supported by cost efficiencies and improved margins in key projects.

Net profit declined slightly due to higher finance costs and tax expenses.

The order book remains robust, providing strong revenue visibility for the coming quarters.

Outlook:

Kalpataru Projects aims to leverage its strong order book and execution capabilities to drive sustained growth while focusing on improving operational efficiency.

Manappuram Finance Limited (-8.20%)

Revenue: ₹2,560 crores, up by 11% YoY.

EBITDA: ₹1,369 crores, down by 13% YoY.

Net Profit: ₹278 crores, down by 51% YoY.

EPS: ₹3.33, down by 51% YoY.

Key Highlights:

Revenue growth is driven by higher gold loan disbursements and expansion in microfinance and home loan segments.

EBITDA decline due to higher provisions for credit losses in the microfinance division.

Net profit dropped significantly, impacted by higher credit costs and loan write-offs in Asirvad Micro Finance Ltd.

The board declared a fourth interim dividend of ₹1 per share.

Outlook:

Manappuram Finance aims to improve asset quality, optimize credit costs, and drive growth in secured lending segments to support profitability recovery.

Afcons Infrastructure Limited (-3.28%)

Revenue: ₹3,211 crores, up by 3% YoY.

EBITDA: ₹364 crores, down by 3% YoY.

Net Profit: ₹149 crores, up by 36% YoY.

EPS: ₹4.05, down by 73% YoY.

Key Highlights:

Record-high order book of ₹38,021 crores, excluding L1 orders worth ₹10,662 crores, ensuring strong revenue visibility.

EBITDA margin at 13.5%, reflecting strong operational efficiency.

PAT increased significantly due to higher project execution and better cost control.

Debt reduced to ₹2,692 crores, improving the company’s financial strength.

Crisil upgraded its credit rating to AA-/Stable for long-term loans, reinforcing financial credibility.

Outlook:

Afcons Infrastructure remains focused on order book execution, margin expansion, and leveraging operational efficiencies to drive long-term growth.

Concord Biotech Limited (-19.86%)

Revenue: ₹244 crores, up by 1% YoY.

EBITDA: ₹98 crores, down by 8% YoY.

Net Profit: ₹74.1 crores, down by 1% YoY.

EPS: ₹7.08, down by 1% YoY.

Key Highlights:

Revenue growth remained muted due to a slowdown in international sales, while domestic demand remained stable.

EBITDA decline is driven by higher raw material costs and increased operational expenses.

Net profit remained stable despite cost pressures, supported by efficiency initiatives.

The company continues to expand its presence in regulated markets, focusing on specialty pharmaceuticals.

Outlook:

Concord Biotech remains committed to expanding its global footprint and enhancing operational efficiencies to drive future profitability.

Deepak Nitrite Limited (-15.09%)

Revenue: ₹1,903 crores, down by 5% YoY.

EBITDA: ₹169 crores, down by 45% YoY.

Net Profit: ₹98.1 crores, down by 51% YoY.

EPS: ₹7.19, down by 51% YoY.

Key Highlights:

Revenue decline is driven by lower realizations in the Advanced Intermediates and Phenolics segments.

EBITDA and profit impacted by higher raw material and energy costs, along with weaker demand.

Operational cost control measures in place to offset margin pressures.

Outlook:

Deepak Nitrite is focused on cost rationalization, capacity expansion, and improving product mix to stabilize profitability amid volatile chemical industry conditions.

Nazara Technologies Limited (0.18%)

Revenue: ₹535 crores, up by 67% YoY.

EBITDA: ₹36.7 crores, up by 1% YoY.

Net Profit: ₹13.7 crores, down by 46% YoY.

EPS: ₹3.59, up by 2% YoY.

Key Highlights:

Strong revenue growth is driven by acquisitions and expansion in gaming and e-sports segments.

EBITDA remained flat due to higher marketing and operational expenses.

Net profit decline attributed to increased investment in content and higher tax expenses.

Recent acquisitions in the casual gaming segment are expected to enhance long-term revenue visibility.

Outlook:

Nazara Technologies continues to focus on scaling up its gaming portfolio and improving profitability through strategic investments and cost optimizations.

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Tadeu Marroco, CEO, British American Tobacco Plc on ITC Hotels

BAT has no interest in being a long-term shareholder of the hotel chain, The firm will decide when is the best moment to maximize shareholder value.

"We will be divesting and we will be using proceeds to make sure that we get to the leverage corridor of 2.5 and 2 by 2026," - Link

Union Finance Minister Nirmala Sitharaman on Food Inflation going forward

“With the first advance estimates of agricultural production of 2024-25 being what it is, kharif food grain production is expected to rise 5.7% and the production of rice and tur dal is expected to increase by 5.9% and 2.5%, respectively, compared to 2023-24. So the prices of food will be well under the inflation radar, with the kind of advance estimates which we are getting, but despite that, the GoM will be keenly monitoring,” - Link

Calendars

In the coming days, we have the following major events, corporate actions, and upcoming earnings releases:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

Thanks for the wonderful report. I just have a small feedback. I know, we all always talk companies in YOY terms. But is it possible when you give those short reports on earnings- is it possible to compare them YOY as you already given, plus can you give in brackets the previous quarter? Like 10% y-o-y increase, but 20% reduction from previous quarter?? Is it possible? I know this is weird as we always compare y-o-y terms, but most of the sectors are down, and just want to know how they are performing-as y-o-y is not giving enough in it..