Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Market Overview

Nifty 50 opened with a gap-up at 24,367.50 but quickly dropped, closing the gap to hit a low of 24,280 within the first 15 minutes. It then steadily climbed throughout the day, breaking the 24,350 resistance level and closing at 24,457.15, up 0.74%.

Broader market performance:

Strong market sentiment prevailed with 2,047 stocks advancing, 772 stocks declining, and 76 stocks remaining unchanged out of 2,895 traded stocks.

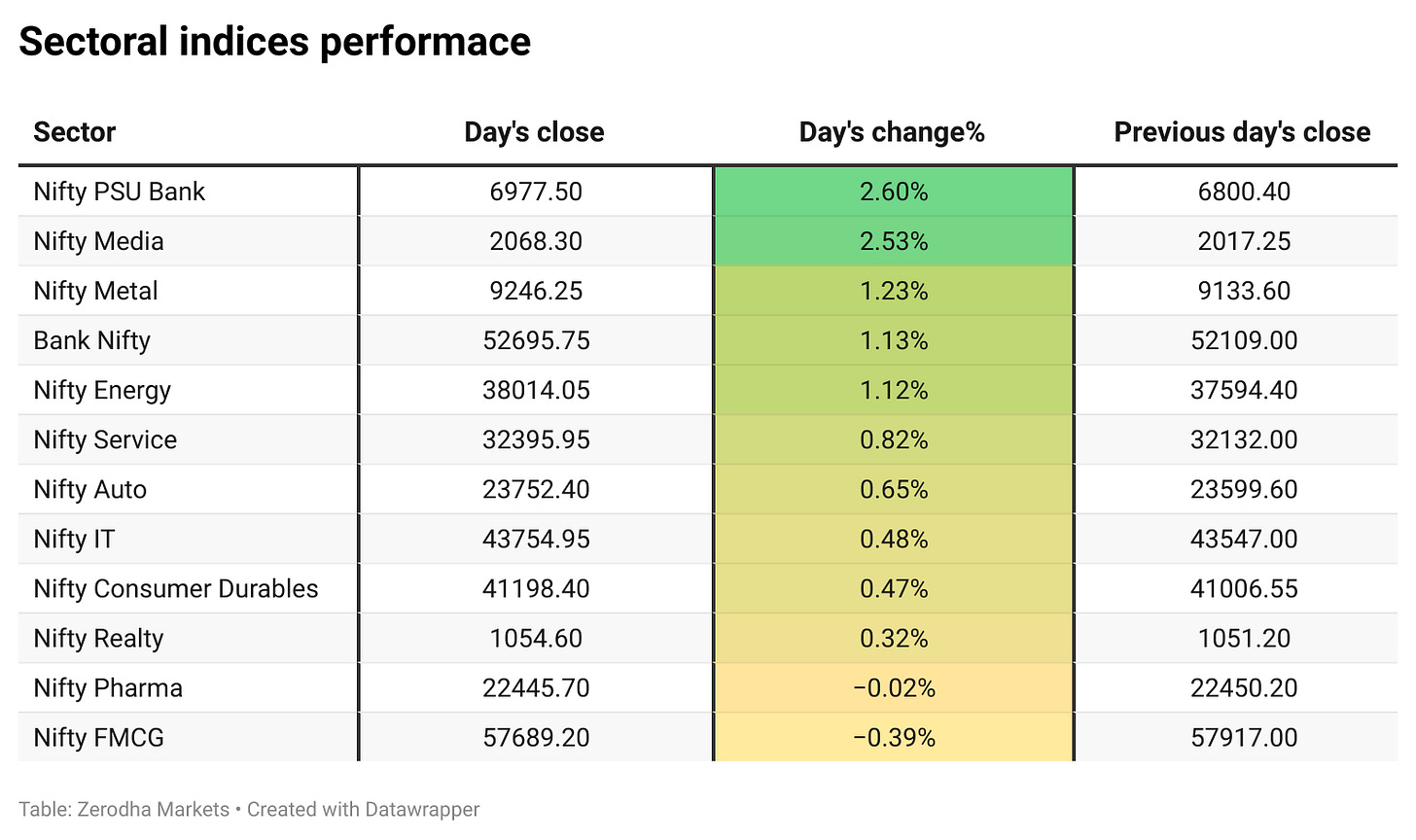

Sectoral indices witnessed broad-based buying, reflecting positive investor sentiment.

Market sentiment:

For the second consecutive day, the markets appeared to have priced in concerns over rumors of higher taxes on aerated beverages, tobacco, and related products and weak GDP numbers reported yesterday.

Looking ahead:

The focus now shifts to the upcoming RBI monetary policy as markets maintain their upward momentum.

Note: The above numbers for Commodity futures were taken around 4 pm.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 5th December:

The maximum CE OI is at 24800 followed by 24500 and 24700, and the maximum Put OI is at 24000 closely followed by 24100 and 24200.

Massive puts OI addition of 41.56 Lakh contracts around 24400 levels today indicates that these levels hold the key for the market trend in the coming week.

Immediate support on the downside can be seen at 24300 levels followed by 24100 levels. Resistance on the upside is at 24500-550 levels followed by 24700.

Note: OI is subject to multiple interpretations but generally, in a falling market if there is an increase in the call OI, it indicates resistance, and in a rising market, if there is an increase in the put OI, it indicates support.

Source: Sensibull

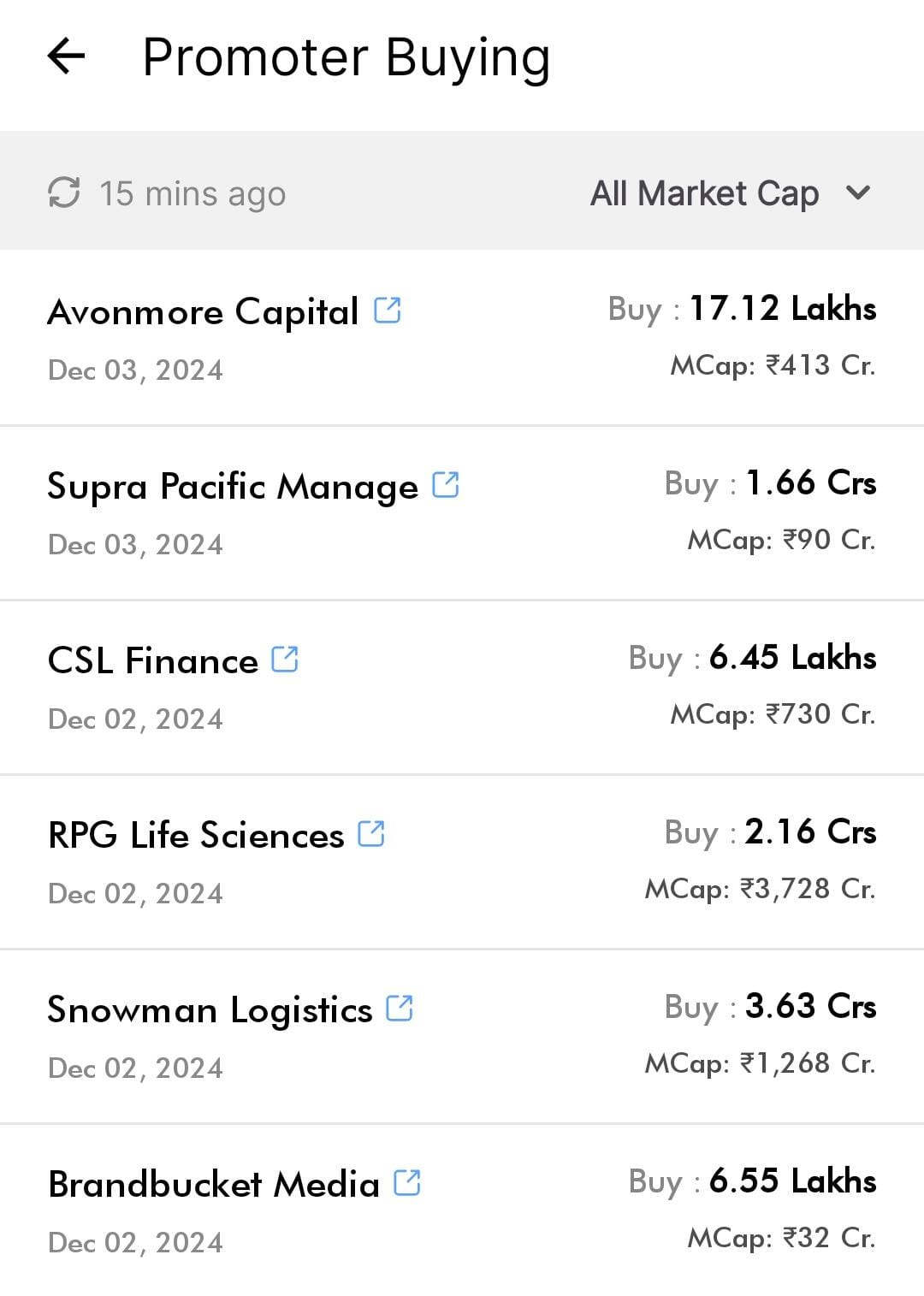

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

Shares of Varun Beverages, ITC, Godfrey Phillips, and VST Industries declined after reports of a proposed GST hike to 35% on aerated beverages, tobacco, and related products. The GST Council is expected to review the proposal on December 21, 2024, potentially impacting revenue in these segments. Dive deeper

Tata Power Renewable Energy Limited (TPREL) has commissioned a 431 MW DC solar project in Neemuch, Madhya Pradesh, spanning 1,635 acres. The project uses advanced solar technology, improving efficiency by 15%, and is expected to reduce carbon emissions by the same amount as taking 1.7 lakh cars off the road each year. It will provide power to Western Central Railways and Madhya Pradesh Power Management Co. Ltd., bringing TPREL's total operational renewable energy capacity to 5.4 GW. Dive deeper

Gland Pharma has received US FDA approval for Latanoprost Ophthalmic Solution, 0.005%, used for treating high eye pressure in glaucoma or ocular hypertension. The product, comparable to Xalatan, had US sales of $111.6 million in 2023 and is set to launch in FY25. Dive deeper

Nazara Technologies approved strategic investments, including ₹43.7 crore for a 60% stake in Funky Monkeys, ₹64 crore for Nodwin Gaming, ₹15 crore for Datawrkz, ₹4.17 crore for a 4.68% stake in LearnTube, and ₹69.17 crore to acquire ESOP shares in Absolute Sports, making it a wholly owned subsidiary. Dive deeper

TCS has partnered with the Bank of Bhutan to modernize its digital core using the TCS BaNCS platform. The initiative aims to enhance customer service, streamline operations, and support Bhutan's digital ecosystem. Serving over 400,000 customers, the bank will use the platform for deposits, loans, and trade finance, while preparing for future digital advancements. Dive deeper

KPI Green Energy has secured a ₹13.11 billion order from Coal India Limited to set up a 300 MWAC ground-mounted solar PV plant with 5-year operation and maintenance services at GIPCL’s Solar Park in Khavda, Gujarat. Dive deeper

HCLTech has completed the acquisition of assets from Hewlett Packard Enterprise’s Communications Technology Group, effective December 1, 2024. This enhances HCLTech's telecom services portfolio, strengthens global partnerships, and integrates over 1,500 engineering specialists across key markets. Dive deeper

Solar Industries India Limited and its subsidiary have received export orders worth ₹2,039 crores for defense products, to be delivered over four years. These are international orders with no related party involvement. Dive deeper

The RBI has lifted the restrictions on Navi Finserv after the company revamped its systems to comply with regulatory standards. The restrictions were initially imposed due to concerns over high lending rates. After reviewing the changes, the RBI decided to lift the ban, emphasizing the importance of fair and transparent loan pricing. Dive deeper

Hindustan Unilever Ltd. paid Rs 192.55 crore towards a Rs 962.75 crore tax demand related to its 2020 Horlicks acquisition. The company has filed an appeal against the demand with the income tax appellate authority. Dive deeper

Torrent Power announced the opening of a Qualified Institutional Placement (QIP) at a floor price of Rs 1,555.75 per share to raise up to Rs 5,000 crore. The company has not disclosed the number of shares or the exact issue size, but estimates range between Rs 3,500 crore and Rs 5,000 crore. The proposal was approved by shareholders in July. Dive deeper

Shares of C.E. Info Systems Ltd., the parent company of MapmyIndia, have declined over 14% in two sessions, reaching a 52-week low of ₹1,534, following CEO Rohan Verma's announcement to establish a new B2C venture and acquiring a 10% stake in it. These developments have raised investor concerns about the company's strategic direction and financial performance. Dive deeper

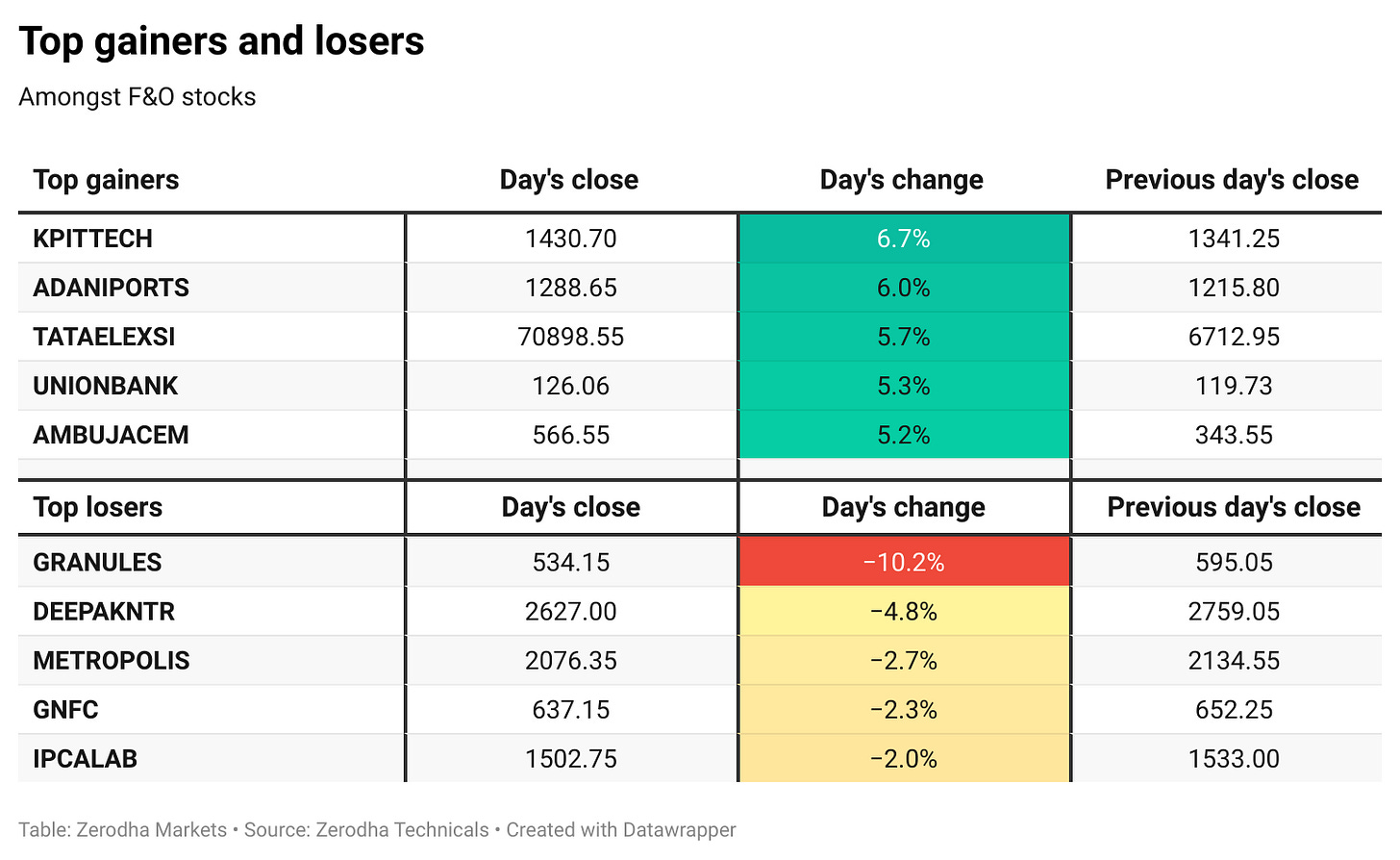

Granules India Limited nosed over 10% over regulatory challenges after the USFDA classified its Gagillapur facility as "Official Action Indicated" (OAI) on December 3, 2024, following an inspection in August-September 2024. This classification highlights non-compliance with regulations, requiring corrective actions. - Dive deeper

ICRA projects domestic air passenger traffic to rise to 164-170 million in FY2025, with a 7-10% growth. Despite challenges like higher fuel costs and grounded aircraft, the outlook remains stable, with a net loss of Rs. 20-30 billion expected in FY2025 and FY2026. Airlines are expanding fleets to support future growth. Dive deeper

Quarterly results

In this section, we'll dive into all the key highlights from today's intriguing results, covering the most impactful performances and standout moments. The numbers are comparable on a year-on-year (YoY) basis.

Swiggy

Key Highlights:

Revenue: ₹3601 crore, up 30.33% YoY from ₹2763 crore.

EBITDA Loss: ₹555 crore, a decrease of 11.06% YoY from ₹624 crore.

Net Loss: ₹625.5 crore, reduced by 4.79% YoY from ₹657 crore.

EPS (loss): ₹2.20, compared to ₹4.43 YoY.

Outlook:

Management expects sustained growth driven by operational efficiencies and potential expansion in high-demand markets. The company expects to achieve positive Adjusted EBITDA by Oct-Dec 2025.

What’s happening globally

Tesla’s deliveries from its Shanghai plant fell 4.3% year-on-year in November, despite increased government subsidies to boost EV sales. The decline comes amid intensified price competition from domestic rival BYD, though Tesla’s sales rose 15.5% compared to October. Tesla is offering further incentives to attract buyers in China, aiming to meet its year-end sales targets, with a focus on achieving record global deliveries in the final quarter of 2024. Dive deeper

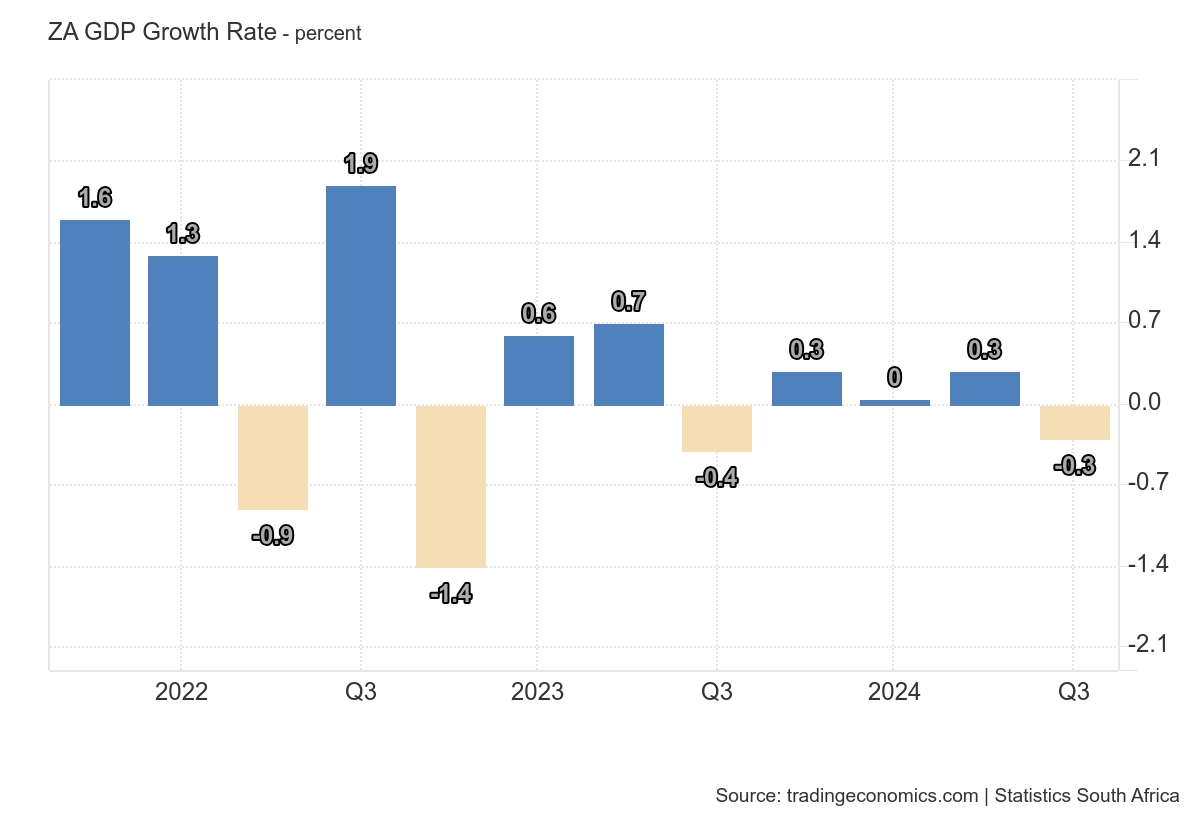

South Africa's GDP declined by 0.3% in the third quarter of 2024, largely due to a 28.8% drop in agriculture caused by drought and adverse weather conditions. Other sectors like transport, trade, and government services also contributed to the slowdown. Despite this, finance, mining, manufacturing, and construction showed positive growth. On the demand side, both exports and imports fell, while household consumption increased slightly, driven by sectors like recreation and culture, with gambling seeing a significant rise. The automotive sector, however, faced challenges with weaker vehicle production and trade. Dive deeper

China's crude oil imports are expected to peak next year as transport fuel demand declines, with the shift to electric vehicles and economic weakness slowing consumption. The country's crude demand growth, which has driven global oil consumption for decades, is set to slow, with petrochemicals and jet fuel being key contributors in the future. Dive deeper

Indonesia expects a $1 billion investment commitment from Apple after banning iPhone 16 sales for not meeting local content requirements. The government requires smartphones to contain at least 40% locally-made parts, a threshold Apple did not meet. Indonesia hopes the investment will strengthen its supply chain and create jobs. Dive deeper

Cargill plans to cut around 8,000 jobs or 5% of its workforce, following a slump in revenue due to low crop prices. The job reductions, primarily focused on streamlining operations, are part of a broader restructuring strategy. The company, which reported a revenue drop to $160 billion for fiscal 2024, aims to improve efficiency as it adapts to market challenges. Dive deeper

Turkey's inflation rose to 47.09% annually and 2.24% monthly in November, surpassing expectations and potentially delaying an interest rate cut. Food and non-alcoholic drink prices surged by 5.1%, highlighting ongoing inflationary pressures. Despite being the lowest annual rate since mid-2023, the central bank is cautious about rate cuts, with market expectations for easing potentially shifting to next year after decisions on wages and administered prices. Dive deeper

Intel CEO Pat Gelsinger retired on December 1, 2024, after a 40-year career, ending a challenging three-year tenure marked by strategic missteps and market share losses. Under his leadership, Intel faced setbacks, including a 52% YTD stock decline and workforce restructuring to cut costs by $10 billion. The board reportedly prompted Gelsinger’s retirement due to dissatisfaction with turnaround progress. Frank Yeary, Intel’s independent chair, will assume interim executive chair duties. - DIve deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

EAM Jaishankar on Trump 2.0’

"Different countries have had their own experiences from the first administration and would presumably draw from that to approach the second. Where India is concerned, I can state with confidence that the strategic convergences with the United States have only grown deeper with time. They have created a larger environment in which more collaborative possibilities can be explored," said the minister, speaking at the CII partnership summit.

"Naturally, between two major economies, there will always be some give and take. When we look at economic or technology domains, the case for trusted and reliable partnerships have actually increased in recent years," - Link

Parag Rao, Country Head - Payments Business, Digital Banking & Marketing, HDFC Bank

The slowdown has happened in the unsecured segment for the banks.

Expect robust growth in credit cards for HDFC Bank.

HDFC Bank has been able to digitize MSME customers to a great extent.

70-80% of incremental business in retail is digital. - Link

Calendars

In the coming days, we have the following major events and corporate actions:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.