Markets recover from day's low to close marginally higher

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

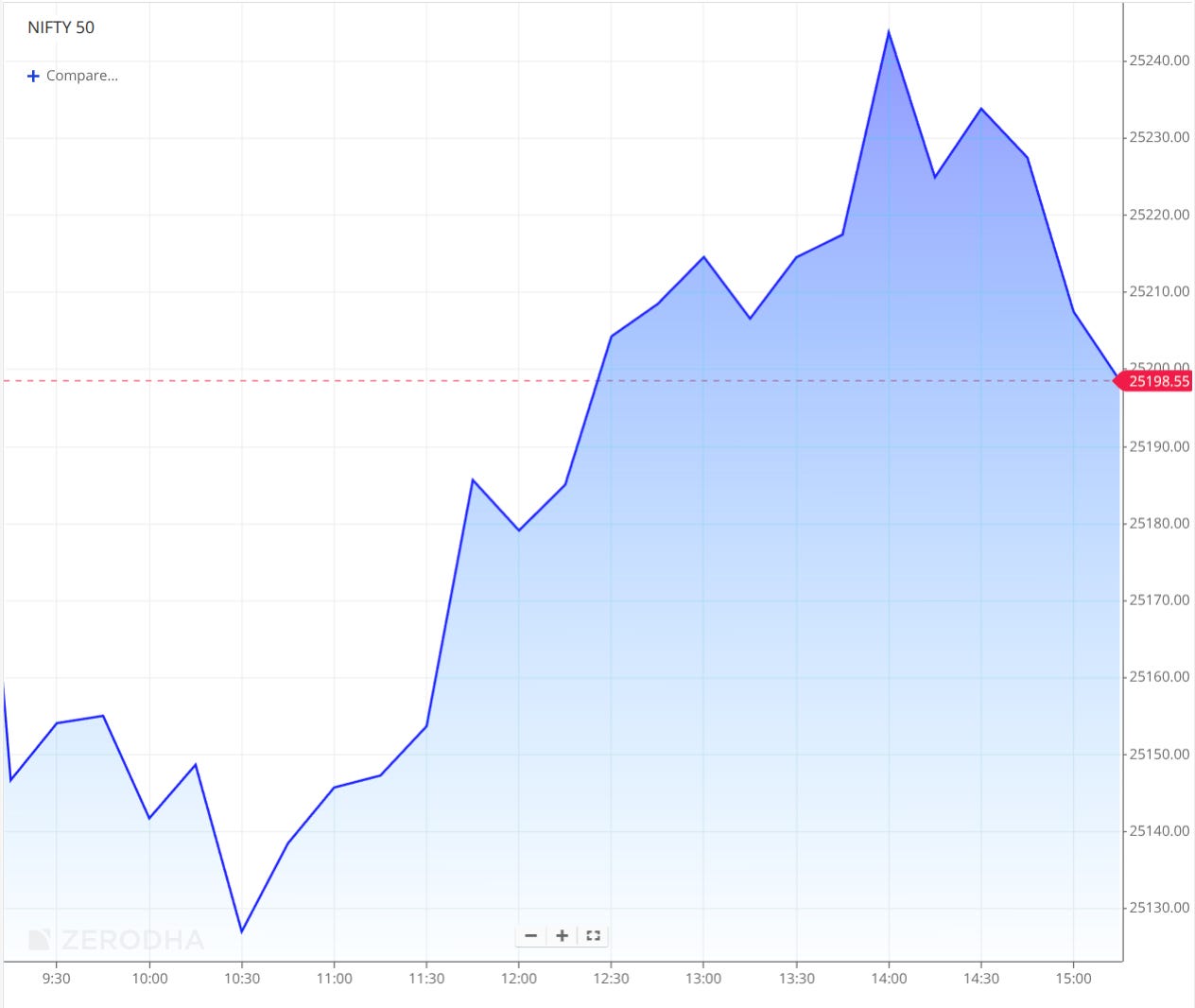

Indian markets recovered from day’s low to end the session marginally higher, with Nifty closing at 25,212, up by a mere ~16 points or 0.06%.

Stocks of PSU banks, IT companies, and auto firms did well, which helped the market stay in the green, even though global news wasn’t very positive. There are still concerns around U.S. tariffs and global trade tensions, which kept investors cautious.

Overall, it was a quiet day, with traders waiting to see how upcoming global events and company results play out.

Broader Market Performance:

The advance-decline ratio on the NSE today painted a mixed but slightly positive picture of market breadth. Of the 3,016 stocks traded, 1,656 advanced, 1,266 declined, and 94 remained unchanged.

Sectoral Performance:

Nifty PSU Bank and Nifty Media indices were top performers for the day with PSU Bank index surging 1.81% and Media index closing up by love 1.3%.

Note: The above numbers for Commodity futures were taken around 4 pm. Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

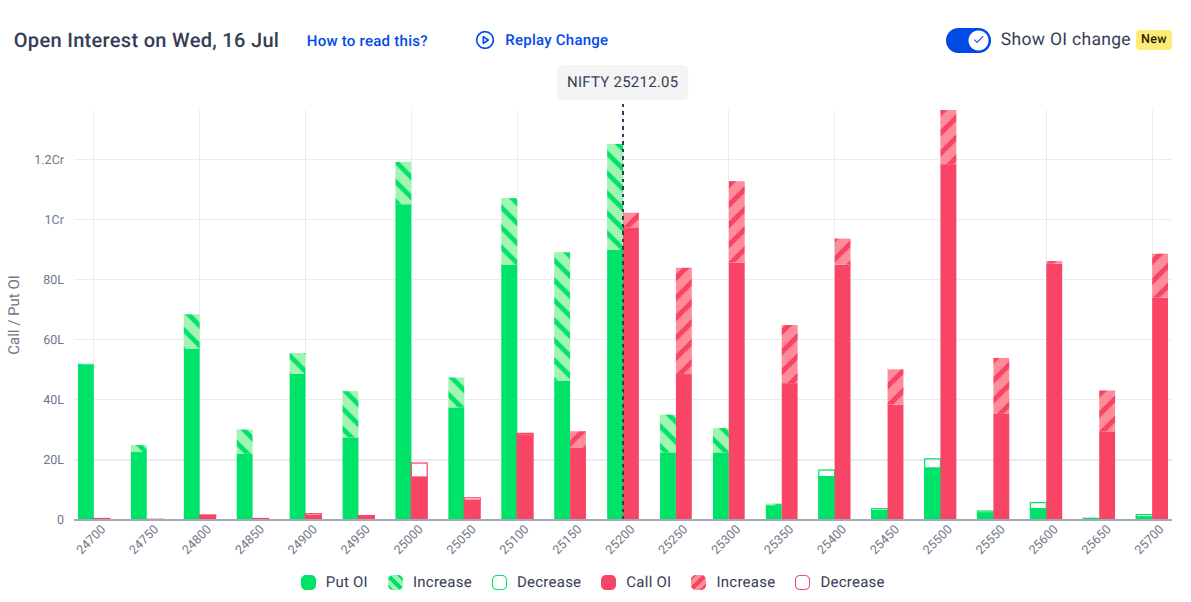

The following is the change in OI for Nifty contracts expiring on 17th July:

The maximum Call Open Interest (OI) is observed at 25,500, followed closely by 25,300, suggesting strong resistance at 25,300 - 25,550 levels.

The maximum Put Open Interest (OI) is observed at 25,200, followed closely by 25,000, suggesting strong support at 25,200 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in Call OI indicates resistance in a falling market, and an increase in Put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

The rupee slipped to ₹85.94/USD after strong US inflation data reduced Fed rate cut hopes, boosting the dollar. Dive deeper.

ITC Hotels posted a 54% YoY rise in Q1 FY26 net profit to ₹133 crore, with revenue climbing 15.5% to ₹816 crore. Operating margins improved ~80 bps to ~30%. Dive deeper.

HDFC Bank's board will meet on July 19 to review proposals for issuing bonus shares—for the first time ever—and declaring a special interim dividend, reflecting strong FY25 performance and shareholder focus. Dive deeper.

Anthem Biosciences IPO oversubscribed 4× on final day, the IPO saw 4× subscription on its last day. Grey market premium indicates a likely listing at ~₹680–700. Dive deeper.

Schneider Electric is in talks to acquire Temasek’s stake in their India JV, aiming for full ownership. Dive deeper.

Swaraj Engines posted record PBT of ₹67.17 crore in Q1 FY26, with revenue at ₹484.1 crore and PAT at ₹49.97 crore. Dive deeper

ICICI Prudential reported a 34.2% YoY rise in Q1 FY26 PAT to ₹302 crore. Net premium rose 8% to ₹8,503 crore, while AUM grew 5.1% to ₹3.24 lakh crore.

Dive deeper

Himadri Speciality posted ₹182.57 crore in Q1 profit, aided by operational efficiencies. It also issued ₹100 crore in A1+ rated commercial papers.

Dive deeper

D.B. Corp reported Q1 FY26 revenue of ₹587.2 crore, down 4.7% YoY, and net profit of ₹80.8 crore, down 31.5%. Dive deeper

ITC Hotels posted Q1 FY26 revenue of ₹815.5 crore, up 15.5% YoY, and net profit of ₹133.7 crore, up 53.4%. Dive deeper

What’s happening globally

Foreign central banks now buy ~20% of euro-zone bonds, up from 16% in 2024, shifting away from US assets. Dive deeper.

Japan’s Nikkei closed nearly unchanged at 39,663, as uncertainty around the July 20 upper-house elections and U.S. trade talks tempered gains in chip stocks despite Nvidia-led momentum Dive deeper

A US–UK trade pact cutting ethanol tariffs threatens UK producers, risking closures and hitting meat, beer, and farming supply chains. Dive deeper.

Myanmar’s key Man Maw tin mine in Wa State is poised to resume operations later this year after a suspension since August 2023. This could significantly increase tin exports and ease pressure on global supply, with Myanmar being the world’s third-largest tin producer Dive deeper.

Klook, backed by SoftBank, is reportedly preparing a U.S. initial public offering that could raise between $300–500 million, after tapping advisers and exploring a confidential filing. Dive deeper.

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

TCS CFO Samir Seksaria on the annual wage hikes

“My priority is getting back to the wage hike”

“Our focus will be growth with profitability. Only profitability without growth doesn't help” - Link

Commerce Minister Piyush Goyal on India and the US bilateral trade agreement

"Negotiations are going on at a very fast pace and in the spirit of mutual cooperation so that we can come out with a win-win trade complementing agreement with the United States,"- Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.