Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

Nifty opened 85 points lower at 24,584.80 and reached an intraday high of 24,624.10 before quickly falling toward the 24,420 zone in the first hour. After a brief recovery to 24,490 levels, the market dipped again to 24,360. By 12:30 PM, it attempted another recovery, touching 24,450, but resumed its downward trend, making fresh lows through the afternoon. Around 2:45 PM, the Nifty hit the day’s low at 24,303.45 and finally closed at 24,336.00, down 1.34% for the day.

Broader Market Performance:

The broader market finally lost its resilience, aligning with the weakness in the headline indices. On the NSE, 953 stocks advanced, 1,854 declined, and 81 remained unchanged, reflecting negative market breadth.

Sectoral Performance:

All sectors ended in the red, except Media, as the market faced broad-based selling. Nearly all indices declined between 1.2% and 1.5%.

Note: The above numbers for Commodity futures were taken around 4 pm.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 19th December:

The maximum Call OI is at 24,700, followed by 24,500, 24,600 & 24,800, while the maximum Put OI is at 24,000, followed by 23,900.

There is a massive addition in call OI in all the strikes starting from 24400 till 24800 today possibly indicating a cap on the upside for this expiry.

Immediate downside support is observed at the 24,200 level, followed by the 24,000 range. On the upside, there is immediate resistance at 24500 for this week followed by multiple resistances till 24800 based on the spike in the put OI.

Note: OI is subject to multiple interpretations but generally, in a falling market if there is an increase in the call OI, it indicates resistance, and in a rising market, if there is an increase in the put OI, it indicates support.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

The SEBI has proposed prohibiting Foreign Portfolio Investors (FPIs) from issuing Offshore Derivative Instruments (ODIs) with derivatives as the underlying asset. Additionally, FPIs would be restricted from using derivatives to hedge their ODI positions in India. Existing ODIs with derivatives as underlying would need to be redeemed within one year from the implementation of the proposed framework. Dive deeper

Sun Pharma Advanced Research Company Ltd. (-3.2%) has signed a binding LOI with UCSF and Tiller Therapeutics for a pre-clinical oncology asset. The company will receive a 55% equity stake in Tiller, with 45% vested upon executing the license agreement and the remaining 10% upon milestone achievement or within six months. Dive deeper

Maruti Suzuki (-1.49%) achieves a historic milestone by producing 2 million vehicles in a year, becoming India's sole OEM to do so, with plans to expand capacity to 4 million units led by a new facility in Haryana. Dive deeper

Ambuja Cements announces plans to merge Sanghi Industries and Penna Cement, expected to be completed within 9-12 months to enhance shareholder value and streamline operations. Dive deeper

Birla Estates, a subsidiary of Aditya Birla Real Estate, has acquired a 70.92-acre land parcel in Boisar for INR 104.3 Crore. Dive deeper

ITC announced that the demerger of ITC Hotels will take effect from January 1, 2025, following all necessary approvals, including the NCLT order filed with the Registrar of Companies. Under the scheme, ITC will retain 40% ownership, with shareholders holding the remaining 60%. The demerger aims to allow ITC Hotels to pursue a focused growth path with an optimal capital structure. Dive deeper

Clean Fino-Chem Limited, a subsidiary of Clean Science and Technology Limited, commenced commercial production of Butylated Hydroxy Toluene (BHT), positioning itself in the antioxidant supply chain along with its existing products. Dive deeper

RMC Switchgears received a ₹90 crore LOA for 5,000 solar pumps in Maharashtra, enhancing their role in clean energy and aligning with their new solar manufacturing plant. This strategic move supports India's renewable goals and fulfills their Vision-2030 objectives. Dive deeper

Coromandel International partners with Mahindra Krish-e to expand drone spraying services in India, enhancing agricultural productivity and profitability. This strategic move leverages in-house developed drones to offer cost-efficient solutions to farmers. Dive deeper

Reliance Power's subsidiary, Reliance NU Suntech, has received a Letter of Award from SECI for a 930 MW solar and 465 MW/1860 MWh Battery Energy Storage System (BESS) project. The project will provide peak power supply for 4 hours daily and will be developed on a build-own-operate basis with a 25-year power purchase agreement. Dive deeper

LT Foods (2.98%) has launched DAAWAT Jasmine Thai Rice in India, a Non-GMO certified product sourced from Thailand. The rice is available on major e-commerce platforms and is designed to cater to consumers seeking global culinary experiences. Dive deeper

Paper Boat Apps, a Nazara Group company, has partnered with Moonbug Entertainment to integrate Little Angel into the Kiddopia app, enhancing its educational content for children. The first set of Little Angel-themed games will launch in 2025, with joint marketing efforts to promote the collaboration. Dive deeper

Shares of One97 Communications Ltd. gained over 5%, marking the third straight session of gains. The rally follows the sale of its 5.4% stake in Japan’s PayPay Corp. for over ₹2,300 crore to SoftBank.

Wipro will acquire three entities of US-based Applied Value Group for $40 million (₹340 crore) to strengthen its application services capabilities. The acquisition, expected to close by month-end, includes deferred earnouts tied to performance. The acquired firms, based in the US, Singapore, and the Netherlands, provide enterprise application development and support services. Dive deeper

Welspun One will invest ₹800 crore to develop a 1 million sq. ft. urban distribution centre (UDC) in Thane, combining logistics with retail and office spaces. Positioned to meet growing delivery demand in the Mumbai Metropolitan Region, its connectivity will benefit from upcoming infrastructure projects. Dive deeper

GMR Airports (-0.55%) reported 1.12 crore passengers in November, up 13.6% YoY. Delhi Airport saw 68 lakh passengers, a 12% rise, with record cargo volumes. Hyderabad Airport recorded 25 lakh passengers, up 24.6% YoY. Dive deeper

Exide Industries Limited (EIL) has invested ₹99.99 crores in its wholly-owned subsidiary, Exide Energy Solutions Limited (EESL), through a rights issue. With this, EIL's total investment in EESL now stands at ₹3,152.24 crores. Dive deeper

Godavari Biorefineries (-1.97%) will invest ₹130 crore in a 200 KLPD corn or grain-based distillery to enhance ethanol production flexibility. The facility, set to be operational by March 2026, will ensure resilience amid climate and policy disruptions, supporting India’s ethanol blending program. Shares closed at ₹349.85 (-2.41%). Dive deeper

IndiGo (-0.45%) has expanded its codeshare with Turkish Airlines to 43 destinations, adding Houston, Atlanta, Miami, and Los Angeles via Istanbul. This brings IndiGo’s network to nine US cities, including New York, Washington, Boston, Chicago, and San Francisco. IndiGo also has codeshare agreements with nine airlines, including American Airlines and Japan Airlines, enhancing connectivity across key global routes. Dive deeper

RVNL (-0.34%) received a ₹270 crore contract from Maharashtra Metro Rail for constructing 10 elevated metro stations under Nagpur Metro Phase-2, to be completed in 30 months. This follows recent project wins from Southern Railway and East Central Railway. RVNL’s Q2 FY25 net profit fell 27% YoY to ₹286.9 crore, with shares closing at ₹469.9, up 0.8%. Dive deeper

Mankind Pharma (-1.07%) launched a QIP to raise up to ₹3,000 crore at a floor price of ₹2,616.55 per share, supporting its ₹13,768 crore acquisition of Bharat Serums and Vaccines. In Q2 FY25, net profit rose 29% to ₹658.88 crore, with revenue up 13.6% to ₹3,076.51 crore. Dive deeper

India's gold imports are set to drop sharply in December after hitting $14.8 billion in November due to rebounding prices and a lack of festive demand. This decline could ease the trade deficit and support the rupee. Dive deeper

What’s happening globally

Bitcoin reached a record high of $107,148, driven by President-elect Trump's plans for a U.S. Bitcoin strategic reserve. The rally was also supported by the inclusion of MicroStrategy in the Nasdaq 100. Dive deeper

Dow Jones Industrial Average (DJIA) has recorded a nine-day losing streak, its longest since 2018. The decline is driven by investor caution ahead of the Federal Reserve's final policy meeting, where a 25-basis-point interest rate cut is expected. Dive deeper

WTI crude oil futures fell toward $70 per barrel on concerns over weak global demand and oversupply. China's economic uncertainty and soft manufacturing data in the US and Eurozone added pressure, while markets await the Fed's rate decision. Dive deeper

The Eurozone trade surplus narrowed to €6.8 billion in October 2024, with imports up 3.2% and exports rising 2.1%. The EU’s trade balance also shrank to €3.9 billion as export growth slowed amid declines in energy and machinery sales. Dive deeper

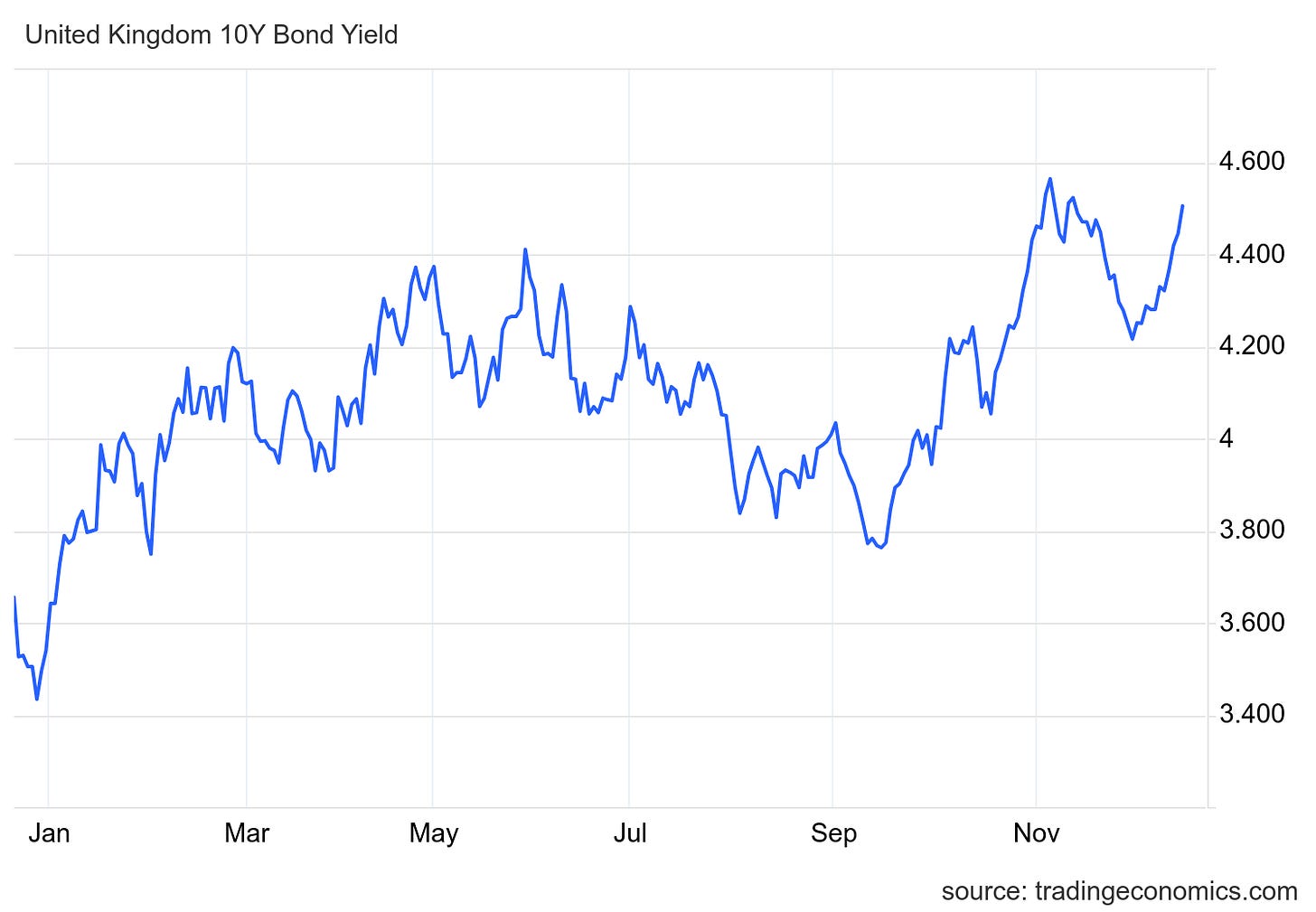

The UK 10-year gilt yield rose above 4.9%, driven by stronger pay growth of 5.2%. Ahead of the Bank of England's policy decision, no rate changes are expected, with investors anticipating three cuts in 2025. Dive deeper

Copper futures fell below $4.13 per pound, pressured by weak demand signals from China and cautious easing expectations from the US Fed. Slowing retail sales, falling home prices in China, and unclear stimulus plans added to concerns. Dive deeper

China's capital outflows surged to a record $45.7 billion in November, driven by a weakening yuan and investor concerns over US tariff threats. Despite Beijing's stimulus efforts, confidence remains low amid economic challenges. Dive deeper

Bangladesh's electricity imports from Adani Power's Jharkhand plant fell by 32.8% in November amid a payment dispute, marking the steepest decline since December 2023. To meet a 5.6% rise in demand, Bangladesh increased fuel oil use for power generation by 47.8%, while natural gas-fired output rose by over 10%. Dive deeper

Cocoa futures hit a record high amid supply concerns from adverse weather in West Africa and ongoing global deficits. Prices have doubled in 2024, with crop diseases, low farmer pay, and delayed production adding to challenges. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Nirmala Sitharaman, Union Finance Minister in Lok Sabha

Important to understand, that the GDP drop has occurred only in 2 quarters out of 12.

Let us not pick on the one GDP drop; there has been steady growth.

The situation is no different from the earlier years when Lok Sabha elections were conducted. - Link

Praveen Jaipuriar, CEO of CCL Products on the impact of rising coffee prices

“The increase in coffee prices will have a top-line impact. Because we pass through, what will happen is that my topline will start looking much higher than my volume growth. So, that is one impact,”

“This means that whatever the coffee price is, all my costs and margins are loaded on top of it, and that's how I quote to the client,”“If the client were to confirm the contract, I would end up buying the coffee today. So, it also doesn't have any impact on my inventory,” - Link

Jairam Sampat, Whole Time Director and CFO, Kaynes Tech on the company’s foray into semiconductors

Commercial production for semiconductor unit will start by Q4 next year.

OSAT & PC board fabrication will be in focus for the company.

Just being an assembler won’t be sufficient to meet growth targets.

PLI on components will benefit all EMS players in the PC boards space.

Have plans of ₹1,400 cr capex for PC boards.

Stick to revenue growth guidance of ₹3,000 cr in FY25. - Link

Calendars

In the coming days, we have the following major events and corporate actions:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

I listen first time today. It is best 👌