Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real time by Tijori.

Market Overview

Nifty opened with a small gap down of 21 points at 23,050.80 but quickly sold off, dropping below 23,000. From there, it continued to decline, reaching 22,850 within the first hour. Panic was evident across the board, particularly in the broader market, as Nifty hit the day's low of 22,798.35.

Following this sharp drop, the market staged a gradual recovery, gaining 100 points in the next hour. A more sustained recovery began only after 11:30 AM. In the second half, Nifty made multiple attempts to cross 23,080 and eventually succeeded, reaching an intraday high of 23,144.70. However, another round of selling soon followed, dragging the index down by nearly 180 points to test 22,950. A late recovery in the final hour helped Nifty close nearly flat at 23,045.25, down 0.11%.

Market sentiment remained weak, weighed down by concerns over Trump's proposed tariffs and overall softness in the broader market. Looking ahead, Nifty is expected to take cues from global developments, including Prime Minister Modi’s visit to the US, domestic economic factors, and key market events as the final phase of the earnings season unfolds.

Broader Market Performance:

Underperforming the headline indices, the broader market saw a decline in advance-to-decline ratios. Out of 2,925 stocks traded on the NSE, 1,154 advanced, 1,685 declined, and 86 remained unchanged.

Sectoral Performance:

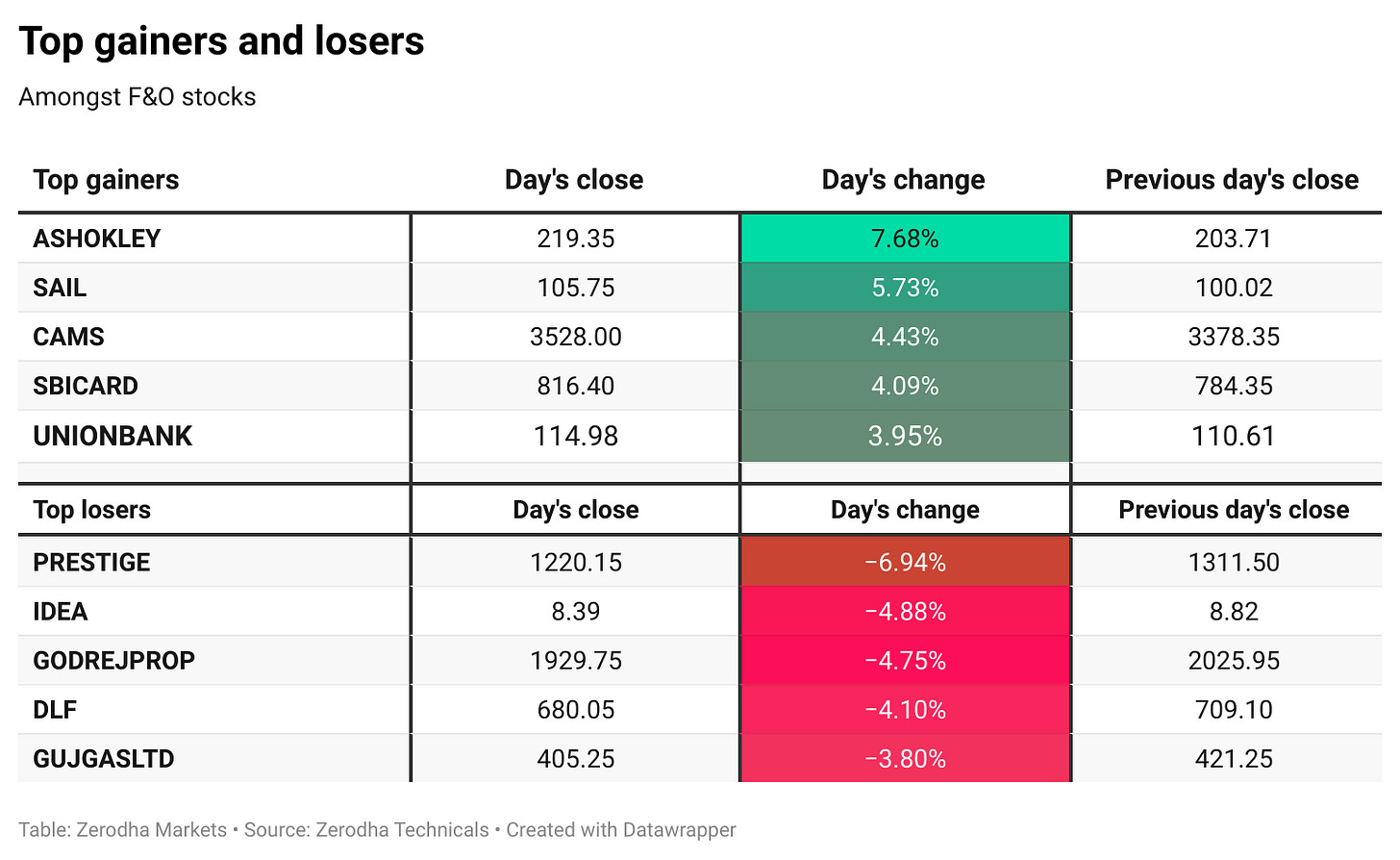

The top-gaining sector of the day was Nifty PSU Bank, which rose by 0.84%, followed by Nifty Metal (+0.67%). On the other hand, the top losing sector was Nifty Realty, which saw a sharp decline of -2.74%, making it the worst performer. Overall, out of the 12 sectors, four closed in green, while eight ended in the red. The broader market sentiment leaned bearish, with a majority of the sectors witnessing declines.

Note: The above numbers for Commodity futures were taken around 4 pm.

Net Flow Breakdown for the day:

FII: Net outflow of ₹4,969.30 crore (Bought ₹12,389.10 crore, Sold ₹17,358.40 crore)

DII: Net inflow of ₹5,929.24 crore (Bought ₹15,357.41 crore, Sold ₹9,428.17 crore)

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 13th February:

The maximum Call Open Interest (OI) is observed at 23,500, followed by 23,300. Meanwhile, The maximum Put Open Interest (OI) is at 22,700, followed by 22,800.

Immediate support is identified in the 22,900–22,800 range, while resistance is expected between 23,400 zones followed by 23,500.

Note: OI is subject to multiple interpretations, but generally, an increase in the call OI indicates resistance in a falling market, and an increase in the put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

India’s retail inflation eased to a five-month low of 4.31% in January from 5.22% in December 2024, driven by a slowdown in food price inflation, which rose 6% compared to 8.4% in the previous month. Vegetable inflation dropped sharply to 11.35% from 26.56%, while pulses inflation stood at 2.59% (down from 3.83%). Cereals inflation was 6.24%, milk and products at 2.85%, and fuel and light inflation remained negative at -1.38%. Dive deeper

Equity mutual fund inflows dipped 3.6% in January to ₹39,687.78 crore, down from ₹41,136 crore in December, according to AMFI data. Despite the slight decline, mid-cap and small-cap funds remained investor favorites. SIP contributions stayed strong, crossing ₹26,000 crore for the month, totaling ₹26,400 crore (vs. ₹26,459 crore in December). Notably, ELSS inflows surged to ₹799 crore, a sharp rise from ₹188 crore in the previous month.

The Gold Exchange-Traded Fund (ETF) category recorded its highest-ever monthly net inflow in January, receiving ₹3,751.42 crore. This marked a significant surge compared to the ₹640 crore net inflow in December, reflecting strong investor interest in gold as an asset class. Dive deeper

The Indian rupee rose for a third session, hitting a two-week high near 86.7 amid RBI intervention. However, pressures from a widening trade deficit, high oil prices, and global risks persist, with further RBI support likely to stabilize the currency. Dive deeper

The RBI will inject ₹2.5 lakh crore via a Variable Rate Repo (VRR) auction to enhance banking system liquidity. Daily VRR auctions will continue until further notice. Additionally, the implementation of Liquidity Coverage Ratio (LCR) and project financing norms has been deferred to March 2026 to ensure a smooth transition. Dive deeper

SEBI has allowed registered stock brokers to trade in government securities via a separate business unit (SBU) on the NDS-OM platform. Brokers must maintain segregation between their core securities operations and the SBU, with separate accounts and net worth requirements as per regulatory guidelines. Dive deeper

IRDAI has intensified scrutiny of insurers exceeding the 30% expense cap, placing eight firms under quarterly monitoring. It is also reviewing high commissions in bancassurance and enforcing new accounting norms requiring annual premium reporting to curb rising expenses. Dive deeper

Bharti Airtel awarded Nokia a contract to expand 5G Fixed Wireless Access (FWA) and Wi-Fi 6 solutions using Qualcomm technology, enabling high-speed broadband in underserved areas. Made in India with recyclable packaging, these devices enhance digital access nationwide. Dive deeper

Intellect Design Arena appointed John Owen as President for the Western Hemisphere to drive eMACH.ai growth and expand sales across the Americas, Europe, and the UK. Dive deeper

Lupin’s Board approved the reappointment of Ms. Vinita Gupta as CEO and Mr. Ramesh Swaminathan as Executive Director & CFO, along with the transfer of its Over-the-Counter (OTC) Consumer Healthcare business to a new subsidiary. Dive deeper

Suzlon secured a repeat order of 201.6 MW from Oyster Renewable, bringing its total order book to a record 5.7 GW. The project, featuring 64 S144 wind turbine generators, will be executed in Madhya Pradesh, reinforcing Suzlon’s leadership in India’s wind energy sector. Dive deeper

TVS Motor signed an MoU with Karnataka to invest ₹2,000 crores, setting up a global capability centre and expanding Mysuru operations. Dive deeper

BEML Ltd. partnered with South Korea’s STX Engine to co-develop and manufacture battle tank and marine engines, enhancing India’s defence self-reliance. The collaboration aims to reduce import dependency, drive innovation, and explore export opportunities. Dive deeper

PI Industries has been featured in the S&P Global Sustainability Yearbook 2025 for the second consecutive year, ranking in the top 3 percentile of ESG-rated companies globally. This recognition highlights PI’s commitment to sustainability-driven innovation and responsible business practices. Dive deeper

Happy Forgings signed an MoU with a global manufacturer for the long-term supply of heavy forged and precision-machined components. Production will begin in 2028, with expected annual revenues of ₹95-160 crore. The order will be executed at HFL’s new heavy forging facility under its ₹650 crore expansion plan. Dive deeper

Oil India signed an MoU with Petrobras during India Energy Week 2025 to collaborate on hydrocarbon exploration in India’s offshore regions. The partnership focuses on deep and ultra-deep offshore basins, aligning with India’s hydrocarbon exploration policies. Dive deeper

SEBI banned LS Industries from the capital market over stock manipulation, despite its ₹5,500 crore valuation and zero revenue. It froze investor JPP’s accounts for unlawful gains and is investigating insider trading, a pump-and-dump scheme, and potential FEMA violations. Dive deeper

OYO will invest $10 million to enhance G6 Hospitality’s digital assets, including its website and app, following its $525 million acquisition of Motel 6 and Studio 6. The expansion aims to add 150 hotels in 2025 and boost direct bookings through advanced digital strategies. Dive deeper

Vedanta approved raising ₹3,000 crore via the issuance of 3,00,000 non-convertible debentures (NCDs) on a private placement basis. The company also plans to appeal a ₹1.08 crore GST penalty, stating it expects no material financial impact. Dive deeper

Mahindra Group plans to invest ₹40,000 crore in Karnataka across renewables, aerospace, real estate, and EVs. Key projects include ₹35,000 crore in solar and hybrid energy, ₹6,000 crore in real estate, and ₹1,000 crore in hospitality expansion. Dive deeper

HAL aims to expand its order book from ₹1.2 lakh crore to ₹2.2 lakh crore by 2030, backed by major contracts, ₹2,500 crore annual R&D investments, and expanded production. The company is also pursuing export opportunities and advancing the AMCA project, targeting its first flight by 2028. Dive deeper

Ashok Leyland’s Board approved investments of up to ₹500 crore in UK subsidiary Optare Plc. and ₹200 crore in Hinduja Leyland Finance Ltd. (HLFL) to enhance capital structure and expansion. Both transactions, subject to approvals, are expected to be completed by March 31, 2025. Dive deeper

What’s happening globally

Brent crude fell to $76.3 per barrel after US crude stocks surged by 9 million barrels, far exceeding expectations. Trade tensions and Trump’s tariffs added caution, while concerns over Russian and Iranian supply disruptions limited losses. Dive deeper

The US inflation rate likely held steady at 2.9% in January, with monthly CPI rising 0.3% amid higher food and energy costs. Core inflation is expected to ease to 3.1% annually but edge up to 0.3% monthly, driven by rising car prices and LA wildfire-related rent increases. Dive deeper

China’s tech stocks entered a bull market, with the Hang Seng Tech Index surging 25% in a month, driven by DeepSeek’s AI breakthrough. Investor confidence grew as Chinese firms, including Alibaba and Baidu, gained sharply, outpacing US tech stocks amid rising AI adoption and stimulus expectations. Dive deeper

The Shanghai Composite gained 0.85% to 3,346, and the Shenzhen Component surged 1.43% to 10,709, reaching over a month-high. The rally was driven by AI optimism, led by DeepSeek’s breakthrough, and boosted by reports of Trump’s call with Xi Jinping, though tariff risks persist. Dive deeper

The FTSE 100 traded flat, staying near record levels. Barratt Redrow jumped 6% on strong home completions, profit guidance, and a dividend hike, lifting other homebuilders. Oil majors Shell and BP fell on weaker oil prices, while HSBC, GSK, and Rolls-Royce also declined. Dive deeper

Japan's machine tool orders rose 4.7% YoY to JPY 116.1 billion in January, marking the fourth straight month of growth, driven by foreign and domestic demand. However, orders fell 18.8% MoM, reversing December’s 18.4% gain. Dive deeper

Quarterly results

In this section, we'll dive into all the key highlights from today's intriguing results, covering the most impactful performances and standout moments. The numbers are comparable on a year-on-year (YoY) basis.

Jubilant FoodWorks Limited (-3.07%)

Revenue: ₹2,151 crores, up by 56% YoY.

EBITDA: ₹402 crores, up by 43% YoY.

Net Profit: ₹43.2 crores, down by 22% YoY.

EPS: ₹0.65, down by 35% YoY.

Key Highlights

Revenue growth driven by higher sales across brands, including Domino’s, Dunkin’ Donuts, and Popeyes.

Increase in costs due to rising raw material expenses and employee costs.

Exceptional charge of ₹4.49 crores related to an impairment in Hashtag Loyalty Pvt. Ltd. due to discontinued operations.

Outlook

The company remains focused on expansion and cost optimization strategies to drive long-term profitability.

Ircon International Ltd (-6.26%)

Revenue: ₹2,613 crores, down by 11% YoY.

EBITDA: ₹132 crores, down by 49% YoY.

Net Profit: ₹86.1 crores, down by 65% YoY.

EPS: ₹0.92, down by 65% YoY.

Key Highlights

Revenue and profitability saw a sharp decline due to a slowdown in project execution.

Order book remains strong at ₹21,939 crores, with ₹17,075 crores from railways, ₹4,775 crores from highways, and ₹89 crores from other sectors.

EBITDA margins contracted due to cost pressures and lower project completions.

The company declared a dividend of ₹1.65 per share.

Outlook

The company remains optimistic about long-term growth, backed by strong government infrastructure initiatives and an expanding project pipeline.

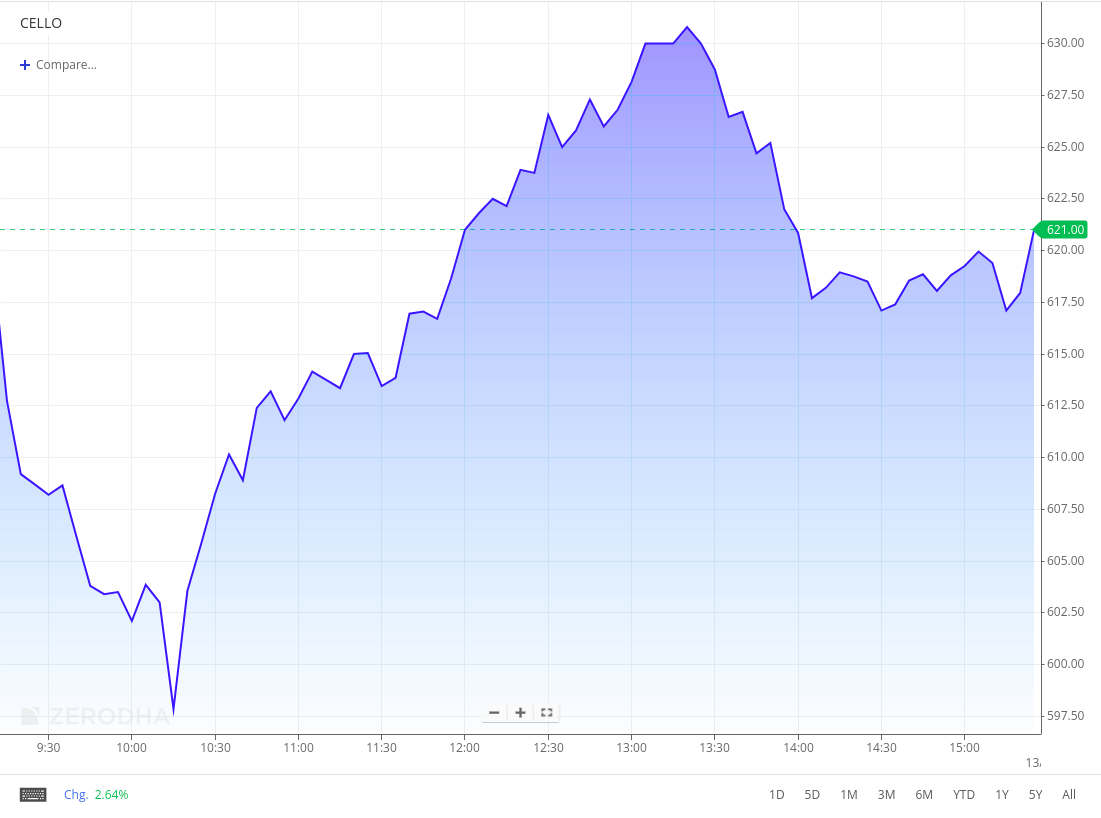

Cello World (-0.22%)

Revenue: ₹556.8 crores in Q3 FY25, up by 6% YoY.

EBITDA: ₹139.7 crores, up by 2% YoY.

Net Profit (PAT): ₹86.4 crores, up by 2% YoY.

EPS: ₹1.44, up by 2% YoY.

Key Highlights:

Cello World has continued to see growth across its diverse product range which includes consumer houseware, writing instruments, and moulded furniture.

The company has managed to maintain a robust EBITDA margin despite a challenging economic environment.

Outlook:

The company is optimistic about demand recovery, particularly in the hydration and back-to-school categories, and plans to enhance its market presence through innovative products and expanded distribution channels.

Lupin Limited (-2.05%)

Revenue: ₹5,768.6 crores, up by 10.6% YoY.

EBITDA: ₹1,409.6 crores, up by 32.1% YoY.

Net Profit (PAT): ₹859 crores, up by 38.8% YoY.

EPS: ₹18.74, up from ₹13.47 YoY.

Key Highlights

Strong performance in North America: sales grew 12.3% YoY to ₹2,121.3 crores, contributing 38% of total revenue.

India sales grew 11.9% YoY to ₹1,930.5 crores, driven by new launches across key therapeutic areas.

EMEA (Europe, Middle East, Africa) sales increased by 20.9%, supporting overall revenue growth.

Investment in R&D stood at ₹434.4 crores (7.7% of revenue), focusing on new product launches and pipeline expansion.

Gross margin improved to 69.4% YoY due to better product mix and operational efficiencies.

Outlook

The company expects continued revenue growth driven by expansion in the U.S., new product launches, and operational efficiencies.

Aegis Logistics Limited (+3.79%)

Revenue: ₹1,707 crores, down by 9% YoY.

EBITDA: ₹233 crores, up by 10% YoY.

Net Profit (PAT): ₹160 crores, down by 5% YoY.

EPS: ₹3.54, down from ₹3.71 YoY.

Key Highlights

Operational improvements and cost efficiencies led to EBITDA growth despite lower revenue.

Interest income increased, supporting bottom-line stability.

The company declared a dividend of ₹1.25 per share.

Outlook

The company remains focused on expanding its terminal operations and improving cost efficiencies to sustain profitability.

Power Finance Corporation Limited (-0.44%)

Revenue: ₹26,798 crores, up by 14% YoY.

EBITDA: ₹26,367 crores, up by 16% YoY.

Net Profit: ₹7,760 crores, up by 23% YoY.

EPS: ₹17.66, up by 23% YoY.

Key Highlights:

Strong revenue growth driven by higher interest income and improved loan disbursements.

Increase in EBITDA and PAT reflect better margins and cost efficiencies.

Dividend income and fee-based earnings contributed positively to profitability.

Asset quality remains stable, with a well-diversified lending portfolio.

Outlook:

PFC expects continued growth, supported by strong demand in power and infrastructure financing, along with stable asset quality.

Graphite India Limited (-3.00%)

Revenue: ₹523 crores, down by 24% YoY.

EBITDA: ₹-8 crores (negative), improved by 38% YoY.

Net Profit: ₹-21 crores (negative), down by 218% YoY.

EPS: ₹-1.02, down by 211% YoY.

Key Highlights:

Decline in revenue is driven by lower demand and pricing pressures in the graphite electrode segment.

EBITDA turned slightly positive compared to the previous negative performance, reflecting cost control measures.

Higher raw material costs and reduced operational efficiency contributed to the net loss.

The company remains focused on stabilizing margins and managing inventory levels amid market fluctuations.

Outlook:

Graphite India aims to navigate market challenges through efficiency improvements and better inventory management, expecting recovery as demand stabilizes.

Hindustan Aeronautics Limited (-1.52%)

Revenue: ₹6,957 crores, up by 15% YoY.

EBITDA: ₹1,681 crores, up by 17% YoY.

Net Profit: ₹1,433 crores, up by 14% YoY.

EPS: ₹21.42, up by 14% YoY.

Key Highlights:

Revenue growth is driven by increased defense contracts and the execution of major aircraft and helicopter orders.

Strong operational efficiency improvements contributed to higher EBITDA margins.

Other income stood at ₹63.1 crores, supporting profitability.

Declared first interim dividend of ₹25 per share.

Outlook:

HAL remains optimistic about sustained order inflows and operational efficiencies, driving future growth in India's defense manufacturing sector.

Campus Activewear Limited (+7.53%)

Revenue: ₹514.9 crores, up by 9% YoY.

EBITDA: ₹85.9 crores, up by 49% YoY.

Net Profit: ₹46.5 crores, up by 87% YoY.

EPS: ₹1.52, up by 85% YoY.

Key Highlights:

Strong revenue growth driven by a distribution channel push and higher online sales, benefiting from the festive season.

Sales volume grew by 10% YoY to 76.2 million pairs in Q3 FY25.

EBITDA margin expanded to 16.6%, up by 4.4% YoY, supported by cost efficiencies and better inventory management.

Declared maiden interim dividend of ₹0.70 per share for FY25.

Outlook:

Campus Activewear aims to drive further market share expansion through distribution growth, product innovation, and enhanced brand visibility.

Steel Authority of India Limited (+5.73%)

Revenue: ₹24,490 crores, up by 5% YoY.

EBITDA: ₹2,030 crores, down by 5% YoY.

Net Profit: ₹142 crores, down by 65% YoY.

EPS: ₹0.34, down by 67% YoY.

Key Highlights:

Revenue growth was supported by higher steel sales volume, though lower realization impacted margins.

EBITDA declined due to higher raw material costs and lower steel prices, reducing operating profitability.

Net profit was significantly impacted by higher interest expenses and other costs.

Production capacity utilization remained stable, with efforts to optimize cost efficiency.

Outlook:

SAIL is focused on cost rationalization and operational efficiency improvements to navigate near-term price fluctuations in the steel sector.

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Avinash Godkhindi, MD & CEO, Zaggle Prepaid Ocean Services on margin guidance

"We've given guidance that in the next 3 to 4 years, we will be in the range of 15% to 16%. That's something that we've already given guidance on, and obviously, it's not going to be a steep step up one day overnight. It's going to be a gradual ramp-up," - Link

R.K. Tyagi, Chairman & Managing Director, Power Grid Corporation of India on lower dividends

As you know, last year, our CapEx was ₹12,500 crores. This year, it is expected to be ₹23,000 crores, and in FY '26, it will increase further. Therefore, we require more equity infusion to meet our CapEx requirements.

This is why we may gradually decrease further. Today, we declared a first interim dividend of ₹4.5, followed by a second interim dividend of ₹3.25, bringing the total to ₹7.75. We expect the total dividend for this financial year to be around ₹9, primarily due to our CapEx requirements. - Link

Heineken N.V. on India Operations for Q4 FY24

"In India, net revenue (BEIA) grew in the low-teens with beer volume growth of a high-single-digit. As the market leader, we continued to expand and develop beer-centric occasions, shaping the beer category to unlock the inherent growth."

"Kingfisher, the largest brand in India, grew by a mid-single-digit boosted by increased sponsorship investment including the Indian Premier League for cricket."

"Our premium portfolio, led by Kingfisher Ultra and Heineken Silver, grew in the mid-thirties, gaining segment market share. We also launched Amstel Grande to expand our premium offerings." - Link

Calendars

In the coming days, we have the following major events, corporate actions, and upcoming earnings releases:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

"Immediate support is identified in the 23,900–23,800 range, while resistance is expected between 23,400 zones followed by 23,500."

Typo? Immediate support is identified in the 22,900–22,800 range (not 23,900–23,800)