Markets struggle amid FII selling and growth concerns

Welcome to the weekly edition of the Aftermarket Report, a newsletter where we do a quick weekly wrap-up of what happened in the markets—both in India and globally.

Catch “Who Said What”, a weekly show where we'll pick fascinating comments from notable figures, break them down, and explore the broader stories behind them.

Market Overview this week

Nifty index declined by 0.97% over the week, closing at 23,203.2. The drop was primarily attributed to sustained selling by Foreign Portfolio Investors (FPIs) and concerns about economic growth, which dampened investor sentiment, macroeconomic factors continued to weigh on market sentiment and contributed to overall market weakness throughout the week.

Looking ahead, the market will closely monitor announcements from the U.S. President following the inauguration, key quarterly earnings, and developments leading up to the Union Budget scheduled for February 1st.

Among sectoral indices, Nifty PSU Banks emerged as the top gainer this week. In contrast, Nifty IT fell by 5.73%, as the market reacted negatively to the earnings reports of major companies in the sector.

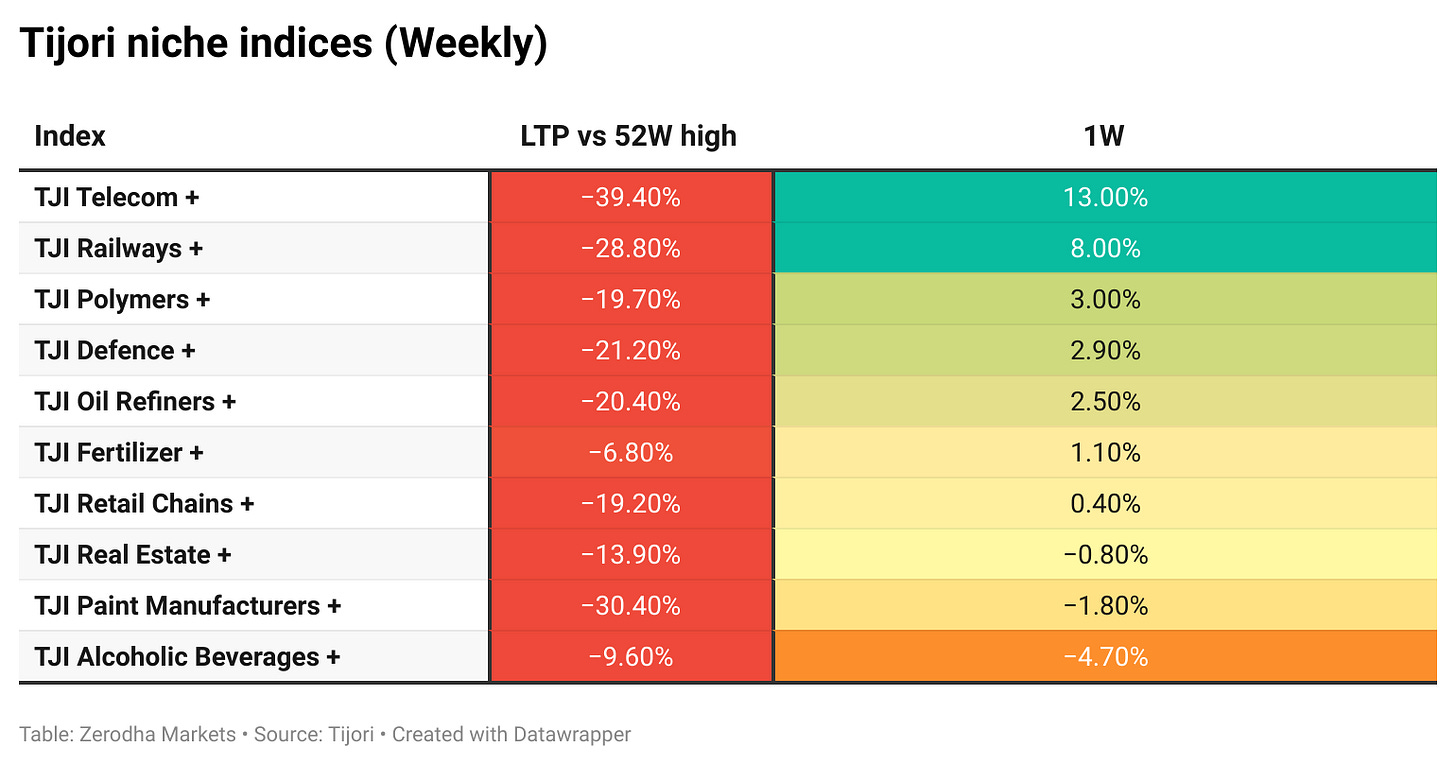

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market.

What happened in India?

India’s annual inflation rate eased to 5.22% in December 2024, down from 5.48% in November, aligning with market expectations. The slowdown was driven by lower food inflation, which dropped to 8.39% from 9.04%, and a slight easing in housing costs. Retail prices fell 0.52% month-on-month, marking the sharpest drop in over a year. Dive deeper

Godrej Properties launched its first project in Hyderabad, Godrej Madison Avenue, a 50-storey residential tower valued at ₹1,300 crores, offering luxury apartments and amenities. Dive deeper

Bharat Electronics secured additional orders worth ₹561 crore for communication equipment, electro-optics, radar systems, and satcom network upgrades. This brought BEL’s total orders for FY25 to ₹10,362 crore, underscoring its continued growth in the defense and electronics sectors. Dive deeper

India’s net direct tax collections grew by 15.88% as of January 12, 2025, reflecting a strong economy. The tax growth was driven by corporate taxes and a significant rise in non-corporate taxes. Dive deeper

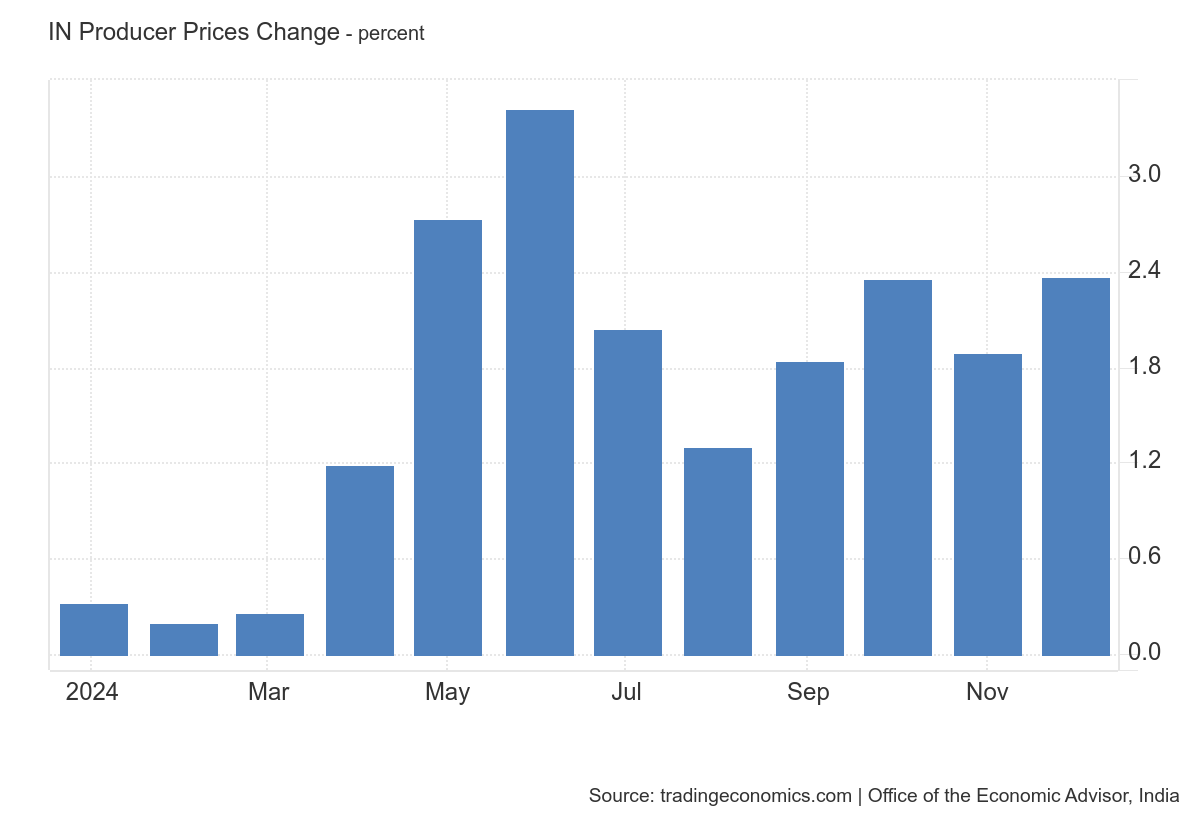

India’s wholesale prices rose 2.37% YoY in December 2024, driven by higher manufacturing prices. However, monthly prices fell 0.38%, marking the second consecutive decline. Dive deeper

Mazagon Dock Shipbuilders held a keel laying ceremony for a training ship for the Indian Coast Guard, valued at ₹310 crore. The ship is scheduled for delivery in December 2026 and will be used for officer training. Dive deeper

Adani Energy Solutions secured ₹28,455 crore in orders during Q3 FY25, including a ₹25,000 crore project in Rajasthan. The company’s order pipeline now stands at ₹54,700 crore, indicating significant growth. Dive deeper

India’s exports declined 1% to $38.01 billion in December 2024, while imports rose 4.8%, leading to a trade deficit of $21.94 billion. This resulted in a slower export growth rate for April- December 2024, with exports growing by 1.6% and imports increasing by 5.15%. Dive deeper

SEBI proposed mandatory dematerialization of shares for corporate actions like splits and restructurings. This move aims to reduce fraud, enhance efficiency, and lower costs by phasing out physical certificates and improving market transparency. Dive deeper

Minda Corporation entered a strategic partnership with Flash Electronics, acquiring a 49% stake for ₹1,372 crore to create a leading EV platform in India. This collaboration strengthens both companies' positions in the rapidly growing EV market. Dive deeper

Adani Green Energy's subsidiary commissioned a 57.2 MW wind-solar hybrid project in Gujarat, boosting AGEL’s total renewable capacity to 11,666.1 MW. This expansion aligns with the company’s efforts to increase its renewable energy footprint. Dive deeper

Tata Capital raised $400 million through its first overseas bond issue at a 5.389% coupon. The offering was highly subscribed and will help strengthen the company’s liability profile, further supporting its financial stability. Dive deeper

India's residential property sales reached a record 3,02,867 units in 2024, marking an 11% YoY growth. Higher-priced homes, particularly those above ₹1 crore, accounted for over 50% of sales, with new launches also hitting record levels. Dive deeper

Exide Industries invested ₹149.99 crore in its subsidiary, Exide Energy Solutions, to support a new lithium-ion battery plant in Bengaluru. This is part of the company’s strategic focus on green energy and electric vehicle batteries. Dive deeper

Rail Vikas Nigam Ltd. won a ₹3,622 crore contract from BSNL to develop and maintain the Bharat Net middle-mile network. The project includes three years of construction and 10 years of maintenance, enhancing India’s rural broadband infrastructure. Dive deeper

Swiggy received approval for its subsidiary, Swiggy Sports Private Limited, which will focus on sports team ownership, talent development, and event management. This move diversifies Swiggy’s portfolio into sports and entertainment. Dive deeper

Adani Group stocks rose following the closure of Hindenburg Research, with Adani Enterprises opening at ₹2,500. This development has led investors to reassess the group's outlook, as the absence of further scrutiny boosts confidence in the company's future. Dive deeper

SEBI resolved 5,636 complaints in December 2024 via the upgraded SCORES 2.0 platform, with an average resolution time of just eight days. The platform’s efficiency helped clear pending complaints, reflecting the streamlined complaint resolution process. Dive deeper

The government approved the formation of the 8th Pay Commission to review and recommend salary and pension revisions for central government employees, effective from January 2026. This move aims to ensure fair compensation and address inflationary concerns. Dive deeper

India's forex reserves fell to a 10-month low of $625.87 billion as of January 10, 2025, marking a decline of $8.72 billion in the week. This is the sixth consecutive weekly drop, reducing reserves by $23.5 billion over the last five weeks. Dive deeper

Maruti Suzuki launched its first electric SUV, the e-VITARA, offering two battery options with a range of over 500 km. Built on the HEARTECT-e platform, it features advanced safety and electric eco-solution for a seamless ownership experience. Dive deeper

Jio Platforms reported a 25.95% rise in Q3 FY25 net profit, driven by tariff hikes, subscriber growth, and increased data usage. ARPU increased by 4.2%, with the full impact of tariff hikes expected in Q4 FY25 and Q1 FY26. Dive deeper

The Reserve Bank of India injected ₹40,000 crore into the banking system through two operations to address a liquidity deficit exceeding ₹2 lakh crore. This was done through an overnight variable rate repo auction and a government securities buyback. Dive deeper

What happened across the globe?

The dollar index surged to 110, its highest since October 2022, following a strong U.S. jobs report. The dollar gained notably against the British pound and euro, with CPI and PPI data being closely watched for future market directions. Dive deeper

China's exports rose 10.7% in December 2024, driven by strong demand and tariff concerns. For the full year, exports increased by 5.9% to $3.58 trillion, led by gains in key sectors like mechanical and electrical products. Dive deeper

Chinese banks issued CNY 990 billion in new yuan loans in December 2024, above November’s low but below December 2023 levels. The rise was driven by stimulus measures, but total new loans for 2024 fell to CNY 18.09 trillion, a 13-year low. Dive deeper

Gold rose above $2,670 per ounce, recovering after a 1% drop. Concerns over Trump's trade policies boosted its appeal, with the outlook remaining positive amid geopolitical uncertainties and central bank demand. Dive deeper

Oil prices slipped slightly but stayed near four-month highs, with Brent crude falling 0.27% to $80.79 after new U.S. sanctions on Russian oil. The sanctions are expected to reduce Russian supply by up to 700,000 barrels per day, though weaker demand from China could dampen their impact. Dive deeper

Robinhood agreed to pay $45 million in fines for a 2021 data breach and record-keeping failures, as part of a $100 million SEC settlement. The settlement also included penalties for 12 other investment firms for violations related to off-channel communications. Dive deeper

UK manufacturing production fell 0.3% month-over-month in November 2024, missing expectations. The decline was led by manufacturing repair, pharmaceuticals, and transport equipment, while gains were seen in petroleum, electronics, and plastic products. Annually, output dropped 1.2%. Dive deeper

China's economy grew by 5.4% in Q4 2024, surpassing expectations and helping the government achieve its annual growth target, marking the fastest growth since Q2 2023. Dive deeper

China proposed a $3.7 billion investment in Sri Lanka to build an oil refinery at Hambantota, part of the Belt and Road Initiative, aimed at strengthening bilateral ties despite past concerns. Dive deeper

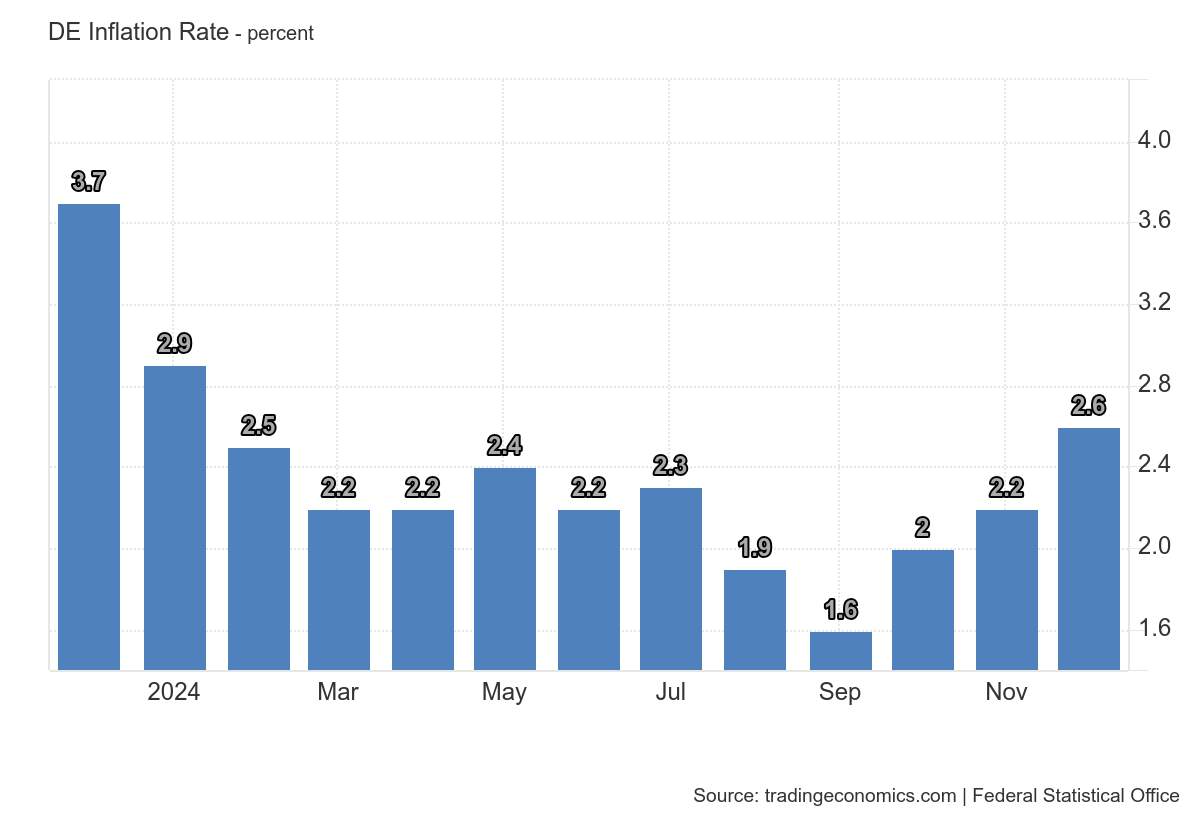

Germany's annual inflation rate rose to 2.6% in December 2024, driven by higher service and food prices, while energy prices fell. Core inflation for 2024 eased to 3%, and the EU-harmonised inflation rate increased by 2.8%. Dive deeper

Toyota shares fell 2.2% after its unit, Hino Motors, pled guilty and agreed to pay over $1.6 billion to settle a U.S. emissions fraud case involving falsified data and engine smuggling. Dive deeper

Social media stocks declined in extended trading after reports that President-elect Donald Trump may issue an executive order to block a TikTok ban. Dive deeper

Quarterly results

In this section, we'll dive into all the key highlights from last week's intriguing results, covering the most impactful performances and standout moments. The numbers are comparable on a year-on-year (YoY) basis.

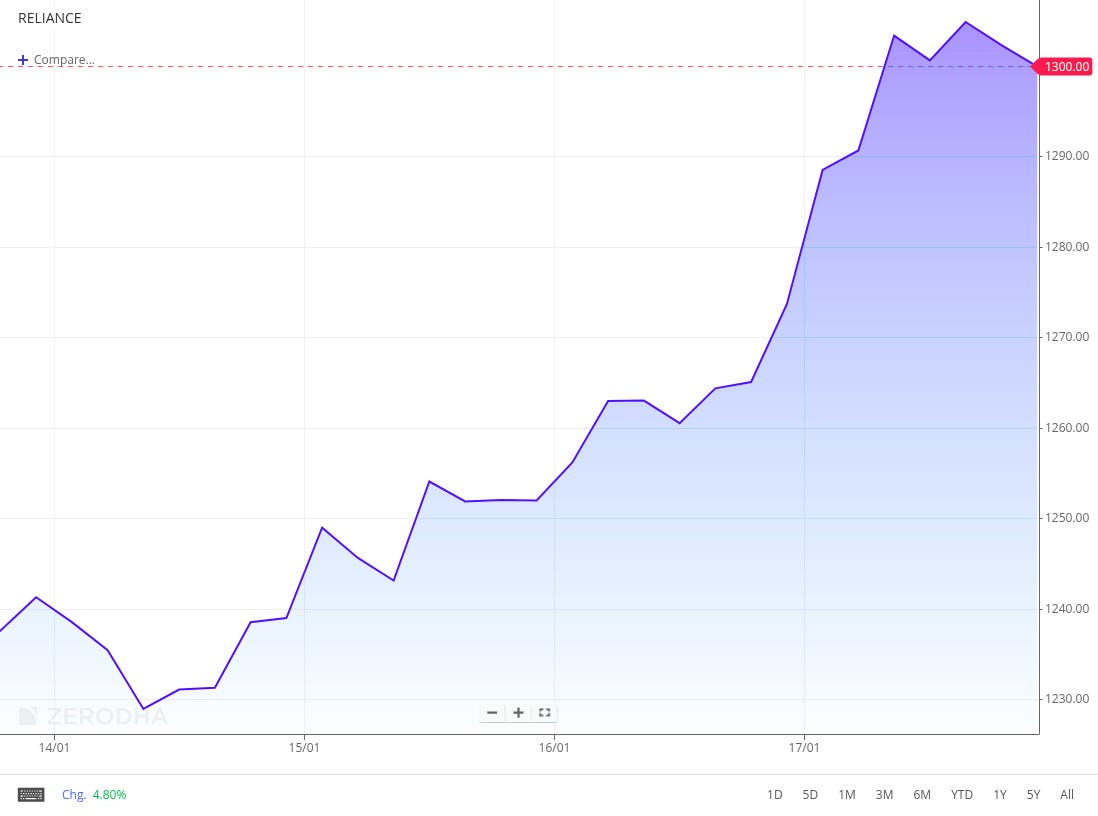

Reliance Industries (RELIANCE) (5.35%)

Financials:

Net Profit: ₹18,540 crore, up 7% YoY.

Revenue: ₹2.43 lakh crore, up 6.7% YoY.

EBITDA: ₹43,789 crore, up 8% YoY.

EBITDA Margin: 18.3%, up 20 bps YoY.

Key Highlights:

The company experienced strong growth in digital services, driven by 5G subscriber upgrades.

The retail business benefitted from festive demand and growth in consumption.

Oil & gas revenues declined due to reduced gas and condensate volumes, but higher CBM gas volumes and prices provided some offset.

The O2C segment was impacted by global oil demand trends and lower crude oil prices, affecting refining margins.

Jio-bp recorded its highest-ever quarterly sales for petrol, diesel, and aviation fuel.

Outlook:

The company expects continued growth in digital services and retail, despite challenges in oil & gas due to price fluctuations.

The company is focused on driving growth through its consumer and digital platforms while maintaining leadership in energy and retail.

Wipro Limited (WIPRO) (-4.94%)

Financials:

Net Profit: ₹3,354 crore, up 24.4% YoY.

Revenue: ₹22,319 crore, up 0.5% YoY.

EBITDA: ₹3,899 crore, up 4.5% QoQ.

EBITDA Margin: 17.5%, up 0.7% QoQ.

Dollar Revenue: $2,629.1 million, slightly down 1% YoY.

Operating Cash Flow: ₹49.3 billion, up 3% YoY.

Key Highlights:

Interim dividend of ₹6 per share, with a record date of January 28, 2025.

The company achieved its highest EBITDA margin in the past three years, expanding to 17.5%.

Wipro revised its capital allocation policy to increase payouts to 70% or more of net income over three years.

Large deal bookings amounted to $961 million, reflecting strong demand.

Outlook:

The company saw a 35% decline in large deal wins from the previous quarter but achieved consistent margin improvements.

The company expects revenue growth in constant currency for Q4 to be between -1% and +1%.

Sbi Life Insurance Company Limited (SBILIFE) (6.24%)

Financials:

Net Profit: ₹551 crore, up 71% YoY.

Net Premium Income: ₹24,828 crore, up 11% YoY.

First-Year Premium: ₹6,451 crore, up 13.6% YoY.

Renewal Premium: ₹14,468 crore, up 14% YoY.

Single Premium: ₹4,079 crore, slightly up from ₹4,062 crore in Q3FY24.

Key Highlights:

Renewal premiums increased by 14% YoY, with strong sequential growth.

Single premium remained steady at ₹4,079 crore.

Outlook:

Robust renewal premiums and stable growth in new business premiums indicate positive momentum for the coming quarters.

Havells India Limited (HAVELLS) (0.10%)

Financials:

Revenue: ₹4,882.50 crore, up 11% YoY.

Net Profit: ₹282.81 crore, down 1.8% YoY.

EPS: ₹4.51, down from ₹4.59 in Q3FY24.

EBITDA: ₹415.11 crore, up 6% YoY.

EBITDA Margin: 8.5%.

Key Highlights:

Declared an interim dividend of ₹4 per equity share.

Segment-wise revenue growth across all major sectors, with Cables and Electrical Consumer Durables showing strong performance.

Lloyd Consumer showed a loss, but other segments remained profitable.

Outlook:

Full-year performance expected to continue steady growth.

Tech Mahindra (TECHM) (-1.69%)

Financials:

Net Profit: ₹988.8 crore up 93% YoY.

Revenue: ₹13,285.6 crore up 1.4% YoY.

EBITDA: ₹1,809 crore up 57.8% YoY.

EBITDA Margin: 13.6%, up 480bps YoY.

EPS: ₹11.10 (Basic), up from ₹5.77 YoY.

Key Highlights:

21% sequential drop in profit due to increased operational costs.

Despite flat revenue, EBIT margin improved, reflecting cost control measures.

Outlook:

Plans to continue emphasizing operational efficiency and focus on key markets to achieve long-term growth goals.

Avenue Supermarts Ltd. (DMart) (0.55%)

Financials:

Revenue: ₹15,972.55 crore, up 17.68% YoY from ₹13,572.47 crore.

EBITDA: ₹1,217.3 crore, up 8.7% YoY from ₹1,119.9 crore.

EBITDA Margin: 7.6%, down from 8.3% YoY.

Net Profit (PAT): ₹723.72 crore, up 4.79% YoY from ₹690.61 crore.

EPS: ₹11.12, up from ₹10.62 YoY.

Key Highlights:

Same-store revenue growth for two years and older stores was 8.3%.

DMart Ready grew by 21.5% in the first nine months of FY25, with home delivery outpacing pick-up points.

Opened 10 new stores in Q3 FY25, expanding the retail area to 16.1 million sq. ft. with 387 operating stores.

Outlook:

Focused on evolving the grocery e-commerce segment, aligning the business to higher home delivery demand.

Leadership transition with Neville Noronha stepping down and Unilever's Anshul Asawa set to take over as CEO & MD in February 2026.

HCL Technologies Ltd. (-9.58%)

Financials:

Revenue: ₹25,944 crore, up 10.6% YoY from ₹23,458 crore.

EBITDA: ₹6,814 crore, up 12.2% YoY from ₹6,070 crore.

EBITDA Margin: 26.3%, slightly improved from 25.9% YoY.

Net Profit (PAT): ₹4,096 crore, up 8.7% YoY from ₹3,769 crore.

EPS: ₹15.2, up from ₹14.0 YoY.

Key Highlights:

Revenue growth is driven by strong performance in digital and engineering services.

Expansion in client base across multiple geographies and sectors.

Investments in AI-based solutions and digital transformation initiatives contributed to growth.

Outlook:

HCLTech projects sustained revenue growth with a focus on digital transformation and cloud solutions.

The company remains optimistic about expanding its global presence and enhancing operational efficiencies.

HDFC Asset Management Co Ltd (HDFCAMC) (4.12%)

Financials:

Revenue: ₹935 crore, up 39% YoY (from ₹671 crore in Q3 FY24)

Total Income: ₹1,028 crore, down 2% QoQ (from ₹1,058 crore in Q2 FY25)

EBITDA: ₹763 crore, up from ₹509 crore YoY

EBITDA Margin: 81.7%, up from 75.9% YoY

Net Profit: ₹641 crore, up 31% YoY

Key Highlights:

Strong YoY growth in net profit and revenue from operations.

The sequential decline in total income and other income.

Significant improvement in EBITDA margin.

Outlook:

Continued focus on operating efficiency and maintaining strong profit growth.

Angel One Ltd (ANGELONE) (-2.69%)

Financials:

Revenue: ₹1,262.2 crore, up 19.2% YoY (from ₹1,059 crore in Q3 FY24)

EBITDA: ₹496 crore, up 24.7% YoY (from ₹397.8 crore in Q3 FY24)

EBITDA Margin: 39.3%, up from 37.6% YoY

Net Profit: ₹281.4 crore, up 8.1% YoY (from ₹260.4 crore in Q3 FY24)

Key Highlights:

Smallest quarterly profit increase since listing in 2020 due to tighter regulations in the derivative sector.

Average daily turnover dropped nearly 12% compared to Q2 FY25.

Total expenses increased by 23.5% YoY.

Outlook:

Focus on client acquisition and activity normalization to drive growth, despite the temporary impact of new SEBI derivatives regulations.

Bank of Maharashtra (MAHABANK) (6.29%)

Financials:

Net Profit: ₹140.65 crore, up 35.7% YoY

Total Income: ₹711.24 crore, up 21.5% YoY

EBITDA: ₹230.30 crore, up 14.5% YoY

Operating Expenses: ₹142.80 crore, up 25.9% YoY

Key Highlights:

Provision for Non-Performing Assets (NPAs): ₹84.07 crore, down from ₹94.27 crore YoY

Capital Adequacy Ratio (CAR): 18.71%

Net NPA Ratio: 0.20%

Outlook:

Strong year-over-year growth in net profit and income.

Focus on improving capital adequacy and maintaining asset quality.

L&T Technology Services Ltd. (LTTS) (9.16%)

Financials:

Revenue: ₹2653 crore, up 9.5% YoY

EBITDA: ₹494.7 crore, up 1.4% YoY

EBITDA Margin: 18.6%, compared to 20.1% YoY.

Net Profit (PAT): ₹324.5 crore, up 0.9% QoQ and down 4.1% YoY

EPS: ₹30.47 (Basic), up slightly from ₹31.80 YoY.

Key Highlights:

Growth is led by strong demand in the transportation and industrial products verticals.

New client acquisitions contributed significantly to revenue.

Investments in next-gen digital engineering and AI-powered solutions driving future growth.

Outlook:

LTTS anticipates continued momentum in its transportation and industrial products segments.

Ongoing focus on leveraging digital technologies and expanding its global footprint for sustained growth.

HDFC Life Insurance Company Ltd. (HDFCLIFE) (6.74%)

Financials:

Revenue: ₹16,771 crore, up 10% YoY

Net Profit (PAT): ₹415.0 crore, up 13.5% YoY

Earnings Per Share (EPS): ₹1.96, compared to ₹1.71 in Q3 FY24

Key Highlights:

Persistency ratios improved across all tenures, reflecting strong customer retention.

Growth in protection and non-par savings products contributed significantly to premium growth.

Steady performance in annuity and group segments supported the overall business expansion.

Outlook:

HDFC Life remains focused on expanding its protection and annuity segments while leveraging bancassurance partnerships.

Emphasis on digitization and customer-centric innovations to drive long-term growth.

Axis Bank Ltd. (AXISBANK) (-5.28%)

Financials:

Net Interest Income (NII): ₹13,606 crore, up 9% YoY

Net Profit (PAT): ₹6,304 crore, a 4% increase YoY

EPS: 20.37, against 19.69 YoY

Key Highlights:

Gross Non-Performing Assets (GNPA) improved to 2.5% from 3.0% YoY.

Capital Adequacy Ratio (CAR) stood at 18.5%, indicating a strong capital position.

Total advances grew by 14% YoY to ₹6,00,000 crore.

Outlook: Axis Bank continues to strengthen its retail and corporate banking segments, aiming for sustainable growth while maintaining asset quality.

Infosys Limited (INFY) (-7.07%)

Financials:

Revenue: ₹41,764 crore, up 7.6% YoY.

EBITDA: ₹12,644 crore, up 9.3% YoY.

EBITDA Margin: 30.3%.

Net Profit: ₹6,806 crore, up 11.4% YoY.

EPS: ₹16.43, up 11.4% YoY.

Operating Margin: 21.3%, up 0.8% YoY.

Free Cash Flow (FCF): ₹10,647 crore, up 59.3% YoY.

Key Highlights:

Revenue growth is seen across financial services, manufacturing, retail, and other sectors.

North America remains the largest revenue contributor.

CEO Salil Parekh granted ₹3 crore worth of Restricted Stock Units (RSUs), 5,552 shares allotted from RSU exercises, and an update in the Whistleblower policy.

Outlook:

FY25 revenue guidance was raised, reflecting strong performance and outlook.

LTIMindtree (LTIM) (-3.46%)

Financials:

Revenue: ₹96,609 million, a 7.1% increase YoY from ₹90,166 million.

EBIT: ₹13,289 million, a 4.1% increase YoY from ₹12,516 million.

EBIT Margin: 13.8%, compared to 15.4% in Q3 FY24.

Net Profit (PAT): ₹10,867 million, a 7.1% decrease YoY from ₹11,693 million.

Earnings Per Share (EPS): ₹36.8, down from ₹39.6 in Q3 FY24.

Key Highlights:

Achieved a record high of $1.68 billion in deal wins, up from $1.5 billion in the year-ago period.

Increased the number of clients contributing over $1 million to 401, up from 388 in Q3 FY24.

Total employees stood at 86,000+, with a utilization rate (excluding trainees) of 85.4%.

Outlook: LTIMindtree continues to focus on strategic growth, particularly in AI investments, to drive future performance.

Waaree Renewable Technologies Limited (WAAREERTL) (-2.40%)

Financials:

Revenue: ₹360.34 crore, an increase of 11.13% YoY from ₹324.19 crore.

EBITDA: ₹71.96 crore, down 17.13% YoY from ₹86.82 crore.

EBITDA Margin: 19.96%, a decrease from 27.09% in Q3 FY24.

Net Profit (PAT): ₹53.48 crore, a decline of 16.73% YoY from ₹64.23 crore.

Earnings Per Share (EPS): ₹5.14, down from ₹6.18 in Q3 FY24.

Key Highlights:

Interim dividend declared at ₹1.00 per equity share.

Approved undertaking EPC for the Data Centre Industry in India and globally.

Plans to amend the object clause of the Memorandum of Association to include new business activities.

Outlook: The company anticipates continued growth by expanding into the data centre EPC sector, leveraging its expertise in renewable technologies to cater to emerging market demands.

Calendars

In the coming week, We have the following quarterly results and other major events:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.