Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

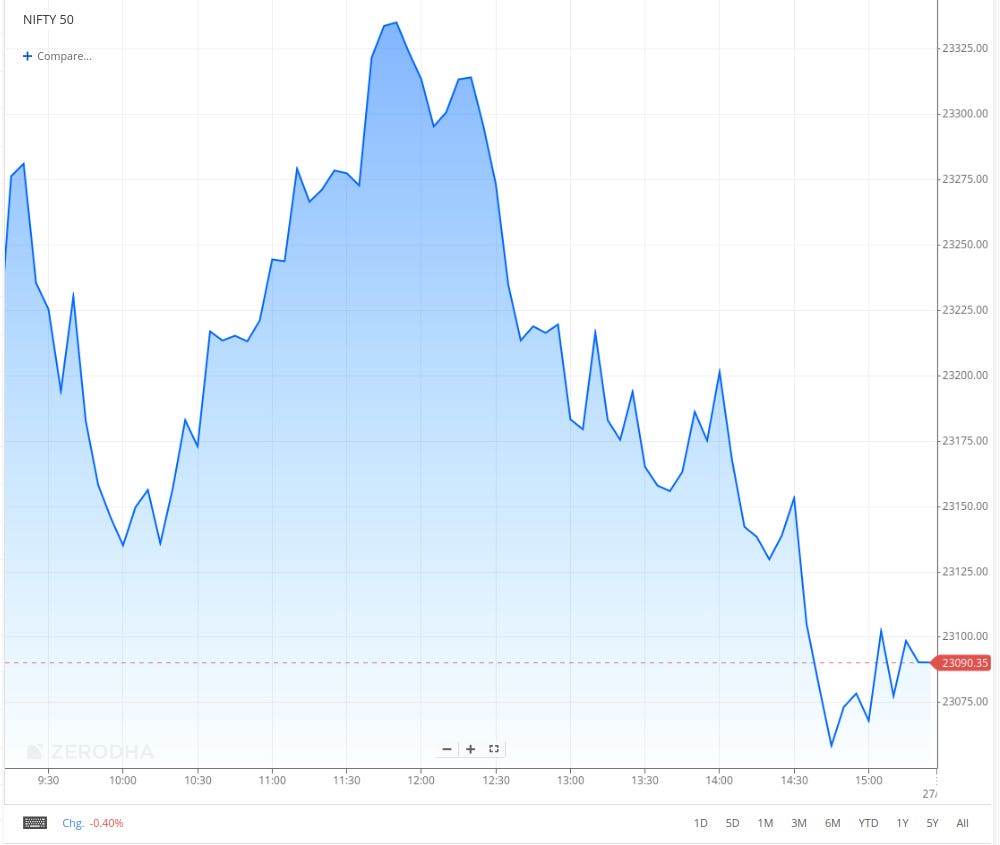

The Nifty opened 22 points lower at 23,183.90, briefly climbed to 23,270, and then gradually slid to test the 23,130 region. After stabilizing within the 23,130 to 23,170 range for about 30 minutes, the market gained momentum and moved toward the 23,250 level. It then broke through the 23,300 barrier during the second half of the trading session.

However, after reaching the day’s high of 23,347, the market reversed course and continued to decline, hitting the day’s low of 23,050 in the final hour. The Nifty eventually closed at 23,092.20, down 0.48%.

Looking ahead, market trends are likely to be shaped by global economic developments and earnings reports from key index heavyweights. Investors will keep a close watch for signs of stabilization to ease the ongoing selling pressure, especially with the Union Budget session scheduled for February 1.

Broader Market Performance:

The broader market had a tough day today, underperforming the headline indices. On the NSE, 635 stocks advanced, 2,183 declined, and 73 remained unchanged.

Sectoral Performance:

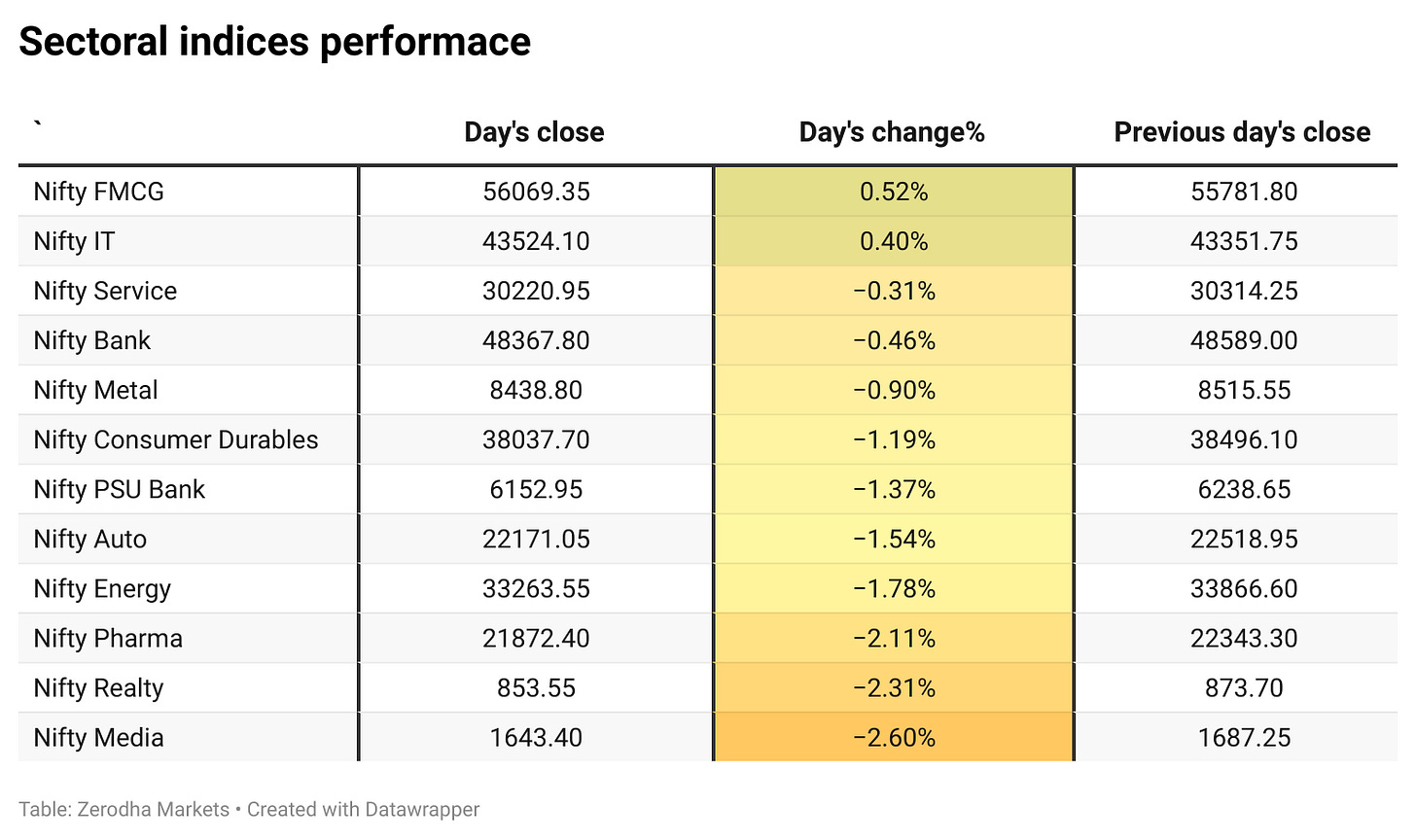

The overall sectoral performance was very negative, with ten indices closing in the red while two ended in the green. Nifty FMCG and IT closed higher by 0.52% and 0.40% respectively, whereas Nifty Media fared the worst, falling by 2.60%.

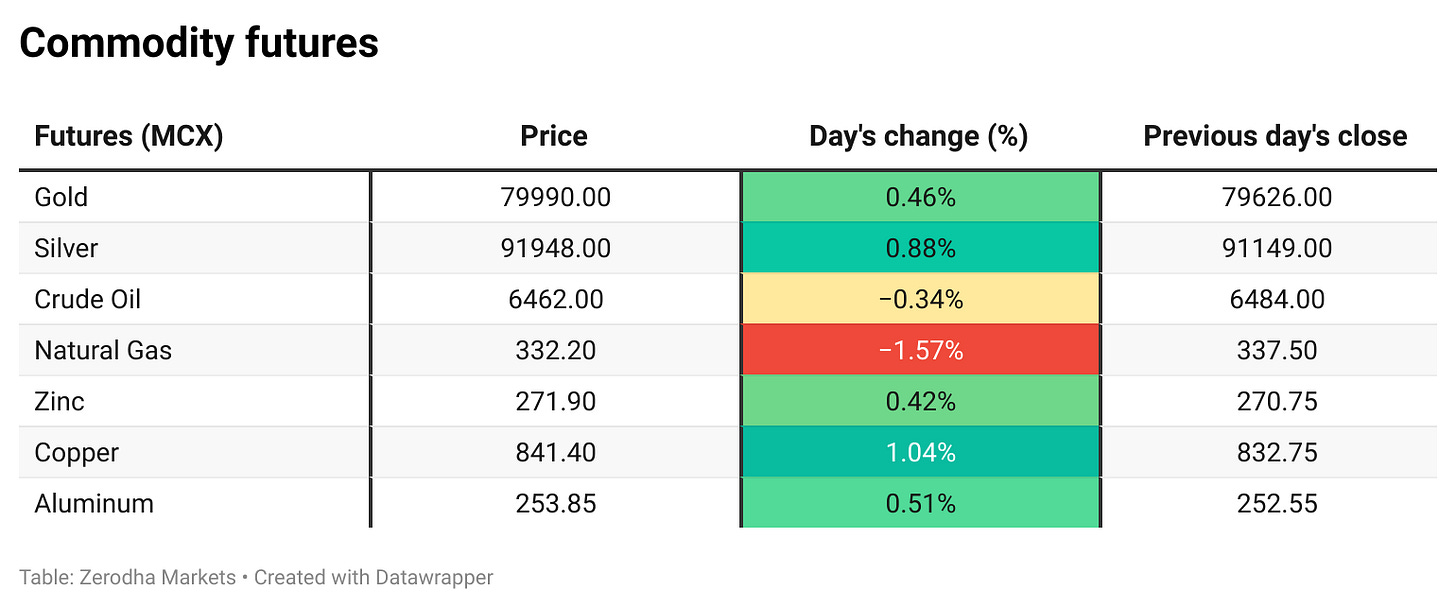

Note: The above numbers for Commodity futures were taken around 4 pm.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 30th January:

The maximum Call Open Interest (OI) is observed at 23,500, followed by 23,200 and 23,300. Meanwhile, the maximum Put Open Interest (OI) is at 23,000, followed by 22,800.

Immediate support is identified in the 23,000–22,800 range, while resistance is expected between 23,400 and 23,550.

Note: OI is subject to multiple interpretations but generally, in a falling market if there is an increase in the call OI, it indicates resistance, and in a rising market, if there is an increase in the put OI, it indicates support.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

The HSBC India Composite PMI fell to 57.9 in January 2025 from 59.2 in December, reflecting slower growth in services but stronger factory activity. Employment reached a record high, while cost pressures rose, particularly in services. Business sentiment improved among manufacturers. Dive deeper

In manufacturing, the PMI rose to 58 in January 2025 from 56.4 in December, marking the fastest growth since July. Output and new orders strengthened, driven by export demand, while job creation and input purchases increased. Finished goods stocks declined, but input cost inflation eased, offering some relief. Dive deeper

Tata Electronics has acquired a 60% stake in Pegatron Technology India, strengthening its role in Apple's iPhone manufacturing ecosystem. The deal includes team integration and rebranding of Pegatron India. Dive deeper

Exicom Tele-Systems Ltd. has received an advance purchase order worth ₹1,412 crore from Rail Vikas Nigam Ltd. for supplying telecom equipment under Bharat Net Phase III in Uttar Pradesh. The order includes power systems and racks over three years, along with a 10-year maintenance contract. Dive deeper

Lloyds Engineering Works Limited has increased its stake in Lloyds Infrastructure and Construction Limited (LICL) to 24.50%, making it an associate company. The acquisition, valued at ₹14.21 crore, is expected to be completed within 10-15 days. Dive deeper

The Great Eastern Shipping Company has contracted to sell its 2011-built Supramax Dry Bulk Carrier, Jag Rishi (56,719 dwt), to an unaffiliated third party. The vessel is set to be delivered by Q4 FY25. This sale reduces the company’s fleet to 39 vessels, including 13 dry bulk carriers. Dive deeper

NTPC Renewable Energy Limited (NTPC REL) has won a 300MW solar project in NHPC’s e-reverse auction, including a 150MW/300MWh Energy Storage System. The auction concluded on January 23, 2025, and NTPC REL is awaiting the Letter of Award from NHPC. Dive deeper

LTIMindtree has appointed Venu Lambu as CEO (Designate) and Whole-time Director, effective immediately. Lambu, with over 30 years of experience, will work alongside CEO Debashis Chatterjee for a smooth transition. Dive deeper

India has become the largest importer of Kenyan tea, with imports rising sharply in 2024, sparking concerns among local producers about oversupply and quality dilution. Industry experts warn that cheaper imports may impact the reputation and pricing of Indian tea. Dive deeper

Tejas Networks has appointed Sanjay Malik, former India Country Head of Nokia, as EVP - Chief Strategy & Business Officer. Dive deeper

Coal India Limited (CIL) has announced the appointment of Mr. Achyut Ghatak as Director (Technical), effective January 23, 2025. He brings extensive experience in underground mining operations, project planning, and technical research. Dive deeper

Max Estates Limited has acquired a 10.33-acre mixed-use land parcel in Noida for ₹711 crore, offering a development potential of 2.6 million sq. ft. with a 40:60 residential-commercial mix. The project is expected to generate a Gross Development Value of over ₹3,000 crore and an annual rental income potential exceeding ₹140 crore. Dive deeper

Suzlon and Torrent Power have reached a significant milestone of 1 GW in wind energy capacity with a new 486 MW order. The latest project, featuring 162 S144 wind turbine generators of 3 MW each, will be implemented in Gujarat's Bhogat region. Dive deeper

Government Pension Fund Global reduced its stake in Home First Finance Company India Ltd by selling 13,076 shares via open market transactions, lowering its holding to 4.3041% from 4.3186% as of January 22, 2025. Dive deeper

Gabriel India Limited has entered into an agreement to acquire fixed assets and inventory from Marelli Motherson Auto Suspension Parts Pvt. Ltd. (MMAS) for ₹600 million, subject to customary approvals. Dive deeper

Kalpataru Projects International Limited (KPIL) has received new orders worth ₹2,038 crore in its Transmission & Distribution business across domestic and international markets, along with a building project in India. Dive deeper

Indus Towers Limited, a leading telecom infrastructure provider, has received board approval to explore opportunities in the EV charging infrastructure sector. The company has initiated pilot projects in Gurugram and Bengaluru, leveraging its expertise in space, power, and operations management. Dive deeper

Paytm clarified that it has not received any notice from the Enforcement Directorate (ED) regarding a crypto scam and stated that the case relates to September 2022. The company emphasized that the investigation is focused on third-party merchants, not Paytm or its subsidiaries. Dive deeper

India’s data centre market is projected to see 450 MW in demand and 600 MW in supply by 2025, driven by cloud adoption and digital expansion. The market is expected to reach 3,400 MW by 2030. Mumbai led absorption in 2024, with demand extending to Tier-II and Tier-III cities due to 5G expansion. Dive deeper

JioCoin, developed in partnership with Polygon Labs, is a token integrated into Jio’s digital ecosystem. It cannot be traded or invested in like traditional cryptocurrencies but can be earned through the JioSphere app, with potential use for Jio services. The project aims to introduce Web3 technology to Jio's large user base. Dive deeper

Adani Group has denied reports of its 484 MW wind power projects in Sri Lanka being cancelled, stating that the government’s tariff review is a routine process under the new administration. The company reaffirmed its commitment to investing $1 billion in Sri Lanka’s green energy sector. Dive deeper

What’s happening globally

WTI crude oil futures traded around $74.5 per barrel on Friday, facing their worst week since November after President Trump urged lower prices. His call for OPEC action at Davos added to market concerns over potential tariffs impacting global demand. On the supply side, US crude inventories fell for the ninth straight week, while gasoline stocks continued to rise. Dive deeper

The Bank of Japan raised its key interest rate by 25 basis points to 0.5%, the highest in 17 years, citing wage growth and inflation progress. It marked the third hike since ending negative rates in March 2024, with further increases signalled. The BoJ revised its FY 2024 inflation forecast to 2.7% and trimmed GDP growth to 0.5%. Dive deeper

Silver prices rose above $30.70 per ounce, nearing six-week highs, amid expectations of Federal Reserve rate cuts and ongoing supply concerns. A weaker dollar and strong industrial demand continue to support the metal's outlook. Dive deeper

The 10-year US Treasury yield fell to 4.63% after President Trump called for rate cuts, though the Fed is expected to hold steady next week. Markets anticipate a cut in July, while Trump's recent tariff threats and investment plans may influence inflation. Dive deeper

Taiwan’s economy grew by 1.84% in Q4 2024, below expectations, with slower domestic demand offset by higher investments and strong export momentum in Artificial Intelligence (AI) and Information and Communication Technology (ICT) products. Dive deeper

Japan’s inflation rose to 3.6% in December 2024, the highest since January 2023, driven by food and energy costs after subsidy removals. Core inflation hit a 16-month high of 3.0%, while monthly CPI increased by 0.6%, the highest in 14 months. Dive deeper

The Shanghai Composite gained 0.7% to 3,253, and the Shenzhen Component rose 1.15% to 10,293 after Beijing encouraged long-term funds to boost equity investments. The People’s Bank of China kept its lending rate steady at 2%, while President Trump indicated a preference for a deal with China over tariffs. Dive deeper

The UK GfK Consumer Confidence Index fell to -22 in January 2025, the lowest since November 2023, missing forecasts of -18. All survey components declined amid rising economic concerns, while higher business taxes added to cautious sentiment. Dive deeper

Singapore’s central bank eased monetary policy for the first time since 2020, slowing the Singapore dollar’s appreciation to address trade concerns and moderating inflation. The MAS expects GDP growth to slow from 4% in 2024 to 1-3% in 2025, with inflation forecast at 1-2%. Dive deeper

Japan’s manufacturing PMI fell to 48.8 in January 2025 from 49.6, marking the steepest contraction since last March. Output and new orders declined further, while employment rose for a second month. Business sentiment stayed positive. Dive deeper

Australia’s Manufacturing PMI rose to 49.8 in January 2025 from 47.8, the highest in a year, though contraction persisted. Output stabilized, but export orders fell, and job cuts continued. Higher input costs pushed selling prices up, while business confidence softened. Dive deeper

Puma shares declined following lower-than-expected Q4 sales and a drop in annual profit, raising concerns about its competitive position. The company is focusing on brand growth and cost-cutting initiatives to improve profitability, with further details expected in its upcoming full-year report. Dive deeper

Venture Global priced its IPO at $25 per share, valuing the company at over $60 billion, below its initial target. The offering raised $1.75 billion amid investor caution. The listing follows Trump’s decision to resume LNG terminal licensing. Venture Global, known for modular LNG facility construction, faces arbitration claims over contract disputes with major customers. Dive deeper

Quarterly results

In this section, we'll dive into all the key highlights from today's intriguing results, covering the most impactful performances and standout moments. The numbers are comparable on a year-on-year (YoY) basis.

Mphasis (MPHASIS) (3.10%)

Financials:

Revenue: ₹2,349.86 crore, up 5.7% YoY.

EBIT: ₹545.5 crore up by 0.2% QoQ; EBIT margin at 15.3% vs. 15.4% in Q2 FY25

Net Profit (PAT): ₹376.43 crore, down 6.3% YoY.

Total Contract Value (TCV): ₹2,900 crore up 46% YoY

Key Highlights:

The revenue from operations rose by 5.7% YoY.

The company made several acquisitions, including Kore.ai, eBecs, and Sonnick Partners LLC, which are expected to enhance its capabilities in AI, Salesforce, and business transformation services.

Outlook:

Gradual recovery in BFS and mortgage segments is expected to support growth.

Optimistic on discretionary spending revival in domestic markets and regulatory support in the US.

Sona BLW (SONACOMS) (-3.23%)

Financials:

Revenue: ₹868 crore, up by 11% from ₹781.7 crore.

EBITDA: ₹234.2 crore, up by 0.7%.

EBITDA margin at 27% down from 29.7%.

Net Profit (PAT): ₹151 crore, up by 13.8% from ₹132.7 crore.

Key Highlights:

A dividend of ₹1.60 per equity share was declared for FY25.

Global market share for differential gears increased from 8.1% to 8.8%.

EV programs accounted for 76% of the net order book, which stood at ₹23,200 crore.

Added one new EV program, reaching a total of 57 programs across 32 customers.

Outlook:

Strong momentum in electrification initiatives with increasing contributions from BEV and EV segments.

HPCL (HINDPETRO) (-2.55%)

Financials:

Revenue: ₹1,19,415 crore, up by 0.35% from ₹1,19,000 crore.

Net Profit (PAT): ₹3,023 crore, up by 471% from ₹529 crore.

Gross Refining Margin (Apr-Dec): $4.73 per barrel, down from $9.84 per barrel in the previous year.

Key Highlights:

Crude throughput rose to 6.47 MMT, up by 21.1% from 5.34 MMT last year.

Quarterly market sales increased to 12.32 MMT, up by 8.5% from 11.36 MMT.

Significant profit growth driven by high marketing margins, declining crude oil prices, and improved domestic sales.

Outlook:

Continued focus on enhancing domestic sales and operational efficiency to sustain profitability despite lower refining margins.

Dr. Reddy's (DRREDDY) (-5.04%)

Financials:

Revenue: ₹8,358.6 crore, up by 15.85% from ₹7,214.8 crore.

EBITDA: ₹2,298 crore, up by 8.9%, EBITDA margin at 27.5% down from 29.3%.

Net Profit (PAT): ₹1,413.3 crore, up by 2.5% from ₹1,378.9 crore.

Key Highlights:

Newly acquired nicotine replacement therapy (NRT) business contributed ₹605 crore to revenue and ₹124 crore to profit before tax.

Excluding the NRT acquisition, underlying revenue growth stood at 7.5%.

Double-digit growth supported by new launches and improved operational efficiencies.

Outlook:

Continued focus on leveraging recent acquisitions, new product launches, and operational efficiencies to drive growth. Commitment to affordability and innovation remains a key priority.

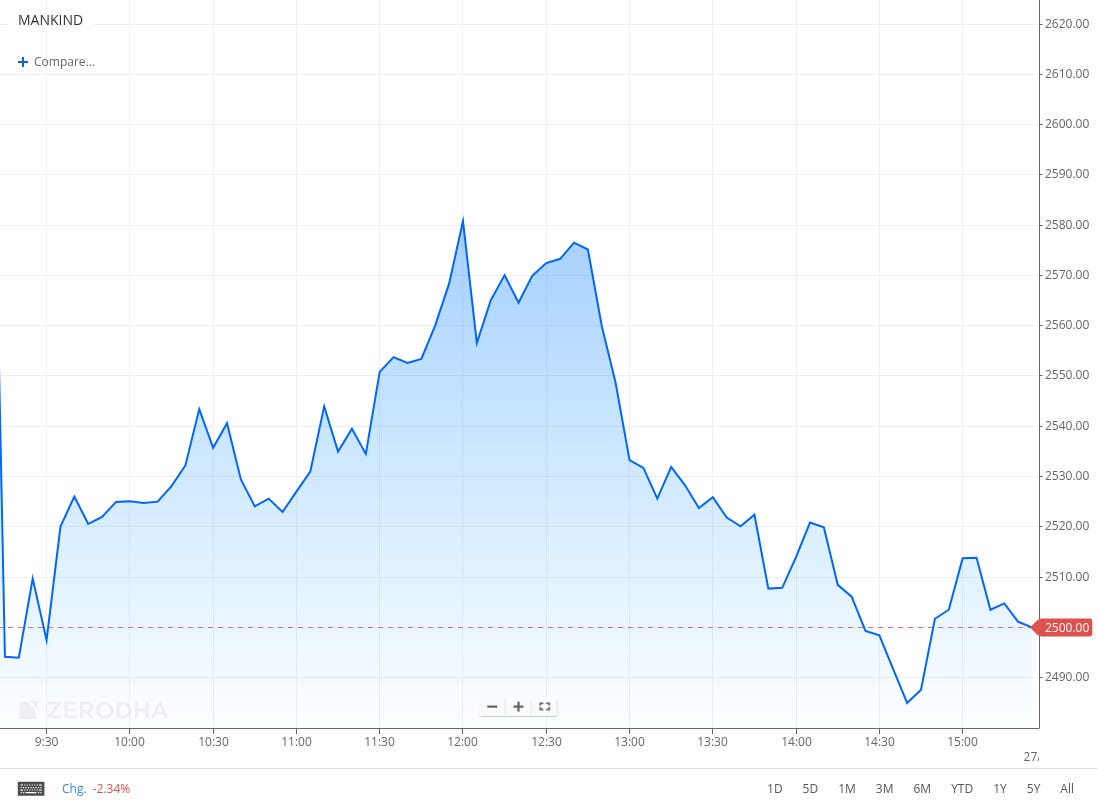

Mankind Pharma (MANKIND) (-4.86%)

Financials:

Revenue: ₹2,396.57 crore, up by 1.61% from ₹2,358.57 crore.

EBITDA: ₹810.75 crore, up by 20.95% from ₹670.34 crore.

Net Profit (PAT): ₹416.38 crore, down by 14.51% from ₹487.07 crore.

EPS: ₹10.35, down from ₹12.16.

Key Highlights:

Modest revenue growth with strong EBITDA performance driven by operational efficiencies.

The decline in net profit and EPS reflects increased costs or other non-operational impacts.

Outlook:

Focus on sustaining operational improvements while addressing profit margin challenges to enhance financial performance.

Indus Towers (INDUSTOWER) (0.37%)

Financials:

Revenue: ₹7,547 crore, up by 4.8% from ₹7,199 crore.

EBITDA: ₹6,997 crore, up by 93.2% from ₹3,622 crore.

Net Profit (PAT): ₹4,003 crore, up by 159.9% from ₹1,541 crore.

Key Highlights:

Significant collections of overdue payments from Vodafone Idea boosted financial performance.

Tower and colocation additions strengthened operational metrics, with a net lean colocation addition of 132 and lean colocations at 11,492.

The average sharing factor per tower at 1.65.

Indus Towers became a subsidiary of Bharti Airtel Limited as of December 31, 2024, following changes in board composition.

Outlook:

Growth is expected to be driven by network expansion from major customers and continued rollouts by others, leveraging the company’s dominant market position and execution capabilities.

Adani Green Energy (ADANIGREEN) (-1.76%)

Financials

Revenue: ₹2,365 crore, up by 2.3% from ₹2,311 crore.

EBITDA: ₹1,601 crore, down by 4% from ₹1,666 crore.

EBITDA margin at 67.7% down from 72.1%/.

Net Profit: ₹474 crore, up by 85.2% from ₹256 crore.

Key Highlights:

Greenfield capacity additions of 3.1 GW boosted operational performance.

Development is underway for the world's largest renewable energy plant in Khavda, Gujarat, and large-scale projects in Rajasthan.

Strategic focus on battery energy storage systems (BESS) to enable renewable growth and grid integration.

Outlook: The company remains focused on capacity expansion and innovation in renewable technologies to drive future growth and improve operational efficiency.

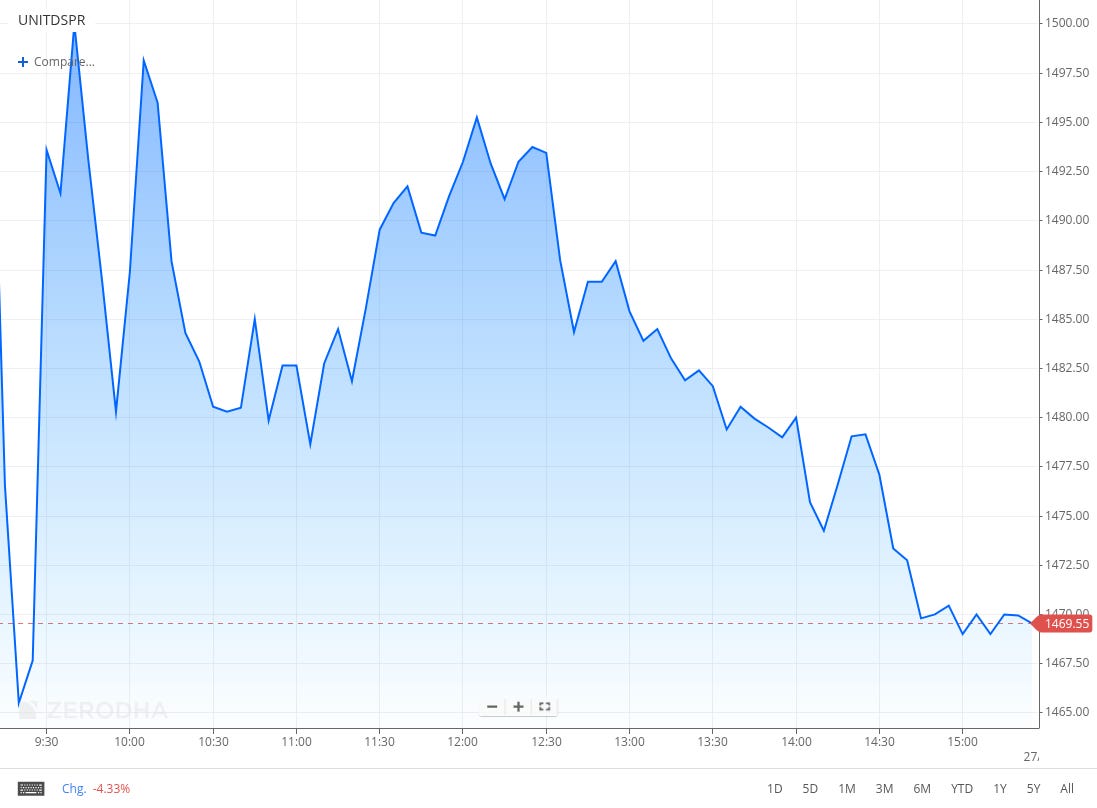

United Spirits (UNITDSPR) (-2.06%)

Financials:

Revenue: ₹7,732 crore, up by 11% from ₹6,962 crore.

Net Profit (PAT): ₹335 crore, down by 4.3% from ₹350 crore.

Total Expenses: ₹7,256 crore, up by 10.7% from ₹6,555 crore.

Key Highlights:

Profit impacted by higher expenses and a ₹65 crore charge for severance costs related to a closed unit.

Strong revenue growth is driven by consistent demand in core operations.

Outlook: The company aims to optimize cost structures and streamline operations to enhance profitability in upcoming quarters.

Nippon Life India (NAM-INDIA) (-5.08%)

Financials:

Revenue: ₹545.4 crore, up by 39% from ₹392.3 crore.

EBITDA: ₹377.6 crores, up by 48.8% from ₹253.8 crores.

EBITDA margin at 69.2% up from 64.7%.

Net Profit (PAT): ₹296 crore, up by 11.8% from ₹264.7 crore.

Key Highlights:

Strong revenue and profit growth driven by robust performance in asset management operations.

Margin improvement reflects enhanced operational efficiency.

Outlook:

Continued focus on scaling operations and improving profitability to sustain growth momentum.

Ujjivan Small Finance Bank (UJJIVANSFB) (-4.37%)

Financials:

Revenue (NII): ₹886.7 crores, up by 3.2% YoY.

Net Profit (PAT): ₹108.6 crores, down by 63.8% YoY.

Key Highlights:

GNPA increased to 2.68%, up from 2.52% in Q2FY25; Net NPA remained flat at 0.56%.

Loan book grew 9.8% YoY to ₹30,466 crores, deposits up 16.3% YoY to ₹34,494 crores; CASA deposits at ₹8,662 crores, up 15% YoY, with 96% collection efficiency.

Outlook:

Gross loan book and deposit growth is expected to remain strong.

Continued improvement in collection efficiency and portfolio quality.

Cyient (CYIENT) (-23.38%)

Financials:

Revenue: ₹1,480 crores, up by 2.1% QoQ.

EBIT: ₹200 crores, with a margin of 13.5%.

Net Profit: ₹124 crores, down by 28.3% YoY.

Key Highlights:

Cyient won 13 large deals, contributing to a contract value of 2.34 crore.

DET segment’s PAT showed a decline despite record order intake.

JSW Steel (JSWSTEEL) (0.27%)

Financials:

Net Profit: ₹717 crore, down 70% YoY.

Revenue: ₹41,378 crore, down slightly by 1% YoY.

EBITDA: ₹5,579 crore.

Key Highlights:

The net profit was impacted by a comprehensive loss of ₹1,391 crore, an exceptional item of ₹103 crore, and higher deferred taxes.

Maintenance activity at Dolvi's blast furnace (Oct-Nov 2024) affected production and capacity utilisation.

The net debt decreased by 2.3% sequentially to ₹80,921 crore in Q3 FY25, with new borrowings of ₹3,687 crore and repayments of ₹3,645 crore.

Outlook: The company is working on expanding its capacity, with projects planned to increase output by 2027 and beyond. The company remains focused on growth amid operational challenges.

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Perplexity CEO Aravind Srinivas, CEO, Perplexity on training foundational AI models to make them open source

“I am ready to invest a $1mm personally and 5 hours/week of my time into the most qualified group of people that can do this right now for making India great again in the context of AI. Consider this as a commitment that cannot be backtracked. The team has to be cracked and obsessed like DeepSeek team and has to open source the models with MIT license,” - Link

Rishad Premji, Executive Chairman, Wipro

The successful adoption of artificial intelligence depends not only on nurturing talent but also on reskilling the workforce.

“The advent of any technology creates opportunities, but the technology itself has limited bearing unless it is leveraged effectively,” At Wipro, the company has made AI pervasive by fostering a strong "mindset, toolset, and skill" set around AI to “operate better, manage better, deliver better, and ultimately change the game.” - Link

Calendars

In the coming days, we have the following major events, corporate actions, and upcoming earnings releases:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

Wonderful report. Thanks!

Well done