Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real time by Tijori.

Market Overview

Nifty opened flat at 23,055.75, dipped near 23,000 within the first 15 minutes, and then quickly recovered 170 points. After consolidating in a range for some time, it moved higher to 23,235.50. However, after hovering around the 23,200 level for an hour, the index started declining post 1 PM, witnessing an intraday drop of nearly 150 points in just 45 minutes. In the final 90 minutes, markets remained range-bound and eventually closed flat at 23,031.40, down 0.06%.

Market sentiment remained weak, weighed down by concerns over Trump’s proposed tariffs and overall softness in the broader market. Looking ahead, Nifty is expected to take cues from global developments, including Prime Minister Modi’s visit to the US, domestic economic factors, and key market events as the final phase of the earnings season unfolds.

Broader Market Performance:

Although the broader market saw a slight decline in advance-to-decline ratios, It outperformed the headline index, Out of 2,893 stocks traded on the NSE, 1,353 advanced, 1,472 declined, and 68 remained unchanged on the NSE.

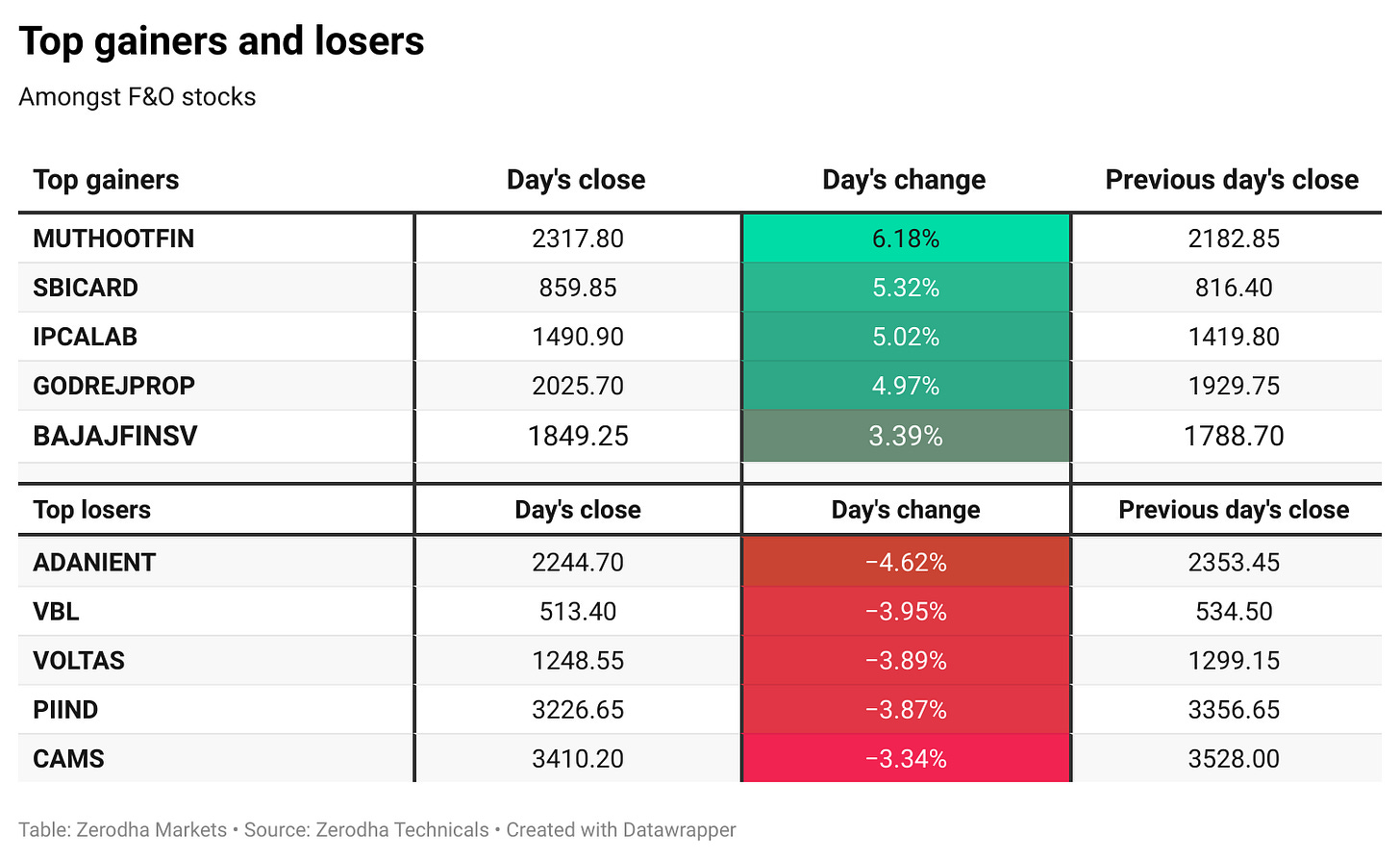

Sectoral Performance:

The top-performing sector of the day was Nifty Pharma, which gained 1.35%, leading the market with strong momentum. On the other hand, the worst-performing sector was Nifty IT, which saw a decline of 1.00%. In terms of overall market sentiment, four sectors closed in the green (Nifty Pharma, Nifty Metal, Nifty Realty, and Nifty Media), while eight sectors ended in the red, indicating a broader negative trend across most industries.

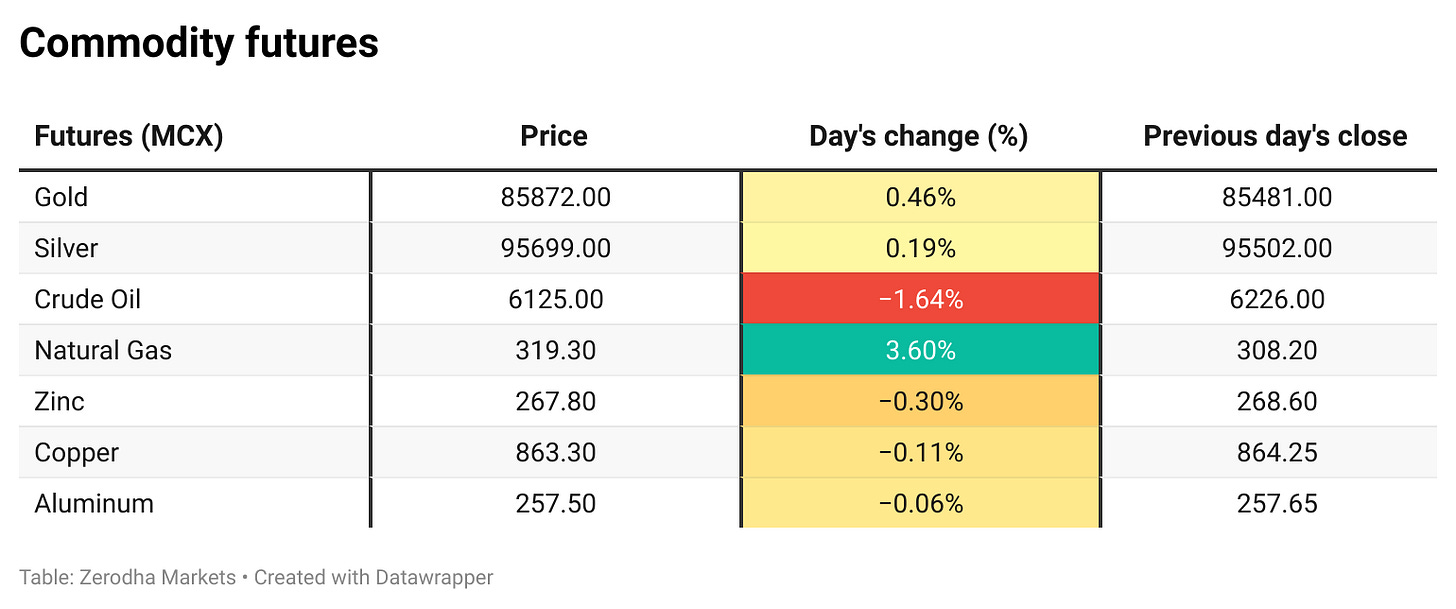

Note: The above numbers for Commodity futures were taken around 4 pm.

Net Flow Breakdown for the day:

FII: Net outflow of ₹2,789.91 crore (Bought ₹12,124.00 crore, Sold ₹14,913.91 crore)

DII: Net inflow of ₹2,934.50 crore (Bought ₹13,148.49 crore, Sold ₹10,213.99 crore)

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 20th February:

The maximum Call Open Interest (OI) is observed at 23,500, followed by 23,400. Meanwhile, The maximum Put Open Interest (OI) is at 23,000, followed by 22,800.

Immediate support is identified in the 22,900–22,800 range, while resistance is expected between 23,400 zones followed by 23,500.

Note: OI is subject to multiple interpretations, but generally, an increase in the call OI indicates resistance in a falling market, and an increase in the put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

SEBI released the Industry Standards Recognition Manual to guide the formation and functioning of Industry Standards Fora (ISFs). Initially launched as a pilot in July 2023, ISFs help market participants implement regulatory guidelines while ensuring compliance and governance. Dive deeper

The RBI has lifted restrictions on Kotak Mahindra Bank, allowing it to issue new credit cards and onboard customers online after the bank addressed IT compliance concerns. The ban, imposed in April 2024, had an estimated financial impact of ₹450 crore annually. The bank has since improved digital services and launched a new mobile app. Dive deeper

ONGC NTPC Green Pvt. Ltd. has signed a Share Purchase Agreement to acquire a 100% stake in Ayana Renewable Power (4.1 GW platform) for ₹195 billion (~$2.3 billion), subject to regulatory approvals. Dive deeper

Mahindra Finance has approved a ₹3,000 crore rights issue to strengthen capital adequacy and support AUM growth. The Board will finalize terms, including price, entitlement ratio, and record date, subject to regulatory approvals. Dive deeper

Mahindra Lifespace Developers Limited’s Board has approved a fundraise of up to ₹1,500 crore through a rights issue of equity shares, subject to regulatory approvals. The Rights Issue Committee will finalize the terms, including pricing, entitlement ratio, and record date. Dive deeper

L&T Technology Services and Altair have launched a 5G-6G Wireless Center of Excellence to enhance connectivity and innovation across industries like telecom, mobility, and healthcare. The CoE will focus on network planning, digital twins, and AI-driven connectivity solutions to optimize wireless infrastructure. Dive deeper

RITES Ltd. and C-DAC have signed an MoU to develop IT solutions for consultancy assignments, focusing on eGovernance, cybersecurity, AI, and cloud computing. The collaboration's first phase includes developing the ‘MAITRI’ platform to digitalize trade information for seamless cargo movement between Indian and Middle Eastern ports. Dive deeper

Thomas Cook (India) Limited announced the incorporation of a new step-down subsidiary, Travel Circle International (Cyprus) Limited, under Travel Circle International (Mauritius) Ltd. The Cyprus entity aims to strengthen the company’s strategic presence in Europe, with an authorized share capital of EUR 200,000. Dive deeper

Zen Technologies showcased its latest defence and training solutions at Aero India 2025, featuring AI-driven simulations, UAV propulsion systems, and tactical engagement technologies, highlighting advancements in military preparedness and technology integration. Dive deeper

Swiggy plans to standardize a 2% collection fee for select restaurant partners but may defer the move beyond Feb. 16 following industry pushback. The change would impact about 10% of merchants, while the majority remain unaffected. Dive deeper

QIP fundraising hit a record ₹1.41 lakh crore in 2024, with real estate leading at ₹22,320 crore from eight developers and one REIT. Institutional investors remain optimistic about the sector’s long-term growth despite market volatility. Dive deeper

Prudential Plc has hired Citigroup to explore a $1 billion IPO for ICICI Prudential Asset Management, involving a partial stake divestment while ICICI Bank retains majority control. Dive deeper

Chevron is establishing a $1 billion Engineering and Innovation Excellence Center (ENGINE) in Bengaluru, its largest outside the US, to support global projects with high-end engineering, AI, and digital solutions. The centre aims to hire 600 employees by 2025, focusing on energy, carbon storage, and advanced process monitoring. Dive deeper

Tata Consultancy Services (TCS) has partnered with UPM to modernize its IT landscape using AI-powered solutions. TCS will deploy its ignio™ platform to enhance automation, improve operational efficiency, and support UPM’s 15,800 employees with AI-driven services. Dive deeper

Bank of Baroda’s board has approved raising up to ₹8,500 crore in equity capital through various modes, including QIP, by March 2028. Additionally, the board extended the timeline for raising ₹4,000 crore via AT1 and Tier II debt instruments until March 2026, as part of a previously approved plan. Dive deeper

What’s happening globally

WTI crude oil hovered around $71.20 per barrel as peace talks between the US and Russia raised speculation of reduced supply risks. The weaker sentiment was reinforced by rising US inflation, a hawkish Fed outlook, and a larger-than-expected 4.1 million-barrel increase in US crude stockpiles. Dive deeper

US annual inflation rose to 3% in January 2025, exceeding forecasts of 2.9%, with energy costs increasing for the first time in six months. Core inflation unexpectedly climbed to 3.3%, while monthly CPI rose 0.5%, driven by shelter costs. Dive deeper

US producer prices are expected to rise 0.3% in January, with annual inflation easing to 3.2% from 3.3%. Core PPI may see its largest monthly gain in four months at 0.3%, while annual core inflation likely slowed to 3.3%. Dive deeper

The UK economy grew 0.1% in Q4 2024, beating expectations of a contraction, driven by services (+0.2%) and construction (+0.5%), while manufacturing (-0.7%) and exports (-2.5%) declined. Government spending (+0.8%) supported growth, but household expenditure remained flat. Dive deeper

Germany’s 10-year Bund yield fell to 2.47%, reversing recent gains, as optimism grew over potential Ukraine peace talks following US diplomatic efforts. Meanwhile, US-EU trade tensions and monetary policy shifts remain in focus, while Germany's political landscape faces uncertainty post-election. Dive deeper

Switzerland’s annual inflation fell to 0.4% in January, the lowest since April 2021, driven by deflation in key sectors. Core inflation rose to 0.9% from 0.7%, while monthly CPI declined by 0.1%. Dive deeper

The Central Bank of the Philippines held its key interest rate at 5.75% in February, defying expectations of a cut to 5.5%. Inflation remained at 2.9% in January, prompting an upward revision of the 2025 forecast to 3.5%. Dive deeper

Eurozone industrial production fell 1.1% MoM in December 2024, reversing a 0.4% rise in November. Declines in capital and intermediate goods offset gains in non-durable goods and energy. Among major economies, Germany, Italy, the Netherlands, and France saw declines, while Spain recorded growth. Dive deeper

European stocks gained, with the STOXX 50 hitting a 25-year high amid optimism over Ukraine talks and strong earnings. Siemens and Nestlé rose on positive results, while Unilever and Barclays fell on weak guidance. UK GDP growth also lifted sentiment. Dive deeper

European natural gas futures fell over 6.5% to below €52.5/MWh amid optimism over Ukraine peace talks and milder weather forecasts. Reports of a potential EU gas price cap also pressured prices, though low storage levels remain a concern. Dive deeper

Japan’s producer prices rose 4.2% year-on-year in January 2025, the highest since May 2023, exceeding forecasts of 4%. Gains were driven by non-ferrous metals, petroleum, and food, while chemical and steel prices declined. Monthly, prices rose 0.3%, easing from 0.4% in December. Dive deeper

Quarterly results

In this section, we'll dive into all the key highlights from today's intriguing results, covering the most impactful performances and standout moments. The numbers are comparable on a year-on-year (YoY) basis.

Ipca Laboratories (+5.01%)

Revenue: ₹2,245 crores, up by 9% YoY.

EBITDA: ₹463 crores, up by 40% YoY.

Net Profit: ₹276 crores, up by 81% YoY.

EPS: ₹9.78, up by 38% YoY.

Key Highlights:

Strong revenue growth led by a 13% increase in Indian formulations revenue and a 6% rise in exports.

EBITDA margin expanded to 19.87% from 16.10% YoY, driven by operational efficiencies and cost optimization.

The company reported a 9% increase in consolidated total income to ₹2,265.48 crores.

Improved profitability supported by higher contribution from branded generics and institutional business.

Outlook:

Ipca Laboratories remains focused on expanding its domestic and international footprint while improving margins through efficiency gains and cost control measures.

SKF India (-3.21%)

Revenue: ₹1,256 crores, up by 15% YoY.

EBITDA: ₹121 crores, down by 30% YoY.

Net Profit: ₹110 crores, down by 17% YoY.

EPS: ₹22.18, down by 17% YoY.

Key Highlights:

Revenue growth driven by strong demand across industrial and automotive segments.

EBITDA declined due to higher raw material costs and increased operating expenses.

Net profit impacted by lower margins and increased employee benefit expenses.

The company continues to invest in capacity expansion and new product innovations to strengthen market positioning.

Outlook:

SKF India remains focused on cost optimization and expanding its product offerings to improve margins and sustain long-term growth.

Lloyds Engineering Works (+1.04%)

Revenue: ₹230 crores, up by 14% YoY.

EBITDA: ₹39.3 crores, up by 10% YoY.

Net Profit: ₹33.7 crores, up by 24% YoY.

EPS: ₹0.29, up by 21% YoY.

Key Highlights:

Revenue growth supported by higher order execution and strong demand in the engineering segment.

EBITDA increased despite higher raw material costs, driven by operational efficiencies.

Continued expansion in the hydrocarbon, steel, marine, and power sectors is expected to support future growth.

Outlook:

Lloyds Engineering remains focused on order book execution, operational efficiency improvements, and diversification across high-growth industries to sustain profitability.

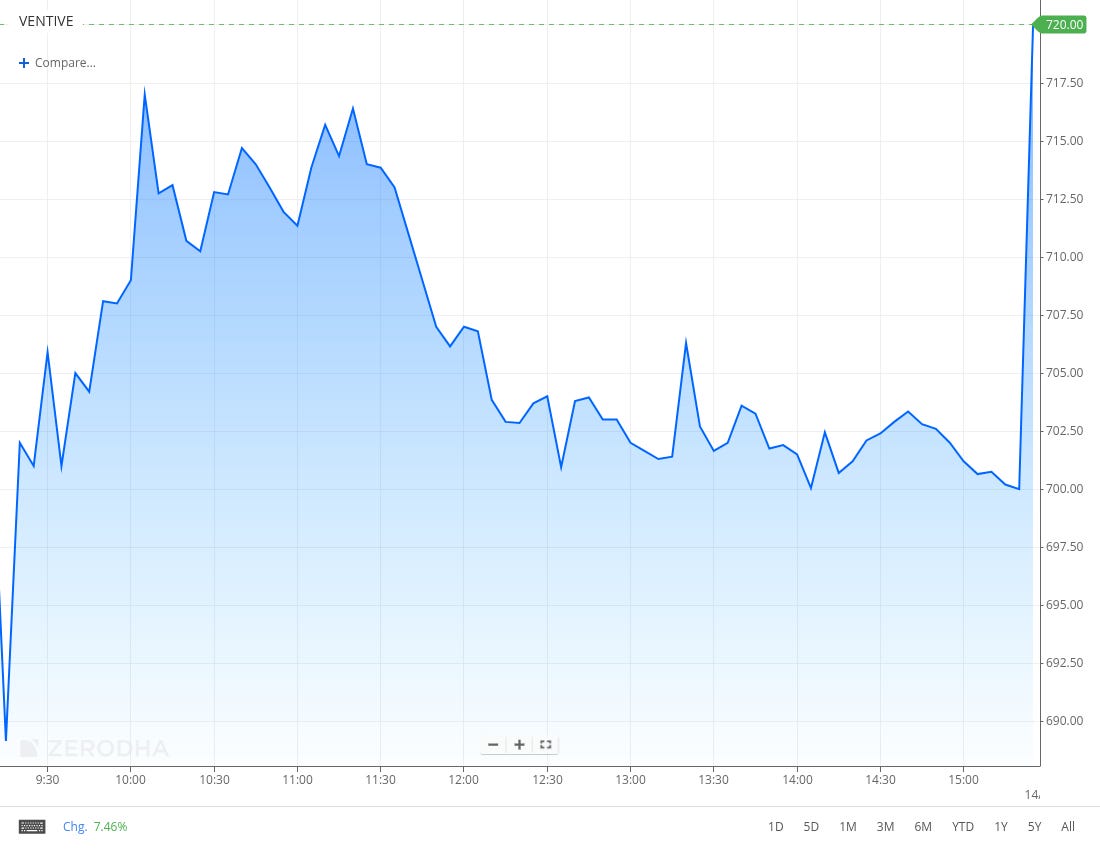

Ventive Hospitality (+0.21%)

Revenue: ₹156 crores, up by 23% YoY.

EBITDA: ₹83.8 crores, up by 13% YoY.

Net Profit: ₹29.4 crores, down by 24% YoY.

EPS: ₹1.26, down by 97% YoY.

Key Highlights:

Revenue growth driven by expansion in hospitality and leasing segments.

EBITDA improvement supported by higher occupancy rates and cost optimization.

Net profit declined due to higher operational expenses and depreciation costs.

Outlook:

Ventive Hospitality aims to expand its hospitality portfolio and enhance operational efficiencies to drive long-term profitability.

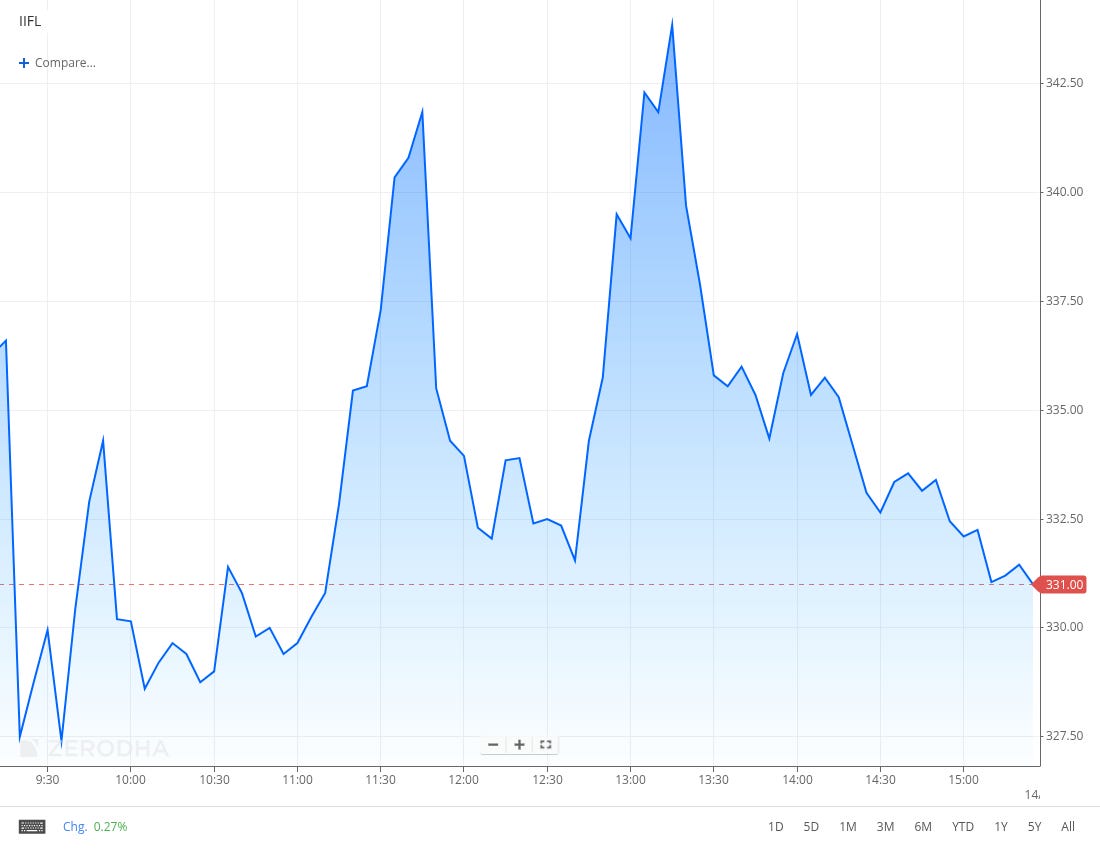

IIFL Finance (-1.24%)

Revenue: ₹2,443 crores, down by 8% YoY.

EBITDA: ₹1,136 crores, down by 33% YoY.

Net Profit: ₹81.7 crores, down by 92% YoY.

EPS: ₹0.96, down by 92% YoY.

Key Highlights:

Revenue decline due to lower interest income and reduced loan disbursements.

Net profit fell sharply, impacted by provisioning for Alternative Investment Funds (AIFs) and exceptional items.

Outlook:

IIFL Finance is prioritizing stabilizing asset quality, optimizing capital allocation, and managing risk exposure to drive long-term recovery.

Endurance Technologies (+2.37%)

Revenue: ₹2,859 crores, up by 12% YoY.

EBITDA: ₹373 crores, up by 25% YoY.

Net Profit: ₹184 crores, up by 21% YoY.

EPS: ₹13.11, up by 21% YoY.

Key Highlights:

Revenue growth driven by strong demand in the automotive components segment and higher export volumes.

The company acquired additional stake in Maxwell Energy Systems, strengthening its presence in the EV ecosystem.

Continued investments in capacity expansion and new technology adoption to support future growth.

Outlook:

Endurance Technologies remains focused on innovation, operational efficiencies, and expanding its global footprint to sustain long-term growth.

Ashok Leyland (-1.04%)

Revenue: ₹11,995 crores, up by 8% YoY.

EBITDA: ₹2,336 crores, up by 19% YoY.

Net Profit: ₹820 crores, up by 38% YoY.

EPS: ₹2.59, up by 36% YoY.

Key Highlights:

Record-high Q3 revenue and profit, driven by strong demand in the MHCV and LCV segments.

Exports grew by 33% YoY, contributing to revenue growth.

The company launched SAATHI, marking its entry into the entry-level LCV segment.

Declared an interim dividend of ₹3 per share for FY25.

Outlook:

Ashok Leyland remains focused on expanding its commercial vehicle portfolio, enhancing exports, and investing in electric and alternate fuel vehicles for sustained growth.

Siemens (-1.81%)

Revenue: ₹3,587 crores, down by 3% YoY.

EBITDA: ₹401 crores, down by 12% YoY.

Net Profit: ₹615 crores, down by 10% YoY.

EPS: ₹17.25, up by 22% YoY.

Key Highlights:

New orders grew by 20% YoY, reflecting strong future business prospects.

Revenue decline attributed to slower private sector capex spending and normalisation of demand in the Digital Industries segment.

Smart Infrastructure and Mobility businesses continued profitable growth, supported by government infrastructure spending.

Outlook:

Siemens expects continued growth in infrastructure-linked segments, supported by government capex spending, while navigating short-cycle demand fluctuations in private sector investments.

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Mr. Sandeep Kumar, Chairman, GAIL India Ltd.

“Since 2022, the prices are unviable, The new US administration and leadership is very bullish on oil and gas. We believe that more gas will be available globally at softer prices, especially to the price-sensitive areas of the consumption in the country.” - Link

Federal Reserve Chair Jerome Powell on January’s higher CPI numbers

"The CPI reading was above almost every forecast, but I just would offer ... two notes of caution,"

"One is we don't get excited about one or two good readings, and we don't get excited about one or two bad readings," Powell said. "The second thing, though, is we target PCE (personal consumption expenditures) inflation because we think it's simply a better measure of inflation. And so you need to know the translation from CPI to PCE, and we get more data on that tomorrow with the Producer Price Index," - Link

Mr. Hemant Jalan – Chairman and Managing Director, Indigo Paints Limited on demand in Rural and Urban markets

So, the definition between rural and urban becomes somewhat arbitrary. But having said that, if we look at metros, Tier 1, Tier 2, Tier 3, Tier 4, in whatever way we define it, we find the demand outlook to be bad across all size of towns. We don't find any noticeable difference between larger cities and smaller towns at this point in time.

Now there is a lot of talk that when it comes to the smaller towns, what you may call the Tier 3, Tier 4 towns, where a good harvest would influence, have a greater influence on the demand, FMCG companies are talking about some uptick that they are beginning to see in rural demand.

Since our presence in the smaller towns is very, very vast and we get a lot of higher percentage of our sale coming from the smaller towns, we hope that we will have a good Q4. But we just have to wait and watch. At the moment, I don't see too much of a difference between size of towns and the growth rate. - Link

Calendars

In the coming days, we have the following major events, corporate actions, and upcoming earnings releases:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

hello. I just wanted to double-check something. In the net inflow/outflow section it says FII bought ~13k crores and sold ~10k crores but it says net outflow ~3kr crores?