Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Market Overview

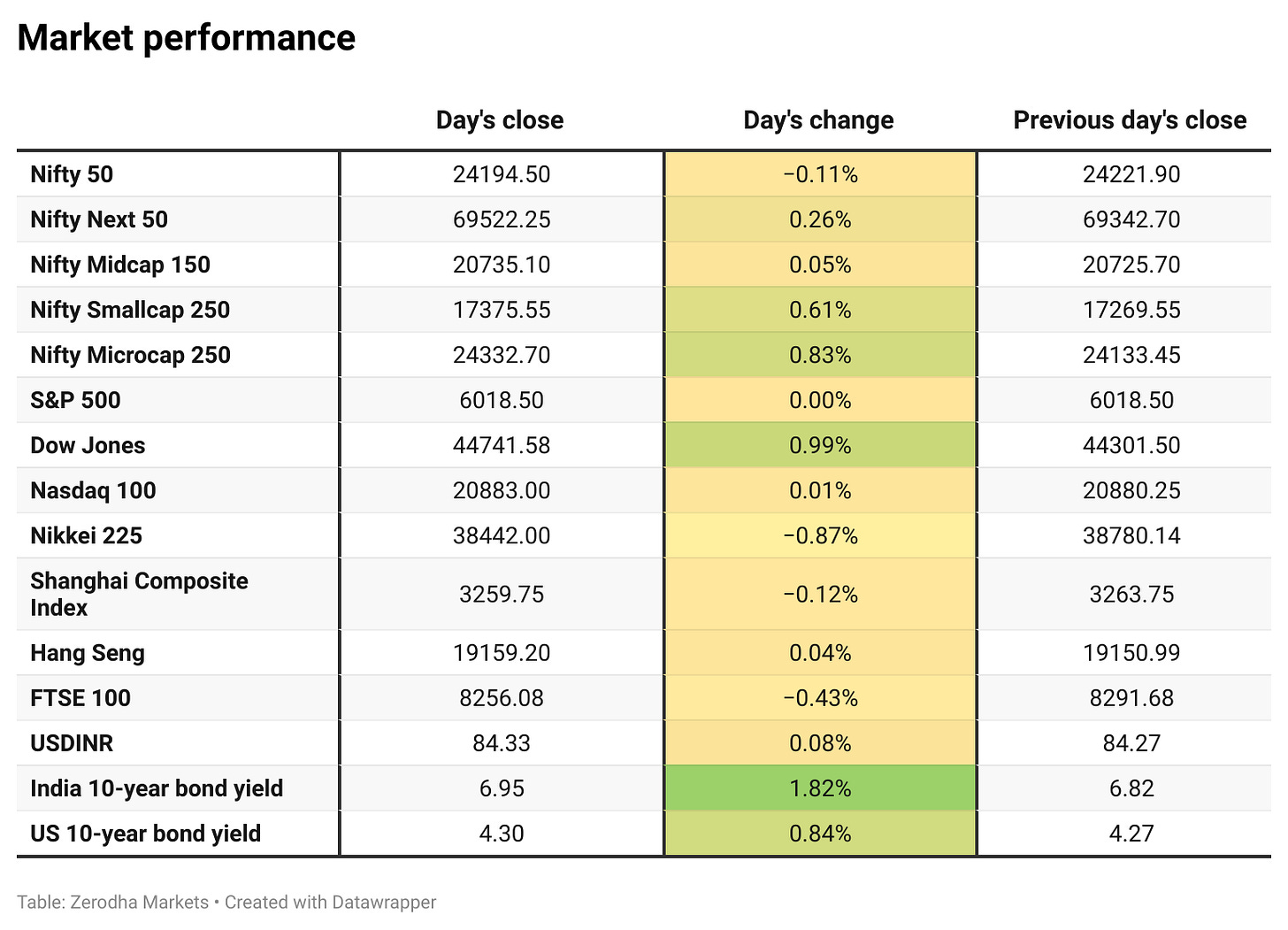

Nifty opened higher by 121 points at 24,343.30 but faced a steady decline to 24,170 within the first hour. It then traded in a narrow range between 24,150 and 24,230 for the rest of the day, eventually closing slightly lower at 24,194.50.

Market sentiment remained positive, with 1,635 stocks advancing and 1,165 declining on the NSE. Broader markets outperformed the headline indices, driven by the IT sector which is trading near all-time highs, and FMCG stocks, continuing their recovery from recent lows. Financial stocks, however, ended slightly in the red.

The market appeared to take a breather after two strong bullish sessions, as investors closely tracked global market reactions to Trump's tariff plans targeting Mexico, Canada, and China.

Note: The above numbers for Commodity futures were taken around 4 pm.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 28th November:

The maximum CE OI is at 24500 followed by 24300, and the maximum Put OI is at 24000 followed by 24300.

Immediate support on the downside can be seen at 24000, which holds the significant Put OI. Resistance is at 24300, followed by 24500, which holds the highest Call OI.

Note: OI is subject to multiple interpretations but generally, in a falling market if there is an increase in the call OI, it indicates resistance, and in a rising market, if there is an increase in the put OI, it indicates support.

Source: Sensibull

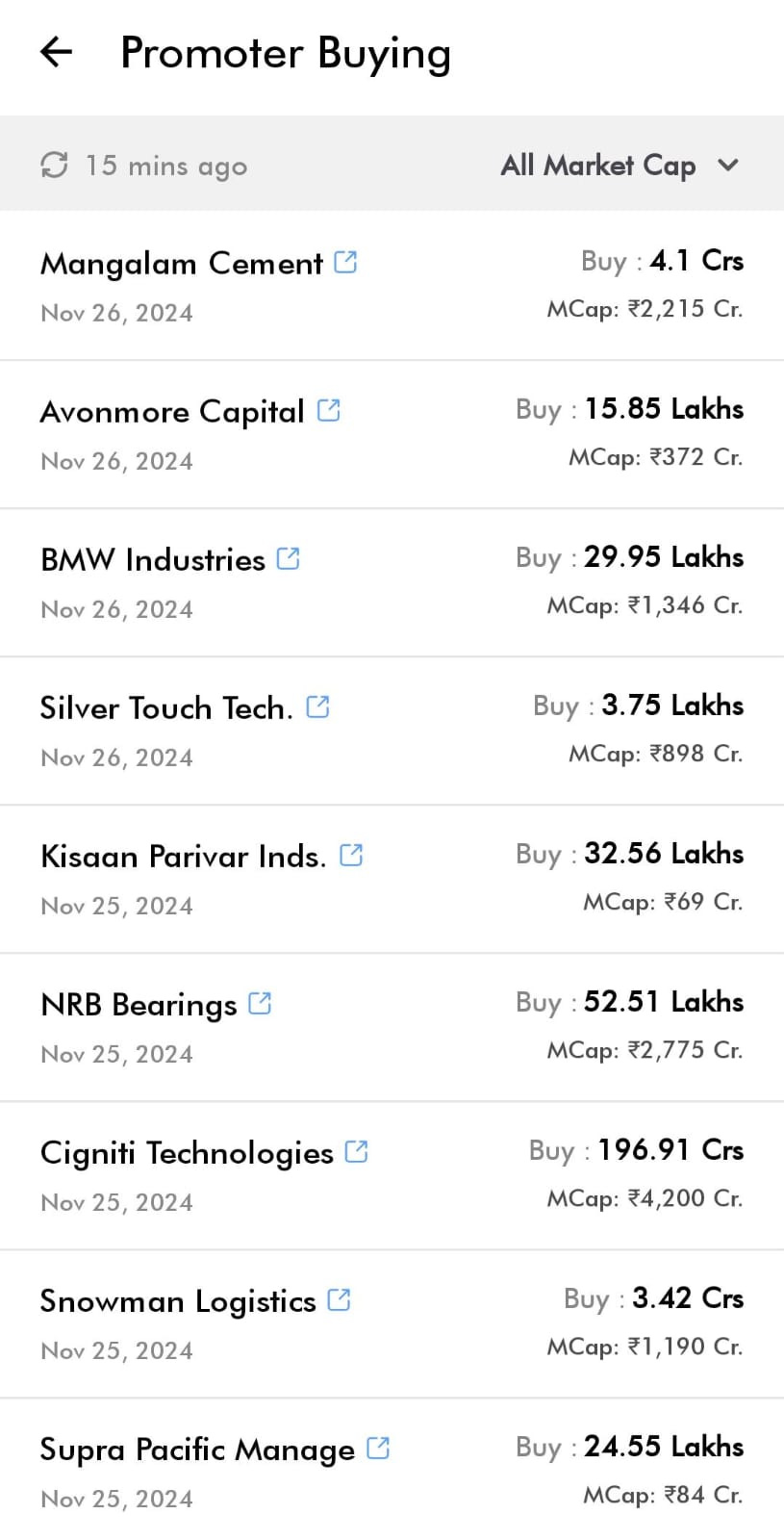

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

The Union Cabinet's in-principle approval to waive bank guarantees for spectrum purchases made up to 2022 boosted telecom stocks, with Vodafone Idea's shares rising significantly on November 26. This waiver is expected to provide major relief to Vodafone Idea, which owes ₹24,700 crore in bank guarantees and aims to ease financial pressures on telecom companies, improving their liquidity and operational efficiency.

Major credit rating agencies have revised their outlook on several Adani Group entities following U.S. indictments of Chairman Gautam Adani and others on alleged bribery charges. Moody’s downgraded the outlook for seven entities, including Adani Ports and Adani Green Energy, citing risks to funding and increased capital costs, though it affirmed their ratings. Fitch placed some Adani bonds on a negative watch, while S&P issued downgrade warnings for key entities like Adani Ports, Adani Green Energy, and Adani Electricity.

L&T Finance has partnered with Amazon Finance India to create new credit solutions that make shopping more affordable for Amazon’s customers and merchants. - Dive deeper

Hitachi Energy's shares rose 10% to ₹12,812 before closing near ₹12,337 after securing a major project with BHEL from Power Grid Corporation of India. The project involves designing 800kV, 6,000 MW, and 1,200 km HVDC terminals to transmit renewable energy from Gujarat’s Khavda to Maharashtra’s Nagpur. The Project completion is expected by 2029. - DIve deeper

The Cabinet has approved several key initiatives, including a national mission on natural farming with a ₹2,481 crore budget, ₹6,000 crore for a research journal subscription scheme, and ₹2,750 crore for Atal Innovation Mission 2.0. Additionally, plans to upgrade the PAN system have been cleared. Two hydroelectric projects in Arunachal Pradesh have been approved, with ₹1,940 crore for a 240 MW Heo project and ₹1,750 crore for a 186 MW Tato 1 project. - Dive deeper

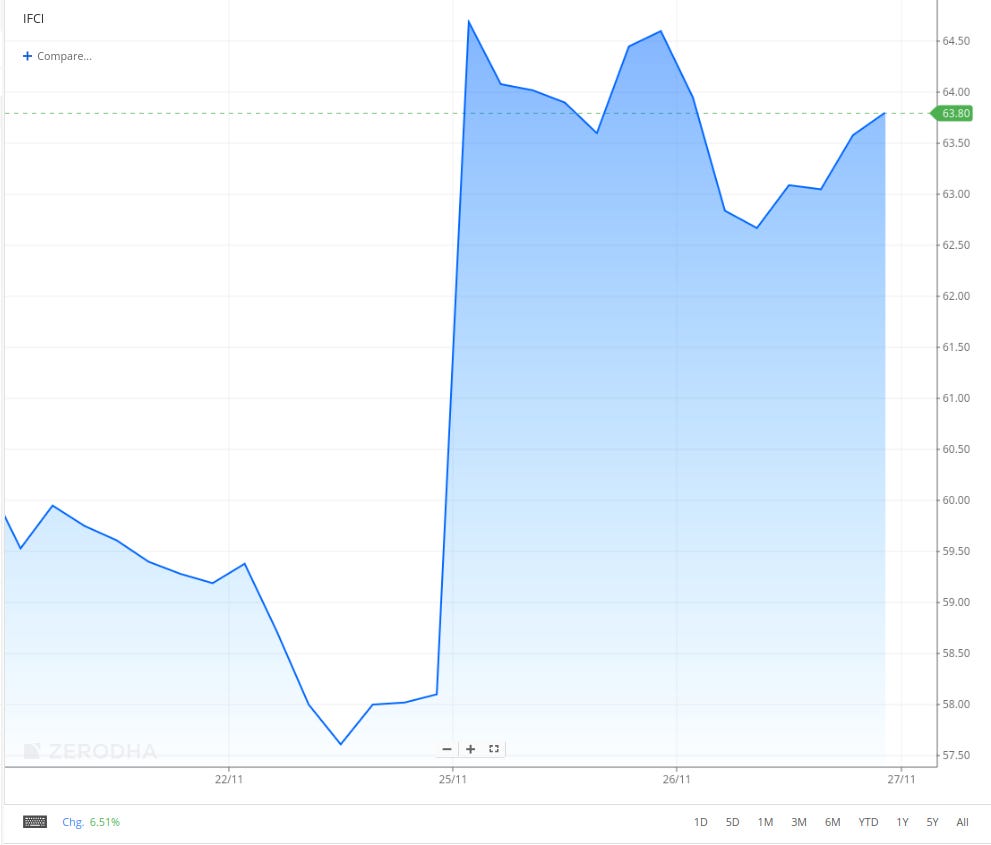

As per a Reuters report, the Indian government plans to revamp the operations of IFCI Ltd by ceasing its lending activities due to capital constraints and converting it into an infrastructure advisory firm. - Dive deeper

What’s happening globally

President-elect Donald Trump plans to impose new tariffs, including a 25% tariff on goods from Canada and Mexico and a 10% tariff on Chinese imports. These measures aim to address illegal immigration, drug trafficking, and trade imbalances. However, the proposed tariffs have raised concerns about potential trade wars, inflation, and disruptions to global supply chains, with economists warning of higher consumer prices and negative impacts on economic growth. - Dive deeper

In October 2024, Japan's corporate service inflation held steady at 2.9% year-on-year, up from 2.8% in September. This increase was driven by rising costs in sectors such as machinery repair and accommodation. - Dive deeper

Chow Tai Fook Jewellery Group Ltd., China's largest jewelry retailer, reported a 20.4% revenue decline for the six months ending September 30, 2024—the most significant drop for this period since 2016. This downturn is attributed to China's economic slowdown and record-high gold prices, which have dampened luxury spending. Despite the revenue decline, the company's operating profit increased by 4.0% to HK$6.8 billion, with an operating profit margin expansion of 400 basis points to 17.2%. The gross profit margin also improved by 650 basis points to 31.4%, benefiting from higher gold prices. - Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Umesh Revankar, Executive Vice Chairman, Shriram Finance

We have not seen any slowdown in credit demand for the company.

Govt spends on infrastructure reduced, need that to improve.

Don’t expect deterioration in MSME lending Expect double-digit growth in the gold loan portfolio. - Link

Sushanth Pai, CFO, Matrimony.com

There is euphoria around the higher number of wedding days

Profiles are bouncing back in wedding season

Expect strong billings in Q4

High competition in the matchmaking segment

Lot of new entrants in new regions; higher churn in business

Not looking at any big-ticket acquisition. - Link

Mahesh Vyas, Managing Director and CEO of Centre for Monitoring Indian Economy (CMIE)

As investments in the country are not doing well, Maharashtra is taking a big hit. Elections impacted new investment proposals and completion. New investment proposals are as of now less than ₹1 lk cr in a month vs an average of ₹6 lk cr - Link

Calendars

In the coming days, We have the following major events and corporate actions:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

Why are DII's selling is it just profit booking or portfolio rebalancing after Adani issue?