Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Market Overview

The Nifty opened 60 points lower at 23,822 and faced weakness throughout the day, closing down by 1.35% at 23,559, breaking its 200-day moving average for the first time since April 2023.

Broader market sentiment worsened, with only 419 stocks advancing while 2,393 declined on the NSE. No sectors showed any strength, as all indices ended in the red.

The downturn can be attributed to high inflation driven by rising food prices, persistent foreign investor selling, weaker earnings, a depreciating rupee, and a strong dollar, with the Dollar Index testing 106 levels, combined with overall technical market weakness.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 14th November

The maximum CE OI is at 24000 followed by 23800 and Put OI is at 23300 followed by 23500.

The addition of 71.98 lakh contracts to the 23,800 CE, 39.99 lakh to the 23,700 CE, and 45.05 lakh to the 23,300 CE indicates substantial call writing at these levels, suggesting a shift in support to lower strikes.

Immediate support on the downside can now be seen at 23500 followed by 23300 which has the maximum OI for contracts expiring tomorrow. Resistance on the upside can be seen around 23700 and 23800 levels with the upside capped at 24000.

Note: This is subject to multiple interpretations but generally, in a falling market if there is an increase in the call OI, it indicates resistance.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market.

Note: The above numbers for Commodity futures were taken around 4 pm.

What’s happening in India

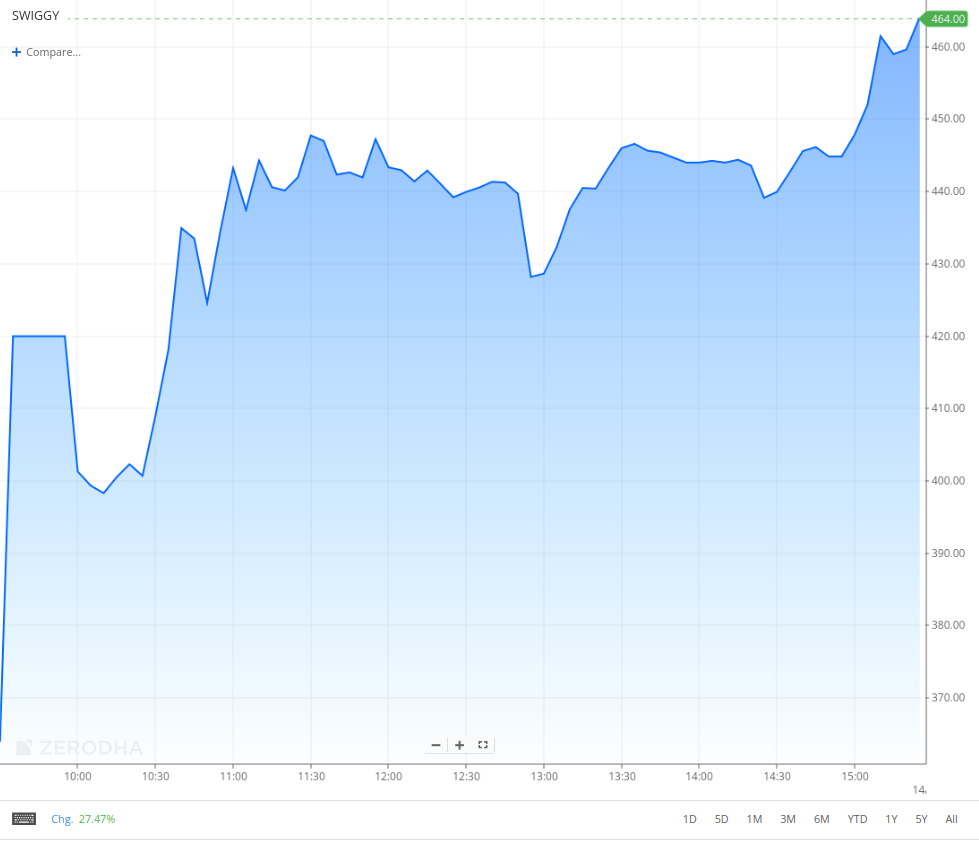

Swiggy, the Indian food delivery giant, made its stock market debut on November 13, 2024, with shares listing at ₹420 on the National Stock Exchange (NSE), reflecting a 7.69% premium over the initial public offering (IPO) price of ₹390. The stock closed at ₹456 reflecting a gain of 16.92%.

The Food Safety and Standards Authority of India (FSSAI) has recently mandated that e-commerce food business operators (FBOs) ensure all food items delivered to consumers have a minimum shelf life of 30% or at least 45 days remaining before expiration at the time of delivery. - Dive deeper

As per the Society of Indian Automobile Manufacturers (SIAM) report, In October 2024, India's automobile industry saw mixed results, with the passenger vehicle (PV) segment achieving record sales of 393,238 units, primarily driven by a 14% rise in utility vehicles, despite declines in car and van sales. The two-wheeler segment also hit a new high, with 2.16 million units sold, marking a 14.2% year-on-year growth, driven by strong sales in scooters and motorcycles, though mopeds saw a slight dip. The three-wheeler market experienced a small 0.7% decrease in sales but showed an 11% increase in registrations, reflecting the dynamic performance across different vehicle categories. - Dive deeper

Nazara Technologies Limited, a leading gaming and sports media platform, has partnered with the Open Network for Digital Commerce (ONDC) to launch "gCommerce," an innovative in-game monetization platform that integrates e-commerce within games. This initiative aims to tackle the challenges of low in-app purchase conversion rates and limited advertising revenue faced by Indian game developers. By leveraging India's growing e-commerce sector, gCommerce offers developers new, scalable revenue streams through an affiliate revenue-sharing model, enabling them to earn commissions on transactions initiated by players within the game environment. - Dive deeper

Quarterly results

In this section, we'll dive into all the key highlights from today's intriguing results, covering the most impactful performances and standout moments. The numbers are comparable on a year-on-year (YoY) basis.

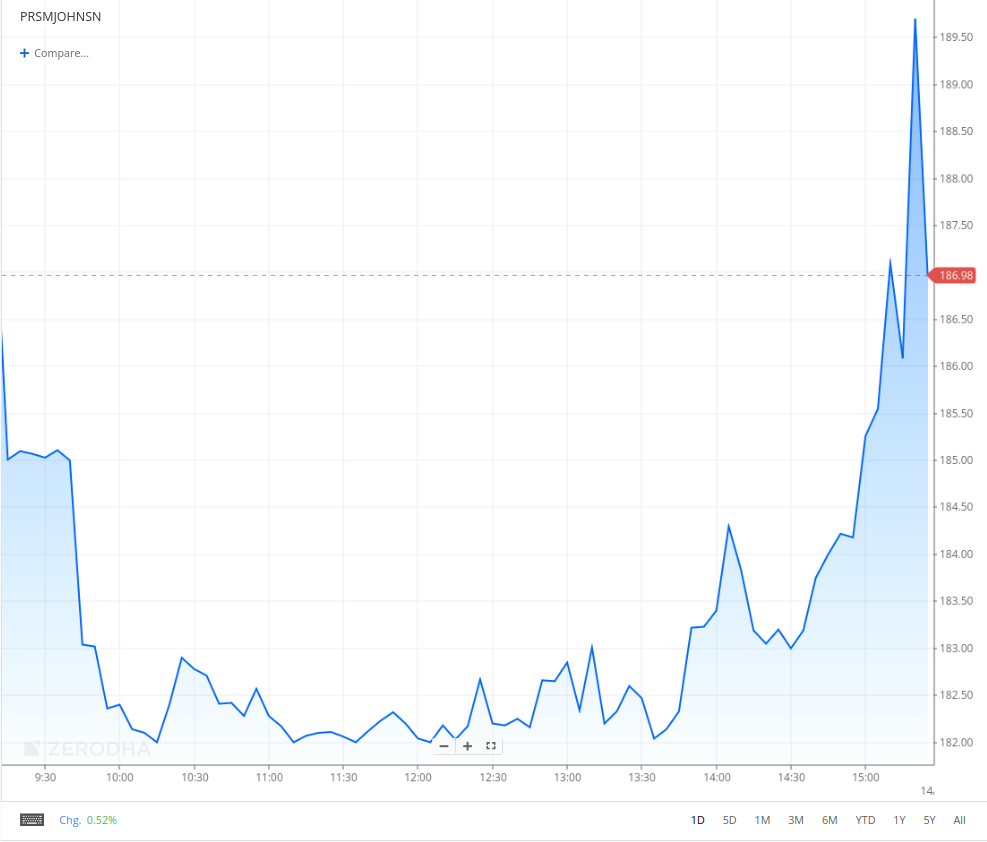

Prism Johnson Ltd. (0.52%)

Financials:

Revenue: ₹1,521.85 crore, down from ₹1,632.28 crore YoY (-6.8%).

Net Profit (PAT): Loss of ₹100.28 crore compared to a profit of ₹206.30 crore in Q2 FY24.

EPS: -₹1.55 per share.

Key Highlights:

Revenue declined due to challenging market conditions across segments. Notable one-time expenses included provisions for litigation and claims.

Segment Performance:

Cement: Revenue ₹622.74 crore, down due to competitive pressures.

HRJ: Revenue ₹562.39 crore, slightly lower due to demand variations.

RMC (Ready Mixed Concrete): Revenue ₹340.58 crore, stable YoY.

Outlook:

Management is cautious but expects a recovery in H2 FY25 with strategic investments.

Sun TV Network Ltd. (1.09%)

Financials

Revenue: ₹934.54 crore, down 10.9% YoY from ₹1,048.45 crore.

EBITDA: ₹528.98 crore (noted in earnings release).

Net Profit (PAT): ₹409.32 crore, down 11.9% YoY from ₹464.69 crore.

EPS: Basic EPS of ₹10.39, down from ₹11.80 YoY.

Key Highlights:

Advertising revenue is up by 2.1% YoY, reaching ₹335.42 crore.

Interim dividend of ₹5 per share declared.

Outlook

The company is focusing on maintaining growth in the Media and Entertainment segment while expanding digital and sports engagement through its franchises.

Wockhardt Ltd. (0.42%)

Financials:

Revenue: ₹809 crore, up 7.4% YoY from ₹753 crore.

Net Profit (PAT): Loss of ₹22 crore, a reduction from the previous year’s loss of ₹77 crore.

EBITDA: ₹110 crore, up 52.78% YoY from ₹72 crore.

EPS: Basic and Diluted EPS of ₹(1.47) per share, compared to ₹(5.37) in Q2 FY24.

Key Highlights:

Revenue growth is driven by increased demand for core pharmaceutical products.

Controlled costs in materials and stock helped narrow the loss YoY.

Strategic investments are expected to drive H2 growth.

Outlook:

Management is focusing on operational efficiency and strategic partnerships to stabilize profitability in the near term.

Minda Corporation Ltd (-4.60%)

Financials:

Revenue: ₹1,301.66 crore, up 21% YoY

EBITDA: ₹147 crore, up 11.7% YoY

Net Profit (PAT): ₹74.34 crore, a 27% YoY

EPS: Basic ₹3.16, up from ₹2.50 last year.

Key Highlights

Revenue growth is driven by increased demand across core automotive products and new product introductions.

Continued investment in R&D to support growth in the electric vehicle segment.

Outlook:

Continued focus on expanding presence in EV components and maintaining growth momentum in traditional automotive products.

Godrej Industries Ltd. (-0.64%)

Financials

Revenue: ₹4,805 crore, up 22% YoY.

EBITDA: ₹575 crore, up 116.5%

Net Profit (PAT): ₹288 crore, a significant increase of 229% YoY.

Key Highlights:

The strong performance was driven by growth in the Chemicals and Real Estate segments, with Godrej Properties achieving record booking values. The Animal Feed segment saw margin improvements due to favorable commodity pricing.

Segment Performance:

Key contributors included Real Estate (₹1,350 crore) and Chemicals (₹819 crore). Other sectors such as Animal Feed and Finance & Investments also saw robust performance.

Outlook:

The company anticipates continued growth from its diversified portfolio and has ongoing expansions in its core businesses, particularly in the Real Estate and Agrovet sectors.

Eicher Motors Ltd. (-2.15%)

Financials

Revenue: ₹4,263.07 crore, up 3.6% YoY.

EBITDA: ₹1,087.7 crore, up 0.1% YoY.

Net Profit (PAT): ₹1,100.33 crore, up 8.3% YoY.

EPS: Basic EPS ₹40.15.

Key Highlights:

Growth was driven by strong performance in its joint venture VE Commercial Vehicles.

Continued investments in global expansion and new product lines within the automobile segment.

Outlook:

Focused on expanding market share and enhancing profitability through operational efficiency and product innovation.

NBCC (India) Ltd. (-2.75%)

Financials

Revenue from Operations: ₹2,458.73 crore, up from ₹2,085.5 crore (YoY increase of 19.4%).

EBITDA: ₹99.9 crore, up from ₹95.5 crore (YoY increase of 4.6%).

Net Profit (PAT): ₹125.13 crore a YoY increase of 52.8% from ₹81.9 crore.

Earnings per Share (EPS): Basic EPS of ₹0.45 (not annualized for the quarter)

Key Highlights:

NBCC's revenue growth is driven by the Project Management Consultancy (PMC) segment.

Reported exceptional items, including provisions related to project expenses and adjustments for past periods.

Segment Performance:

PMC: Main contributor to revenue, showing steady growth.

Real Estate: Performance fluctuating, influenced by regulatory and project-specific challenges.

Outlook:

Focus on expanding operations, including resolving ongoing issues related to real estate projects.

Kalyan Jewellers India Ltd. (-5.38%)

Financials

Revenue: ₹6,065 crore, up 37.4% YoY.

EBITDA: ₹327.1 crore, up 4.3% YoY.

Net Profit (PAT): ₹130 crore, down 3.3% YoY

India Operations (Standalone):

Revenue: ₹5,227 crore in Q2 FY25, up over 34% YoY.

PAT: ₹120 crore, a significant improvement over the previous year's performance.

Middle East Operations:

Revenue: ₹800 crore, growing over 21% YoY.

PAT: ₹14 crore, also showing a steady increase.

E-commerce (Candere):

Revenue: ₹41 crore, with a YoY increase from ₹66 crore for H1 FY25.

Net Loss: ₹3.8 crore for Q2 FY25, attributed to lower profit margins in the e-commerce segment.

Key Highlights:

Strong growth in India and Middle East markets and increased footfall in the ongoing wedding season, providing optimism for year-end performance.

E-commerce division, Candere, saw Q2 revenue of ₹41 crore, with a net loss of ₹3.8 crore.

One-time loss of ₹69 crore in Q2 due to customs duty adjustments.

SSSG (Same Store Sales Growth) over 20% during Diwali season.

Outlook:

A positive outlook with robust footfalls in the festive and wedding seasons, expecting a strong close to the calendar year.

What’s happening globally

The U.S. Consumer Price Index (CPI) data for October, scheduled for release tonight, is anticipated to show a slight uptick in inflation. Economists forecast a 0.2% month-over-month increase, consistent with the previous three months, and a year-over-year rise to 2.6%, up from 2.4% in September. This marks the first increase in annual inflation in seven months. Core CPI, which excludes food and energy prices, is expected to remain steady at a 3.3% annual rate. These figures could influence the Federal Reserve's monetary policy decisions and impact financial markets. - Dive deeper

Samsung Electronics shares have recently declined to their lowest point in over four years, influenced by concerns over potential U.S. tariffs under President Donald Trump's administration and the company's challenges in the AI chip market. - Dive deeper

As of October 31, 2024, global net inflows into exchange-traded funds (ETFs) reached $1.4 trillion, surpassing the previous full-year record of $1.33 trillion set in 2021. This surge was notably influenced by the election of Donald Trump as U.S. President, which spurred significant investor activity. On November 6, the day after the election, U.S.-listed ETFs experienced inflows of $22.2 billion, setting a new post-election day record. - Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies.

Anil Tulsiani, Director of Finance, of SAIL Ltd. on debt levels of the company;

We have planned our entire expansion considering a debt-to-equity ratio of 1:1. So, the maximum debt, I think, will be around INR1 lakh crores. The debt-equity, The debt will be -- in the year, it will maximize at -- the financial year '28, '29 and the debt-equity ratio at that point of time will be around INR1.1 crores. - Link

Vetri Subramaniam, Chief Investment Officer at UTI AMC on the overall market outlook;

Believe momentum will not be as strong as it was in the last few years. More than flows, earnings determine where markets are headed. We have been positive on banks for over a year as the scope for growth of Banking & Financial companies looks good, balance sheets strong - Link

Management of Nykaa on discounts and the Fashion Industry

Fashion discounts are moderating from peak, and will continue to moderate. We do not offer discounts, discounts are retailer-led. Brands are looking to moderate discounts, Fashion industry hoping for better outcomes in H2. The company is chasing assortment growth and new brand tie-ups (such as Foot Locker) - Link

Calendars

In the coming days, We have the following quarterly results and other major events:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

love how you have reduced the Management chatter comments to 2-3(major ones)a day from about 7-8, would really love if you could pick 2-3 companies at max for quarterly results as well, instead of current 6-7

Superb