Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Market Overview

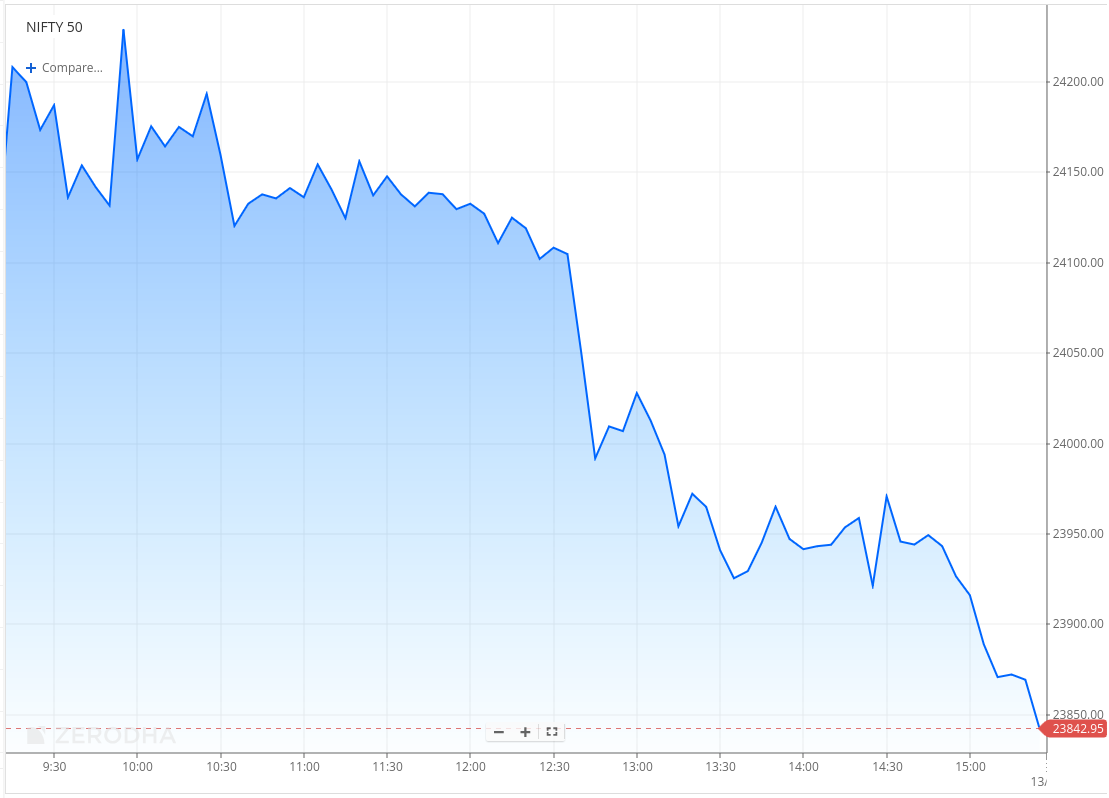

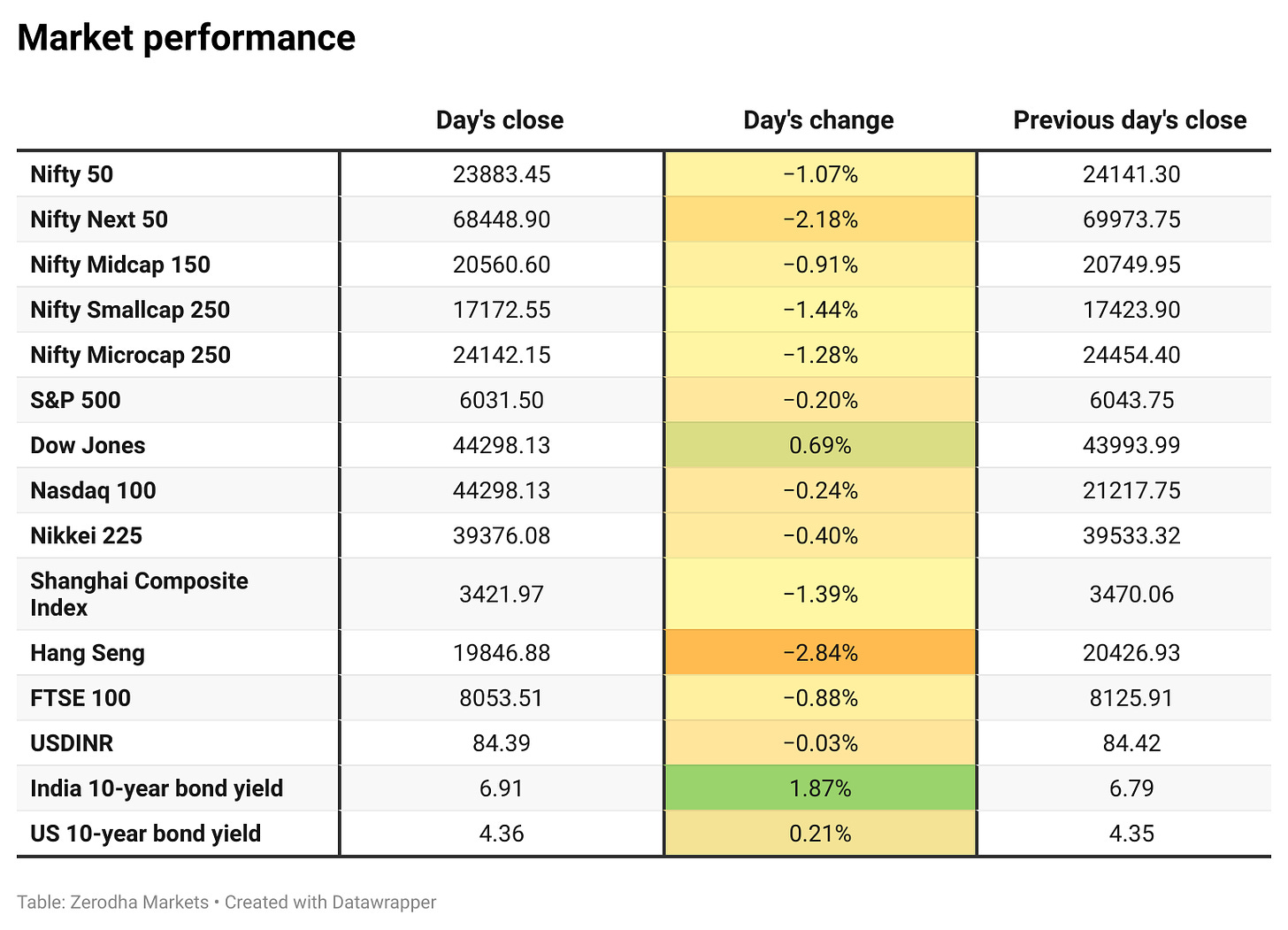

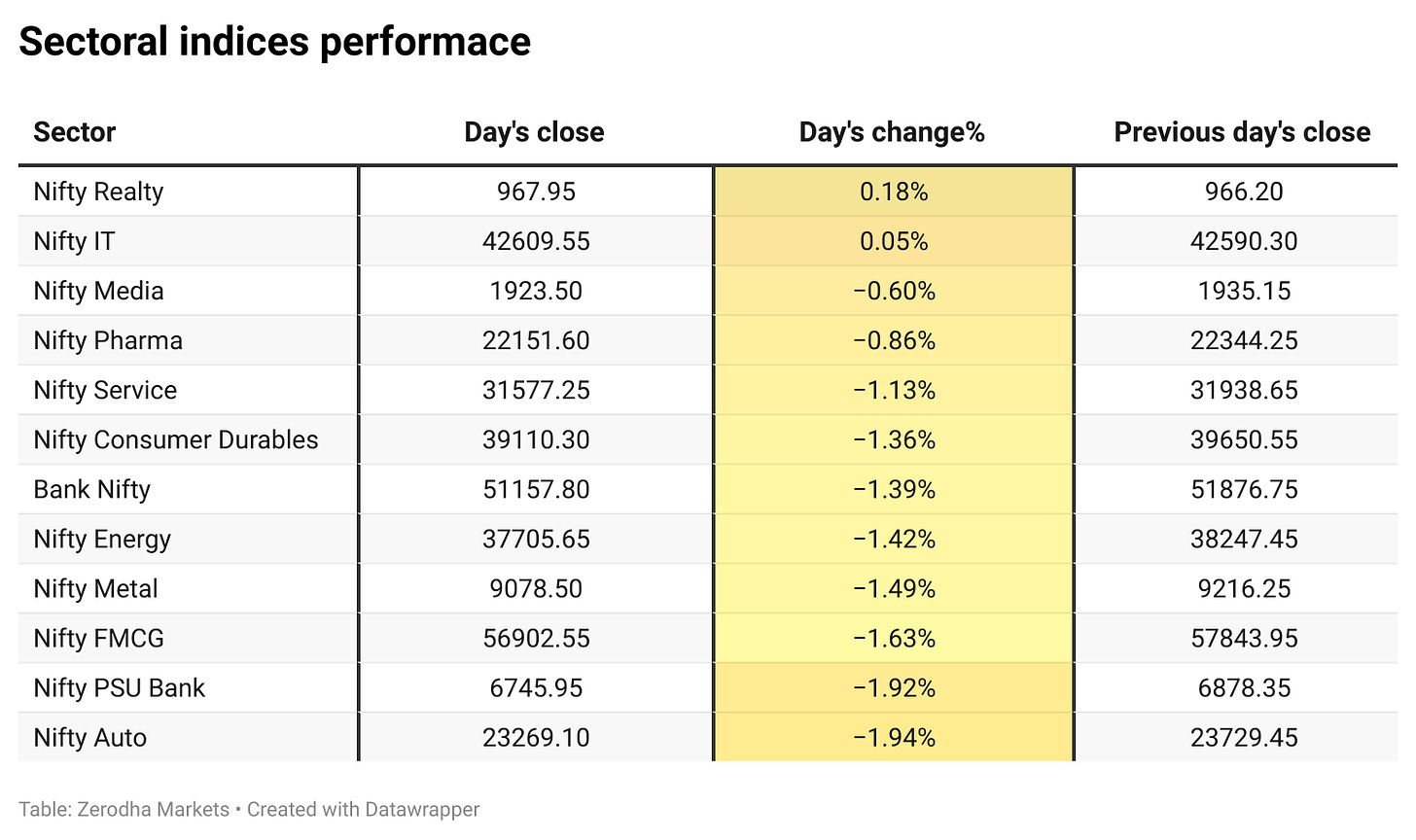

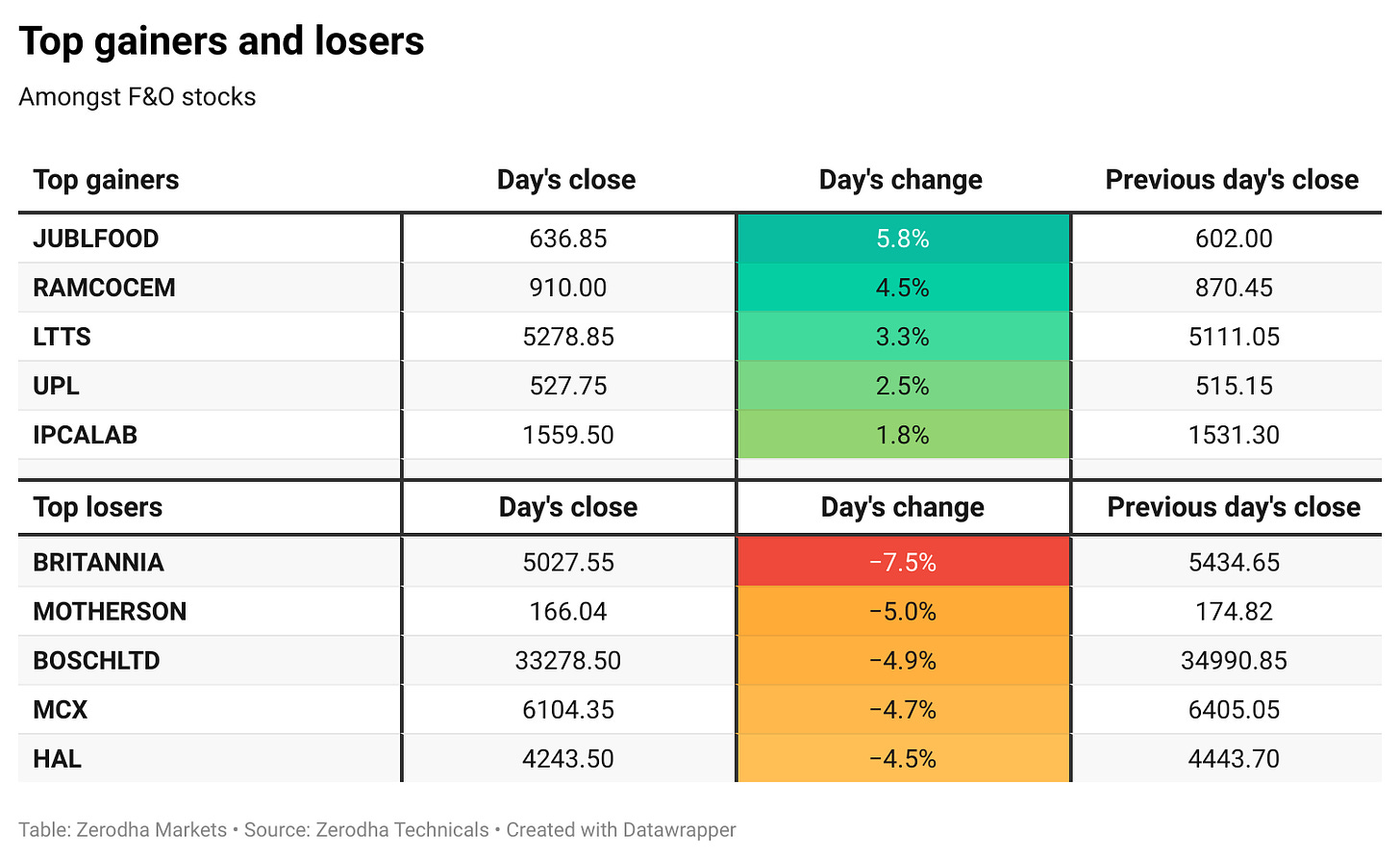

The Nifty opened higher at 24,225.8 but faced consistent selling pressure throughout the day, ultimately closing near its daily low at 23,883.45. Market sentiment remained broadly negative, with only 674 stocks advancing while 2,117 declined on the NSE. No sector showed any signs of strength, as Banking, Auto, and Metal stocks faced notable losses. The downturn may be attributed to persistent foreign investor selling, weaker earnings, and overall technical market weakness.

Nifty has now closed in the red in 7 of the last 10 trading sessions, closing today at its lowest level since June 27, 2024—over 4 months ago.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 14th November

The maximum CE OI is at 24200 followed by 24000 and Put OI is at 23500 followed by 24000

51.01 L OI got added to 24000 CE which was at 12.67 L contracts at the beginning of the day indicating massive selling of calls at these levels.

Immediate support on the downside can now be seen at 23800 followed by 23700 and 23500. Resistance can be seen around 24000 and 24200 levels

Note: This is subject to multiple interpretations but generally, in a falling market if there is an increase in the call OI, it indicates resistance.

Source: Sensibull

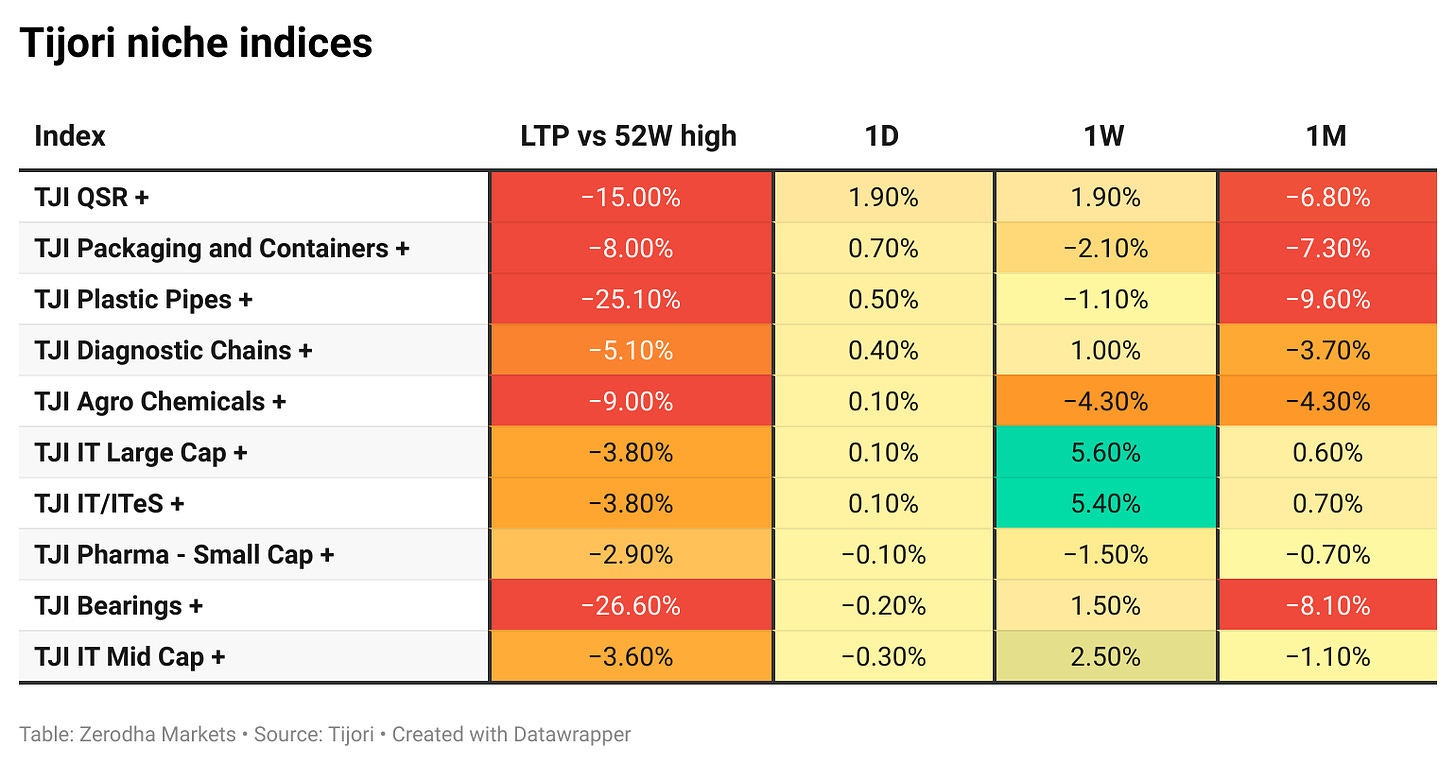

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market.

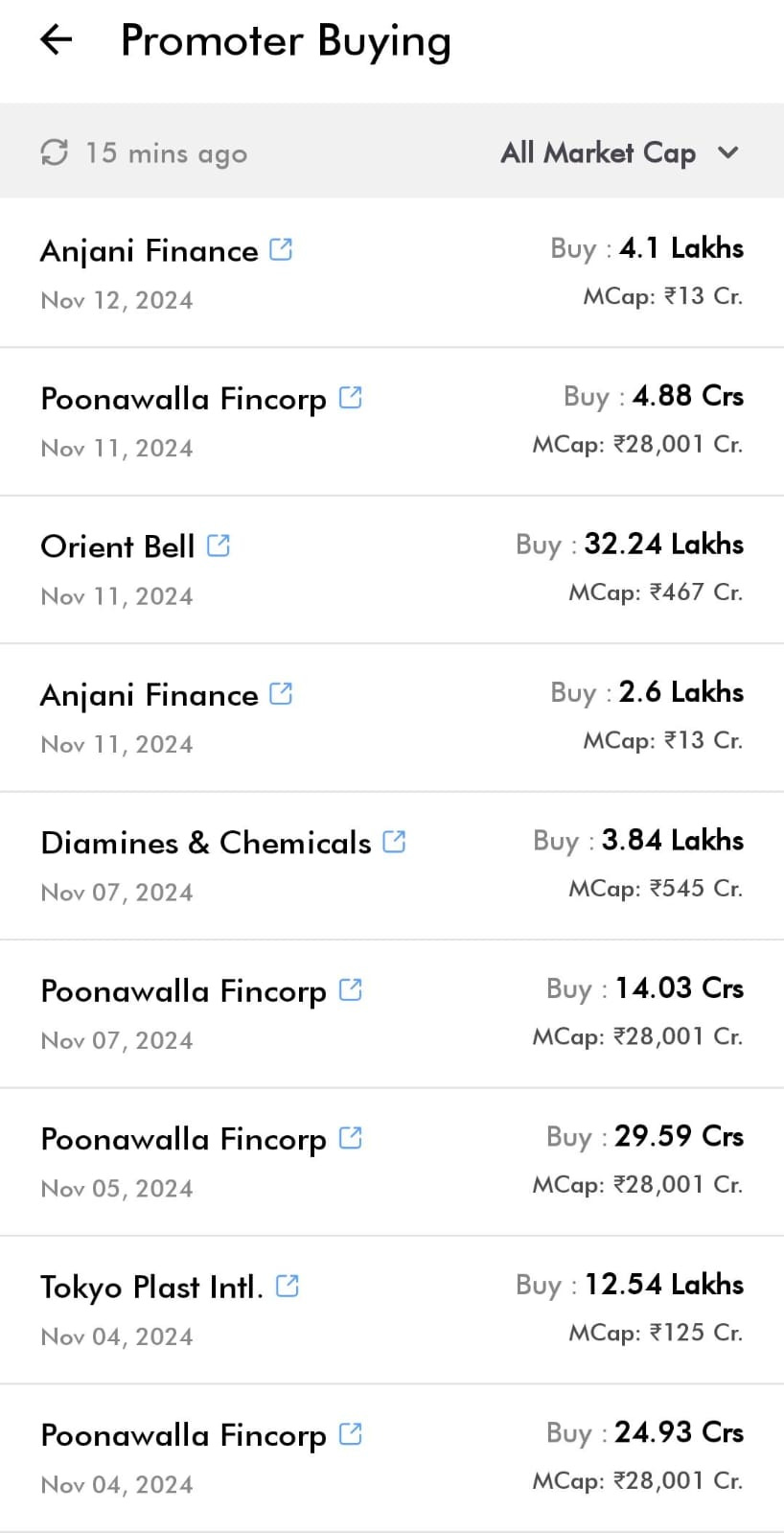

Stocks with Promoter buying

Source: Tijori Finance App

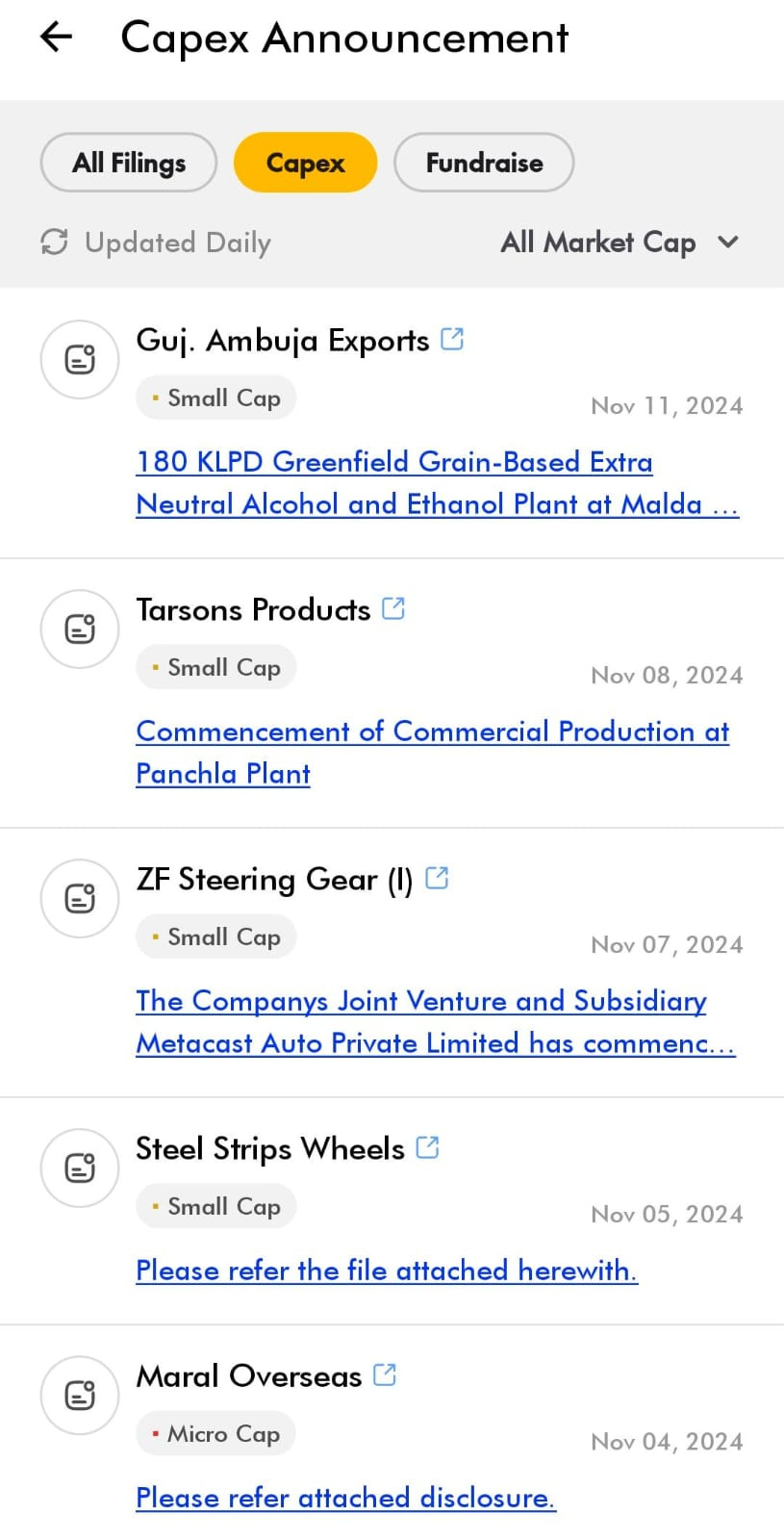

Stocks with CapEx announcement

Source: Tijori Finance App

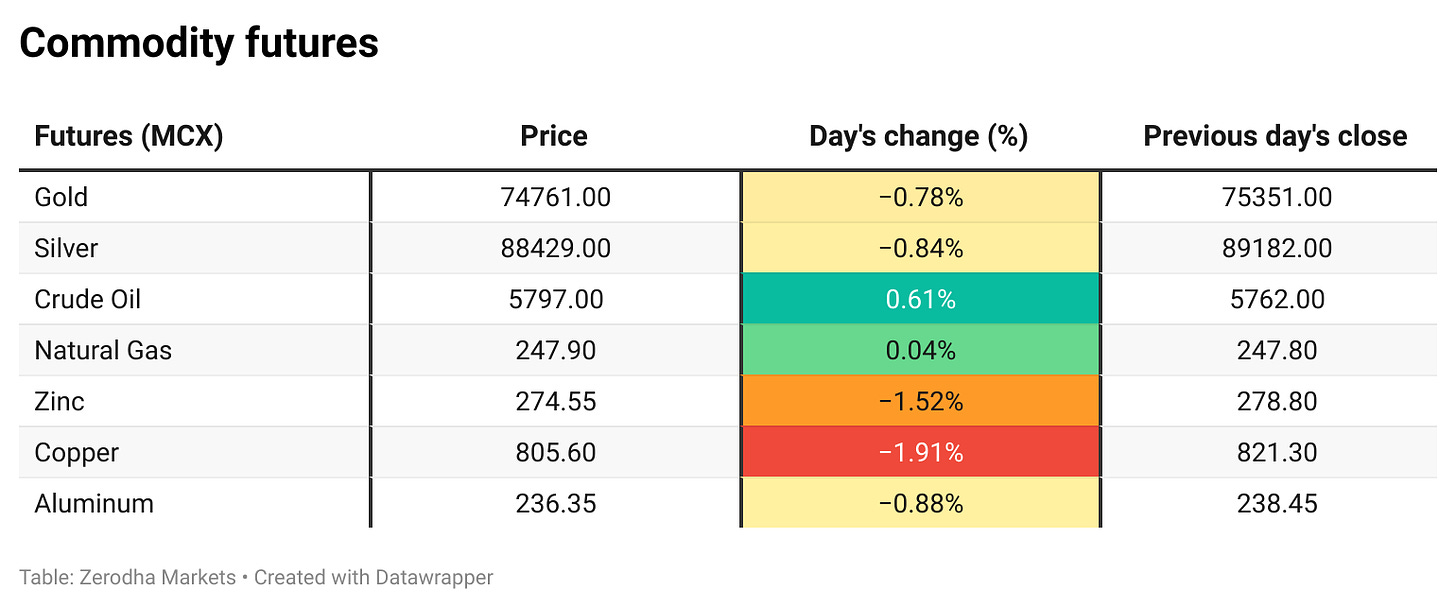

Note: The above numbers for Commodity futures are as of 3.45 PM

What’s happening in India

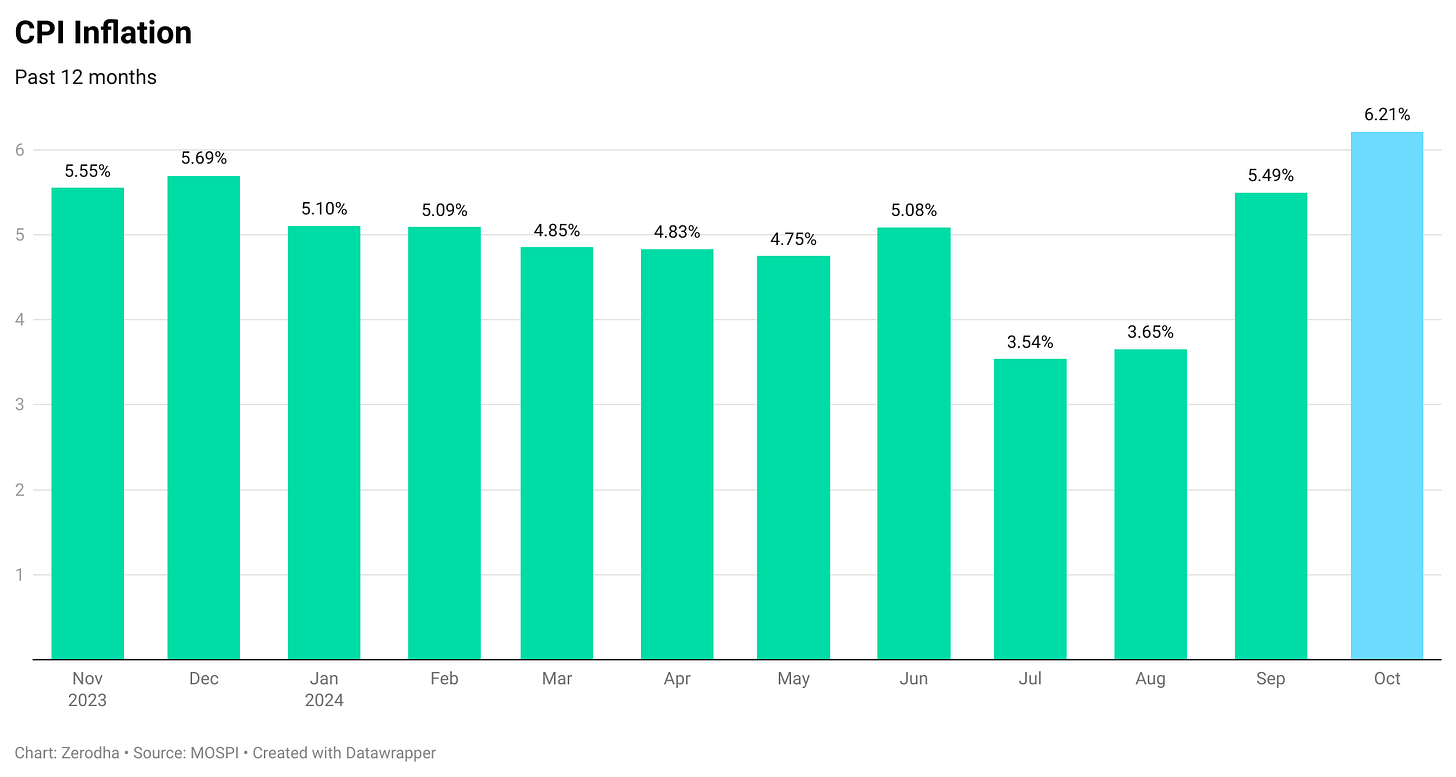

India's Consumer Price Index (CPI) inflation rate for October 2024 surged to 6.21%, marking a 14-month high. This increase was primarily driven by a significant rise in food prices which came in at 10.87% for the month. With the food prices, In October, inflation declined significantly in pulses, eggs, sugar, and spices, while high food inflation was driven by rising prices of vegetables, fruits, oils, and fats. - Dive deeper

Net Direct Tax collections in the country have grown by 15.41% this financial year, reaching over ₹12.1 lakh crore. The gross direct tax collection, before refunds, rose by 21.2% to exceed ₹15 lakh crore from April 1 to November 10, while refunds issued totaled ₹2.91 lakh crore, a 53% increase over last year. Corporate Tax collections showed modest growth, rising to ₹5.1 lakh crore from ₹4.79 lakh crore in the same period last year, according to the CBDT. - Dive deeper

L&T Technology Services (LTTS) has announced its acquisition of Intelliswift Software, a California-based firm specializing in software and artificial intelligence solutions, for $110 million. This strategic move aims to enhance LTTS's offerings in software product development, platform engineering, digital integration, data, and AI. Intelliswift serves four of the top five hyperscalers and over 25 Fortune 500 companies, including five of the top 10 ER&D spenders in software and technology. The acquisition is expected to strengthen LTTS's presence in the retail, fintech, and private equity sectors, aligning with its goal to achieve $2 billion in revenue in the medium term. - Dive deeper

The Reserve Bank of India (RBI) has introduced a framework allowing Foreign Portfolio Investors (FPIs) to reclassify their investments as Foreign Direct Investments (FDI) when their equity holdings in Indian companies exceed the prescribed 10% limit. This move provides FPIs with a structured approach to maintain higher stakes in Indian firms, subject to necessary government approvals and compliance with FDI regulations. - Dive Deeper

Quarterly results

In this section, we'll dive into all the key highlights from today's intriguing results, covering the most impactful performances and standout moments. The numbers are comparable on a year-on-year (YoY) basis.

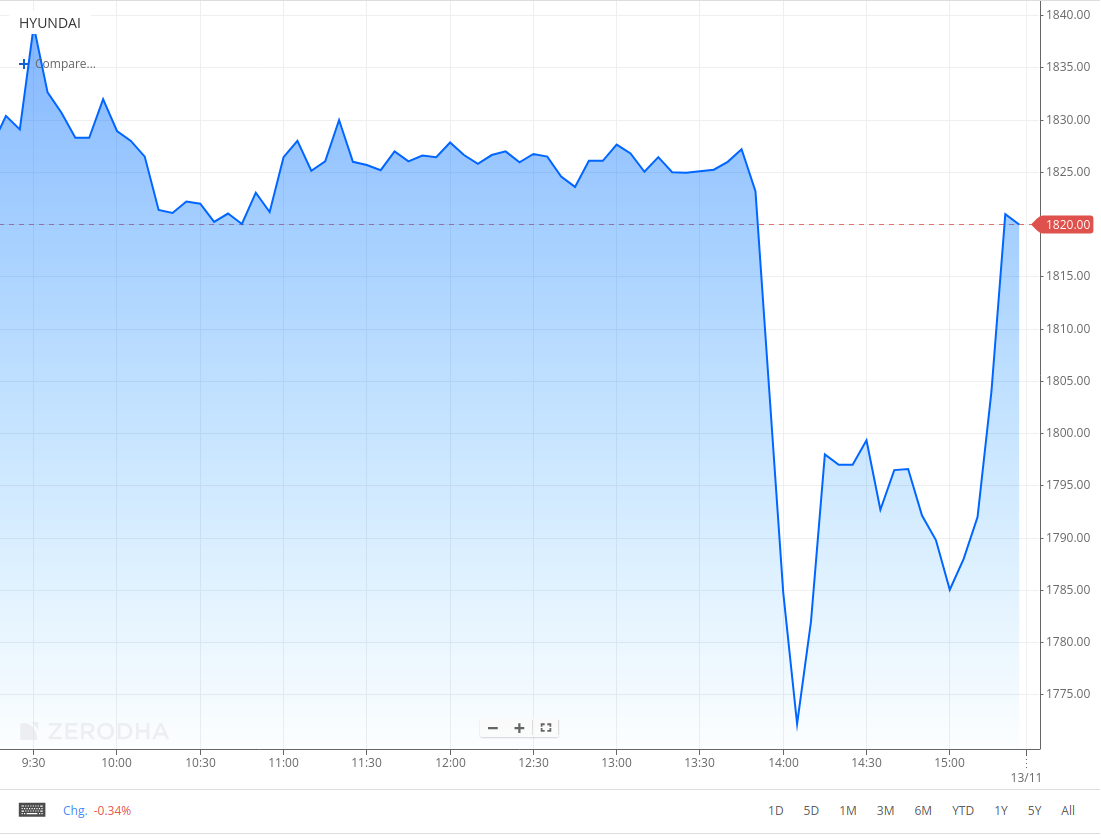

Hyundai Motor India (-0.42%)

Key Figures:

Revenue: ₹17,260 crore (down 7.5% YoY)

EBITDA: ₹2,205 crore with a margin of 12.8% (down from 13.1% YoY)

Net Profit (PAT): ₹1,375 crore (down 15.5% YoY)

Key Highlights: Domestic SUV sales grew, and exports faced challenges.

Outlook: Focus on sustained demand and new launches, including the Creta EV.

Segment Performance: SUVs contributed significantly to domestic sales growth.

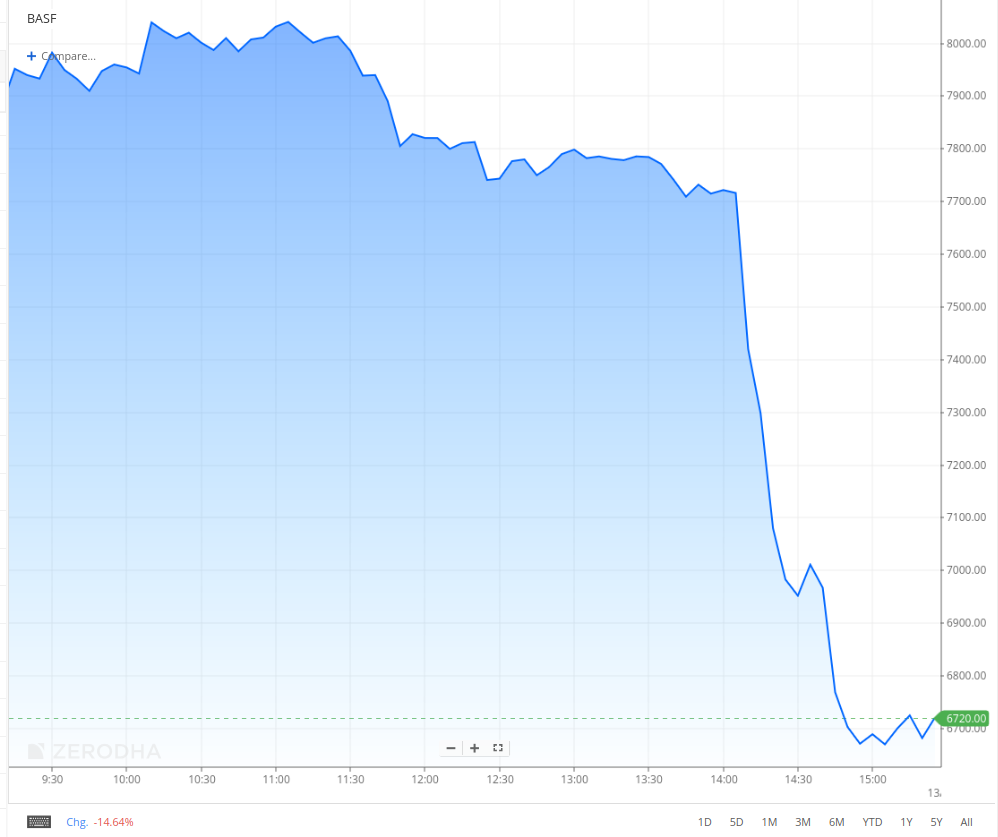

BASF India Limited (-14.64%)

Key Figures

Revenue from Operations: ₹4,247.72 Cr (₹42,477.2 million) (↑ 14.5% YoY, ↑ 7.1% QoQ)

Net Profit: ₹127.93 Cr (₹1,279.3 million) (↓ 14.2% YoY, ↓ 42.0% QoQ)

EBITDA Margin: 5.76% (vs 6.25% YoY, 8.07% QoQ)

EPS: ₹29.60 (vs ₹34.50 YoY, ₹51.00 QoQ)

Key Highlights

Strong revenue growth is driven by the Agricultural Solutions and Materials segments.

Sequential decline in net profit due to increased costs of raw materials and a dip in inventory gains.

Exceptional income of ₹13.78 Cr in Q1 FY24 absent this quarter, contributing to QoQ profit decline.

Segment Performance

Agricultural Solutions: ₹725.71 Cr (↑ 6% QoQ, ↑ 6% YoY)

Materials: ₹1,333.39 Cr (↑ 7.6% QoQ, ↑ 27.1% YoY)

Industrial Solutions: ₹647.45 Cr (↓ 1.5% QoQ, ↑ 27.1% YoY)

Cash Flow Insights

Operating Cash Flow: ₹536.1 Cr (↓ 19% YoY)

Investing Cash Flow: Net outflow of ₹69.7 Cr, primarily for asset upgrades.

Financing Cash Flow: Net outflow of ₹100.92 Cr due to dividend payouts and lease payments.

Outlook

BASF India continues to benefit from robust demand in key segments. However, rising input costs and macroeconomic headwinds may impact profitability in the near term.

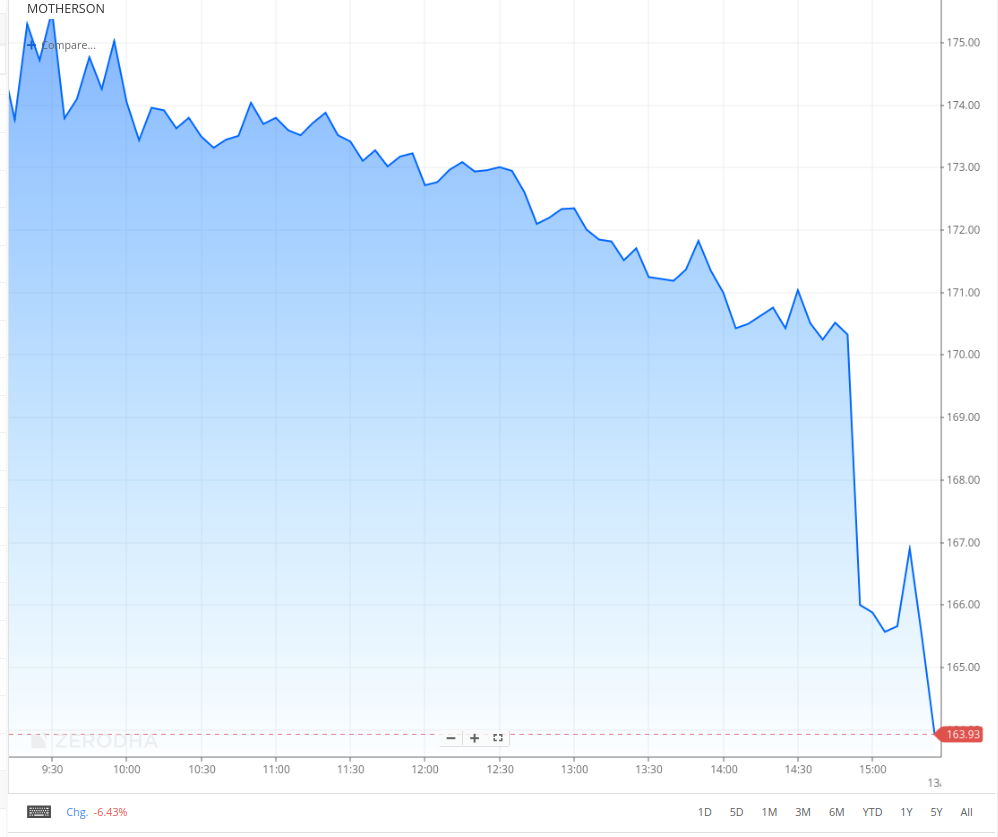

Samvardhana Motherson (-6.43%)

Financials:

Revenue: ₹27,811.86 crores (up 18% YoY)

EBITDA: ₹2,641.18 crores (up 32% YoY)

EBITDA Margin: 9.49% (up from 8.63% YoY)

Net Profit (PAT): ₹948.81 crores (up 223% YoY)

EPS: ₹1.29 (Basic, up from ₹0.30 YoY)

Key Highlights:

The automotive segment continues to perform well with significant revenue contributions.

Significant growth in modules and polymer products, driving overall growth.

No exceptional items in this quarter, unlike last year.

Strong share of profit from associates and joint ventures.

Improved liquidity and asset management.

Segment Performance:

Wiring Harness: Revenue of ₹8,111.21 crores (up 4% YoY)

Modules and Polymer Products: Revenue of ₹14,640.40 crores (up 28% YoY)

Vision Systems: Revenue of ₹4,807.47 crores (up 2% YoY)

Integrated Assemblies: Revenue of ₹2,527.68 crores (up 53% YoY)

Emerging Businesses: Revenue of ₹2,905.11 crores (up 43% YoY)

Outlook:

Focus on expanding automotive and non-automotive businesses.

Expect continued growth in the second half of the fiscal year, supported by strong demand across segments.

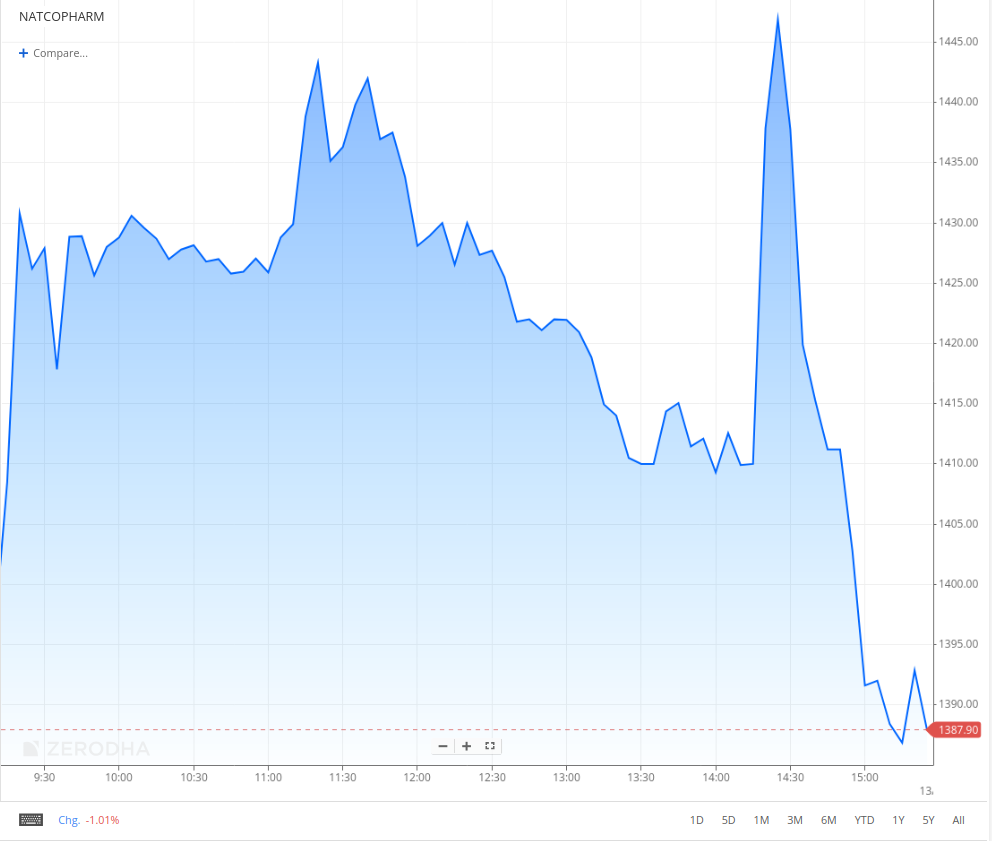

Natco Pharma (-1.01%)

Financials:

Revenue: ₹1,434.9 crores (up 35.3% YoY)

EBITDA: ₹802.8 crores (up 55.3% YoY)

EBITDA Margin: 56.0% (up from 51.0% YoY)

Net Profit (PAT): ₹636.3 crores (up 56.9% YoY)

EPS: ₹35.53 (Basic)

Key Highlights:

Strong growth is driven by exports, especially in the formulation business.

Continued stability in the domestic pharmaceutical market.

The board declared an interim dividend of ₹1.50 per share.

Segment Performance:

Active Pharmaceutical Ingredients (API): ₹49.6 crores (down from ₹77.8 crores YoY)

Formulations, Domestic: ₹102.3 crores (stable YoY)

Formulations, Export: ₹1,211.3 crores (up significantly from ₹792.3 crores YoY)

Crop Health Sciences: ₹14.1 crores (down from ₹55.8 crores YoY)

Outlook:

Focus on expanding the export formulation business and stabilizing domestic market performance.

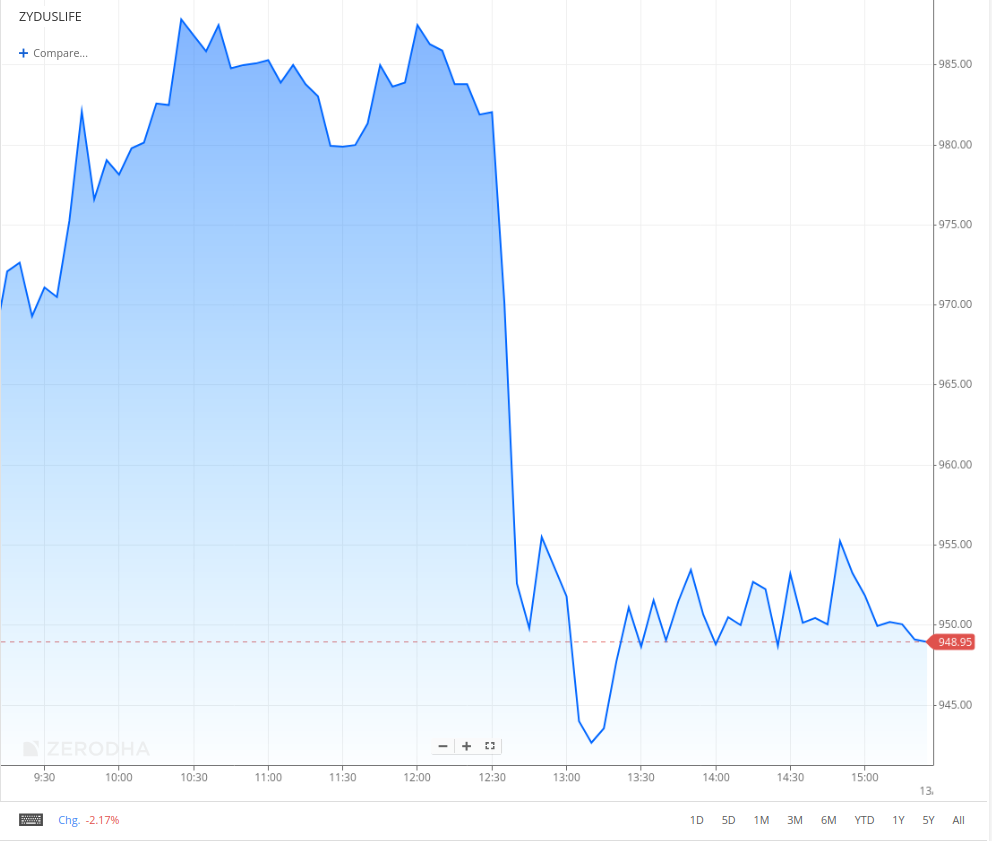

Zydus Lifesciences (-2.17%)

Financials:

Revenue: ₹52,370 crores (up 19.9% YoY)

EBITDA: ₹15,045 crores (up 22.1% YoY)

EBITDA Margin: 28.7% (up from 27.0% YoY)

Net Profit (PAT): ₹9,112 crores (up 33.7% YoY)

EPS: ₹9.06 (Basic, up from ₹7.91 YoY)

Key Highlights:

Strong growth is driven by the Pharmaceuticals segment.

Acquisition of a 50% stake in Sterling Biotech, now a joint venture.

Consistent improvement in operational efficiencies and cost control.

Segment Performance:

Pharmaceuticals: Revenue of ₹47,475 crores (up 20.5% YoY), Profit Before Tax (PBT) of ₹12,549 crores (up 25.7% YoY).

Consumer Products: Revenue of ₹4,895 crores (up 11.4% YoY), PBT of ₹160 crores (up significantly YoY).

Outlook:

Focus on expanding global footprint, particularly in emerging markets.

Strategic acquisitions to enhance product and market diversification.

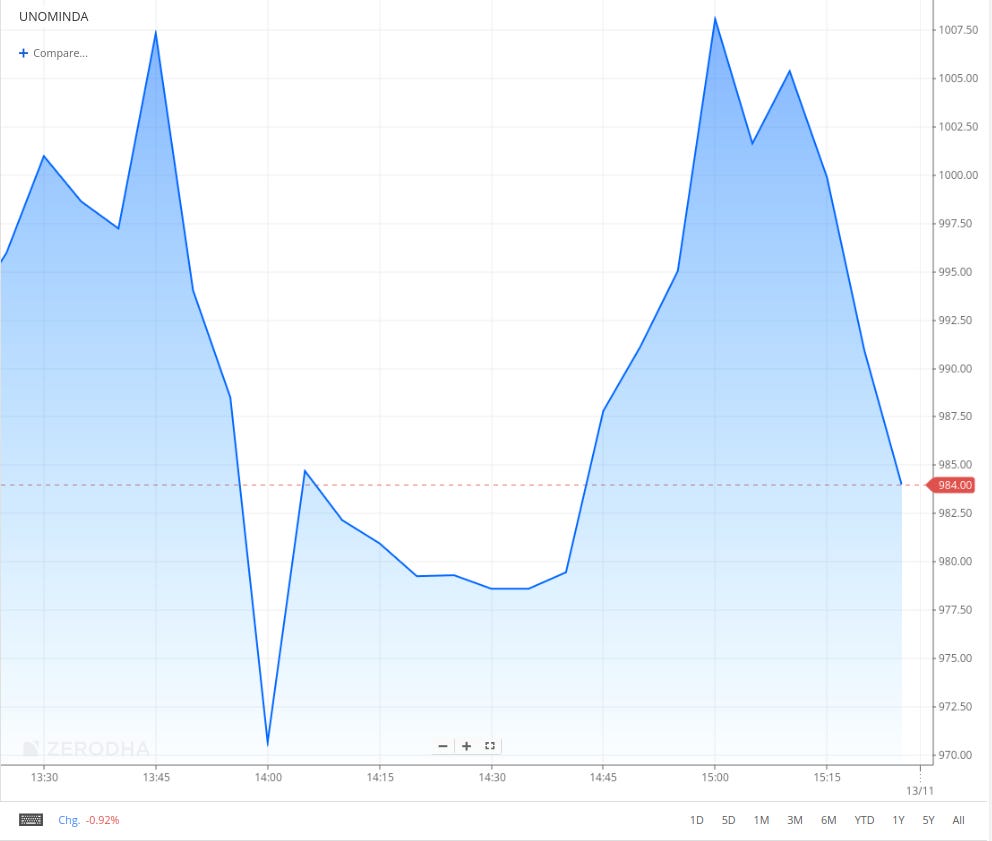

UNO Minda (-0.92%)

Financials:

Revenue: ₹4,246.95 crores (up 17% YoY)

EBITDA: ₹587.31 crores (up 12% YoY)

EBITDA Margin: 13.9% (down from 14.1% YoY)

Net Profit (PAT): ₹266.16 crores (up 11.9% YoY)

EPS: ₹4.27 (Basic, up from ₹3.93 YoY)

Key Highlights:

Strong growth in automotive component demand, with significant contributions from subsidiaries.

Profitability improved despite some margin compression.

Exceptional items included gains from the remeasurement of existing interest in joint ventures.

Segment Performance:

Automotive Components: Revenue driven by strong demand across key verticals.

International Operations: Contributing positively to overall growth, especially in Southeast Asia.

Outlook:

Focus on increasing market share in both domestic and international markets.

Plans for strategic acquisitions and investments to expand global presence.

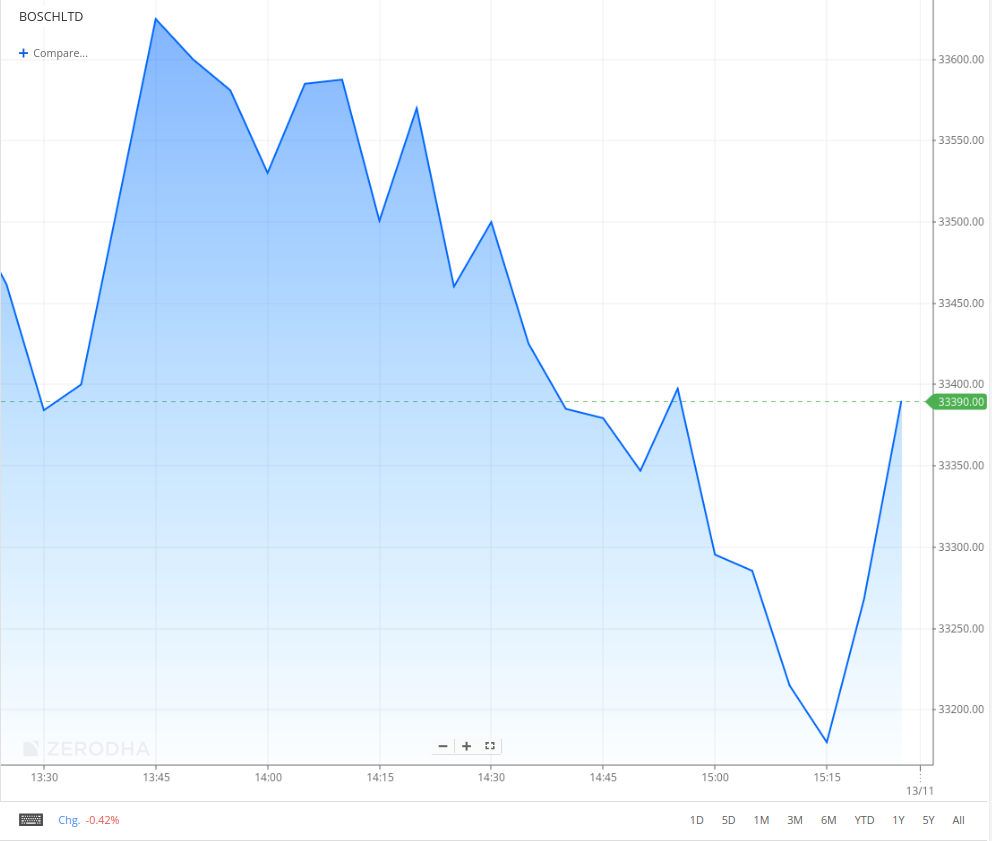

Bosch (-0.42%)

Financials:

Revenue: ₹4,394 crores (up 6.4% YoY)

EBITDA: Not directly mentioned, but Profit Before Tax (excluding exceptional items) stood at ₹677 crores (15.4% of revenue), up 27.3% YoY.

EBITDA Margin: Approximately 15.4% (excluding exceptional items).

Net Profit (PAT): ₹536 crores (12.2% of revenue), up 12.2% YoY.

EPS: ₹181.99 (Basic, up from ₹158.09 YoY).

Key Highlights:

Strong growth in the automotive segment driven by passenger cars and genset applications.

Mobility Aftermarket business grew 8.8%, while Beyond Mobility grew 13.8%.

Exceptional items related to the gain from the sale of the OE/OES diagnosis business.

Profitability improved despite unpredictable market conditions.

Segment Performance:

Automotive Products: ₹37,594 crores (up 6.7% YoY).

Consumer Goods: ₹4,290 crores (up 10.1% YoY).

Others: ₹2,130 crores (up 22.6% YoY).

Outlook:

Expect continued growth driven by the festive period and strategic investments in advanced technologies and localization efforts.

What’s happening globally

Saudi Arabia's financial services sector has recently witnessed significant investor interest in initial public offerings (IPOs). Notably, United International Holding Co. attracted approximately 131 billion riyals ($34.8 billion) in orders for its IPO, underscoring robust demand for new listings in the kingdom. - Link

Financial markets are underpricing the risks of escalating geopolitical conflict, a dangerous “disconnect” that could trigger significant sell-offs similar to the stock market panic seen in August, the International Monetary Fund has warned. - Link

The UK’s Annual growth in average weekly earnings in the private sector was 4.8% in the three months to September, unchanged from the three-month period to August. The figure was the lowest since the winter of 2021-22 and was in line with the forecasts the central bank published last week when it cut interest rates to 4.75% and said further easing would be “gradual”. - Link

Management chatter

In this section, we pick out interesting comments made by the management of major companies.

Amit Syngle, CEO, of Asian paints

Due to the monsoon, we saw muted demand; The rural market has performed better compared to urban markets. Diwali was not as good as we had anticipated and we remain cautious about demand conditions in Q3 - Link

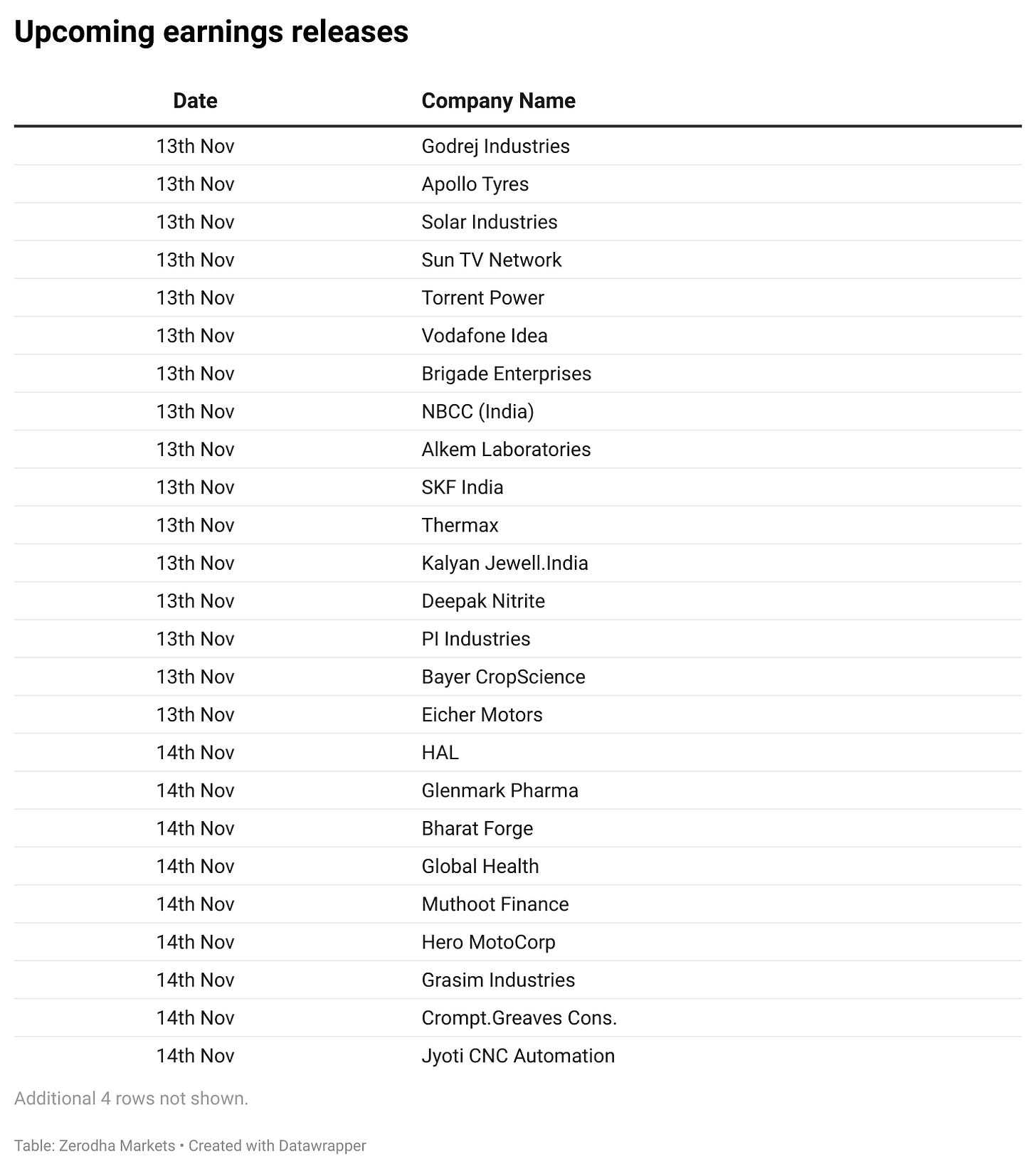

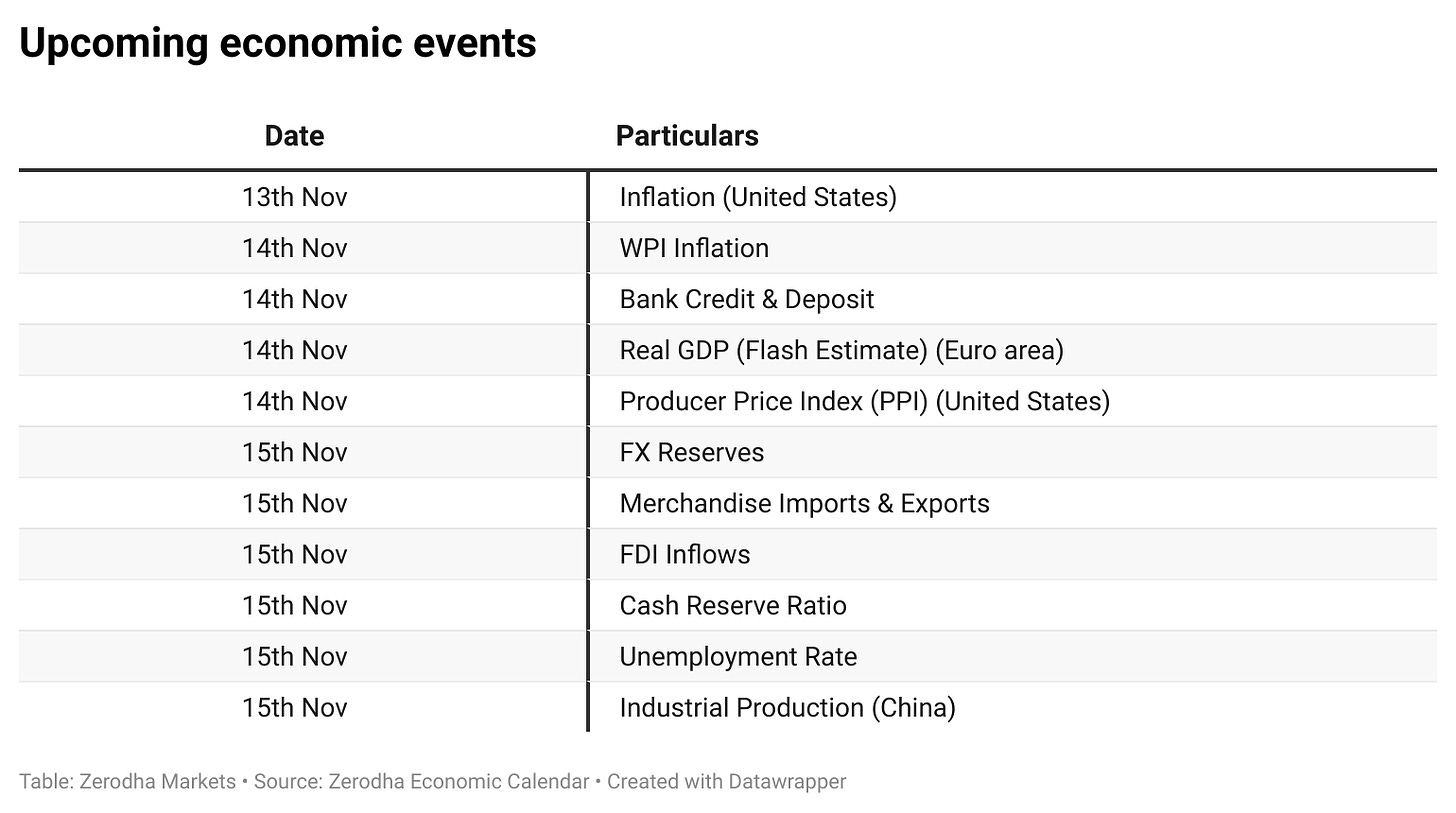

Calendars

In the coming days, We have the following quarterly results and other major events:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

Pls include the daily FII and DII addition/withdrawal numbers, that was a useful daily metric to look for