Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Market Overview

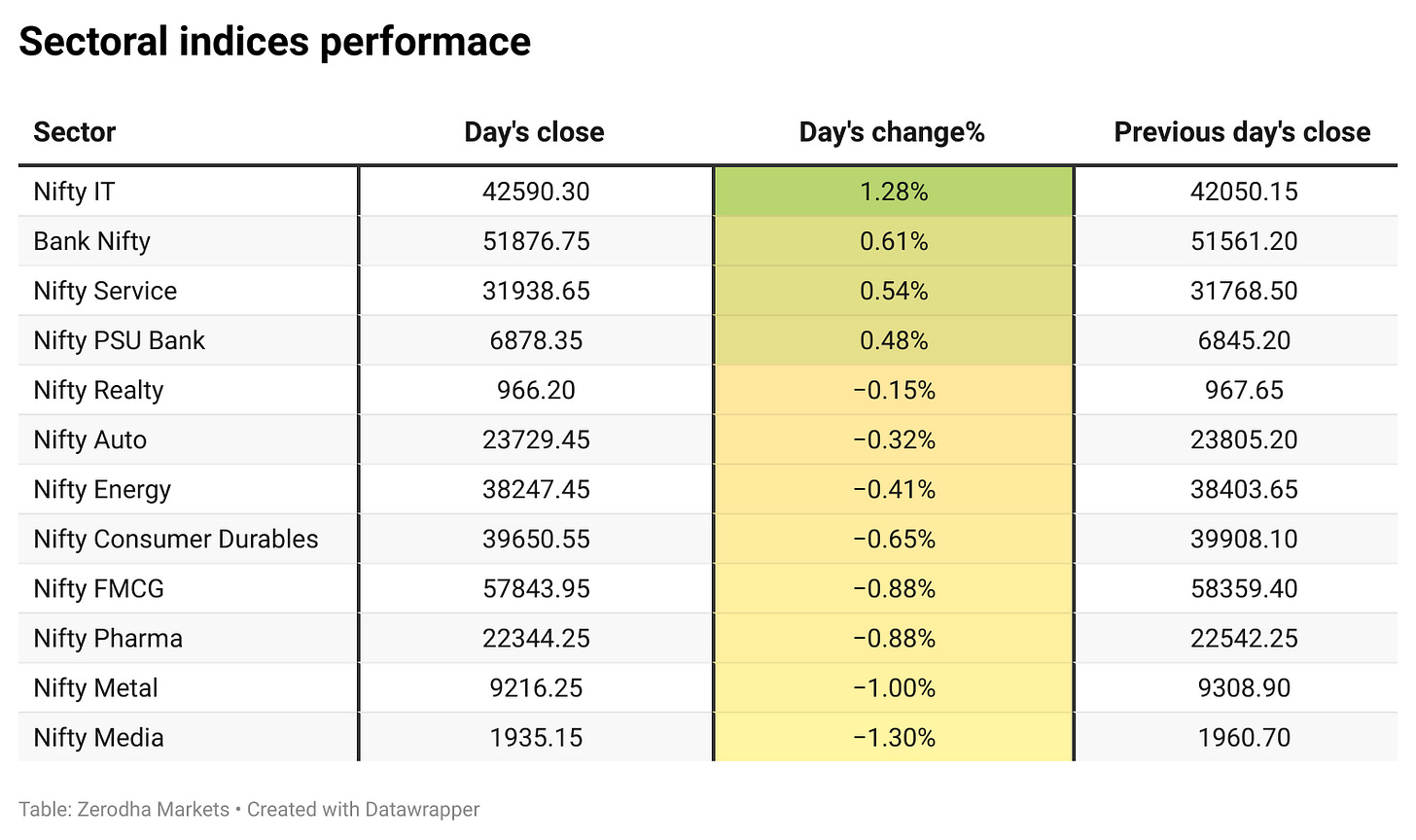

In a volatile trading session, the Nifty index closed nearly flat at 21,141.30, down 0.03%. Despite most indices trading in the red, Nifty IT and Bank Nifty prevented a significant market drop. The Nifty hit an early low of 24,004 before recovering 330 points and dropping 200 points later again to close flat. Broader market sentiment remained weak, with 895 stocks advancing while 1,949 declined on the NSE. Weak earnings reported by Asian Paints over the weekend contributed to market pressures.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 14th November

The maximum CE OI is at 24500 followed by 24300 and Put OI is at 24000 followed by 24200

15.98 L OI got added to 24300 CE which was at 31.94 L contracts at the beginning of the day indicating massive addition of more than 50%

Immediate resistance can be seen at 24500 as we can see in the last few days. The immediate support appears near 24000 which if broken may lead to incremental selling.

Note: This is subject to multiple interpretations but generally, in a falling market if there is an increase in the call OI, it indicates resistance.

Source: Sensibull

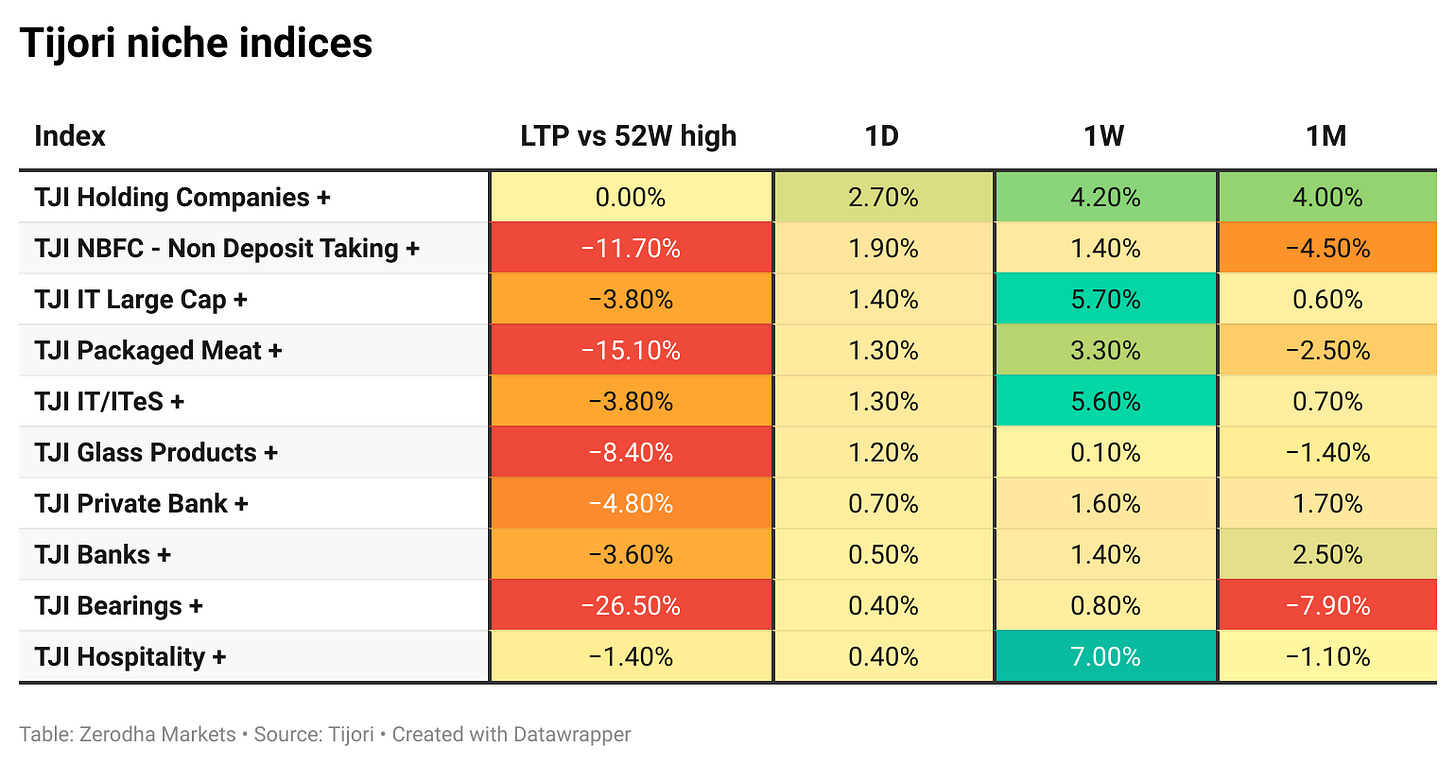

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market.

What’s happening in India

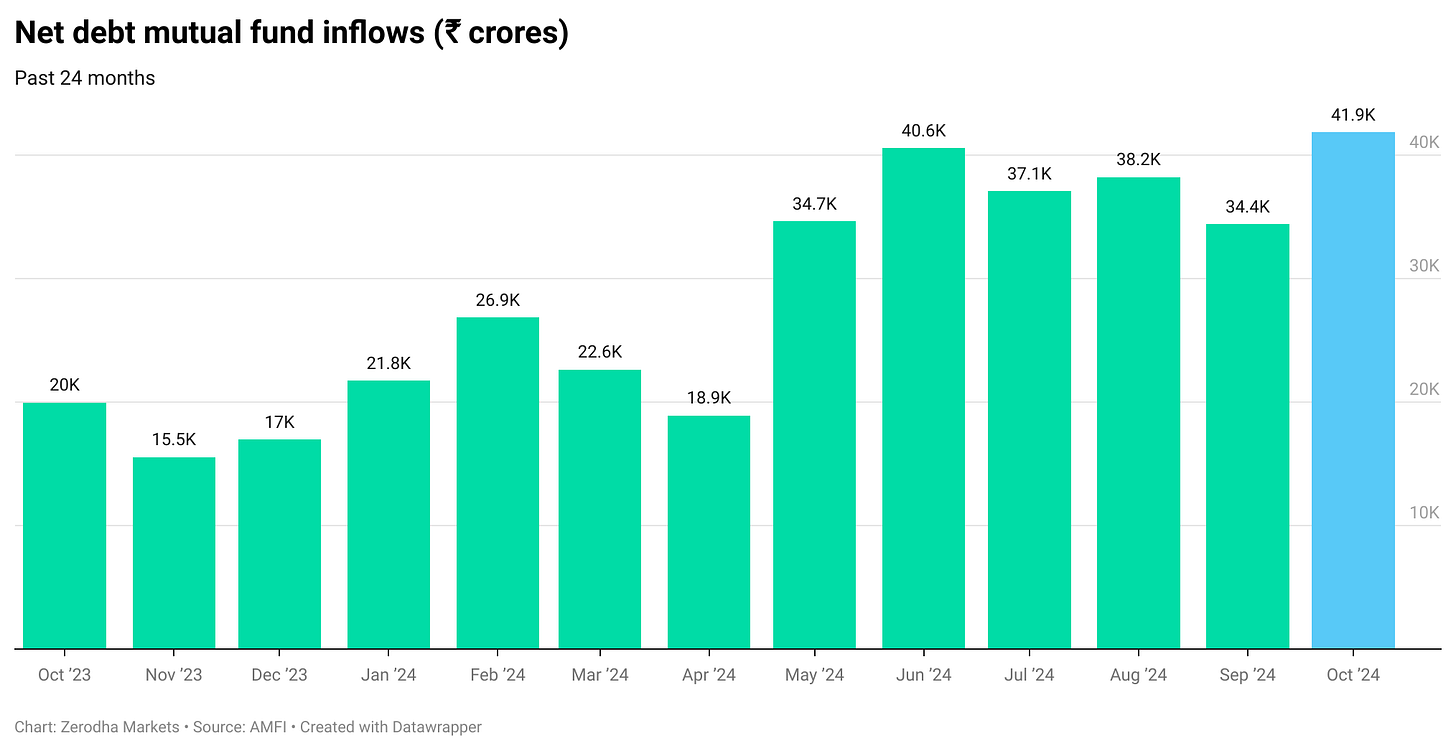

Equity Mutual Funds See Record Inflow of Rs. 41,887 Crore in October

What happened:

Equity mutual funds recorded a net inflow of Rs 41,887 crore in October, a 21% increase from the previous month. This marks the 44th consecutive month of net inflows into equity-oriented funds.

Why?

The surge was driven by strong investor interest in thematic funds, despite a broader market correction.

Additionally, overall mutual fund industry inflows reached Rs 2.4 trillion for the month, supported by Rs 1.57 trillion in investments into debt schemes, following an outflow in September.

This trend underscores the continued appeal of mutual funds among Indian investors, as per data from the Association of Mutual Funds in India (AMFI).

Source: Business Standard

Solar Manufacturing Stocks Drop Sharply on Trump's Anti-Renewable Stance

What happened:

Shares of Indian solar manufacturing companies, including Waaree Energies, Premier Energies, and Websol Energy, have fallen by 25%, 18%, and 13% respectively from their recent peaks.

Why?

The declines follow Donald Trump’s victory speech, in which he stated plans to halt renewable energy projects on his first day in office. This has raised concerns about the impact on Indian exporters to the U.S., such as Waaree Energies, as they may need to reconsider expansion plans if the U.S. pivots to prioritizing domestic manufacturing.

Source: Economic Times

IT Hardware PLI Scheme Faces Slow Progress Amid Import Challenges

What’s happening:

Most of the 27 manufacturers under the ₹17,000 crore PLI scheme have yet to begin production or make initial investments.

Only a few companies, like VVDN Technologies and Flextronics, are on track to meet the first-year targets.

Dixon Technologies is delaying capacity expansion and will miss its second-year targets.

Why?

Major PC companies are favoring direct imports, bypassing local content requirements.

A lack of sufficient orders has deterred manufacturers from scaling production.

Meaningful progress is expected only by FY2026.

Source: The Economic Times

RBI prepared for controlled rupee depreciation amid yuan weakness and trade concerns

What’s happening:

The rupee is depreciating in tandem with the Chinese yuan, closing at 84.3750 to the dollar, marking its sharpest weekly loss since May.

Analysts predict the rupee will breach 85 to the dollar within a year.

The RBI is using its $680 billion forex reserves to manage volatility and prevent sharp fluctuations.

Why?

To address India’s widening trade deficit with China, which hit $83 billion in 2023.

To maintain the rupee’s competitiveness and attract businesses relocating from China.

To support export sectors like electronics, where India has gained market share from China.

Source: Business Standard

Onion Prices hit five-year high Due to Poor Crop Quality and Supply Shortages

Source: IndiaDataHub

What's happening?

Onion prices in key wholesale markets like Nashik and Lasalgaon have surged to their highest levels in five years, with prices jumping to Rs 70 per kilogram from Rs 51 within two weeks.

Why:

Poor quality kharif crops in major states worsened by heavy September rains, have delayed new crop arrivals. Meanwhile, increased export demand, especially from Bangladesh lifting its onion import duty until mid-January, has further tightened domestic supplies, leading to stockpiling by wholesalers and retailers and pushing prices higher. Traders are optimistic about a price correction in the next 8-10 days as new crop arrivals are expected to ease the supply shortage.

Source: NDTV Profit

Quarterly results

In this section, we'll dive into all the key highlights from today's intriguing results, covering the most impactful performances and standout moments. The numbers are comparable on a year-on-year (YoY) basis.

Devyani International (+3.07%)

What happened:

Q2 FY25 revenue rose 49.1% YoY to ₹1,222.16 crore.

Net profit dropped by 99.9% YoY to ₹10.87 lakh.

EBITDA increased 27% YoY to ₹195.5 crore.

Why?

Revenue growth was driven by new brand partnerships and expansion in diverse food categories, aligning with the company’s “FOOD ON THE GO” and “HOUSE OF BRANDS” strategy.

The sharp drop in profit reflects pressures in the QSR industry, likely due to increased costs or market challenges impacting short-term profitability.

UPL (-6.87%)

What happened:

Net loss of ₹443 crore in Q2 FY25, up from a ₹189 crore loss YoY.

Revenue rose 9% YoY to ₹11,090 crore, with volumes up 16% but prices down by 7%.

EBITDA remained stable at ₹1,576 crore, though the EBITDA margin narrowed to 14.2% from 15.5%.

UPL’s stock fell as much as 8% following the earnings release.

Why?

Pricing pressure in the crop protection segment widened net loss and narrowed margins, affecting contribution margins.

Revenue growth, driven by higher volumes, was not enough to offset the profit decline due to reduced pricing.

The seed business contributed positively to margin growth, but challenges in other segments and geographies limited profitability.

Jubilant FoodWorks (-1.21%)

What happened:

Q2 FY25 revenue rose 42.8% YoY to ₹1,954.72 crore

Total income reached ₹1,985.01 crore

PAT dropped 31.5% YoY to ₹66.53 crore

EBITDA grew 11.3% YoY to ₹309 crore, but the EBITDA margin contracted to 15.8% from 20.3%.

Why?

Strong revenue growth stems from heightened brand demand, yet profitability declined due to cost pressures and rising operational expenses.

EBITDA margin declined due to challenges in managing costs despite sales growth.

Seasonal factors and cost inflation impacted QoQ performance

Godfrey Phillips (-1.11%)

What happened:

Q2 FY25 sales rose to ₹1,640.3 crores.

Revenue increased to ₹1702.75 crores.

Net income grew to ₹248.33 crores.

Basic and diluted EPS from continuing operations improved to ₹47.92 from ₹38.86 YoY.

Why?

Strong market demand and higher volumes improved sales and revenue growth.

Improved EPS and net income highlight enhanced profitability, driven by operational efficiency.

Positive half-year performance further underscores stable growth and earnings consistency, as reflected in the YoY rise in EPS from ₹87.8 to ₹92.02.

What’s happening globally

Bitcoin hits record high above $ 81,000

What's Happening:

Bitcoin surged past $81,000 on Monday, marking a record high and more than doubling its value from this year's low of $38,505. The cryptocurrency briefly touched $81,899 before settling at $81,572.

Why?

1. The surge is fueled by expectations of a crypto-friendly regulatory environment following the election of Donald Trump as U.S. president and pro-crypto candidates to Congress.

2. Trump campaigned on promises to boost digital assets, aiming to establish the U.S. as a global crypto hub and accumulate a national bitcoin reserve.

3. While other market trends dubbed 'Trump trades'—including U.S. stocks and bond shorts—have cooled, cryptocurrencies continue their rapid climb.

Source: Reuters

Impact of Trump Presidency on Crude Oil Prices

Chart: TradingView

What’s happening:

Analysts predict an 80% chance of a decline in global crude oil prices due to Trump’s pro-drilling policies and trade uncertainties. While these policies could lead to oversupply and keep prices soft, rising US production costs, expected to hit $67-$70 per barrel in the coming years, may limit drilling efforts.

Why:

US dominance in crude production weakens OPEC’s influence, potentially further depressing prices. In India, lower crude costs could reduce inflation, improve fiscal stability, and benefit industries reliant on crude. However, India's reliance on discounted Russian oil amid shifting Indo-US trade terms may pose fiscal and inflationary challenges, complicating policy decisions.

Source: Mint

Norway’s Inflation slows, supporting potential rate cut in March

What’s happening:

Norway’s core inflation fell to 2.7% in October, the lowest since April 2022 and matching analyst expectations.

Headline inflation also slowed to 2.6%, aligning with Norges Bank’s forecast.

The krone, one of the weakest G-10 currencies this year, remained stable against the euro at 11.7986. Traders estimate a 22% chance of a rate cut in January and a higher likelihood of a cut in March.

Why?

The broad-based slowdown in inflation supports Norges Bank’s guidance for a potential interest rate cut in Q1 2025.

High wage growth and the weak krone have delayed earlier easing plans, with policymakers cautious about external pressures and international rate expectations.

Risks remain of a delay to the rate cut if external factors like the krone’s exchange rate worsen further.

Source: Financial Post

Management chatter

In this section, we pick out interesting comments made by the management of major companies.

Bhavish Aggarwal, CEO, Ola Electric Mobility on Future Growth and Premium v/s Mass

See my expectation would be, we would year-on-year aim to grow around (+50%). That's our aim. Some quarters it might be more some quarters it might be less. So, now within there is obviously seasonality. So, Q3 will always be a good season, Q2 will be a little weaker season. I am sure you will apply the seasonality discount whenever you look at it quarter-on-quarter. The other comment on Premium versus Mass. So, Mass has obviously helped increase penetration. Our focus is to let both of our portfolios – Premium and Mass grow in the market. We are not really worried about cost cannibalization since gross margins are broadly similar and Premium like I mentioned also makes just about 52% of our revenue overall so the majority of our revenue comes from Premium. Now looking ahead also even after Q2 in October, we have had the generally similar ratios. The Premium continues to also grow, while Mass is really the one growing significantly. - Link

CS Shetty, Chairman, State Bank of India on medium-term goals of the bank

Our medium-term goal is to become the first Rs 1-trillion net profit company in the country. We are aspirational about that. The run rate indicates that we should be able to reach that operating profit level of Rs 1 trillion this year. The macros are playing well and credit growth is coming out across the segments and our efforts to mobilise the deposits has paid dividends in Q2. We have registered good growth and we were able to contain the cost of deposits also, which means that we are probably heading towards one trillion rupee operating profit. - Link

Calendars

In the coming days, We have the following quarterly results and other major events:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

Devyani international is profitable at the EBIDTA level but why is PAT gone down by 99.95 percent? PAT can go down so heavily for QSR chain if depreciation costs are high and if they their interest coverage ratio is low. This means that they are expanding by acquisitions of franchise rights and increasing new stores.

Why are they expanding so much when EBIDTA margins are falling. Is it to survive the competition faced in QSR space? What impact can this have on balance sheet of the company?

SBI i trillion net profit??