Nifty closes flat after facing resistance around 200 DMA for the second day

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real time by Tijori.

Market Overview

Nifty opened flat at 23,769.10 but quickly dipped into the red, hitting the day’s low of 23,685.15 within the first 20 minutes. It then rebounded sharply, climbing nearly 135 points to test 23,820. After a brief pause, the index moved higher to reach the day’s high of 23,867.65.

However, the momentum faded as the market gradually drifted lower until 1:30 PM, settling around 23,750. For the remainder of the session, the Nifty traded within a narrow 30-point range between 23,720 and 23,750. It eventually closed at 23,727.65, down 0.1% for the day.

With FIIs stepping away for year-end holidays, market volumes may remain slightly lower over the next week to ten days.

Broader Market Performance:

While the headline indices closed in the red, broader market sentiment showed improvement compared to yesterday, turning positive. A total of 1,443 stocks advanced, up from 1,130 in the previous session, while 1,334 stocks declined, down from 1,703 on the NSE.

Sectoral Performance:

Sectoral trends were predominantly negative, with all major indices closing in the red except for Auto and FMCG. The Auto sector led the gains, rising 0.57%, while the Metal sector was the biggest laggard, dropping 0.83%.

Note: The above numbers for Commodity futures were taken around 4 pm.

Note: Today’s numbers are yet to be released by the exchanges.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 26th December:

The maximum Call Open Interest (OI) is observed at 24,000, followed by 23,800, while the maximum Put Open Interest is at 23,500, followed by 23,700.

On the downside, immediate support is seen at 23,500, followed by the 23,300-400 range. On the upside, resistance is expected at the 23,800–23,900 range, with 24,000 acting as the critical resistance level moving forward.

Note: OI is subject to multiple interpretations but generally, in a falling market if there is an increase in the call OI, it indicates resistance, and in a rising market, if there is an increase in the put OI, it indicates support.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

NACDAC Infrastructure had a stellar debut on the BSE SME platform on December 24, listing at ₹66.50 per share—a 90% premium over its issue price. The strong performance follows an extraordinary response to its ₹10.01 crore IPO, which was oversubscribed nearly 2,000 times. It closed higher by 99.48% at the close.

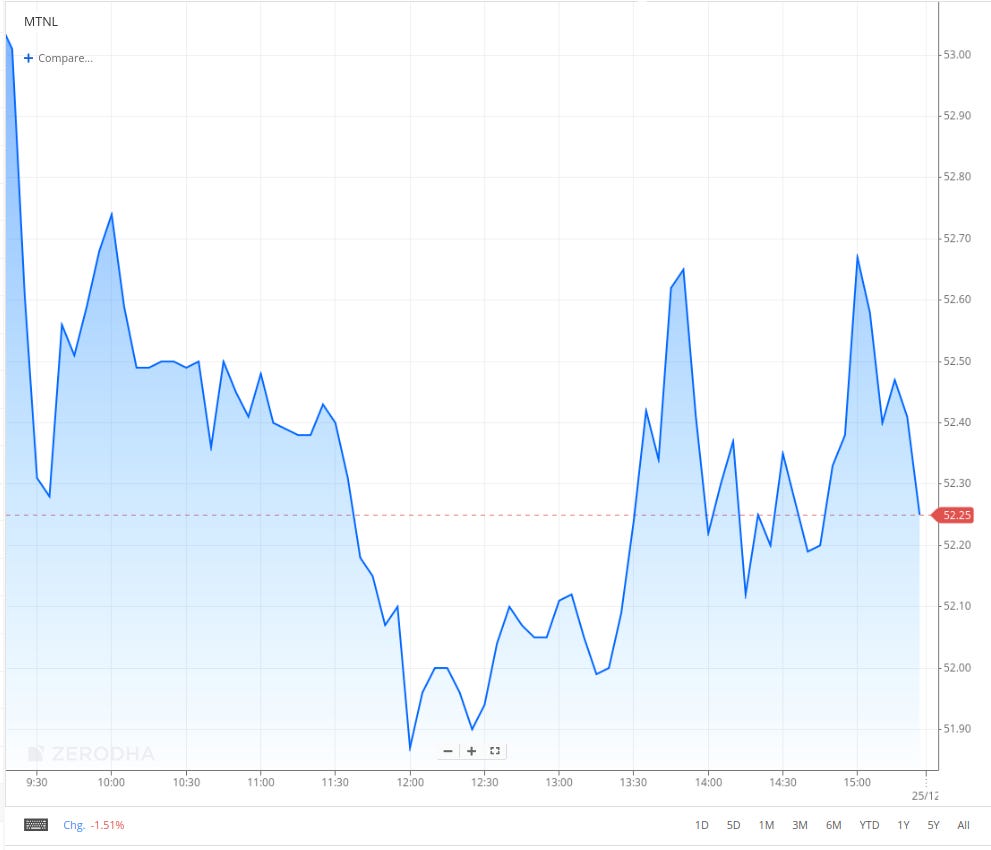

MTNL shares closed higher by 2.22% after the board approved a Voluntary Retirement Scheme on 23.12.2024 to reduce employee costs by offering VRS based on the Gujarat Model to employees aged 45 and above. Dive deeper

Greaves Cotton Ltd shares surged 7.36% after its subsidiary, Greaves Electric Mobility Limited (GEML), filed a draft red herring prospectus with SEBI, signaling plans for a potential public offering. Dive deeper

Biocon shares were up by 4.5% after the USFDA issued an Establishment Inspection Report (EIR) with Voluntary Action Status (VAI) for its API facility in Bengaluru. Earlier, the stock rose following the company and its European partner Zentiva receiving EU approval for Liraglutide, a complex formulation for treating Type-2 Diabetes and weight management, as a generic alternative to Victoza® and Saxenda®. Dive deeper

Aurionpro Solutions acquires Fenixys for €10 million, enhancing their European presence in the banking and fintech sectors. Dive deeper

HFCL inaugurated an advanced defense manufacturing facility in Hosur, producing Thermal Weapon Sights, Electronic Fuzes, and Surveillance Radars to support India's defense needs and export potential. Dive deeper

Shares of Tata Investment Corp. surged in early trade on Tuesday amid market buzz about the upcoming IPO of Tata Capital, the Tata group’s flagship financial services arm. According to media reports, the group has enlisted advisors for the mega-IPO, which is expected to be valued at over ₹15,000 crore. Dive deeper

Akums Drugs and Pharmaceuticals Ltd. (-0.33%) announced that it has signed an agreement with a leading global pharmaceutical company to manufacture and supply selected oral liquid formulations for the European market. The deal, valued at approximately ₹1,760 crore (€200 million), involves multiple SKUs to be marketed across several European countries. Dive deeper

PG Electroplast (PGEL) shares rose 4.8% to an intraday high of ₹1,000.20 on the BSE before closing 1.66% higher at 966.65 after the company announced a definitive agreement with Whirlpool of India to manufacture select Whirlpool-branded semi-automatic washing machines. Dive deeper

Newgen Software’s (1.09%) subsidiary in Saudi Arabia secured a purchase order worth USD 2,266,667 from an international entity, to be executed in one year. Dive deeper

What’s happening globally

Chinese authorities plan to issue a record 3 trillion yuan ($411 billion) in special treasury bonds in 2025 to boost fiscal stimulus and support the slowing economy, according to Reuters. This marks a significant increase from this year’s 1 trillion yuan issuance and comes as Beijing braces for potential economic challenges, including a possible rise in U.S. tariffs on Chinese imports under Donald Trump's upcoming presidency. Dive deeper

The US dollar strengthened in light holiday trading on Tuesday, maintaining its recent momentum as traders adjusted expectations for fewer Federal Reserve rate cuts in 2025.

In Europe, the EUR/USD pair dipped 0.1% to 1.0396, hovering near a two-year low. The European Central Bank is anticipated to cut interest rates more aggressively than the Federal Reserve, amid the eurozone's ongoing struggle to achieve growth. Dive deeper

The U.S. Federal Reserve announced plans to revise its annual bank stress tests, including allowing banks to comment on the models and hypothetical scenarios used, following recent legal developments. It also proposed averaging results over two years to reduce volatility in capital requirements, marking a significant win for Wall Street banks. Dive deeper

Honda Motor Co shares surged 14% on Tuesday following news of merger talks with Nissan Motor, planned for 2026, and the announcement of a 1.1 trillion yen ($7 billion) stock buyback. In contrast, Nissan shares dropped 7% despite the merger discussions. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Amitabh Chaudhry, MD & CEO, Axis Bank

“I don't think interest rate cut is going to spur the capex. Interest rates are pretty decent by Indian standards. There are other issues which need to be looked at more closely, rather than interest rate cut,”

“Liquidity needs to be released in the banking system. RBI did that to some extent in the latest monetary policy announcement,”

“RBI rightly has tightened a number of areas on the banking side. In some cases, the tightening has gone to a point maybe where the flow of credit has reduced quite a bit,” - Link

Kapish Malhotra, Business Head (Commerce) of Ola Consumer

The entire food delivery business is on ONDC, fully committed to open network philosophy.

Actively working with merchant partners and adding categories almost on a daily basis.

Will soon enter D2C brand store categories, which captures a large part of the beauty, and personal care markets.

Also plan to launch fashion and electronics categories very soon. - Link

Calendars

In the coming days, we have the following major events and corporate actions:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.