Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Market Overview

Nifty opened 19 points lower at 23,542 and traded within a narrow range initially before climbing to 23,676. It then tested fresh lows at 23,484 before settling into a consolidation phase between 23,500 and 23,550 for the rest of the day. The index hovered around its 200-day moving average (DMA), which provided temporary support and halted further declines. Broader market sentiment improved, with 1,531 stocks advancing and 1,269 declining on the NSE.

The auto sector showed strength, while the FMCG sector continued to see selling pressure. Other sectors remained mostly flat. With the 200 DMA acting as support for now, it will be interesting to see how the market moves in the coming week.

Note: The above numbers for Commodity futures were taken around 4 pm.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 21st November;

The maximum CE OI is at 24000 followed by 23600 and Put OI is at 23500 followed by 23600.

The addition of 24.5 lakh contracts to the 24000 CE, 22.52 lakh to the 23,600 CE, and 21.68 lakh to the 23,500 CE with prices remaining in a narrow range indicates a defined range for the markets for now.

Immediate support on the downside can now be seen at 23500 followed by 23400 which has the maximum OI for contracts expiring next week. Resistance on the upside can be seen around 23700 and 23800 levels with the upside capped at 24000.

Please note that we have 2 trading holidays before the upcoming weekly expiry.

Note: This is subject to multiple interpretations but generally, in a falling market if there is an increase in the call OI, it indicates resistance.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the promoter activity in Tijori App’s idea dashboard.

What’s happening in India

Niva Bupa Healthcare debuted with a 6% premium but fell 6.24% post-listing, erasing gains ending on a flat note, as cautious investor sentiment weighed on the moderately subscribed IPO amid recent negative earnings.

India's merchandise trade deficit in October 2024 expanded to $27.14 billion, up from $20.78 billion in September. This increase was primarily due to a significant rise in imports, which grew by 20% month-over-month to $66.34 billion. Exports also saw growth, increasing by 13.4% to $39.2 billion during the same period. - Dive deeper

In October 2024, India's Wholesale Price Index (WPI) inflation reached 2.36% year-on-year, a four-month high, primarily due to a significant 11.6% increase in food prices. Vegetable prices surged the most, and cereals also saw notable rises. Conversely, fuel and power prices declined by 5.8% during the same period.

India's edible oil imports fell 3.09% in 2023-24 due to higher domestic production and reduced demand amid rising global prices, with crude palm oil and soybean oil imports declining."International prices firmed up due to various reasons which reflected in rise in domestic prices and also reduction in import to some extent." – Solvent Extractors Association of India (SEA). - Link

Eicher Motors Ltd., the parent company of Royal Enfield, has recently shifted its strategic focus from prioritizing EBITDA margins to emphasizing sales growth. This change was highlighted during their post-earnings call, where management discussed the reintroduction of key products and noted a significant 26% year-over-year increase in festive retail sales, surpassing the industry's 6-7% growth. This strategic shift has been well-received by investors, leading to a 6.42% increase in Eicher Motors' stock price, even amid a declining market. - Dive deeper

SpiceJet settled a $90.8 million (₹763 crore) liability with Export Development Canada for $22.5 million (₹189 crore), saving $68.3 million (₹574 crore). The airline gained ownership of 13 Q400 aircraft, reducing costs and strengthening finances. SpiceJet plans to expand regional operations under the UDAN scheme, adding 18 more flights with revitalized Q400s to enhance connectivity. - Dive deeper

Quarterly results

In this section, we'll dive into all the key highlights from today's intriguing results, covering the most impactful performances and standout moments. The numbers are comparable on a year-on-year (YoY) basis.

Hindustan Aeronautics (0.53%)

Financials:

Revenue from operations: ₹5,976.3 crore, up 6% YoY from ₹5,635.7 crore.

EBITDA: ₹1,640 crore, up 7.3% YoY from ₹1,527.7 crore.

EBITDA Margin: 27.4%, slightly improved from 27.1% YoY.

Net Profit (PAT): ₹1,510.5 crore, up 22.4% YoY from ₹1,236.7 crore.

Key Highlights:

Strong revenue growth attributed to increased operations and diversified portfolio investments.

Investments in the newly incorporated defence testing and advanced material foundations reflect HAL's commitment to R&D and strategic development.

Outlook:

HAL anticipates continued growth driven by new collaborations and increased defence spending.

The focus remains on improving operational efficiencies and furthering technological advancements in its aviation and defence sectors.

Segment Performance:

Investments in electronic warfare and advanced materials are expected to provide long-term growth opportunities.

Bharat Forge (0.44%)

Financials

Total Revenue: ₹2,246.6 crore, a slight decline of 0.1% YoY from ₹2,249.3 crore.

EBITDA: ₹625.4 crore, up 3% YoY from ₹606.7 crore.

EBITDA Margin: Improved to 27.8% from 27.1% YoY.

Net Profit (PAT): ₹361.1 crore, up 4.4% YoY from ₹346 crore.

Key Highlights:

Modest revenue decline offset by strong EBITDA growth, driven by operational efficiencies.

Margin improvement due to better cost management amidst challenging pricing conditions.

Segment Performance:

Forgings: Grew by 1%, led by strong demand in Brazil.

Defence and Others: Exhibited a combined 5% growth.

Outlook:

The company expects steady growth in core segments, with a continued focus on expanding into high-margin areas and optimizing production efficiency to support profitability.

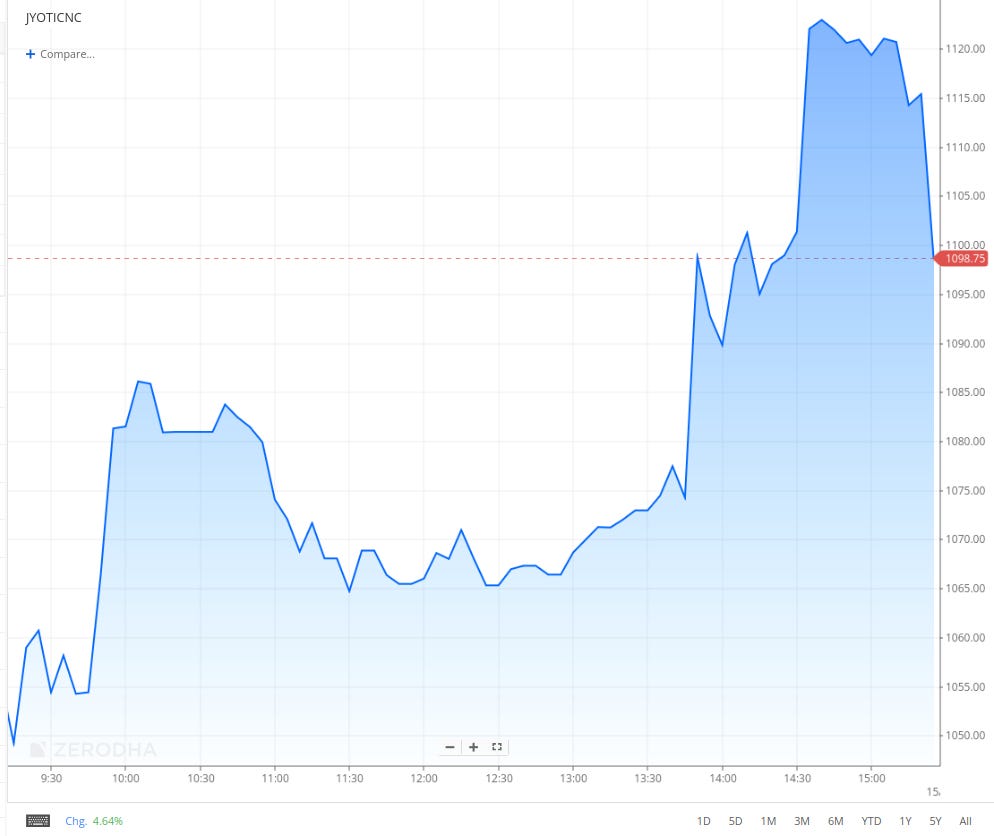

Jyoti CNC Automation Ltd. (4.64%)

Financials

Revenue from operations: ₹430.67 crores, up from ₹302.28 crores, a 42.5% YoY increase.

EBITDA: ₹99.42 crores, an increase from ₹23.03 crores YoY, reflecting a 331.6% growth.

Net Profit (PAT): ₹75.88 crores, compared to ₹16.76 crores, showing a 352.8% YoY rise.

Key Highlights

Significant revenue and profit growth attributed to operational efficiencies and increased demand in the Machine & Tool Industries sector.

The company undertook an expansion project to increase manufacturing capacity to 16,000 machines annually, backed by a ₹400 crore investment over the next two years.

Segment Performance

Single business segment focus on Machine & Tool Industries, showing robust growth.

Outlook

Future growth is anticipated through expanded production capacity and strategic investments in infrastructure development and manufacturing.

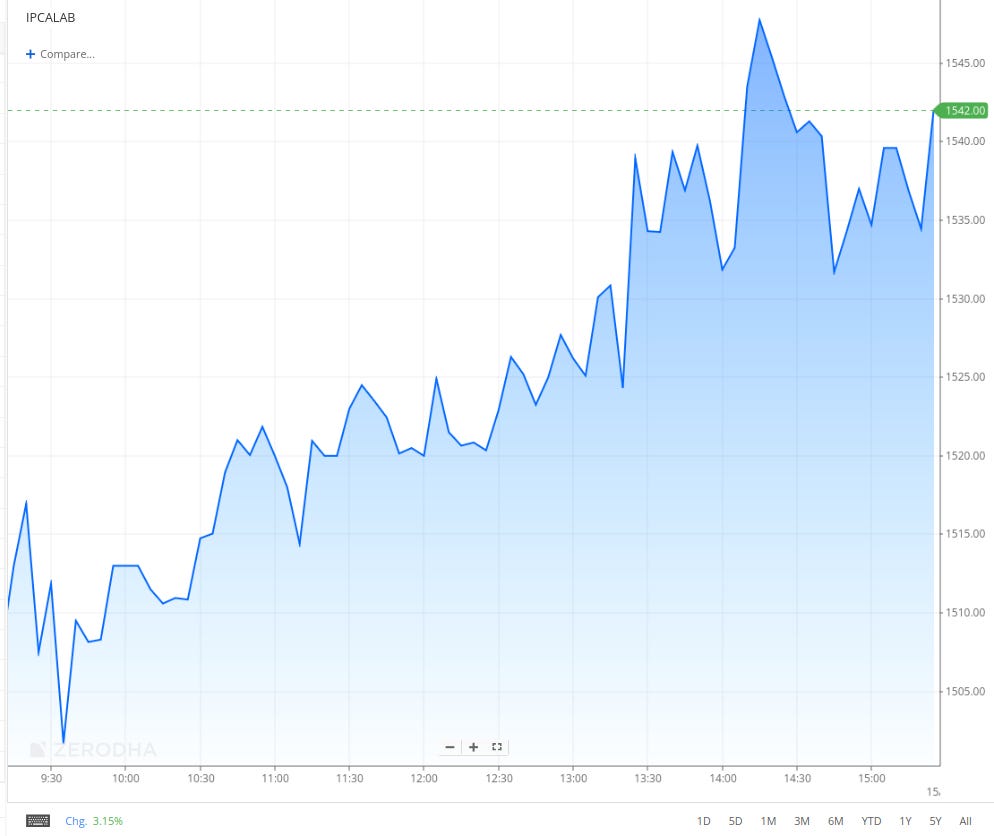

Ipca Laboratories Ltd. (3.15%)

Financials

Revenue from operations: ₹2,355 crore, up 15.8% YoY from ₹2,034 crore.

EBITDA: ₹441.7 crore, an increase of 22.5% YoY from ₹360.5 crore.

EBITDA Margin: 18.8%, up from 17.7% YoY.

Net Profit (PAT): ₹229.5 crore, up 58.3% YoY from ₹145 crore.

Key Highlights:

Strong growth in both domestic and export formulations segments.

Indian formulations revenue grew by 11%, with export growth at 6%.

Outlook:

Focused on expanding market share in both domestic and international markets, with continued product innovations to drive future growth.

Crompton Greaves (-3.52%)

Financials

Revenue from operations: ₹1,896 crore, up 6.4% YoY from ₹1,782 crore.

EBITDA: ₹203 crore, up 20% YoY from ₹175 crore.

EBITDA Margin: 10.7%, up from 9.8% YoY.

Net Profit (PAT): ₹125 crore, up 28.5% YoY from ₹97 crore.

Key Highlights:

Electric Consumer Durables (ECD): Strong growth of 13% YoY, driven by pumps and appliances.

Lighting Products: Revenue up 6% YoY with a focus on premium offerings.

Butterfly Appliances: Revenue at ₹258 crore, a decline of 16% YoY; however, sequential improvement in EBITDA margin to 8.9%.

Outlook:

Continued investment in the brand, expansion of sustainable product lines, and strong order pipeline.

Muthoot Finance (1.11%)

Financials

Net Interest Income (NII): ₹2,518.1 crore, up 35.5% YoY from ₹1,858.4 crore.

Net Profit (PAT): ₹1,251.1 crore, up 26.5% YoY from ₹990.99 crore.

Key Highlights:

Robust YoY growth driven by increased interest income and consistent customer demand for financing solutions.

Strategic investment in expanding branch network and digital capabilities to enhance customer access.

Outlook:

The company remains optimistic about continuing growth with focus on digital finance innovations and further operational expansion to maintain its market position.

What’s happening globally

The U.S. Consumer Price Index (CPI) rose by 2.6% year-over-year in October 2024, up from 2.4% in September, driven primarily by several key factors. Housing costs, particularly shelter, and rents, saw a 0.4% increase, contributing significantly to the overall inflation rate.

Source: Trading Economics

Ukraine's dollar-denominated bonds surged 12% in a month as investors bet on a Trump-driven ceasefire, with bonds maturing in 2036 rising to 49 cents on the dollar. The September restructuring of $20bn in debt gave bondholders potential higher payouts tied to economic recovery, but doubts remain over Trump's ability to deliver a rapid peace deal or its impact on Ukraine's postwar economy. - Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian Economy.

Pieter Elbers, CEO of IndiGo on the Indian Aviation sector;

We will double in size in the next couple of years, India is the most competitive market in the world. If you can sustain in the Indian market you will be able to compete in the world. - Link

Uday Kotak, Chairperson of Kotak Mahindra Bank on Trump and US Domination in Global Economy;

Trump's win has changed perspectives on how he is going to run the world. 66% of the global market cap belongs to the US - we need to ensure America does not make the rest of the world irrelevant. Military, finance, and creativity are 3 market segments that give the US its power - India can take a cue from here. India needs to transform its defence spending as a percentage of its GDP - Link

Anuj Jain, MD of Kansai Nerolac Paints on competition and demand environment;

I think it is still early to comment on that, to determine how it will play out. We are monitoring the trend. But our understanding is that such moves stabilize over a period of time. And I think our objective is to remain resilient and keep delivering value in this situation. But I think, as we said earlier, it is a slow-paced industry; in order to build the distribution, the painter, and the bank, it takes time. I think that is what is being demonstrated in the market today. I also still believe, as I said earlier, that overall, unfortunately, for the last few quarters, the demand scenario is down, but I am sure it is a short-term kind of thing—a blip. Because never have we seen demand trending low for such a long period. I am sure that sooner or later, the demand will come back. And in that situation, the size of the industry is good, and a greater number of players helps in terms of driving innovation, raising standards, and expanding the markets. So, I think in that way, it is a good scenario.

Calendars

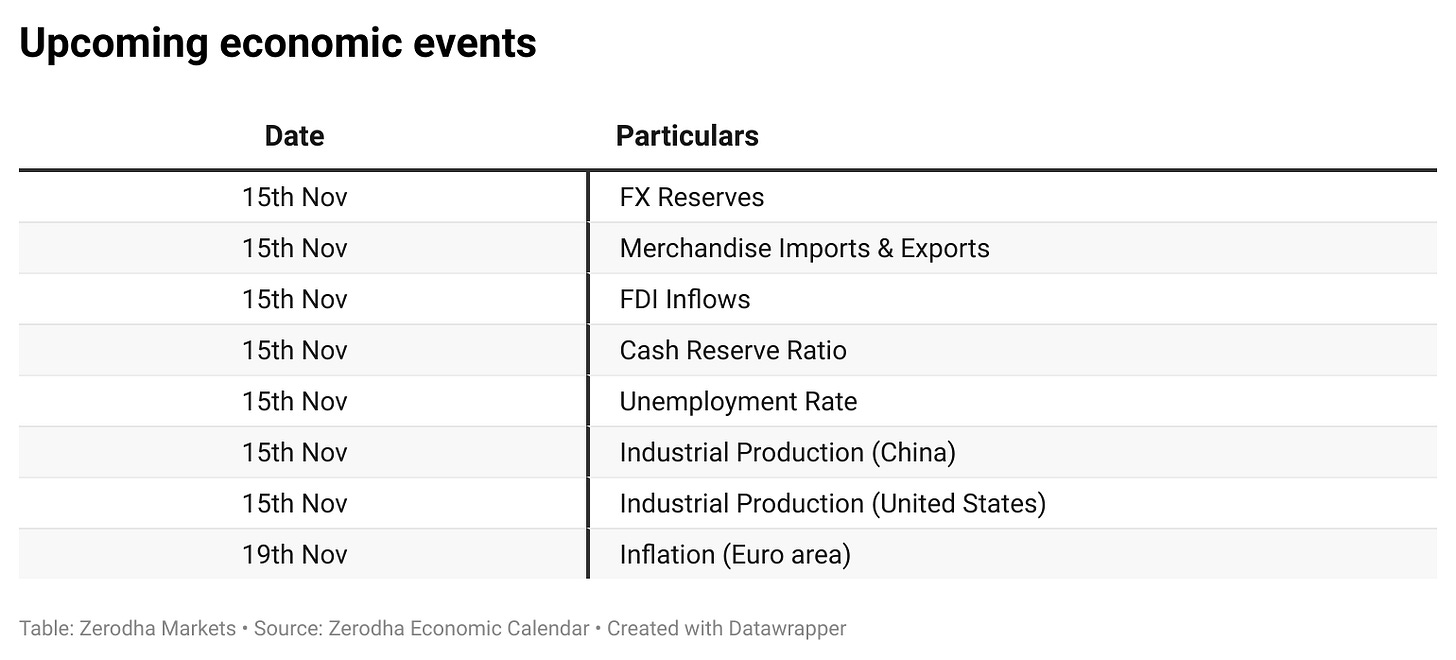

In the coming days, We have the following quarterly results and other major events:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

I like the Quarterly Results section and Management Chatter 😊

Great inside, thank you for sharing