Nifty concludes the week of consolidation near 24,800

Welcome to the weekly edition of the Aftermarket Report, a newsletter where we do a quick weekly wrap-up of what happened in the markets—both in India and globally.

Catch “Who Said What”, a weekly show where we'll pick fascinating comments from notable figures, break them down, and explore the broader stories behind them.

Market Overview this week

Nifty traded within a narrow range for the first four days of the week, oscillating within a 150-point band between 24,520 and 24,670–24,700 levels. However, Friday brought a breakout from this range as the index initially dropped 300 points but staged a remarkable recovery of 600 points from the lows to close near the weekly high at around 24,770.

The Information Technology (IT) sector emerged as a strong performer during the week, particularly on December 12, driven by expectations of a potential U.S. Federal Reserve rate cut. This optimism bolstered IT companies with significant U.S. revenue exposure. In contrast, the metal sector faced headwinds due to a strengthening U.S. dollar and uncertainties about stimulus measures from China, weighing on major players such as Tata Steel and Hindalco. Financials and banking stocks exhibited mixed trends, with some profit-taking seen as markets reacted to domestic inflation data and broader global economic cues.

On the economic front, India’s November inflation data showed an easing in overall price levels, but rising food inflation in rural and urban areas raised concerns about its impact on consumer spending and corporate profitability. Globally, U.S. inflation data and expectations of a Federal Reserve rate cut shaped investor sentiment, providing a boost to IT stocks while keeping other sectors cautious.

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market.

What happened in India?

Sanjay Malhotra, a 1990-batch IAS officer and Revenue Secretary, was appointed as the new RBI Governor, bringing over 33 years of experience in finance and public policy. Dive deeper

The IRDAI and Finance Ministry supported reducing GST on insurance premiums, with discussions set for December 21. Proposed exemptions included senior citizens' health insurance, policies up to ₹500,000, and term life insurance, aiming to boost penetration. Dive deeper

Mutual fund inflows in November 2024 fell by 75% to ₹60,363 crore, compared to ₹2.39 lakh crore in October. Equity fund inflows saw a decline of 14%, while sectoral funds received the highest inflows. Dive deeper

SIP contributions in November 2024 saw a slight decrease to ₹25,320 crore, marking a brief pause after 16 months of steady growth. Dive deeper

SEBI warned against trading securities of unlisted companies on unauthorised platforms, stating such transactions violate regulations and carry higher risks. Dive deeper

Life insurance premiums saw a 4.5% YoY decline in November 2024, totalling ₹25,306 crore, largely due to a drop in LIC’s performance. However, the private sector experienced significant growth, with ICICI Prudential, Max Life, and HDFC Life driving a 31% rise in premiums. Dive deeper

Coca-Cola sold a 40% stake in Hindustan Coca-Cola Beverages to Jubilant Bhartia Group for ₹12,500 crore, marking a strategic shift and boosting Bhartia Group’s presence in India’s beverage sector. Dive deeper

India's retail inflation eased to 5.48% in November 2024, down from 6.21% in October, mainly due to moderating food prices. Food inflation dropped to 9.04%, with vegetable price growth slowing to 29.33% from 42.18% in October. Dive deeper

India's industrial output grew by 3.5% in October 2024, up from 3.1% in September. Manufacturing rose 4.1%, electricity generation increased 2%, and mining activity grew 0.9%. For April-October, industrial output rose 4%, down from 7% last year. Dive deeper

Banks' deposit mobilization increased by 10.6% to ₹224.7 lakh crore by November 29, 2024. Term deposits rose 10.5% to ₹26.3 lakh crore, and demand deposits grew 10.6% to ₹198.4 lakh crore. Credit also increased 10.6% to ₹179.6 lakh crore, according to RBI data. Dive deeper

Passenger vehicle dispatches rose 4% YoY in November to 3,47,522 units, reflecting continued demand after the October festive period, as per SIAM. Dive deeper

SEBI proposed a framework for retail investors to engage in algorithmic trading, requiring broker approval for algorithms and unique tags for algo orders. Algos were categorized into Execution (White Box) and Black Box types. Comments were due by January 3, 2025. Dive deeper

BlueStone Jewellery filed its DRHP with SEBI to raise ₹1,000 crore through an IPO, including a fresh issue and an offer for sale of 2.4 crore shares. Dive deeper

India's edible oil imports rose 38.5% to 15.9 lakh tonnes in November, driven by higher shipments of crude sunflower and soybean oils. Total vegetable oil imports increased by 40% to 16.28 lakh tonnes, with palm oil imports declining. Dive deeper

Apple began assembling AirPods in India in early 2025, aiming to reduce reliance on China. Production will be managed by Foxconn at a new facility near Hyderabad. Dive deeper

What happened across the globe?

The U.S. defence bill negotiations excluded a provision to blacklist five Chinese-linked biotech firms from federal research, citing due process concerns. Lawmakers may revisit the measure in future funding discussions. Dive deeper

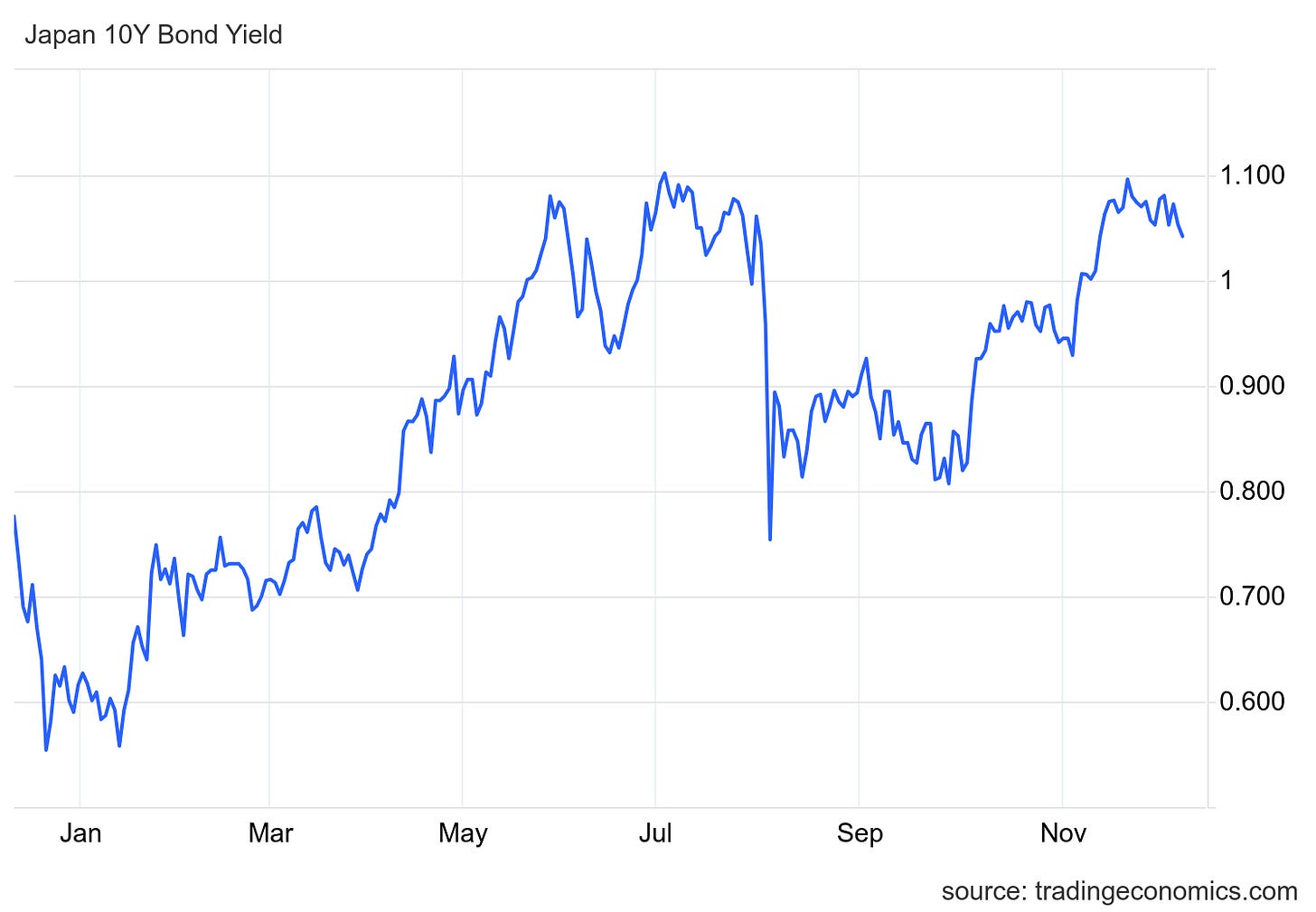

Japan's 10-year bond yield fell below 1.04% amid uncertainty over the timing of the next BOJ rate hike. Despite a Q3 growth revision to 0.3%, concerns about wage growth and economic fragility persist. Dive deeper

Iron ore prices rose above $106 per ton in mid-December, driven by China's pledge to implement a "moderately loose" monetary policy and "proactive" fiscal stimulus, improving the demand outlook. Dive deeper

Norway's annual inflation eased to 2.4% in November 2024, down from 2.6% in October, as lower housing and utility costs offset higher prices for food and household items. Dive deeper

Alphabet's shares increased following Google's announcement of its quantum computing chip, "Willow," which outperformed its 2019 predecessor in a key benchmark. Willow, featuring 100 qubits, brings Google closer to developing practical quantum computers for applications like drug discovery and energy. Dive deeper

The IEA expected the global oil market to be well-supplied in 2025, despite OPEC+ extending supply cuts and raising its demand growth forecast to 1.1 million barrels per day (bpd), up from 990,000 bpd. This growth was mainly driven by Asia, particularly China. Dive deeper

U.S. inflation rose 2.7% year-on-year in November 2024, with a 0.3% CPI increase. Core prices rose 3.3%, driven by higher food and housing costs, though rent and motor vehicle insurance growth slowed. Food prices increased 0.4%, and gas prices rose 0.6%, with inflation remaining a concern ahead of the Fed's rate decision. Dive deeper

The Swiss National Bank (SNB) reduced its key policy rate by 50bps to 0.5% in December 2024. Inflation eased to 0.7%, with GDP growth expected around 1%, amid rising unemployment and global uncertainties. Dive deeper

US initial jobless claims rose by 17,000 to 242,000 in the first week of December, surpassing expectations. Outstanding claims increased by 15,000 to 1,886,000, nearing a three-year high. Dive deeper

Germany's imports fell 0.1% to EUR 111.2 billion in October 2024, reversing September's 2.0% growth. Imports from non-EU countries dropped by 0.6%, while those from the EU rose by 0.4%. Total imports for the first ten months contracted by 3.6%, totalling EUR 1,100 billion. Dive deeper

China expanded its private pension scheme nationwide from December 15, allowing those covered by public pension insurance to open private accounts and invest up to 12,000 yuan annually in products like government bonds and index funds. This follows a 2022 pilot program in 36 cities, which led to over 60 million accounts. Dive deeper

Calendars

In the coming week, We have the following quarterly results and other major events:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.