Nifty edges higher; Broader markets lead the recovery

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

After a modest rebound in U.S. markets overnight, the Nifty opened 80 points higher at 23,165.90. In the first hour, it remained within a narrow 50-point range, fluctuating between 23,150 and 23,200. After hitting an intraday low of 23,134.15, the market witnessed a sharp 130-point recovery, driven mainly by gains in auto and financial stocks, pushing it to the day's high of 23,264.95 around 11:15–11:20 AM.

However, during the second half of the session, the market cooled off and spent the last four hours oscillating within a 50-point range between 23,140 and 23,190. It eventually closed at 23,176.05, marking a 0.39% gain.

With macroeconomic factors continuing to weigh heavily on sentiment, the outlook remains cautious. Moving forward, market trends are expected to be influenced by global economic developments and earnings reports from key index heavyweights like Reliance and Infosys. Investors are hoping for signs of stabilization to curb the ongoing sell-off.

Broader Market Performance:

The broader markets outperformed the headline indices, providing some relief to portfolios heavily weighted in mid and small-cap stocks. On the NSE, 2,117 stocks advanced, 700 declined, and 65 remained unchanged.

Sectoral Performance:

Sectoral performance displayed a broadly positive trend, with all sectors closing in the green except IT and FMCG. PSU Banks and Metals emerged as the top performers, posting impressive gains of 3.68% and 3.63%, respectively. In contrast, Nifty IT and FMCG recorded declines of 2.13% and 1.66%, respectively.

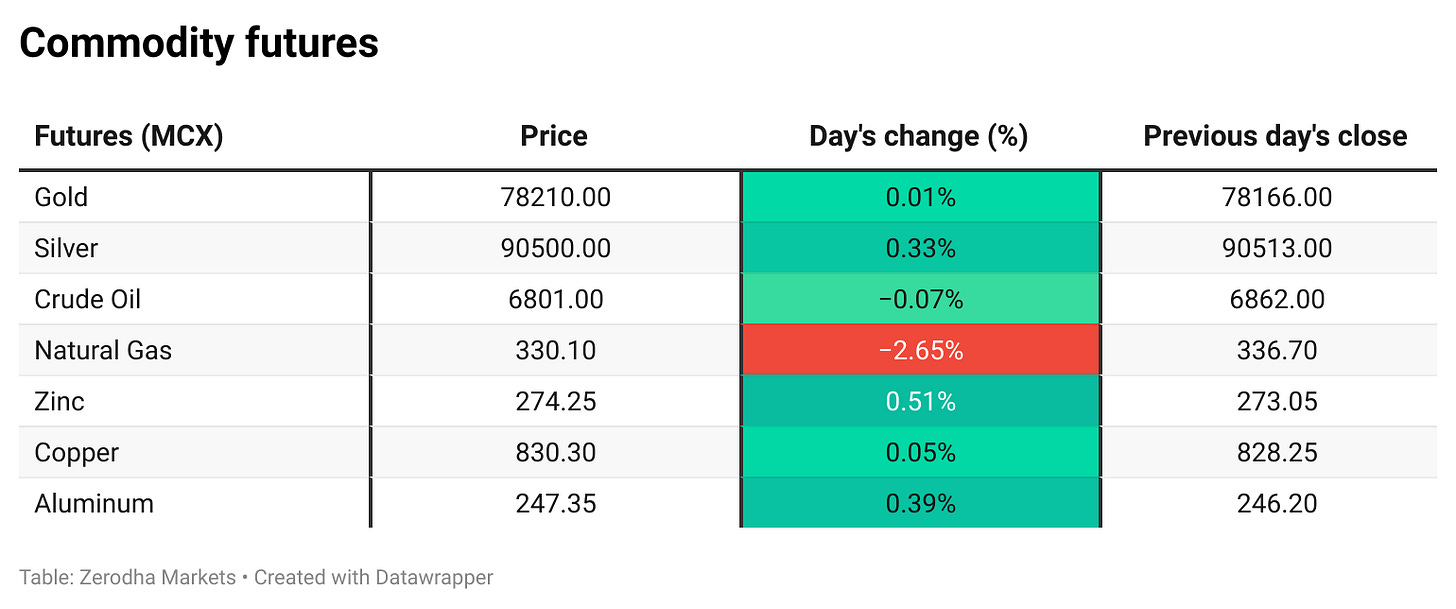

Note: The above numbers for Commodity futures were taken around 4 pm.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 16th January:

The maximum Call Open Interest (OI) is observed at 23,500, followed by 23,400. Meanwhile, the maximum Put Open Interest (OI) is at 23,000, followed by 23,200.

Immediate support is identified in the 23,000–22,900 range, while resistance is expected between 23,350 and 23,500.

Note: OI is subject to multiple interpretations but generally, in a falling market if there is an increase in the call OI, it indicates resistance, and in a rising market, if there is an increase in the put OI, it indicates support.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

India's net direct tax collections grew by 15.88% as of January 12, 2025, slightly slowing from 16.5% in December 2024. Gross receipts totalled ₹20.64 lakh crore, with corporate taxes contributing 47.07% and non-corporate taxes 50.6%. Net corporate tax collections rose 8.12%, while non-corporate taxes grew by 21.6%. Dive deeper

India’s wholesale prices rose 2.37% YoY in December 2024, driven by higher manufacturing prices and slower fuel price declines. Primary articles and manufacturing saw faster growth, with food products, textiles, and apparel contributing significantly. Monthly prices fell 0.38%, marking the second consecutive decline.Dive deeper

Mazagon Dock Shipbuilders Ltd (MDL) conducted the keel laying ceremony for a training ship for the Indian Coast Guard on January 13, 2025. The ₹310 crore project is scheduled for delivery in December 2026. The ship will be equipped with two diesel engines, achieving speeds over 20 knots, and will serve as a training platform for Coast Guard officers. Dive deeper

The Indian Hotels Company Limited has acquired 55% of Rajscape Hotels Private Limited for ₹17.66 crores, gaining 7,989 shares at ₹22,100 each. Rajscape Hotels, which operates 16 properties under the "Tree of Life Resorts & Hotels" brand, is now a subsidiary, enabling expansion into the boutique and experiential stays segment. The acquisition was completed on January 13, 2025. Dive deeper

JSW Energy has received a Letter of Intent for its resolution plan for KSK Mahanadi Power Company Limited, following approval from the Committee of Creditors. The transaction, involving a 3,600 MW thermal power plant in Chhattisgarh, is subject to regulatory approvals. This acquisition supports JSW's target of 20 GW capacity by 2030. Dive deeper

Tata Consultancy Services 2025 eMobility study finds 64% of consumers are likely to choose electric vehicles for their next purchase. Challenges remain, particularly around charging infrastructure, but 56% are open to paying up to $40K for an EV. Dive deeper

Hyundai Motor India plans to accelerate EV adoption with the Creta EV, targeting the mass market. COO Tarun Garg expects a significant jump in EV penetration by 2026, with a 17% market share by 2030. The company aims to expand its EV offerings, addressing customer needs with strong reliability and range. Dive deeper

Nazara Technologies' Board approved a cash payment of INR 72.73 crore for acquiring a 9.09% stake in Absolute Sports, replacing the previously planned equity issuance. Following this, Nazara will hold 91.03% of Absolute's equity, and the earlier approved preferential issue of shares has been annulled. Dive deeper

Tata Communications and JLR have expanded their partnership to enhance JLR's connected vehicle ecosystem using the Tata Communications MOVE platform. This will provide continuous connectivity, real-time location services, and more frequent software updates over the air, ensuring a smarter driving experience for JLR’s upcoming SUVs launching in 2026. Dive deeper

Air India plans to increase premium economy and business class seats, focusing on improving flight timings and attracting more connecting traffic. Under Tata Group's leadership, the airline has seen significant revenue growth, with a 2.3x increase in premium cabin revenue. Dive deeper

WeWork India has raised ₹500 crore through a rights issue to repay debt and strengthen its balance sheet, aiming for long-term growth and a 2025 IPO. The company operates 63 centres across 8 cities, serving a diverse client base. Dive deeper

Afcons Infrastructure has won the lowest bid for a ₹4,787 crore road project for Pune Ring Road and secured a ₹1,084 crore infrastructure project from DRDO. Both projects will be completed in 36 months. Dive deeper

HPCL has commissioned a ₹4,750 crore LNG regasification terminal in Chhara, Gujarat, with a capacity of 5 million tonnes per annum, expandable to 10 MT. The terminal will support India's goal of increasing natural gas share to 15% by 2030. Dive deeper

Shares of Delta Corp fell after reporting a decline in Q3FY25 revenue to Rs 194.33 crore, compared to Rs 210.13 crore last year. However, the company saw an increase in net profit, reaching Rs 35.73 crore, with a 32.4% sequential growth in net profit. For the first nine months of FY25, net profit dropped to Rs 84.39 crore, with net sales down to Rs 562.63 crore. Dive deeper

Bharat Electronics Limited (BEL) shares rose after securing additional orders worth Rs 561 crore, bringing its total FY25 order book to Rs 10,362 crore. The new orders include communication equipment, radar systems, and satcom network upgrades. Dive deeper

Adani Energy Solutions Ltd. shares surged over 12% after securing major orders worth Rs 28,455 crore in Q3 FY25, including a Rs 25,000 crore project in Rajasthan. The company’s order pipeline now stands at Rs 54,700 crore, with significant growth in transmission network and capacity. Dive deeper

Blue Dart has launched India's largest low-emission logistics hub in Bijwasan, Delhi, enhancing connectivity and handling over 5.5 lakh shipments daily. The facility supports the company’s sustainability efforts with solar power installations and advanced sorting systems. Dive deeper

What’s happening globally

Brent crude oil futures fell to $80.4 per barrel after a three-day surge, as new US sanctions on Russian energy tighten global supply, though weaker demand from China may limit the impact on prices. Dive deeper

Chinese banks issued CNY 990 billion in new yuan loans in December 2024, above November’s low but below December 2023 figures. The rise was driven by stimulus measures, while the money supply grew 7.3% YoY. However, total new yuan loans for 2024 fell to CNY 18.09 trillion, marking a 13-year low. Dive deeper

Gold rose above $2,670 per ounce, recovering after a 1% drop, as concerns over Trump's trade policies boosted its appeal. The outlook remains positive amid geopolitical uncertainties and central bank demand, with key U.S. economic data awaited. Dive deeper

Iron ore prices rose to $99 per ton, supported by China’s stimulus plans and record imports. However, potential US tariffs under President Trump pose risks. Dive deeper

Oil prices slipped slightly but remained near four-month highs after new U.S. sanctions on Russian oil. Brent crude fell 0.27% to $80.79, while U.S. WTI dropped 0.2% to $78.66. The sanctions are expected to reduce Russian supply by up to 700,000 barrels per day, potentially pushing prices higher, though weaker demand from China could dampen the impact. Dive deeper

Robinhood has agreed to pay $45 million in fines for a 2021 data breach and record-keeping failures, marking the largest penalty in a $100 million SEC settlement with financial groups. The settlement also included fines for 12 investment firms, including Blackstone and KKR, over violations related to off-channel communications. Dive deeper

Ukrainian drones reportedly targeted the TurkStream pipeline, a key Russian gas route to the EU, pushing gas prices up by over 7%. The Kremlin called the incident part of Ukraine's "energy terrorism," as Hungary remains the last major EU buyer of Russian gas. Dive deeper

Schlumberger (SLB) is facing increased pressure to cease operations in Russia following new US sanctions prohibiting the provision of petroleum services to Russia. This comes as SLB, one of the last US-based energy firms still operating in Russia, risks legal issues and further sanctions for continuing its support of Russia's oil sector. Dive deeper

Japan's 10-year government bond yield rose to 1.25%, its highest since April 2011, amid expectations of further rate hikes by the Bank of Japan. This follows growing speculation of revised inflation forecasts and tightening monetary policy. Dive deeper

Australia's total dwelling approvals fell by 3.6% to 14,998 units in November 2024, reversing the previous month's 5.2% gain. The decline was driven by a 10.8% drop in private sector dwelling permits, excluding houses, with regional decreases in most states, except for Queensland and Western Australia. Dive deeper

Japan's current account surplus rose to JPY 3,352.5 billion in November 2024, driven by a higher primary income surplus, a jump in the services account surplus, and a shift to a small goods surplus. However, the secondary income deficit widened. Dive deeper

Quarterly results

In this section, we'll dive into all the key highlights from today's intriguing results, covering the most impactful performances and standout moments. The numbers are comparable on a year-on-year (YoY) basis.

HDFC Asset Management Co Ltd (HDFCAMC) (0.80%)

Financials:

Revenue: ₹935 crore, up 39% YoY (from ₹671 crore in Q3 FY24)

Total Income: ₹1,028 crore, down 2% QoQ (from ₹1,058 crore in Q2 FY25)

EBITDA: ₹763 crore, up from ₹509 crore YoY

EBITDA Margin: 81.7%, up from 75.9% YoY

Net Profit: ₹641 crore, up 31% YoY

Key Highlights:

Strong YoY growth in net profit and revenue from operations.

Sequential decline in total income and other income.

Significant improvement in EBITDA margin.

Outlook:

Continued focus on operating efficiency and maintaining strong profit growth.

Angel One Ltd (ANGELONE) (-3.11%)

Financials:

Revenue: ₹1,262.2 crore, up 19.2% YoY (from ₹1,059 crore in Q3 FY24)

EBITDA: ₹496 crore, up 24.7% YoY (from ₹397.8 crore in Q3 FY24)

EBITDA Margin: 39.3%, up from 37.6% YoY

Net Profit: ₹281.4 crore, up 8.1% YoY (from ₹260.4 crore in Q3 FY24)

Key Highlights:

Smallest quarterly profit increase since listing in 2020 due to tighter regulations in the derivative sector.

Average daily turnover dropped nearly 12% compared to Q2 FY25.

Total expenses increased by 23.5% YoY.

Outlook:

Focus on client acquisition and activity normalization to drive growth, despite the temporary impact of new SEBI derivatives regulations.

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Sanjiv Puri, Chairman, ITC Ltd. on Work-life balance

"So it's not so much about, you know, really monitoring each individual's number of hours. It's more about enabling individuals, helping them to actualise their potential, and then reviewing what goals people have achieved."

"We put a lot of effort into making sure that everybody understands the vision of the enterprise. We use a part of the vision and want to contribute to making the vision a reality. And we enable vitality through our processes, by the resources we provide, the freedom to act, that we provide, and the empowerment that we provide, which are very different and very clear goals for individuals to achieve, and these are the primary things that we look at," - Link

C Vijayakumar, CEO & MD, HCLTech on the demand outlook for FY25

From what we have seen last quarter and the quarter before, there is a gradual improvement in the spending environment. We believe that will continue into the coming quarters. However, there could be significant changes in the broader business environment and business landscape a few days from now. So, barring anything specifically correlated to that, the demand environment is good. - Link

Calendars

In the coming days, we have the following major events, corporate actions, and upcoming earnings releases:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.