Nifty ends 5 day losing streak on strong global cues

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real time by Tijori.

Market Overview

Nifty opened with a strong gap-up of nearly 150 points at 23,738.20. After trading in a narrow range of 23,720 to 23,800 for approximately 90 minutes, it gained momentum and climbed to test the day's high of 23,869.55. The index then consolidated within the upper range of 23,840 to 23,860 for about an hour, between 11:00 AM and 12:00 noon.

However, the market experienced a sharp decline of nearly 200 points, hitting the day's low of 23,647.20 around 1:30 PM, with no major recoveries during this period. Subsequently, the market rebounded by approximately 100 points, closing at 23,753.45, up 0.7% for the day.

Despite failing to decisively break through its initial resistance zone of 23,800–23,850, today's recovery can largely be attributed to a strong rebound in global markets. This rebound was primarily driven by robust performance in US markets on Friday, following lower-than-expected US Personal Consumption Expenditures (PCE) Price Index inflation data.

Broader Market Performance:

Although headline indices rebounded, broader market sentiment remained negative. A total of 1,130 stocks advanced, an improvement from 535 in the previous session, while 1,703 stocks declined, a decrease from 2,267. This reflects a continued negative market breadth on the NSE.

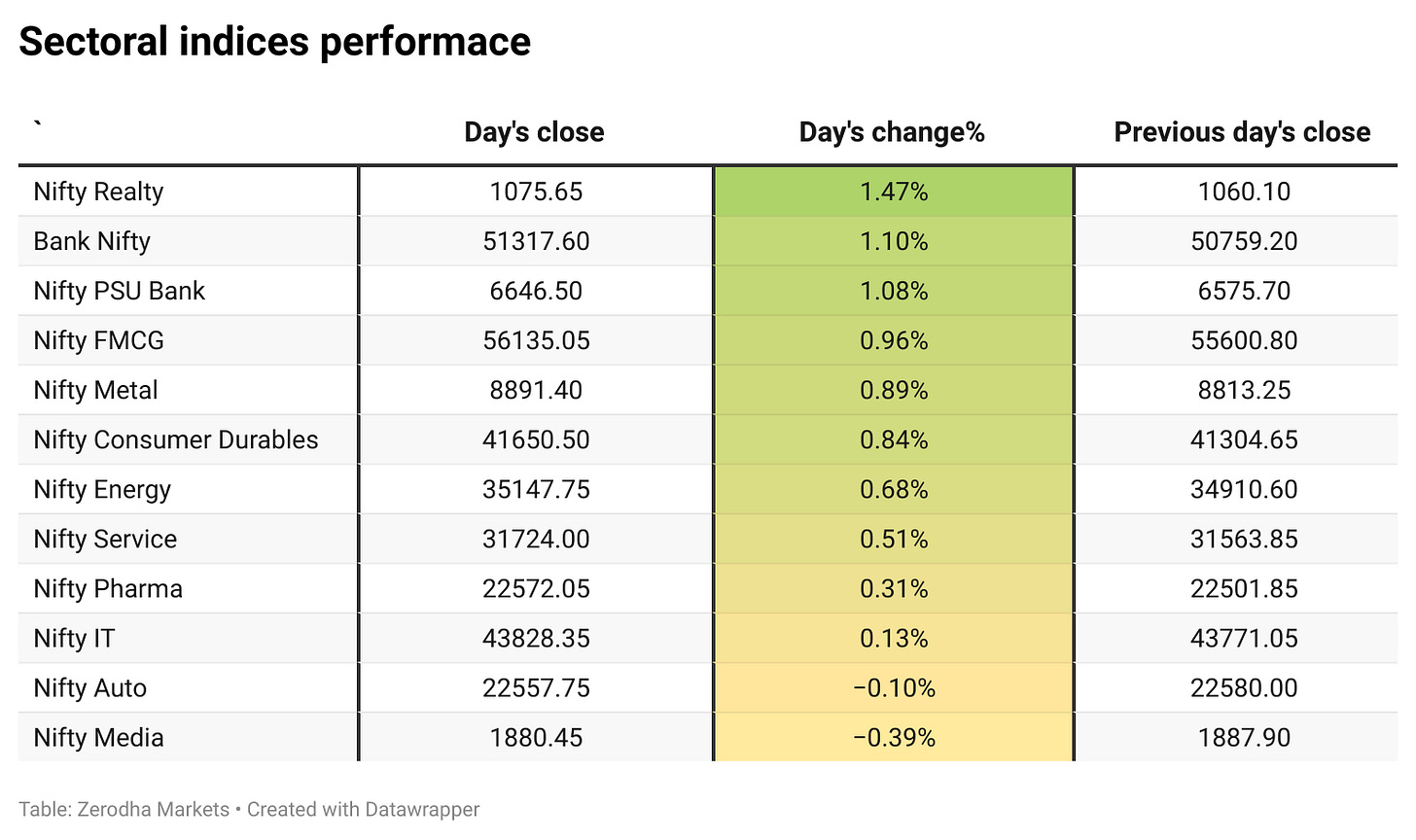

Sectoral Performance:

Sectoral trends were largely positive, with all major indices, except Auto and Media, closing in the green. The Realty sector emerged as the top gainer, rising by 1.47% after a 4% loss on Friday. On the other hand, the Media sector was the top loser, declining by 0.39%.

Note: The above numbers for Commodity futures were taken around 4 pm.

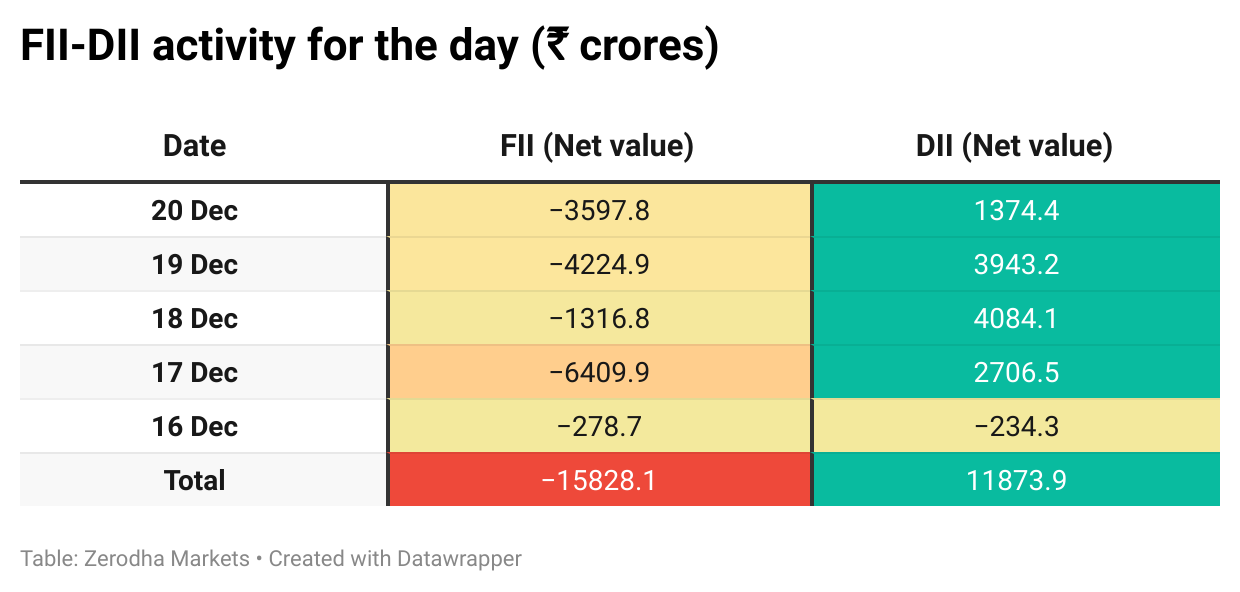

Note: Today’s numbers are yet to be released by the exchanges.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 26th December:

The maximum Call Open Interest (OI) is observed at 24,000, followed by 23,800, while the maximum Put Open Interest is at 23,500, followed by 23,700.

On the downside, immediate support is seen at 23,500, followed by the 23,300-400 range. On the upside, resistance is expected at the 23,800–23,900 range, with 24,000 acting as the critical resistance level moving forward.

Note: OI is subject to multiple interpretations but generally, in a falling market if there is an increase in the call OI, it indicates resistance, and in a rising market, if there is an increase in the put OI, it indicates support.

Source: Sensibull

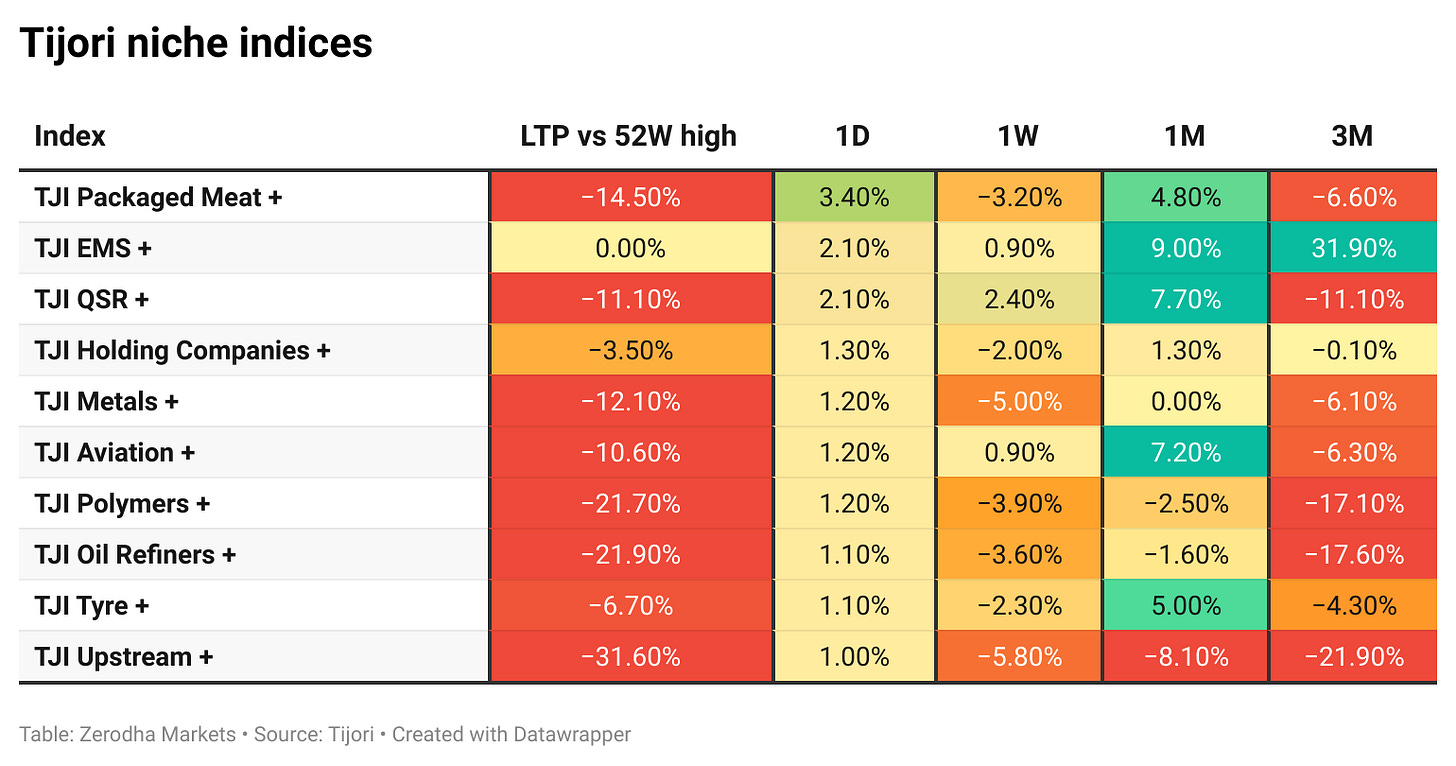

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

SEBI has suspended trading in Bharat Global Developers Ltd (BGDL) for financial misrepresentation and price manipulation, freezing ₹271.6 crore in illegal profits. The company's management and preferential allottees are barred from the securities market. Trading remains suspended until further notice. Dive deeper

As per the latest TRAI data, Reliance Jio lost 37.6 lakh subscribers in October, while Vodafone Idea lost 19.3 lakh. BSNL gained 5 lakh subscribers, continuing its growth, and Bharti Airtel added 5 lakh subscribers after a previous decline. India saw a net loss of 33 lakh subscribers in October, an improvement from the 1 crore loss in September. Dive deeper

Zomato joined the BSE Sensex on Monday, replacing JSW Steel, but saw a 2.89% drop in shares. With a market cap of ₹2.72 lakh crore, it outpaces JSW Steel. Dive deeper

Sterling and Wilson Renewable Energy Limited (SWSOLAR ) has received an order valued at approximately Rs 1,200 crore for a 500 MW Solar PV project in Gujarat, including a three-year O&M contract. Dive deeper

Reliance Industries shares rose 1.4% to ₹1,223.40 after announcing that its subsidiary, Reliance Digital Health, will acquire a 45% stake in Health Alliance Group for $10 million. The deal is expected to close in two weeks and will support RDHL in expanding healthcare access through a virtual diagnostic platform. Dive deeper

Indian Oil Corporation’s board approved a ₹4,382.21 crore investment in a yarn project at Bhadrak, Odisha, through a joint venture with MCPI Private Ltd. Despite weak Q2 results, the company’s equity contribution is ₹657.33 crore. Shares closed at ₹137.78, down 0.51%. Dive deeper

Larsen & Toubro (L&T) has secured a contract from the Ministry of Defence to supply K9 Vajra-T Artillery Platforms to the Indian Army. Co-developed with Hanwha Aerospace, the platforms will be manufactured at L&T’s Hazira facility, supporting India’s defense self-reliance goals. Dive deeper

Poonawalla Fincorp has integrated AI across its Human Resources processes, significantly reducing hiring time by 90%. The company is using AI for candidate matching, document verification, and real-time screening, alongside a WhatsApp-powered AI bot to improve employee experience. Dive deeper

L&T Technology Services (LTTS) has expanded its collaboration with Siemens Digital Industries Software, enhancing its Centre of Excellence (CoE) and launching a Digital Manufacturing Academy. This partnership aims to drive innovation and improve product quality across industries, leveraging Siemens' technology platforms for faster time-to-market. Dive deeper

Praj Industries has inaugurated India’s first sustainable road using lignin-based bio-bitumen in the Nagpur-Mansar Bypass. This eco-friendly solution, developed in collaboration with CSIR-CRRI, offers a 70% reduction in greenhouse gas emissions compared to conventional bitumen, contributing to India's sustainable infrastructure goals. Dive deeper

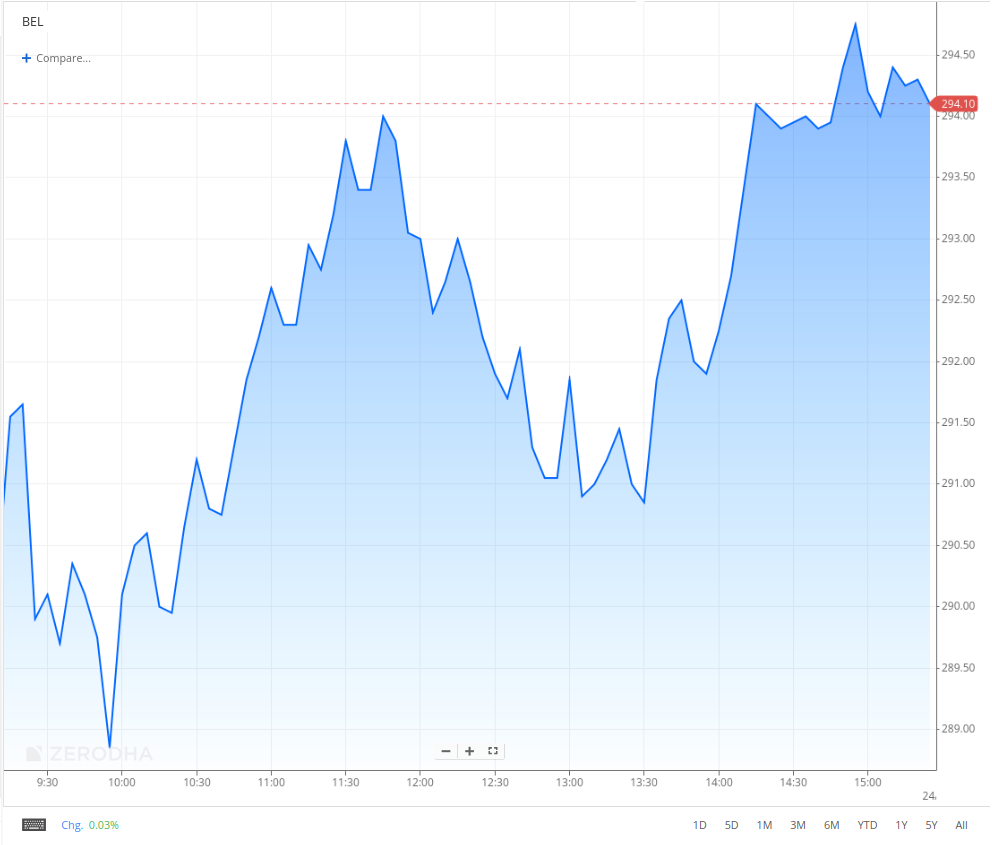

Bharat Electronics Limited (BEL) has secured additional orders worth Rs. 973 Crores, including platform screen doors for metro rail, radars, communication equipment, jammers, submarine sonar upgrades, satcom terminals, test stations, spares, and services. With these new orders, BEL's total orders for the current financial year have reached Rs. 9,801 Crores. Dive deeper

Shares of India Cements surged 8% following the Competition Commission of India (CCI) approval for UltraTech Cement’s ₹7,000-crore deal to acquire a majority stake. The acquisition, which includes a 32.72% stake from promoters and a ₹390 per share open offer, will bolster UltraTech's market position amid rising competition. UltraTech’s stock also saw a slight gain. Dive deeper

The government has approved a capital infusion of Rs 500 crore into the state-owned Industrial Finance Corporation of India (IFCI) to strengthen its financial health ahead of its proposed restructuring. This will increase the government's stake in the company, which was 71.72% as of September 2024. The infusion is part of the supplementary demand for grants for 2024-25 and will help facilitate IFCI's consolidation with other group companies. Dive deeper

The Reserve Bank of India (RBI) has denied banks' request for more time to classify a borrower as a "wilful defaulter." The process must be completed within six months to prevent asset devaluation. Banks follow a set procedure, allowing borrowers to present their case, but delays are common as some borrowers intentionally drag the process. Dive deeper

Interest rates on bank deposits are expected to remain steady until the end of this fiscal year, as banks focus on mobilizing funds to meet rising loan demand. Despite a recent CRR cut, liquidity pressures and strong credit demand are likely to keep funding conditions elevated, with deposit rates staying high. Dive deeper

What’s happening globally

U.S. stock markets experienced a notable rebound following the release of November's Personal Consumption Expenditures (PCE) Price Index, which indicated cooler-than-expected inflation. The PCE index rose by 0.1% in November, below the anticipated 0.2%, suggesting that inflationary pressures may be easing. Dive deeper

Brent crude oil futures rose to $73.3 per barrel, supported by lower-than-expected US PCE inflation data, sparking hopes of rate cuts and increased energy demand. However, concerns over China's economy and a potential US-EU trade conflict limited further gains. Dive deeper

The UK economy stalled in Q3 2024, with no growth, revised down from an initial 0.1% increase. The services sector saw no growth, and production fell 0.4%, driven by a drop in energy supply. However, construction grew by 0.7%, and business investment rose more than expected. Dive deeper

Starbucks workers from the union representing over 10,000 baristas went on strike in multiple U.S. cities, citing unresolved issues over wages, staffing, and schedules. The walkouts, which began in Los Angeles, Chicago, and Seattle, are expected to expand to more locations in the coming days. Despite the strike, Starbucks reported minimal impact on store operations. Dive deeper

Singapore's annual inflation rose to 1.6% in November 2024, up from 1.4% in October. Healthcare and transport costs increased, while core inflation fell to 1.9%, the lowest in three years. Dive deeper

Spain's GDP grew 0.8% quarter-on-quarter in Q3 2024, driven by domestic demand. Household consumption rose 1.2%, while exports grew 0.4%. However, construction contracted 1.5%, and industrial activity saw minimal growth. Year-on-year, the economy expanded by 3.3%. Dive deeper

The STOXX 50 and STOXX 600, indices that track the performance of major European companies, dipped 0.3% and 0.1%, respectively, near four-week lows as the Christmas week began. Investors are focused on the ECB's potential to tighten policy further, with President Lagarde noting the Eurozone is close to meeting inflation targets. Bayer and Mercedes-Benz underperformed, while Munich Re, Repsol, and Nokia gained. Dive deeper

Nissan and Honda have agreed to merge, forming a joint holding company, set to be listed in August 2026. This move aims to enhance synergies, with a target of ¥30 trillion in sales and ¥3 trillion in operating profit, strengthening global competitiveness and adapting to rapid technological advancements. Dive deeper

Global bond funds saw record inflows exceeding $600bn this year, driven by expectations of easier monetary policy and slowing inflation. Despite a mixed performance in the bond market, corporate bonds performed better, and investors turned to fixed-income products amid high equity valuations. However, $6bn was withdrawn in the week to December 18, marking the largest outflow in nearly two years. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

G. Shivakumar, Executive Director and CFO of GE Shipping

Tanker freight rates have been disappointing for the past 3 months due to poor demand

Oil demand growth has been disappointing this year

Arbitrage in east-to-west oil has vanished

Tanker spot pricing in Q4CY24 is down $10,000-$15,000/day YoY

Will expand the fleet if the ships prices significantly decline.

US Tariffs might lead to strange trade patterns and arbitrage

Orderbook hasn’t built up during the current market

Chinese oil demand not coming back could have a significant impact

Chinese demand for dry bulk remains strong. - Link

RK Goyal, MD , Kalyani Steels

Don't see any revenue or volume growth in FY25, the impact of Karnataka duty + rise in iron ore prices would lead to a Rs 3,000/tonne price hike, which would be around a 4% increase.

Finding it very difficult to increase prices due to China dumping, would want the scope of dumping investigation to be expanded beyond flat rolled products. - Link

Narayana Murthy, Co-founder, Infosys

Cities have seen an increase in pollution and have become very difficult to navigate and live in. They are on the verge of becoming uninhabitable,"

"In India, we, especially the business community, must work with policymakers and government officials to prevent mass migration. That's the problem," - Link

Calendars

In the coming days, we have the following major events and corporate actions:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.