Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets, both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real time by Tijori.

Market Overview

Nifty opened flat at 24,787.65 but surged sharply in the first hour, crossing 24,900 and touching 25,030 by 10:30 AM. It then consolidated for a couple of hours in a narrow range between 25,000 and 25,040 before dipping to 24,960. The index gradually recovered and moved higher to around 25,050 by 3 PM, followed by a sharp rally in the final hour, hitting an intraday high of 25,136.20. Nifty eventually closed strong at 25,112.40, up by 1.29%.

Market sentiment remains cautious amid escalating tensions in the Middle East, which have driven oil prices higher. Investors are closely monitoring geopolitical developments and awaiting any updates on global tariff actions.

Broader Market Performance:

Broader markets rebounded strongly today. Of the 2,954 stocks traded on the NSE, 1,909 advanced, 961 declined, and 84 remained unchanged.

Sectoral Performance:

Nifty Realty emerged as the top gainer, closing up by 2.11%, while Nifty Media was the weakest performer, though still in the green, with a modest gain of 0.35%. All 12 sectoral indices ended the day in positive territory, with 12 sectors closing in green and none in red, reflecting broad-based market strength.

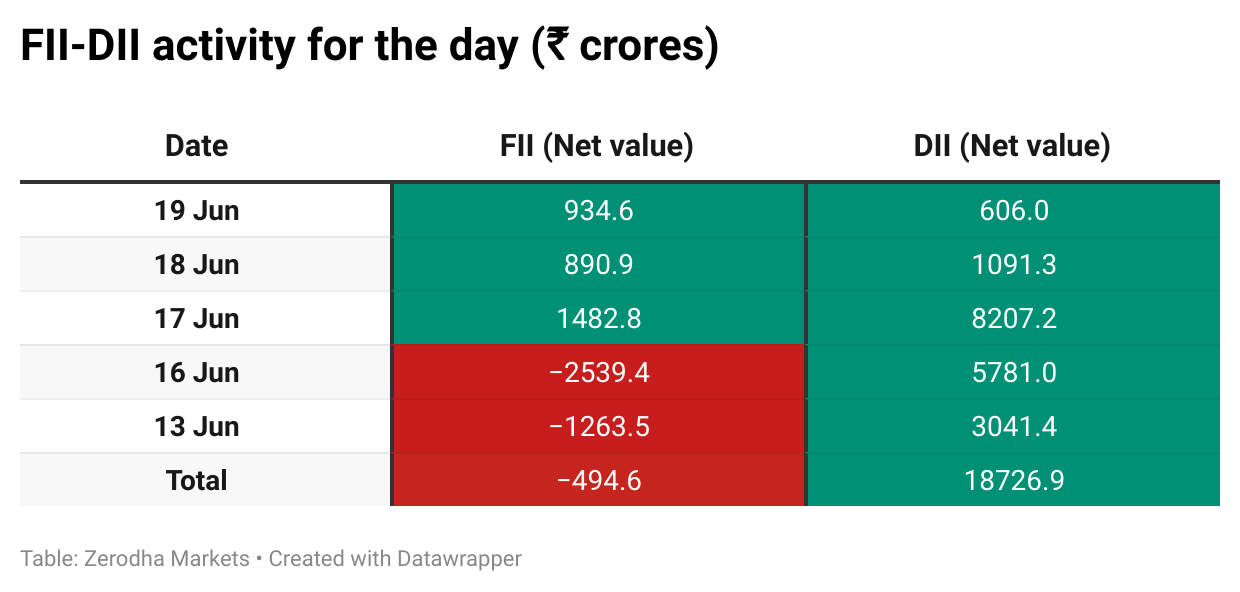

Note: The above numbers for Commodity futures were taken around 5 pm. Here’s the trend of FII-DII activity from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 26th June:

The maximum Call Open Interest (OI) is observed at 25,000, followed closely by 25,500, suggesting strong resistance at 25,300 - 25,400 levels.

The maximum Put Open Interest (OI) is observed at 25,000, followed closely by 24,800, suggesting strong support at 24,800 to 24,700 levels.

Note: OI is subject to multiple interpretations, but generally, an increase in the call OI indicates resistance in a falling market, and an increase in the put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard

What’s happening in India

RBI has eased project finance loan norms, reducing provisioning for under-construction projects to 1% from the proposed 5%. The new rules, effective October 1, 2025, allow more flexibility on Date of Commencement of Commercial Operations (DCCO) extensions and loan upgrades. Dive deeper

HDB Financial Services has filed its RHP for a ₹12,500 crore IPO, with a price band of ₹700–740 per share. The offer opens on June 25 and closes on June 27, including a ₹2,500 crore fresh issue and ₹10,000 crore OFS by HDFC Bank. Proceeds will support capital needs and business expansion. Dive deeper

The government is planning a 10% average hike in third-party motor insurance premiums, with higher increases for commercial vehicles. Insurers had sought a 5-15% hike, citing rising claims and court awards. The revised rates may take effect from October 2025 or April 2026. Dive deeper

IndiGo will begin direct flights from Hindon Airport to eight cities, including Mumbai, Chennai, and Kolkata, starting July 20. This will be its second airport in the NCR and 93rd domestic station. The move aims to enhance connectivity for Ghaziabad, East Delhi, and nearby areas. Dive deeper

Larsen & Toubro raised Rs 500 crore via debentures linked to sustainability targets under SEBI’s ESG framework. The debentures mature on June 19, 2028, with annual interest payouts. Dive deeper

Suzlon Energy secured a 170.1 MW wind power order from AMPIN Energy Transition, its third consecutive deal with the firm. The project in Andhra Pradesh involves supplying 54 advanced turbines along with installation and maintenance. Dive deeper

The U.S. FDA issued seven observations to Natco Pharma’s Kothur facility after a recent inspection. The company said it will address them within the stipulated timeline and remains committed to compliance. The site had earlier received a warning letter in April 2024. Dive deeper

Bajaj Markets has joined the ONDC Network, enabling its 16 million users to shop for electronics and appliances through its app and website. The platform now acts as a buyer network participant on ONDC. This integration offers access to over 1.5 lakh products with financing options. Dive deeper

Jawaharlal Nehru Port Authority plans to raise $3.5 billion in debt for the $9 billion Vadhvan Port project, set to become India’s largest port. The debt will be raised in two phases with tenors of 15–20 years. The project aims to boost maritime infrastructure and handle 23 million containers annually. Dive deeper

Reliance Retail and Havells are in the race to acquire a 31% stake in Whirlpool of India, alongside PE firms like EQT and Bain. Whirlpool aims to raise up to $600 million as part of its global restructuring. The deal may trigger an open offer, taking the buyer’s stake to 57%. Dive deeper

HCL Technologies signed a partnership with US-based Just Energy to deliver generative AI-powered digital process outsourcing solutions. This marks its second energy sector deal this week after a tie-up with European utility firm E.ON (Energieversorgung Oberhausen). Dive deeper

HAL will manufacture two small rockets for ISRO over the next two years, as confirmed by IN-SPACe Chairman Pawan Goenka. The company has scheduled a board meeting on June 27 to consider the final dividend for FY25. Dive deeper

Amazon will invest $233 million in India in 2025 to expand its operations infrastructure, upgrade fulfillment and delivery facilities, and enhance tech-driven safety measures. The move builds on its plan to invest $26 billion in India by 2030. Dive deeper

LTIMindtree launched BlueVerse, an AI ecosystem with over 300 industry-specific agents and tools to enhance enterprise productivity. It features both no-code and pro-code platforms for building AI solutions. The initiative aims to strengthen its position as a strategic AI partner. Dive deeper

ITD Cementation secured two new orders worth Rs 960 crore for projects at Thiruvananthapuram Airport and a commercial building in Kolkata. This follows a recent Rs 893 crore contract for a port project in Odisha. Dive deeper

Sun TV came under focus after a legal notice from Dayanidhi Maran to Chairman Kalanithi Maran raised a dispute over the 2003 share transactions. The notice seeks to reinstate original shareholding positions. It also mentions possible legal action if the issue is not resolved. Dive deeper

The National Bank for Financing Infrastructure and Development (NaBFID) plans to raise up to $1 billion overseas in FY26 via external commercial borrowings or dollar bonds. The move aims to diversify funding sources. It has sanctioned over ₹2 trillion in loans and targets ₹1.2 trillion more by year-end. Dive deeper

What’s happening globally

Brent crude traded around $77 per barrel, set for a third straight weekly gain amid rising Middle East tensions and fears of supply disruptions. Dive deeper

Gold fell to around $3,350 per ounce, hitting a one-week low and heading for its first weekly decline in three. The drop came as investors sold bullion amid Middle East tensions and uncertainty over U.S. action on Iran. Dive deeper

The Bank of England held the Bank Rate at 4.25% in June with a 6-3 vote, as three members backed a cut to 4%. It flagged persistent inflation and weak GDP growth, while warning of risks from energy prices and US tariffs. The Bank maintained a cautious stance on further policy easing. Dive deeper

Germany’s producer prices fell 1.2% year-on-year in May 2025, the sharpest drop since September 2024, driven mainly by a 6.7% fall in energy costs. Prices for consumer and capital goods rose, while intermediate goods edged down. Excluding energy, PPI rose 1.3%, and the monthly PPI declined 0.2%. Dive deeper

The People’s Bank of China held the one-year and five-year loan prime rates steady at 3.0% and 3.5% in June. The move follows last month’s rate cut and recent deposit rate reductions by state banks. It comes amid mixed data and pressure from new US tariffs. Dive deeper

Japan’s inflation eased to 3.5% in May 2025, the lowest since November, while core inflation rose to 3.7%, a two-year high. Price growth slowed in clothing and healthcare but remained high in food and energy. Rice prices more than doubled despite government efforts. Dive deeper

X will soon enable investing and trading on its platform, supporting Elon Musk’s vision of a super app. CEO Linda Yaccarino said features like X Money and an X card are in the works. The platform is also witnessing a recovery in ad revenue. Dive deeper

The UK’s Groceries Code Adjudicator has launched a probe into Amazon over suspected payment delays to suppliers between March 2022 and June 2025. The focus will be on recent practices and possible breaches of the Groceries Code. Dive deeper

Tesla has signed a 4 billion yuan ($557 million) deal with Shanghai and China Kangfu International Leasing Co. to build its first grid-scale energy storage station in China. The facility will use Tesla’s megapack batteries and be located in Shanghai. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

CS Setty, Chairman, SBI, on profitability, sustainability, and digital transformation

“SBI, broadly we have understood how do we contain our risk… we are better positioned to handle the cycles, which means that today our operating profit to net profit conversion has significantly improved over the years.”

“Currently, we have about ₹70,000 crore portfolio, which is green… with the current credit growth rate, around ₹6 lakh crore portfolio would be green by 2030, almost 10 times of what we currently have.”

“Yono 2.0 is a very paradigm shift from what we have pursued… it is an omnichannel one… where we are planning to have a uniform code across internet banking, mobile banking, branch channel, even our field teams.” - Link

Sandeep Tandon, CIO, Quant Mutual Fund, on market cycle, retail behavior, and structural trends

“I can say with good amount of confidence, at least till 2047 when demographic cycle peaks out in India, till then India PE multiple remains elevated.”

“Every bull run is driven by some leadership, this time, leadership is retail, and the retail base is very large.”

“If I have to say, maybe two-thirds of my redemption is coming from HNI and family office… retail investors are not panicking, they have become more mature.” - Link

Juliane Kokott, Advocate General, EU Court of Justice, on Google’s Android antitrust case

“Google held a dominant position in several markets of the Android ecosystem and thus benefited from network effects that enabled it to ensure that users used Google Search.”

“As a result, Google obtained access to data that enabled it, in turn, to improve its service.”

“Google’s appeal should fail because the legal arguments put forward by the US tech giant fell short.” - Link

🧑🏻💻Have you checked out The Chatter?

Every week, we listen to the big Indian earnings calls—Reliance, HDFC Bank, and even smaller logistics firms—and copy the full transcripts. We then remove the fluff and keep only the sentences that could move a share price: a surprise price hike, a cut-back on factory spending, a warning about weak monsoon sales, or a hint from management on RBI liquidity. We add a quick, one-line explainer and a timestamp so you can trace the quote back to the call. The whole thing lands in your inbox as one sharp page of facts you can read in three minutes—no 40-page decks, no jargon, just the hard stuff that matters for your trades and your macro view.

Go check out The Chatter here.

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us for today. We’d love to hear your feedback in the comments, and feel free to share this with your friends to spread the word!

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

Love the insights

Good