Nifty ends November expiry on a weak note

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Market Overview

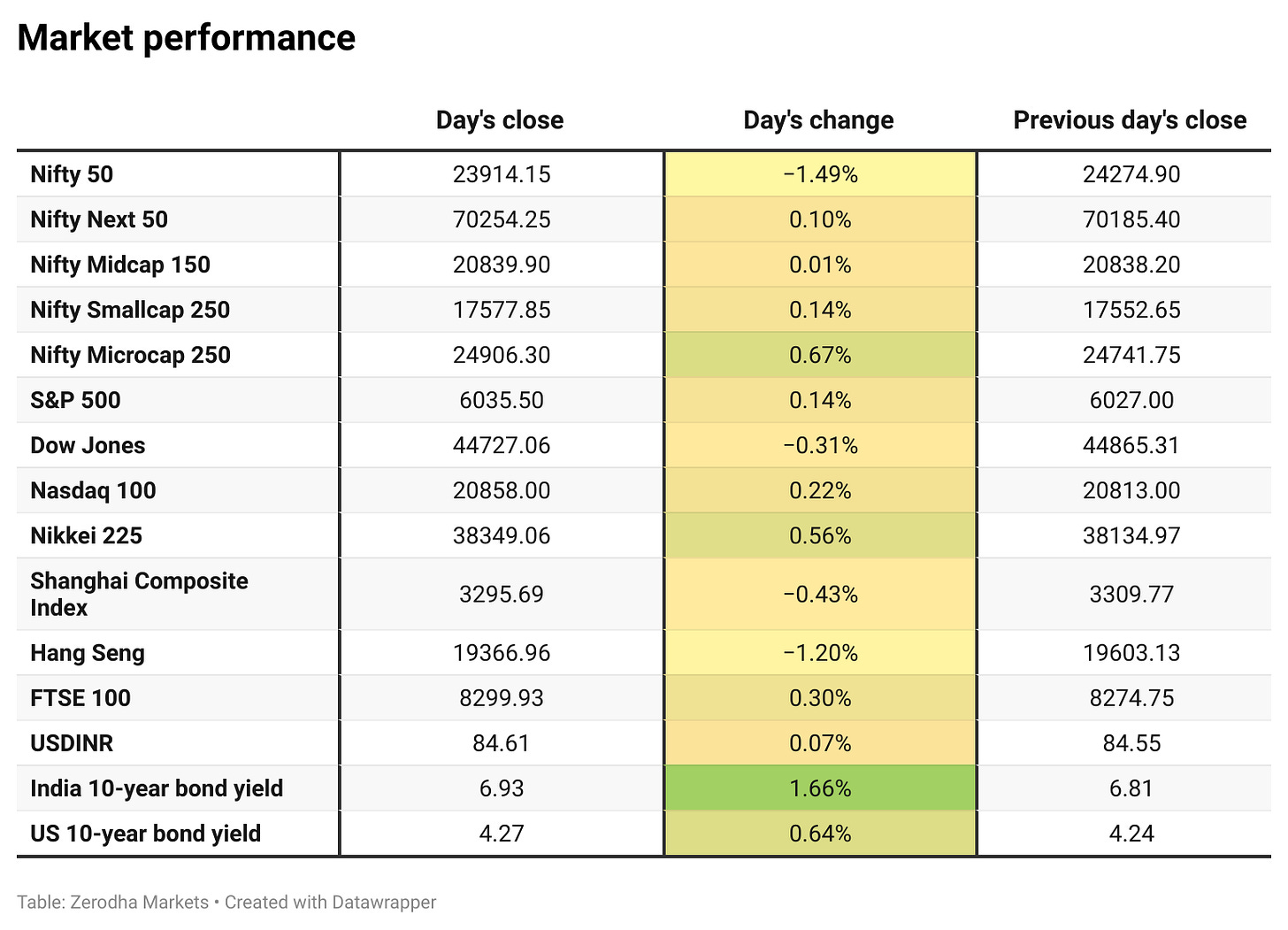

The Nifty opened flat at 24,274.15 and traded within a narrow 30-point range around 24,300 until 10 AM. However, the market suddenly nosedived 250 points to 24,050 within 30 minutes. From there, it gradually drifted lower throughout the day, hitting a low of 23,873.35 before making a slight recovery and closing at 23,914.15, down 1.48%.

Despite the weak session, market breadth remained positive, with 1,537 stocks advancing compared to 1,245 declining on the NSE. Broader markets showed resilience and outperformed the headline indices, with all three indices—Midcap, Smallcap, and Microcap—closing in the green.

Nifty IT was the weakest sector, impacted by strong overnight U.S. GDP and inflation data that reinforced the Federal Reserve's cautious stance on rate cuts.

Financials, particularly insurance stocks, also struggled following reports that IRDAI is considering capping the proportion of an insurer’s business sourced from its parent bank’s bancassurance channel to 50%.

Note: The above numbers for Commodity futures were taken around 4 pm.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 5th December:

The maximum CE OI is at 24300 followed by 23900 and 24000, and the maximum Put OI is at 23500 closely followed by 23900.

Massive call and puts OI addition around 23900 levels indicates that these levels hold the key for the market trend in the coming week.

Immediate support on the downside for tomorrow can be seen at 23900 levels followed by 23800 levels. Resistance on the upside is at 24000 - 24100 levels followed by 24300, which holds the highest Call OI.

Note: OI is subject to multiple interpretations but generally, in a falling market if there is an increase in the call OI, it indicates resistance, and in a rising market, if there is an increase in the put OI, it indicates support.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

Shares of life insurance companies declined by up to 7% on Thursday following reports that the Insurance Regulatory and Development Authority of India (IRDAI) is considering capping the proportion of an insurer's business sourced from its parent bank's bancassurance channel to 50%. This move aims to address concerns over mis-selling and over-reliance on single distribution channels.- Dive deeper

BEML Limited closed higher by 2% on an otherwise wise day after the company announced a ₹3,658 crore contract from Chennai Metro Rail Limited. The deal involves designing, manufacturing, supplying, testing, and commissioning 210 metro cars (70 three-car train sets) for Chennai Metro's Phase 2 expansion. The comprehensive contract also includes maintenance for 15 years. - Dive deeper

Mirae Asset Financial Group has completed its ₹3,000 crore acquisition of Sharekhan after securing all necessary regulatory approvals. The deal strengthens Mirae Asset's foothold in India’s retail brokerage market by leveraging Sharekhan's extensive network of over 3.1 million users and 120+ branches. - Dive deeper

Reliance Industries Limited (RIL), through its subsidiary Reliance Finance and Investments USA LLC, has acquired a 21% stake in U.S.-based Wavetech Helium, Inc. (WHI) for $12 million. Helium's critical role in industries such as medical imaging, semiconductor manufacturing, aerospace, and telecommunications has led to soaring prices, surpassing $300 per thousand cubic feet due to rising demand and limited supply.

This investment enables RIL to diversify its portfolio and strengthen its position in the vital helium supply chain, tapping into high-growth markets. - Dive deeper

The Allana Group, a prominent exporter of processed food products and agro-commodities, has ventured into the poultry sector with the launch of the Indian Poultry Alliance. The company has committed an initial investment of $120 million and aims to achieve $300 million in revenue by 2026. - Dive deeper

What’s happening globally

In Q3 2024, the U.S. economy grew at an annualized rate of 2.8%, supported by strong consumer spending (up 3.5%) and a 7.5% rise in exports, despite slower business investments in housing and nonresidential buildings.

Inflation eased, with the personal consumption expenditures (PCE) index at 1.5% and core PCE inflation at 2.1%. The unemployment rate remained steady at 4.1%, reflecting a resilient economy with moderated inflationary pressures.

Source: Trading Economics

Russia launched a significant missile and drone assault targeting Ukraine's energy infrastructure, leading to widespread power outages across the country. This attack resulted in emergency power cuts, affecting regions such as Lviv, Rivne, and Volyn, leaving over half a million households without electricity. - Dive deeper

Russia’s rouble plunged to 110 against the dollar, its weakest level since March 2022, amid new Western sanctions and rising geopolitical tensions. Before the Ukraine war in February 2022, the rouble traded at 75-80 per dollar. The decline follows recent U.S. sanctions on Gazprombank, Russia's third-largest bank, which handles payments for its remaining natural gas exports to Europe. - Dive deeper

Source: Trading Economics

The U.S. Federal Trade Commission (FTC) has initiated a comprehensive antitrust investigation into Microsoft, focusing on its cloud computing, cybersecurity, and artificial intelligence sectors. This probe aims to assess whether Microsoft's practices in these areas hinder competition or violate antitrust laws. The investigation reflects the FTC's ongoing efforts to scrutinize major technology firms' market behaviors. - Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Commerce and Industry Minister Piyush Goyal on Indo-American relations

“We should not jump the gun. We should let the new government come and express their formal and official views. But to the best of my understanding of the situation and my own experience in working with the Trump administration and India’s experience in working with the Trump administration, I do not foresee any problem whatsoever.” - Link

Sapnesh Lalla, CEO, NIIT Learning Systems on AI

The full potential of GenAI will be commercially realized within the next 2 years.

Over 100 trained professionals are already skilled in GenAI.

Greenshoots are emerging in BFSI and tech spending, with promising growth anticipated by 2025.

The focus is on leveraging AI to enhance and deliver training services. - Link

Calendars

In the coming days, we have the following major events and corporate actions:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.