Welcome to the first weekly edition of the Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Catch “The world, simplified”, a weekly show that will break down some of the biggest developments in finance and economics that are shaping our world.

You can check out all the charts in Beyond the Charts! A newsletter where we dive into fascinating charts from the world of finance and the economy, breaking down what’s happening in a way that’s easy to understand.

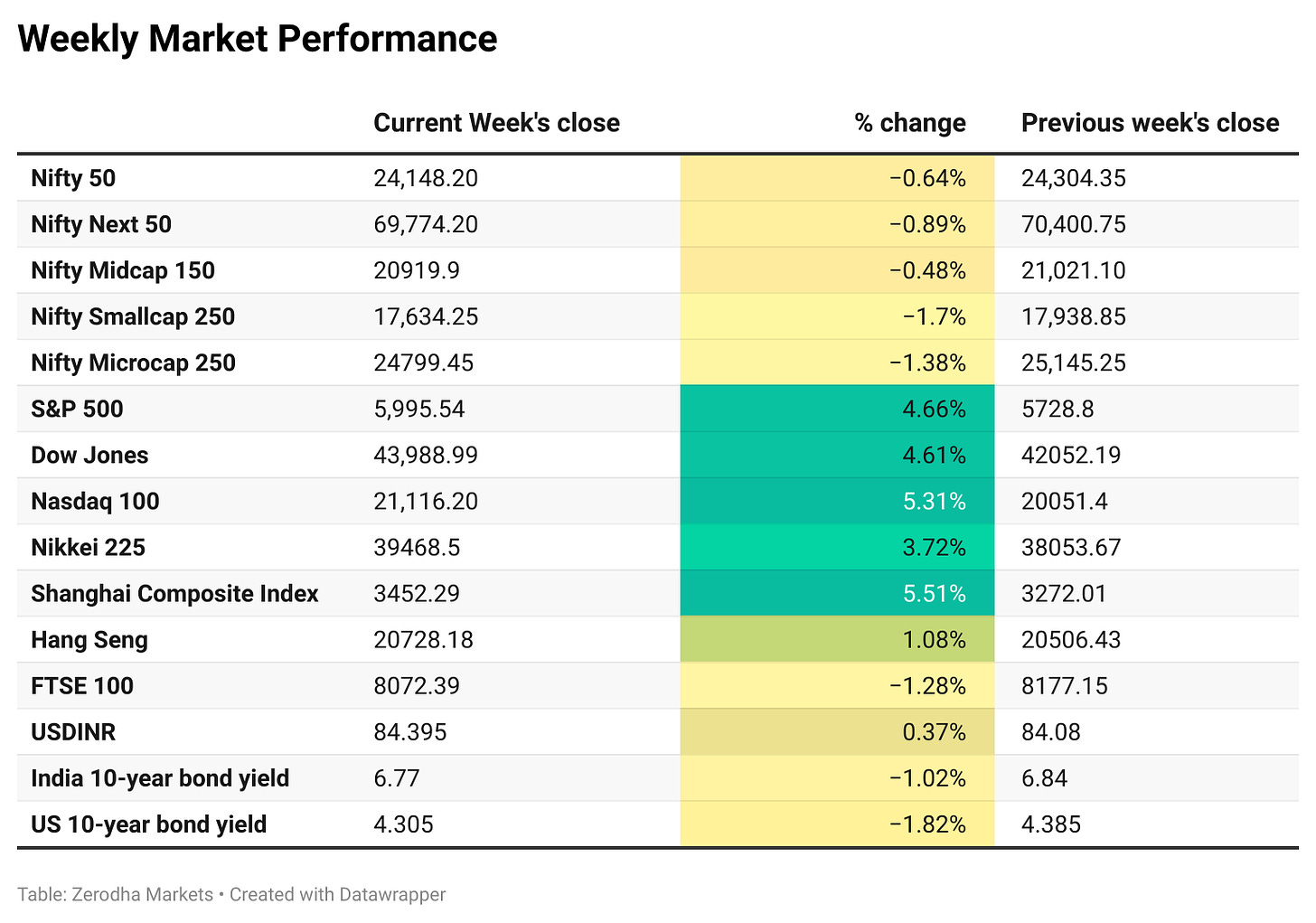

Market Overview this week

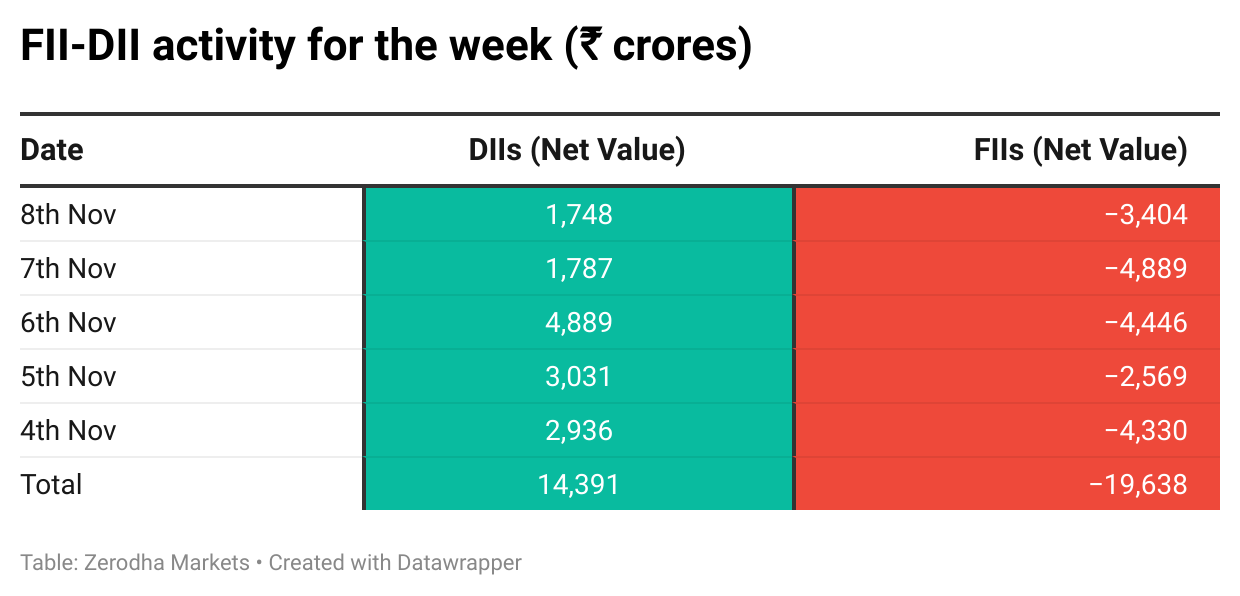

The Nifty index closed the week down by 0.64% at 24,148.20, trading within a wider range as it tested 23,800 on the downside and 24,500 on the upside. The Indian markets underperformed compared to global markets, particularly the U.S., which rose nearly 5% last week. Factors contributing to this weaker performance include continued selling by foreign institutional investors (FIIs) and a slowdown in earnings for many large-cap companies, leading to a broadly negative market sentiment.

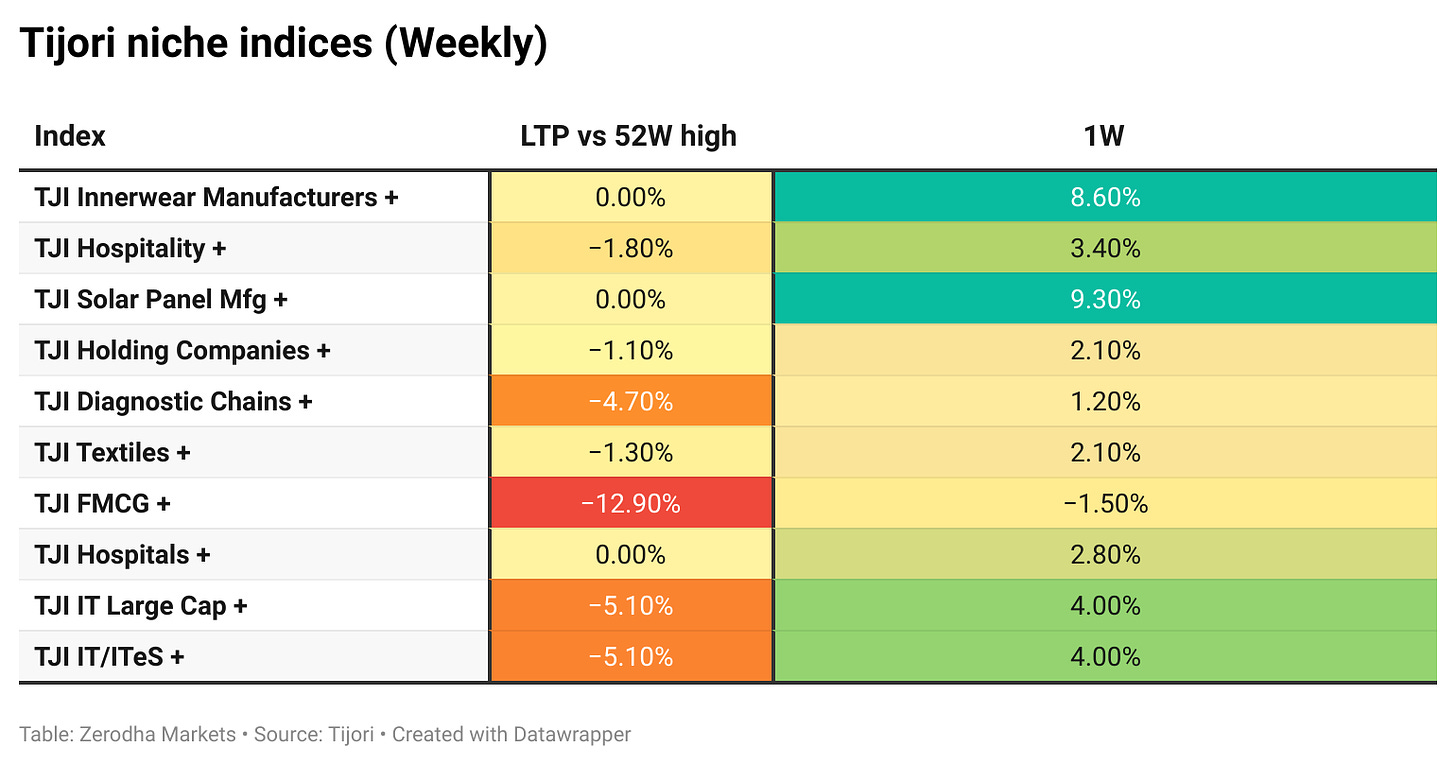

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market.

What happened in India?

Manufacturing and Services Sectors:

In October, the Purchasing Managers' Index (PMI) for manufacturing rose to 57.5 from September’s 56.5, marking robust expansion driven by strong demand and new product launches. Manufacturing output has now grown for 40 consecutive months since July 2021, with employment increasing amid ongoing inflationary pressures.

The services sector also saw growth, with the PMI climbing to 58.5 in October from 57.7 in September, driven by strong domestic and international demand.

Shadow Banks and RBI Actions:

India's shadow banking (NBFC sector), including major players like Bajaj Finance, Shriram Finance, and Mahindra Financial, faces challenges due to rising unpaid loans. In response, the Reserve Bank of India (RBI) has restricted some lenders from issuing new loans and increased cash reserve requirements. Lending growth in the sector has slowed to 12.8% year-over-year.

Rupee Vostro Accounts Initiative:

The RBI plans to broaden the use of rupee vostro accounts, enabling cross-border lending and loans to Non-Resident Indians (NRIs) within a new framework expected within six months. This initiative aims to encourage more rupee transactions by foreign institutions and NRIs, reduce dollar dependency, lower trade costs, and enhance the rupee's international role.

Import Restrictions on IT Hardware:

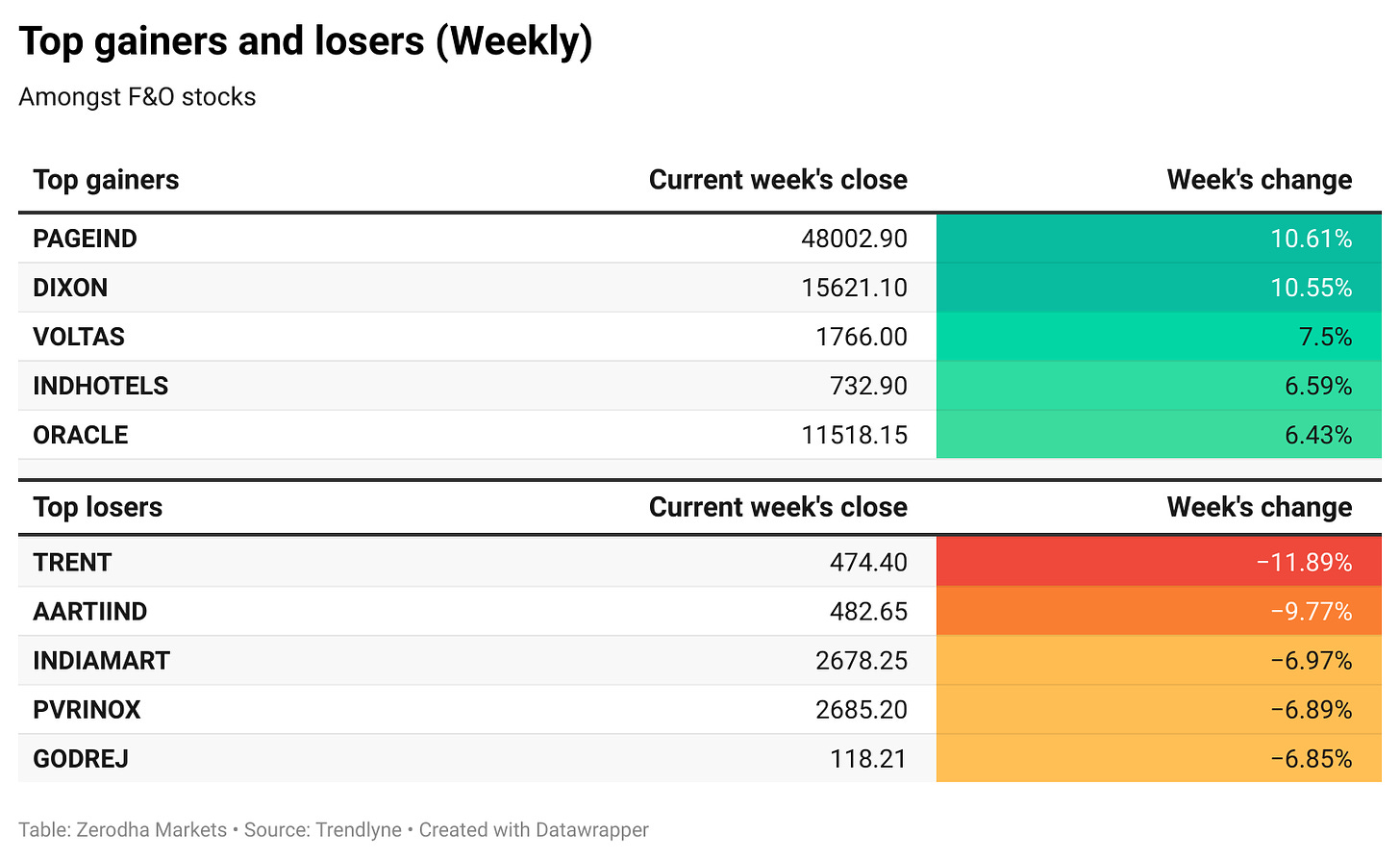

Starting January 2025, India will implement stricter import restrictions for laptops, PCs, and other IT hardware, potentially requiring prior approvals and setting minimum quality standards. This move could boost local manufacturing and attract major companies to set up factories in India.

FMCG Sector Performance:

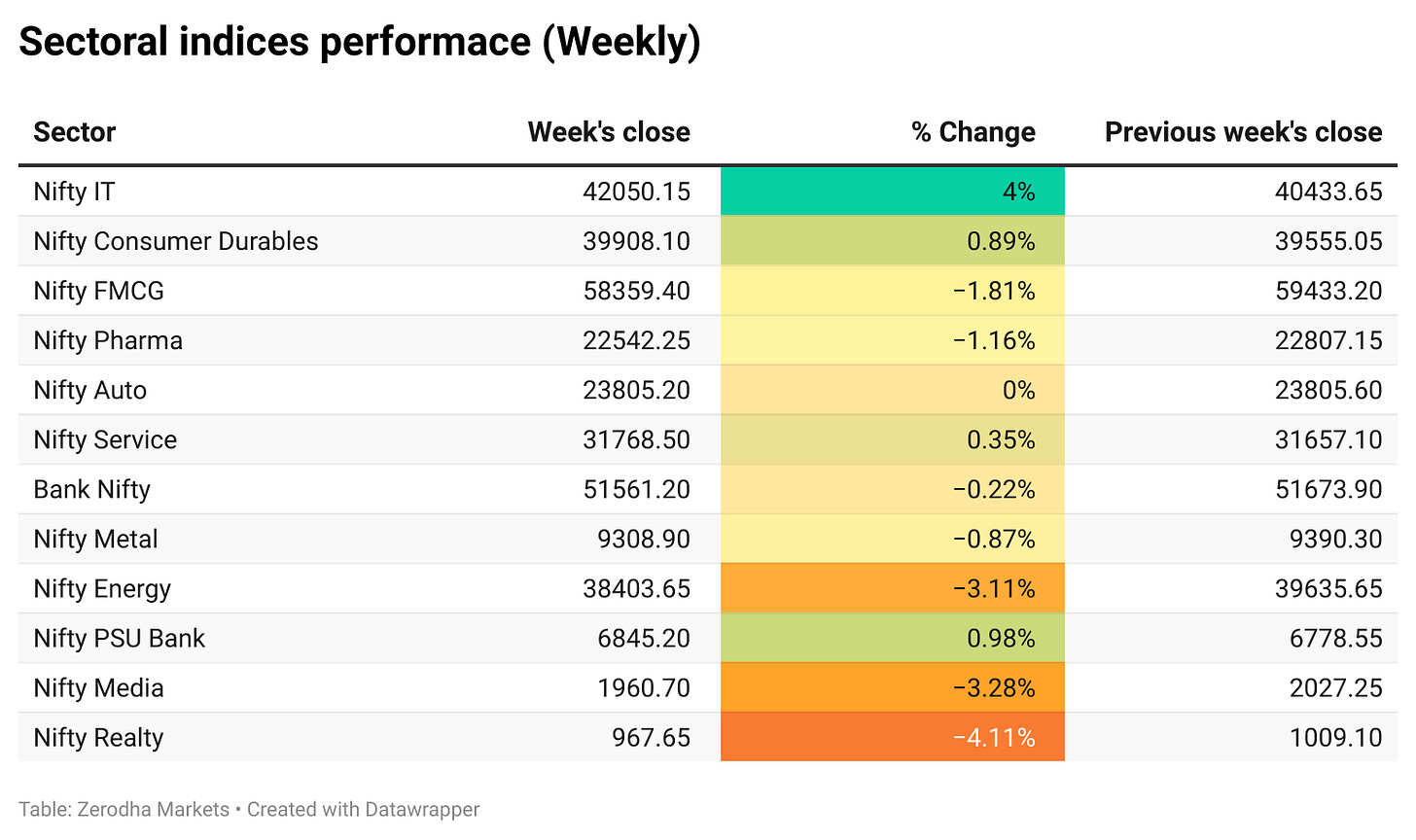

India's FMCG sector grew with 5.7% value and 4.1% volume growth in the July-September quarter, driven by a 6% rise in rural volume, which outpaced urban growth for the third consecutive quarter. NielsenIQ reported strong performance from small manufacturers, while larger players like Hindustan Unilever (HUL) saw slower urban market growth. Rising crude palm oil costs may lead to product price hikes. Traditional trade volumes grew 4.1%, with modern trade slightly ahead. Packaged food consumption rose by 3.4%, indicating resilient rural demand.

Supply Chain and Trade Activity:

October saw significant growth in India's supply chain activity, with a record 117.25 million e-way bills generated, a 17% increase from the previous year. This surge reflects strong trade activity, driven by the festive season and increased manufacturing output.

Potential Impact of Trump's Second Term:

Elara Capital predicts mixed but generally positive effects for India if Donald Trump serves a second term as US President. Sectors like IT, pharmaceuticals, EMS, and defense may benefit, while higher tariffs on Indian exports could pose risks. A hawkish Federal Reserve stance may strengthen the US dollar, pressuring the rupee. Increased tariffs on Chinese goods could present both challenges and opportunities for Indian exports, while Trump's domestic manufacturing focus and anti-China policies may shift trade dynamics. His energy agenda could also help lower global oil prices, benefiting India as an oil importer.

What happened across the globe?

Eurozone Manufacturing Activity:

Eurozone manufacturing contracted for the 28th consecutive month in October, but the pace of decline slowed. The HCOB Manufacturing PMI improved slightly to 46.0 from 45.9 in September. Despite still being below the 50 threshold indicating contraction, the modest gains in manufacturing output (index at 45.8) and new orders (four-month high of 44.2) suggest a possible easing of the sector's downturn.

EU-China Trade Relations:

EU-China diplomatic channels remain open amid fears of a growing tariff war, despite stalled trade talks on electric vehicles (EVs). Recent EU tariffs on Chinese EV imports, citing unfair subsidies, prompted China to retaliate with import restrictions on European goods like pork, dairy, and brandy. The EU aims to prevent a full trade conflict, while individual member states like France continue fostering commercial ties with China.

Global Market Reactions to Trump’s 2024 Victory and other news this week:

US Markets: The Dow Jones, S&P 500 and Nasdaq rose 5%. The Russell 2000 Index jumped 8.7%, reflecting optimism for smaller U.S. firms.

Global Markets: European markets gained nearly 1%. In Asia, the markets were broadly positive; Japan’s markets rallied by 3.72%, while Hong Kong's Hang Seng Index was up 1% and Chinese markets like the Shanghai Index were up by 5% despite concerns over potential U.S. trade policies.

Cryptocurrencies: Bitcoin surpassed $77,000 for the first time, continuing its bullish momentum.

German Industrial Production:

German industrial output fell by 2.5% in September, surpassing the expected 1% decline. The automotive and chemicals sectors were notably impacted, while exports dropped by 1.7% during the same period.

China’s Gold Reserves and Economic Measures:

China's central bank has not purchased gold for six months, despite a 33% surge in gold prices this year. The value of its reserves rose to $199.06 billion in October, driven by U.S. interest rate cuts and strong demand from global central banks.

The Standing Committee of China’s National People's Congress approved an $839 billion debt swap program to help local governments refinance off-balance-sheet debt.

U.S. Federal Reserve Interest Rate Cut:

The U.S. Federal Reserve reduced interest rates by 25 basis points to 4.5%-4.75%, marking its second cut in seven weeks. Fed Chair Jerome Powell emphasized that near-term policy would remain unaffected by the presidential election results. The move aims to support stable prices and employment amid mixed economic signals, including persistent inflation concerns and weak job growth, alongside expectations for a slower pace of future rate cuts.

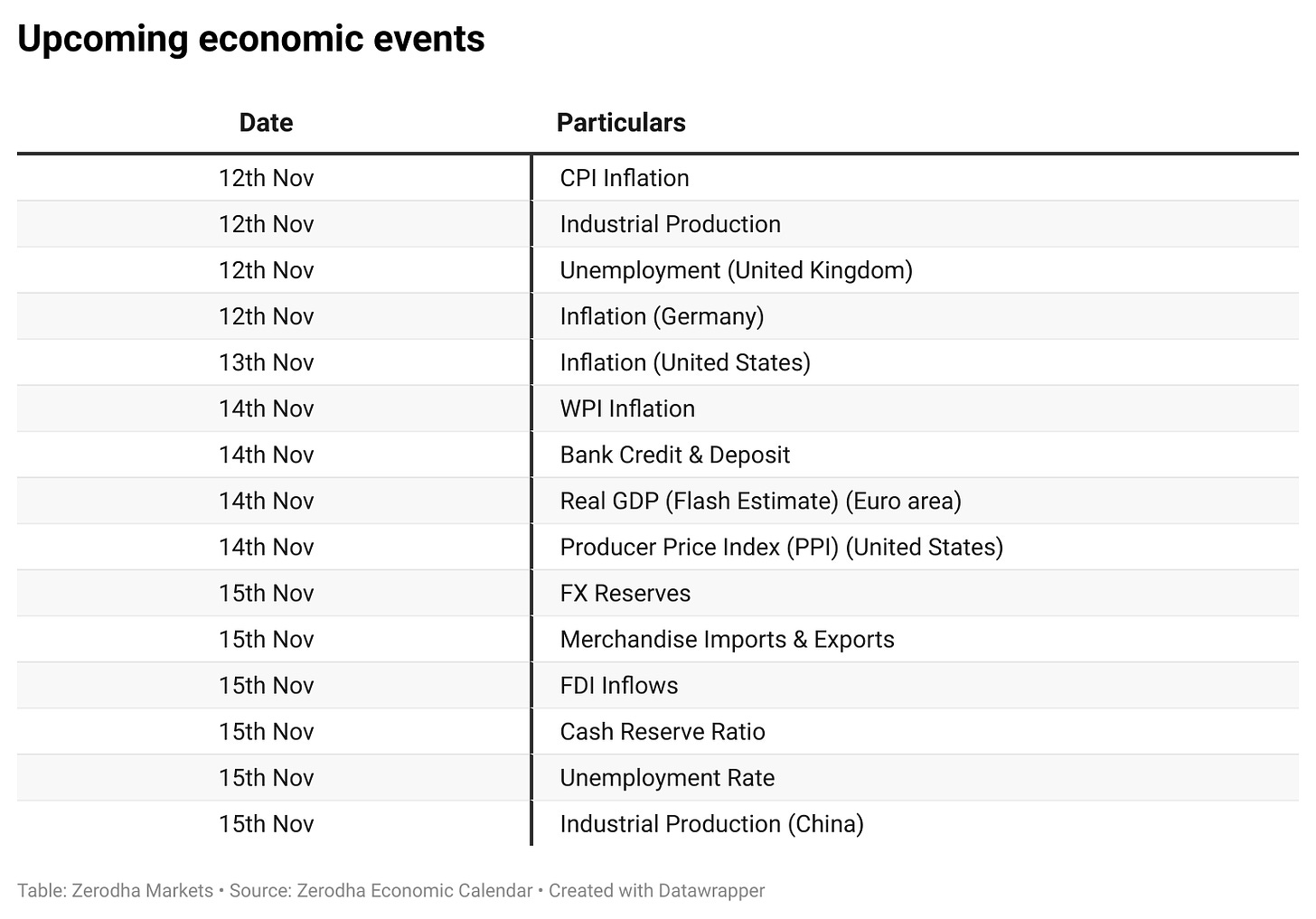

Calendars

In the coming week, We have the following quarterly results and other major events:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

Great newsletter

Really like Oil section and

Loved the economic events section

great summarised newsletter thanks