Nifty ends the week near the 200 DMA

Welcome to the weekly edition of the Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Catch “The world, simplified”, a weekly show that will break down some of the biggest developments in finance and economics that are shaping our world.

You can check out all the charts in Beyond the Charts! A newsletter where we dive into fascinating charts from the world of finance and the economy, breaking down what’s happening in a way that’s easy to understand.

Market Overview this week

The Nifty index closed the week down by 2.55% at 23,532.7, breaking its long-held support at 23,800 and testing the 200-day moving average (DMA) before closing near it. The Indian markets underperformed, falling in line with global markets like the US, which saw profit booking last week. Contributing factors to this weaker performance include continued selling by foreign institutional investors (FIIs), subdued Global markets, and a slowdown in earnings for many large-cap companies, resulting in broadly negative market sentiment.

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market.

What happened in India?

Equity Mutual Funds See Record Inflow of Rs. 41,887 Crore in October: Equity mutual funds saw a 21% jump in net inflows in October, driven by strong investor interest in thematic funds despite market corrections.

IT Hardware PLI Scheme Faces Slow Progress Amid Import Challenges: Most manufacturers under the ₹17,000 crore PLI scheme have delayed production due to reliance on imports and insufficient orders.

RBI Prepared for Controlled Rupee Depreciation Amid Yuan Weakness and Trade Concerns: The RBI is managing rupee volatility using its forex reserves to address the trade deficit with China and attract businesses.

Onion Prices Hit Five-Year High Due to Poor Crop Quality and Supply Shortages: Heavy rains and delayed crops have pushed onion prices to a five-year high, driven further by strong export demand.

India's CPI Inflation Rate for October 2024 Rises to 6.21%: October's CPI inflation surged to a 14-month high due to a sharp rise in food prices, despite some relief in pulses and sugar.

Net Direct Tax Collections Grow by 15.41% This Fiscal Year: India’s net direct tax collections rose by 15.41%, driven by corporate tax growth and a significant increase in issued refunds.

RBI Allows FPIs to Reclassify Investments as FDI: Foreign Portfolio Investors can reclassify their holdings as FDI if they exceed the 10% limit, enabling higher stakes in Indian companies.

Swiggy Debuts on Stock Market at 7.69% Premium: Swiggy's shares opened with a 7.69% premium on the NSE, closing 16.92% higher on debut.

India's Automobile Industry Sees Mixed Results in October 2024: Passenger vehicle sales hit record highs, but two-wheeler growth was uneven, and three-wheeler sales faced minor declines.

India's Merchandise Trade Deficit Expands in October 2024: The trade deficit grew to $27.14 billion, driven by a sharp increase in imports and steady export growth.

India's Wholesale Price Index (WPI) Inflation at Four-Month High: WPI inflation reached 2.36% due to rising food prices, particularly vegetables, while fuel prices dropped.

India's Edible Oil Imports Fall by 3.09% in 2023-24: Higher domestic production and reduced demand, coupled with rising global prices, led to a drop in edible oil imports.

Eicher Motors Focuses on Sales Growth Over Margins: Eicher Motors shifted its focus from EBITDA margins to boosting sales, with festive sales up 26% year-over-year.

What happened across the globe?

Impact of Trump Presidency on Crude Oil Prices: Analysts predict a potential drop in crude oil prices due to Trump's pro-drilling policies, which could lead to oversupply, though rising U.S. production costs may limit new drilling efforts.

Saudi Arabia's IPO Market Sees Strong Demand: United International Holding Co. drew approximately $34.8 billion in orders for its IPO, signaling robust investor interest in Saudi Arabia's financial sector.

IMF Warns of Underpriced Geopolitical Risks: The IMF cautions that markets are underestimating geopolitical conflict risks, which could lead to significant market sell-offs similar to the August panic.

UK Private Sector Wage Growth Steady: Average weekly earnings growth in the UK’s private sector remained at 4.8% through September, marking its lowest level since early 2022.

Samsung Electronics Shares Hit Four-Year Low: Samsung shares dropped due to fears over potential U.S. tariffs and struggles in the AI chip market under Trump's presidency.

Global ETF Inflows Hit Record $1.4 Trillion: Global net inflows into ETFs reached a record $1.4 trillion as Trump's election spurred heightened investor activity, with U.S.-listed ETFs seeing record inflows.

U.S. October CPI Rise Driven by Housing Costs: The U.S. Consumer Price Index rose by 2.6% year-over-year in October, primarily due to a 0.4% increase in housing and rent costs.

Ukraine's Dollar Bonds Surge on Ceasefire Hopes: Ukraine's bonds jumped 12% amid hopes for a Trump-brokered ceasefire, though skepticism remains about its impact on Ukraine’s recovery.

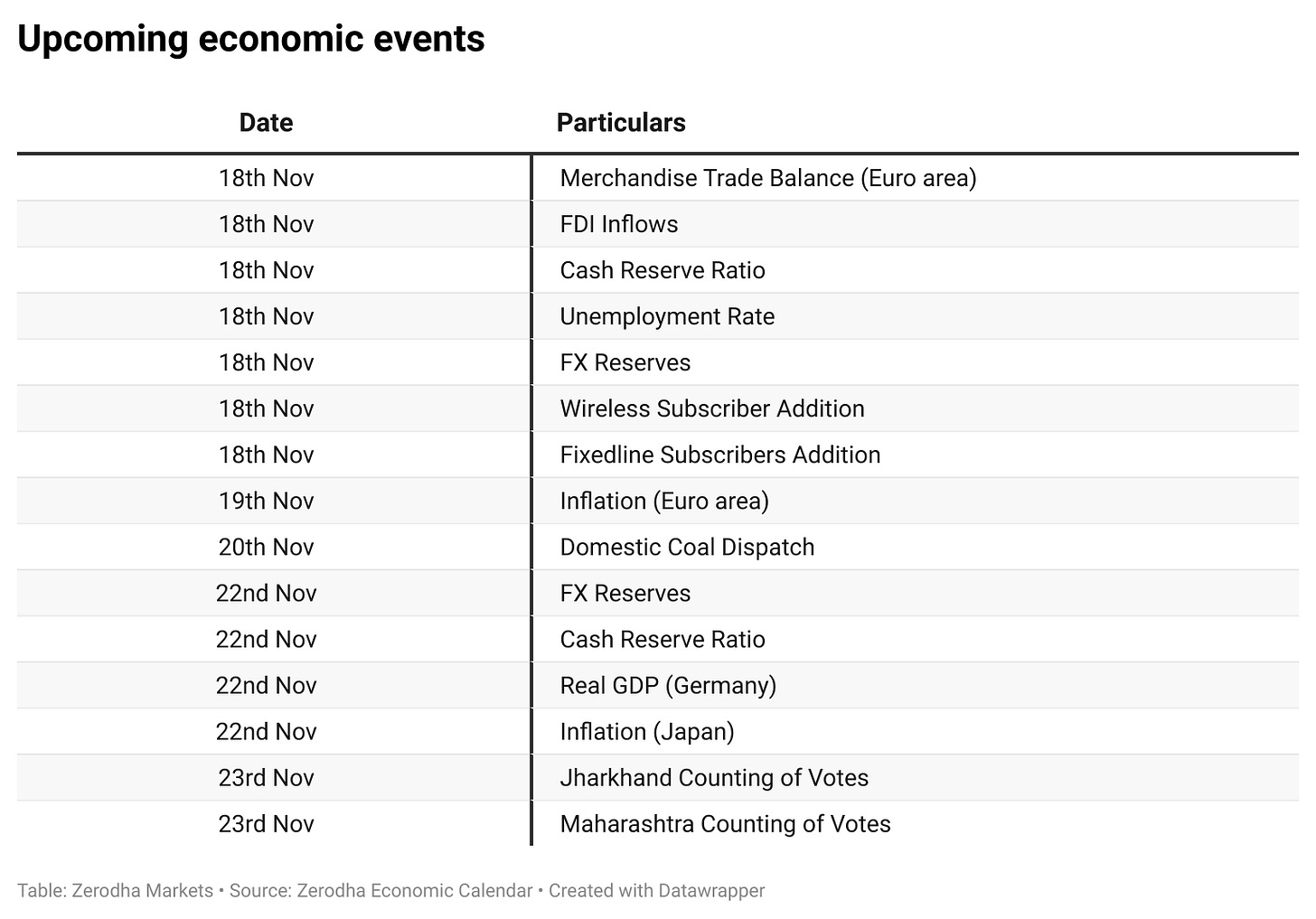

Calendars

In the coming week, We have the following quarterly results and other major events:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.