Nifty fails to cross 24000 after a big gap down

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

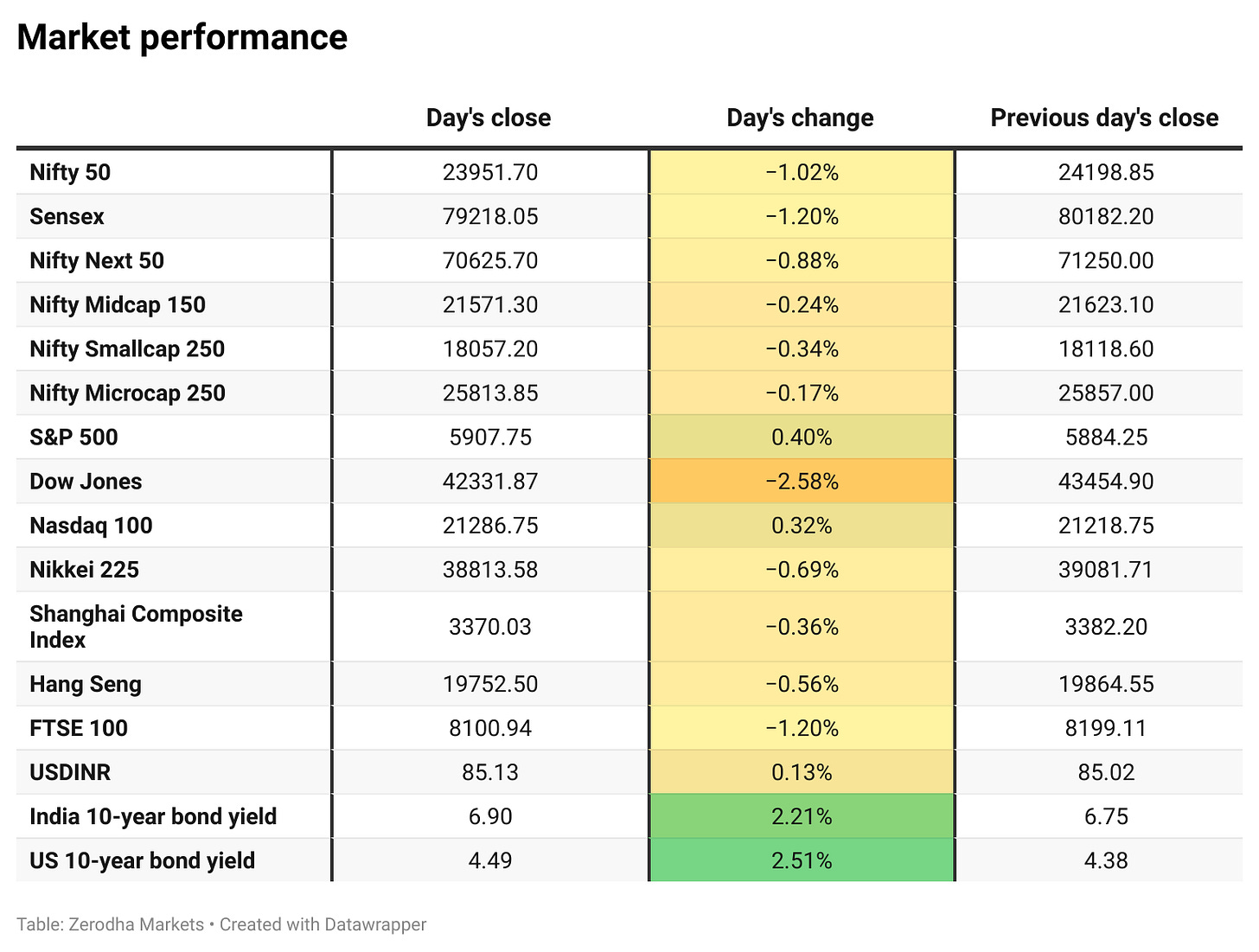

Following the overnight news from the US Federal Reserve indicating a lower rate cut projection for next year, US markets nosedived, impacting sentiment globally. As a result, the Nifty opened with a significant gap down of 321 points at 23,877.15. Within the first 15 minutes, it hit the day’s low at 23,870.30.

The market made two attempts to cross the 24,000 level but faced persistent selling pressure, failing to sustain gains at those levels. For the remainder of the session, Nifty traded in a narrow 50-point range between 23,910 and 23,960 before closing at 23,951.70, down 1.02% for the day.

The upcoming weekend GST meeting is an important event that the market is closely monitoring.

Broader Market Performance:

The broader market sentiment, while still weak and negative, showed some improvement compared to the headline indices and the previous day. A total of 1,095 stocks advanced (up from 878), while 1,706 stocks declined (down from 1,922), reflecting a slightly less negative market breadth on the NSE.

Sectoral Performance:

Sectoral trends were broadly negative, with all major sectors closing in the red. Banks, consumer durables, metals, and energy sectors saw losses ranging between 1% and 1.1%. However, pharma emerged as the top gainer, advancing by 1.72%, while Nifty IT outperformed the broader market by closing flat.

Note: The above numbers for Commodity futures were taken around 4 pm.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 26th December:

The maximum Call OI is at 24,000, closely followed by 24,300, while the maximum Put OI is at 24,000, followed by 23,500.

The massive gap between the highest and second highest call and put based on OI indicates that the 23,900-24,000 range will be key in determining the next move.

Immediate downside support is seen at the 23,800 level, followed by the 23,500 range. On the upside, immediate resistance lies at the 24,000–24,100 range, with 24,350 being the key resistance level going forward.

Note: OI is subject to multiple interpretations but generally, in a falling market if there is an increase in the call OI, it indicates resistance, and in a rising market, if there is an increase in the put OI, it indicates support.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

Inventurus Knowledge Solutions debuted on the NSE at Rs 1,900, a 42.96% premium over its IPO price of Rs 1,329, after a successful 52.68x oversubscription.

Bharti Airtel has prepaid Rs. 3,626 crores to clear all liabilities for spectrum acquired in 2016. This brings its total spectrum liability prepayments to Rs. 28,320 crores in 2024. The payment clears all dues with interest rates higher than 8.65%. Dive deeper

Amazon sold a 4% stake in Shoppers Stop for ₹276 crore, offloading nearly 44 lakh shares at ₹627.60 each. The sale attracted significant investor interest, with several institutional buyers participating in the transaction. Dive deeper

ITC has acquired a 2.44% stake in EIH Limited and a 0.53% stake in HLV Limited, bringing its total holdings to 16.13% in EIH and 8.11% in HLV. The shares were acquired from Russell Credit Limited, a wholly owned subsidiary of ITC. Dive deeper

Tata Consumer Products has issued a clarification regarding the recent news article titled "Starbucks to Exit India Due to High Costs, Bad Taste, and Mounting Losses," stating that the information provided in the article is incorrect. Dive deeper

India's direct tax collections rose 16.5% to ₹15.82 lakh crore by December 17, 2024. Non-corporate taxes grew 22.5%, outpacing corporate taxes, which increased 8.6%. Securities Transaction Tax surged 85.5% to ₹40,100 crore. Dive deeper

SEBI has tightened IPO rules for small businesses, requiring profitability in two of the last three years and capping shareholder sales at 20%. It also revamped merchant banking regulations, mandating the separation of unrelated business activities. Dive deeper

Adani Energy Solutions Limited has incorporated a wholly owned subsidiary, Adani Energy Solutions Step-Ten Limited (AESSTL), on December 18, 2024, with a paid-up capital of ₹1 lakh. AESSTL will focus on power transmission and related infrastructure services. The company holds 100% ownership, and AESSTL is yet to begin its operations. Dive deeper

Zydus Lifesciences has received final approval from the USFDA for its Lidocaine and Prilocaine Cream USP, 2.5%/2.5%, a topical anesthetic for local analgesia and superficial minor surgeries. The cream will be produced at Zydus' Changodar site in Ahmedabad. Dive deeper

SpiceJet has settled a $16 million dispute with Genesis, where SpiceJet will pay $6 million, and Genesis will acquire $4 million in equity at INR 100 per share. This agreement will help reduce liabilities and strengthen SpiceJet’s financial position. Both parties have agreed to withdraw related litigations. Dive deeper

DOMS shares dropped 5.4% intraday but closed 4.09% lower at ₹2,930.30 after FILA announced the sale of up to 4.57% of its stake. Post-sale, FILA’s stake will reduce to 26.01%, while remaining the largest shareholder and key partner. The move is aimed at boosting liquidity and free float.. Dive deeper

Punjab & Sind Bank raised Rs 3,000 crore through its first infrastructure bond issuance, attracting bids of Rs 6,031 crore. The bonds, with a 10-year tenure and a 7.74% annual coupon, will be listed on the NSE. Dive deeper

IndiGo and Air India opposed the DGCA’s proposal to reduce night flying hours, citing operational challenges. IndiGo rejected it outright, while Air India suggested implementation only after a fatigue management system is in place. Both airlines also raised concerns over extending pilot weekly rest, with IndiGo proposing a phased approach starting in June 2025. Dive deeper

Gems and jewellery exports fell 12.94% to $1.98 billion in November, hit by geopolitical tensions. Cut and polished diamond exports dropped 39.81%, while lab-grown diamond exports declined 42.37%. However, plain gold jewellery exports rose 72.12%. Despite challenges, demand is expected to rise with the holiday season approaching. Dive deeper

Brigade Group has launched Brigade Citrine, India’s first net-zero residential development in Whitefield, Bengaluru. The project spans 4.3 acres with 420 homes and incorporates eco-friendly materials, energy-efficient designs, and water conservation measures. Brigade Citrine aims to save 8900 tankers of water annually and uses renewable energy for common area lighting. Dive deeper

Borosil Renewables Ltd. (-2.78%) informed that its board approved temporarily cooling down the furnace at its subsidiary GMB due to low demand. The board also approved expanding production capacity by 500 TPD and withdrew the proposed Rights Issue, opting for a preferential issue of equity shares and warrants instead. Dive deeper

Glenmark Pharmaceuticals has acquired a 34% stake in O2 Renewable Energy XXIV Private Limited, a special-purpose vehicle for renewable energy projects. This investment, amounting to ₹1.99 Crores, aligns with Glenmark’s goal to enhance renewable energy use and become carbon neutral by 2030. Dive deeper

ABB has agreed to acquire the power electronics business of Gamesa Electric from Siemens Gamesa. The acquisition will enhance ABB’s portfolio in renewable power conversion, particularly in wind, solar, and energy storage. The deal, expected to close by mid-2025, will expand ABB’s serviceable base by about 40 GW and strengthen its position in the growing renewable energy market. Dive deeper

JSW Infrastructure aims to expand its cargo-handling capacity to 400 MTPA by FY30, with a capex of Rs 30,000 crores for FY25-30. The company plans to enhance existing ports and develop new ones, including greenfield projects and logistics integration. JSWIL has increased its third-party cargo share from 5% in FY19 to 48% in 1HFY25, supported by a strong balance sheet with zero net debt. Dive deeper

Nodwin Gaming, a Nazara Technologies subsidiary (-1.76%), has acquired AFK Gaming for INR 7.6 Crores, making it a fully owned subsidiary. The founders will join NODWIN's verticals while continuing their agency business, Max Level, and the Pixel P&L newsletter. This acquisition boosts NODWIN’s content, distribution, and marketing capabilities in the esports industry. Dive deeper

Bank of Baroda's board has approved raising Rs 10,000 crore via long-term bonds for infrastructure and affordable housing. The bonds will be issued in tranches based on market conditions. This comes after a strong Q2 FY24, with a 23.2% rise in net profit and a 7.3% increase in net interest income. Dive deeper

JK Cement has secured the Mahan Coal Mine in Madhya Pradesh with a 107.4 million tonne reserve and 1.2 million tonnes per annum capacity. This is the company’s second commercial coal mine after West of Shahdol. The Vesting Order was received from the Ministry of Coal, marking a step toward starting operations. Dive deeper

PTC Industries has completed the acquisition of Trac Precision Solutions Limited (TPSL) following approval from the UK’s National Security and Investment Act. The acquisition, initially planned for three months, was completed ahead of schedule, making TPSL a material subsidiary and the other companies step-down subsidiaries. Dive deeper

What’s happening globally

The US Fed cut the federal funds rate by 25bps in December 2024, bringing it to 4.25%-4.5%. They now expect two more cuts in 2025, with revised GDP and inflation forecasts for the coming years. Unemployment projections were lowered for 2024 and 2025. Dive deeper

US stock futures steadied after a sharp drop in the Dow, which fell 2.58% amid the Fed's revised outlook. The central bank cut rates by 0.25% but reduced its 2025 rate cut projections from four to two, alongside higher growth and inflation expectations, pushing Treasury yields higher. Dive deeper

The Bank of Japan (BoJ) kept its key interest rate at 0.25% during its December meeting, with a split vote of 8-1. Despite the US's third rate cut this year, the BoJ opted for caution, considering risks such as US policies and wage outlook. Japan’s economy is on a moderate recovery path, with private consumption increasing, while exports and industrial output remained flat. Inflation remains between 2.0% and 2.5%, driven by higher service prices. Dive deeper

New Zealand's economy contracted by 1% in Q3 2024, marking a return to recession after a 1.1% decline in Q2. Key sectors like manufacturing, business services, and construction drove the downturn, while agriculture and real estate saw growth. Annual GDP dropped by 1.5%. Dive deeper

As a result, the New Zealand dollar fell to $0.562, its lowest level since October 2022, further compounded by the US dollar's strength. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Gautam Singhania, MD & CEO, Raymond Group on real estate business growth

"I see real estate catching up to the lifestyle business because it is only a five-year-old business now. It will grow at a faster pace because if India is going to develop and be developed, the sector will expand exponentially"

"We started with our own historical land and then shifted to an asset-light model with joint developments. Today, we have about five JDs, showing that we’re bringing a value proposition to our partners," - Link

Jerome Powell, Federal Reserve Chairman on the recent rate cut:

"Today was a closer call, but we decided it was the right call because we thought it was the best decision to foster achievement of both of our goals, maximum employment and price stability. We see the risks as two-sided, moving too slowly and needlessly undermine economic activity in the labor market or move too quickly and needlessly undermine our progress on inflation. So we're trying to steer between those two risks. And, on balance, we decided to go ahead with a further cut." Link

Mahesh Babu, CEO, of Switch Mobility Ltd. on electric bus growth

"Last year to this year, we’ll be doubling our sales. And we’ll be doing so for the next three years," Mahesh Babu, CEO of Ashok Leyland Ltd.’s EV unit, said. "At least in the next 3-5 years, we’ll be among the top three electric bus makers in India; the ultimate goal is to be No. 1."

"We are expecting the tender from CESL in the next couple of months, and we are prepped to qualify for a subsidy under the PM E-Drive scheme." Link

Calendars

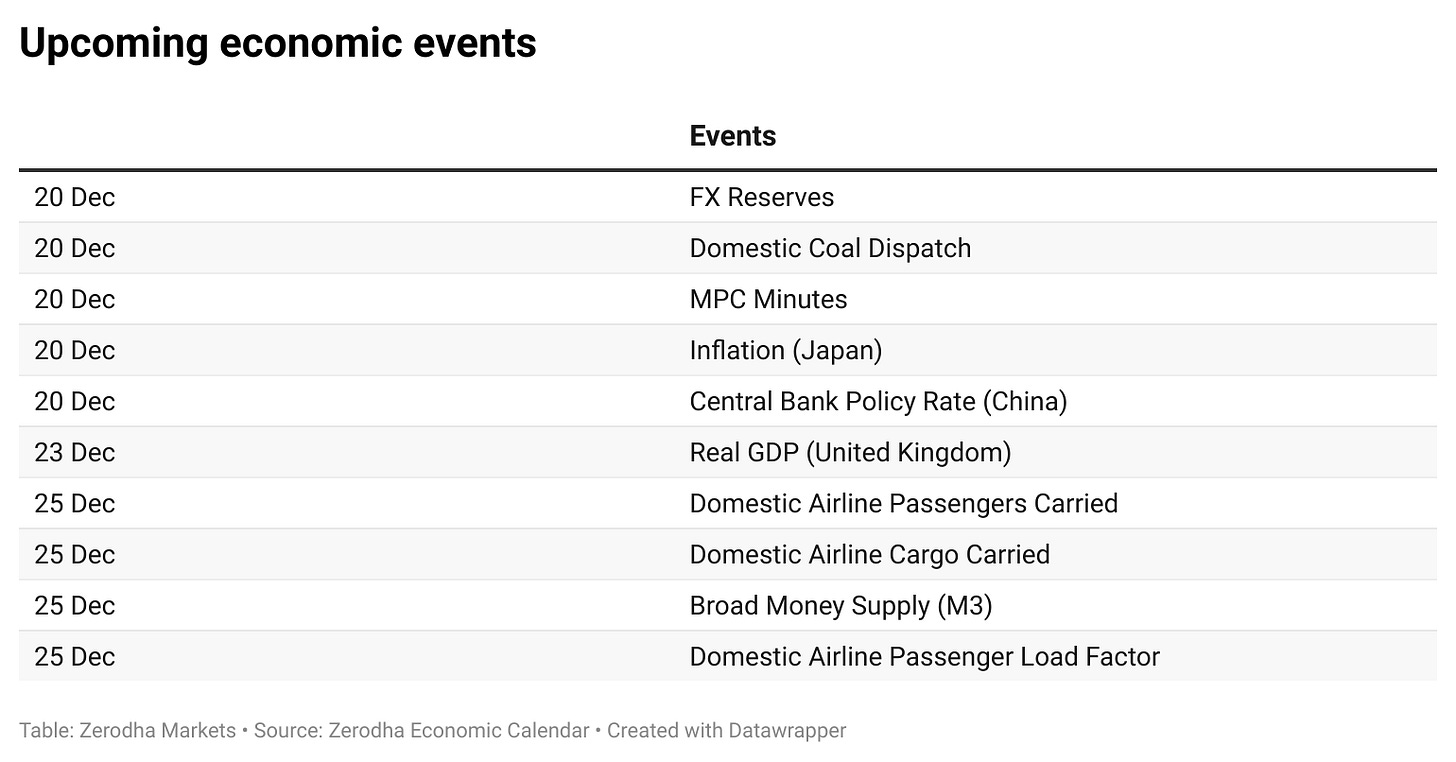

In the coming days, we have the following major events and corporate actions:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.