Nifty Gains on Rate-Cut Hopes as Budget Nears

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

Nifty opened 70 points higher at 23,026.75 and traded positively through the session. A brief dip between 11:00 and 12:30 was quickly reversed, pushing the index to a high of 23,183.35 before closing near the peak at 23,163.10, up nearly 1%.

Mid-cap stocks outperformed, rising over 2%, while the Nifty Bank index added 299 points to close at 49,166. Bajaj Auto, TVS Motor, and KPIT Technologies were among the standout gainers.

Expectations of a rate cut, fueled by the RBI’s liquidity measures and improved global cues, buoyed sentiment. However, caution lingered amid foreign outflows and the upcoming Union Budget.

Broader Market Performance:

The broader market had a strong session today, outperforming the headline indices with a notable number of advancing stocks. On the NSE, 2,311 stocks advanced, 528 declined, and 70 remained unchanged.

Sectoral Performance:

Sectoral performance was mostly positive, with Nifty Realty leading the gains, up by 2.91%, followed by Nifty IT and Nifty Media, which rose by 2.62% and 2.54%, respectively. Nifty Pharma also saw an increase of 1.77%. On the downside, Nifty FMCG was the only index in the red, falling by 0.50%.

Net Flow Breakdown for the day:

FII: Net outflow of ₹- 2,586.43 crore (Bought ₹7,644.40 crore, Sold ₹10,230.83 crore)

DII: Net inflow of ₹1,792.71 crore (Bought ₹12,871.38 crore, Sold ₹11,078.67 crore)

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 30th January:

The maximum Call Open Interest (OI) is observed at 23,000, followed by 23,300 and 23,500, indicating strong resistance around these levels.

The maximum Put Open Interest (OI) is at 23,000, followed by 22,900 and 22,800, suggesting support at these levels, particularly around 23,000.

Note: OI is subject to multiple interpretations but generally, in a falling market if there is an increase in the call OI, it indicates resistance, and in a rising market, if there is an increase in the put OI, it indicates support.

Source: Sensibull

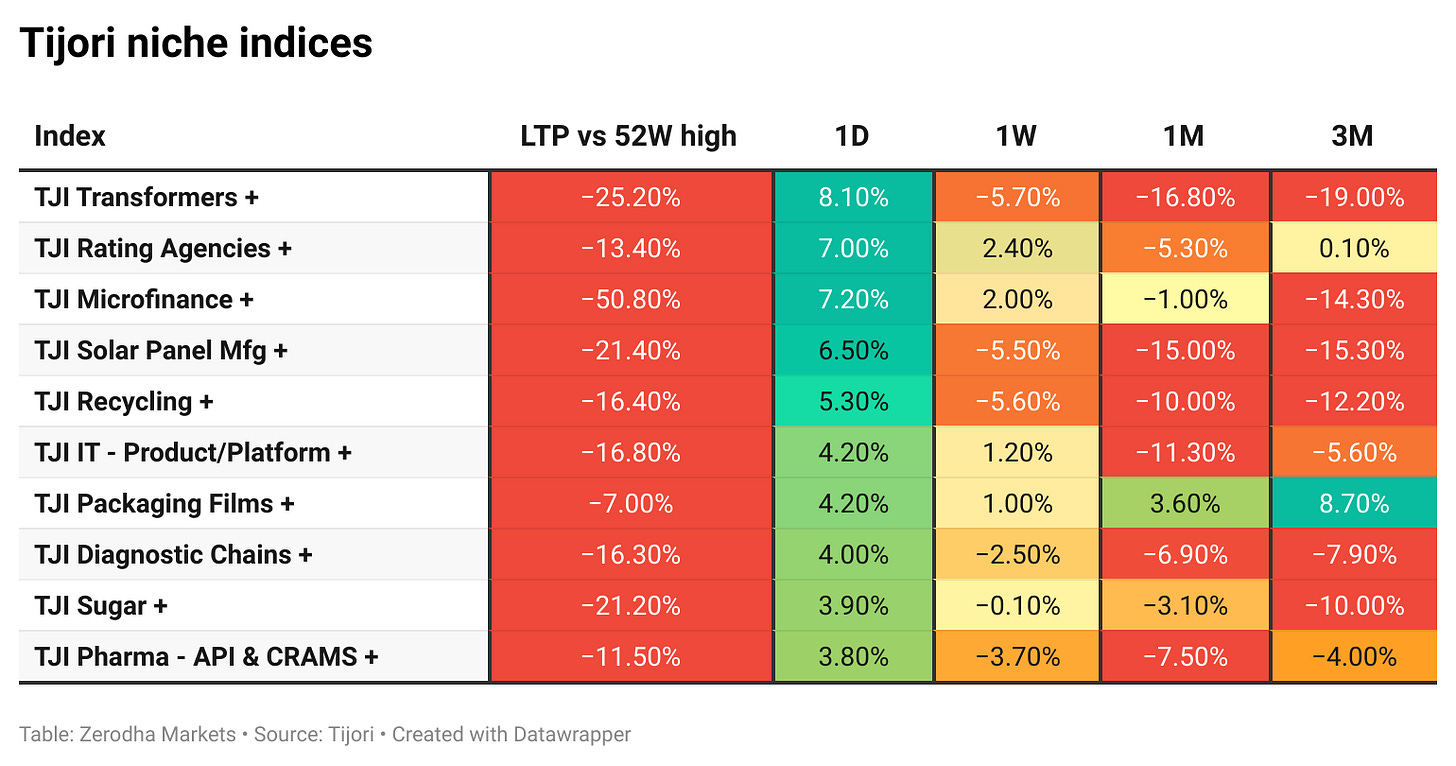

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

ITC Hotels Ltd. is listed at a 30% discount, debuting at ₹188 on BSE and ₹180 on NSE. With a ₹54,000–56,000 crore market cap, it is the second-largest hotel firm by valuation.

Lloyds Enterprises Limited has approved an additional 12.25% stake acquisition in Lloyds Infrastructure & Construction Limited (LICL), raising its total holding to 24.50%. The transaction, executed at ₹2.90 per share for ₹142.1 crore, is a related party deal at arm’s length. The investment is for strategic opportunities, with completion expected in 10-15 days. Dive deeper

The Union Cabinet revised ethanol procurement prices for Oil Marketing Companies (OMCs), raising the C-heavy molasses ethanol price to ₹57.97/litre. The move supports price stability, ethanol availability, and the target of 18% blending in FY25. Dive deeper

Denta Water & Infra Solutions debuted at a 12% premium, closing at ₹341.25, up 16.07%. The stock hit a 5% upper circuit post-listing, with the IPO subscribed 221 times. Dive deeper

JSW Natural Resources Limited, a wholly owned subsidiary, has extended the long stop date for acquiring a 92.19% stake in Minas de Revuboe Limitada from January 31, 2025, to June 30, 2025, due to ongoing arbitration with the Republic of Mozambique. Dive deeper

The Union Cabinet approved the National Critical Mineral Mission with a ₹34,300 crore budget, including ₹16,300 crore in government funding and ₹18,000 crore from PSUs. The mission aims to fast-track approvals, incentivize exploration, and promote mineral recovery. It also supports overseas acquisitions, mineral processing parks, and R&D initiatives. Dive deeper

Aarti Industries has acquired a 26.25% stake in Pro-Zeal Green Power Seven Pvt Ltd to develop a 9.24 MW solar plant, supporting its renewable energy goals. The plant is expected to generate power from H2 FY26, reducing costs. The ₹36.39 crore investment includes equity and CCDs, with completion expected in 30 days. Dive deeper

Raymond Limited has approved an investment of up to ₹50 crore in Redeemable Preference Shares of its step-down subsidiary Ten X Realty West Ltd (TXRWL) to fund a joint redevelopment project. TXRWL, incorporated in January 2024, is in the project stage, with the investment made in cash at fair value. Dive deeper

India’s food services market, valued at $80 billion in 2024, is projected to reach $144-152 billion by 2030 at a 10-11% CAGR, per Redseer. Organised players, cloud kitchens, and multi-brand strategies are driving growth, while consumer preferences shift toward convenience and social dining. Dive deeper

Home First Finance plans to raise ₹1,250 crore via QIP or other modes to expand its loan portfolio. Q3 net profit rose 24% to ₹97.4 crore, with AUM up 33% to ₹11,949 crore. Ajay Khetan was appointed Deputy CEO. Dive deeper

JSW Group will invest ₹35,000 crore in a 5-million-tonnes per annum (MTPA) steel plant in Keonjhar, Odisha. While POSCO’s role is undecided, major commitments at the Odisha summit include ₹50,000 crore from Aditya Birla Group and ₹20,000 crore from Avaada Group. Tata Steel plans a 10 MTPA expansion. Dive deeper

SEBI returned Danny Gaekwad’s request to bid for a 55% stake in Religare, citing no exemption under security laws. His offer came after the deadline, while Religare’s independent directors flagged concerns over the Burman family’s open offer and RBI’s conditional approval. Dive deeper

Adani Group plans to invest ₹2.3 lakh crore in Odisha over five years across key sectors. At the Utkarsh Odisha 2025 summit, MoUs were exchanged with the state government. Notable developments include the first test flight at Dhamra Airstrip, the commissioning of six Adani Total Gas projects, and new EV charging and CNG stations. Dive deeper

India Ratings projects housing prices to rise 3-4% in FY26, moderating from 5-6% in FY25, as new launches and base effects take hold. Sales growth will be led by premium and luxury segments, with NCR, Bengaluru, and MMR expected to stay resilient. Dive deeper

Hero Future Energies is planning a ₹3,500 crore IPO, with KKR and IFC expected to pare stakes. It operates 5.2 GW of renewable assets, primarily in India, and aims to invest $20 billion in renewables by 2030. Dive deeper

The Competition Commission of India (CCI) approved Renew Exim DMCC’s acquisition of up to 72.64% in ITD Cementation India, including 46.64% from promoters for ₹3,204 crore and a 26% open offer worth ₹2,553 crore. The Adani Group-owned Dubai-based firm aims to expand in India’s infrastructure sector. Dive deeper

What’s happening globally

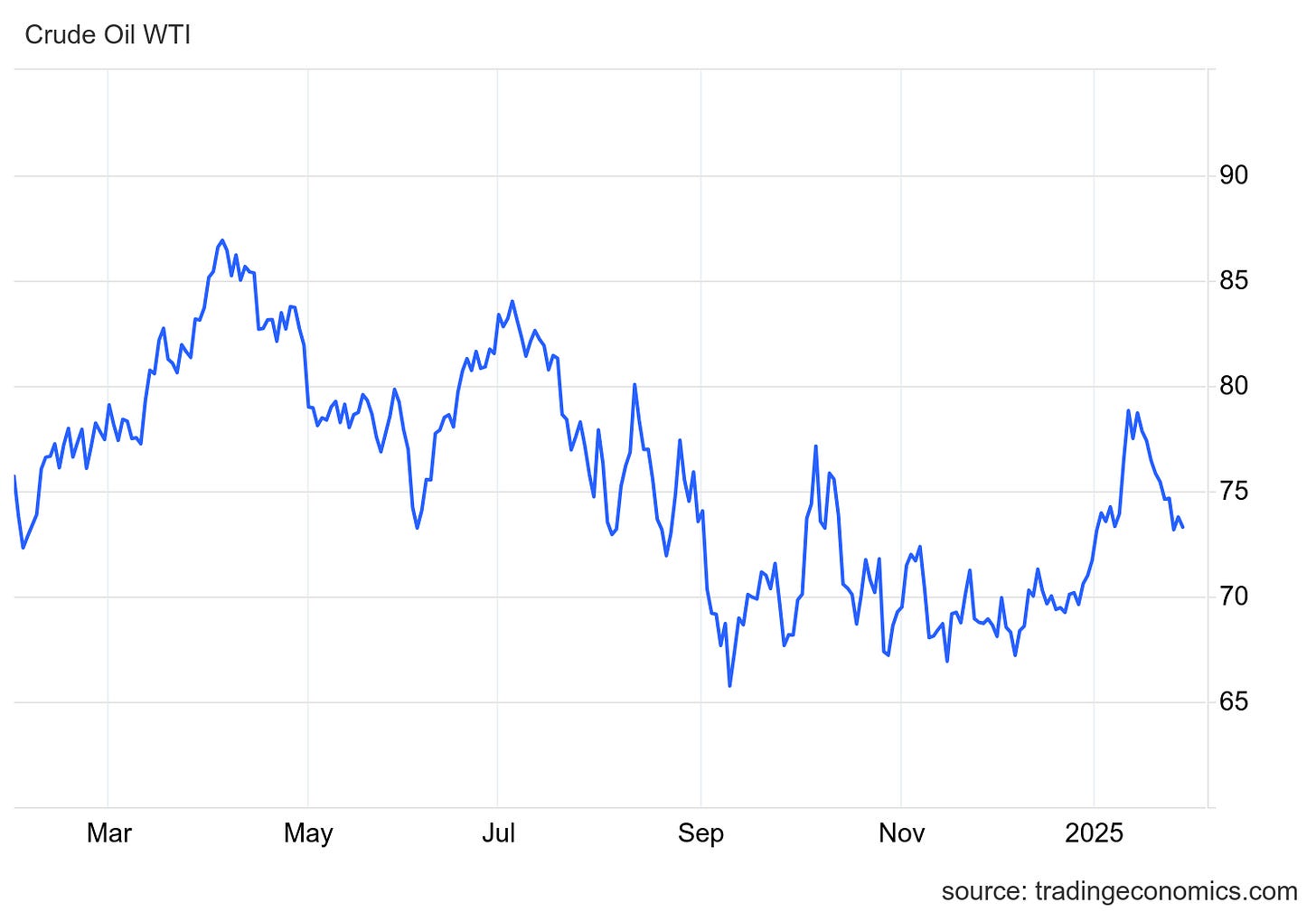

WTI crude hovered near $73.8 as markets weighed Trump’s tariff plans, Libya’s resumed exports, and Russia’s oil shipments to India despite US sanctions. Weak China data and rising US crude stocks added pressure. Dive deeper

Eurozone household lending rose 1.1% YoY to €6.93T in December, the fastest since August 2023, while corporate lending grew 1.5% to €5.2T. Private sector credit expanded 2%, up from 1.5% in November. Dive deeper

The Fed is expected to hold rates at 4.25%-4.5% in January 2025, pausing after three cuts in 2024. Markets await signals on future policy amid inflation at 2.9%, easing core inflation, and a cooling but resilient job market. Dive deeper

Italy’s consumer confidence index rose to 98.2 in January, the highest since September, beating expectations of 96. Sentiment improved across economic outlook, future expectations, and personal climate, per ISTAT. Dive deeper

Sweden’s Riksbank cut rates by 25 bps to 2.25%, its fifth consecutive cut, citing near-target inflation and economic weakness. The 175 bps reduction since May aligns with forecasts, though policy may adjust as conditions evolve. Dive deeper

Spain’s GDP grew 0.8% QoQ in Q4 2024, beating forecasts, with domestic demand driving growth. Household spending rose 1%, investment 2.8%, while exports lagged. Services and construction expanded, but the primary sector contracted. Annual GDP rose 3.5%, making Spain a Eurozone outperformer. Dive deeper

Shell led the carbon credit market in 2024, retiring 14.9 million credits as oil firms scaled back clean energy spending. The fossil fuel sector used over 40% of credits, while tech firms like Microsoft continue investing in new offsets. Amid scrutiny, energy firms rely on existing credits to meet climate goals. Dive deeper

Australia’s CPI rose 2.5% YoY in December 2024, up from 2.3%, as energy rebates waned. Electricity and fuel prices fell slower, while housing and transport costs increased. Core inflation eased to 2.7% from 2.8%. Dive deeper

Boeing plans to ramp up 737 production to 38 per month in 2025, pending FAA approval. Despite a $4 billion Q4 loss and $14.3 billion cash burn, shares rose 5.8% on recovery hopes. A portfolio review may lead to asset sales, including Jeppesen. Dive deeper

Quarterly results

In this section, we'll dive into all the key highlights from today's intriguing results, covering the most impactful performances and standout moments. The numbers are comparable on a year-on-year (YoY) basis.

Adani Power Ltd (ADANIPOWER) (+5.14%)

Financials

Revenue: ₹14,833 crore, up by 11% YoY.

EBITDA: ₹6,185 crore, up by 23% YoY.

Net Profit: ₹2,940 crore, up by 7% YoY.

Key Highlights

Power sales volume rose 8% YoY to 23.3 BU in Q3 and 22% YoY to 69.5 BU in 9M.

Higher revenue supported by volume growth and lower fuel costs.

Continued expansion with installed capacity at 17,550 MW vs 15,250 MW YoY.

Outlook

The company aims at targeting 30+ GW capacity by 2030, leveraging supply chain strength, PPA tie-ups, and rising power demand.

Ambuja Cement (AMBUJACEM) (-3.88%)

Financials

Revenue: ₹9,329 crore, up by 15% YoY.

EBITDA: ₹1712 crore, down by 1% YoY.

Net Profit: ₹2,620 crore, up by 157% YoY.

EPS: ₹8.59, up by 107% YoY.

Key Highlights:

Completed acquisition of Orient Cement (37.90%) and initiated an open offer for an additional 26% stake.

Consolidated Penna Cement (99.94% stake) into operations, adding 14 MTPA capacity.

Finalised acquisition of 1.5 MTPA grinding unit in Tamil Nadu.

Recognised ₹189.52 crore refund from excise duty exemption.

No material impact from regulatory proceedings, per Supreme Court and SEBI conclusions.

Outlook:

The company aims for continued expansion through strategic acquisitions, focuses on operational efficiencies and cost optimisation, and expects market demand to remain stable with a positive pricing environment.

Maruti Suzuki (MARUTI) (-1.20%)

Financials

Net Profit: ₹3,727 crore, up by 16% YoY.

Revenue: ₹38,764.3 crore, up by 15.7% YoY.

EBITDA: ₹5,076 crore, up by 14.4% YoY.

EBITDA Margin: 11.6%, down from 11.7% YoY.

Vehicle Sales: 5,66,213 units, up by 13% YoY.

Key Highlights:

The company achieved a strong growth trajectory with higher profits, revenue, and vehicle sales, marking significant milestones in exports and domestic market performance.

The company also achieved the highest-ever net sales of ₹36,802 crore in Q3FY25.

Outlook:

The company is positioned for continued growth in the automotive sector with strong domestic sales, record exports, and a focus on operational efficiencies, while stable market demand and favorable pricing support future performance.

Indian Bank (INDIANB) (+5.95%)

Financials

Profit: ₹2,910 crore, up by 32% YoY.

Net Interest Income (NII): ₹6415 Cr, up by 10.3% YoY

Total Income: ₹17,912.03 Cr, up by 11.26% YoY

Key Highlights:

Indian Bank's Gross NPA improved to 3.26%, down by 121 bps YoY, and Net NPA decreased to 0.21%, with a Provision Coverage Ratio of 98.09%, up by 219 bps YoY.

The bank expanded its network to 5877 domestic branches, including 1987 rural branches. It also operates 5224 ATMs/BNAs and has a strong presence with 13,292 Business Correspondents.

Outlook:

The bank is seeing strong profit growth and improving asset quality. With a robust network and increased provision coverage, it is well-positioned to maintain stability and achieve sustained growth in the coming quarters.

Blue Star Limited (BLUESTARCO) (+3.65%)

Financials

Revenue: ₹2,807.36 Crore, up by 25.24% YoY.

Net Profit: ₹132.46 Crore, up by 31.84% YoY.

Key Highlights:

Strong YoY growth in both sales and profitability driven by higher demand in the HVAC and refrigeration segments.

Positive performance from subsidiaries and joint ventures, contributing to overall revenue growth.

Outlook:

The company is focused on sustaining its growth trajectory by expanding its product offerings and maintaining operational efficiencies. The company is well-positioned to capitalise on increasing demand in its key segments while enhancing its domestic and international footprint.

Deepak Fertilisers And Petrochemicals Corporation Ltd. (DEEPAKFERT) (+15.90%)

Financials:

Sales: ₹2,579 Crore, up by 39% YoY.

EBITDA: ₹486 crore, up by 72% YoY.

Net Profit: ₹253 Crore, up by 336% YoY.

EPS: ₹19.86, up by 336% YoY.

Key Highlights:

Enhancing performance across core segments drove significant growth in both sales and net profit.

A strong market position drives sustained growth, and the company focuses on expanding its product portfolio and enhancing production capabilities.

Outlook:

The company is well-positioned to benefit from favourable market conditions in the fertiliser and petrochemicals sectors.

Blue Jet Healthcare Ltd (BLUEJET) (+9.99%)

Financials

Revenue from Operations: ₹318.38 crores, up by 91% YoY.

Net Profit: ₹98.98 crore, up by 154% YoY.

EPS: ₹5.71 (basic).

Key Highlights:

Significant growth in revenue is driven by the strong demand for pharmaceutical intermediates and active pharmaceutical ingredients (APIs).

Increased profitability due to optimised operational efficiency and reduced depreciation expenses following adopting the Straight-Line Method for depreciation.

Outlook:

The company continues to focus on expanding its manufacturing capabilities, particularly in the pharmaceutical sector, to support long-term growth and meet increasing market demand.

JBM Auto Ltd. (JBMA) (+2.71%)

Financials

Revenue: ₹1,396.15 crores, up by 4.5% YoY.

Net Profit: ₹56.4 crores, up by 8% YoY.

EPS: ₹4.45, up by 8% YoY.

Key Highlights:

Revenue growth is driven by increased demand and operational efficiencies in the automotive sector.

Improved cost management and product mix contributed to higher margins, leading to strong profit growth despite challenges.

Outlook:

The company is focused on expanding its market presence through innovative product offerings and strengthening its manufacturing capabilities to meet growing demand in the automotive sector.

M&M Financial Services Ltd. (M&MFIN) (-0.74%)

Financials

Revenue: ₹4,797 crores, up by 17% YoY.

EBITDA: ₹3,472 crores, up by 31% YoY.

Net Profit: ₹918 crores, up by 47% YoY.

EPS: ₹7.43, up by 47% YoY.

Key Highlights:

Mahindra & Mahindra Financial Services Limited reported a 19% YoY increase in revenue from operations to ₹4,143 crores for Q3 FY24, while net profit surged 63% YoY to ₹899.47 crores.

The company also improved its earnings per share (EPS) to ₹7.28, reflecting strong financial performance.

Outlook:

The company is expected to continue its growth trajectory with a focus on managing impairments and improving cost efficiencies in the coming quarters.

Bajaj Auto Ltd. (BAJAJ-AUTO) (+2.71%)

Financials

Revenue: ₹13,169 crores, up by 8% YoY.

EBITDA: ₹2,751 crores, up by 14% YoY.

Net Profit: ₹2,196 crores, up by 8% YoY.

EPS: ₹78.62, up by 10% YoY.

Key Highlights:

M&M Financial Services' Q3 revenue rose 6% YoY to ₹12,807 Cr, driven by exports, Green Energy, & spare parts.

EBITDA and PAT exceeded ₹2,500 crores and ₹2,000 crores, aided by stable EBITDA margins and strategic EV and Green Energy investments.

Outlook:

The company is poised for continued growth with a focus on maintaining momentum in the domestic and export markets, enhancing its Green Energy and electric vehicle portfolios.

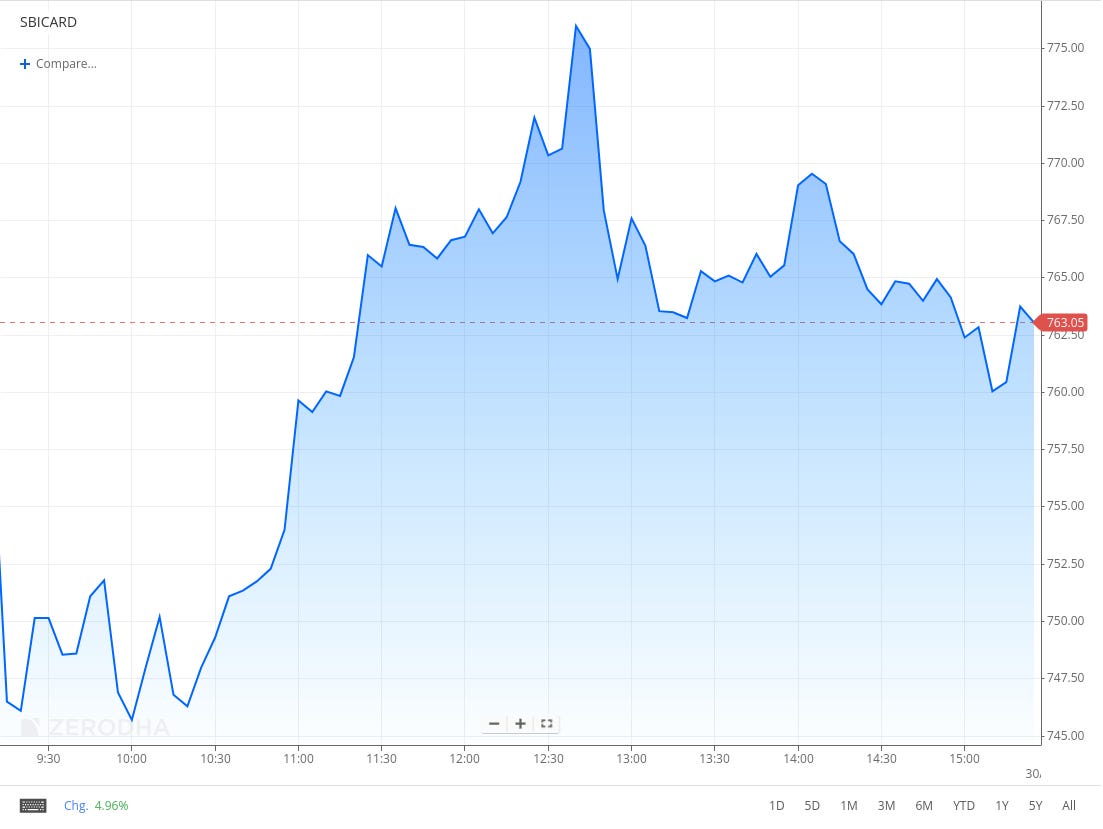

SBI Cards & Payment Services Ltd. (SBICARD) (+0.30%)

Financials

Revenue: ₹4,619 crores, down by 0% YoY.

EBITDA: ₹1,247 crores, down by 9% YoY.

Net Profit: ₹383 crores, down by 30% YoY.

EPS: ₹4.03, down by 30% YoY.

Key Highlights:

The company also saw a rise in impairment provisions and expenses, while its basic earnings per share decreased.

Outlook:

The company is expected to maintain its financial discipline, ensure continued transparency and compliance with regulatory standards, and drive growth in its core operations.

Bharat Heavy Electricals Ltd. (BHEL) (+6.52%)

Financials:

Revenue: ₹7,277 crores, up by 32% YoY.

EBITDA: ₹304 crores, up by 40% YoY.

Net Profit: ₹135 crores, up by 123% YoY.

EPS: ₹0.39, up by 129% YoY.

Key Highlights:

Bharat Heavy Electricals Limited maintained stable operational performance, with financial provisions and receivables under review.

Governance matters, including audit committee quorum issues, were noted, but financial reporting complies with standards.

Outlook:

The company focuses on resolving outstanding receivables and strengthening financial oversight to ensure sustained growth.

JSW Steel (JSWSTEEL) (+2.34%)

Financials:

Revenue: ₹41,378 crores, down by 1% YoY

EBITDA: ₹5,579 crores, down by 22% YoY

Net Profit: ₹719 crores, down by 68% YoY

EPS: ₹2.93, down by 70% YoY

Key Highlights:

JSW Steel reported its highest-ever quarterly crude steel production, supported by strong sales and operational efficiencies.

The company maintained a stable financial position, with steady revenue growth and disciplined cost management.

Outlook:

JSW Steel remains focused on capacity expansion, cost optimization, and strategic initiatives to strengthen its market position amid evolving global and domestic economic conditions.

Tata Motors (TATAMOTORS) (+3.33%)

Financials:

Revenue: ₹1,13,575 crores, up by 2.7% YoY.

EBITDA: ₹15,500 crores.

EBITDA margin at 13.7%.

PBT: ₹7,700 crores, down by ₹75 crores YoY.

Key Highlights:

Tata Motors reported revenue growth with strong performance from Jaguar Land Rover, which achieved its highest EBIT margin in a decade.

Commercial vehicle revenues declined due to lower volumes, while passenger vehicle EBITDA margins improved on cost controls and PLI incentives.

Outlook:

The company expects demand to improve with infrastructure spending, new product launches, and stable interest rates while remaining watchful of global economic conditions.

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

P R Seshadri, CEO, South Indian Bank on growth and updates

"We expect transactional accounts growth should be about Rs 1,500 to Rs 2,000 crore, when we come closer to March 31 this fiscal. We would expect between 8-10% growth in our CASA balances."

"We are being cautious and making personal loan offers more judiciously. When the environment improves, we will be a little bit more aggressive."

"We are awaiting RBI’s review of our submission for co-branded credit cards. Once they revert, we’ll keep you posted."

"The liens on the NRE deposits have been removed and whatever had cost is no longer in effect." - Link

Sharad Mahendra, CEO, JSW Energy on operational goals and updates

"We are on track to reach 10 GW capacity by March 2025 with current capacity at 8.8 GW as of January."

"Acquisitions of O2 Power Ltd. and KSK Mahanadi Power Co. will help expand capacity to 14 GW by June 2025."

"We expect to have our first operational energy storage capacity by next financial year, despite facing hurdles with the BESS project." - Link

Calendars

In the coming days, we have the following major events, corporate actions, and upcoming earnings releases:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.