Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Market Overview

Nifty opened 71 points higher at 24,539.15 but quickly turned negative, hitting a low of 24,295. After staying in the red until 11:45 AM, it staged a sharp recovery, testing 24,850 before a sudden 300-point drop. The index rebounded again to close above 24,700.

Broader market performance:

Market breadth weakened compared to recent days but remained positive, with 1,483 stocks advancing, 1,304 declining, and 77 unchanged out of 2,864 traded stocks.

Most sectoral indices closed in the green, driven by buying in IT, private banks, FMCG, and metals, while profit booking was seen in PSU banks and the realty sector.

Looking ahead:

The focus now shifts to tomorrow’s RBI monetary policy, with markets maintaining their upward momentum despite elevated volatility.

Note: The above numbers for Commodity futures were taken around 4 pm.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 12th December:

The maximum CE OI is at 25000 followed by 25200, and the maximum Put OI is at 24500 closely followed by 24700.

Immediate support on the downside can be seen at 24500 levels followed by 24400 levels. Resistance on the upside is at 24800 levels followed by 25000.

Note: OI is subject to multiple interpretations but generally, in a falling market if there is an increase in the call OI, it indicates resistance, and in a rising market, if there is an increase in the put OI, it indicates support.

Source: Sensibull

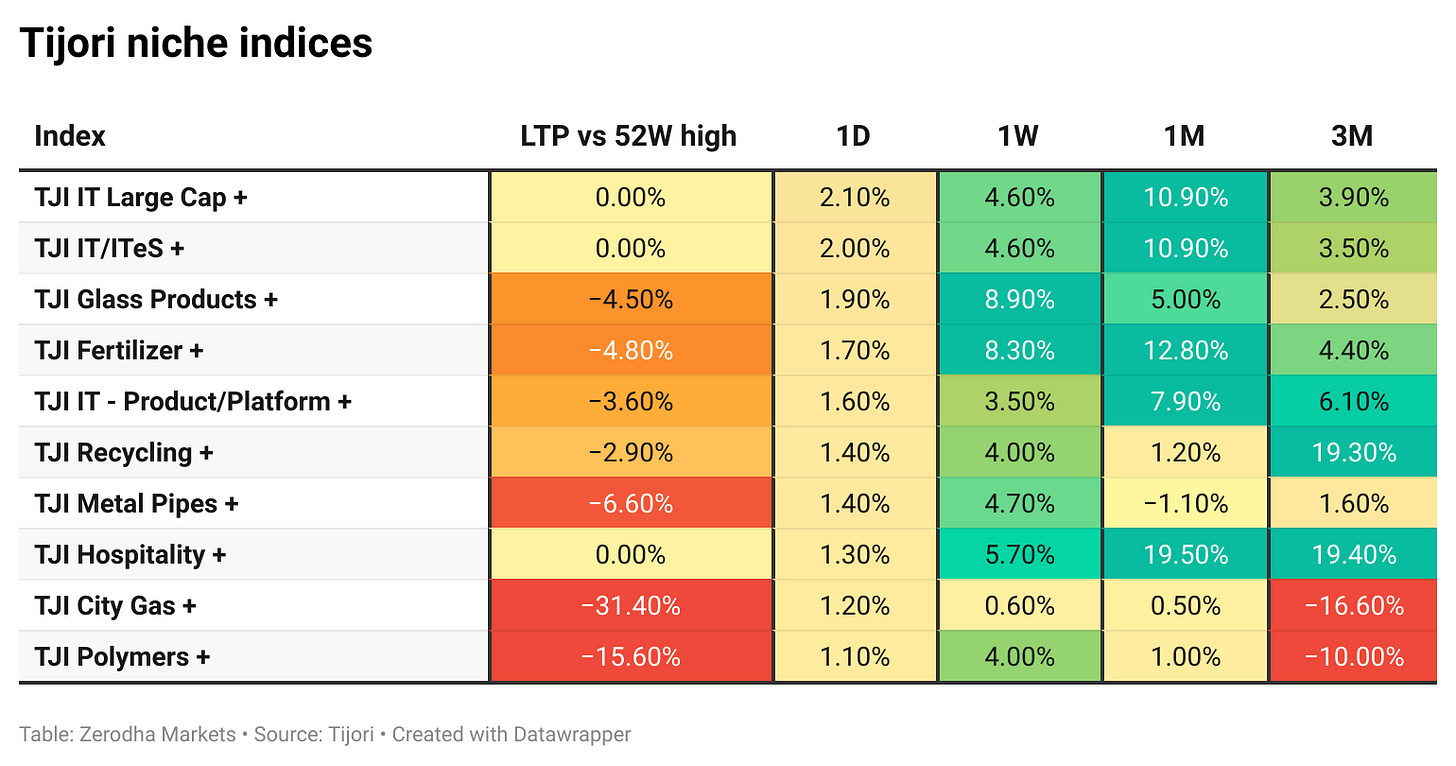

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

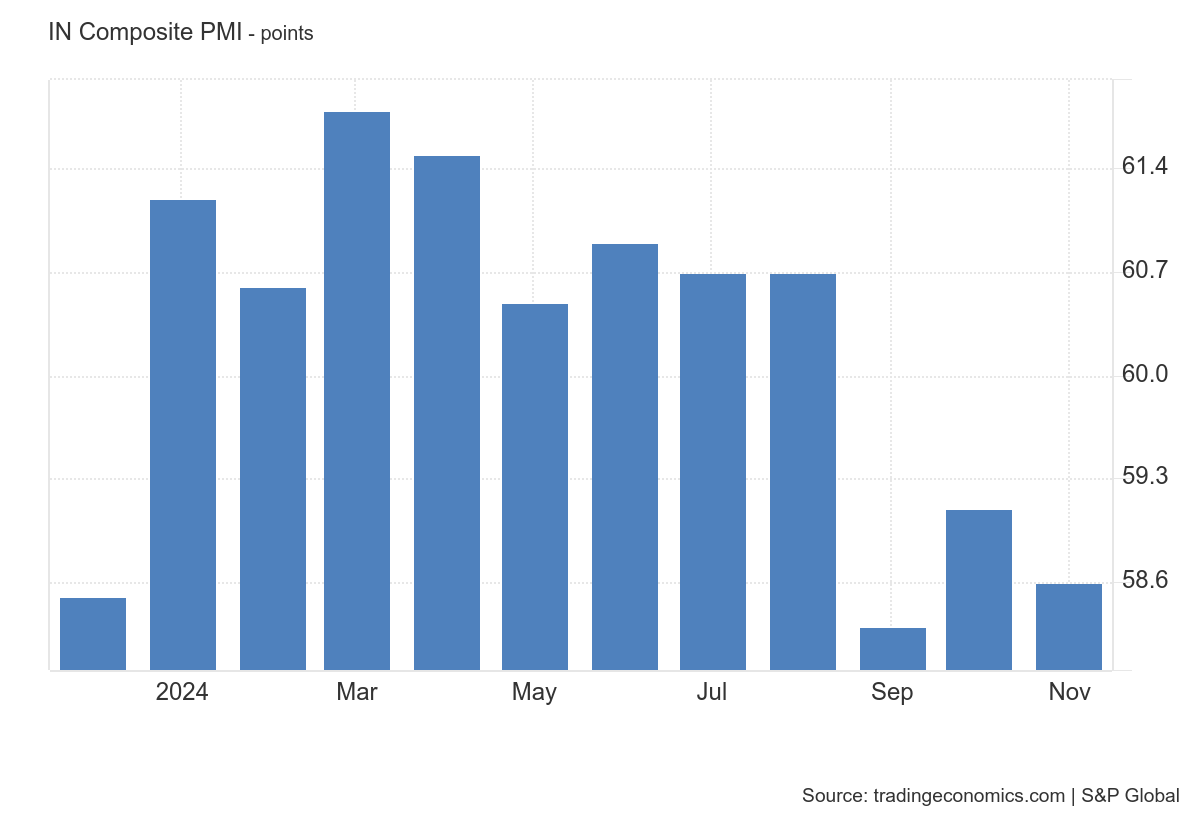

India's Composite PMI eased to 58.6 in November 2024 from October's 59.1, signaling robust private sector growth for the 40th month despite rising costs and record hiring. Manufacturing growth outpaced services, with input prices and output charges climbing significantly. Dive deeper

Indraprastha Gas (IGL) shares closed at ₹383.45, gaining 6.44% on Thursday, following the announcement of a December 10 board meeting to consider a bonus share issue proposal. Dive deeper

BSE stock jumped 13% today, crossing ₹5,000 for the first time. The stock has gained 90% in six months, fueled by strong investor interest amid potential re-rating linked to NSE’s anticipated IPO. Dive deeper

Hyundai Motor India announced a price hike across its model range by up to ₹25,000, effective January 1, 2025. The increase is attributed to higher input costs, adverse exchange rates, and rising logistics expenses. Tarun Garg, HMIL COO, stated that passing on a part of the cost escalation was necessary. The price adjustment will apply to all 2025 models. Dive deeper

The Indian rupee traded steady at 84.7350 against the U.S. dollar on Thursday, holding near its record low of 84.7575 earlier this week. Market focus remains on the Reserve Bank of India's policy decision amid slowing domestic growth and global rate-cut expectations. Dive deeper

Vishal Mega Mart's ₹8,000 crore IPO will open for subscription from December 11-13, with anchor bidding on December 10. The company operates 626 stores across India, focusing on apparel, general merchandise, and FMCG products. Dive deeper

Swiggy's shares surged 11.4% to ₹576.95 during the day before closing the day at 540, driven by narrowing losses and robust Q2 FY25 financial performance. Gross Order Value (GOV) for Instamart saw strong growth, adding 12 cities, improving margins, and achieving a 24% QoQ increase. Expansion plans include doubling Instamart's store count by March 2025 and investing ₹1,600 crore in Scootsy Logistics. Dive deeper

Waaree Energies Ltd. is set to commission a 1.6 GW solar panel manufacturing facility in Houston, Texas, this fiscal, with plans to expand capacity to 3 GW in the near term. The $1 billion investment aims to tap into the robust US market, supported by a pipeline of 15-20 GW orders. Currently, revenue contributions from the US and Indian markets are nearly balanced, with expectations for the order book to strengthen further in the fiscal second half. Dive deeper

Banks have raised over ₹6 lakh crore through certificates of deposit (CDs) till November 15 this fiscal, a 57% increase from ₹3.9 lakh crore a year ago, driven by credit demand outpacing deposit growth. Liquidity pressures persist as deposit growth at 11.5% lags behind credit growth of 12.6%. Public and private sector banks continue to rely on CDs to meet funding requirements. Dive deeper

Vodafone Idea plans to raise up to ₹2,000 crore through a preferential equity issuance to a promoter entity. The board will meet on December 9 to consider the proposal. This follows Vodafone UK’s plan to invest proceeds from its 3% Indus Towers stake sale into Vodafone Idea to help clear outstanding dues. Dive deeper

Eicher Motors' Royal Enfield inaugurated its first Completely Knocked Down (CKD) assembly facility in Samut Prakan, Bangkok, Thailand. This fully owned plant aligns with Royal Enfield's strategy to expand in high-potential Asia-Pacific markets and cater to the growing demand for mid-segment motorcycles Dive deeper

What’s happening globally

Bitcoin crossed the $100,000 mark, reaching $103,449.70, driven by pro-crypto policies in the U.S. and global shifts like China lifting restrictions on personal crypto ownership. Other cryptocurrencies, including Solana and XRP, also hit record highs, reflecting increased global adoption. Dive deeper

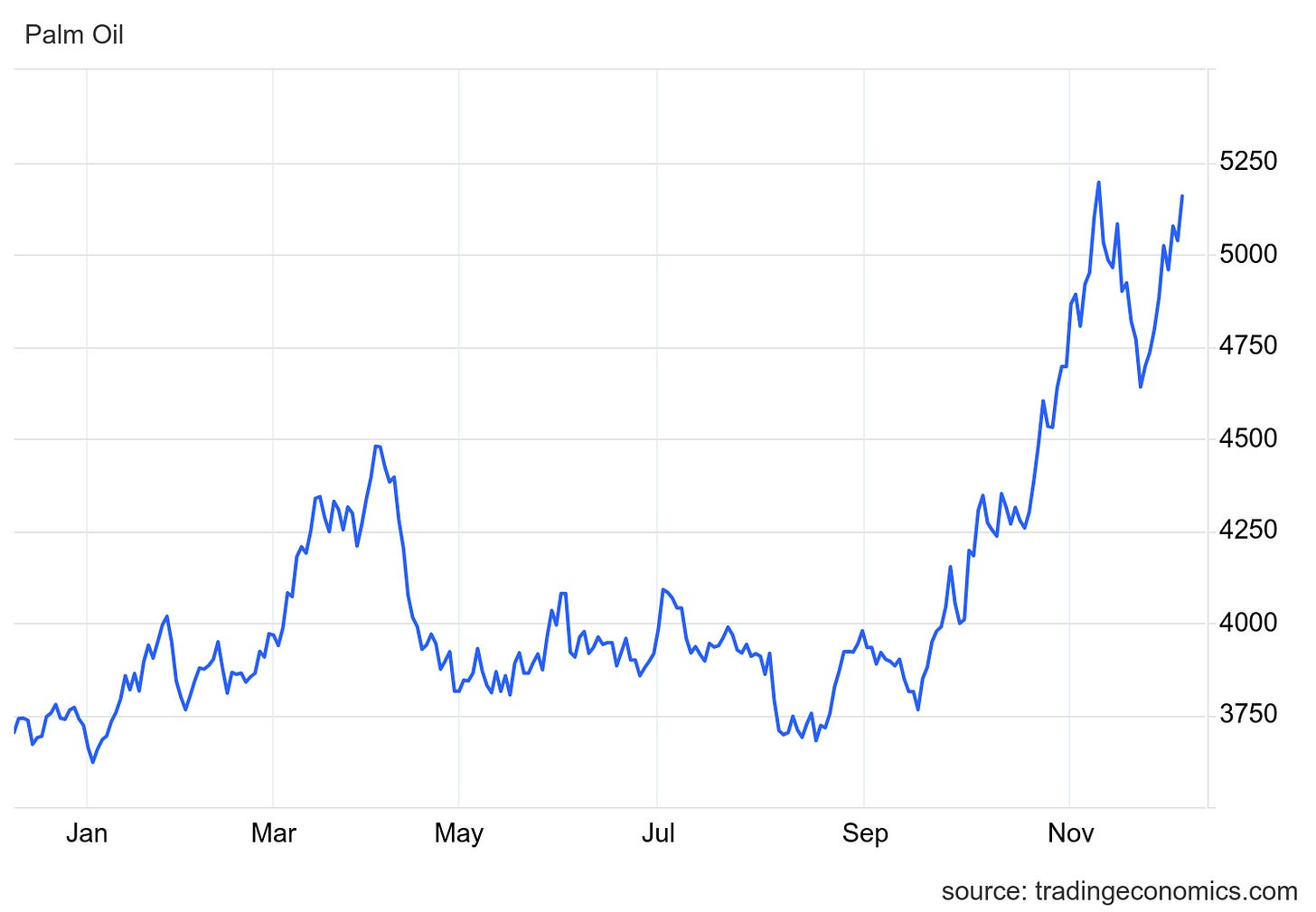

Malaysian palm oil futures rose 1% to over MYR 5,080 per tonne, driven by expectations of lower inventories from rain-hit production and robust pre-festival demand in India and China. November's edible oil imports in India reached a four-month high, reflecting strong restocking trends. Dive deeper

France's 10-year OAT yield remained stable at 2.9% after a no-confidence vote ousted Prime Minister Barnier over disagreements on a €60 billion budget proposal aimed at reducing the deficit. The political uncertainty has pushed France's risk premium over German Bunds to 90 basis points, the highest since 2012, highlighting concerns about fiscal stability. Dive deeper

UK passenger car registrations fell 1.9% year-on-year in November 2024 to 153,610 units, driven by declines in petrol by 17.7% and diesel by 10.1%. Meanwhile, battery electric vehicle registrations surged 58.4%, highlighting a steady transition toward greener alternatives. Dive deeper

Retail sales in the Euro Area fell by 0.5% month-over-month in October 2024, reversing a 0.5% rise in September, driven by declines in non-food products and auto fuel, while food sales saw a slight rebound. Year-on-year, retail sales grew 1.9%, slightly above expectations of 1.7%. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Vidya Iyer, Head - Fixed Income, ICICI Prudential Life Insurance Co.

"Within the sovereign portfolio, we prefer the liquid 10-year bond, 15-year bond and long bonds of 30-to-50-year maturity,"

"Long bonds tend to do well in the last quarter of the year as that is the period when long-term investors get decent flows into their funds"

"We expect the RBI to cut Cash Reserve Ratio (CRR) by 50 basis points...Given the fact that we are still above the pre-pandemic levels of 4% on CRR, the case for a CRR cut becomes even stronger." - Link

B. Thiagarajan, MD, Blue Star

Saw a fantastic festive season with more than 30% growth for ACs

The market for RACs will continue to grow

Demand for commercial refrigeration continues to grow at 20%

Quick commerce is driving growth in commercial refrigeration

Inventory levels are reasonable at present

We will continue to maintain 30% growth for RACs

Invested ₹500 crore for working capital inventory raised from internal accruals - Link

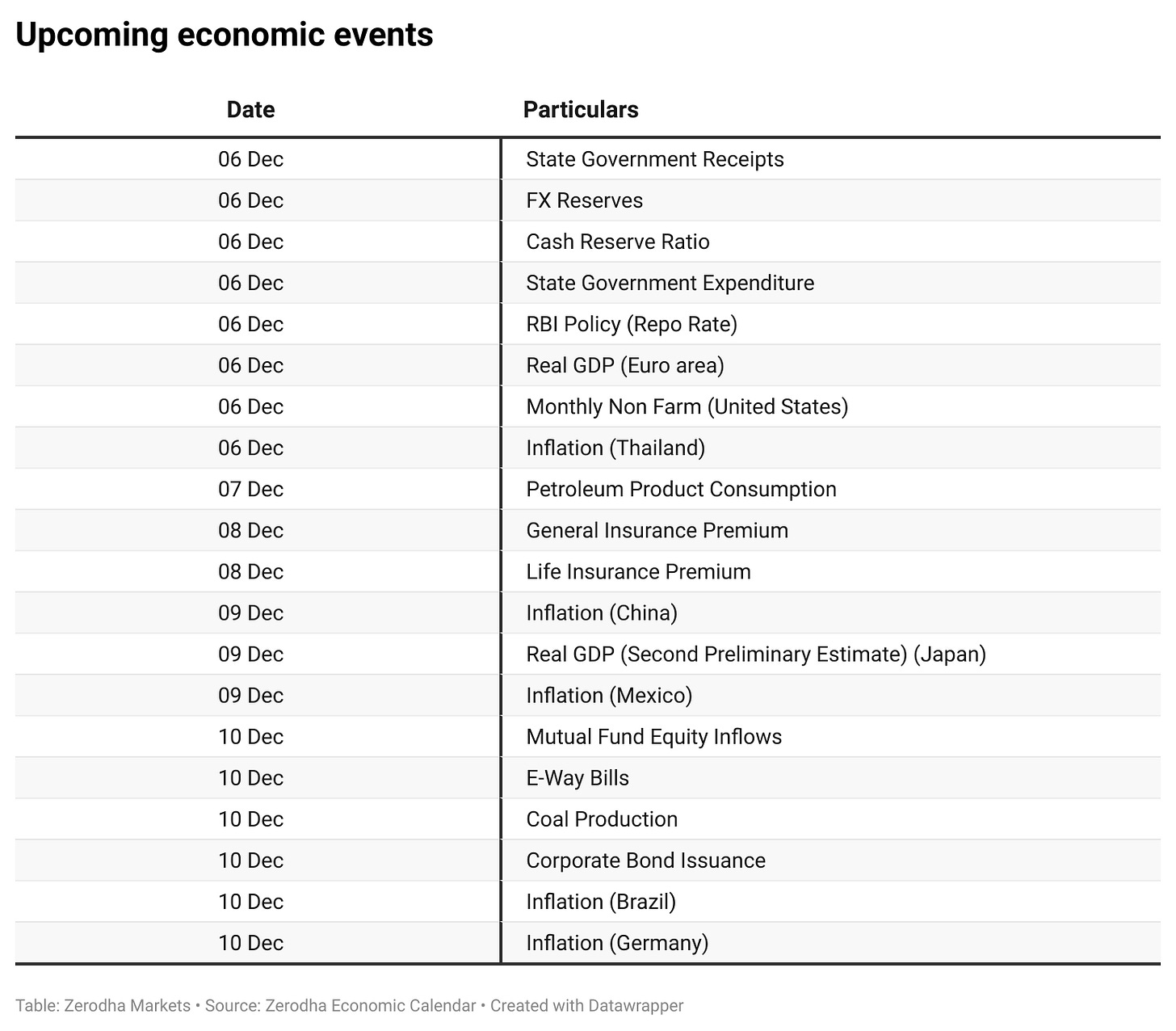

Calendars

In the coming days, we have the following major events and corporate actions:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

Superb