Happy New Year, everyone! 🎉

Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real time by Tijori.

Market Overview

Nifty opened flat at 23,637.65 and continued the bearish trend from recent sessions during the first hour, hitting a low of 23,562.80, weighed down primarily by financials. However, the market steadily recovered over the next two hours, rebounding nearly 200 points to test 23,760.

After consolidating between 23,700 and 23,750 for two hours, Nifty reached the day’s high of 23,822.80 around 2 PM. It then dipped by 70-80 points and traded within a range before closing at 23,742.90, up by 0.41%. The recovery was largely driven by better-than-expected auto sales figures, which boosted overall market sentiment.

Broader Market Performance:

Driven by positive movements in the headline indices, the broader market maintained its upward momentum. A total of 2,048 stocks advanced, 766 declined, and 78 remained unchanged.

Sectoral Performance:

Sectoral performance reflected positive trends, with Nifty Auto emerging as the top gainer, up 1.34% due to better-than-expected December sales figures. All sectors, except Realty and Metals, ended the day in the green.

Note: The above numbers for Commodity futures were taken around 4 pm.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 2nd January:

The maximum Call Open Interest (OI) is observed at 24,100, followed closely by 24,200 and 24,000, while the maximum Put Open Interest (OI) is concentrated at 23,500, with 23,600 coming in next.

Immediate support is identified around 23,500, with additional support in the 23,300–23,400 range. On the upside, resistance is noted at 23,900 and 24,000, with the 23,800–23,900 zone being a critical area to monitor.

Nifty has tested the 23,800 and 23,900 levels multiple times, and the shift in call OI from 24,000 to 24,100, along with notable put writing at strikes between 23,500 and 23,800, adds an interesting dynamic. It will be crucial to observe how the market reacts if it revisits the 23,850–23,900 range tomorrow.

Note: OI is subject to multiple interpretations but generally, in a falling market if there is an increase in the call OI, it indicates resistance, and in a rising market, if there is an increase in the put OI, it indicates support.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

The Union Cabinet approved a ₹3,500 per metric tonne subsidy for DAP fertilizer, effective January 1, 2025, to ensure affordability. The allocation for Pradhan Mantri Fasal Bima Yojana (PMFBY) was increased to ₹69,515 crore, with an ₹800 crore fund established to promote innovation, technology, and faster claim settlements. Dive deeper

The Reserve Bank of India (RBI) will sell state bonds worth Rs 4.73 lakh crore in the January-March 2025 quarter on behalf of state governments and union territories, with weekly auction schedules and expected borrowings released in its notification. Dive deeper

India’s GST collections in December 2024 reached Rs 1.77 trillion, reflecting a 7.3% increase from the previous year. Domestic transactions contributed Rs 1.32 trillion, while GST from imports rose 4%. After a 31% rise in refunds, net GST collections grew 3.3% year-on-year to Rs 1.54 trillion. Dive deeper

Reliance has converted 24,61,33,682 compulsorily convertible preference shares (CCPS) in Viacom18 Media Private Limited into equity shares, increasing its stake to 83.88%. Viacom18, now a subsidiary of Reliance, ceased to be a subsidiary of Network18, effective December 30, 2024. Dive deeper

Mahindra & Mahindra Ltd. reported a 16% increase in total sales for December 2024, with 69,768 vehicles sold, including 41,424 SUVs domestically. Exports rose by 70% to 3,092 vehicles. Dive deeper

Nishant Pitti, Co-Founder and CEO of EaseMyTrip, has resigned from his position effective January 1, 2025, citing personal reasons. The company's board has appointed his brother, Rikant Pitti, previously serving as Chief Financial Officer, as the new CEO with immediate effect. Dive deeper

Hyundai Motor India Limited recorded its highest-ever domestic sales of 6,05,433 units in CY 2024, with CRETA achieving its best-ever sales of 1,86,919 units. The company also saw a 13.1% contribution from CNG vehicles. Total sales, including exports, amounted to 7,64,119 units. In December 2024, Hyundai sold 55,078 units, with 42,208 units domestically and 12,870 units exported. Dive deeper

SJVN shares closed 6.17% higher at Rs 110.85 after signing an MoU with the Bihar government for the 1,000 MW Hathidah Durgawati Pumped Storage Project. The project, estimated at Rs 5,663 crore, will generate 6.325 million units of peak energy daily and create significant employment opportunities. Dive deeper

Shares of Indian Renewable Energy Development Agency (IREDA) closed 3.02% higher at Rs 221.76 after reporting a 41% YoY increase in Q3 loan disbursements, reaching Rs 17,236 crore. The company's sanctioned loans grew 129% YoY to Rs 31,087 crore, while its outstanding loan book rose 36% YoY to Rs 69,000 crore. Dive deeper

Gravita India Limited’s subsidiary, Recyclers Ghana Limited, has started commercial production at its new plant in Ghana with a capacity of 4,000 MTPA, set to expand to 8,000 MTPA. The company invested Rs. 6.75 crores in phase I. The plant will source aluminium scrap locally and serve industries in Europe and Asia. Dive deeper

Tamil Nadu Power Distribution Corporation (TANGEDCO) cancelled a global tender for procuring smart meters, citing the high cost quoted by Adani Energy Solutions Ltd (AESL), the lowest bidder. A re-tender is expected, and the move follows controversy surrounding the Adani Group. Dive deeper

Newgen Software Technologies Limited has accepted a purchase order for its Newgen Remittance system license, valued at INR 20.9 crore. The order, awarded by a domestic entity, will be executed within one year. Dive deeper

Aster DM Healthcare Limited has agreed to convert ₹225.94 crore in loans to Alfaone Medicals Private Limited (AMPL) into equity shares and Optionally Convertible Redeemable Preference Shares (OCRPS). This will increase Aster's equity stake in AMPL to 48.92%. The conversion is set to be completed by February 28, 2025, with no fresh capital infusion. Dive deeper

Paytm shares closed 2.97% lower at Rs 987.6 after NPCI extended the deadline for UPI providers to comply with the 30% market share cap until December 2026, providing relief to dominant players like PhonePe and Google Pay. The delay allows more time for adjustments in the UPI payments market. Dive deeper

Piramal Enterprises Limited has invested Rs. 1,000 crore in its subsidiary, Piramal Capital & Housing Finance Limited, through a rights issue. The funds will be used for business and corporate purposes, with no change in shareholding. Dive deeper

Jet fuel prices were reduced by 1.5%, while commercial LPG rates were cut by ₹14.5 per 19-kg cylinder to ₹1,804 in the national capital, following international price benchmarks. The reduction marks the first decrease in commercial LPG prices after five consecutive monthly hikes. Dive deeper

Sasan Power Limited, a subsidiary of Reliance Power, has repaid US$150 million to India Infrastructure Finance Company Limited (IIFCL) UK, improving its financial metrics. The repayment enhances liquidity and strengthens Reliance Power’s balance sheet. Reliance Power has also raised Rs. 1,525 crore through equity-linked warrants, supporting its focus on renewable energy. Dive deeper

PNC Infra Holdings Ltd received in-principle approval from the National Highways Authority of India (NHAI) on December 31, 2024, for the divestment of its interest in PNC Rajasthan Highways Private Limited. This approval is part of the ongoing asset sale process, subject to necessary regulatory approvals. Dive deeper

Power Mech Projects Limited has secured a ₹294 crore order from Adani Power Limited for overhauling services, condition assessment, and commissioning of Steam Generators and Turbine Generators at the Korba Phase-II Thermal Power Project. The order includes an incentive of ₹1.25 crore per unit upon synchronization. Dive deeper

RITES Limited has received a notification of Intent to Award from the Ministry of Public Works, Government of Guyana, for engineering services to upgrade the Palmyra to Moleson Creek Highway. The contract, valued at USD 9.71 million, will be executed over 60 months. Dive deeper

APL Apollo Tubes Limited reported a record sales volume of 828,200 tons in Q3FY25, up from 758,267 tons in Q2FY25 and 603,659 tons in Q3FY24. For 9MFY25, the company saw a 19% year-on-year growth, with total sales of 2,307,531 tons. Dive deeper

Aerolloy Technologies, a subsidiary of PTC Industries, has successfully commissioned India’s first Vacuum Arc Remelting (VAR) furnace for producing aerospace-grade Titanium alloy ingots. This development strengthens India’s position in advanced manufacturing for critical aerospace and defence applications. Dive deeper

Maruti Suzuki India Limited sold 178,248 units in December 2024, including 132,523 units domestically, 8,306 units to other Original Equipment Manufacturers (OEMs), and a record 37,419 units in exports. For April-December 2024, the company recorded total sales of 1,629,631 units, marking a 5.0% increase year-on-year. Dive deeper

Thomas Cook India Ltd. reported a cyberattack on its IT infrastructure, causing its website to be temporarily unavailable. The company is investigating the issue with cybersecurity experts and has taken steps to resolve it. Dive deeper

What’s happening globally

Russian gas flows through Ukraine ceased on January 1, 2025, after the transit deal expired, affecting EU gas imports by 5%. The halt comes amid high winter demand, particularly impacting Slovakia. The move follows Ukraine’s refusal to extend the deal and could lead to increased reliance on LNG imports. Dive deeper

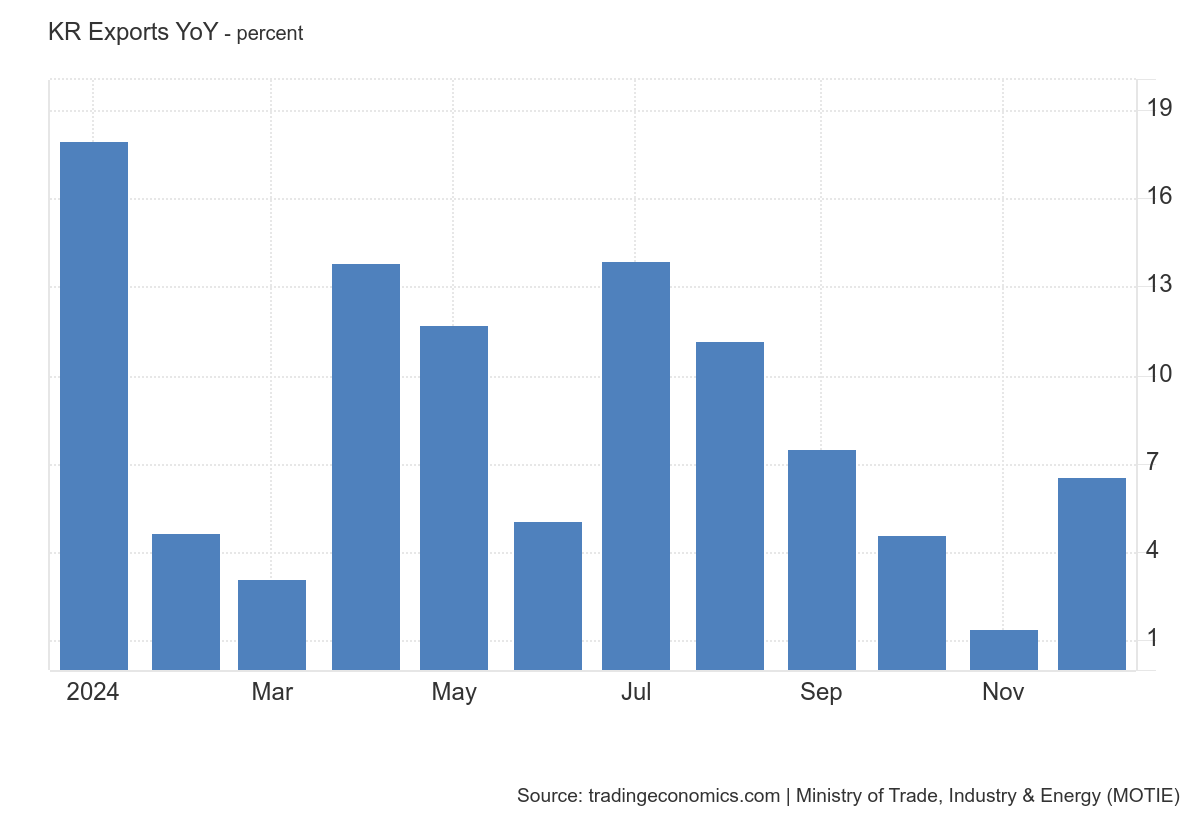

South Korea's exports rose 6.6% to a 31-month high of USD 61.38 billion in December 2024, exceeding market expectations. The increase was driven by strong global demand, with semiconductor exports surging 32%, while vehicle exports declined 5.3%. For the full year, exports grew 8.2%, reaching a record total of USD 683.8 billion, boosted by robust microchip shipments. Dive deeper

Telecom companies are expected to earn over $10bn from copper sales as they decommission legacy copper lines. Operators like BT, Telia, Telenor, and Telstra have already benefited from copper recycling, with prices set to rise to $12,000 per tonne by 2035. The demand for copper is increasing, driven by its role in energy transition, despite challenges in the extraction process. Dive deeper

The S&P 500 rose 23.3% in 2024, driven by gains in AI-focused tech stocks like Nvidia and Meta. Despite concerns over overvaluation and inflation, the US market outperformed Europe and Asia, supported by Fed rate cuts and strong economic data. Dive deeper

Copper futures fell below $4.05 per tonne, nearing their lowest since September, amid weak manufacturing demand from China and concerns over fiscal support. Despite a 5% gain for 2024, copper prices dropped nearly 30% from May's record high. Dive deeper

Nippon Steel has proposed giving the U.S. government a veto over any reduction in U.S. Steel's production capacity to secure approval for its $14.9 billion acquisition, addressing concerns over potential impacts on domestic steel production and national security. Dive deeper

Mexico's peso dropped nearly 23% in 2024, closing at 20.82 per US dollar, its biggest decline since the 2008 financial crisis. The currency weakened after the June election victory of the leftist Morena party and subsequent constitutional reforms. Additionally, concerns over US tariff threats further pressured the peso. Dive deeper

Alibaba Cloud cut prices by up to 85% for its visual reasoning AI model, Qwen-vl-max, to 0.003 yuan per thousand tokens, intensifying competition with ByteDance in China’s AI market. This marks Alibaba's third price cut in 2024. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Rajnath Singh, Defence Minister on 2025 being the 'Year of Reforms' will be 'momentous' in modernizing the Armed Forces

"Our defence exports, which were around Rs 2,000 crore a decade ago, have crossed the record figure of Rs 21,000 crore today. We have set an export target of Rs 50,000 crore by 2029, Unconventional methods like information warfare, Artificial Intelligence (AI)-based warfare, proxy warfare, electromagnetic warfare, space warfare, and cyber-attacks are posing a big challenge," - Link

Anand Mahindra, Chairman of Mahindra Group

"Globally, the last few years have been full of shocks, changes and uncertainties, and the year that is drawing to a close has been no exception. We are seeing a shifting world where interdependencies and a flat world may well be things of the past. International relations could become more and more transactional, driven strongly by national interest and national muscle-flexing,"

"India is well positioned to more than fend for itself. It is no longer the 99-pound lightweight on the beach. It can demonstrate military might. It can boast of political stability, anchored by its raucous and robust democracy that was on full display in the central elections, when a nation of over a billion people voted seamlessly, peaceably, and effectively,""India can enhance its economic potential, by seizing the opportunity offered by shifting affinities and alliances to become a keystone in the global supply chain system. We will be less affected by capricious global winds than many other countries." - Link

Calendars

In the coming days, we have the following major events and corporate actions:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.