Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

Nifty opened with a 165-point gap-up, tracking a strong close in the US markets and building on the positive momentum from last week. After dipping 80 points from the opening near the 23,440 level, Nifty rebounded sharply and continued to gain strength throughout the day. It crossed the 23,600 mark, and in the second half, briefly surpassed 23,700 before cooling off by around 60 points. The index eventually closed at 23,658.35, up 1.32%.

Following its best weekly performance in nearly four years, the market has maintained its strong momentum. The key question now is whether this rally will continue or if a short-term breather is on the horizon.

Broader Market Performance:

The broader market outperformed the headline indices. On the NSE, a total of 3,027 stocks were traded, with 1,865 advancing (down from 2,120 yesterday), 1,082 declining (up from 804), and 80 remaining unchanged.

Sectoral Performance:

The market saw broad-based buying interest with all 12 sectoral indices ending the day in the green. The top-performing sector was Nifty PSU Bank, which surged 3.18%, followed by Nifty Bank, up 2.20%, as banking stocks led the charge. On the other end, Nifty Media was the weakest performer, though it still managed to close slightly higher with a marginal gain of 0.06%. Notably, no sectors ended in the red, reflecting the strength and breadth of the ongoing rally across the board.

Note: The above numbers for Commodity futures were taken around 5 pm. NSE has not released today’s FII-DII data yet. Here’s the trend from the last 5 days:

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 27th March:

The maximum Call Open Interest (OI) is observed at 24,000, followed by 24,100 indicating strong resistance at 23,800 levels followed by 24,000.

The maximum Put Open Interest (OI) is at 23,500, followed by 23,300, suggesting strong support at 23,500, with additional support at 23,300.

Note: OI is subject to multiple interpretations, but generally, an increase in the call OI indicates resistance in a falling market, and an increase in the put OI indicates support in a rising market.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you understand the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

The HSBC India Manufacturing PMI rose to 57.6 in March 2025, reflecting stronger conditions driven by higher sales, new business, and output growth. However, rising input prices squeezed margins, and factory gate prices increased at the slowest rate in a year. Manufacturers showed slightly less optimism for future output. Dive deeper

The HSBC India Composite PMI slightly eased to 58.6 in March 2025, reflecting slower services growth despite strong factory output. New orders continued to grow, while job creation slowed to a six-month low. Input prices rose, but inflation remained below average, and business sentiment dipped due to intense competition. Dive deeper

Adani Energy Solutions Ltd (AESL) secured a Rs 2,800 crore power transmission project in Gujarat, aimed at supporting Green Hydrogen and Green Ammonia production. The project will expand AESL’s infrastructure by 150 cKM of transmission lines and 3,000 MVA capacity, boosting its order book to Rs 57,561 crore. Dive deeper

The government has revised MSME classification criteria, effective April 1, raising investment and turnover limits for micro, small, and medium enterprises. Micro-enterprises now have a ₹2.5 crore investment limit, and small enterprises' turnover limit is ₹100 crore. Dive deeper

NSE will begin facilitating trading of its unlisted shares through Central Depository Services India Ltd., shortening the settlement process. This change eliminates the need for regulatory approvals, which previously took months. Dive deeper

Indian airlines, including IndiGo, Air India Group, and SpiceJet, refused to share airfare data with the aviation regulator, citing potential commercial setbacks. This conflicts with the regulator’s efforts to monitor fares in a near-duopoly market. Airlines proposed sharing limited future data instead. Dive deeper

The Indian government scrapped the 20% export duty on onions, effective from April 1, 2025, a move welcomed by Maharashtra but deemed too late by Kisan Sabha. While praising the decision, the farmers' organization urged the government to avoid irregular export bans and implement a long-term export policy for onions to ensure stable prices and market trust. Dive deeper

Amazon India has announced the removal of referral fees on over 1.2 crore products priced below ₹300 to support small businesses and boost seller growth. This applies across 135 product categories and includes reduced shipping and handling fees, starting from April 7, 2025. Dive deeper

Apollo Hospitals' subsidiary, Apollo Healthco (AHL), plans to acquire an additional 11.2% share in Keimed Pvt Ltd for Rs 625.43 crore from promoter Shobana Kamineni. AHL will also invest Rs 99.99 crore in Keimed under a framework agreement. Dive deeper

NCC received a Rs 1,480 crore Letter of Acceptance (LoA) for the redevelopment of Darbhanga Medical College & Hospital. The project has a 42-month construction timeline and a 36-month defect liability period. It is classified as a "Major Order" by NCC. Dive deeper

SAIL shares advanced after the company announced plans to operationalize its 4 MTPA Tasra coking coal mines by 2026, potentially increasing its crude steel production capacity to 35.65 MTPA by 2031. The company’s production was 19.10 MTPA in FY24, with the Tasra mine aimed at boosting domestic coking coal supply. Dive deeper

Ola Electric shares are in focus as the company begins deliveries of its S1 Gen 3 scooter range across India, with prices ranging from Rs 79,999 to Rs 1,69,999. The Gen 3 platform offers 20% more peak power, an 11% cost reduction, and a 20% increase in range compared to the Gen 2. Dive deeper

India and the U.S. aim to increase market access, reduce tariffs, and enhance supply chain integration, with plans for a multi-sector Bilateral Trade Agreement. The goal is to double bilateral trade to $500 billion by 2030. Dive deeper

Over 90 lakh updated Income Tax Returns have been filed in the last four years, generating ₹9,118 crore in additional taxes. The government has proposed extending the filing deadline for updated returns to up to 4 years from the relevant assessment year under the Finance Bill, 2025. Dive deeper

Larsen & Toubro's board approved a Rs 12,000 crore fundraising plan through various financial instruments. Additionally, Subramanian Sarma was elevated to deputy managing director and president, effective April 2, 2025. Dive deeper

What’s happening globally

Brent crude oil futures fell to around $72 per barrel as traders considered increased supply from Russia amid efforts to end the Russia-Ukraine war. OPEC+ plans to gradually revive production next month, while concerns over U.S. trade policies and sanctions on Iran weighed on market sentiment, adding uncertainty to future oil demand. Dive deeper

Silver prices rose above $33.10 per ounce, supported by safe-haven demand amid geopolitical tensions and economic uncertainty. The weaker US dollar and concerns over further Fed rate cuts also boosted silver. Dive deeper

Copper futures surged towards $5.15 per pound, driven by concerns over US tariffs and China's new stimulus measures. Supply constraints from reduced mining investment and soaring demand for copper due to electric vehicles and renewable energy boosted prices. Dive deeper

Canada's CFIB Business Barometer long-term index dropped sharply by 24.8 points to a record low of 25.0 in March 2025, signalling severe pessimism among businesses. This marks the largest decline since the index began in 2000, driven by the impact of tariffs and trade restrictions. Additionally, staffing plans have turned negative, and price increase expectations have surged. Dive deeper

The S&P Global UK Composite PMI rose to 52.0 in March 2025, signaling modest private sector growth, driven by strong expansion in services. Manufacturing output declined for the fifth consecutive month, and new orders diverged, with services showing growth while manufacturing saw a steep drop. Business confidence remained low, reflecting ongoing uncertainty. Dive deeper

The HCOB Eurozone Composite PMI rose to 50.4 in March, indicating modest growth across the region. Manufacturing returned to expansion, while service sector growth slowed. Despite easing inflation and stable employment, business confidence declined for the second consecutive month. Dive deeper

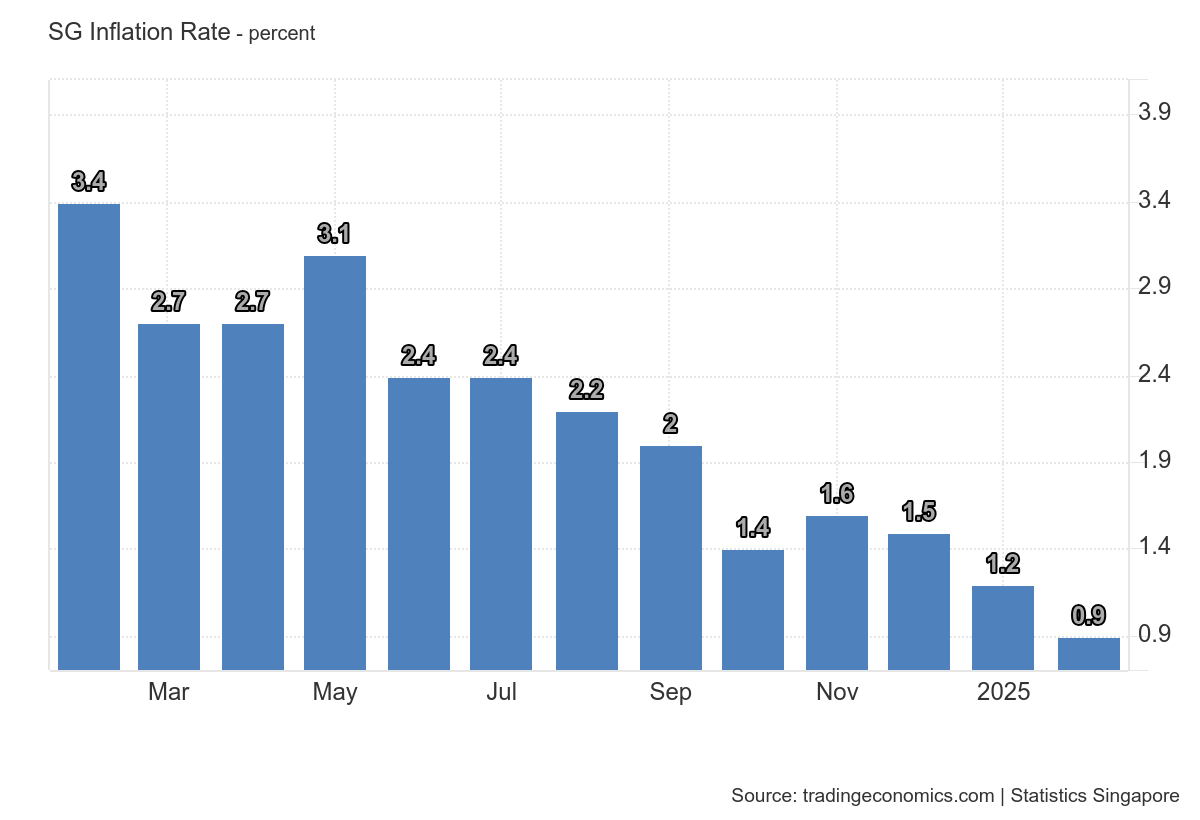

Singapore's annual inflation eased to 0.9% in February 2025, the lowest since 2021, with slower price rises in food and transport. Deflation worsened for recreation and miscellaneous goods, while health and education costs increased. Core inflation fell to 0.6%. Dive deeper

The Au Jibun Bank Japan Manufacturing PMI fell to 48.3 in March 2025, marking the ninth straight month of contraction. Production and new orders declined sharply, though foreign sales rose. Employment and sentiment improved, while price inflation eased. Dive deeper

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Sean Hyunil, CEO of South Korean gaming giant KRAFTON (Battlegrounds Mobile India (BGMI) on Gaming Industry in India

"In terms of size or in terms of development stage, as an industry, I think it is still early or relatively small compared to the global gaming markets. But I think India has a very unique position because India is a mobile gaming native country. So other countries that are in more mature stages, have gone through (the path of) consoles, PCs, and mobiles now. But in India, gamers started with playing games from mobile, that is a very unique difference,"

"And then we have one of the most popular game in the country, which is still steadily growing in terms of user base, and in terms of revenue. So I think India market has been very attractive for us to build our presence and invest more," - Link

Ramesh Damani, MD of Ramesh S. Damani Finance Pvt. Ltd. and a veteran Investor on Globalization

“The bad news is globalization under a cloud right now, it's under a very serious cloud. The good news that is my personal belief and my personal call that these are irreversible changes, that you could delay globalisation by another three years or four years. It will delay globalisation, but it cannot deny it, because the human arc works towards progress.” - Link

Elon Musk, CEO, Tesla on Stock Plunge and Future Outlook

“What I’m saying is hang on to your stock.”

“There are times when there are rocky moments. But what I’m here to tell you is that the future is incredibly bright and exciting, and we’re going to do things that no one has even dreamed of.”

“I’d actually love to make aeroplanes, especially, but I’m stretched pretty thin. I have, like, 17 jobs.” - Link

Calendars

In the coming days, we have the following significant events and corporate actions:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

It took me fair amount of time wading through your treasure trove of very important economic news and statements from people who matter. The provision to go deeper on matters that excite and important to you makes an unbeatable source of information.