Welcome to Aftermarket Report, a newsletter where we do a quick daily wrap-up of what happened in the markets—both in India and globally.

Follow Market Alerts by Zerodha on X (Twitter) to get instant summaries of key exchange filings as soon as they happen. These alerts are delivered in real-time by Tijori.

Market Overview

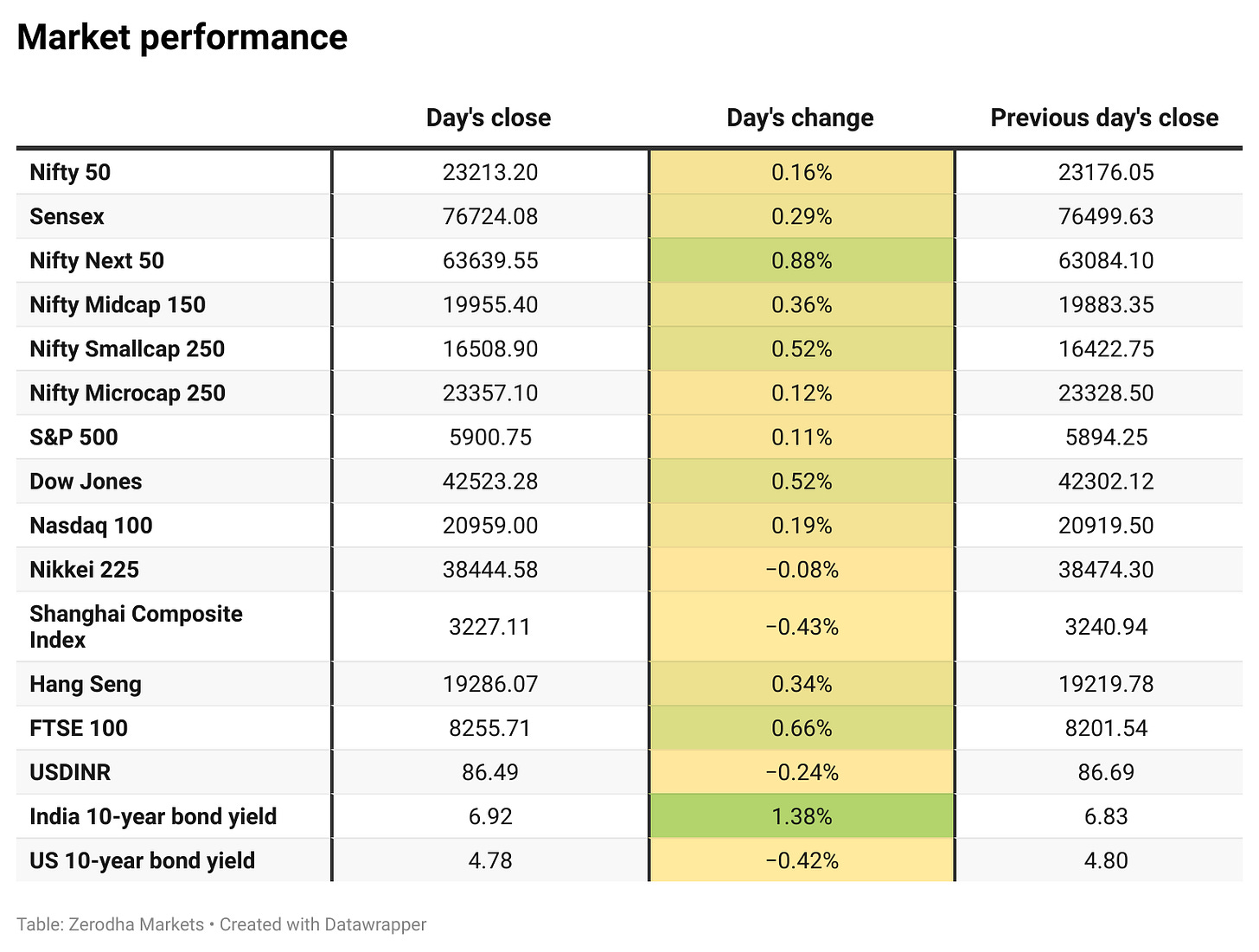

Tracking stable global cues overnight, the Nifty opened 75 points higher at 23,250.45. However, the markets dipped shortly after the opening and traded within a narrow 50-point range between 23,180 and 23,230 for the first 90 minutes. Later, Nifty attempted an upward breakout, reaching an intraday high of 23,293.65 but failed to surpass the key resistance level of 23,300.

In the second half of the session, the market cooled off and oscillated within a broader 60-point range between 23,170 and 23,230 during the last two hours. Ultimately, Nifty closed at 23,213.20, recording a modest gain of 0.16%.

With macroeconomic factors continuing to weigh on market sentiment, the outlook remains cautious. Going forward, market trends will likely be shaped by global economic developments and earnings reports from key index heavyweights, including Reliance and Infosys. Investors are keenly watching for signs of stabilization to ease the ongoing selling pressure.

Broader Market Performance:

In line with the headline indices, advances and declines were nearly balanced, with a slight edge to advances. On the NSE, 1,535 stocks advanced, 1,252 declined, and 96 remained unchanged.

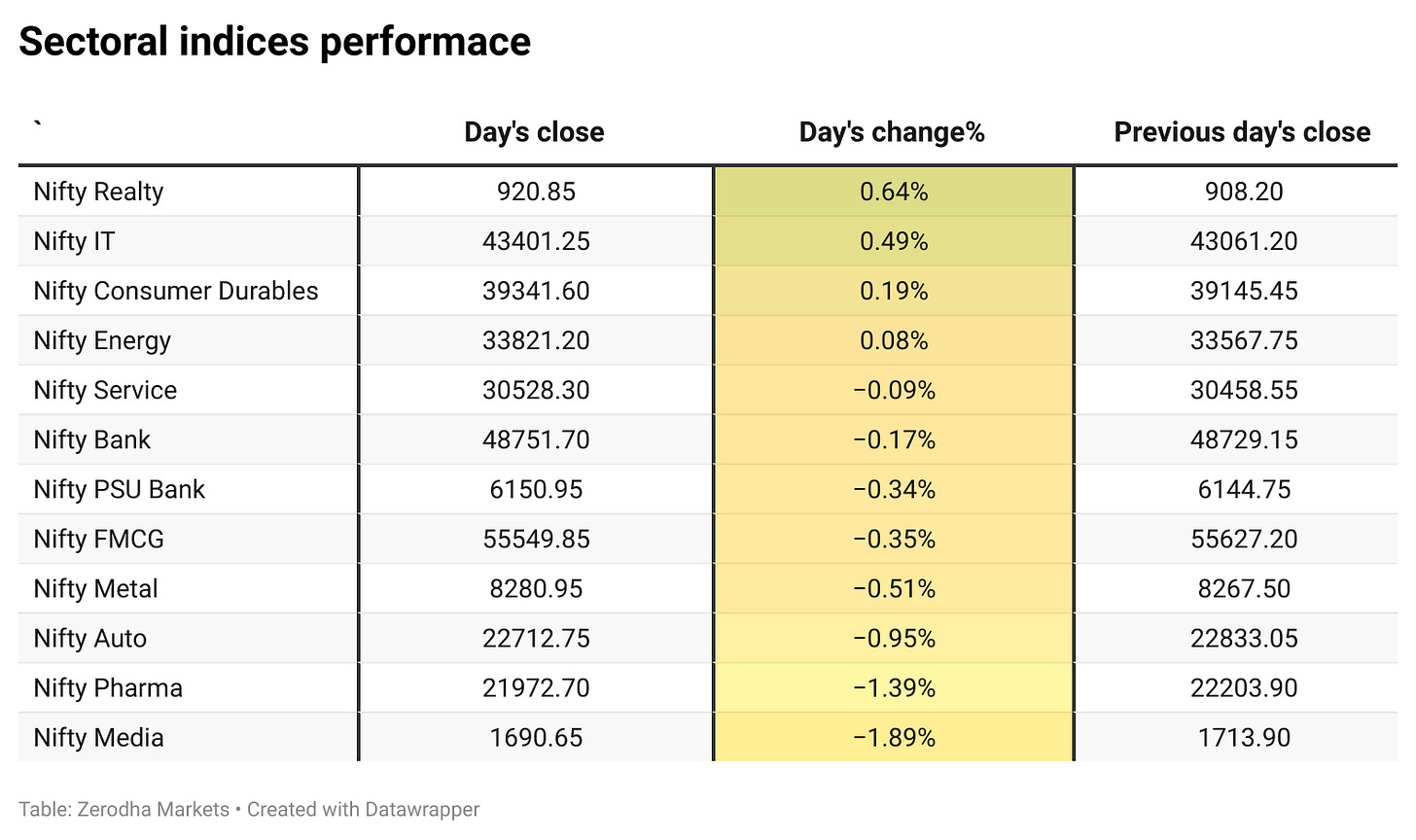

Sectoral Performance:

The overall sectoral performance showed a broadly negative trend, with eight sectors ending in the red and only four finishing in the green. After the recent downturn, Nifty Realty emerged as the top gainer, rising by 0.64%. Meanwhile, Nifty Media and Nifty Pharma closed lower, declining by 1.89% and 1.39%, respectively.

Note: The above numbers for Commodity futures were taken around 4 pm.

Change in OI for the day

The following is the change in OI for Nifty contracts expiring on 16th January:

The maximum Call Open Interest (OI) is observed at 23,300, followed by 23,200 and 23,500. Meanwhile, the maximum Put Open Interest (OI) is at 23,200, followed by 23,000.

For tomorrow, With maximum open interest at 23,300, a breakout on the upside could lead to levels of 23,400 and beyond. However, if Nifty sustains below 23,200, a move toward 23,000 may also be likely.

Immediate support is identified in the 23,000–22,900 range, while resistance is expected between 23,350 and 23,500.

Note: OI is subject to multiple interpretations but generally, in a falling market if there is an increase in the call OI, it indicates resistance, and in a rising market, if there is an increase in the put OI, it indicates support.

Source: Sensibull

Tijori is an investment research platform, and they have constructed niche indices for various themes and sub-sectors. They help you get a sense of the market performance of narrow slices of the market. You can also track the Promoter buying and other interesting stuff like Capex activity by the companies in the Tijori App’s idea dashboard.

What’s happening in India

India's exports declined 1% to $38.01 billion in December 2024, while imports rose 4.8% to $59.95 billion. The trade deficit stood at $21.94 billion. For April-December 2024, exports grew 1.6% to $321.71 billion, and imports increased by 5.15% to $532.48 billion. Dive deeper

The Indian rupee gained 0.3%, rebounding from a lifetime low, supported by a softer U.S. dollar and foreign banks' dollar sales. It closed at 86.3625, marking its best day in seven months. Despite the recovery, the rupee has weakened by 3% since November 2024, amid concerns over inflation and India's slowing growth. Dive deeper

The weakening rupee raises concerns over India's interest rate cuts, impacting inflation control and economic growth. Despite strong overall growth, slowing GDP and rising import costs add uncertainty to monetary policy decisions. Dive deeper

SEBI is proposing mandatory dematerialization of shares for corporate actions like splits and restructurings to reduce fraud, enhance efficiency, and lower costs. The initiative aims to phase out physical certificates and improve market transparency. Public feedback is invited until February 4, 2025. Dive deeper

Aditya Birla Fashion and Retail approved a ₹2,400 crore preferential issue to promoters and QIBs. Pilani Investment's stake will rise from 0.37% to 3.9% post-fundraising. The company will retain its retail business, while its lifestyle and sportswear brands will be part of Aditya Birla Lifestyle Brands Limited. Dive deeper

Minda Corporation has entered a strategic partnership with Flash Electronics to create a leading EV platform in India, acquiring a 49% stake for ₹1,372 crore. This collaboration will enhance both companies' positions in the automotive sector, combining strengths in product innovation and technology. Dive deeper

ABB India marks 75 years, highlighting its contributions to India's industrial growth, focusing on electrification, automation, and sustainability. The company has supported advancements in energy, transportation, and manufacturing sectors, contributing to the nation's green transition. Dive deeper

Persistent Systems has launched ContractAssIst, an AI-powered contract management solution in collaboration with Microsoft. Integrated with Microsoft 365 Copilot and Azure, the platform enhances contract tracking, collaboration, and decision-making, offering efficiency and cost savings for enterprises. Dive deeper

Alembic Pharmaceuticals has received USFDA final approval for its Brexpiprazole Tablets in multiple dosages. This approval allows the company to market the product, which is used to treat major depressive disorder and schizophrenia, in the US market. Dive deeper

Nazara's subsidiary, Fusebox Games, collaborates with Banijay Rights to develop the Bigg Boss Interactive Fiction Game. Slated for release in 2025, the game will feature interactive elements, localized storytelling, and in-game events inspired by the popular reality TV show. Dive deeper

Nesco Ltd.'s share price rose after securing a ₹300 crore annual contract from National Highways Logistics Management Ltd. for developing, operating, and maintaining wayside amenities on the Raipur-Visakhapatnam Expressway. The lease period is 30 years, with a potential 30-year extension, and the project is set to be completed within 10 months. Dive deeper

Premier Energies secured ₹1,460 crore in orders from IPPs, including ₹1,041 crore for solar modules and ₹419 crore for solar cells, with supply starting in May 2025. Dive deeper

Tata Capital raised $400 million through its first overseas bond issue, offering unsecured notes maturing in 3.5 years at a 5.389% coupon. The bonds, rated BBB-, were highly subscribed with participation from global investors, and the company plans to strengthen its liability profile. Dive deeper

Adani Green Energy shares closed up 2.80% at ₹1,035.05 after its subsidiary commissioned a 57.2 MW wind-solar hybrid project in Gujarat, boosting AGEL's total renewable capacity to 11,666.1 MW. Dive deeper

IRFC shares gained 1.48%, reaching ₹137.56, after emerging as the lowest bidder to finance ₹3,167 crore for the Banhardih coal block project in Jharkhand, a joint venture with NTPC. Dive deeper

Adani Energy Solutions secured transmission projects worth ₹28,455 crore, expanding its project pipeline to ₹54,700 crore. The company also reported a 3% rise in units sold by its distribution subsidiary, Adani Energy Mumbai, in Q3FY25. Dive deeper

Vedanta Resources plans to raise $1 billion through a dual-tranche bond issuance to refinance its 2026 and 2028 bonds. The offering, which has attracted strong demand, includes a 5.5-year tranche at 9.475% and an 8.25-year tranche at 9.850%. The settlement is expected on January 24, 2025. Dive deeper

Akasa Air received a warning from the DGCA for violations in dangerous goods handling, including unverified lithium battery shipments and exceeding weight limits. The airline acknowledged the lapses, took corrective actions, and was asked to conduct internal audits and report back within 30 days. Dive deeper

What’s happening globally

Germany's wholesale prices rose 0.1% year-on-year in December 2024, reversing November's 0.6% decline. Increases were seen in non-ferrous metals (22.3%), coffee, tea, and cocoa (34.3%), and dairy products (5.7%), while prices for computers and mineral oil products fell. Monthly prices edged up by 0.1%. On an annual average, wholesale prices dropped 1.3% in 2024. Dive deeper

Euro Area industrial production rose by 0.2% in November 2024, following a 0.2% increase in October, below expectations of a 0.3% rise. Energy, durable goods, and non-durable goods saw improvements. Germany recorded a 1.3% rise, while Spain declined by 1.5%. On an annual basis, industrial output fell by 1.9%. Dive deeper

The UK's annual inflation rate eased to 2.5% in December 2024, from 2.6% in November, below forecasts. Price decreases were seen in restaurants, hotels, and transport, while inflation slowed in services and recreation. Monthly, CPI rose by 0.3%, surpassing the previous month's 0.1% increase but falling short of forecasts. The core inflation rate also dropped to 3.2% from 3.5%. Dive deeper

Germany's GDP fell 0.2% in 2024, after a 0.3% decline in 2023. Manufacturing dropped by 3%, construction fell 3.8%, and the service sector grew 0.8%. Household consumption rose 0.3%, while government spending increased 2.6%. Exports dropped 0.8%, and imports edged up. Dive deeper

Malaysian palm oil futures fell 1% to below MYR 4,400 per tonne, pressured by a 41% drop in December imports by India and weaker Q1 2025 demand expectations. Export estimates showed a decline in January shipments. Losses were partly offset by a drop in stocks and output. Dive deeper

Japan's machine tool orders rose 11.2% year-on-year to JPY 141,259 million in December 2024, driven by a 4.4% increase in domestic orders and a 14.1% rise in foreign orders. Monthly orders grew 18.4%, while total orders for 2024 saw a slight decline of 0.2%. Dive deeper

The Bank of Indonesia cut its benchmark interest rate by 25 bps to 5.75% in January 2025, aiming to support economic growth and inflation targets. Inflation remained within the target range at 1.57% in December. Economic growth for 2024 is expected to be slightly below the target range. Dive deeper

The People’s Bank of China (PBoC) injected CNY 958.4 billion through seven-day reverse repurchase agreements to manage liquidity pressures from expiring loans and seasonal cash demand. This move reflects the PBoC's shift towards using reverse repo rates to guide market borrowing costs, maintaining the rate at 1.5% since September. Dive deeper

Japan's Reuters Tankan sentiment index rose to +2 in January 2025 from -1 in December, driven by stronger conditions in materials industries. While sentiment improved in sectors like steel and chemicals, it declined in automotive and electronics. Confidence is expected to stay steady with a +2 outlook for April. Dive deeper

Microsoft is halting hiring in part of its U.S. consulting business as a cost-cutting measure, with a focus on managing expenses while continuing its AI investments. The company plans to reduce non-billable costs and avoid travel for internal meetings. Dive deeper

Hyundai Motor raised concerns over BYD's entry into South Korea's passenger car market, warning against underestimating the Chinese EV giant's competitive strengths. BYD plans to release passenger vehicles in South Korea in Q1 2025, despite current negative perceptions of Chinese brands. Dive deeper

Mark Wiedman, a senior executive at BlackRock, is leaving the company, raising questions about the firm's succession plans as it navigates recent acquisitions and leadership changes. Dive deeper

Investors have invested a record $14.4bn into the Invesco S&P 500 Equal Weight ETF, driven by concerns over the dominance of big tech stocks like Alphabet and Microsoft. This surge highlights growing concerns about market concentration risks, with top tech stocks contributing to half of the S&P’s 24% gain last year. Dive deeper

The SEC has sued Elon Musk for failing to disclose his 5% stake in Twitter on time, allegedly securing a $150 million discount on additional stock purchases. His late disclosure in March 2022 led to a 27% surge in Twitter shares. Dive deeper

Quarterly results

In this section, we'll dive into all the key highlights from today's intriguing results, covering the most impactful performances and standout moments. The numbers are comparable on a year-on-year (YoY) basis.

Bank of Maharashtra (MAHABANK) (-3.32%)

Financials:

Net Profit: ₹140.65 crore, up 35.7% YoY

Total Income: ₹711.24 crore, up 21.5% YoY

EBITDA: ₹230.30 crore, up 14.5% YoY

Operating Expenses: ₹142.80 crore, up 25.9% YoY

Key Highlights:

Provision for Non-Performing Assets (NPAs): ₹84.07 crore, down from ₹94.27 crore YoY

Capital Adequacy Ratio (CAR): 18.71%

Net NPA Ratio: 0.20%

Outlook:

Strong year-over-year growth in net profit and income.

Focus on improving capital adequacy and maintaining asset quality.

Network18 Media & Investments (NETWORK18) (-6.97%)

Financials:

Net Loss: ₹1,435 crore, compared to a net loss of ₹59 crore in Q3 FY24

Revenue: ₹1,361 crore, down 23% YoY

Exceptional Loss: ₹1,426 crore, related to the demerger of Viacom18

Net Profit (excluding exceptional items): ₹26 crore, compared to a loss of ₹148 crore in Q2 FY25 and ₹102 crore in Q3 FY24

Key Highlights:

The significant loss was primarily due to exceptional items tied to the derecognition of subsidiaries following the demerger with Viacom18.

Viacom18’s business merged with Star India, forming a major broadcasting JV with Reliance Industries, which invested ₹11,500 crore.

The company has completed its restructuring, simplifying its corporate structure and focusing on growth in regional markets and digital business.

Outlook:

Focus on growing regional television markets and digital platforms for further expansion.

The merger with Star India creates one of India’s largest broadcasting and streaming entities.

L&T Technology Services Ltd. (LTTS) (3.09%)

Financials:

Revenue: ₹2653 crore, up 9.5% YoY

EBITDA: ₹494.7 crore, up 1.4% YoY

EBITDA Margin: 18.6%, compared to 20.1% YoY.

Net Profit (PAT): ₹324.5 crore, up 0.9% QoQ and down 4.1% YoY

EPS: ₹30.47 (Basic), up slightly from ₹31.80 YoY.

Key Highlights:

Growth is led by strong demand in the transportation and industrial products verticals.

New client acquisitions contributed significantly to revenue.

Investments in next-gen digital engineering and AI-powered solutions driving future growth.

Outlook:

LTTS anticipates continued momentum in its transportation and industrial products segments.

Ongoing focus on leveraging digital technologies and expanding its global footprint for sustained growth.

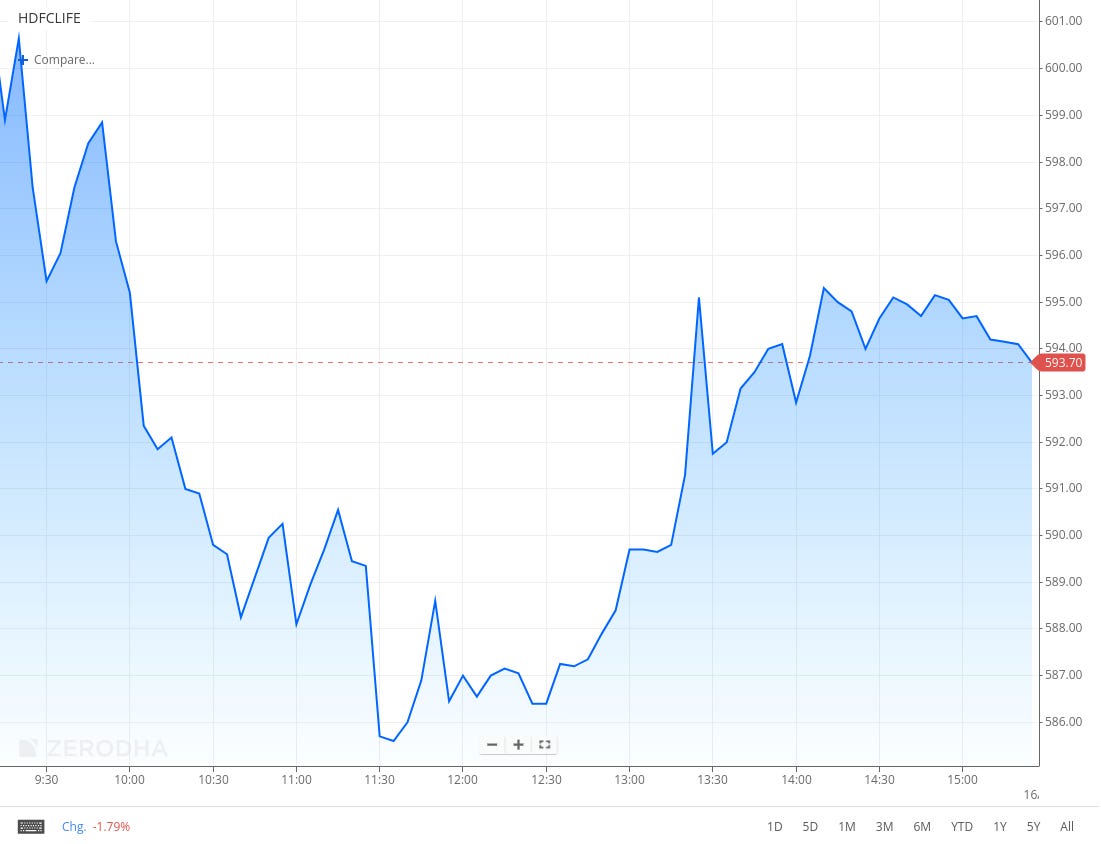

HDFC Life Insurance Company Ltd. (HDFCLIFE) (-1.04%)

Financials:

Revenue: ₹16,771 crore, up 10% YoY

Net Profit (PAT): ₹415.0 crore, up 13.5% YoY

Earnings Per Share (EPS): ₹1.96, compared to ₹1.71 in Q3 FY24

Key Highlights:

Persistency ratios improved across all tenures, reflecting strong customer retention.

Growth in protection and non-par savings products contributed significantly to premium growth.

Steady performance in annuity and group segments supported the overall business expansion.

Outlook:

HDFC Life remains focused on expanding its protection and annuity segments while leveraging bancassurance partnerships.

Emphasis on digitization and customer-centric innovations to drive long-term growth.

Management chatter

In this section, we pick out interesting comments made by the management of major companies and policymakers of the Indian and Global Economy.

Manoj Raghavan, MD & CEO, Tata Elxsi on the impact on the new government in the US

The U.S. market is important because all three verticals—automotive, media and communication, and healthcare—have a significant presence in this market for us. In both media and communication and healthcare, we have a sizable customer base and large deals taking place in the U.S. geography.

We are continuing to invest in the U.S. geography by enhancing the sales team and implementing several initiatives to ramp up our business in this market.

Regarding our transportation business, there are several discussions underway with both OEMs and Tier 1 suppliers. We have recently announced a strategic partnership with Qualcomm, which is a positive development for us. Together, we plan to collaborate with customers who use Qualcomm's chipsets for SDVs.

These various discussions and initiatives give me greater confidence that there will be some recovery in the U.S. market for us.

Vibha Padalkar, Managing Director and CEO of HDFC Life on Q3 results

“We have registered a healthy growth of 22%, based on individual WRP for 9MFY25, outpacing overall industry growth of 14%. We have witnessed both ticket size and volume expansion during this period. The number of policies has grown by 15%, outperforming the private sector's growth of 9%. Retail protection continues to grow well. Retail protection APE for nine months saw a growth of 28%.”

Calendars

In the coming days, we have the following major events, corporate actions, and upcoming earnings releases:

That’s it from us. Do let us know your feedback in the comments and share it with your friends to spread the word.

We’re now on Telegram, follow us for interesting updates on what’s happening in the world of business and finance. Join the conversation on today’s market action here.

Good and Awesome.

So now viacom has undergone demerger and it is a seperate entity, and the joint venture will have nothing to do with network18 and jiostar revenues will not be a part of network18 am I right ?